The global market for high-performance polymer sealing solutions has experienced robust growth, driven by increasing demand from industries such as automotive, aerospace, oil & gas, and semiconductor manufacturing. According to a report by Mordor Intelligence, the global PTFE (Polytetrafluoroethylene) market was valued at USD 6.72 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2029. This expansion is fueled by PTFE’s exceptional thermal stability, chemical resistance, and low friction properties—making it ideal for critical sealing applications. Teflon rings, in particular, are gaining traction due to their durability in extreme environments and minimal maintenance requirements. As industrial automation and high-precision engineering continue to rise, the need for reliable Teflon ring manufacturers has never been greater. The following list highlights the top nine manufacturers leading innovation and quality in this expanding sector.

Top 9 Teflon Ring Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Teflon Encapsulated O

Domain Est. 1998 | Founded: 1987

Website: m-cor.com

Key Highlights: We have been manufacturing Teflon® encapsulated o-rings, CamLock encapsulated gaskets, and high performance sealing products since 1987. Additionally, our ……

#2 Leading Teflon O

Domain Est. 2002

Website: o-rings.org

Key Highlights: Quickly access the USA’s leading teflon o-ring manufacturers and industrial suppliers making premium quality, custom engineered products that are available….

#3 O-Rings, Caps, Gaskets and Plugs

Domain Est. 2004

Website: azseal.com

Key Highlights: Arizona Sealing Devices, Inc. is a Distributor of Military and Standard Rings, Gaskets, Sheeting, Back Up Rings, Quad Rings, Oil Seals, Clamps, Cord Stock, ……

#4 Seals and O-Rings

Domain Est. 1995

Website: ph.parker.com

Key Highlights: … WEB VERSION”,”document-type”:”Static File”,”document-url”:”https://www … PTFE Lip Seal Design Guide–EPS 5340″,”document-type”:”Static File ……

#5 Freudenberg Sealing Technologies

Domain Est. 1995

Website: fst.com

Key Highlights: Freudenberg Sealing Technologies is a proven supplier for demanding products and applications, and a development and service partner to customers….

#6 PTFE O-Rings

Domain Est. 1996

Website: trelleborg.com

Key Highlights: PTFE O-Ring for axial static face or flange-type applications. Resistant to practically all chemicals and to high temperatures. Available in any required size….

#7 Teflon O

Domain Est. 1997

Website: marcorubber.com

Key Highlights: Looking for high performance plastics? Explore Teflon® o-rings and a number of other product material options from Marco Rubber — the o-ring industry ……

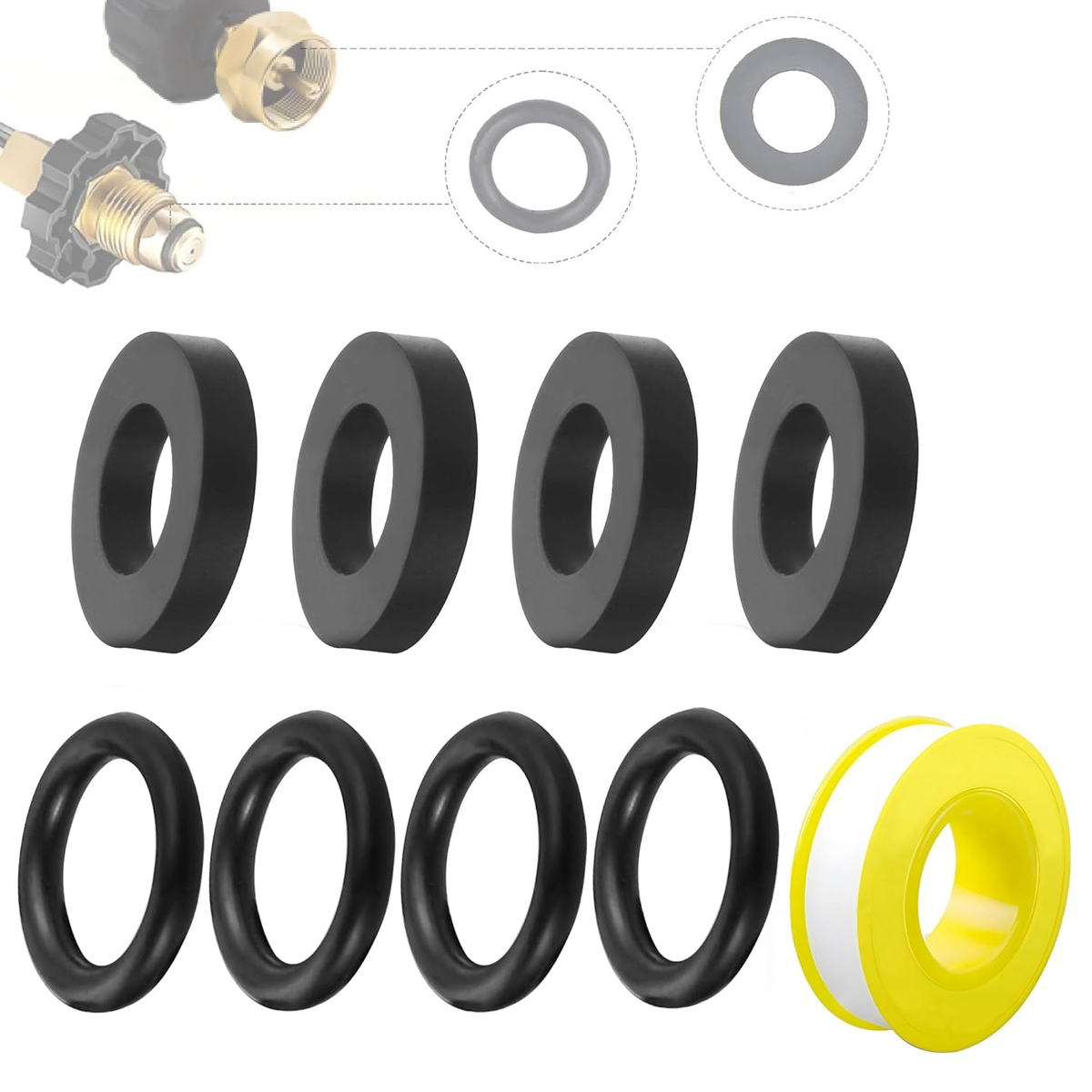

#8 PTFE (Teflon) O

Domain Est. 2007

Website: globaloring.com

Key Highlights: Teflon o-rings are known for high heat resistance, high resistance to chemical agents and solvents, anti-adhesiveness, dielectric properties, low friction ……

#9 PTFE Seal Rings

Domain Est. 2018

Website: kelcoind.com

Key Highlights: High-performance PTFE seal rings from WCT. Custom configurations and precision cuts ensure superior chemical and wear resistance….

Expert Sourcing Insights for Teflon Ring

H2: Projected Market Trends for Teflon Rings in 2026

The global market for Teflon (PTFE) rings is expected to experience steady growth by 2026, driven by rising demand across key industrial sectors and advancements in material engineering. Several macroeconomic, technological, and regional factors are shaping the trajectory of this specialized polymer component market.

1. Increasing Industrial Demand

Teflon rings are critical in applications requiring high thermal stability, chemical resistance, and low friction. By 2026, expanding industries such as aerospace, automotive, semiconductor manufacturing, and oil & gas are projected to boost demand. In particular, the aerospace and defense sectors are anticipated to lead consumption due to stringent performance requirements in extreme environments.

2. Growth in Semiconductor and Electronics Manufacturing

With the global push toward advanced electronics and semiconductor production—especially in Asia-Pacific countries like China, South Korea, and Taiwan—Teflon rings are increasingly used in wafer processing equipment and cleanroom environments. Their non-contaminating and dielectric properties make them ideal for precision applications, supporting market expansion through 2026.

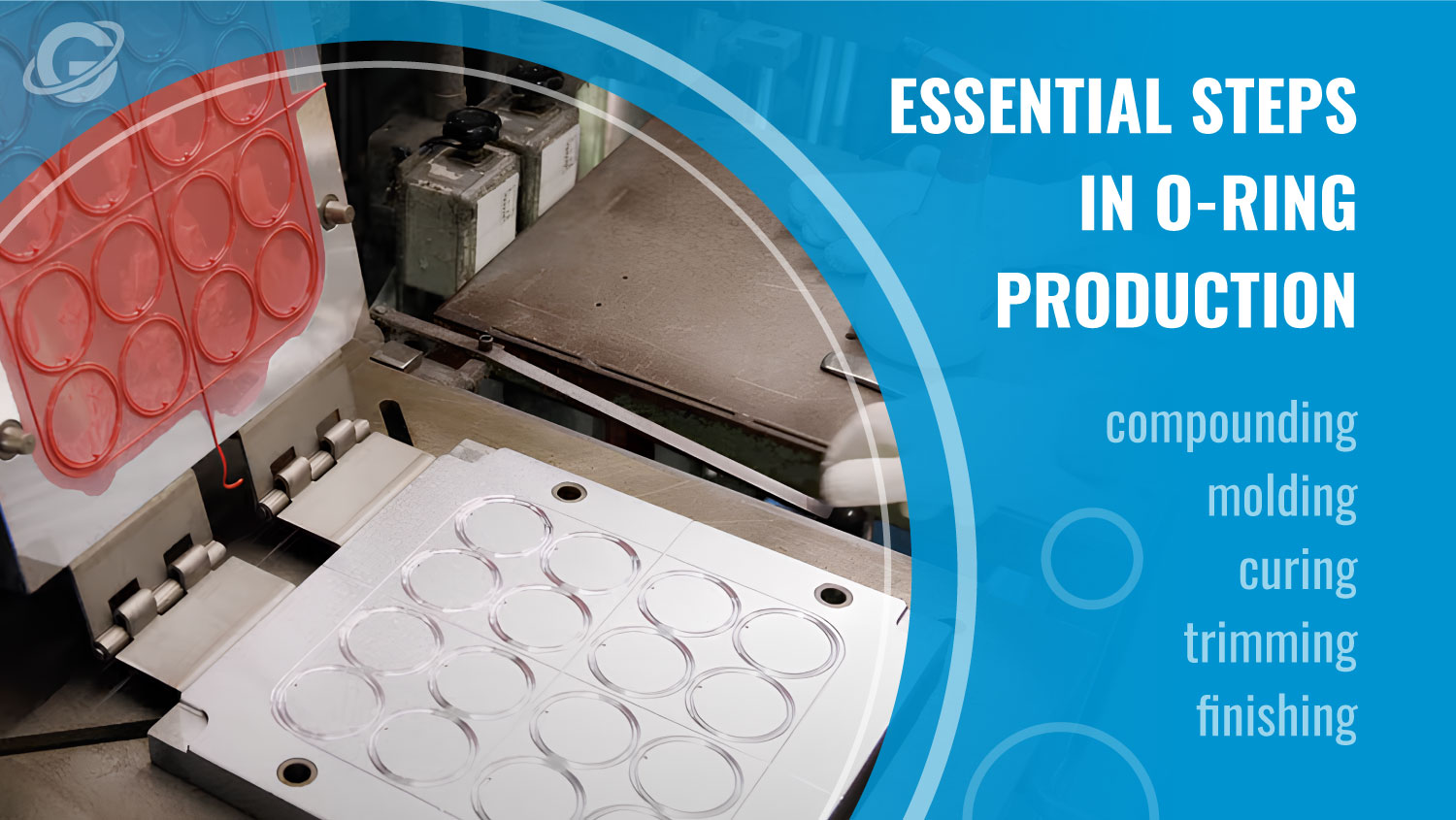

3. Technological Advancements and Customization

Manufacturers are investing in modified PTFE formulations (e.g., filled Teflon with glass, carbon, or graphite) to enhance mechanical strength and wear resistance. This trend toward high-performance, application-specific Teflon rings is expected to gain momentum, allowing suppliers to command premium pricing and cater to niche markets.

4. Regional Market Dynamics

Asia-Pacific is projected to dominate the Teflon ring market by 2026, fueled by rapid industrialization, infrastructure development, and government support for high-tech manufacturing. North America and Europe will maintain strong demand, particularly in the chemical processing and pharmaceutical industries, where regulatory compliance favors inert and non-reactive sealing materials.

5. Sustainability and Regulatory Pressures

Environmental concerns surrounding fluoropolymer production may influence market dynamics. While PTFE itself is chemically inert and safe in end-use, scrutiny over PFAS (per- and polyfluoroalkyl substances) in manufacturing processes could lead to stricter regulations. Companies are responding by adopting cleaner production methods and investing in recyclable or bio-based alternatives, although full substitution remains unlikely due to performance limitations.

6. Supply Chain Resilience and Raw Material Costs

Fluctuations in the price of fluorinated raw materials, along with supply chain disruptions, could impact profit margins. However, localized manufacturing and strategic stockpiling are expected to mitigate risks. Leading chemical companies such as Chemours, Daikin, and Saint-Gobain are likely to strengthen vertical integration to ensure consistent quality and supply.

Conclusion

By 2026, the Teflon ring market is poised for moderate but resilient growth, supported by technological innovation and sector-specific demand. While regulatory and environmental challenges persist, the unmatched performance characteristics of PTFE ensure its continued relevance in critical sealing and insulation applications across high-value industries.

Common Pitfalls When Sourcing Teflon Rings: Quality and Intellectual Property Risks

Sourcing Teflon® rings—especially those made from PTFE (Polytetrafluoroethylene)—involves navigating several critical challenges related to material quality and intellectual property (IP) protection. Avoiding these pitfalls is essential to ensure product performance, regulatory compliance, and legal safety.

Quality-Related Pitfalls

1. Substandard Material Composition

A major risk is receiving rings made from inferior or non-conforming PTFE material. Some suppliers may substitute genuine virgin PTFE with regrind, recycled content, or lower-grade polymers. This compromises key properties such as chemical resistance, thermal stability (typically -200°C to +260°C), and mechanical strength. Always verify material certifications (e.g., ASTM D1710, ISO 13000) and request test reports for density, tensile strength, and elongation.

2. Inconsistent Manufacturing Processes

Poor sintering, molding, or machining processes lead to voids, cracks, or dimensional inaccuracies. Under-sintered PTFE lacks structural integrity, while over-sintering can cause brittleness. Ensure suppliers follow controlled molding and curing procedures, and require dimensional inspection reports (e.g., using CMM or optical measurement).

3. Lack of Traceability and Certification

Without proper material traceability (e.g., batch numbers, mill test reports), it’s impossible to verify compliance with industry standards (e.g., FDA, USP Class VI, NSF) for food, pharmaceutical, or semiconductor applications. Insist on full documentation and third-party certification where applicable.

4. Inadequate Quality Control Testing

Some suppliers conduct minimal or no in-house testing. Confirm that the supplier performs essential quality checks such as visual inspection, dimensional verification, and performance testing (e.g., leak testing, compression set). ISO 9001 certification is a baseline indicator of a robust quality management system.

Intellectual Property (IP) Pitfalls

1. Trademark Infringement: Misuse of “Teflon®”

“Teflon®” is a registered trademark of Chemours (formerly DuPont) and applies only to products made from their fluoropolymer resins. Suppliers may falsely label generic PTFE rings as “Teflon®” to imply authenticity. This misrepresentation can expose buyers to legal liability. Always clarify whether the product uses genuine Chemours Teflon® or generic PTFE, and verify trademark compliance in contracts.

2. Unauthorized Use of Proprietary Designs or Grades

Some high-performance PTFE formulations (e.g., filled grades with glass, carbon, or bronze) are protected by patents or trade secrets. Sourcing rings that replicate proprietary blends without authorization can lead to IP infringement claims. Ensure suppliers have rights to the formulations they use, and avoid reverse-engineered or “compatible” claims unless properly licensed.

3. Lack of IP Warranty in Supply Agreements

Many procurement contracts fail to include IP indemnification clauses. Without these, the buyer assumes the risk if the sourced rings infringe on third-party patents or trademarks. Include explicit warranties that the products do not violate any IP rights and require the supplier to defend against claims.

4. Counterfeit or Gray Market Products

Illegitimate suppliers may offer “Teflon®” rings at suspiciously low prices, which are often counterfeit or diverted from authorized channels. These products lack quality assurance and may breach IP rights. Source only from authorized distributors or certified manufacturers with verifiable supply chains.

Mitigation Strategies

To avoid these pitfalls:

– Conduct supplier audits and request material test reports (MTRs).

– Specify material requirements using correct terminology (e.g., “virgin PTFE per ASTM D1710” instead of “Teflon®” unless licensed).

– Include IP warranties and indemnification clauses in purchase agreements.

– Partner with reputable, certified suppliers and verify trademark usage.

By addressing both quality and IP concerns proactively, organizations can ensure reliable performance and legal compliance when sourcing PTFE rings.

Logistics & Compliance Guide for Teflon Rings

Overview of Teflon Rings

Teflon rings, typically made from Polytetrafluoroethylene (PTFE), are widely used in sealing applications across industries such as chemical processing, pharmaceuticals, food and beverage, and aerospace due to their excellent chemical resistance, high-temperature tolerance, and low friction properties. Proper logistics and compliance handling are essential to ensure product integrity, regulatory adherence, and safe distribution.

Regulatory Classification & Compliance

Chemical & Material Regulations

Teflon (PTFE) is generally considered chemically inert and stable under normal conditions. However, compliance with the following regulations is required during manufacturing, transport, and handling:

– REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) – PTFE is exempt from registration under REACH (Annex V, Entry 7) due to its low solubility and stability. Ensure no intentionally added substances (e.g., processing aids) are subject to authorization or restriction.

– RoHS (Restriction of Hazardous Substances) – PTFE itself is compliant; verify absence of lead, cadmium, or other restricted substances in additives or fillers (e.g., glass-filled PTFE).

– FDA Compliance – For rings used in food, beverage, or pharmaceutical applications, ensure compliance with FDA 21 CFR §177.1550 for PTFE intended for repeated use in food contact.

Transportation & Safety Compliance

– GHS/CLP Classification – Solid PTFE is not classified as hazardous under GHS. However, thermal decomposition above 300°C may release toxic fumes (e.g., hydrogen fluoride); provide Safety Data Sheet (SDS) accordingly.

– UN/DOT Regulations – PTFE rings are not classified as dangerous goods for transport under UN Model Regulations when in solid form and not overheated. No special labeling required for standard shipments.

– IATA/IMDG – Non-hazardous for air and sea freight under normal conditions. Declare as “Non-hazardous material” if requested by carrier.

Packaging & Handling Requirements

Packaging Standards

– Use anti-static or non-abrasive packaging (e.g., polyethylene bags, foam inserts) to prevent surface damage or contamination.

– For bulk shipments, use rigid containers with dividers to avoid deformation.

– Clearly label packages with part number, material (PTFE), batch/lot number, and compliance markings (e.g., FDA, RoHS if applicable).

Storage Conditions

– Store in a clean, dry, and temperature-controlled environment (15–30°C).

– Avoid direct sunlight and exposure to strong UV sources to prevent long-term degradation.

– Keep away from strong oxidizing agents and molten alkali metals.

– Shelf life: Indefinite under proper storage conditions; inspect for physical damage prior to use.

Shipping & Logistics

Domestic & International Transport

– No special permits required for standard PTFE rings.

– For export, ensure compliance with destination country regulations (e.g., China RoHS, UK REACH post-Brexit).

– Maintain documentation including Certificate of Conformance (CoC), Material Test Report (MTR), and SDS.

Customs Documentation

– Harmonized System (HS) Code: Typically 3920.93 (PTFE in primary forms, including rings). Confirm with local customs authority.

– Provide accurate commercial invoice stating description, quantity, value, origin, and material composition.

Environmental & Disposal Considerations

- PTFE is non-biodegradable and thermally stable.

- Incineration must be conducted in controlled facilities with emissions scrubbing due to potential release of toxic gases at high temperatures.

- Landfill disposal is permitted in most jurisdictions but not recommended; consider recycling through specialized polymer reclaimers.

Quality Assurance & Traceability

- Implement batch traceability through lot numbering and documentation.

- Conduct routine quality checks per ISO 9001 or industry-specific standards (e.g., ASME B16.21 for gaskets).

- Retain compliance records for minimum of 5 years or per customer requirements.

Summary of Key Actions

- Verify material compliance (REACH, RoHS, FDA as applicable).

- Package to prevent contamination and physical damage.

- Ship as non-hazardous material with proper documentation.

- Maintain traceability and retain compliance records.

- Follow destination-specific regulations for international shipments.

This guide ensures safe, compliant, and efficient logistics for Teflon rings across the supply chain.

Conclusion for Sourcing Teflon Rings:

After a thorough evaluation of suppliers, material specifications, cost considerations, and quality standards, sourcing Teflon (PTFE) rings is best achieved through a balanced approach that prioritizes material authenticity, dimensional accuracy, and supplier reliability. Teflon rings are critical in applications requiring chemical resistance, low friction, and high-temperature performance, making it essential to source from certified suppliers who comply with industry standards such as ASTM D3295 or ISO 3303.

Both domestic and international suppliers offer competitive pricing, but long-term performance and consistency should outweigh initial cost savings. Preferred suppliers should provide material traceability, testing reports, and customization capabilities to meet specific engineering requirements. Additionally, establishing strong quality assurance protocols, including incoming inspection and periodic audits, ensures continued reliability of the sourced Teflon rings.

In conclusion, successful sourcing involves a strategic partnership with qualified suppliers, adherence to technical specifications, and ongoing performance monitoring—ensuring that Teflon rings deliver optimal performance in their intended applications across industries such as automotive, aerospace, pharmaceuticals, and semiconductor manufacturing.