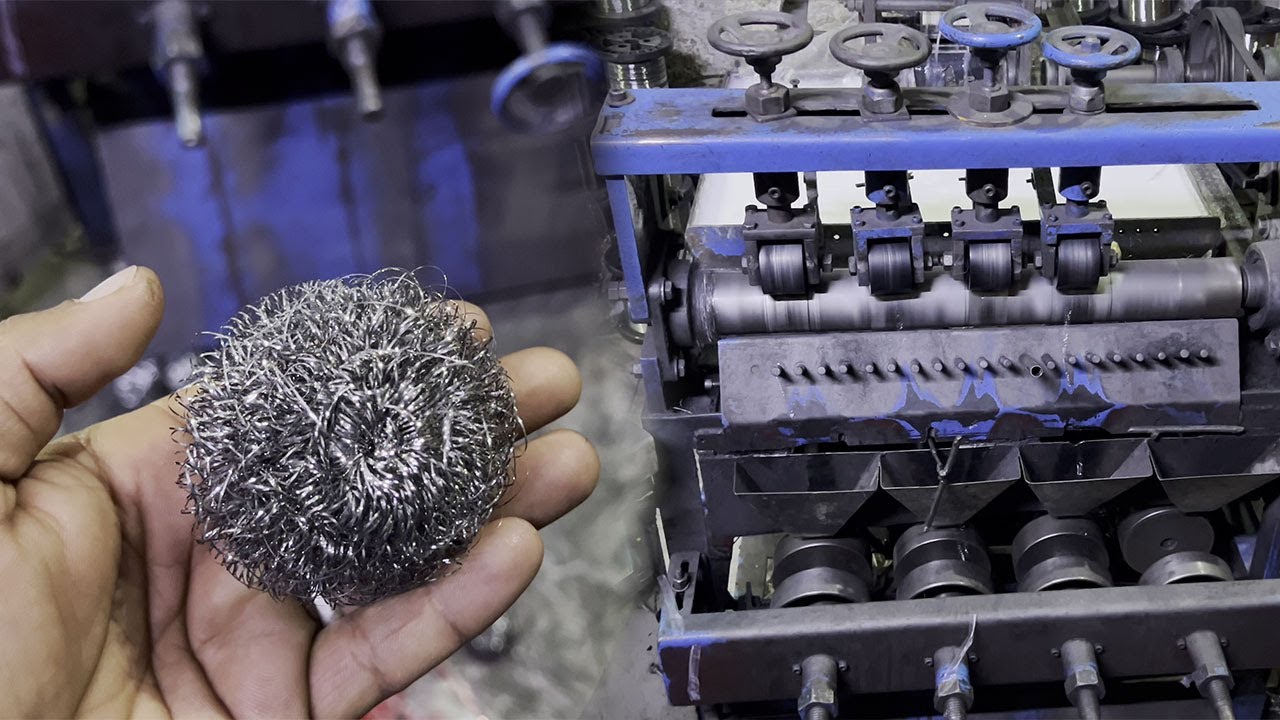

The global stainless steel cleaning products market has seen steady expansion in recent years, driven by rising demand for effective, non-abrasive cleaning solutions across residential, commercial, and industrial sectors. According to a 2023 report by Mordor Intelligence, the market for stainless steel maintenance products, including specialty sponges and cleaning pads, is projected to grow at a CAGR of approximately 5.2% from 2023 to 2028. This growth is fueled by increasing hygiene standards, widespread use of stainless steel in kitchens and food processing environments, and the need for scratch-free cleaning tools that preserve surface integrity. As a result, manufacturers of stainless steel sponges are prioritizing innovation in material science—integrating microfiber, non-scratch polymers, and dual-layer designs—to enhance performance and durability. In this competitive landscape, seven manufacturers have emerged as leaders, combining technical expertise, scalable production, and sustainability practices to meet the evolving needs of global consumers and industrial clients alike.

Top 7 Sponge For Stainless Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

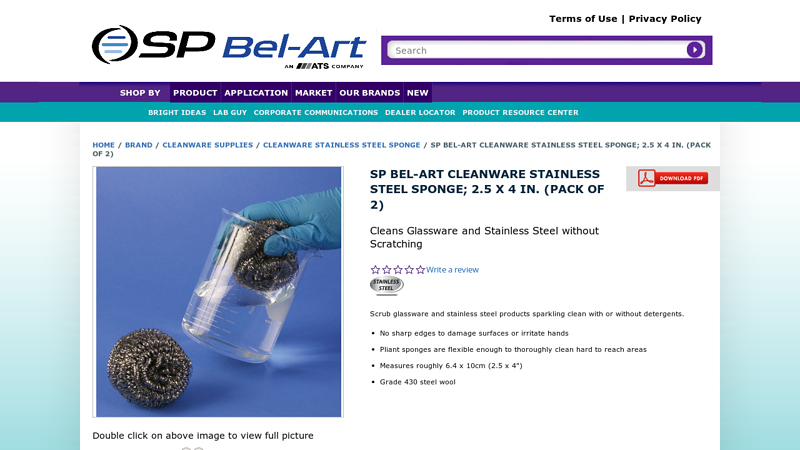

#1 SP Bel

Domain Est. 1996

#2 Advantage® Stainless Steel Sponge

Domain Est. 1999

Website: empirejanitorial.com

Key Highlights: Available in 35 or 50 gram. Large curled stainless steel, which provides durable abrasive scrubbing of grills, ovens and roasting pans. Add to Cart….

#3 Royal Paper AmerCareRoyal® Stainless Steel Sponge

Domain Est. 2002

Website: bettymills.com

Key Highlights: In stock Rating 5.0 1 Crafted from durable stainless steel and featuring a neutral gray color, these sponges are an essential tool for any cleaning arsenal. Manufactured by Royal…

#4 Stainless Steel Sponge

Domain Est. 2003

Website: lancelotjanitorial.com

Key Highlights: Will not rust or splinter. Commercial Series Stainless Steel: sturdy, yet economical. Provides durable abrasive scrubbing of grills, ovens and roasting pans….

#5 SPG

Domain Est. 2004

Website: wincous.com

Key Highlights: Stainless Steel Scrubbing Sponge – 50 grams. SKU: SPG-50. Size: 50 g. Features: Collections Back of House, Cleaning Accessories, Janitorial & Sponges….

#6 Stainless Steel Sponge

Domain Est. 2016

Website: laboratorysales.com

Key Highlights: 1–2 day deliveryDurable sponges clean without scratching. Use with or without detergents. Grade 430 Stainless Steel wool. Measurements: 64mm x 100mm (2.5″ x 4″)….

#7 Scrubbing Sponge Stainless Steel 12/Pack

Domain Est. 2017

Website: imperialdade.com

Key Highlights: Each pack contains 12 sponges made with durable stainless steel material that can handle even the most demanding cleaning tasks. Whether used to scrub grease, ……

Expert Sourcing Insights for Sponge For Stainless Steel

H2: Projected Market Trends for Sponge in Stainless Steel Applications by 2026

The global market for sponge materials used in stainless steel cleaning and maintenance is poised for moderate yet steady growth by 2026, driven by increased demand in household, industrial, and commercial sectors. While “sponge for stainless steel” typically refers to non-abrasive cleaning tools designed specifically to preserve the finish of stainless steel surfaces, market dynamics are being reshaped by sustainability trends, material innovation, and evolving consumer preferences.

1. Rising Demand in Household and Commercial Kitchens

By 2026, the residential and food service industries are expected to remain key drivers of demand. With stainless steel being a preferred material for kitchen appliances, countertops, and equipment due to its durability and hygienic properties, consumers and businesses alike are investing in specialized cleaning tools. Sponges tailored for stainless steel—often infused with mild abrasives or waxes to enhance shine without scratching—are witnessing increased adoption, particularly in urban households and high-end commercial kitchens.

2. Shift Toward Eco-Friendly and Biodegradable Materials

Environmental concerns are significantly influencing product development. Traditional synthetic sponges made from polyurethane or polyester are facing scrutiny due to microplastic shedding and non-biodegradability. In response, manufacturers are introducing plant-based alternatives such as cellulose, loofah, and bamboo fiber sponges. By 2026, eco-friendly sponges are projected to capture a growing market share, especially in regions with stringent environmental regulations like the European Union and North America.

3. Innovation in Multi-Layer and Hybrid Sponge Designs

Product differentiation is accelerating through innovation. Hybrid sponges combining a soft foam side with a fine abrasive pad (e.g., melamine or non-scratch nylon) are gaining popularity for their versatility. Some advanced versions include antimicrobial coatings to prevent bacterial growth—a key selling point in healthcare and food processing environments. These value-added features are expected to boost average selling prices and support market expansion.

4. Expansion in Industrial and Maintenance Applications

Beyond domestic use, industrial maintenance of stainless steel surfaces in pharmaceutical, automotive, and manufacturing facilities is creating new opportunities. Sponges used in cleaning large-scale stainless steel tanks, conveyors, and machinery require higher durability and chemical resistance. Specialized industrial-grade sponges, often compatible with cleaning solvents and sanitizers, are anticipated to see rising demand, particularly in emerging economies undergoing industrial modernization.

5. E-Commerce and Private Label Growth

Online retail platforms are playing a crucial role in market penetration. By 2026, e-commerce is expected to account for over 35% of sponge sales for stainless steel, fueled by subscription models, bundled cleaning kits, and direct-to-consumer branding. Private label and store-brand sponges are also gaining traction, offering competitive pricing and customized formulations that appeal to cost-conscious buyers.

6. Regional Market Dynamics

Asia-Pacific is projected to be the fastest-growing region, led by China, India, and Southeast Asia, due to rising urbanization, appliance ownership, and food service expansion. North America and Europe will maintain strong demand, with a focus on premium and sustainable products. Latin America and the Middle East represent emerging markets with untapped potential, particularly in commercial infrastructure development.

Conclusion

By 2026, the sponge for stainless steel market will be characterized by a blend of innovation, sustainability, and expanded application scope. Companies that invest in eco-conscious materials, product differentiation, and digital distribution channels are likely to gain a competitive edge. As stainless steel continues to dominate modern surfaces across industries, the complementary cleaning tools market—especially purpose-built sponges—will remain resilient and adaptive to evolving global trends.

Common Pitfalls When Sourcing Sponge for Stainless Steel (Quality & IP)

Sourcing the right sponge for stainless steel cleaning and polishing may seem straightforward, but several quality and intellectual property (IP)-related pitfalls can lead to subpar results, damage to surfaces, or even legal issues. Being aware of these risks ensures you select a reliable, effective, and compliant product.

1. Poor Material Quality Leading to Surface Damage

One of the most frequent issues is selecting sponges made from low-grade abrasives or binders. Inferior sponges may contain overly aggressive particles (such as coarse silicon carbide or poorly graded minerals) that scratch or dull stainless steel surfaces. Additionally, inconsistent binder quality can cause the abrasive granules to dislodge prematurely, leaving residue or causing micro-scratches. Always verify the abrasive grade and backing material—opt for products specifically engineered for stainless steel to maintain its finish and corrosion resistance.

2. Misrepresentation of Performance Claims

Suppliers may exaggerate a sponge’s cutting power, longevity, or compatibility with stainless steel. For example, a product advertised as “non-scratching” might still leave swirl marks if the abrasive is too coarse or unevenly distributed. Be cautious of generic performance claims without independent testing data or certifications. Request technical data sheets and, if possible, conduct side-by-side testing with trusted brands before large-scale procurement.

3. Use of Counterfeit or Knockoff Products

The market includes counterfeit sponges that mimic well-known brands but fail to meet quality standards. These knockoffs often use cheaper materials and may not adhere to safety or environmental regulations. Purchasing such products not only risks poor performance but may also expose your business to liability if the sponge contributes to surface damage or worker injury. Verify supplier authenticity and look for tamper-evident packaging or brand authentication features.

4. Intellectual Property Infringement Risks

Some suppliers manufacture sponges that replicate patented designs, such as specific abrasive patterns, layered construction, or ergonomic shapes. Using such products—even unknowingly—can expose your organization to IP infringement claims, especially in regulated industries or export markets. Always source from reputable manufacturers who can provide proof of IP compliance or licensing agreements. Avoid suppliers offering “compatible” or “generic” versions of proprietary products unless legal rights are clearly established.

5. Inadequate Regulatory or Safety Compliance

Low-quality sponges may contain restricted substances (e.g., heavy metals, hazardous binders) that violate environmental or workplace safety regulations like REACH, RoHS, or OSHA standards. Non-compliant products pose health risks to workers and may lead to fines or import restrictions. Ensure your supplier provides full material disclosure and relevant compliance documentation.

6. Inconsistent Batch-to-Batch Quality

Especially with overseas or low-cost suppliers, there can be significant variability in sponge composition, abrasive distribution, or durability between production batches. This inconsistency affects cleaning performance and can result in unpredictable results across your operations. Establish quality control agreements and conduct regular batch testing to maintain consistency.

By paying close attention to material specifications, supplier credibility, and IP compliance, you can avoid these common pitfalls and ensure your stainless steel cleaning process remains effective, safe, and legally sound.

Logistics & Compliance Guide for Sponge For Stainless Steel

Product Classification and HS Code

The “Sponge For Stainless Steel” is typically classified as an abrasive or cleaning tool used specifically for stainless steel surfaces. The appropriate Harmonized System (HS) code may vary by country, but a common classification is 6802.91 (Abrasive articles with a basis of natural or synthetic abrasives, for hand use). Confirm the correct HS code with your local customs authority to ensure accurate tariff application and compliance.

Packaging and Labeling Requirements

Package the sponges in moisture-resistant, durable materials to prevent contamination or degradation during transit. Each unit or batch should be clearly labeled with the following:

– Product name: “Sponge For Stainless Steel”

– Material composition (e.g., non-scratch polyester, embedded cleaning agents)

– Manufacturer or supplier name and address

– Country of origin

– Batch or lot number

– Safety warnings, if applicable (e.g., “For external use only,” “Avoid contact with eyes”)

Ensure labeling complies with destination country regulations, including language requirements.

Transportation and Storage

Transport sponges in dry, well-ventilated conditions, away from direct sunlight and extreme temperatures. Use sealed containers or pallet covers to prevent dust, moisture, or contamination. Store in a clean, dry warehouse with temperatures between 10°C and 30°C. Avoid stacking excessive weight to prevent compression damage to packaging.

Regulatory Compliance

Verify compliance with relevant chemical and product safety regulations, especially if the sponge contains cleaning agents or coatings. In the European Union, ensure conformity with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations. In the United States, comply with EPA and OSHA guidelines if applicable. Provide Safety Data Sheets (SDS) upon request.

Import/Export Documentation

Prepare and maintain the following documents for international shipments:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of origin (if required)

– Export declaration (as per country requirements)

– Any applicable permits or conformity certificates

Ensure all documents accurately describe the product and its intended use to prevent customs delays.

Environmental and Disposal Considerations

Dispose of used sponges in accordance with local waste management regulations. If the product contains non-biodegradable or hazardous materials, provide disposal guidance to end users. Encourage recycling where facilities exist and communicate any eco-friendly attributes of the product (e.g., recyclable packaging).

Quality Control and Traceability

Implement a quality assurance process to inspect incoming and outgoing sponge batches for defects, contamination, or non-conformance. Maintain traceability records (e.g., batch numbers, manufacturing dates, shipping logs) for at least two years to support recalls or compliance audits.

In conclusion, sourcing the right sponge for cleaning and polishing stainless steel is crucial to maintaining its appearance, durability, and corrosion resistance. It is recommended to use non-abrasive, stainless steel-specific sponges—such as white non-scratch scouring pads or microfiber cloths—to avoid surface scratching, contamination, and rust formation. Avoid steel wool or green abrasive sponges, as they can leave iron particles that promote rusting. When sourcing, prioritize quality, compatibility, and supplier reliability, ensuring the product is explicitly labeled for use on stainless steel. By selecting the appropriate sponge and following proper cleaning techniques, you can preserve the aesthetic and functional integrity of stainless steel surfaces in both industrial and household applications.