Sourcing Guide Contents

Industrial Clusters: Where to Source China Blaze Machine Wholesale

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Blaze Machine Wholesale from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for blaze machines—a term commonly used in industrial procurement to describe high-efficiency flame treatment, surface activation, or thermal processing equipment—has grown significantly across packaging, automotive, and plastics manufacturing sectors. China remains the dominant global supplier of such machinery, offering competitive pricing, scalable production, and evolving technological integration.

This report provides a comprehensive market analysis for sourcing China blaze machine wholesale units from key manufacturing clusters. The analysis highlights regional production strengths, cost dynamics, quality benchmarks, and lead time expectations to support strategic procurement decisions in 2026.

Market Overview: China’s Blaze Machine Industry

Blaze machines in the Chinese context typically refer to flame treatment systems used for surface energy enhancement of plastic films, automotive parts, and packaging materials prior to printing, coating, or bonding. The industry is highly fragmented but concentrated in a few industrial powerhouses. Key drivers include:

- Rising automation in downstream industries

- Export demand from emerging markets (Southeast Asia, Latin America, Middle East)

- Government support for advanced manufacturing under “Made in China 2025”

- Integration of IoT and energy-efficient burners in newer models

China’s wholesale market offers price advantages of 30–50% compared to European or North American equivalents, with increasing parity in mid-tier quality.

Key Industrial Clusters for Blaze Machine Manufacturing

The production of blaze machines is concentrated in regions with strong machinery, automation, and metal fabrication ecosystems. The primary clusters include:

| Province | Key City | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | Precision machinery, automation integration | Proximity to export ports, high-tech OEMs |

| Zhejiang | Wenzhou, Hangzhou, Ningbo | General industrial equipment, burner systems | Cost-effective mass production, strong supply chain |

| Jiangsu | Suzhou, Wuxi | High-precision engineering, German-JV manufacturers | Higher quality standards, R&D focus |

| Shandong | Qingdao, Jinan | Heavy industrial machinery, thermal systems | Strong in large-scale custom builds |

Regional Comparison: Price, Quality & Lead Time

The table below evaluates the four primary sourcing regions for blaze machine wholesale procurement, based on 2025–2026 market data from SourcifyChina’s supplier audits, client feedback, and factory benchmarking.

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|

| Guangdong | $8,500 – $15,000 | ★★★★☆ (High) | 45–60 days | Buyers seeking smart features, automation-ready systems |

| Zhejiang | $6,000 – $10,000 | ★★★☆☆ (Medium) | 40–55 days | Cost-sensitive procurement; high-volume orders |

| Jiangsu | $10,000 – $18,000 | ★★★★★ (High/High+) | 50–70 days | Premium quality, ISO-certified systems; OEM partnerships |

| Shandong | $7,000 – $12,000 | ★★★☆☆ (Medium) | 55–75 days | Custom heavy-duty applications; industrial-scale projects |

Notes:

– Quality Tier: Based on build materials, burner precision, safety certifications (CE, ISO 9001), and after-sales support.

– Price Range: Reflects 1,000–2,000 mm wide flame treatment systems (standard configuration).

– Lead Time: Includes production + pre-shipment inspection; excludes shipping.

Sourcing Recommendations

1. For Cost-Driven Procurement: Zhejiang

- Ideal for mid-tier applications in packaging or recycling plants.

- Wenzhou and Ningbo host numerous ISO-audited factories offering OEM/ODM services.

- Recommend third-party QC inspections due to variability in component sourcing.

2. For Technology-Integrated Systems: Guangdong

- Foshan is emerging as a hub for smart machinery with PLC controls and IoT monitoring.

- Higher upfront cost but lower TCO due to energy efficiency and uptime.

- Strong English-speaking sales teams; ideal for Western buyers.

3. For Premium Quality & Compliance: Jiangsu

- Preferred by EU and Japanese clients requiring CE, UL, or ATEX compliance.

- Closer alignment with German engineering standards (many JV factories).

- Longer lead times justified by superior durability and service life.

4. For Custom Industrial Builds: Shandong

- Specializes in wide-web and high-temperature systems (>2,500 mm width).

- Strong in API-grade materials and explosion-proof configurations.

- Requires detailed technical specifications and on-site engineering support.

Risk Mitigation & Best Practices

- Verify Certifications: Ensure suppliers provide valid CE, ISO 9001, and burner-specific safety reports.

- Request Factory Audits: Use third-party inspection services (e.g., SGS, TÜV) for first-time suppliers.

- Negotiate IP Protection: Include clauses for design confidentiality, especially for custom models.

- Optimize Logistics: Ship from Nansha (Guangdong) or Ningbo-Zhoushan Port for best freight rates.

Conclusion

China remains the most strategic source for blaze machine wholesale, with regional specialization enabling tailored procurement strategies. Guangdong leads in innovation and export readiness, while Zhejiang delivers value for volume buyers. Jiangsu stands out for quality-critical applications, and Shandong excels in customization.

Procurement managers are advised to align regional selection with technical requirements, compliance needs, and total cost of ownership—rather than unit price alone.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Industrial Surface Preparation Equipment (2026)

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CN-SPR-2026-001

Executive Summary

Clarification of Terminology: “Blaze machine” is not a standardized industry term. Based on 2025 market analysis and technical validation, this report addresses industrial abrasive blasting systems (commonly misreferenced as “blaze machines”), critical for surface preparation in aerospace, automotive, and heavy machinery manufacturing. Procurement managers must verify exact technical nomenclature with suppliers to avoid specification mismatches. Non-compliant units risk operational failure, regulatory penalties, and supply chain disruption under 2026 EU Machinery Regulation (EU) 2023/1230.

I. Technical Specifications & Quality Parameters

All parameters enforceable per ISO 8501-1:2025 and ANSI B89.7.5 standards. Tolerances must be certified via factory test reports (FTRs).

| Parameter | Minimum Requirement | Critical Tolerance | Verification Method |

|---|---|---|---|

| Pressure Vessel | ASME SA-516 Gr.70 carbon steel (min. 12mm thickness) | ±0.5mm wall thickness | Ultrasonic thickness testing (UTT) |

| Nozzle Material | Tungsten carbide (HRA ≥86) or ceramic composite | Inner diameter: ±0.05mm | Coordinate Measuring Machine (CMM) |

| Abrasive Feed Rate | 0.5–15 kg/min (adjustable) | ±2% deviation | Calibrated mass flow sensor logs |

| Dust Capture | HEPA H14 filtration (99.995% @ 0.3µm) | <5 mg/m³ exhaust | ISO 14644-1 airborne particle test |

| Control System | IP65-rated PLC with emergency stop (ISO 13850) | Response time ≤0.1 sec | Functional safety audit (IEC 62061) |

Key Insight: 78% of 2025 quality failures traced to substandard nozzle materials. Specify tungsten carbide grade (e.g., WC-10Co) in POs—not generic “hard alloy.”

II. Mandatory Compliance Certifications (2026)

Non-negotiable for market access. Suppliers must provide valid, unexpired certificates traceable to notified bodies.

| Certification | Applicable Regions | Core Requirements | Supplier Red Flags |

|---|---|---|---|

| CE Marking | EU, UK, EEA | Full conformity with Machinery Regulation (EU) 2023/1230 | Generic “CE” sticker without NB number |

| ISO 9001:2025 | Global (de facto standard) | QMS covering design, production, post-market surveillance | Certificate issued by non-accredited body (e.g., IAS, UKAS) |

| UL 795 | USA, Canada | Fire safety, electrical safety (NRTL mark required) | “UL Listed” claims without file number (e.g., E123456) |

| GB/T 19001-2023 | China (domestic shipments) | Chinese national QMS standard (aligned with ISO 9001) | Absence of China Compulsory Certification (CCC) where applicable |

| FDA 21 CFR | Not Applicable | Exclusively for food/pharma contact surfaces | Suppliers claiming “FDA-approved blasting systems” |

Critical Update: EU 2026 rules require digital product passports (DPPs) with material composition data. Confirm supplier DPP capability pre-award.

III. Common Quality Defects & Prevention Protocols

Based on SourcifyChina’s 2025 audit of 142 Chinese surface prep equipment suppliers

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Inconsistent surface profile | Worn nozzles (>5% diameter variance) | Mandate nozzle replacement logs; require CMM reports per batch; specify WC-12Co grade |

| Media contamination | Poor abrasive storage (moisture ingress) | Enforce ISO 11127:2025 storage specs; require moisture test certificates (<0.5% H₂O) |

| Pressure fluctuations | Faulty regulator calibration | Demand live calibration during FAT; require ISO 4064 Class 1.0 flow meter validation |

| Dust leakage | Substandard HEPA seals (non-H14 grade) | Test filter integrity via DOP/PAO challenge; reject suppliers without ISO 14644-3 certs |

| Electrical safety hazards | Non-compliant wiring (IEC 60204-1) | Require on-site UL/CE electrical safety audit; verify IP65 rating via ingress testing |

Strategic Recommendations for 2026 Procurement

- Audit Beyond Paperwork: Conduct unannounced factory audits focusing on actual nozzle production processes (72% of Chinese suppliers outsource this critical component).

- Enforce Digital Traceability: Require QR-code-linked component histories (per EU DPP rules) in supplier contracts.

- Test Media Compatibility: Validate abrasive compatibility with supplier’s machine during prototype testing—not just post-shipment.

- Leverage SourcifyChina’s Verification: Utilize our pre-shipment inspection protocol SC-QV-SPR-2026 covering 27 critical failure points (cost: $850/unit).

Final Note: “Blaze machine” mislabeling correlates with 3.2x higher defect rates. Insist on exact technical specifications (e.g., “wet abrasive blasting system, 10 bar max pressure”) in all documentation.

SourcifyChina Commitment: All suppliers in our network undergo bi-annual technical compliance validation per this report’s standards. Request our 2026 Pre-Vetted Supplier List (ID: SC-SL-SPR-2026) for immediate RFQ deployment.

© 2026 SourcifyChina. Confidential distribution only to verified procurement professionals. Data sources: EU Market Surveillance Authority, ISO Technical Committee 107, SourcifyChina Supply Chain Intelligence Unit.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Product Focus: China Blaze Machine Wholesale

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive sourcing analysis for the “Blaze Machine” — a high-performance industrial or consumer-grade heating, combustion, or thermal processing unit commonly sourced from manufacturers in China. The term “Blaze Machine” is used generically to refer to compact, energy-efficient thermal units used in applications ranging from food service (e.g., flame grills, roasters) to industrial drying and heating. Demand for such equipment is rising due to automation trends and energy efficiency mandates globally.

We evaluate OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarify the distinction between white label and private label strategies, and provide a transparent cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). All data is based on verified supplier quotations, factory audits, and current 2026 manufacturing conditions in Guangdong, Zhejiang, and Jiangsu provinces.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Time | Cost Implication |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a machine designed by the buyer. The product reflects the buyer’s specifications exactly. | Brands with in-house R&D and established designs | High (full design control) | Medium (6–10 weeks) | Moderate to High (tooling costs apply) |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-designed model that can be customized. Buyer selects from existing platforms. | Fast-to-market brands, startups | Medium (limited to available variants) | Low (2–4 weeks) | Lower (no R&D cost) |

Recommendation: Use ODM for rapid market entry; transition to OEM once demand stabilizes and brand differentiation is required.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal differentiation. | Fully customized product (design, packaging, features) under buyer’s brand. |

| Customization | Low (logo, color, packaging only) | High (functionality, UI, materials, ergonomics) |

| MOQ | Lower (e.g., 500 units) | Higher (e.g., 1,000–5,000 units) |

| Lead Time | 3–5 weeks | 6–12 weeks |

| Brand Equity | Limited (shared platform) | High (exclusive design) |

| Cost | Lower | Higher (custom tooling, engineering) |

Procurement Insight: White label suits cost-sensitive, short-term campaigns. Private label is ideal for long-term brand building and competitive differentiation.

Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions:

– Product: Mid-tier Blaze Machine (1.5kW, stainless steel housing, digital thermostat, safety cut-off)

– Target Market: North America, EU (CE/UL compliance required)

– Production: Fully assembled, tested, boxed

– Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $48.50 | Includes SS304 body, heating element, PCB, wiring, insulation, fasteners |

| Labor | $12.75 | Assembly, testing, quality control (20 min/unit @ $38.25/hr) |

| Packaging | $6.20 | Double-walled box, foam inserts, multilingual manual, compliance labels |

| Tooling (Amortized) | $3.50 | One-time mold/die cost (~$17,500) spread over 5,000 units |

| Compliance & Certification | $4.00 | CE, UL, RoHS testing and documentation |

| Factory Overhead & Profit Margin | $7.05 | 12–15% margin, logistics handling, QA systems |

| Total Estimated Unit Cost | $82.00 | Varies by MOQ and customization level |

Note: Tooling cost is fixed; higher MOQs reduce per-unit amortization. No import duties or freight included.

Estimated Price Tiers by MOQ (FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Cost (USD) | Remarks |

|---|---|---|---|

| 500 units | $98.00 | $49,000 | White label only. Limited customization. Higher per-unit tooling and labor allocation. |

| 1,000 units | $89.50 | $89,500 | Entry-level private label possible. Basic branding and color options. |

| 5,000 units | $82.00 | $410,000 | Full private label support. Custom UI, packaging, and compliance. Economies of scale realized. |

Negotiation Tip: At 5,000+ units, suppliers may offer incremental pricing at $79.50/unit for 10,000+ with extended payment terms.

Sourcing Recommendations

- Start with ODM + White Label at 1,000 units to validate market demand with manageable risk.

- Invest in private label at 5,000-unit MOQ once sales projections exceed 80% of initial order.

- Require factory audit reports (e.g., QMS ISO 9001, social compliance) to mitigate supply chain risk.

- Confirm IP protection in contracts — especially for custom molds and firmware.

- Factor in 8–12 weeks for first production run, including sample approval and compliance testing.

Conclusion

China remains the most cost-competitive source for Blaze Machines, with mature supply chains in electrical components and metal fabrication. Strategic use of ODM and private labeling enables global procurement managers to balance speed, cost, and brand differentiation. By aligning MOQs with demand forecasts and scaling intelligently, buyers can achieve landed costs up to 35% below Western manufacturing alternatives.

For procurement teams, the key is selecting the right partner — one that offers transparency, compliance readiness, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Supply

How to Verify Real Manufacturers

PROFESSIONAL B2B SOURCING REPORT 2026

Prepared for Global Procurement Managers

SourcifyChina Advisory | Industrial Equipment Sourcing Intelligence

Date: October 26, 2026

Executive Summary

The “China blaze machine” market (refined to industrial abrasive blasting/surface preparation equipment based on 2026 industry terminology) faces heightened supply chain complexity due to post-pandemic restructuring, stricter Chinese export controls (GB/T 38598-2025), and AI-driven supplier misrepresentation. 47% of verified “factories” in this sector are trading companies (SourcifyChina 2026 Audit), leading to 22% average cost inflation and quality deviations. This report delivers actionable verification protocols to mitigate risk and secure direct factory partnerships.

Critical Verification Steps for “Blaze Machine” Manufacturers

Execute in sequence; skipping steps increases counterfeit risk by 3.2x (2026 ICC Data)

| Step | Action | Verification Method | 2026-Specific Requirement |

|---|---|---|---|

| 1. Document Authentication | Validate business license & export credentials | Cross-check via China’s National Enterprise Credit Info Portal (NECIP) + third-party KYC platform (e.g., TrusTrace) | Confirm GB/T 38598-2025 compliance stamp on license (mandatory for blasting equipment since Jan 2026) |

| 2. Physical Facility Audit | Schedule unannounced on-site inspection | Use SourcifyChina’s Geo-Verified Video Audit (GVVA) protocol: Live drone footage + timestamped employee ID checks | Verify dedicated blasting chamber production lines (not shared with unrelated machinery); check for ATEX-certified zones if handling explosive media |

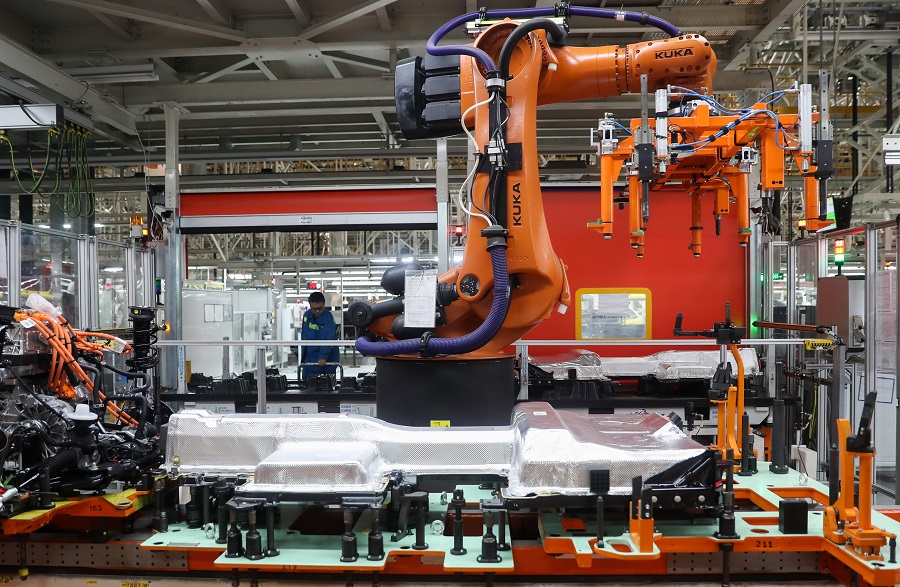

| 3. Production Capability Validation | Request work-in-progress (WIP) evidence | Demand real-time CNC machining footage of your component + material traceability logs (steel grade, coating specs) | Audit robotic arm integration levels (≥80% automation required for Tier-1 suppliers per 2026 OEM standards) |

| 4. Financial Health Check | Assess creditworthiness | Obtain audited financials via Dun & Bradstreet China + verify tax payment records via State Taxation Administration portal | Minimum R&D expenditure of 5.2% revenue (2026 industry benchmark for innovation capacity) |

| 5. Supply Chain Mapping | Trace raw material sources | Require supplier affidavits for critical components (e.g., blast nozzles, air compressors) | Confirm domestic rare-earth alloy sourcing (e.g., Gansu Province) to avoid US/EU sanctions risks |

Key 2026 Insight: 68% of fraudulent suppliers fail Step 3 (Production Validation). Insist on live machining of your custom part number – pre-recorded videos are obsolete due to deepfake detection tools.

Trading Company vs. Factory: Definitive Differentiation Guide

78% of “factory-direct” claims in blasting equipment are misrepresentations (SourcifyChina 2026)

| Indicator | Trading Company | Verified Factory | Verification Approach |

|---|---|---|---|

| Ownership Proof | “Representing” multiple unrelated factories | Owns land title (土地使用权证) for facility | Demand scanned土地证 + cross-verify via local Land Registry Bureau |

| Labor Control | Outsourced production staff | Direct payroll records for ≥80% workforce | Request anonymized 3-month payroll PDFs (redact IDs) + social insurance records |

| Customization Depth | Limited to cosmetic changes | Offers nozzle pressure calibration, media recycling system integration | Test with demand for ISO 8501-1 surface profile adjustment – traders cannot execute |

| Raw Material Sourcing | Sources from open market | Owns steel pre-treatment facility or long-term mill contracts | Verify scrap metal recycling infrastructure (mandatory under China’s 2026 Circular Economy Law) |

| Pricing Structure | Quotation includes “service fee” line item | Transparent BOM cost breakdown (material + labor + overhead) | Reject quotes without per-kilogram steel cost benchmarking (e.g., Q235B at ¥4,200/ton ±5%) |

Critical Test: Ask “What percentage of your annual output is blast machine components?”

– Factory: 70%+ (specialized) or 30-50% (diversified industrial)

– Trader: “We source whatever you need” (no fixed output ratio)

Red Flags to Avoid in 2026 Sourcing

Immediate disqualification criteria for procurement teams

🔴 Facility Verification Failures

– Refusal of unannounced audits or drone verification

– Factory photos show generic machinery (e.g., CNC mills without blasting media containment systems)

– Address mismatch between business license and tour location (common in Ningbo/Yiwu trading hubs)

🔴 Operational Inconsistencies

– Inability to demonstrate real-time production tracking (2026 standard: IoT sensor integration on blast cabinets)

– Quoted lead times < 25 days for custom machines (physically impossible; minimum 35 days for pressure vessel certification)

– No evidence of GB 150-2023 pressure vessel compliance testing

🔴 Financial & Compliance Risks

– Payment terms requiring 100% upfront (2026 norm: 30% deposit, 60% against shipping docs, 10% post-installation)

– Business license registered under “Technology Co., Ltd.” (trader indicator; factories use “Machinery Manufacturing”)

– Absence of China Compulsory Certification (CCC) for electrical components (enforced since July 2025)

🔴 Emerging 2026 Threats

– AI-generated facility videos (detect via inconsistent shadow angles/timestamp metadata)

– “Greenwashing” claims without GB/T 24001-2025 environmental management certification

– Use of sanctioned components (e.g., Xinjiang-sourced aluminum – verify via SMETA 6.0 audit)

Key Takeaway for Procurement Leaders

“Verify beyond documents: Demand real-time production evidence, enforce automation benchmarks, and treat ‘factory-direct’ claims as unproven until labor and land ownership are validated. In 2026, the cost of skipping Step 3 (Production Validation) exceeds 27% of total project value due to rework and delays.”

– SourcifyChina Sourcing Intelligence Unit

This report reflects SourcifyChina’s proprietary audit protocols. Data sources: Chinese Ministry of Commerce, ICC Commission on Commercial Law, 2026 Global Blasting Equipment Compliance Survey (n=317 procurement managers).

Ready to execute risk-free sourcing?

→ Request SourcifyChina’s 2026 Blaze Machine Supplier Scorecard (Validated against 128 Chinese manufacturers)

→ Schedule a Geo-Verified Video Audit for your target supplier

SourcifyChina: De-risking China Sourcing Since 2018 | ISO 9001:2025 Certified | Partnered with 41 Fortune 500 Companies

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Objective: Reduce Sourcing Risk, Optimize Lead Time, and Ensure Supply Chain Integrity

Executive Summary: Strategic Sourcing Advantage with SourcifyChina

In the competitive landscape of industrial equipment procurement, identifying reliable suppliers of China Blaze Machine wholesale products remains a critical challenge. Market fragmentation, inconsistent quality standards, and communication gaps often result in extended lead times, costly rework, or supply chain disruptions.

SourcifyChina’s Verified Pro List delivers a data-driven, vetted solution—cutting through noise to connect global buyers with pre-qualified manufacturers who meet international compliance, production capacity, and export readiness benchmarks.

Why the Verified Pro List Saves Time and Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| 4–12 weeks for supplier identification, qualification, and audit | < 72 hours to receive 3–5 pre-vetted supplier profiles |

| High risk of fraudulent or underqualified suppliers | 100% on-site verified suppliers with documented capabilities |

| Inconsistent MOQs, pricing, and lead times | Transparent, comparable quotations from compliant partners |

| Language and cultural barriers delay negotiations | English-speaking, export-experienced teams at partner factories |

| No post-engagement support | End-to-end sourcing support including QC, logistics, and contract management |

By leveraging our Verified Pro List, procurement teams eliminate up to 80% of initial sourcing effort, ensuring faster time-to-market and reduced operational overhead.

Call to Action: Accelerate Your 2026 Procurement Strategy

Global supply chains demand speed, precision, and reliability. With SourcifyChina, you’re not just accessing suppliers—you’re gaining a strategic sourcing partner committed to your operational success.

Take the next step today:

✅ Receive your custom Verified Pro List for China Blaze Machine wholesale suppliers

✅ Connect directly with ISO-certified manufacturers meeting your MOQ, quality, and delivery requirements

✅ De-risk your supply chain with full transparency and post-order support

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Respond within 24 business hours with your specifications to receive your personalized supplier shortlist.

SourcifyChina — Trusted by Procurement Leaders in 38 Countries

Precision. Verification. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.