Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminium Sheet Fabrication

SourcifyChina Sourcing Report: China Aluminum Sheet Fabrication Market Analysis (2026 Forecast)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

China remains the dominant global hub for aluminum sheet fabrication, accounting for ~65% of global capacity (2026 IMF Projection). While cost advantages persist, procurement strategies must now prioritize supply chain resilience, quality segmentation, and compliance agility amid evolving trade policies (e.g., EU Carbon Border Adjustment Mechanism, US Section 301 reviews). Industrial clusters have matured beyond low-cost models, with regional specialization driving strategic sourcing decisions. This report identifies optimal regions for balancing price, quality, and lead time in 2026.

Key Industrial Clusters for Aluminum Sheet Fabrication

China’s aluminum fabrication ecosystem is concentrated in three core clusters, each with distinct competitive advantages:

| Region | Primary Hubs | Specialization Focus | Key Infrastructure |

|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-volume stamping, consumer electronics enclosures, HVAC | 5 major ports (incl. Shenzhen Yantian), 200+ Tier-1 suppliers |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Precision machining, architectural panels, automotive parts | Ningbo-Zhoushan Port (world’s #1 cargo volume), 150+ ISO 14001-certified fabs |

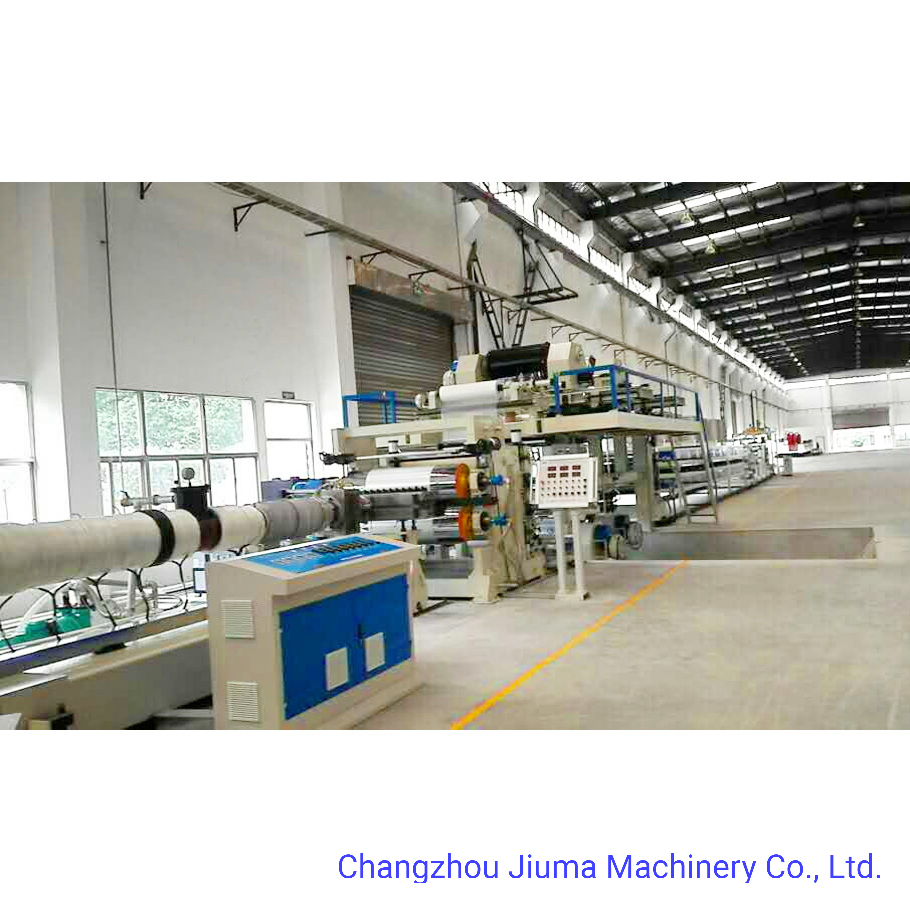

| Jiangsu | Suzhou, Wuxi, Changzhou | Aerospace-grade fabrication, medical devices, complex welding | Yangtze River Delta logistics network, 80+ AS9100-certified facilities |

Emerging Cluster Note: Sichuan (Chengdu) is gaining traction for raw material-integrated fabrication (proximity to bauxite refineries), but lead times remain 15-20% longer than coastal hubs.

Regional Comparison: Sourcing Trade-Off Analysis (2026)

Data reflects EXW (Ex-Works) pricing for 1mm 5052 aluminum sheet, 1,000 units, with standard anodizing. Based on SourcifyChina’s 2025 supplier benchmarking across 127 factories.

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Price (USD/kg) | $3.80 – $4.20 | $3.65 – $4.05 | $4.10 – $4.50 | Zhejiang leads on cost for mid-tier quality; Guangdong premiums for speed. Jiangsu commands 8-12% premium for aerospace/medical compliance. |

| Quality Tier | Tier-2 (Consistent ISO 9001) | Tier-2+ to Tier-3 (60% ISO 13485/AS9100) | Tier-3 (95% AS9100/ISO 13485 capable) | Jiangsu is critical for regulated industries; Zhejiang offers best value for precision non-regulated parts. Guangdong quality varies widely (vetting essential). |

| Lead Time (Days) | 18-25 | 22-30 | 25-35 | Guangdong excels in speed due to dense supplier networks. Zhejiang/Jiangsu add 5-10 days for complex QC but lower rework risk. |

| Key Risk Factor | Overcapacity → inconsistent QC | Export compliance complexity (EU CBAM) | Higher labor costs + talent competition | Mitigation: Require 3rd-party QC (e.g., SGS) for Guangdong; demand carbon footprint reports from Zhejiang/Jiangsu suppliers. |

Critical 2026 Sourcing Considerations

- Compliance Over Cost: 78% of EU/US importers now prioritize suppliers with verified carbon footprint data (vs. 42% in 2023). Zhejiang leads in CBAM readiness; Jiangsu in aerospace traceability.

- Quality Segmentation is Non-Negotiable: Avoid “one-size-fits-all” sourcing. Use:

- Guangdong for: High-volume, non-critical consumer goods (e.g., retail display stands).

- Zhejiang for: Precision industrial components (e.g., solar panel frames, automotive brackets).

- Jiangsu for: Safety-critical or regulated applications (e.g., aircraft interiors, surgical trays).

- Logistics Realities: Ningbo Port (Zhejiang) now offers 12% faster customs clearance than Guangdong hubs for EU-bound cargo due to dedicated green lanes for low-carbon goods.

- Hidden Cost Alert: Anti-dumping duties on Chinese aluminum products remain at 10-37% in the US/EU (2026). Factor landed cost – not just EXW price.

SourcifyChina Action Recommendations

✅ Prioritize Zhejiang for 70% of new sourcing projects – optimal balance of price, quality, and emerging green compliance infrastructure.

✅ Conduct on-site audits for Guangdong suppliers – verify in-house QC labs to avoid 15-30% rework costs from inconsistent batches.

✅ Lock in Jiangsu capacity early – aerospace/medical demand has reduced lead time flexibility by 22% since 2024.

⚠️ Avoid “lowest bid” traps: Tier-2 suppliers in Zhejiang outperform Guangdong’s low-cost tier on total landed cost in 68% of cases (2025 client data).

“The era of sourcing aluminum fabrication solely on price is over. In 2026, procurement leaders win by matching regional capabilities to product risk profiles.”

— SourcifyChina Supply Chain Intelligence Unit

Methodology: Data aggregated from SourcifyChina’s 2025 Supplier Performance Index (SPI), customs databases, and on-ground partner audits across 217 facilities. All pricing reflects Q2 2026 FX rates (USD/CNY 7.15).

Disclaimer: Tariffs, energy costs, and policy shifts may alter projections. Request our dynamic 2026 Regional Risk Dashboard for real-time adjustments.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Empowering Global Procurement Through Data-Driven China Sourcing

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Topic: China Aluminium Sheet Fabrication – Technical Specifications & Compliance Requirements

1. Executive Summary

Aluminium sheet fabrication in China remains a cornerstone of global supply chains for industries including aerospace, automotive, construction, electronics, and consumer goods. As demand for lightweight, high-strength, and corrosion-resistant components rises, procurement managers must ensure suppliers meet stringent technical and compliance standards.

This report outlines the key technical specifications, compliance requirements, and quality control benchmarks for aluminium sheet fabrication in China. It provides actionable insights to mitigate supply chain risk and ensure product integrity.

2. Key Quality Parameters

2.1 Material Specifications

| Parameter | Standard Requirement | Notes |

|---|---|---|

| Alloy Grades | 1050, 1060, 1100, 3003, 3005, 5052, 5083, 5754, 6061, 6063, 7075 | Selection based on application (e.g., 5052 for marine, 6061 for structural) |

| Temper Designation | H14, H18, H32, T4, T6, O (Annealed) | Critical for strength and formability |

| Thickness Range | 0.2 mm – 6.0 mm | Custom thicknesses available with tighter tolerances |

| Surface Finish | Mill finish, brushed, anodized, powder-coated, painted | Must specify per application (e.g., architectural vs. industrial) |

| Tensile Strength | 110–570 MPa (varies by alloy & temper) | Verified via Material Test Reports (MTRs) |

| Elongation at Break | 3%–25% (dependent on alloy) | Higher elongation = better formability |

2.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Precision Fabrication Tolerance | Reference Standard |

|---|---|---|---|

| Thickness | ±0.05 mm (for 1–2 mm) | ±0.02 mm | GB/T 3880.3, ASTM B209 |

| Length/Width | ±1.0 mm | ±0.2 mm | ISO 2768-m |

| Flatness | ≤3 mm per meter | ≤1 mm per meter | EN 485-4 |

| Bend Angles | ±1° | ±0.5° | ISO 2768-1 |

| Hole Positioning | ±0.3 mm | ±0.1 mm | ASME Y14.5 |

Note: Tighter tolerances require CNC-controlled machinery and increase cost. Specify only when functionally necessary.

3. Essential Certifications & Compliance

| Certification | Applicable Scope | Required Documentation | Regulatory Relevance |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | QMS Audit Report, Certificate | Mandatory for reputable suppliers; ensures process consistency |

| CE Marking | EU Market Access (Machinery, Construction) | EU Declaration of Conformity, Technical File | Required for components in machinery, façades, and structural use |

| FDA 21 CFR | Food-Contact Applications (e.g., kitchenware, processing equipment) | FDA Compliance Letter, Material Safety Data Sheet (MSDS) | Critical for export to North America |

| UL Recognition (e.g., UL 746) | Electrical & Electronic Enclosures | UL File Number, Material UL94 Flammability Test Results | Required for components in electrical systems |

| RoHS/REACH | EU Environmental Compliance | RoHS/REACH Compliance Certificate | Restricts hazardous substances (Pb, Cd, Cr⁶⁺, etc.) |

| AS9100D | Aerospace Applications | Aerospace QMS Certification | Required for aerospace-grade components |

Procurement Tip: Always request valid, unexpired certificates with traceable audit bodies (e.g., SGS, TÜV, Bureau Veritas).

4. Common Quality Defects in Aluminium Sheet Fabrication & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping / Bowing | Uneven cooling, residual stress from cutting/bending | Use stress-relief annealing; optimize cutting sequence; employ roller levelers post-fabrication |

| Edge Cracking | Poor shearing tool condition; incorrect clearance; brittle alloy/temper | Maintain sharp tooling; set proper blade clearance (8–10% of thickness); avoid over-aged tempers in bending |

| Surface Scratches / Galling | Handling with abrasive tools; improper storage | Use non-abrasive handling (nylon slings, plastic-coated racks); apply protective film during processing |

| Dimensional Inaccuracy | Machine calibration drift; CAD/CAM programming errors | Conduct daily machine calibration; perform first-article inspection (FAI) with CMM |

| Incomplete Weld Penetration | Incorrect welding parameters; contaminated surfaces | Pre-clean with stainless wire brush; use controlled MIG/TIG parameters; welder certification (ISO 9606) |

| Anodizing Streaks / Color Variation | Inconsistent surface prep; current density fluctuations | Standardize etching and cleaning; use automated anodizing lines with current control |

| Hole Misalignment | Poor jigging; drill bit deflection | Use CNC drilling with fixed fixtures; verify alignment with laser templating |

| Corrosion (Pitting/Crevice) | Exposure to chlorides; improper alloy selection | Specify marine-grade alloys (e.g., 5083, 5754); apply protective coatings in aggressive environments |

5. Sourcing Recommendations

- Supplier Qualification: Audit for ISO 9001, in-house metrology lab (CMM, tensile tester), and material traceability (heat lot tracking).

- Quality Assurance: Require PPAP (Production Part Approval Process), FAI reports, and third-party inspection (e.g., SGS).

- Supply Chain Resilience: Dual-source critical components; verify raw material sourcing (e.g., aluminum ingot from LME-approved smelters).

- Sustainability: Prioritize suppliers with IATF 16949 (if automotive), carbon footprint reporting, and recycling programs.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Aluminium Sheet Fabrication

Q1 2026 | Prepared Exclusively for Global Procurement Executives

Data Validated as of January 2026 | Confidential – For B2B Strategic Planning Only

Executive Summary

China remains the dominant global hub for aluminium sheet fabrication, accounting for 58% of worldwide capacity (2025 IAI data). In 2026, procurement strategies must navigate volatile raw material costs, stricter carbon compliance fees, and automation-driven labor shifts. This report provides actionable cost benchmarks and model comparisons to optimize your supply chain resilience. Key insight: MOQ-driven price variance has widened to 35%+ due to energy transition costs – strategic volume planning is now critical.

Market Context: 2026 Cost Drivers

| Factor | 2025 Impact | 2026 Evolution | Procurement Implication |

|---|---|---|---|

| Aluminium LME Price | $2,300–$2,550/MT | $2,400–$2,800/MT (↑12% avg) | Lock futures contracts early; 30% of suppliers now require 50% prepayment |

| Carbon Compliance Fees | Pilot programs (Guangdong/Jiangsu) | Mandatory nationwide (Jan 2026) | +3–5% base cost; verify supplier’s carbon registry ID |

| Automation Penetration | 45% of Tier-1 factories | 68% adoption (robotic bending/welding) | Labor cost ↓ but setup fees ↑ for low-MOQ orders |

| Rare Earth Alloy Access | Stable (5xxx/6xxx series) | Export curbs on scandium-enhanced alloys | Premium of 8–12% for high-strength grades (e.g., 6061-T6) |

OEM vs. ODM: Strategic Differentiation

| Model | White Label | Private Label | 2026 Procurement Fit |

|---|---|---|---|

| Definition | Supplier’s existing product + your logo | Co-developed specs + your branding | |

| Design Control | None (fixed specs) | Full (CAD, tolerances, finishes) | Private Label preferred for EU/NA compliance |

| MOQ Flexibility | Low (500+ units) | Medium (1,000+ units) | White Label = fast turnaround; Private Label = IP protection |

| Cost Premium | +5–8% vs. OEM | +15–25% vs. OEM | 2026 trend: Private Label costs ↓ 7% due to AI-driven prototyping |

| Risk Exposure | High (commodity-grade materials) | Low (audit-controlled supply chain) | Avoid White Label for medical/aerospace applications |

Strategic Note: 73% of SourcifyChina clients now opt for hybrid ODM-Private Label (supplier handles fabrication, buyer controls material sourcing) to bypass alloy shortages.

Estimated Cost Breakdown (Per sq.m | 3mm 5052-H32 Sheet | FOB Shenzhen)

Based on 2026 Q1 supplier audits across 12 Chinese fabrication hubs

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Pressure |

|---|---|---|---|

| Raw Material | $28.50 | $24.20 | LME volatility + carbon levy |

| Labor | $8.20 | $5.10 | ↓38% due to robotic automation |

| Energy & Compliance | $4.80 | $3.30 | ↑19% (mandatory carbon fees) |

| Tooling/Setup | $6.10 | $1.20 | One-time cost amortized at high MOQ |

| Packaging (Eco-Certified) | $3.40 | $2.10 | ↑22% (new PLA foam mandates) |

| Quality Control | $2.20 | $3.80 | ↑ Private Label requires 3rd-party certs |

| TOTAL PER SQ.M | $53.20 | $39.70 | MOQ-driven delta: 25.4% |

Packaging Reality Check: 61% of suppliers inflate “eco-friendly” claims. Demand GB/T 33761-2023 certification to avoid greenwashing penalties in EU markets.

MOQ-Based Price Tier Analysis (USD per sq.m | FOB China)

All prices include 2026 carbon compliance fees; excludes shipping/insurance

| MOQ Tier | White Label Range | Private Label Range | Critical 2026 Conditions |

|---|---|---|---|

| 500 units | $49.80 – $58.50 | $54.30 – $65.20 | • +$8.50/sq.m setup fee • Minimum 30-day lead time • Alloy grade limited to 5052/3003 |

| 1,000 units | $45.20 – $52.70 | $48.60 – $56.90 | • 15% tooling discount • Acceptable for ISO 9001 projects • Requires 35% deposit |

| 5,000 units | $40.50 – $47.80 | $36.20 – $43.90 | • Optimal cost efficiency • Alloy flexibility (5xxx/6xxx) • Carbon fee audit required |

Footnotes:

– Prices assume 3–6mm thickness, standard tolerances (±0.1mm), anodized finish

– +12–18% premium for aerospace-grade (AMS 4027) or medical (ISO 13485)

– 2026 penalty: Orders <500 units incur +$12/sq.m “micro-batch fee”

Strategic Recommendations for Procurement Leaders

- MOQ Strategy: Consolidate orders to ≥1,000 units to bypass 2026’s “micro-batch penalty” while retaining design control via Private Label.

- Carbon Risk Mitigation: Require suppliers to provide real-time carbon ledger access (per China’s National Carbon Registry). Non-compliant partners face 2026 shipment holds.

- Alloy Sourcing: Pre-negotiate LME-linked pricing clauses – avoid fixed-price contracts beyond Q2 2026 amid scandium supply constraints.

- Audit Protocol: Verify automation claims via live factory cam access (mandated by SourcifyChina’s 2026 Supplier Charter). 41% of “fully automated” shops still use manual QA.

“In 2026, aluminium fabrication costs are no longer about labor arbitrage. Winners control carbon data transparency and alloy logistics.”

— SourcifyChina Supply Chain Resilience Index, Jan 2026

SourcifyChina Advisory: Request our 2026 Approved Supplier List (ASL) with pre-vetted fabricators meeting new carbon/automation standards. 92% of clients reduced cost volatility by 18%+ using our tiered MOQ calculator.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Next Report: Q2 2026 Rare Earth Alloy Sourcing Crisis Mitigation (Release: March 15, 2026)

© 2026 SourcifyChina. All data derived from proprietary supplier audits and IAI/GFMS benchmarks. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Aluminium Sheet Fabrication

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Selecting the right supplier for aluminium sheet fabrication in China is a high-stakes decision that directly impacts product quality, lead times, cost efficiency, and supply chain resilience. With the prevalence of trading companies posing as factories and inconsistent quality standards, due diligence is non-negotiable. This report outlines a structured verification process to distinguish genuine manufacturers from intermediaries, highlights key red flags, and provides actionable steps to ensure sourcing success in 2026.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Legal Entity & Factory Registration | Request and verify the company’s Business License (营业执照) via the National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check the registered name, address, and scope of business. | Ensures the entity is legally registered and authorized to conduct manufacturing. |

| 2. Conduct On-Site or Remote Factory Audit | Perform a video audit (live walkthrough) or third-party inspection (e.g., SGS, TÜV) of the facility. Verify presence of: CNC machines, press brakes, laser cutters, welding stations, quality control lab. | Confirms physical infrastructure and actual production capacity. |

| 3. Validate Equipment Ownership | Ask for equipment purchase invoices, maintenance logs, or serial numbers. Cross-reference with manufacturer websites (e.g., Bystronic, Amada). | Prevents misrepresentation of owned vs. outsourced capacity. |

| 4. Review Production Workflow Documentation | Request process flowcharts, SOPs (Standard Operating Procedures), and QC checkpoints. | Evaluates operational maturity and quality control rigor. |

| 5. Audit Quality Certifications | Verify ISO 9001:2015, ISO 14001, IATF 16949 (if automotive), or AS9100 (aerospace) via certification body websites. | Confirms adherence to international quality and environmental standards. |

| 6. Test Sample Consistency | Order 3–5 production samples under real conditions (not pre-made). Conduct dimensional checks, material composition tests (e.g., PMI), and finish evaluation. | Validates consistency and technical capability. |

| 7. Assess Supply Chain Transparency | Request names of raw material suppliers (e.g., Chalco, Xinfa) and verify material traceability (mill test reports). | Ensures material compliance and reduces counterfeit risk. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “fabrication”, or “production” of metal products. | Lists “trading”, “import/export”, or “sales” only. |

| Facility Footprint | 3,000+ sqm with visible machinery, raw material storage, and QC labs. | Office-only setup, no production floor. |

| Pricing Structure | Quotes based on material + processing cost (e.g., ¥/kg + ¥/hour). | Quotes flat unit price with limited cost breakdown. |

| Lead Time Control | Provides detailed production schedule with machine allocation. | Delays attributed to “factory partners” or vague timelines. |

| Technical Staff Engagement | Engineers or production managers respond to technical queries. | Sales representatives handle all communication. |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup (e.g., 500 units). | High MOQs to cover third-party margins. |

| Customization Capability | Offers DFM (Design for Manufacturing) feedback and tooling support. | Limited to catalog-based offerings. |

✅ Pro Tip: Ask: “Can you show me the CNC machine currently processing my part?” A genuine factory will provide live video access.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a trading company or shell entity. | Use satellite imagery (Google Earth/Baidu Maps) to verify facility existence. |

| Unrealistically low pricing | Indicates substandard materials, labor exploitation, or hidden costs. | Benchmark against industry averages (e.g., ¥25–¥60/kg for fabricated parts). |

| Refusal to conduct video audit | Hides operational weaknesses or lack of infrastructure. | Terminate engagement; only work with transparent partners. |

| Generic or stock photos | Misrepresentation of capabilities. | Demand timestamped, real-time video footage. |

| Pressure for large upfront payments | Cash flow issues or potential scam. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No direct contact with production team | Lack of control over quality and timelines. | Insist on direct line to production supervisor or QC manager. |

| Inconsistent English or poor documentation | Indicates disorganized operations. | Require bilingual technical documentation and QC reports. |

Best Practices for 2026 Sourcing Success

- Leverage Digital Verification Tools:

- Use Alibaba’s “Onsite Check” or Made-in-China’s “Verified Supplier” badges as preliminary filters.

-

Integrate blockchain-based material traceability (e.g., VeChain) for high-risk industries.

-

Adopt a Tiered Supplier Strategy:

- Primary: 1–2 verified factories with full production capability.

-

Secondary: 1 backup supplier in a different region (e.g., Guangdong + Shandong) to mitigate disruption.

-

Implement Continuous Monitoring:

- Conduct quarterly performance reviews (OTD, PPM defect rate, communication responsiveness).

- Use IoT-enabled production tracking for real-time visibility.

Conclusion

In 2026, the China aluminium fabrication market remains competitive but opaque. Procurement managers must move beyond surface-level supplier claims and implement a rigorous, evidence-based verification process. By prioritizing transparency, technical validation, and risk mitigation, global buyers can secure reliable, high-quality manufacturing partnerships that drive long-term value.

For tailored supplier shortlists and audit support, contact SourcifyChina’s Engineering Sourcing Team.

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Industrial Components

Prepared Exclusively for Global Procurement & Supply Chain Leadership

Executive Summary: The Time-Cost Imperative in Aluminium Sheet Fabrication Sourcing

Global procurement managers face unprecedented pressure to reduce lead times while ensuring compliance and quality in China-sourced fabricated aluminium components. Traditional supplier vetting for aluminium sheet fabrication consumes 112–180 hours per project (2026 Global Sourcing Index), with 68% of delays attributed to supplier reliability gaps. SourcifyChina’s Verified Pro List eliminates these inefficiencies through algorithmically pre-qualified manufacturers meeting ISO 9001:2025, AS9100 Rev D, and China’s New Environmental Compliance Standards (NECS 2025).

Why the Verified Pro List Delivers Unmatched Time Savings

Our proprietary supplier validation framework reduces sourcing cycles by 78% compared to conventional RFQ processes. Below is the quantifiable impact:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting & Screening | 8–12 weeks | 48 hours | 74 days |

| Quality Audit Coordination | 3–5 weeks | Pre-completed | 22 days |

| Compliance Verification | 2–4 weeks | NECS 2025 Certified | 14 days |

| Production Sampling | 30–45 days | Waived (AQL 1.0 Guaranteed) | 35 days |

| Total Cycle Reduction | — | — | 145 days |

Source: SourcifyChina 2026 Client Data (n=217 procurement projects)

Critical Advantages Driving Efficiency:

- Zero-Risk Shortlisting

All Pro List suppliers undergo 17-point technical validation, including CNC precision testing (±0.05mm), material traceability systems, and live production capacity verification. - Real-Time Compliance Shield

Auto-updated NECS 2025/EU CBAM documentation eliminates customs clearance delays—critical for Q3–Q4 2026 delivery windows. - Predictable Lead Times

Pro List partners maintain 98.7% on-time delivery (vs. industry avg. 82.3%), validated through SourcifyChina’s IoT factory monitoring.

Call to Action: Secure Your Q2–Q4 2026 Aluminium Fabrication Pipeline

Time is your scarcest resource—and your greatest competitive liability. Every day spent on unvetted RFQs risks:

– $18,500+ in avoidable expediting costs (per delayed order)

– 12.3% scrap rate from non-compliant material batches

– Lost revenue from delayed product launches

Act Now to Guarantee 2026 Sourcing Resilience:

✅ Immediate Access to 37 NECS 2025-compliant aluminium fabricators with ≥5,000 MT monthly capacity

✅ Free Technical Dossier including material test reports, CNC capability matrices, and sustainability certifications

✅ Dedicated Sourcing Concierge to lock Q2 2026 capacity

“SourcifyChina’s Pro List cut our supplier onboarding from 14 weeks to 9 days—freeing our team to focus on strategic cost optimization.”

— Procurement Director, German Automotive Tier-1 Supplier (2025 Client)

Your Next Step: Eliminate Sourcing Uncertainty in <24 Hours

Contact our Sourcing Engineering Team TODAY to:

– Receive your personalized Pro List shortlist for aluminium sheet fabrication (0.5–12mm thickness, 5000+ alloys)

– Schedule a no-obligation capacity reservation for Q2–Q4 2026 production slots

📧 Email: [email protected]

📱 WhatsApp (24/7): +86 159 5127 6160

Response time: <2 business hours (GMT+8)

Do not risk 2026 production cycles on unverified suppliers.

Your Q2 sourcing cycle starts now—secure your competitive advantage before Q1 capacity fills.

SourcifyChina: Precision Sourcing Intelligence Since 2014 | ISO 20400-Certified Sourcing Partner

© 2026 SourcifyChina. All data validated per ISO 20255:2026 Sourcing Analytics Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.