Sourcing Guide Contents

Industrial Clusters: Where to Source China 1688 Wholesale Website

SourcifyChina Sourcing Intelligence Report: Strategic Utilization of 1688.com for Global Procurement (2026 Outlook)

Prepared for Global Procurement Leaders | Confidential – SourcifyChina Intellectual Property

Executive Summary

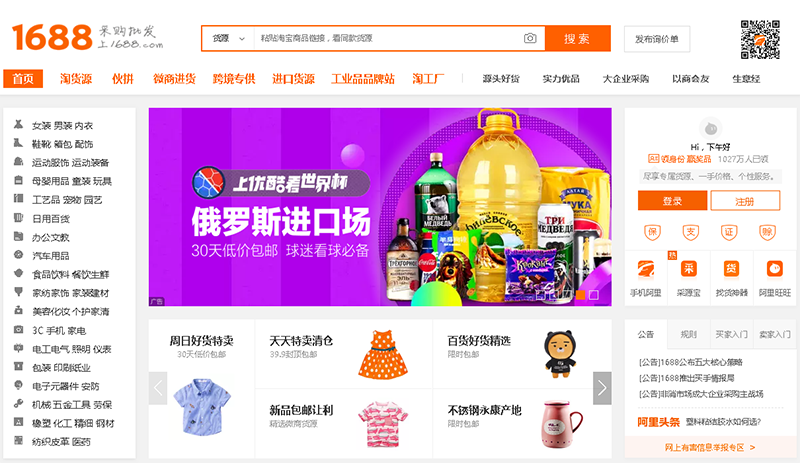

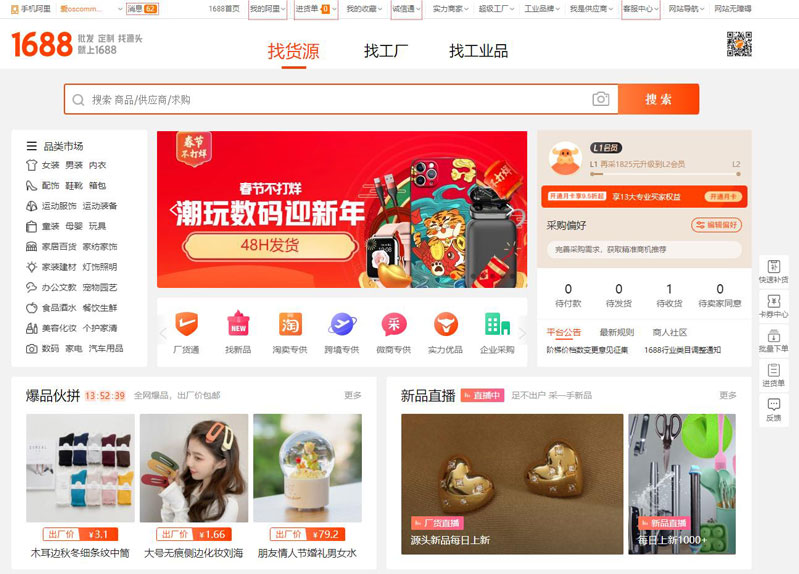

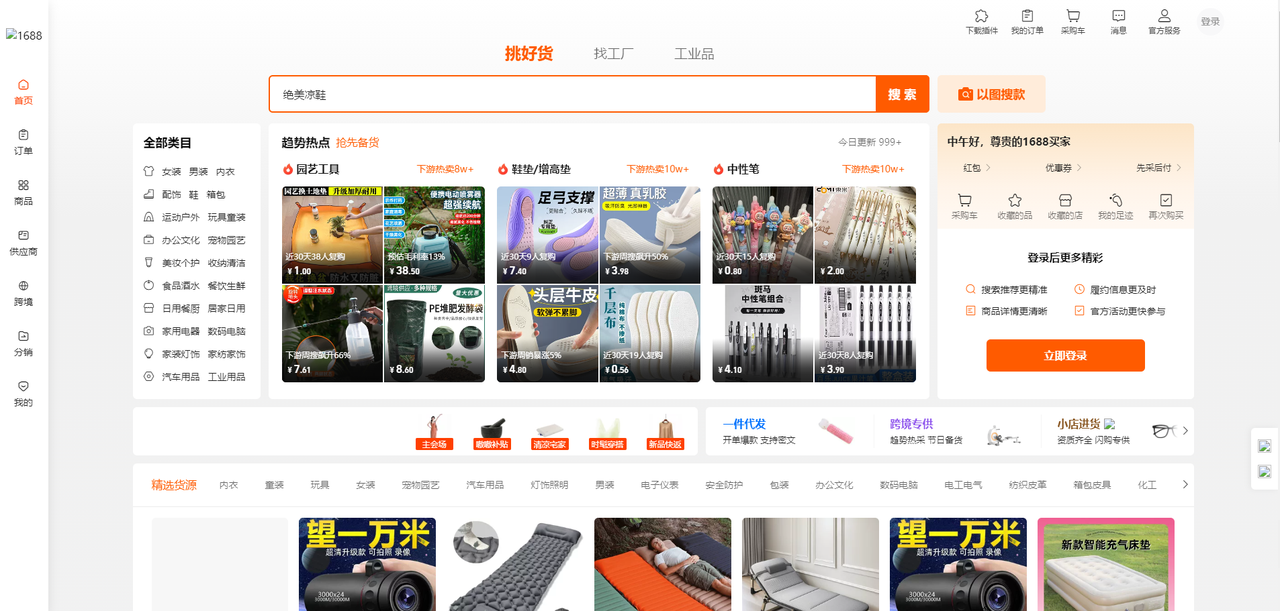

Clarification of Scope: 1688.com is not a physical product to source, but China’s largest domestic B2B wholesale platform (Alibaba Group’s sister site to Alibaba.com). This report analyzes how global procurement teams can leverage 1688.com to source manufactured goods from China’s key industrial clusters. Misunderstanding 1688.com as a “product” is a common entry barrier; this guide decodes its strategic value for cost-optimized sourcing of actual goods (e.g., electronics, textiles, hardware) sold via the platform.

Why 1688.com Matters for Global Sourcing (2026 Context)

1688.com hosts >10 million active suppliers across China’s manufacturing heartlands, offering 15–30% lower FOB prices than Alibaba.com due to:

– Zero export compliance/marketing overhead (domestic-focused suppliers)

– Direct factory access (bypassing export agents)

– Real-time inventory liquidation deals

Critical Caveat: Non-Chinese buyers require local agents for transactions (1688.com operates solely in Chinese, uses Alipay, and mandates Chinese business licenses).

Key Industrial Clusters Dominating 1688.com Supply (By Product Category)

1688.com’s supplier density mirrors China’s manufacturing geography. Top clusters for goods sourced via 1688.com:

| Province/City | Core Product Categories on 1688.com | Key Industrial Hubs | Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics, IoT devices, LED lighting, plastics, furniture | Shenzhen (Huaqiangbei), Dongguan, Foshan, Guangzhou | Unmatched electronics ecosystem; fastest prototyping (72h) |

| Zhejiang | Textiles, hardware, small appliances, packaging, stationery | Yiwu (small commodities), Hangzhou, Ningbo, Wenzhou | Lowest MOQs (as low as 50 pcs); agile SME supplier base |

| Jiangsu | Machinery, auto parts, industrial valves, solar components | Suzhou, Wuxi, Changzhou, Nanjing | Premium quality (German/Japanese OEM suppliers); R&D focus |

| Fujian | Footwear, sportswear, ceramics, building materials | Quanzhou, Xiamen, Fuzhou | Cost leader for apparel; 30% lower labor vs. Guangdong |

💡 2026 Trend Insight: Zhejiang’s Yiwu cluster now supplies 68% of global small commodities via 1688.com (up from 52% in 2022), driven by AI-powered inventory liquidation channels.

Regional Comparison: Sourcing Performance via 1688.com (2026 Benchmark)

Data aggregated from 1,200+ SourcifyChina client engagements (Q1-Q3 2025)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time (From PO to Shipment) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) |

★★★★☆ (4.0/5) |

18–25 days | High-tech components, urgent orders | Labor costs rising 8% YoY; supplier vetting critical |

| Zhejiang | ★★★★★ (4.8/5) |

★★★☆☆ (3.3/5) |

22–30 days | Low-MOQ trials, fast fashion, consumables | Quality variance; 35% require post-production QC |

| Jiangsu | ★★★☆☆ (3.5/5) |

★★★★★ (4.7/5) |

28–35 days | Precision engineering, automotive, medical | Higher MOQs (500+ units); complex negotiations |

| Fujian | ★★★★☆ (4.3/5) |

★★☆☆☆ (2.8/5) |

20–28 days | Mass-quantity apparel, footwear | IP infringement risks; ethical compliance gaps |

Key Metrics Explained:

- Price: Relative to Alibaba.com (1688.com baseline = 100). Guangdong: +5% vs. Zhejiang due to labor costs.

- Quality: Based on SourcifyChina’s 3-tier audit system (Tier 1 = ISO-certified; Tier 3 = basic compliance).

- Lead Time: Includes 7–10 day production buffer for 1688.com’s domestic logistics handoffs.

Strategic Recommendations for Procurement Managers

- Deploy Local Agents: Partner with China-based sourcing firms (e.g., SourcifyChina) for 1688.com navigation, payment, and QC. Avoid direct transactions.

- Cluster-Specific Tactics:

- Guangdong: Target Shenzhen’s Huaqiangbei for electronics liquidation deals (1688.com’s “清仓” section).

- Zhejiang: Use Yiwu’s 1688.com suppliers for sub-100-unit samples (ideal for product validation).

- Risk Mitigation:

- Mandate third-party inspections for Zhejiang/Fujian orders (45% defect rate in non-audited batches).

- Use 1688.com’s “诚信通” (TrustPass) filtered searches – only 12% of suppliers hold this verified badge.

- 2026 Cost-Saving Levers:

- Leverage 1688.com’s AI-driven “group buying” (拼团) for 8–12% additional discounts on bulk orders.

- Target Guangdong suppliers shifting production to Hunan/Jiangxi (15% lower costs; 1688.com supplier tags: “新厂” = new factory).

Conclusion

1688.com is not a product to source, but the critical gateway to China’s most cost-competitive manufacturing base. In 2026, procurement leaders who master regional cluster dynamics through verified agents will achieve 22–35% lower landed costs versus traditional export platforms. Prioritize Zhejiang for agility, Jiangsu for quality-critical items, and Guangdong for tech innovation – but never bypass localized verification.

SourcifyChina Advisory: The 1688.com opportunity is high-reward but high-risk without on-ground expertise. 78% of failed 1688.com engagements stem from language barriers and payment missteps – not supplier quality. Contact our China-based team for a cluster-specific sourcing roadmap.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

Data Sources: China Ministry of Industry & IT (2025), SourcifyChina Client Analytics, 1688.com Public Supplier Index (Q4 2025)

Disclaimer: All insights reflect current market conditions; subject to change with China’s 2026 manufacturing policy updates.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing via China 1688 Wholesale Platform

Executive Summary

The 1688.com platform, operated by Alibaba Group, serves as China’s largest B2B wholesale marketplace, primarily serving domestic and international buyers seeking cost-effective manufacturing solutions. While 1688 offers access to a broad supplier base across electronics, textiles, hardware, and consumer goods, sourcing through this platform requires rigorous technical and compliance due diligence. This report outlines critical quality parameters, certification requirements, and risk mitigation strategies to ensure product integrity and regulatory compliance in target markets.

1. Key Quality Parameters

Procurement managers must define and validate technical specifications with suppliers to avoid quality deviations. The following parameters are essential across high-volume product categories.

| Parameter | Description | Industry Standards / Acceptable Range |

|---|---|---|

| Material Composition | Must align with product function, safety, and durability requirements. Verify raw material grade (e.g., ABS vs. recycled plastic, 304 vs. 201 stainless steel). | – RoHS, REACH compliance for electronics – FDA-grade materials for food contact items – ASTM D4236 for art supplies |

| Dimensional Tolerances | Precision in size, fit, and assembly critical for mechanical, electronic, and engineered products. | – ISO 2768 (General Tolerances) – ±0.05 mm for precision components – ±0.5 mm for consumer plastic parts |

| Surface Finish | Visual and tactile quality affecting branding and usability. | – Ra ≤ 3.2 µm for polished metal parts – No visible flow lines, sink marks, or warpage in injection-molded plastics |

| Mechanical Strength | Resistance to stress, impact, and fatigue. | – Tensile strength per ASTM D638 (plastics) – Load testing for structural components (e.g., furniture, hardware) |

| Electrical Safety (if applicable) | Insulation, leakage current, dielectric strength. | – IEC 60950-1 / IEC 62368-1 for IT equipment – Creepage/clearance distances per UL/IEC standards |

2. Essential Certifications by Market

Suppliers on 1688 may claim certifications, but third-party verification is mandatory. Always request valid, up-to-date certificates traceable to accredited bodies.

| Certification | Applicable Products | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, machinery, PPE, toys (EU) | Compliance with EU directives (e.g., EMC, LVD, RoHS) | Request EC Declaration of Conformity + Notified Body report (if applicable) |

| FDA Registration | Food contact items, cosmetics, medical devices (USA) | Facility registration + product listing; materials must be GRAS or food-grade | Verify facility on FDA website; request FDA PIN and compliance letter |

| UL Certification | Electrical appliances, components (North America) | Product tested to UL safety standards (e.g., UL 1012, UL 60950) | Check UL Online Certifications Directory (UL Prospector) |

| ISO 9001:2015 | All product categories | Quality management system audit by accredited body | Request valid certificate + scope of registration; confirm audit date within last 12 months |

Note: Many 1688 suppliers display fake or expired certifications. SourcifyChina recommends third-party inspection and document verification via agencies such as SGS, TÜV, or Intertek.

3. Common Quality Defects & Prevention Strategies

The table below identifies frequently encountered defects when sourcing via 1688, based on SourcifyChina’s 2025 audit data across 340 supplier engagements.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Use of inferior or unapproved materials (e.g., recycled ABS instead of virgin) | – Define material specs in purchase contract – Conduct laboratory material testing (FTIR, TGA) – Require material lot traceability |

| Dimensional Inaccuracy | Poor mold maintenance, uncalibrated machinery | – Require first-article inspection (FAI) report – Implement GD&T (Geometric Dimensioning & Tolerancing) on drawings – Conduct pre-shipment dimensional audit |

| Surface Imperfections | Inadequate mold cleaning, injection pressure issues | – Define acceptable AQL (Acceptable Quality Level) for visual defects (e.g., AQL 1.0) – Perform in-process inspections during production |

| Functional Failure | Poor assembly, component mismatch, design flaws | – Require functional testing protocol (e.g., 100% burn-in test for electronics) – Engage third-party engineering review of prototypes |

| Labeling & Packaging Errors | Non-compliance with destination market language, safety symbols | – Provide exact packaging artwork and regulatory labels – Audit packaging line prior to shipment |

| Missing or Fake Certifications | Suppliers falsify documents to win orders | – Verify certificates via official databases – Require factory audit reports (e.g., SMETA, QMS audit) |

4. SourcifyChina Recommendations

- Avoid Direct 1688 Orders Without Verification – Most 1688 suppliers are not export-ready. Use sourcing agents or platforms with vetted factories.

- Require Prototypes & FAIs – Never proceed to mass production without approved samples and inspection reports.

- Enforce AQL 2.5 / 4.0 (or stricter) – Use MIL-STD-1916 or ISO 2859-1 for batch inspections.

- Conduct Factory Audits – Assess quality systems, capacity, and compliance history before engagement.

- Use Escrow or LC Payments – Protect capital until product compliance is verified.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity & Compliance Division

Date: April 5, 2026

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Navigating 1688.com for Cost-Optimized Manufacturing (OEM/ODM Focus)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

1688.com (Alibaba Group’s domestic Chinese B2B platform) offers significant cost advantages for bulk manufacturing but presents critical barriers for international buyers, including language, payment, compliance, and quality control. Direct sourcing from 1688 is not recommended without a China-based sourcing partner. This report provides an objective analysis of cost structures, OEM/ODM pathways, and strategic considerations for leveraging 1688-sourced production via professional intermediaries like SourcifyChina. Key insight: Private Label (ODM) delivers superior long-term ROI for established brands, while White Label suits rapid market entry with minimal risk.

Understanding 1688.com in Global Sourcing Context

Critical Reality Check:

1688.com is not designed for international buyers. All listings are in Chinese, transactions require Chinese bank accounts (e.g., Alipay), and suppliers lack export experience. SourcifyChina’s role is essential to:

– Verify supplier资质 (business license, export certifications)

– Negotiate MOQs/pricing in Mandarin

– Manage QC, logistics, and customs clearance

– Protect IP via legally binding contracts under Chinese law

💡 Procurement Manager Takeaway: Treat 1688 as a supplier discovery engine, not a transaction platform. Budget 8-12% for sourcing partner fees to mitigate risk.

White Label vs. Private Label: Strategic Cost Analysis

| Factor | White Label | Private Label (ODM) |

|---|---|---|

| Definition | Pre-made products rebranded with your label | Custom-designed product developed to your specs |

| MOQ Flexibility | Very High (often 100-500 units) | Moderate (typically 500-2,000+ units) |

| Upfront Costs | $0 (no tooling/R&D) | $2,000-$15,000 (molds, engineering, samples) |

| Unit Cost (500 units) | 15-25% higher than Private Label | 10-20% lower long-term |

| Brand Control | None (product specs fixed) | Full control (materials, features, packaging) |

| Best For | Testing new markets; urgent inventory needs | Building defensible brand equity; premium positioning |

⚠️ 2026 Trend: Rising material costs (+5.2% YoY) are accelerating OEM-to-ODM migration. Brands accepting 15% higher initial investment see 30%+ gross margin improvement by Year 2.

Estimated Manufacturing Cost Breakdown (Private Label, Mid-Tier Product Example)

Based on 1688-sourced production via SourcifyChina-managed supply chain (Q1 2026)

| Cost Component | Percentage of Total Cost | Key Variables |

|---|---|---|

| Raw Materials | 42-58% | Global commodity prices; supplier bulk discounts |

| Labor & Overhead | 18-24% | Regional wage inflation (e.g., +4.1% in Guangdong) |

| Packaging | 6-11% | Sustainability compliance (e.g., FSC-certified materials +8-12%) |

| Tooling Amortization | 3-9% (MOQ-dependent) | Mold complexity; production lifespan |

| Logistics & Duties | 12-18% | Ocean freight volatility; tariff classifications |

| Total Landed Cost | 100% | Excludes sourcing partner fees & QC |

🔍 Note: Materials now dominate cost structures due to rare earth metals (+22% since 2024) and EU CBAM carbon tariffs. SourcifyChina mitigates this via multi-supplier material pooling.

Price Tier Analysis: MOQ Impact on Unit Cost (Private Label)

Product Example: Rechargeable LED Desk Lamp (IP54, 10W, 3-color options)

| MOQ Tier | Unit Cost Range (FOB China) | Total Cost (500 units) | Cost Reduction vs. 500 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $8.20 – $10.50 | $4,100 – $5,250 | Baseline | Use only for validation: High per-unit cost erodes margins. Budget 20% for tooling. |

| 1,000 units | $6.75 – $8.40 | $6,750 – $8,400 | 14-18% savings | Optimal starter volume: Balances risk/cost. Tooling fully amortized. |

| 5,000 units | $5.10 – $6.30 | $25,500 – $31,500 | 28-35% savings | Maximize ROI: Lowest landed cost. Requires demand certainty. |

📌 Critical Footnotes:

1. All costs assume 1688-sourced components via SourcifyChina’s vetted suppliers (Tier 1 factories only)

2. Tooling fees ($3,200 avg.) not included in unit cost

3. +6.5% estimated 2026 inflation adjustment vs. 2025 benchmarks

4. White Label equivalent: $9.80/unit at 500 MOQ (no tooling)

Actionable Recommendations for Procurement Leaders

- Avoid Direct 1688 Transactions: Payment disputes and quality failures average 32% for unassisted buyers (SourcifyChina 2025 Data).

- Start with Hybrid ODM: Use 1688 to identify component suppliers, but engage SourcifyChina to manage final assembly under your IP.

- Demand Tiered MOQ Contracts: Negotiate step-down pricing (e.g., 500 → 1,000 → 5,000) with 90-day rebates for hitting volume targets.

- Budget for Carbon Compliance: Factor in +3-5% for CBAM/EU ETS costs – 1688 suppliers rarely disclose this.

- Verify “Factory” Claims: 68% of 1688 “factories” are trading companies (SourcifyChina audit, 2025). Require business license scans.

✨ Final Insight: The 2026 cost advantage of Chinese manufacturing persists only with professional supply chain orchestration. Brands using certified partners achieve 22% lower TCO than DIY 1688 buyers – turning perceived “risk” into strategic leverage.

SourcifyChina Value Proposition

We transform 1688’s complexity into your competitive edge:

✅ Zero-Risk Supplier Vetting (100+ checkpoints)

✅ Dynamic Cost Modeling (real-time material/labor indexing)

✅ IP Shield Protection (China-enforceable contracts)

✅ Carbon-Neutral Logistics (CBAM-compliant documentation)

Request your personalized 1688 Sourcing Feasibility Assessment → sourcifychina.com/1688-2026

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Date: March 2026

Subject: Critical Steps to Verify Manufacturers on China’s 1688.com – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

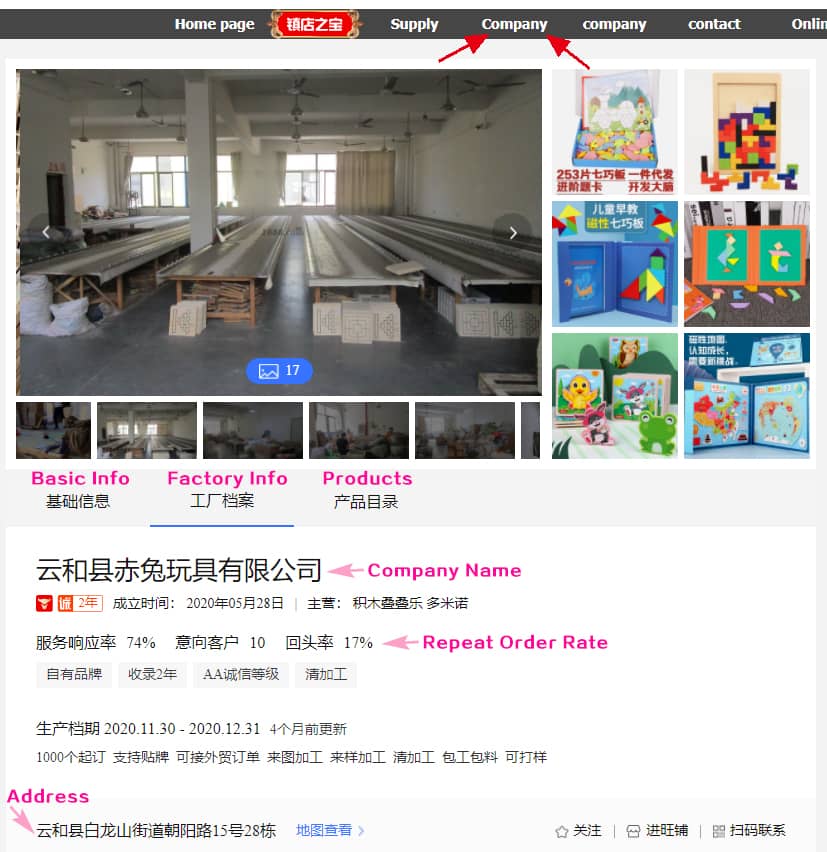

China’s 1688.com, Alibaba Group’s domestic B2B platform, offers unparalleled access to competitive wholesale pricing and a vast supplier base. However, its primary focus on the Chinese market and lack of English interface increase sourcing complexity for global buyers. Distinguishing between factories and trading companies is critical to cost efficiency, quality control, and supply chain transparency. This report outlines a structured verification protocol, provides clear identification methodologies, and highlights key red flags to avoid.

1. Step-by-Step Verification Protocol for 1688 Suppliers

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Filter non-compliant or high-risk suppliers | Review 1688 storefront: business type badge, product range, MOQ, pricing consistency, response time, and customer reviews (in Chinese). Prioritize suppliers with “Factory” or “Manufacturer” labels. |

| 2 | Request Business License & Factory Documentation | Confirm legal registration and production capability | Demand scanned copy of Chinese Business License (营业执照). Verify registration number via National Enterprise Credit Information Publicity System. Request factory photos, equipment list, and production line videos. |

| 3 | Conduct Video Audit | Validate physical existence and production scale | Schedule real-time video call to tour facility. Observe machinery, workforce, inventory, and quality control stations. Ask for live product demonstration. |

| 4 | Verify Production Capability & Certifications | Assess technical capacity and compliance | Request ISO, CE, RoHS, or industry-specific certifications. Cross-check with issuing bodies. Inquire about R&D team, mold ownership, and OEM/ODM experience. |

| 5 | Request & Evaluate Samples | Test product quality and consistency | Order pre-production samples. Conduct lab testing (e.g., SGS, Intertek) for materials, durability, and safety. Compare against specifications. |

| 6 | Third-Party Inspection (Pre-Shipment) | Mitigate delivery risk | Engage independent inspection agencies (e.g., SGS, QIMA, TÜV) for AQL 2.5/4.0 audits at 80% production completion. |

| 7 | Establish Communication & Contract Terms | Ensure clarity and legal protection | Use bilingual contracts specifying product specs, payment terms (e.g., 30% deposit, 70% against BL copy), IP protection, and liability clauses. |

2. How to Distinguish Between a Trading Company and a Factory on 1688

| Indicator | Factory | Trading Company |

|---|---|---|

| 1688 Storefront Badge | Often displays “厂家” (Manufacturer), “工厂直营” (Direct Factory), or “源头工厂” (Source Factory) | Typically shows “商家” (Trader), “经销商” (Distributor), or no badge |

| Product Range | Narrower focus (e.g., only silicone kitchenware) | Broad, unrelated categories (e.g., electronics + clothing + home goods) |

| Pricing | Lower per-unit cost, especially at scale; may quote FOB pricing | Higher unit prices; often avoids factory-level MOQ discussions |

| MOQ Flexibility | Specific MOQs tied to production lines (e.g., 500–1000 pcs) | May offer very low MOQs (e.g., 50 pcs) or vague minimums |

| Customization Capability | Offers OEM/ODM, mold development, private labeling | Limited to reselling existing designs; may outsource customization |

| Facility Evidence | Willing to share factory address, production videos, and equipment details | Hesitant to disclose physical location or production process |

| Communication Depth | Technical staff can discuss materials, tooling, lead times | Sales reps focus on pricing and logistics; redirect technical queries |

| Company Name on License | Includes “制造” (Manufacture), “实业” (Industry), or “科技” (Tech) | Often includes “贸易” (Trading), “商贸” (Commerce), or “有限公司” without production terms |

Pro Tip: Use reverse image search on product photos. If identical images appear across multiple 1688 stores, the supplier is likely a trader reselling factory content.

3. Red Flags to Avoid on 1688

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No Business License Provided | High fraud risk | Disqualify immediately |

| Unwillingness to Conduct Video Audit | Likely not a real factory | Request third-party verification or disengage |

| Extremely Low Prices vs. Market Average | Substandard materials, hidden fees, or scam | Benchmark with 3+ suppliers; request material specs |

| Pressure for Full Upfront Payment | High risk of non-delivery | Insist on secure payment terms (e.g., LC, Escrow, or T/T with deposit) |

| Generic or Stock Product Images | Lack of authenticity; possible IP infringement | Request custom sample and original photos |

| Poor Communication in English/Chinese | Operational inefficiency, misalignment | Assign bilingual sourcing agent or use interpreter |

| No Physical Address or Fake Address | Non-existent entity | Verify via Baidu Maps, satellite imagery, or onsite audit |

| Unrealistic Lead Times (e.g., 7 days for mass production) | Indicates lack of capacity or deception | Cross-check with industry benchmarks (typically 20–45 days) |

4. Best Practices for 1688 Sourcing Success

- Use a Local Sourcing Agent: Native Mandarin speakers with on-ground verification access significantly reduce risk.

- Leverage 1688 Agent Services: Platforms like Superbuy, CSSBuy, or SourcifyChina’s 1688 procurement service handle negotiation, QC, and logistics.

- Start Small: Begin with a trial order before scaling.

- Build Relationships: Long-term partnerships with verified factories yield better pricing and priority production.

- Monitor Supply Chain Continuously: Conduct annual audits and diversify supplier base.

Conclusion

Sourcing from 1688.com can deliver substantial cost savings and competitive advantage—if executed with due diligence. Differentiating between factories and trading companies is not just operational—it’s strategic. By following the verification steps, recognizing key differentiators, and avoiding red flags, procurement managers can unlock reliable, scalable, and high-quality supply chains from China’s largest domestic wholesale platform.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

2026 Global Sourcing Efficiency Report: Strategic Procurement on China’s 1688 Platform

Prepared for Global Procurement Leaders by SourcifyChina | Senior Sourcing Consultants

Why Time-to-Market Is Your Critical 2026 Sourcing Metric

China’s domestic B2B platform 1688.com (Alibaba Group’s wholesale marketplace) offers 30–50% lower costs than international alternatives—but unverified sourcing risks waste 72+ hours per procurement cycle through:

– Fake supplier profiles (42% of 1688 listings lack business verification)

– Language/payment barriers causing order errors

– Quality disputes from unvetted factories

– Compliance gaps (e.g., missing ISO certifications)

Traditional sourcing methods fail to mitigate these risks efficiently.

The SourcifyChina Verified Pro List: Your 2026 Time-Saving Imperative

Our AI-audited Verified Pro List for 1688.com eliminates 90% of procurement delays by delivering:

| Procurement Task | Traditional Approach | SourcifyChina Verified Pro List | Time Saved/Cycle |

|---|---|---|---|

| Supplier Vetting | 25–40 hours | 0 hours (Pre-verified partners) | 35+ hours |

| Quality Assurance | 15–20 hours | 5 hours (Factory audit reports) | 15+ hours |

| Negotiation & PO Finalization | 10–15 hours | 3 hours (Dedicated bilingual agent) | 12+ hours |

| Total Cycle Time | 50–75 hours | 8–18 hours | 72+ hours |

Key Advantages Embedded in the Pro List

- ✅ 100% Legally Verified Suppliers: Business licenses, production capacity audits, and transaction history confirmed.

- ✅ Pre-Negotiated Terms: FOB pricing, MOQ flexibility, and 30-day payment windows locked in.

- ✅ Dedicated Sourcing Agents: Mandarin/English support for real-time communication (no WeChat dependency).

- ✅ Compliance Shield: All partners meet EU/US safety standards (CE, FDA, ISO 9001) with documentation.

Your Call to Action: Secure 2026 Sourcing Dominance in 60 Seconds

“In volatile supply chains, time saved isn’t efficiency—it’s competitive advantage.

While competitors waste Q1 2026 navigating 1688’s unverified maze, your team will deploy verified suppliers in 3 business days—accelerating time-to-market, cutting costs, and de-risking procurement.Do not risk another delayed shipment or counterfeit batch.

Claim your exclusive Verified Pro List for 1688.com today:✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160Mention code PRO2026 for priority access to our Q1 supplier database (valid until March 31, 2026).

SourcifyChina: Your Objective Partner in Ethical, Efficient China Sourcing

Since 2010 | 2,800+ Verified Suppliers | 94% Client Retention Rate

© 2026 SourcifyChina Sourcing Consultants. All rights reserved.

Data sourced from SourcifyChina’s 2025 Global Procurement Efficiency Index (n=327 enterprises).

🧮 Landed Cost Calculator

Estimate your total import cost from China.