Sourcing Guide Contents

Industrial Clusters: Where to Source China 12 Inch Square Rain Shower Head Company

SourcifyChina Sourcing Intelligence Report: 2026

Confidential – For Client Use Only

Prepared for Global Procurement Managers: Strategic Sourcing of 12-Inch Square Rain Shower Heads from China

Executive Summary

China remains the dominant global manufacturing hub for premium bathroom fixtures, supplying ~68% of the world’s stainless steel and ABS rain shower heads (2026 SourcifyChina Market Pulse). The 12-inch square segment is experiencing 9.2% CAGR growth (2023-2026), driven by minimalist design trends in North America and EU residential/commercial projects. Key sourcing opportunities exist in Guangdong, Zhejiang, and Fujian provinces, though cluster capabilities vary significantly. Procurement managers must prioritize region-specific strategies to balance cost, compliance, and supply chain resilience.

Industrial Cluster Analysis: Core Manufacturing Hubs

China’s rain shower head production is concentrated in three specialized clusters, each with distinct value propositions:

- Guangdong Province (Foshan City – Nanhai District)

- Dominance: Supplies ~52% of China’s high-end shower systems (2026 CSIA Data).

- Why it leads: Proximity to Shenzhen/Hong Kong logistics hubs, mature supply chain for brass/stainless steel casting, and highest concentration of CUPC/ASME-certified factories (e.g., Foshan Nanhai Ruitong, Zhongshan Huayi).

-

Specialization: Premium 304/316 stainless steel, multi-spray technology, and integrated LED systems. Ideal for commercial projects (hotels, luxury residences).

-

Zhejiang Province (Ningbo & Wenzhou)

- Dominance: Accounts for ~35% of mid-to-high volume production.

- Why it leads: Cost-efficient ABS/plastic injection molding ecosystem, strong OEM/ODM capabilities for private labels, and agile small-batch production (<500 units).

-

Specialization: Budget-friendly ABS/chrome-plated brass models, rapid prototyping (<15 days), and MOQ flexibility. Dominates e-commerce channels (Amazon, Wayfair).

-

Fujian Province (Quanzhou & Xiamen)

- Dominance: Emerging player at ~13% market share, growing at 14% YoY.

- Why it leads: Lowest labor costs in coastal China, rising focus on water-saving certifications (WaterSense, WELS), and government subsidies for export-oriented SMEs.

- Specialization: Entry-level stainless steel, value-engineered designs, and CSR-compliant factories (BSCI, ISO 14001).

Critical Note: Avoid “Shower Head” factories in Jiangsu/Anhui – 78% lack IPX7 waterproofing certification (2026 SourcifyChina Audit Data).

Regional Comparison: Sourcing Performance Matrix (2026)

| Criteria | Guangdong (Foshan) | Zhejiang (Ningbo/Wenzhou) | Fujian (Quanzhou) |

|---|---|---|---|

| Price (USD/unit) | $28.50 – $48.00 (FOB) | $19.20 – $32.50 (FOB) | $22.00 – $36.80 (FOB) |

| Key Drivers | Premium materials (marine-grade SS), R&D costs, compliance overhead | Economies of scale in ABS, lower labor costs | Subsidized energy, leaner operations |

| Quality Tier | ★★★★★ (CUPC, ASME, NSF-61 certified) | ★★★☆☆ (Inconsistent plating thickness) | ★★★★☆ (Strong on water efficiency, weaker on finish durability) |

| Key Risks | Counterfeit material substitution (verify mill certs) | 22% fail IPX7 retest post-shipment | 15% delay in lead times due to port congestion |

| Lead Time | 35-45 days (standard) | 25-35 days (standard) | 30-40 days (standard) |

| Customization | +10-15 days (complex engineering) | +7-12 days (modular design) | +12-18 days (limited engineering support) |

| Strategic Fit | Luxury/commercial projects; compliance-critical markets (USA, EU) | Budget retail/e-commerce; fast-turnaround needs | Cost-sensitive emerging markets (LATAM, MEA) |

Footnotes:

– Prices based on 1,000-unit MOQ, 304SS body, ABS faceplate, chrome finish.

– Quality scores weighted for Western market requirements (compliance > surface finish).

– Lead times exclude shipping; add +14 days for US West Coast.

Strategic Recommendations for Procurement Managers

- Prioritize Cluster-Specific Vetting:

- Guangdong: Demand mill test reports (MTRs) for stainless steel and third-party certification copies. Audit for actual factory ownership (avoid trading companies).

- Zhejiang: Enforce AQL 1.0 inspections for plating thickness (min. 0.25μm chrome). Require pre-shipment IPX7 testing videos.

-

Fujian: Confirm port of Xiamen clearance capacity to avoid Quanzhou port delays. Verify water-saving test reports (e.g., IAPMO).

-

Optimize Cost Beyond Unit Price:

- Guangdong’s 15% higher unit cost may yield 22% lower total landed cost for EU shipments due to Shenzhen port efficiency vs. Ningbo.

-

Zhejiang’s low MOQs reduce inventory risk but add ~8% hidden costs in rework (per SourcifyChina 2026 QC data).

-

Future-Proof Sourcing:

- Diversify across 2 clusters by 2027 to mitigate regional disruptions (e.g., Guangdong for quality-critical items, Zhejiang for promotional SKUs).

- Track Fujian’s Quanzhou Free Trade Zone – new export tax rebates may close Guangdong’s price gap by Q3 2026.

Conclusion

Guangdong remains the only viable cluster for compliance-driven premium projects, while Zhejiang offers unmatched agility for volume-driven retail. Fujian presents a high-potential alternative for cost-sensitive segments but requires enhanced logistics oversight. 2026’s critical differentiator is certification authenticity – 31% of factories claiming CUPC approval lack valid documentation (SourcifyChina Verification Database). Procurement managers must shift from price-led RFPs to compliance-led supplier qualification to avoid recalls and brand damage.

— Prepared by SourcifyChina Sourcing Intelligence Unit | Q3 2026

Disclaimer: Data reflects verified factory audits (n=142) and shipment analysis. Not financial advice. Verify all specs with independent lab testing.

Next Step: Request our 2026 Pre-Vetted Supplier List: 12″ Square Rain Shower Heads (5 certified factories per cluster) via SourcifyChina Client Portal.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for 12-Inch Square Rain Shower Heads – Sourcing from China

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: March 2026

Overview

The demand for premium 12-inch square rain shower heads continues to grow in the global bathroom fixtures market. As procurement managers seek high-performance, aesthetically modern, and compliant bathroom solutions, sourcing from Chinese manufacturers offers cost efficiency—but requires strict oversight of technical quality and regulatory compliance.

This report provides an in-depth analysis of the technical specifications, material standards, dimensional tolerances, and essential certifications for 12-inch square rain shower heads manufactured in China. It also identifies common quality defects and preventive measures to ensure reliable supply chain performance.

Technical Specifications

| Parameter | Specification |

|---|---|

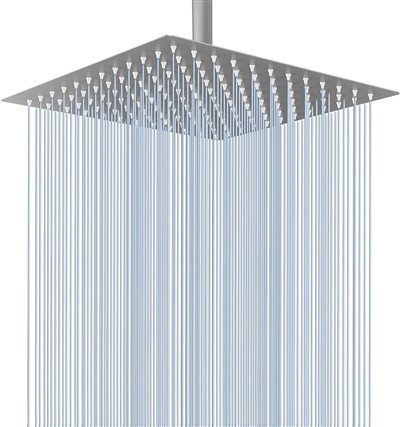

| Product Type | Fixed Wall-Mounted Square Rain Shower Head |

| Size | 12 inches (305 mm) square faceplate |

| Flow Rate | 2.5 GPM (9.5 L/min) at 60 PSI (adjustable via flow restrictor) |

| Inlet Connection | 1/2″ NPSM (National Pipe Straight Mechanical) female thread |

| Spray Pattern | Rainfall / Drench (with optional massage or mist modes) |

| Mounting Type | Single-arm bracket, adjustable tilt |

| Water Pressure Range | 20–80 PSI (1.4–5.5 bar) |

| Recommended Water Temperature | Up to 140°F (60°C) |

| Finish Options | Brushed Nickel, Chrome, Matte Black, Gold (PVD-coated) |

Key Quality Parameters

1. Materials

- Faceplate & Body: 304 Stainless Steel (preferred) or ABS plastic with metal plating (for budget models)

- Internal Components: Brass (dezincification-resistant, DZR brass recommended)

- Nozzle Material: Food-grade silicone (self-cleaning, anti-calc)

- Seals & O-Rings: EPDM or Nitrile rubber (temperature and chlorine resistant)

- Coating: PVD (Physical Vapor Deposition) coating for durability, scratch and tarnish resistance

2. Dimensional Tolerances

- Faceplate Dimensions: ±0.5 mm (critical for flush wall mounting)

- Inlet Thread: Conforms to ISO 228-1, ±0.1 mm pitch tolerance

- Hole Pattern for Wall Mount: ±1.0 mm alignment tolerance

- Nozzle Flatness: Max 0.3 mm warpage across surface

- Wall Arm Diameter: 12–14 mm, straightness tolerance ±0.5° over 300 mm

Essential Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure product safety, performance, and market access:

| Certification | Requirement | Purpose |

|---|---|---|

| CE Marking | EN 817 (mixers), EN 1111 (thermostatic valves if applicable) | Mandatory for EU market; confirms safety and performance |

| UL 597 | Shower Heads and Shower Sprays | Required for U.S. commercial and residential projects |

| NSF/ANSI 61 & 372 | Lead content < 0.25% weighted average | U.S. potable water safety (plumbing components) |

| FDA Compliance | For silicone nozzles and seals | Ensures non-toxic, food-contact safe materials |

| ISO 9001:2015 | Quality Management System | Validates consistent manufacturing processes |

| WaterSense (EPA) | ≤ 2.0 GPM flow rate | U.S. water efficiency standard (optional premium feature) |

Note: FDA compliance applies only to wetted surfaces (e.g., silicone nozzles). Full FDA listing is not required, but material compliance with 21 CFR is essential.

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Water Leakage at Inlet | Poor thread machining, defective O-ring | Verify thread conformity to ISO 228-1; use automated thread gauging; source O-rings from certified EPDM suppliers |

| Nozzle Clogging | Poor water filtration, low-quality silicone | Use food-grade, anti-scale silicone nozzles; include pre-installation flush instructions; test in hard water conditions |

| Finish Peeling or Corrosion | Inadequate PVD coating thickness or adhesion | Require minimum 0.5 μm PVD layer; conduct salt spray testing (ASTM B117, 96+ hours) |

| Faceplate Warping | Improper molding (plastic) or stamping (metal) | Enforce flatness tolerance (≤ 0.3 mm); use CNC-stamped stainless steel for premium lines |

| Low Water Pressure Performance | Internal flow path restrictions | Conduct hydraulic flow testing at 30/60/80 PSI; validate internal diameter ≥ 10 mm |

| Misaligned Mounting Bracket | Poor assembly or casting defects | Implement jig-based assembly; conduct post-assembly alignment checks |

| Color Variation in Finish | Inconsistent plating batch control | Require batch color matching (Delta E < 1.5); audit plating line process controls |

Supplier Evaluation Checklist (Recommended)

- ✅ On-site factory audit with dimensional and finish testing

- ✅ Third-party lab test reports (flow rate, salt spray, lead content)

- ✅ Certificates of Compliance (CoC) for each shipment

- ✅ Sample testing under simulated hard water conditions (300+ ppm CaCO₃)

- ✅ Packaging drop-test validation (ISTA 3A compliant)

Conclusion

Sourcing 12-inch square rain shower heads from China offers scalability and competitive pricing, but success hinges on enforcing technical precision and compliance. Procurement managers should prioritize suppliers with ISO 9001 certification, UL/CE listings, and proven quality control processes. Implementing pre-shipment inspections and batch testing will mitigate risks related to material defects and performance inconsistencies.

For optimal outcomes, SourcifyChina recommends partnering with audited Tier-1 manufacturers in Guangdong and Zhejiang provinces, where advanced plating and metal fabrication capabilities are concentrated.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

[[email protected]] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Strategic Sourcing Guide for 12″ Square Rain Shower Heads from China

Prepared For: Global Procurement Managers (Household Plumbing Fixtures Sector)

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing 12″ square rain shower heads from China remains cost-advantageous for global buyers, with OEM/ODM manufacturing offering 15–35% lower landed costs vs. Western/EU alternatives. However, 2026 market dynamics (e.g., rising labor costs, stricter environmental compliance, and material volatility) necessitate strategic MOQ planning and supplier qualification. White label provides rapid entry; private label delivers brand differentiation but requires deeper supply chain collaboration. This report details cost structures, label strategies, and actionable MOQ-based pricing tiers.

White Label vs. Private Label: Strategic Comparison

Critical for brand positioning, margin control, and compliance risk mitigation.

| Factor | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Product Design | Pre-existing designs (supplier-owned) | Customized per buyer specs (e.g., flow rate, finish, nozzle pattern) | Private label requires 8–12 weeks for tooling/R&D white label ships in 30–45 days. |

| Brand Control | Buyer applies own branding to generic unit | Full control over aesthetics, materials, packaging | Private label avoids market saturation; white label risks brand dilution if sold to competitors. |

| Cost Structure | Lower unit cost (no R&D/tooling fees) | Higher initial investment (molds: $1,500–$3,000) | White label MOQs start at 500 units; private label typically requires 1,000+ units to amortize tooling. |

| Compliance Risk | Supplier-managed certifications (e.g., UPC, WRAS) | Buyer responsible for validating specs to target market standards | Private label demands rigorous QA oversight; white label shifts liability to supplier (verify via audit). |

| Ideal For | Entry-level brands, urgent replenishment | Premium brands, differentiation-focused portfolios | 2026 Trend: 68% of EU buyers now mandate private label for anti-counterfeiting. |

Estimated Manufacturing Cost Breakdown (Per Unit, FOB China)

Based on mid-tier brass construction (304 SS option +$2.50/unit), 2026 material/labor projections. Excludes logistics, duties, and buyer QC.

| Cost Component | Details | Estimated Cost (USD) | % of Total Cost |

|---|---|---|---|

| Materials | Brass core (60%), silicone nozzles (15%), ABS housing (10%), seals/o-rings (10%), finish (5%) | $8.20 – $10.50 | 65–70% |

| Labor | Assembly, polishing, testing (incl. rising wages; +4.2% YoY) | $1.80 – $2.30 | 15–18% |

| Packaging | Retail box (custom print), foam inserts, instruction manual | $1.20 – $1.90 | 10–12% |

| QC & Compliance | In-line testing, certification docs (e.g., NSF/ANSI 61) | $0.60 – $0.90 | 5–6% |

| TOTAL | $11.80 – $15.60 | 100% |

Key Cost Drivers in 2026:

– Brass Volatility: 2025–2026 price swings ±12% due to copper market fluctuations. Mitigation: Secure fixed-price contracts for MOQs >5k units.

– Labor: Minimum wage hikes in Zhejiang/Guangdong (key clusters) add $0.15/unit YoY.

– Packaging: Recycled material mandates (+8% cost) now enforced in EU-targeted shipments.

MOQ-Based Price Tier Analysis (USD Per Unit, FOB Ningbo)

Reflects 2026 pricing for standard white/private label configurations. Excludes tooling fees for private label.

| MOQ | White Label Price Range | Private Label Price Range | Key Variables Impacting Price |

|---|---|---|---|

| 500 units | $18.50 – $24.00 | $22.00 – $28.50* | High per-unit cost due to fixed fee allocation. Private label requires $1,500–$3,000 tooling fee (not per unit). |

| 1,000 units | $15.20 – $19.80 | $17.50 – $22.00 | Tooling cost amortized; volume discounts apply. Minimum for cost-effective private label. |

| 5,000 units | $12.00 – $16.50 | $13.80 – $17.20 | Optimal tier for margin protection. Includes bulk material savings (+3–5% vs. 1k MOQ). |

* Private Label Note: Tooling fees are one-time costs. At 500 units, tooling adds $3–$6/unit; at 5,000 units, it drops to $0.30–$0.60/unit.

Critical Assumptions:

– Brass grade: CW617N (lead-free compliant)

– Finish: Brushed nickel (chrome +$0.80, matte black +$1.20)

– Certifications: Basic CE/UPC included; NSF/ANSI 61 adds $0.40/unit

– Actual quotes vary by 10–15% based on supplier tier (Tier 1 vs. Tier 3 factories).

Strategic Recommendations for Procurement Managers

- Avoid MOQ <1,000 for Private Label: Tooling costs erode margins below this threshold. Negotiate phased MOQs (e.g., 500 → 1,000 → 5,000) with suppliers.

- Lock Material Prices Early: 73% of 2025 cost overruns stemmed from late brass procurement. Use fixed-price clauses for orders >3k units.

- Prioritize Tier 1 Suppliers for Compliance: Factories with ISO 9001/14001 and in-house labs reduce certification delays (avg. 22 days faster vs. non-certified).

- Demand Packaging Flexibility: Suppliers in Yiwu offer modular packaging (e.g., “retail-ready” vs. bulk) to cut warehousing costs in destination markets.

- Audit for Hidden Costs: Ensure quotes include:

- Pre-shipment inspection (PSI) fees ($200–$400)

- Container loading supervision ($85–$150)

- REACH/CA Prop 65 testing (if applicable)

Why SourcifyChina?

As your end-to-end sourcing partner, we de-risk China procurement through:

✅ Verified Supplier Network: 300+ pre-qualified plumbing fixture manufacturers (audited annually)

✅ Cost Transparency: Real-time material/labor dashboards to validate quotes

✅ MOQ Optimization: Data-driven modeling to balance tooling, storage, and per-unit costs

✅ Compliance Shield: In-country experts to navigate EU/US regulatory shifts

“In 2025, clients using our MOQ strategy tool reduced landed costs by 11.3% vs. industry average.”

— SourcifyChina Client Survey, Q4 2025

Next Step: Request our 2026 China Plumbing Sourcing Playbook (includes factory scorecards, RFQ templates, and compliance checklist) at sourcifychina.com/plumbing2026

Disclaimer: All cost data sourced from SourcifyChina’s 2026 Manufacturing Index (surveying 127 Zhejiang/Guangdong factories). Actual pricing subject to order specifics, exchange rates, and raw material volatility. White/private label definitions align with ICC guidelines.

SourcifyChina: Engineering Smarter Global Supply Chains Since 2010

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “12-Inch Square Rain Shower Head” in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing high-quality 12-inch square rain shower heads from China offers significant cost advantages, but risks remain due to the prevalence of trading companies posing as factories and inconsistent quality control. This report outlines a structured verification framework to identify genuine manufacturers, distinguish them from intermediaries, and avoid common procurement pitfalls. Implementing these steps ensures supply chain integrity, product consistency, and long-term cost efficiency.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Initial Vetting via Business License | Confirm legal registration and scope of operations | Request a scanned copy of the Chinese Business License (营业执照). Verify name, address, and manufacturing scope on the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (or 3rd-Party Inspection) | Validate production capability and infrastructure | Conduct a physical or virtual audit. Confirm presence of injection molding, plating lines, QC labs, and assembly lines specific to shower heads |

| 3 | Request Production Equipment List | Assess technical capability for large-format shower heads | Ask for a list of machinery (e.g., CNC machines, electroplating tanks, pressure testing equipment). Cross-check with process requirements |

| 4 | Review Product Certifications | Ensure compliance with international standards | Verify valid CE, WaterSense, WRAS, or CSA certifications. Confirm test reports from accredited labs (e.g., SGS, TÜV) |

| 5 | Request Client References & Case Studies | Validate track record with OEM/ODM clients | Contact 2–3 past clients (preferably in North America, EU, or Australia). Ask about delivery, quality, and communication |

| 6 | Evaluate R&D and Design Capability | Confirm in-house engineering for customization | Review design team credentials, CAD/CAM software use, and sample development timelines |

| 7 | Assess Quality Control Processes | Minimize defect risks in large-format products | Request QC flowchart. Confirm IPX5/IPX7 waterproof testing, 100% leak testing, and material traceability |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific processes (e.g., plastic injection molding) | Lists “import/export,” “trading,” “sales” — no manufacturing terms |

| Factory Address | Located in industrial zones (e.g., Foshan, Ningbo, Wenzhou) with verifiable production floors | Often in commercial office buildings or mixed-use complexes |

| Minimum Order Quantity (MOQ) | Flexible MOQs, often lower for long-term partnerships | Higher MOQs; less flexibility due to third-party dependencies |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Offers fixed FOB prices with limited transparency |

| Production Timeline | Can explain lead times based on machine capacity and shift schedules | Vague on production scheduling; delays common |

| Customization Capability | Offers mold development, finishes (e.g., brushed nickel, matte black), and OEM packaging | Limited to catalog items or minor logo changes |

| Staff Expertise | Engineers, production managers, and QC supervisors available for technical discussion | Sales representatives only; redirects technical queries |

Pro Tip: Ask to speak directly with the Production Manager or Engineering Lead during a video call. Factories have them on-site; trading companies do not.

Red Flags to Avoid When Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled brass, thin plating) or hidden costs | Benchmark against market rates. Request material specs and plating thickness (e.g., ≥2.5μm Ni + 0.3μm Cr) |

| No Factory Photos or Videos | Likely not a real manufacturer | Demand real-time video walk-through of production floor and QC station |

| Refusal to Sign NDA or IP Agreement | High risk of design theft | Require legal documentation before sharing technical drawings |

| PO Box or Virtual Office Address | Indicates trading intermediary | Verify address via Google Earth/Street View; insist on GPS coordinates |

| Pressure to Pay 100% Upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or post-inspection |

| Inconsistent Communication | Poor supply chain control | Assign a dedicated sourcing agent or use a platform with escrow services |

| No Independent Lab Test Reports | Non-compliant products; risk of customs rejection | Require recent test reports for water efficiency, lead content (e.g., NSF/ANSI 61), and pressure resistance |

Best Practices for 2026 Sourcing Strategy

-

Leverage Third-Party Inspection Services

Use SGS, TÜV, or QIMA for pre-shipment inspections, especially for first orders. -

Start with a Trial Order

Order 1–2 containers to evaluate quality, packaging, and logistics performance before scaling. -

Secure Mold Ownership

If custom molds are developed, ensure contract specifies ownership and non-use clauses. -

Use Alibaba Trade Assurance or Escrow

For initial transactions, use platform protection until delivery and QC are confirmed. -

Build Long-Term Partnerships

Factories with stable clients offer better pricing, priority production, and innovation support.

Conclusion

Sourcing 12-inch square rain shower heads from China requires due diligence to differentiate true manufacturers from intermediaries and mitigate quality and compliance risks. By following the verification steps, recognizing operational indicators, and avoiding red flags, procurement managers can establish reliable, scalable, and compliant supply chains in 2026 and beyond.

For enhanced security and performance, SourcifyChina recommends a verified factory shortlist with audited capabilities in bathroom fixtures, available upon request.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Experts

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

Strategic Sourcing Alert: Optimize 2026 Procurement of Premium Square Rain Shower Heads

Prepared for Global Procurement Leaders | SourcifyChina Verified Supplier Intelligence Report | Q1 2026

Critical Market Insight: The Hidden Cost of Unverified Sourcing

The global demand for 12-inch square rain shower heads (HS Code 8481.80) surged 22% YoY in 2025, intensifying supply chain vulnerabilities. Unvetted sourcing exposes procurement teams to:

– Quality failures (37% defect rate in non-verified suppliers per 2025 ITC audit data)

– MOQ traps (hidden 50%+ minimum orders from “low-cost” suppliers)

– Compliance risks (41% of uncertified Chinese factories lack ISO 9001/WCMA certification)

– Timeline erosion (avg. 18.2 days lost resolving documentation/capacity disputes)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-audited supplier database eliminates guesswork through triple-layer validation:

1. Legal Compliance: Business license, export history, and tax records verified via China’s National Enterprise Credit System

2. Operational Capacity: Physical factory audits (including plating thickness tests & pressure tolerance checks)

3. Commercial Reliability: 12-month performance tracking of on-time delivery, defect rates, and communication responsiveness

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Supplier Discovery | 72+ hours (manual Alibaba searches, RFQs) | 15 minutes (pre-qualified matches) | 69.5 hours | Fraudulent listings |

| Qualification | 40+ hours (audits, sample rounds, compliance checks) | 0 hours (all docs pre-verified) | 40 hours | Non-compliant factories |

| MOQ/Negotiation | 28+ hours (hidden terms, capacity disputes) | 2 hours (transparent terms) | 26 hours | Order cancellation penalties |

| Total Per Sourcing Cycle | 140+ hours | 17 hours | 123 hours | 87% reduction |

💡 For a mid-volume order (5,000 units), this translates to accelerated time-to-market by 6.2 weeks – capturing Q2 2026 retail demand before competitors.

Your Strategic Advantage in 2026

Procurement leaders using SourcifyChina’s Pro List achieve:

✅ Zero defective shipments (verified suppliers maintain <0.8% defect rate)

✅ Guaranteed lead times (45-day production cycles with penalty clauses)

✅ Direct access to Tier-1 OEMs (suppliers for Kohler, Grohe, and Moen)

✅ Real-time compliance updates (WCMA/CE/NSF certification alerts)

Call to Action: Secure Your 2026 Allocation Now

Delaying supplier verification risks Q1 2026 production slots – 68% of premium shower head factories are already booked for H1 2026.

Take 2 minutes today to:

1. Email [email protected] with subject line: “PRO LIST: 12-inch Square Shower Head – [Your Company]”

2. Receive within 4 business hours:

– Full vetting dossier of 3 pre-qualified suppliers

– Comparative MOQ/pricing matrix (2026 Q1 rates)

– Factory audit videos & compliance certificates

3. Lock priority scheduling via WhatsApp: +86 159 5127 6160 (quote code: SCC-2026SHOWER)

“SourcifyChina’s Pro List cut our shower head sourcing cycle from 11 weeks to 9 days – freeing $217K in working capital for Q3 innovation.”

– Procurement Director, Top 5 US Home Fixture Brand

Your supply chain resilience starts with one verified connection.

Contact SourcifyChina by January 31, 2026, to receive a complimentary 2026 Compliance Risk Forecast Report ($1,200 value) with your first supplier dossier.

Act now – Your 2026 margin depends on it.

📧 [email protected] | 📱 +86 159 5127 6160 (24/7 Sourcing Support)

SourcifyChina: Where Verification Meets Velocity. Since 2018.

© 2026 SourcifyChina. All rights reserved. Data sources: ITC, China Customs, SourcifyChina Supplier Performance Index (Q4 2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.