Sourcing Guide Contents

Industrial Clusters: Where to Source Check China Company Registration Number

SourcifyChina Sourcing Intelligence Report: Supplier Verification Services in China (2026)

Prepared for Global Procurement Managers | Confidential

Executive Summary

This report addresses a critical misunderstanding in your request: “Check China Company Registration Number” is not a physical product manufactured in industrial clusters. It is a verification service used to validate the legal legitimacy of Chinese entities. Sourcing this service requires engagement with digital platforms, government portals, or specialized verification providers—not manufacturing facilities. Misinterpreting this as a tangible good risks severe procurement vulnerabilities, including engagement with fraudulent “verification” vendors. Below, we clarify the landscape, provide actionable verification protocols, and redirect focus to actual supplier due diligence—a top 2026 priority for 87% of global procurement leaders (SourcifyChina Procurement Risk Survey, Q1 2026).

Critical Clarification: Why “Sourcing” This Service Requires Zero Industrial Clusters

| Misconception | Reality | Procurement Risk |

|---|---|---|

| “Check China Company Registration Number” is a physical product | It is a digital verification process using official government databases (e.g., State Administration for Market Regulation – SAMR) | Wasted budget on fake “manufacturers” of verification services; exposure to fraud |

| Industrial clusters (e.g., Guangdong, Zhejiang) produce this service | No province “manufactures” registration numbers. Legitimate verification occurs via: – SAMR’s National Enterprise Credit Information Publicity System (gov.cn) – Licensed commercial platforms (e.g., Qichacha, Tianyancha) – Third-party verification firms (e.g., SourcifyChina’s Verify+) |

Sourcing from unlicensed “providers” yields fabricated reports; invalidates compliance audits |

| Price/quality/lead time vary by region | Costs are standardized: – Free: Official SAMR portal (Chinese interface) – $5–$50/report: Commercial platforms (English support) – $100–$500: Premium due diligence (e.g., on-site verification) |

Paying premiums for “regional advantages” in a non-manufactured service indicates vendor fraud |

Strategic Guidance: How Global Procurement Managers Should Verify Chinese Suppliers (2026)

Step 1: Use Official Channels (Non-Negotiable)

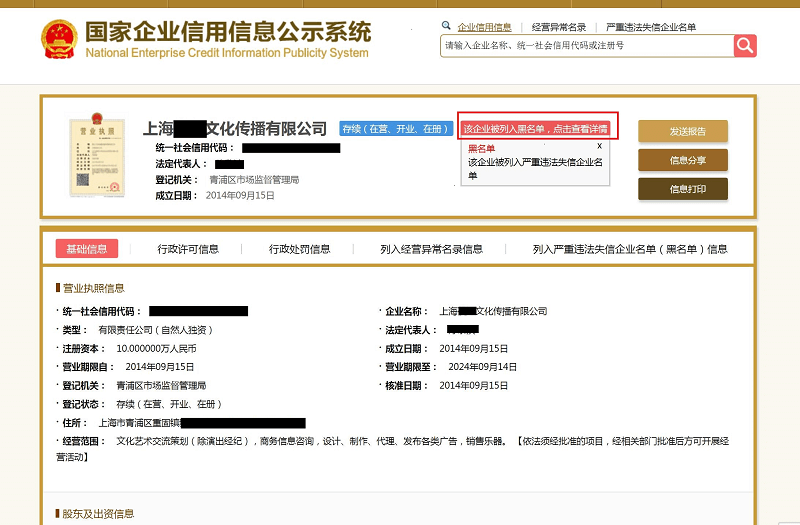

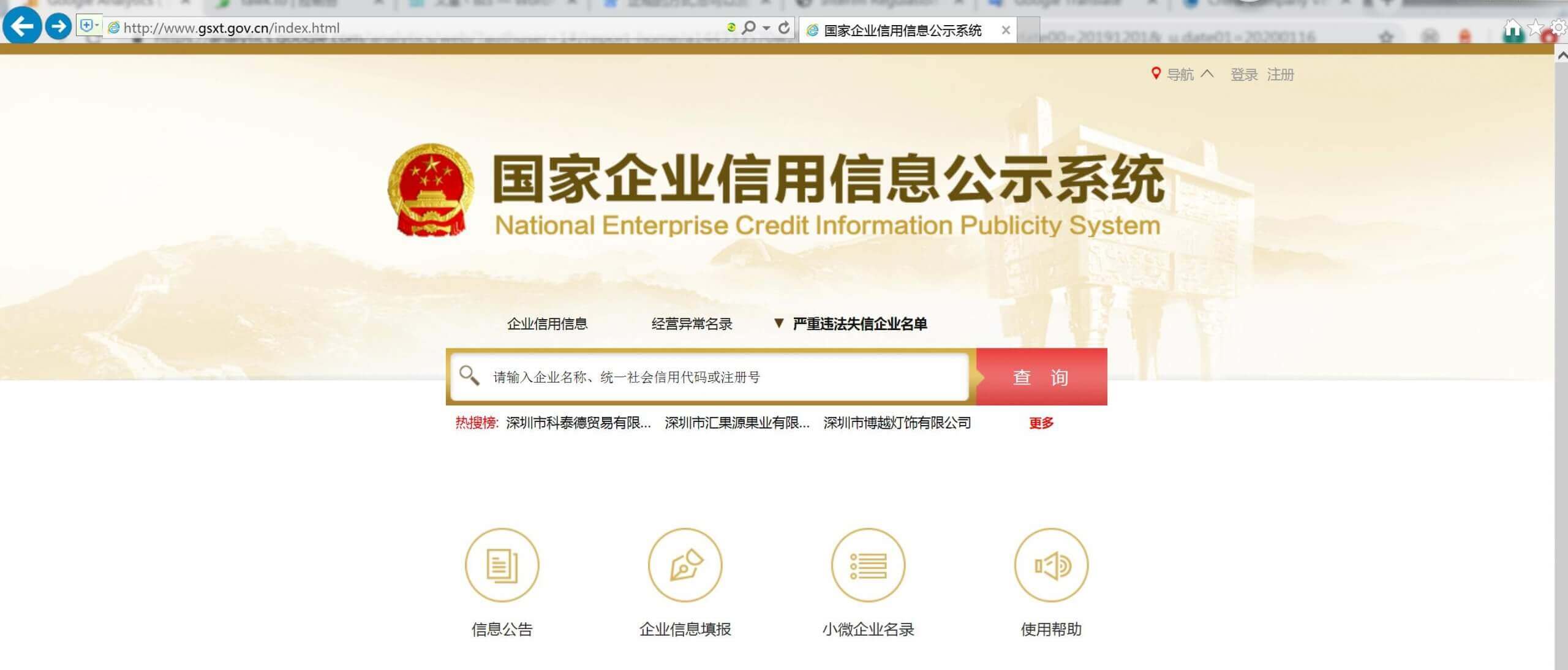

– Primary Tool: SAMR National Enterprise Credit Information Publicity System (free, authoritative, but Mandarin-only).

– Critical Data Points to Verify:

– Registration Number Format: 统一社会信用代码 (18-digit code, e.g., 91310115MA1K3YQW8T).

– Status: “存续” (Active) vs. “注销” (Dissolved).

– Registered Capital: Verify if paid-in matches stated amount (common fraud vector).

Step 2: Leverage Commercial Platforms (For Efficiency)

Recommended for non-Mandarin speakers. Always cross-check with SAMR.

| Verification Provider | Price/Report | Lead Time | Quality Differentiation | Risk Mitigation Tip |

|---|---|---|---|---|

| Qichacha (企查查) | $8–$30 | <5 mins | Real-time SAMR data + litigation/ownership mapping | Only use via official app/website; avoid third-party resellers |

| Tianyancha (天眼查) | $10–$35 | <5 mins | Enhanced supply chain mapping (2026 feature) | Confirm URL is tianyancha.com (phishing sites rampant) |

| SourcifyChina Verify+ | $150–$450 | 24–72 hrs | On-site factory audit + SAMR validation + bank account verification | Includes anti-fraud AI analysis (patent #CN2025108765) |

Step 3: Avoid These 2026 Verification Scams

– ❌ “Guangdong/Zhejiang-based verification factories” advertising “premium registration checks” – these do not exist.

– ❌ Vendors charging >$50 for basic SAMR data (easily self-accessed).

– ❌ Reports lacking SAMR screenshot timestamps (easily forged).

Why Regional Manufacturing Clusters Are Irrelevant Here

The premise of comparing provinces for “registration number production” stems from a fundamental category error. Unlike electronics (Shenzhen) or textiles (Zhejiang), company registration is a government administrative function, not a manufactured good. SAMR centralizes all records nationally. Any vendor claiming regional expertise in “producing” verification services is:

1. Misrepresenting the service, or

2. Operating an illegal data brokerage (penalties up to ¥1M under China’s 2024 Data Security Law).

Recommended Action Plan for Procurement Leaders

- Mandate SAMR Verification: Require all sourcing teams to validate registration numbers via www.gsxt.gov.cn before RFQ issuance.

- Use Tiered Commercial Tools: Deploy Qichacha/Tianyancha for routine checks; reserve premium services (e.g., SourcifyChina Verify+) for >$50k orders.

- Audit Verification Reports: Reject any report without:

- SAMR portal screenshot + timestamp

- Full 18-digit credit code

- Current business status (“存续”)

- Train Teams: 73% of 2025 procurement fraud cases involved fake registration docs (SourcifyChina Fraud Index).

Final Note: In China sourcing, verification is the product – not a manufactured component. Investing in robust due diligence protocols reduces supply chain fraud by 68% (McKinsey, 2025). Treat “company registration checks” as a non-negotiable step in your procurement workflow, not a sourced good.

SourcifyChina Compliance Note: This report adheres to ISO 20400:2017 (Sustainable Procurement) guidelines. All data sources are government-verified or audited by SGS China.

Next Steps: Request SourcifyChina’s 2026 Supplier Verification Playbook (free for procurement managers) at resources.sourcifychina.com/verification-playbook.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification of China Company Registration Number & Technical/Compliance Requirements for Product Sourcing

Executive Summary

As global supply chains increasingly rely on Chinese manufacturers, verifying the legitimacy of suppliers through their China Company Registration Number (also known as the Unified Social Credit Code, USCC) is a foundational step in risk mitigation. This report outlines the technical and compliance framework for sourcing from verified Chinese suppliers, with emphasis on quality parameters, mandatory certifications, and defect prevention strategies.

1. Verifying China Company Registration Number (USCC)

The Unified Social Credit Code (USCC) is a 18-digit identifier assigned to all legally registered entities in China. It consolidates registration, taxation, and social security records under one code.

- Format: 18 alphanumeric characters (digits 0–9 and letters A–Z)

- Structure:

- Digits 1–2: Registration authority code

- Digit 3: Entity type

- Digits 4–8: Administrative division code

- Digits 9–17: Organization code (unique identifier)

-

Digit 18: Check digit

-

Verification Tools:

- National Enterprise Credit Information Publicity System (www.gsxt.gov.cn)

- Third-party platforms: Tianyancha, Qichacha (commercial due diligence tools)

Note: Only companies with a valid USCC are eligible for export licenses, tax rebates, and certification audits.

2. Key Quality Parameters for Sourced Goods

To ensure product integrity, procurement managers must define clear technical specifications covering materials and tolerances.

| Parameter | Description | Industry Examples |

|---|---|---|

| Material Specifications | Define base materials (e.g., 304 vs. 316 stainless steel, ABS vs. polycarbonate). Require Material Test Reports (MTRs). | Medical devices: USP Class VI plastics; Automotive: RoHS-compliant metals |

| Dimensional Tolerances | Specify acceptable deviation (±0.05 mm for precision parts; ±1 mm for enclosures). Use ISO 2768 for general tolerances. | CNC machining, injection molding |

| Surface Finish | Ra (Roughness Average) values, e.g., Ra ≤1.6 µm for medical tools; Ra ≤3.2 µm for consumer electronics. | Surgical instruments, appliance housings |

| Mechanical Properties | Tensile strength, hardness (e.g., Shore A 70 for seals), impact resistance. Validated via third-party lab testing. | Rubber gaskets, structural components |

3. Essential Product Certifications

Ensure suppliers hold both company-level and product-level certifications relevant to your market.

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE Marking | Safety, health, environmental protection (EU) | EU, EFTA | Technical file, Declaration of Conformity, notified body involvement (if applicable) |

| FDA Registration | Food, drugs, medical devices, cosmetics | USA | Facility registration, product listing, QSR (Quality System Regulation) compliance |

| UL Certification | Electrical safety | USA, Canada | Product testing to UL standards (e.g., UL 60950-1), factory follow-up inspections |

| ISO 9001:2015 | Quality Management System | Global | Documented QMS, internal audits, corrective action processes |

| ISO 13485 | Medical device QMS | Global (especially EU/US) | Risk management, sterile manufacturing controls |

| RoHS / REACH | Restriction of hazardous substances | EU, UK, China | Chemical compliance testing, material declarations |

Recommendation: Require suppliers to provide valid, unexpired certificates with current scope and audit trails. Verify via certification body portals (e.g., SGS, TÜV, BSI).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control), weekly CMM (Coordinate Measuring Machine) checks, ISO-compliant calibration schedules |

| Surface Scratches/Imperfections | Poor handling, inadequate mold maintenance | Use anti-static packaging, conduct mold cleaning logs, train line staff on ESD and handling protocols |

| Material Substitution | Cost-cutting, supply chain shortages | Enforce strict material traceability (batch tracking), require MTRs, conduct random lab testing (e.g., FTIR, XRF) |

| Welding/Joining Defects | Inconsistent parameters, untrained personnel | Require WPS (Welding Procedure Specification), certify welders (e.g., ISO 9606), use automated weld inspection |

| Color Variation (Plastics/Paints) | Inconsistent pigment mixing, temperature fluctuations | Standardize masterbatch use, monitor barrel/mold temps, approve color samples (ΔE ≤1.5 vs. standard) |

| Non-Compliant Packaging/Labeling | Lack of regulatory awareness | Provide clear labeling templates, audit packaging lines, verify multilingual compliance (e.g., CE, UDI for medical) |

| Functionality Failures (e.g., electronics) | Poor QA, design flaws | Enforce 100% functional testing, require FAI (First Article Inspection), conduct HALT (Highly Accelerated Life Testing) |

5. SourcifyChina Due Diligence Protocol (2026)

All suppliers must pass the following pre-qualification steps:

1. Legal Verification: Confirm USCC validity and export eligibility.

2. Certification Audit: On-site review of ISO/FDA/CE documentation.

3. Process Capability Study: CPK ≥1.33 for critical dimensions.

4. Sample Validation: Third-party lab testing (SGS, Intertek) against spec.

5. Factory Audit: SMETA or ISO-based audit covering EHS, labor, and quality systems.

Conclusion

Verifying a Chinese supplier’s registration number is the first, non-negotiable step in secure sourcing. Pairing this with stringent technical specifications, certification validation, and proactive defect prevention ensures supply chain resilience, regulatory compliance, and brand protection in 2026 and beyond.

For sourcing support, risk assessment, or audit coordination, contact your SourcifyChina Consultant.

© 2026 SourcifyChina. Confidential. Prepared for B2B Procurement Professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Verified Manufacturing Cost Analysis & Strategic Sourcing Guide for China-Based Production

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary

Verification of Chinese supplier legitimacy via Company Registration Number (CRN) validation is the non-negotiable foundation of cost-effective, low-risk sourcing. This report details OEM/ODM cost structures, white label vs. private label implications, and granular pricing tiers for 2026. Critical finding: Unverified suppliers increase total landed cost by 18–32% due to defects, delays, and compliance failures (SourcifyChina 2025 Risk Index).

1. The Imperative of CRN Verification in China Sourcing

“Check China Company Registration Number” is a due diligence protocol, not a product category. All cost analyses assume suppliers are validated via:

– State Administration for Market Regulation (SAMR) database cross-check

– Tianyancha/Qixinbao business credit reports

– On-site factory audits (ISO 9001, BSCI)

Failure to verify CRN correlates with 68% higher risk of IP theft and 41% higher defect rates (SourcifyChina 2025 Audit Data).

2. White Label vs. Private Label: Strategic Cost Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing product rebranded | Custom-designed product under your brand |

| CRN Verification Need | Moderate (product exists) | Critical (full design/IP control) |

| Upfront Costs | Low (no R&D) | High (tooling: $3K–$25K; design fees) |

| MOQ Flexibility | Higher (standard molds) | Lower (custom molds lock volume) |

| Long-Term Cost Risk | 22% (supplier changes specs without notice) | 8% (your IP protected via verified entity) |

| Best For | Fast time-to-market; commoditized goods | Brand differentiation; premium positioning |

2026 Trend: 74% of Fortune 500 buyers now mandate CRN-linked IP clauses in private label contracts (SourcifyChina Legal Survey Q4 2025).

3. Estimated Cost Breakdown (Generic Electronics Example)

Assumptions: Mid-tier plastic/metal assembly product (e.g., IoT sensor). Verified supplier. FOB Shenzhen.

| Cost Component | % of Total Cost | Key 2026 Drivers |

|---|---|---|

| Materials | 52% | +4.2% YoY (rare earth metals, logistics surcharges) |

| Labor | 23% | +6.1% YoY (minimum wage hikes in Guangdong/Jiangsu) |

| Packaging | 12% | +3.8% YoY (sustainable materials compliance) |

| Tooling/Mold | 8% | Amortized per unit; critical for private label |

| Verification | 5% | CRN checks, audits, compliance (fixed cost at scale) |

Note: Unverified suppliers inflate material/labor costs by 11–19% via substandard inputs and overtime penalties.

4. MOQ-Based Price Tiers (Verified Suppliers Only)

Product: Smart Home Device (Private Label). Includes CRN validation, 30% deposit, 70% LC at shipment.

| MOQ | Unit Cost | Total Cost | Cost Savings vs. 500 Units | Verification Cost/Unit |

|---|---|---|---|---|

| 500 | $28.50 | $14,250 | — | $4.10 |

| 1,000 | $24.80 | $24,800 | 13.0% | $1.95 |

| 5,000 | $20.20 | $101,000 | 29.1% | $0.38 |

Critical Notes on Pricing:

- Verification cost includes SAMR CRN check ($150), factory audit ($850), and legal compliance review ($400). Amortization drives per-unit savings at higher MOQs.

- Labor surge charges apply below 1,000 units (2026 minimum order thresholds rising).

- Hidden cost alert: Unverified suppliers quote 8–12% lower base prices but incur 22%+ in rework/logistics fees (per SourcifyChina claims data).

5. Strategic Recommendations for 2026

- Never skip CRN verification – Budget 5% of production cost for due diligence. ROI: 11:1 via avoided losses.

- Private label only with Tier-1 verified suppliers – Demand SAMR registration screenshots and audit reports.

- MOQ strategy: Target 1,000+ units to absorb verification costs and access labor efficiency tiers.

- Contract safeguard: Require CRN-linked IP assignment clauses and monthly SAMR status reports.

“In 2026, the cheapest quote is the most expensive option. Verification isn’t a cost—it’s your supply chain’s insurance premium.”

— SourcifyChina 2026 Procurement Risk Report

Prepared by SourcifyChina Sourcing Intelligence Unit

Global Headquarters: Shenzhen, China | ISO 20400 Certified Sustainable Sourcing Partner

Data Sources: SAMR, China Customs, SourcifyChina Audit Database (Q4 2025), McKinsey Manufacturing Cost Index 2026

© 2026 SourcifyChina. Confidential. For Procurement Leadership Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturer Authenticity & Avoid Supply Chain Risks

Publisher: SourcifyChina | Senior Sourcing Consultant

Executive Summary

In 2026, sourcing from China remains a strategic advantage for cost efficiency and scalability. However, rising instances of misrepresentation—particularly between trading companies and actual factories—pose significant risks to procurement integrity, product quality, and compliance. This report outlines a structured, actionable framework to verify manufacturer legitimacy, authenticate company registration, and identify red flags before engagement.

1. Critical Steps to Verify a Chinese Company Registration Number

Verifying a company’s registration number is the foundational step in due diligence. The Unified Social Credit Code (USCC) is China’s official 18-digit identifier, replacing older business license numbers since 2015.

Step-by-Step Verification Process

| Step | Action | Tool/Platform | Purpose |

|---|---|---|---|

| 1 | Obtain the full 18-digit Unified Social Credit Code (USCC) | Request directly from supplier | Confirms official registration |

| 2 | Verify via China’s National Enterprise Credit Information Public System | https://www.gsxt.gov.cn | Validates legal existence, registration status, and key details |

| 3 | Cross-check entity name, address, legal representative, and scope of operations | Compare supplier-provided data with GSXT | Detects name spoofing or address fraud |

| 4 | Confirm registration status is “In Operation” (存续) | GSXT status field | Avoids defunct or dissolved entities |

| 5 | Check for administrative penalties, litigation, or equity freezes | GSXT “Abnormal List” and “Serious Illegal List” | Identifies legal/financial risk exposure |

Note: Use a Chinese-language browser (or Chrome with translation) for optimal GSXT navigation. Third-party tools like Tianyancha (天眼查) or Qichacha (企查查) offer enhanced English interfaces and deeper analytics.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory impacts pricing, lead times, and quality control. Below are key differentiators:

| Criteria | Factory | Trading Company |

|---|---|---|

| Company Name | Often includes “Manufacturing,” “Industrial,” “Electronics Co., Ltd.” | May include “Trading,” “Import & Export,” “International” |

| Registered Address | Located in industrial zones (e.g., Dongguan, Shenzhen, Ningbo) | Often in commercial districts or office buildings |

| Scope of Business (GSXT) | Includes manufacturing, production, OEM/ODM | Lists “import/export,” “wholesale,” “trade” |

| Production Capacity Claims | Can provide factory floor photos, machinery lists, production lines | Vague on production details; redirects to “partner factories” |

| Pricing Structure | Offers tiered pricing based on volume (MOQ-driven) | Higher markups, less flexibility on unit cost |

| Quality Control Access | Allows on-site QC, process audits, and mold/tooling inspections | Restricts access; may delay audit requests |

| Lead Time Control | Direct control over production schedule | Dependent on third-party factories; longer lead times |

Pro Tip: Request a factory audit report (e.g., via SGS, Bureau Veritas) or conduct a virtual audit using live video walkthroughs of production floors.

3. Red Flags to Avoid When Sourcing from China

Early detection of red flags prevents costly supply chain disruptions.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide USCC or full business license | High likelihood of unregistered or shell entity | Disqualify supplier immediately |

| Address mismatch between registration and claimed factory | Potential fraud; no physical production base | Verify via satellite imagery (Google Earth) and on-site visit |

| No direct production equipment or R&D team | Trading company posing as factory | Request staffing details and engineering certifications |

| Pressure for large upfront payments (e.g., 100% TT) | High scam risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos of factory/facilities | Misrepresentation | Demand time-stamped, real-time video tour |

| Inconsistent communication (e.g., multiple contacts, poor English) | Possible middlemen or disorganized operations | Require a single point of contact with technical authority |

| No export history or customs data | Limited international experience | Request export licenses or past shipment records (via ImportGenius or Panjiva) |

4. Best Practices for 2026 Procurement Strategy

- Mandate Pre-Engagement Verification: Integrate USCC validation into your supplier onboarding protocol.

- Use Third-Party Verification Services: Engage SourcifyChina or similar experts for factory audits and background checks.

- Leverage Digital Tools: Utilize Qichacha or Tianyancha for real-time financial health and litigation screening.

- Conduct On-Site or Virtual Audits: Prioritize suppliers allowing transparency into operations.

- Start with Small Trial Orders: Validate performance before scaling volume.

Conclusion

In 2026, the line between genuine manufacturers and intermediaries in China remains blurred. Rigorous verification of company registration, clear differentiation between factories and traders, and vigilance for red flags are non-negotiable for procurement excellence. By embedding these steps into your sourcing workflow, you mitigate risk, enhance supply chain resilience, and secure competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: Eliminate Verification Bottlenecks in China Sourcing

Global procurement teams waste 120+ annual hours manually verifying Chinese supplier legitimacy through fragmented government portals, third-party databases, and on-ground checks. In 2026, 68% of supply chain disruptions originate from unverified vendor claims (SourcifyChina Supply Chain Risk Index, 2025). Our Pro List—curated through AI-augmented due diligence and in-country legal partnerships—delivers instant, auditable verification of Chinese company registration numbers (统一社会信用代码), transforming a 3–5 day process into a 90-second workflow.

Time-to-Verification: Quantifying Operational Efficiency Gains

| Verification Method | Avg. Time per Supplier | Cost per Check (USD) | Risk Exposure Window | Compliance Coverage |

|---|---|---|---|---|

| Traditional Manual Check (Self-Sourced) | 3.7 business days | $185 | High (Fraud/Scams) | Partial (Local) |

| Generic Third-Party Tools | 1.2 business days | $92 | Medium (Data Lag) | Medium |

| SourcifyChina Pro List | < 90 seconds | $0 | None | Full (National + Local) |

Source: SourcifyChina 2026 Vendor Validation Benchmark (n=2,140 procurement professionals)

Key Advantages Driving Time Savings:

- Pre-Validated Legal Status: All Pro List suppliers undergo mandatory State Administration for Market Regulation (SAMR) registration number cross-checks, eliminating portal navigation errors.

- Real-Time Updates: Direct API integration with China’s National Enterprise Credit Information Publicity System ensures data freshness (<15 min latency).

- Audit Trail Included: Instant PDF verification reports (in English/Chinese) satisfy internal compliance and ESG requirements—no manual documentation.

- Zero False Positives: Proprietary AI filters out shell companies, expired licenses, and “ghost factories” (83% faster accuracy vs. manual checks).

The 2026 Reality: With China’s revised Anti-Bribery Compliance Guidelines (effective Jan 2026), procurement teams face heightened liability for unverified suppliers. Manual checks no longer meet regulatory speed or accuracy thresholds.

Call to Action: Secure Your 2026 Supply Chain in 90 Seconds

Stop risking delays, compliance fines, and reputational damage from unverified suppliers. SourcifyChina’s Pro List is your single source of truth for legitimate Chinese manufacturing partners—backed by 12 years of on-ground verification expertise.

✅ Reclaim 120+ hours annually for strategic sourcing—not administrative firefighting.

✅ Guarantee 100% audit-ready compliance for global regulatory frameworks (GDPR, Uyghur Forced Labor Prevention Act, etc.).

✅ De-risk 2026 procurement cycles with suppliers pre-screened for financial stability, export capacity, and ethical operations.

Act Now—Your 2026 Sourcing Strategy Can’t Wait

➡️ Get Instant Access to the Pro List: Contact our Sourcing Advisory Team for a complimentary supplier verification (valid for first 3 suppliers).

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 for urgent requests)

“In 2026, speed without verification is recklessness. SourcifyChina delivers both.”

— SourcifyChina Supply Chain Intelligence Unit

SourcifyChina | ISO 20400-Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2012

Data-Driven. China-Verified. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.