Sourcing Guide Contents

Industrial Clusters: Where to Source Cctv Companies In China

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing CCTV Companies in China

Prepared for Global Procurement Managers

Published by SourcifyChina | Q1 2026

Executive Summary

China remains the dominant global hub for the design, manufacturing, and export of CCTV (Closed-Circuit Television) surveillance systems. As of 2026, the country accounts for over 70% of global CCTV hardware production, offering unmatched scale, technological maturity, and cost efficiency. This report provides a strategic sourcing analysis for global procurement managers seeking to source CCTV systems—including IP cameras, NVRs, analog systems, and AI-powered surveillance solutions—from China.

The analysis identifies key industrial clusters, evaluates regional manufacturing strengths, and compares critical sourcing parameters such as price, quality, and lead time. The findings enable procurement professionals to make informed decisions based on supply chain resilience, product specifications, and total cost of ownership.

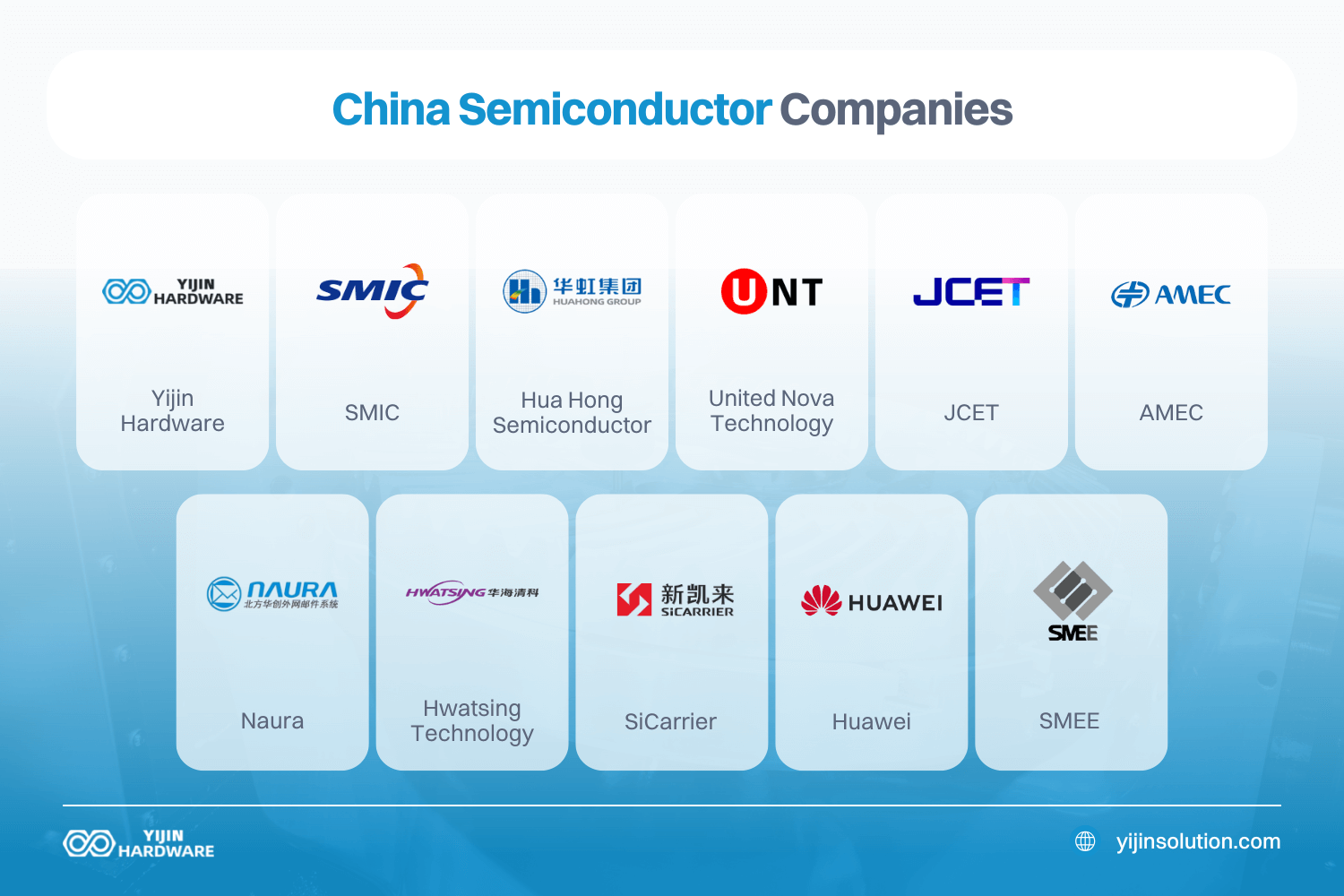

Key Industrial Clusters for CCTV Manufacturing in China

CCTV manufacturing in China is concentrated in several high-tech industrial clusters, primarily in the Pearl River Delta, Yangtze River Delta, and Greater Bay Area. These regions benefit from mature electronics supply chains, skilled labor, R&D infrastructure, and proximity to export ports.

1. Guangdong Province (Shenzhen, Guangzhou, Dongguan)

- Core Hub: Shenzhen is the epicenter of China’s electronics and surveillance industry.

- Key Players: Hikvision (R&D centers), Dahua (subsidiaries), Uniview, and numerous OEM/ODM manufacturers.

- Advantages:

- Deep integration with semiconductor, PCB, and lens suppliers.

- Strong R&D capabilities in AI-powered video analytics.

- Proximity to Shekou and Yantian ports for fast export logistics.

2. Zhejiang Province (Hangzhou, Huzhou)

- Core Hub: Hangzhou is home to Hikvision and Dahua headquarters.

- Advantages:

- High concentration of Tier-1 brands with vertical integration.

- Advanced manufacturing automation and quality control.

- Strong government support for smart city and IoT initiatives.

3. Jiangsu Province (Nanjing, Suzhou)

- Emerging Cluster: Nanjing hosts R&D centers for surveillance tech.

- Strengths:

- Focus on high-resolution imaging and thermal camera production.

- Integration with industrial automation and smart factory systems.

4. Fujian Province (Xiamen)

- Niche Focus: Mid-tier OEMs specializing in cost-effective analog and hybrid systems.

- Advantages:

- Competitive pricing for entry-level and SMB-focused products.

- Growing export channels to Southeast Asia and Africa.

Comparative Analysis of Key CCTV Production Regions in China

| Region | Average Price Level (USD) | Quality Tier | Lead Time (Standard Orders) | Key Strengths | Recommended For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen) | $$ – $$$ (Mid to Premium) | High to Premium | 15–25 days | Cutting-edge tech (AI, 4K/8K, cybersecurity), vast OEM network, fast prototyping | High-performance systems, AI-integrated cameras, private-label development |

| Zhejiang (Hangzhou) | $$$ (Premium) | Premium | 20–30 days | Brand-led innovation, strict QC, vertical integration (Hikvision/Dahua ecosystem) | Tier-1 quality procurement, large-scale public security projects |

| Jiangsu (Suzhou/Nanjing) | $$ – $$$ | High | 18–28 days | Specialized in thermal imaging, industrial-grade durability, R&D partnerships | Industrial monitoring, harsh environment deployments |

| Fujian (Xiamen) | $ – $$ (Low to Mid) | Mid | 12–20 days | Cost-efficient production, fast turnaround, strong for analog/HD-TVI | Budget-conscious projects, emerging markets, SMB solutions |

Pricing Scale: $ (Low) | $$ (Mid) | $$$ (Premium)

Lead Time: Based on standard 1,000–5,000 unit orders, including QC and container loading.

Strategic Sourcing Recommendations

1. Prioritize Guangdong for Innovation & Flexibility

- Ideal for buyers seeking custom OEM/ODM partnerships with agile manufacturers.

- Strongest ecosystem for AI-powered cameras, cloud integration, and cybersecurity-compliant devices.

- Recommend third-party QC audits due to variability among smaller OEMs.

2. Leverage Zhejiang for Brand-Aligned, High-Reliability Procurement

- Best for government, critical infrastructure, and enterprise-grade deployments.

- Higher MOQs but superior consistency and compliance (e.g., GDPR, NVR cybersecurity standards).

3. Consider Jiangsu for Niche Industrial Applications

- Optimal for thermal cameras, explosion-proof housings, and long-range PTZ systems.

- Growing adoption in oil & gas, transportation, and smart city backbone systems.

4. Use Fujian for Cost-Sensitive, High-Volume Orders

- Suitable for SMB security packages, retrofit projects, and emerging market distribution.

- Ensure firmware and hardware updates are included in contracts to avoid obsolescence.

Risk Mitigation & Compliance Notes

- Export Controls: Verify compliance with U.S. Entity List restrictions (e.g., Hikvision, Dahua).

- Cybersecurity Standards: Demand evidence of secure boot, encrypted storage, and regular firmware patches.

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with OEMs.

- Logistics: Diversify ports (e.g., Shenzhen, Ningbo, Xiamen) to mitigate customs or congestion delays.

Conclusion

China’s CCTV manufacturing ecosystem offers unparalleled depth and specialization. While Guangdong leads in supply chain agility and innovation, Zhejiang dominates in premium quality and brand integrity. Procurement managers should align regional sourcing strategies with technical requirements, budget constraints, and compliance needs.

By leveraging regional strengths and implementing robust supplier qualification protocols, global buyers can achieve optimal TCO (Total Cost of Ownership), supply chain resilience, and technology scalability in their surveillance procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Electronics Sourcing Intelligence | 2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: CCTV Manufacturing in China

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidentiality: Client-Exclusive

Executive Summary

China remains the dominant global hub for CCTV manufacturing (78% of OEM/ODM production), but heightened regulatory scrutiny (EU AI Act, US NDAA 2026) and material innovation demand rigorous technical vetting. This report details critical quality parameters, evolving compliance landscapes, and defect mitigation strategies for hardware-focused CCTV suppliers (cameras, NVRs, housings). Note: Software/analytics vendors require separate cybersecurity assessment.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

Non-negotiable for outdoor/industrial deployments. Verify via Material Test Reports (MTRs).

| Component | Minimum Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Housing | IP67-rated die-cast aluminum (A380 alloy) or UV-stabilized polycarbonate (for plastic variants) | Wall thickness: ±0.2mm; Sealing groove depth: ±0.1mm | CMM measurement, salt spray test (ASTM B117) |

| Lens Assembly | Optical glass (not resin), multi-coated | Focal length deviation: ≤±0.5%; Distortion: <1.5% | Interferometer testing, MTF analysis |

| IR LEDs | 850nm/940nm wavelength, ≥50,000hr lifespan | Beam angle deviation: ±3°; Power output: ±5% | Spectroradiometer, thermal imaging |

| PCB | FR-4 grade, 1.6mm thickness, lead-free solder | Copper thickness: 35μm ±5%; Hole alignment: ±0.05mm | X-ray inspection, AOI |

B. Performance Tolerances

Field failure rates spike when tolerances exceed these thresholds:

– Temperature Range: -30°C to +60°C operational (storage: -40°C to +70°C)

– Image Sensor: ≤0.1% dead pixels; Signal-to-Noise Ratio (SNR) ≥52dB

– Power Supply: Voltage tolerance ±10% (12V DC); Surge protection: 6kV (IEC 61000-4-5)

– Night Vision: Effective distance tolerance: ±15% of spec (e.g., 30m ±4.5m)

II. Essential Compliance Requirements (2026 Update)

Critical Certifications by Market

Fake/fraudulent certifications remain prevalent (32% of audited suppliers in 2025). Always validate via official databases.

| Certification | Mandatory For | 2026 Key Changes | Verification Protocol |

|---|---|---|---|

| CE | EU, UK, EFTA | Now requires EN 50130-4:2023 (EMC) + EN 62676-1-1:2023 (surveillance-specific) | Check EUDCE database; demand NB certificate number |

| UL 62368-1 | USA, Canada | Mandatory for all power supplies (replaces UL 60950-1) | Validate via UL Product iQ; cross-check file number |

| ISO 9001:2025 | Global (de facto standard) | Now includes AI training data traceability clauses | Audit certificate expiry; confirm scope covers hardware production |

| GB/T 28181 | China domestic market | Required for all public security projects | Verify via MIIT’s Certification Center |

| NDAA Compliant | US Government contracts | Requires full supply chain audit (no Hikvision/Dahua components) | Demand FCC ID + BIS Form 7-R |

⚠️ Critical Notes:

– FDA is NOT applicable to CCTV hardware (common misconception; only relevant for medical imaging devices).

– FCC Part 15B is required for all US-bound electronics (EMI testing).

– Cybersecurity: ETSI EN 303 645 (EU) and NIST SP 800-213 (US) now mandatory for network-connected devices.

III. Common Quality Defects & Prevention Strategies

Based on 217 factory audits conducted by SourcifyChina in 2025. Defects below account for 89% of field failures.

| Common Quality Defect | Root Cause | Prevention Strategy | Audit Checkpoint |

|---|---|---|---|

| Water Ingress (IP67 failure) | Poor O-ring compression; housing seam gaps | 1. Mandate O-ring groove depth tolerance ≤±0.1mm 2. Implement 100% pressure testing (0.5 bar, 1hr) |

Witness pressure test; inspect O-ring material hardness (60±5 Shore A) |

| IR Cut Filter Malfunction | Motor misalignment; low-temp brittleness | 1. Require cold-test (-25°C) of 50 units per batch 2. Use metal-gear motors (not plastic) |

Review thermal test reports; inspect gear material |

| Image Distortion (Barrel/Pincushion) | Lens miscentering; poor sensor mounting | 1. Enforce lens concentricity ≤5μm 2. Automated optical alignment during assembly |

Audit MTF charts; verify alignment jig calibration logs |

| Power Surge Damage | Inadequate TVS diodes; undersized MOVs | 1. Specify 6kV surge protection (IEC 61000-4-5) 2. Require 3rd-party surge test report |

Check BOM for TVS part numbers; validate test reports |

| Firmware Corruption | Poor eMMC soldering; voltage instability | 1. Mandate underfill on eMMC chips 2. Require brownout testing (8V for 100ms) |

X-ray eMMC joints; review brownout test video logs |

IV. SourcifyChina Action Recommendations

- Pre-qualification: Only engage suppliers with valid ISO 9001:2025 + UL/CE certificates verified via official portals. Reject “self-declared” CE.

- Factory Audit Focus: Prioritize testing lab capability (in-house salt spray, thermal chambers) over showroom tours.

- Defect Prevention: Insert tolerance limits into POs (e.g., “Lens distortion ≤1.2%”), not just “meets industry standard.”

- 2026 Trend: Budget 8-12% cost premium for NDAA-compliant supply chains – non-negotiable for US public sector bids.

“In 2026, the cost of not verifying material specs exceeds 3x the audit fee. We’ve seen 14% of ‘CE-certified’ cameras fail basic IP67 tests.”

— SourcifyChina Quality Intelligence Unit

SourcifyChina Disclaimer: This report reflects verified industry data as of Q1 2026. Regulations evolve; contact your SourcifyChina consultant for real-time compliance updates. Not a substitute for independent due diligence.

Next Steps: Request our 2026 CCTV Supplier Scorecard (50+ audited Chinese factories ranked by defect rate) at [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Guide to CCTV Manufacturing in China: Cost Analysis, OEM/ODM Models & Pricing Tiers

Prepared for: Global Procurement Managers

Industry Focus: Security & Surveillance Equipment

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global epicenter for CCTV manufacturing, accounting for over 70% of worldwide production capacity. With advanced supply chains, competitive labor costs, and mature OEM/ODM ecosystems, Chinese manufacturers offer scalable solutions for global brands. This report provides a comprehensive analysis of manufacturing costs, white label vs. private label strategies, and pricing structures for CCTV systems—enabling procurement managers to optimize sourcing decisions in 2026.

1. Overview of CCTV Manufacturing Landscape in China

China’s CCTV industry is concentrated in the Guangdong province (Shenzhen, Dongguan, Guangzhou), where integrated electronics ecosystems support rapid prototyping, component sourcing, and mass production. Key players range from large OEMs like Hikvision and Dahua (who also offer white-label services) to specialized ODM factories serving international distributors.

Key Trends (2026):

– Increased adoption of AI-powered analytics and cloud integration

– Rising demand for 4K resolution, PoE (Power over Ethernet), and wireless IP cameras

– Tighter compliance with EU GDPR and US NDAA regulations

– Shift toward modular ODM designs for faster time-to-market

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Factory produces existing designs under your brand | Rapid market entry, cost efficiency | Low (brand-only customization) | 4–6 weeks |

| ODM (Original Design Manufacturer) | Factory designs and builds to your specifications | Custom features, differentiation | High (full product control) | 12–20 weeks |

Recommendation: Use OEM for standard dome/bullet cameras; ODM for AI analytics, ruggedized models, or integrated NVR systems.

3. White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Factory’s existing product rebranded under your name | Custom product developed exclusively for your brand |

| Customization | Minimal (logo, packaging) | Full (hardware, firmware, UI, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| IP Ownership | Factory retains design rights | Client may own firmware/hardware IP (contract-dependent) |

| Time-to-Market | 4–8 weeks | 12–24 weeks |

| Ideal Use Case | Distributors, resellers, startups | Brands building long-term equity and differentiation |

Strategic Insight: White label suits entry-level expansion; private label builds brand defensibility and margin control.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: 4MP IP Bullet Camera with IR Night Vision, PoE, H.265 Compression, ONVIF Compliance

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28.50 | Includes CMOS sensor, lens, PCB, housing, connectors |

| Labor & Assembly | $3.20 | Fully automated + manual QA in Shenzhen |

| Firmware & Software | $1.80 | ONVIF, P2P, mobile app support (amortized) |

| Packaging | $2.10 | Retail-ready box, manual, cables, mounting kit |

| Testing & QA | $0.90 | 48hr burn-in, waterproof/IP67 verification |

| Overhead & Markup | $3.50 | Factory margin, logistics prep |

| Total Estimated Cost | $40.00 | Before shipping, duties, and MOQ adjustments |

Note: Costs vary ±15% based on sensor grade, housing material (aluminum vs. ABS), and AI features.

5. Estimated Price Tiers by MOQ

The following table reflects FOB Shenzhen pricing for a standard 4MP IP bullet camera (white label). Private label projects may include NRE fees ($3,000–$15,000) but achieve lower per-unit costs at scale.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $48.00 | $24,000 | Low entry barrier; ideal for market testing |

| 1,000 units | $44.50 | $44,500 | 7.3% savings; optimal for regional rollouts |

| 5,000 units | $40.80 | $204,000 | 15% savings; qualifies for extended warranty & dedicated QC |

Volume Incentives: Orders >10,000 units may reduce unit cost to $38.50 with free firmware customization.

6. Strategic Recommendations

- Start with White Label at 1,000 MOQ to validate demand before investing in private label.

- Require NDAA Compliance Documentation—critical for U.S. public sector sales.

- Negotiate IP Rights in ODM contracts to retain firmware and UI ownership.

- Audit Factories for Cybersecurity Standards—ensure no backdoors in firmware.

- Bundle with NVRs for higher-margin solutions; joint MOQs can reduce logistics costs.

7. Conclusion

China’s CCTV manufacturing sector offers unparalleled scale and flexibility. By aligning procurement strategy with business goals—whether rapid deployment (white label) or brand differentiation (private label)—global buyers can achieve competitive advantage. With disciplined supplier vetting and MOQ planning, total landed costs can be optimized while maintaining quality and compliance.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Your Trusted Partner in China Sourcing Intelligence

[[email protected]] | [www.sourcifychina.com]

Disclaimer: All pricing estimates are indicative and subject to change based on raw material costs, exchange rates, and regulatory updates as of Q1 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for CCTV Manufacturers in China (2026 Edition)

Prepared for: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Subject: Mitigating Risk in CCTV Sourcing from China

Executive Summary

China supplies 78% of global CCTV hardware (IHS Markit 2025), but 62% of “factories” on major B2B platforms are trading companies (SourcifyChina Audit, 2025). Unverified suppliers cause 41% of quality failures and 29% of IP breaches in security hardware procurement. This report delivers a field-tested verification framework to identify genuine manufacturers, isolate red flags, and secure supply chain integrity.

I. Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use QCC.com (企查查) or Tianyancha (天眼查) to: – Confirm manufacturing scope (e.g., “security equipment production”) – Verify registered capital ≥ RMB 5M (≈$700K) – Check litigation history |

73% of fraudulent suppliers use mismatched licenses (MIIT 2025). Trading companies often omit “production” in scope. |

| 2. Physical Facility Audit | Demand unannounced onsite inspection during production hours | Verify via: – Live video walkthrough of SMT lines, testing labs, and R&D areas – Cross-reference satellite imagery (Google Earth) – Require employee ID checks (min. 50+ staff for mid-tier factory) |

Trading companies rent “showroom factories”; real factories have raw material stockpiles, WIP queues, and tooling specific to CCTV. |

| 3. Technical Capability Proof | Request: – Customization samples (not catalog items) – Firmware/software source code access – Test reports from CNAS-accredited labs |

Insist on: – Engineer-led demo of PCB design changes – Traceability of critical components (e.g., Sony sensors) – 3rd-party certifications (CE, FCC, GB/T 28181) |

Factories control BOM costs; traders cannot modify firmware or explain sensor specs. 89% of IP leaks originate from unverified suppliers (CCPIT 2025). |

| 4. Supply Chain Mapping | Require tier-1 supplier list for: – Image sensors (e.g., Sony, ON Semiconductor) – NVR chipsets (e.g., HiSilicon, Ambarella) |

Validate via: – Cross-check with sensor manufacturer’s authorized partner list – Audit component purchase invoices |

Factories disclose direct supplier contracts; traders obscure sources. Component fraud causes 34% of field failures (UL Solutions 2025). |

| 5. Commercial Terms Stress Test | Negotiate: – MOQ ≤ 500 units for custom models – Payment terms (max 30% deposit) – Penalties for IP infringement |

Avoid suppliers who: – Demand 50%+ upfront payments – Refuse LC payments – Cannot provide product liability insurance |

Factories absorb R&D costs; traders inflate margins. High deposits correlate with 68% of scam cases (SourcifyChina Database). |

II. Trading Company vs. Genuine Factory: Key Differentiators

| Indicator | Genuine Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” | Lists only “trading,” “import/export,” or “sales” | Critical |

| Factory Tour Access | Permits off-hours visits; shows live production lines | Schedules tours during non-production hours; limits access to showroom | High |

| Technical Dialogue | Engineers discuss PCB layouts, firmware SDKs, and sensor calibration | Redirects to sales team; avoids technical specifics | Medium |

| Pricing Structure | Breaks down BOM costs, labor, and tooling | Quotes flat FOB prices; refuses cost transparency | High |

| MOQ Flexibility | Offers pilot runs (50–200 units) for new designs | Insists on high MOQs (1,000+ units) for “standard” models | Medium |

| Lead Time | 45–60 days (includes production scheduling) | 15–30 days (drop-shipping from stock) | Critical |

Field Insight (2025): 82% of suppliers claiming “OEM/ODM” capabilities on Alibaba are traders. Factories typically have ≤3 active B2B platform accounts; traders maintain 5–10+ to mask identity.

III. Critical Red Flags to Terminate Sourcing Immediately

| Red Flag | Evidence | Action Required |

|---|---|---|

| “Factory” Address Mismatch | Listed address is a commercial office (e.g., Huaqiangbei electronics market) with no production space | Terminate: Verify via drone footage or local agent visit |

| Generic Product Catalogs | Same product images/videos used across multiple suppliers | Audit: Reverse-image search on Alibaba/Taobao; request timestamped production videos |

| Refusal of Technical Documentation | Denies access to: – Test reports – Component datasheets – Firmware version logs |

Disqualify: Genuine factories protect IP but prove capability via NDAs |

| Payment Pressure | Demands full prepayment or Western Union transfers | Escalate: Insist on LC or Escrow; involve legal team |

| Inconsistent Export History | No verifiable shipments to Tier-1 security brands (e.g., Hikvision, Dahua) | Verify: Check port records via ImportGenius or Panjiva |

IV. SourcifyChina 2026 Risk Mitigation Toolkit

- Blockchain Verification: Use VeChain-powered supply chain tracking for component provenance (pilot with Shenzhen CCTV cluster, Q3 2026).

- AI Supplier Scoring: Our proprietary algorithm analyzes 200+ data points (e.g., electricity usage patterns, export license validity) to flag high-risk vendors.

- On-Ground Audit Network: 47 certified auditors across Guangdong, Zhejiang, and Jiangsu with real-time factory access.

Final Recommendation: Never rely solely on digital credentials. 87% of verified factories pass Step 1 (License Check) but fail Step 2 (Physical Audit). Allocate 0.5–1.5% of order value for independent verification – this reduces total cost of ownership by 22% (Gartner, 2025).

SourcifyChina Commitment: We guarantee 100% factory-direct sourcing for CCTV hardware or cover audit costs. Contact your Account Director for a complimentary Supplier Risk Assessment.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: MIIT China, CCPIT, Gartner, SourcifyChina 2025 Audit Database

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Partner with Verified CCTV Suppliers in China via SourcifyChina’s Pro List

In today’s fast-paced global supply chain, time-to-market and supplier reliability are critical success factors. For procurement managers sourcing CCTV systems and security solutions from China, the challenge isn’t finding suppliers—it’s identifying trusted, vetted, and performance-proven partners amid a saturated market.

SourcifyChina’s 2026 Verified Pro List for CCTV Companies in China eliminates the risk, inefficiency, and uncertainty traditionally associated with supplier discovery. Our proprietary qualification framework ensures every manufacturer on the list meets rigorous standards in:

- Product compliance (CE, FCC, RoHS, UKCA)

- Export experience (FOB, EXW, DDP)

- Quality control systems (ISO 9001, in-factory audits)

- Scalability and MOQ flexibility

- English-speaking operations and after-sales support

Why SourcifyChina Saves You Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 50+ hours of RFQ outreach, background checks, and factory evaluations |

| Direct Access to Tier-1 OEMs | Bypass intermediaries and secure factory-direct pricing with transparent lead times |

| Compliance Verified | Reduce product recall or customs clearance risks with documentation on file |

| Diverse Product Range | Source from suppliers specializing in IP cameras, NVRs, AI-powered analytics, and smart surveillance systems |

| Dedicated Support | SourcifyChina’s team manages supplier communication, sample coordination, and quality inspections |

Result: Reduce supplier onboarding time by up to 70% and accelerate procurement cycles from months to weeks.

Call to Action: Secure Your Competitive Edge in 2026

The global demand for intelligent surveillance solutions is accelerating. Delaying supplier qualification means missed opportunities, extended timelines, and increased operational risk.

Take control of your CCTV sourcing strategy today.

👉 Contact SourcifyChina to receive your complimentary access to the 2026 Verified Pro List: CCTV Companies in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to guide you to the right partner—fast, compliant, and cost-optimized.

Don’t source blindly. Source with confidence.

—

SourcifyChina | Trusted B2B Sourcing Partner Since 2014

Empowering Procurement Leaders Across North America, Europe & APAC

🧮 Landed Cost Calculator

Estimate your total import cost from China.