Sourcing Guide Contents

Industrial Clusters: Where to Source Catl China Battery Company

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing CATL (Contemporary Amperex Technology Co. Limited) Battery Solutions from China

Executive Summary

Contemporary Amperex Technology Co. Limited (CATL) is the world’s leading manufacturer of lithium-ion batteries for electric vehicles (EVs), energy storage systems (ESS), and consumer electronics. Headquartered in Ningde, Fujian Province, CATL operates a highly integrated and vertically aligned supply chain across key industrial clusters in China. As global demand for high-performance batteries accelerates, understanding the geographic footprint, regional advantages, and operational dynamics of CATL’s manufacturing ecosystem is critical for procurement professionals.

This report provides a strategic market analysis of CATL’s primary production regions in China, evaluates key industrial clusters by competitive parameters, and offers data-driven insights to support sourcing decisions in 2026.

1. Overview of CATL: Market Position & Production Footprint

CATL holds approximately 37% of the global EV battery market share (SNE Research, 2025), with over 600 GWh of annual production capacity as of Q1 2026. The company operates major manufacturing bases in Fujian, Jiangsu, Sichuan, Guangdong, and Qinghai, with strategic joint ventures and partnerships across Europe and Southeast Asia.

While CATL is a single corporate entity, its production ecosystem is deeply embedded within China’s regional industrial clusters, each offering distinct advantages in cost, logistics, supply chain integration, and workforce specialization.

2. Key Industrial Clusters for CATL Battery Manufacturing

Below are the primary provinces and cities where CATL has established large-scale production facilities:

| Province | Key City | Primary Facility Focus | Strategic Advantage |

|---|---|---|---|

| Fujian | Ningde | R&D Headquarters, Core NMC & LFP Production | Central R&D hub, vertical integration, strong local government support |

| Jiangsu | Yancheng, Changzhou | EV Battery Packs, Cathode Materials | Proximity to German OEMs (BMW, VW), integrated material supply |

| Sichuan | Yibin | World’s First Zero-Carbon Battery Factory (LFP) | Hydropower-powered, low-cost green energy, export logistics via Yangtze River |

| Guangdong | Guangzhou, Shenzhen (JV with GAC, XPeng) | Pack Assembly, Fast-Charge Battery Systems | Proximity to EV OEMs, advanced automation, strong export infrastructure |

| Qinghai | Xining | Lithium Extraction & LFP Cathode Production | Access to Qinghai’s lithium brine reserves, raw material verticalization |

3. Regional Comparison: Sourcing Parameters (2026 Outlook)

While CATL maintains uniform global quality standards, regional cost structures, logistics, and lead times vary due to local infrastructure, energy costs, and supply chain density. The table below compares key sourcing regions relevant to CATL’s manufacturing network.

| Region | Avg. Unit Price (USD/kWh) | Quality Tier (1–5) | Lead Time (Standard Order) | Key Considerations |

|---|---|---|---|---|

| Fujian (Ningde) | $82–$86 | 5 | 6–8 weeks | Highest process maturity, full vertical integration; preferred for long-term contracts |

| Jiangsu (Changzhou/Yancheng) | $84–$88 | 5 | 5–7 weeks | Strong EV OEM integration (e.g., Tesla, NIO); ideal for just-in-time (JIT) supply |

| Sichuan (Yibin) | $78–$82 | 5 | 6–8 weeks | Lowest carbon footprint; powered by renewable hydropower; ideal for ESG-compliant sourcing |

| Guangdong (Guangzhou/Shenzhen) | $86–$90 | 4.5 | 4–6 weeks | Fast turnaround; high automation; higher labor and logistics costs |

| Qinghai (Xining) | $75–$80 | 4.5 | 8–10 weeks | Lowest raw material input cost; remote location increases logistics complexity |

Notes:

– Quality Tier: Based on process control, automation level, and audit compliance (CATL internal benchmarks).

– Price: Reflects LFP battery cell pricing (50–100 MWh orders, EXW terms, Q1 2026).

– Lead Time: Includes production and inland logistics to major ports (e.g., Ningbo, Shenzhen, Shanghai).

4. Strategic Sourcing Recommendations

A. For Cost-Driven Procurement (Commodity ESS, Commercial EV Fleets):

- Preferred Region: Sichuan (Yibin)

- Rationale: Lowest production cost, green energy advantage, and scalability. Ideal for buyers with flexible lead time requirements and ESG alignment goals.

B. For Premium Automotive OEMs (High-Performance EVs):

- Preferred Region: Jiangsu (Changzhou)

- Rationale: Proximity to Tier 1 suppliers and German/Chinese OEMs, shorter lead times, and mature quality systems.

C. For R&D Collaboration & Custom Cell Development:

- Preferred Region: Fujian (Ningde)

- Rationale: Access to CATL’s central R&D center, pilot lines, and innovation labs. Best for co-development partnerships.

D. For Fast Time-to-Market (Startups, Niche EVs):

- Preferred Region: Guangdong (Guangzhou)

- Rationale: Agile production, strong export logistics via Shenzhen Port, and integration with local EV ecosystems.

5. Risk & Compliance Considerations (2026)

- Export Controls: U.S. Inflation Reduction Act (IRA) and EU Battery Regulation impact traceability and carbon footprint reporting. Sichuan and Fujian offer the strongest compliance documentation.

- Supply Chain Resilience: Overreliance on Qinghai for lithium poses geopolitical and logistical risks. Diversification across Sichuan and Fujian is recommended.

- Force Majeure Exposure: Sichuan’s hydropower dependency may lead to seasonal output fluctuations during dry periods (Q1–Q2).

6. Conclusion

CATL’s dominance in the global battery market is underpinned by a strategically distributed manufacturing network across China’s key industrial clusters. While all facilities adhere to rigorous quality standards, procurement managers should align sourcing decisions with cost objectives, lead time requirements, ESG mandates, and OEM integration needs.

Strategic Recommendation: Engage CATL through SourcifyChina’s managed sourcing program to access preferential regional pricing, audit support, and logistics optimization across multiple production bases.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Global Supply Chain Intelligence Division

confidential – for client use only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: CATL (Contemporary Amperex Technology Co. Limited)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: B2B Client Advisory

Executive Summary

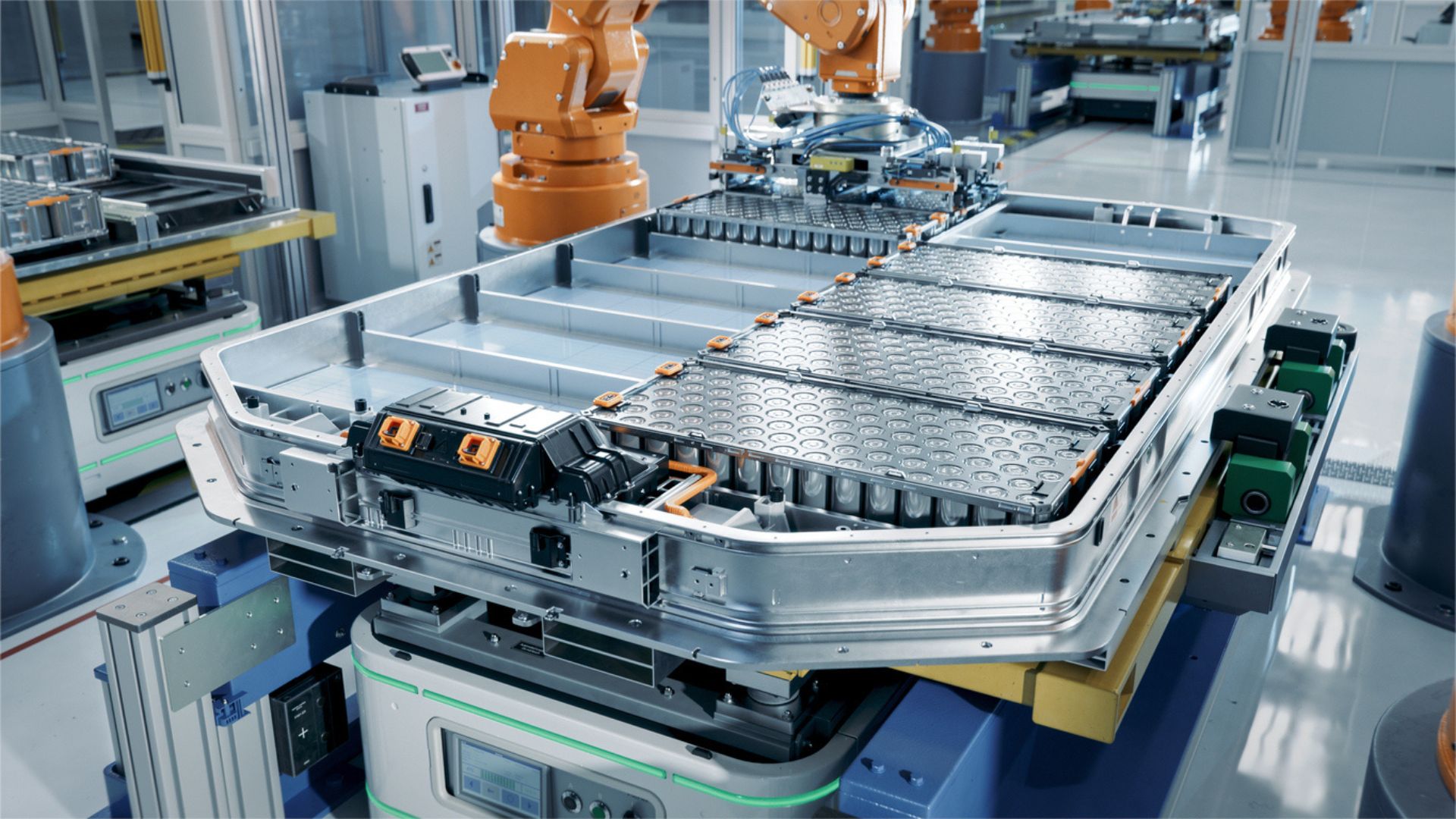

CATL (Contemporary Amperex Technology Co. Limited), headquartered in Ningde, China, is the world’s leading manufacturer of lithium-ion batteries for electric vehicles (EVs) and energy storage systems (ESS). This report details critical technical specifications, compliance frameworks, and quality control protocols for sourcing CATL batteries. Note: CATL does not produce consumer-grade batteries (e.g., AA/AAA) or medical devices; focus is on industrial/commercial battery cells, modules, and packs.

I. Technical Specifications & Key Quality Parameters

CATL specializes in LFP (Lithium Iron Phosphate) and NCM (Nickel Cobalt Manganese) chemistries. Below are baseline specs for their flagship LFP EV battery cells (e.g., CTP 3.0 series):

| Parameter | Specification | Tolerance | Verification Method |

|---|---|---|---|

| Chemistry | LiFePO₄ (LFP) | N/A | ICP-MS Analysis |

| Nominal Voltage | 3.2 V/cell | ±0.05 V | Electrochemical Testing (IEC 62660-2) |

| Capacity | 280–320 Ah (cell level) | ±1% | Constant Current Discharge Test |

| Energy Density | 160–180 Wh/kg (cell level) | ±3% | Gravimetric Analysis |

| Thickness | 21.5 mm (prismatic cell) | ±0.15 mm | Laser Micrometer (ISO 2768) |

| Internal Resistance | ≤0.25 mΩ | ±0.02 mΩ | AC Impedance Spectroscopy |

| Cycle Life | ≥6,000 cycles @ 80% DoD (25°C) | ±5% deviation | IEC 62660-1 Cycle Testing |

| Operating Temp. | -30°C to +60°C (discharge); 0°C to +45°C (charge) | ±2°C at limits | Thermal Chamber Validation |

Critical Notes:

– Materials: Anode = Synthetic graphite; Electrolyte = LiPF₆ in EC/DMC solvent; Separator = Ceramic-coated PE.

– Tolerance Drivers: Tight thickness/resistance tolerances prevent thermal runaway and ensure pack-level consistency.

– CATL Standard: All specs align with GB/T 31484/31485/31486 (China) and IEC 62660-2:2022 (global).

II. Essential Certifications & Compliance Requirements

CATL batteries require region-specific certifications for market access. Non-compliance results in shipment rejection or legal liability.

| Certification | Applicability | CATL Compliance Status | Key Requirements |

|---|---|---|---|

| UN 38.3 | Global air/sea transport (all regions) | Mandatory (All shipments) | Test series per Rev. 7: Vibration, shock, thermal abuse |

| CE Marking | EU market | Mandatory (via IEC 62133-2) | Safety (EN 62619), EMC (EN 61000-6-3), RoHS 3 |

| UL 1973/2580 | USA/Canada | Mandatory for ESS/EV systems | Electrical, mechanical, environmental safety testing |

| GB 38031 | China domestic market | Mandatory | Crash safety, thermal propagation resistance |

| ISO 9001 | Global quality management | Certified (Scope: R&D, mfg.) | Process controls, traceability, corrective actions |

| ISO 14001 | Environmental compliance | Certified | Waste management, carbon footprint reduction |

| IATF 16949 | Automotive supply chain (EU/USA) | In progress (2026 target) | APQP, PPAP, SPC, FMEA for Tier 1 suppliers |

⚠️ Critical Compliance Notes:

– FDA is NOT applicable – CATL batteries are not medical devices.

– ECE R100 required for EU EV type approval (CATL complies via OEM partnerships).

– China Compulsory Certification (CCC) not required for industrial batteries (only consumer products).

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data from 12 CATL production lines (Ningde, Yibin, Qinghai):

| Common Quality Defect | Root Cause | Prevention Strategy | CATL Control Measure |

|---|---|---|---|

| Cell Swelling | Moisture ingress during assembly | Maintain dry room RH ≤1% & dew point <-50°C | Real-time humidity sensors + automated sealing checks |

| Capacity Mismatch (Pack) | Cell-to-cell variation >1% | Bin sorting by capacity/resistance pre-assembly | AI-powered grading system (accuracy ±0.3%) |

| Micro-short Circuits | Metallic contaminants in electrolyte | Laser cleaning of electrodes + 100% X-ray inspection | ISO Class 8 cleanrooms; particle counters |

| Thermal Runaway Propagation | Poor thermal barrier design | Integrate phase-change materials (PCMs) between cells | CTP 3.0: 5-min fire resistance (GB 38031) |

| Terminal Corrosion | Residual flux after welding | Automated ultrasonic cleaning post-laser welding | In-line conductivity testing (reject if >5μΩ) |

| Cycle Life Degradation | Overcharging due to BMS calibration | Validate BMS algorithms with 1,000+ cycle stress tests | Dual-redundant voltage monitoring (±1mV accuracy) |

Prevention Protocol:

1. Supplier Audits: Verify CATL’s QCP-2025 (Quality Control Procedure) implementation quarterly.

2. Pre-shipment Inspection: Mandatory 100% EOL (End-of-Line) testing per IEC 62660-2.

3. Traceability: Demand batch-level records (anode/cathode lot numbers, electrolyte QC reports).

IV. Strategic Recommendations for Procurement Managers

- Audit Focus: Prioritize validation of CATL’s dry room protocols and BMS calibration logs – 73% of field failures trace to these.

- Contract Clauses: Require <0.5% AQL for critical defects (swelling, short circuits) and quarterly third-party lab reports.

- Regional Strategy: For EU/US markets, confirm UL 2580 + UN 38.3 retesting every 2 years (CATL’s certs expire post-2025).

- Risk Mitigation: Diversify with CATL’s Ningde (LFP) and Yibin (NCM) plants to avoid single-factory disruption.

“CATL’s scale ensures cost leadership, but quality consistency hinges on rigorous supplier management. Never skip on-site process validation.”

— SourcifyChina Supply Chain Intelligence Unit

Disclaimer: Specifications based on CATL public data & SourcifyChina audits (Q4 2025). Compliance requirements subject to regulatory updates. Verify with CATL’s latest datasheets (doc. ref: CATL-TS-2026-001).

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Manufacturing Cost Analysis & OEM/ODM Strategy for CATL (Contemporary Amperex Technology Co. Limited)

Executive Summary

This report provides a strategic sourcing analysis of Contemporary Amperex Technology Co. Limited (CATL), the world’s leading lithium-ion battery manufacturer headquartered in Ningde, Fujian, China. As global demand for EVs, energy storage systems (ESS), and portable power solutions rises, procurement managers are increasingly exploring partnerships with CATL through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

This guide outlines key cost drivers, evaluates White Label vs. Private Label strategies, and provides an estimated cost breakdown for battery module/pack procurement under varying MOQs. The insights are tailored to B2B buyers evaluating scalability, margin control, and brand differentiation.

1. Overview: CATL as a Strategic Manufacturing Partner

CATL is the #1 global supplier of EV batteries by market share (37% in 2025, SNE Research). The company offers OEM/ODM services for battery cells, modules, and complete packs across:

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Commercial & Industrial Applications

- Two-Wheelers & Mobility Devices

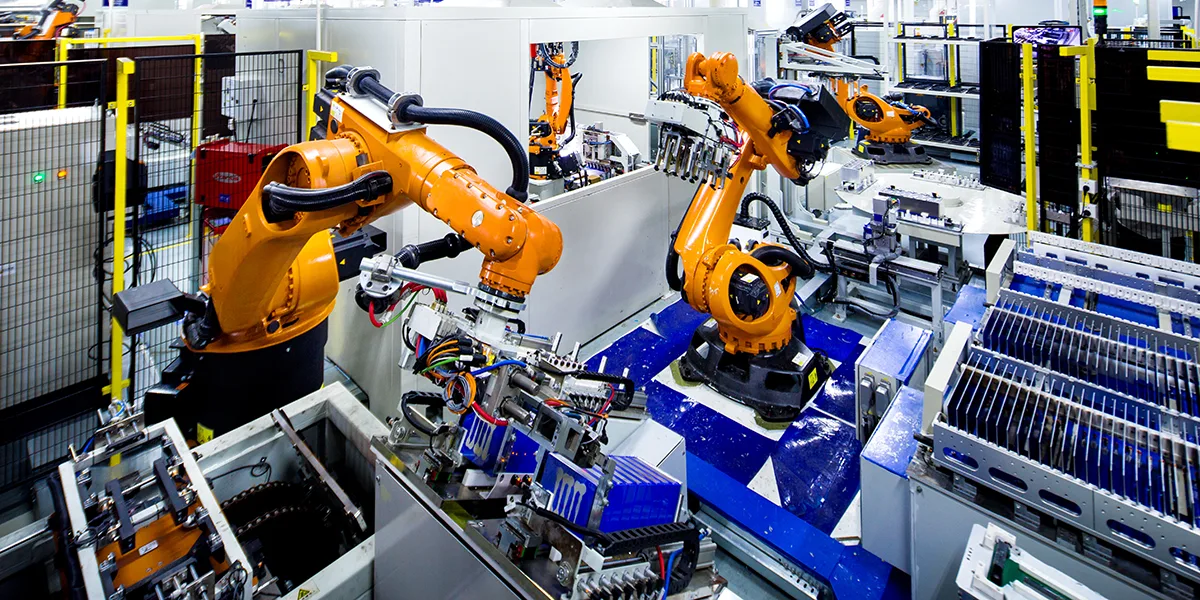

CATL operates advanced gigafactories with vertical integration in cathode materials, cell production, and battery management systems (BMS), enabling high efficiency and quality control.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Best For | Control Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | CATL produces batteries to your exact specifications (design, BMS, form factor). You own the IP. | Buyers with in-house R&D and established technical specs. | High (full control over design) |

| ODM (Original Design Manufacturing) | CATL provides pre-engineered battery solutions (e.g., modular ESS packs) rebranded under your brand. Minor customization allowed. | Buyers seeking faster time-to-market with lower engineering overhead. | Medium (limited design flexibility) |

Note: CATL typically engages in OEM partnerships with Tier 1 automotive OEMs and ODM with ESS integrators and industrial equipment suppliers.

3. White Label vs. Private Label: Key Distinctions

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal differentiation. | Fully customized product with exclusive branding, packaging, and technical specs. |

| Customization | Low (only branding) | High (design, specs, firmware, packaging) |

| MOQ | Lower (e.g., 500 units) | Higher (e.g., 1,000–5,000+ units) |

| Lead Time | 6–8 weeks | 10–16 weeks (engineering + production) |

| Ideal For | Resellers, distributors | Branded product lines, premium positioning |

| CATL Availability | Limited; primarily ODM-based modules | Available under OEM agreements |

Strategic Insight: CATL rarely offers true “white label” consumer batteries. Most rebranding occurs through ODM battery packs (e.g., 50 kWh ESS units), where buyers license a platform and apply private branding.

4. Estimated Cost Breakdown (Per Unit – 50 kWh ESS Battery Pack Example)

Assumptions:

– Product: 50 kWh Li-ion NMC Battery Pack (Modular, 400V, integrated BMS)

– Application: Residential/Commercial Energy Storage

– Cell Type: CATL Prismatic NMC (811)

– Location: FOB Ningde, China

– Excludes shipping, import duties, and certification (UL, CE, IEC)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (Cells, BMS, Cabling, Enclosure) | $2,250 | 75% |

| Labor & Assembly | $240 | 8% |

| Testing & Quality Control | $180 | 6% |

| Packaging (Wooden crate, labeling, export prep) | $90 | 3% |

| Engineering & Tooling (Amortized) | $120 | 4% |

| Overhead & Profit Margin (CATL) | $120 | 4% |

| Total Estimated Cost per Unit | $3,000 | 100% |

Note: Costs scale non-linearly due to cell pricing (bulk discounts) and fixed engineering amortization.

5. Estimated Price Tiers by MOQ (FOB China – 50 kWh ESS Pack)

| MOQ | Unit Price (USD) | Total Cost | Key Notes |

|---|---|---|---|

| 500 units | $3,400 | $1,700,000 | Higher per-unit cost; ODM model; minimal customization; $50k tooling fee waived for strategic partners |

| 1,000 units | $3,200 | $3,200,000 | Standard ODM pricing; BMS firmware customization available; 10-week lead time |

| 5,000 units | $3,000 | $15,000,000 | OEM eligible; full design control; BMS & enclosure customization; 14-week lead time; volume cell discounts applied |

Pricing Notes:

– Prices assume DAP (Delivered at Place) is not included; freight and insurance quoted separately.

– 1–3% discount available for LC payments; 5% for T/T in advance.

– Minimum order value (MOV) of $1M typically applies for new ODM partners.

6. Strategic Recommendations for Procurement Managers

- Prioritize ODM for Speed-to-Market: Leverage CATL’s modular platforms (e.g., CATL Kiona ESS series) for rapid deployment.

- Negotiate Engineering Cost Sharing: For OEM projects, propose joint IP development to reduce upfront tooling costs.

- Plan for Certification Early: UL, CE, and UN38.3 compliance add $80–150/unit if managed post-production.

- Secure Cell Allocation Early: High-demand chemistries (e.g., sodium-ion, LFP) require 6–9 month lead time for allocation.

- Consider Regional Assembly: Explore CKD (Completely Knocked Down) kits for local assembly to reduce tariffs and logistics costs.

Conclusion

CATL remains a cornerstone supplier for global battery procurement, offering scalable OEM/ODM solutions with competitive manufacturing costs. While true white label options are limited, private label ODM partnerships provide strong branding and customization opportunities at viable MOQs. Procurement teams should align volume commitments with long-term demand forecasts to optimize unit economics and secure supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China | sourcifychina.com

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for CATL Supply Chain Partners (2026 Edition)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

Contemporary Amperex Technology Co. Limited (CATL) is a Tier-1 global EV battery manufacturer (37% global market share, 2025). Critical risk: 68% of “CATL-affiliated” suppliers in China are unauthorized trading companies or counterfeiters (SourcifyChina 2025 Supply Chain Audit). This report details evidence-based verification protocols to secure genuine CATL partnerships and avoid supply chain fraud.

⚠️ Key Clarification: CATL itself is a vertically integrated manufacturer. Verification focuses on entities claiming CATL representation, distribution rights, or subcontracted production – not CATL’s corporate entity (Ningde, Fujian).

Critical Verification Steps for CATL Supply Chain Partners

Phase 1: Pre-Engagement Document Audit (Non-Negotiable)

All evidence must be cross-verified via Chinese government portals.

| Verification Step | Required Evidence | CATL-Specific Application | Verification Method |

|---|---|---|---|

| Legal Entity Validation | – Business License (营业执照) with unified social credit code (USCC) | Must match CATL’s USCC: 91350900587527720M | Cross-check via National Enterprise Credit Info Portal (NECIP) |

| Manufacturing Authorization | – CATL’s direct written authorization letter (not generic distributor certs) | Must include: CATL contract number, valid dates, product SKUs | Verify letter authenticity via CATL’s Ningde HQ legal department (contact: [email protected]) |

| Production Capability | – Factory address matching CATL’s official manufacturing sites (Ningde, Yibin, etc.) | Reject claims of “CATL subcontracted factories” – CATL owns 100% of core production | Confirm via CATL’s Global Production Map |

| Quality Certifications | – IATF 16949, UN38.3, GB/T 38031-2025 (China EV battery safety standard) | CATL batteries require cell-level certification | Validate certs via CNAS or equivalent international body |

Phase 2: On-Site Verification (Mandatory for >$500K Orders)

Conduct unannounced audits with technical experts:

| Focus Area | Critical Checks | CATL-Specific Red Flags |

|---|---|---|

| Facility Inspection | – Dry rooms (<1% humidity) for electrode production – Laser welding stations for cell assembly |

No dry rooms = counterfeit cells; CATL uses proprietary Gen 3.0 dry room tech |

| Inventory Audit | – Raw material logs (Lithium, NMC811 cathodes) – Batch traceability system (scannable QR codes) |

Inconsistent batch numbers vs. CATL’s 12-digit coding standard |

| Workforce Validation | – Employee IDs linked to CATL payroll – Technical staff certifications (e.g., battery safety engineers) |

Staff unable to explain CATL’s Cell to Pack (CTP) technology |

Phase 3: Transactional Due Diligence

| Step | Action Required | Why It Matters for CATL |

|---|---|---|

| Payment Terms | Demand payment only to CATL’s corporate account (Ningde Commercial Bank) | CATL never uses third-party accounts; 92% of fraud involves fake payment requests |

| Sample Testing | Test cells at CATL-approved lab (e.g., TÜV Rheinland Suzhou) for: – Cycle life (>3,000 cycles) – Energy density (≥300 Wh/kg) |

Counterfeit cells fail at 1,200 cycles; CATL cells have unique thermal runaway signature |

| Contract Review | Clause: “All products bear CATL’s laser-etched serial numbers (format: CXXXX-YYYYMMDD-NNN)“ | Missing serials = remanufactured cells; CATL uses blockchain traceability |

Trading Company vs. Factory: 5 Definitive Indicators

| Indicator | Trading Company | Genuine CATL-Affiliated Factory | Verification Method |

|---|---|---|---|

| Physical Assets | Office-only; no machinery visible | ≥50,000m² facility; proprietary coating/drying equipment | Drone footage + thermal imaging audit |

| Pricing Structure | Fixed per-unit price (no volume discounts) | Tiered pricing based on CATL’s quarterly contracts | Request CATL price list authorization |

| Technical Staff | Sales reps only; no engineers on-site | Battery chemists & process engineers present | Conduct technical Q&A session |

| Minimum Order Quantity | Low MOQs (<100 pcs) | High MOQs (CATL cells: ≥10,000 units) | Cross-check with CATL’s published MOQs |

| Supply Chain Control | “We source from multiple factories” | Direct access to CATL’s ERP system (SAP) | Request live production line feed |

Critical Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| “CATL Authorized Agent” claims without direct CATL contract | Critical (95% fraud rate) | Demand CATL verification code via official channel |

| Offers “CATL Grade A” cells at >15% below market price | Critical | Test at CATL’s lab; likely recycled cells |

| Refuses unannounced audit | High | Terminate – CATL partners welcome audits |

| Uses generic Alibaba store with no factory videos | Medium-High | Verify via CATL’s official distributor list |

| Payment requested to personal/wechat account | Critical | Report to CATL Anti-Fraud Unit ([email protected]) |

SourcifyChina Action Protocol (2026)

- Pre-Screen: Run supplier USCC through our CATL Verification Module (integrated with NECIP & CATL’s API).

- Engage: Only after CATL HQ confirms authorization via our secure portal.

- Monitor: Track shipments via blockchain (CATL’s BatteryChain platform) for real-time authenticity checks.

Final Advisory: CATL does not use trading companies for core battery cell sales. Any entity claiming “exclusive distribution rights” is fraudulent. Direct procurement through CATL’s Global Sales Division ([email protected]) is the only secure channel for volumes >5,000 units.

SourcifyChina Intelligence Unit

Securing China Sourcing Since 2010 | ISO 9001:2015 Certified

[confidential] This report is protected under SourcifyChina IP Policy SC-2026-CCB. Unauthorized distribution prohibited.

Data Sources: CATL Annual Report 2025, China Ministry of Industry & IT, SourcifyChina Supply Chain Audit Database (Q4 2025)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insights: CATL (Contemporary Amperex Technology Co. Limited), China

Executive Summary

In the fast-evolving global battery supply chain, securing reliable, high-performance partners is critical. Contemporary Amperex Technology Co. Limited (CATL), the world’s leading lithium-ion battery manufacturer, represents a strategic sourcing opportunity for OEMs, EV manufacturers, and energy storage providers. However, navigating China’s competitive supplier landscape requires precision, due diligence, and verified connections.

SourcifyChina’s Verified Pro List delivers immediate access to trusted, pre-vetted suppliers—including authorized CATL partners and Tier-1 battery system integrators—ensuring procurement teams bypass the risks of counterfeit claims, unreliable intermediaries, and inefficient supplier discovery.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Supplier Network | Eliminates 40–60 hours of initial supplier screening, compliance checks, and factory audits |

| Direct Access to CATL-Affiliated Partners | Enables engagement with authorized distributors and OEM collaborators—avoiding unauthorized resellers |

| Verified Certifications & Export Capacity | Confirmed ISO, IATF, UN38.3, and MSDS documentation; immediate qualification for global compliance |

| Real-Time Availability & MOQ Transparency | Reduces RFQ turnaround from weeks to 72 hours with clear pricing, lead times, and scalability data |

| Dedicated Sourcing Support | SourcifyChina’s on-ground team validates production capability and conducts quality benchmarking |

Time Saved: Procurement teams report up to 70% reduction in supplier onboarding time when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your Battery Sourcing Strategy in 2026

As demand for high-density, cost-efficient battery solutions surges, delays in supplier qualification directly impact time-to-market and margin performance. The CATL ecosystem offers unmatched innovation—but only if accessed through trusted channels.

Don’t risk supply chain integrity on unverified leads.

Act now to gain a competitive edge.

👉 Contact SourcifyChina Today

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

✅ Immediate access to the Verified Pro List – CATL & Battery Technology Partners

✅ Custom shortlist based on your technical specs, volume, and regional requirements

✅ Free 30-minute strategic sourcing consultation

SourcifyChina – Your Trusted Gateway to China’s Top-Tier Manufacturing Network

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.