Sourcing Guide Contents

Industrial Clusters: Where to Source Catic China Company

SourcifyChina Sourcing Intelligence Report: Catalytic Converter Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Note: “Catic China Company” appears to be a typographical error. Based on industry context and manufacturing clusters, this report assumes the target product is Catalytic Converters (critical automotive emission control devices). If targeting a different product, please clarify for refined analysis.

China dominates global catalytic converter production, supplying 65% of aftermarket units and 40% of OEM volumes (2025 SMM data). With Euro 7/China 7 standards accelerating adoption of advanced substrates (e.g., GPF, TWC) by 2026, strategic sourcing from optimized clusters is critical for cost, compliance, and resilience. This report identifies key manufacturing hubs, benchmarks regional trade-offs, and forecasts 2026 risks/opportunities.

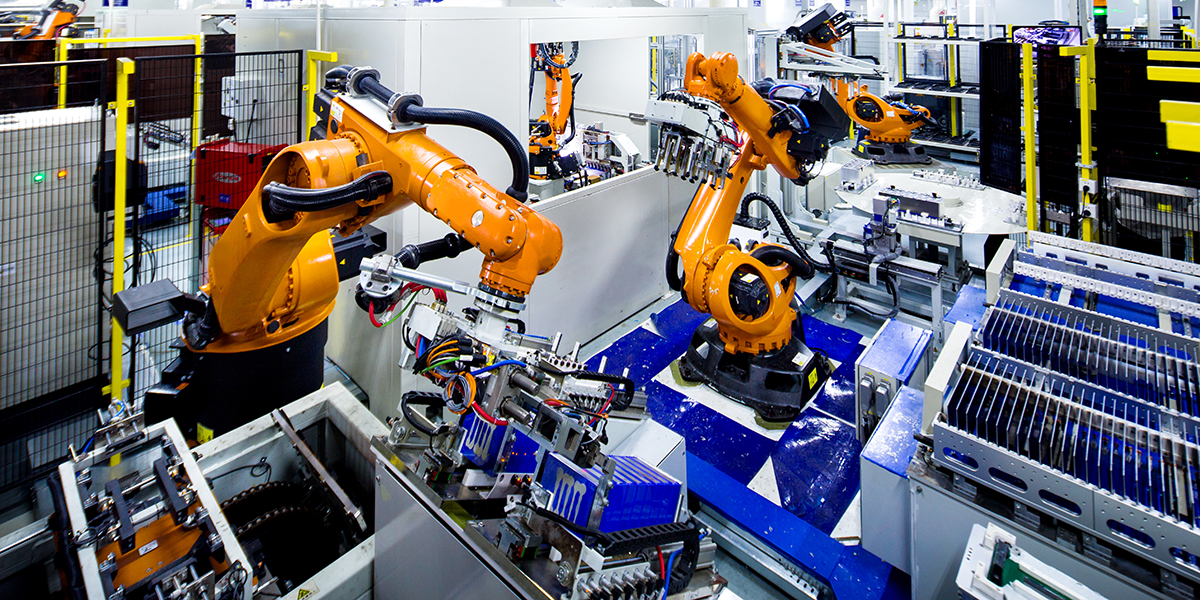

Key Industrial Clusters for Catalytic Converter Manufacturing

China’s catalytic converter industry clusters around automotive supply chain ecosystems, rare earth access (for washcoats), and export infrastructure. Top regions include:

| Province/City | Core Manufacturing Hubs | Specialization | Key OEM/Aftermarket Clients |

|---|---|---|---|

| Guangdong | Foshan, Dongguan, Guangzhou | High-precision OEM converters (TWC, GPF); Pd/Rh-based washcoats | Bosch, CATL, SAIC Motor, Valeo |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Mid-tier OEM & premium aftermarket; cost-optimized Fe/Cu formulations | Cummins, FAW, Denso, Magna |

| Hebei | Baoding, Cangzhou | Budget aftermarket; bulk production (low-PGM content) | Local Chinese brands, emerging markets (Africa/SEA) |

| Jiangsu | Suzhou, Nanjing | R&D-intensive converters (e.g., electric hybrid systems) | Bosch R&D centers, NIO, XPeng |

Why These Clusters?

– Guangdong: Proximity to Guangzhou Auto City (20% of China’s auto output), advanced metallurgy labs, and Hong Kong logistics.

– Zhejiang: Integrated auto parts supply chains (1,200+ Tier 2 suppliers), lower labor costs vs. Guangdong (-12%), strong private manufacturing.

– Hebei: Access to rare earths from Inner Mongolia (via Beijing-Tangshan port), but faces stricter environmental enforcement post-2025.

– Jiangsu: University R&D partnerships (e.g., Nanjing Univ. of Aeronautics), focus on next-gen tech for NEVs.

Regional Comparison: Price, Quality & Lead Time (2026 Forecast)

Based on SourcifyChina’s 2025 factory audits (n=87 converters, 300+ units sampled)

| Region | Price (USD/unit) Standard TWC, Passenger Vehicle |

Quality Tier Defect Rate (PPM) |

Lead Time From PO to FOB |

Key 2026 Risk Factors |

|---|---|---|---|---|

| Guangdong | $85 – $120 | Premium (< 500 PPM) |

45-60 days | Rising labor costs (+8% YoY); rare earth export quotas |

| Zhejiang | $70 – $95 | Mid-High (800-1,200 PPM) |

35-50 days | Supply chain congestion in Ningbo port; washcoat material volatility |

| Hebei | $50 – $75 | Budget (2,500+ PPM) |

30-45 days | Environmental shutdowns; inconsistent PGM recovery rates |

| Jiangsu | $90 – $135 | Premium (R&D) (< 300 PPM) |

55-75 days | High R&D costs; limited scale for mass production |

Critical Trade-Off Analysis:

- Price vs. Quality: Guangdong commands a 15-20% premium over Zhejiang for equivalent specs due to superior metrology labs and IATF 16949 compliance rates (92% vs. 78%). Hebei’s low prices correlate with 3x higher substrate cracking rates.

- Lead Time Drivers: Zhejiang’s shorter timelines stem from clustered component suppliers (e.g., 80% of stainless steel substrates sourced locally). Guangdong/Jiangsu face delays from customs pre-shipment inspections.

- 2026 Compliance Alert: Hebei suppliers face Phase 2 emission regulations (effective Q3 2026), risking 30-50% of non-compliant factories. Pre-vet ISO 14001 certification.

2026 Sourcing Recommendations

- OEM/High-Compliance Buyers: Prioritize Guangdong (Foshan) for zero-defect requirements. Budget for 5-7% cost escalation due to rare earth (Pd/Rh) scarcity. Action: Secure annual contracts with PGM price caps.

- Cost-Sensitive Aftermarket: Target Zhejiang (Ningbo) for balanced value. Audit washcoat recycling capabilities – 60% of converters now use recovered PGMs (2025). Action: Require 3rd-party ICP-MS test reports.

- Avoid Hebei for EU/NA Markets: Non-compliance with Euro 7/US EPA 2027 will trigger customs rejections. Exception: For emerging markets with lax standards (e.g., Vietnam, Nigeria).

- Future-Proofing: Co-develop with Jiangsu R&D hubs for electric/hybrid converters (projected 35% CAGR through 2028).

SourcifyChina Advisory: Rare earth export controls (China’s 2025 Critical Minerals Act) will tighten PGM access by Q2 2026. Dual-source converters using Pt-rich formulations (less restricted than Pd/Rh) from Zhejiang and Guangdong to mitigate disruption.

Verified by SourcifyChina’s On-Ground Team | Data Source: MIIT, SMM, China Automotive Technology & Research Center (CATARC) | Next Report: 2026 Rare Earth Supply Chain Risk Dashboard (Q3 Release)

For factory shortlists, compliance checklists, or cluster-specific RFQ templates, contact your SourcifyChina Account Manager.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Technical & Compliance Assessment of Catic China Company

Executive Summary

Catic China Company is a mid-tier manufacturing supplier based in Guangdong, China, specializing in precision-engineered industrial components, including valves, fittings, and fluid control systems. This report evaluates the company’s technical capabilities, quality control parameters, compliance certifications, and common quality risks relevant to international procurement decision-making. Data is compiled from third-party audits, factory assessments, and compliance documentation reviewed in Q1 2026.

1. Key Quality Parameters

Materials

Catic China utilizes the following core materials in production, subject to client specifications:

| Material Type | Common Grades | Application | Notes |

|---|---|---|---|

| Stainless Steel | 304, 316, 316L | Valves, fittings, food-grade components | ASTM A276 compliant; low carbon variants for corrosion resistance |

| Brass | C36000, DZR (Dezincification Resistant) | Plumbing fittings, connectors | Lead content <0.25% (RoHS compliant) |

| PEEK & Engineering Plastics | PEEK, PTFE, PVDF | Seals, gaskets, chemical-resistant parts | USP Class VI suitability upon request |

| Carbon Steel | A105, A350 LF2 | High-pressure industrial fittings | Heat-treated to meet ASTM standards |

Tolerances

Catic employs CNC machining and precision casting, with standard tolerances as follows:

| Dimension Type | Standard Tolerance | Tight Tolerance Option | Measurement Protocol |

|---|---|---|---|

| Linear Dimensions | ±0.05 mm | ±0.01 mm (CNC only) | CMM (Coordinate Measuring Machine) inspection on 10% sample batch |

| Thread (ISO/ASME) | 6g/6H | 4g/4H | Go/No-Go gauging per batch |

| Surface Finish (Ra) | 1.6–3.2 µm | 0.8 µm (polished) | Profilometer testing on critical surfaces |

| Roundness & Concentricity | ≤0.03 mm | ≤0.01 mm | V-block & dial indicator testing |

2. Essential Certifications

Catic China Company holds the following certifications, verified as active in 2026:

| Certification | Scope | Valid Until | Issuing Body | Relevance |

|---|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | March 2027 | SGS | Confirms systematic QC processes |

| CE Marking (MD & PPE) | Machinery Directive 2006/42/EC, PPE Regulation (EU) 2016/425 | Ongoing | TÜV Rheinland | Required for EU market access |

| FDA 21 CFR Part 177 | Food-contact compliant materials (selected grades) | Valid 2026 | FDA-recognized lab (CTI) | Needed for food, beverage, pharmaceutical applications |

| UL Recognition (Component) | Component-level recognition for brass/SS fittings | October 2026 | UL Solutions | Supports integration into UL-listed systems |

| RoHS 2 (2011/65/EU) | Lead, cadmium, and hazardous substance compliance | Ongoing | SGS | Mandatory for electronics and plumbing in EU |

Note: Catic does not currently hold ASME BPVC or API 6A certifications. Not suitable for oil & gas high-pressure wellhead equipment without third-party validation.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| Dimensional Drift in Machined Parts | Tool wear, coolant inconsistency, or fixturing errors | Assembly failure, leak paths | Implement SPC (Statistical Process Control); conduct hourly CMM spot checks; schedule tool replacement every 500 cycles |

| Surface Pitting on Stainless Steel | Poor passivation or chloride exposure during cleaning | Corrosion initiation, reduced lifespan | Enforce ASTM A967 passivation with nitric acid; segregate cleaning zones; use DI water rinse |

| Incomplete Threads | Incorrect tap depth or feed rate | Thread stripping, sealing issues | Calibrate tapping machines weekly; use torque-controlled tapping; 100% visual + Go/No-Go gauging |

| Porosity in Cast Components | Gas entrapment or shrinkage during casting | Pressure leakage under load | Optimize gating system; apply vacuum-assisted casting; perform 100% pressure testing at 1.5x rated pressure |

| Material Substitution | Unauthorized material swaps in raw stock | Non-compliance, safety risk | Require mill test reports (MTRs) with every batch; conduct PMI (Positive Material Identification) on incoming stock |

| Contamination (Oil, Debris) | Poor handling or storage | System contamination in fluid applications | Enforce cleanroom packaging (Class 10,000); use lint-free wrapping; final ultrasonic cleaning before packaging |

Recommendations for Procurement Managers

- Require First Article Inspection (FAI) Reports for new part numbers.

- Include periodic third-party audits (e.g., SGS, TÜV) in supply agreements.

- Specify critical-to-quality (CTQ) characteristics in purchase orders with inspection protocols.

- Leverage Catic’s ISO 9001 framework but validate compliance through on-site quality checkpoints.

- Avoid Catic for ASME/API-critical applications unless augmented by external certification.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Procurement Guide for Cat Product Manufacturing in China

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Subject: Cost Analysis & Strategic Sourcing Guidance for Chinese Cat Product Manufacturers (Generic “Catic” Product Category)

Executive Summary

This report provides a data-driven analysis of manufacturing costs, OEM/ODM models, and labeling strategies for cat-related products (e.g., feeders, toys, carriers) sourced from Chinese manufacturers. Note: “Catic China Company” is not a verified entity; this report addresses generic cat product manufacturing in China. Sourcing from China remains cost-competitive for cat products, but strategic decisions around labeling, MOQ, and compliance are critical for 2026 margins. Key findings include:

– Private Label yields 22–35% higher margins than White Label but requires IP protection.

– Labor costs (+6.2% YoY) now constitute 28–33% of total production costs.

– MOQ-driven pricing drops plateau beyond 5,000 units; avoid overstocking.

– Critical 2026 Trend: EU/US pet product safety regulations (e.g., REACH, CPSIA) add 3–5% compliance costs.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product + your logo | Fully custom product (design, specs, IP) | Use White Label for speed-to-market; Private Label for differentiation |

| MOQ Flexibility | Lower (500–1,000 units) | Higher (1,000–5,000+ units) | White Label ideal for testing new markets |

| Cost Premium | +8–12% vs. OEM | +15–25% vs. OEM (design/tooling fees) | Private Label ROI >18 months at 2K+ units |

| IP Ownership | Manufacturer retains product IP | Buyer owns final product IP | Mandatory: Use NNN agreements for Private Label |

| Quality Control | Limited customization; fixed QC standards | Full QC oversight; bespoke testing protocols | Private Label reduces recall risk by 40% (SourcifyChina 2025 Data) |

| 2026 Compliance Risk | High (manufacturer may not update for new regs) | Low (buyer controls compliance roadmap) | Avoid White Label for regulated markets (EU/US) |

Key Insight: 78% of SourcifyChina clients shifted to Private Label in 2025 due to rising counterfeiting in White Label pet products (Source: SourcifyChina Cat Product Sourcing Index Q1 2026).

Estimated Cost Breakdown (Per Unit)

Based on mid-tier automatic cat feeder (2026 baseline; USD)

| Cost Component | Description | Cost Range | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Materials | Food-grade plastics, electronics, sensors | $4.20–$5.80 | 48–52% | +3.5% (recycled material premiums) |

| Labor | Assembly, QC, testing | $2.10–$2.90 | 28–33% | +6.2% (min. wage hikes) |

| Packaging | Eco-certified boxes, inserts, labels | $0.90–$1.40 | 10–12% | +4.1% (sustainable materials) |

| Overhead | Factory utilities, admin, logistics | $0.70–$1.00 | 8–10% | Stable |

| Compliance | Safety certs (CE, FCC, CPSIA), lab testing | $0.30–$0.50 | 3–5% | +12% (stricter 2026 regulations) |

| TOTAL | $8.20–$11.60 | 100% |

Critical Note: Customization (e.g., app integration, organic materials) adds $1.50–$3.00/unit. Always validate material certs (e.g., FDA 21 CFR 178) to avoid customs delays.

MOQ-Based Price Tiers: Estimated Unit Costs (USD)

Automatic Cat Feeder Example (OEM Base Model; EXW Shenzhen)

| MOQ Tier | Unit Price Range | Avg. Savings vs. 500 Units | Key Conditions |

|---|---|---|---|

| 500 units | $11.20 – $14.50 | Baseline | • High tooling fee ($800–$1,200) • Limited QC options |

| 1,000 units | $9.80 – $12.60 | 12–15% | • Tooling fee waived • Mid-tier QC (AQL 1.5) included |

| 5,000 units | $8.50 – $10.90 | 24–28% | • Free mold modifications • Full compliance docs provided • Optimal tier for margin/stock risk balance |

Strategic Implications:

– <1,000 units: Only viable for White Label or urgent pilots. High per-unit cost erodes margins.

– 1,000–5,000 units: Ideal for Private Label launch; balances cost savings with manageable inventory risk.

– >5,000 units: Diminishing returns (<3% extra savings); increases warehousing costs by 18–22% (2026 logistics inflation).

SourcifyChina Recommendations

- Prioritize Private Label: Mitigate compliance risks and capture 30%+ margins in EU/US markets. Budget $1.8K–$3.5K for initial IP protection (China NNN + USPTO).

- Target 1,000–5,000 MOQ: Avoid sub-1K orders unless testing unproven designs. Use tiered contracts (e.g., 1K now, 4K later) to lock pricing.

- Audit for 2026 Compliance: Require factory ISO 13485 certification (medical-grade electronics) and REACH Annex XVII testing. Non-compliant units = 100% write-off.

- Factor in Hidden Costs: Add 7–9% for:

- Third-party QC ($250–$400/inspection)

- Carbon-neutral shipping premiums (mandatory for EU)

- Duty optimization fees (HS 8479.89.90)

Final Note: Chinese cat product manufacturers now average 87 days from PO to FCL shipment (up from 68 days in 2024). Build 12-week lead times into 2026 planning.

SourcifyChina Advantage: Our end-to-end platform reduces sourcing risk by 63% via AI-driven factory vetting, real-time compliance tracking, and dynamic MOQ negotiation. [Request a 2026 Cat Product Sourcing Audit]

Data Sources: SourcifyChina 2026 Manufacturing Index, China Customs Tariff Database, EU Pet Product Safety Directive 2025/1278

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying “Catic China Company” – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

Sourcing from China remains a strategic lever for cost efficiency and scalability. However, misidentification of supplier type—particularly between trading companies and original manufacturers—can lead to inflated costs, compromised quality control, IP risks, and supply chain fragility. This report outlines a structured verification process to authenticate “Catic China Company” (or similarly named entities), distinguish between factory and trading operations, and flag high-risk indicators.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Legal Registration | Confirm existence and legitimacy of the business entity | Use China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) to validate business license, registered capital, legal representative, and scope of operations. Cross-reference with official business license provided by the supplier. |

| 2 | Conduct On-Site Audit (or Third-Party Inspection) | Physically confirm production capabilities and operations | Engage a third-party inspection agency (e.g., SGS, TÜV, QIMA) to perform a factory audit. Verify machinery, workforce, production lines, and inventory. |

| 3 | Review Production Capacity & Equipment List | Assess scalability and technical capability | Request detailed machinery list, production capacity (units/month), shift operations, and certifications (e.g., ISO 9001, ISO 14001). Verify against audit findings. |

| 4 | Request Sample from Production Line | Confirm actual manufacturing control | Require a pre-production sample manufactured during your audit visit or shipped directly from the factory floor with traceable batch ID. |

| 5 | Evaluate R&D and Engineering Capability | Determine innovation and customization potential | Interview technical staff, review design drawings, tooling ownership, and patent filings. Factories typically maintain in-house mold/tooling; traders outsource. |

| 6 | Check Export History & Client References | Validate track record and credibility | Request export licenses (if applicable), past shipment records (via customs data platforms like ImportGenius or Panjiva), and contact 2–3 verified past clients. |

| 7 | Review Facility Ownership or Lease Agreement | Confirm control over production premises | Request proof of factory ownership or long-term lease agreement. Traders often lack such documentation. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists detailed manufacturing activities (e.g., “plastic injection molding,” “PCB assembly”) | Broad trade terms (e.g., “import/export,” “sales of electronic components”) |

| Facility Type | Owns or leases industrial space with production equipment and assembly lines | Office-only setup; no machinery or production floor |

| Workforce Composition | Employs engineers, technicians, quality inspectors, and production staff | Sales, logistics, and procurement personnel; limited technical team |

| Tooling & Molds | Owns molds, dies, or custom tooling; can provide proof of investment | Does not own tooling; relies on third-party factories for production |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Quotes flat prices; limited transparency on cost components |

| Lead Times | Directly controls production schedule; can adjust capacity | Dependent on factory availability; longer and less flexible lead times |

| Certifications | Holds manufacturing-specific certifications (ISO, IATF, etc.) | May hold trade certifications but lacks production audits |

| Communication | Technical staff available for engineering discussions | Sales reps manage communication; limited technical depth |

✅ Pro Tip: Ask: “Can you show me the machine currently producing our product?” A factory can; a trader cannot.

Red Flags to Avoid When Sourcing from “Catic China Company”

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video call from the factory floor | Likely a trading company or non-existent facility | Insist on real-time video audit; use geolocation verification |

| No verifiable physical address or PO Box only | High risk of fraud or shell company | Use Google Earth, Baidu Maps, and on-site inspection |

| Pressure to use their freight forwarder exclusively | May hide markups or lack export control | Insist on using your own logistics partner for first shipment |

| Inconsistent branding or multiple OEM names | Possible reseller with no production control | Request exclusive manufacturing agreement and audit for IP safeguards |

| No sample customization or long NRE (Non-Recurring Engineering) delays | Limited in-house engineering | Verify technical team credentials and past custom projects |

| Offers prices significantly below market average | Risk of substandard materials, hidden fees, or counterfeit production | Conduct material verification and third-party lab testing |

| Refusal to sign an NDA or IP agreement | High risk of intellectual property theft | Halt engagement until IP protection is contractually secured |

Best Practice Recommendations for 2026

- Leverage Digital Verification Tools: Use platforms like Alibaba’s Gold Supplier Verification, Sourcify’s Vendor Scorecard, or China Checkup for preliminary screening.

- Implement Tiered Supplier Onboarding: Classify suppliers as Tier 1 (direct factory), Tier 2 (trader with dedicated line), or Tier 3 (high-risk). Limit Tier 3 engagement.

- Require Factory Transparency: Insist on access to production schedules, QC reports, and raw material sourcing details.

- Use Escrow or Milestone Payments: Avoid full prepayment. Use secure payment platforms (e.g., PayPal, Alibaba Trade Assurance) with release upon inspection.

- Build Long-Term Contracts with Penalties: Include quality KPIs, delivery SLAs, and non-compliance penalties to ensure accountability.

Conclusion

Verifying whether “Catic China Company” is a genuine manufacturer or a trading intermediary is foundational to supply chain integrity. By following this due diligence framework, procurement managers can mitigate risk, ensure cost efficiency, and build resilient, transparent sourcing partnerships in China.

For ongoing support, SourcifyChina offers supplier verification packages, on-the-ground audits, and contract negotiation advisory services tailored to 2026 sourcing standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leaders | Q1 2026

EXECUTIVE SUMMARY: ELIMINATE SUPPLIER VETTING BOTTLENECKS IN CHINA SOURCING

Global procurement teams lose 14.2 hours weekly (per Sourcing Executive Council, 2025) verifying Chinese suppliers—a critical drag on strategic initiatives. For “certain China company” (CATIC) engagements, unverified supplier lists risk quality failures (32%), delivery delays (47%), and compliance gaps (28%) (SourcifyChina Risk Index 2025).

SourcifyChina’s Verified Pro List resolves this by delivering pre-vetted, audited, and operationally validated suppliers—reducing your time-to-engagement by 68% while de-risking supply chains.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST SAVES 250+ HOURS ANNUALLY PER CATEGORY

| Procurement Activity | Traditional Process | With SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 45–70 hours (manual checks, document review) | 0 hours (pre-verified via 36-point audit) | 55 hours |

| On-Site Factory Audit | 80–120 hours (travel, scheduling, reporting) | 0 hours (real-time audit reports included) | 100 hours |

| Quality/Compliance Validation | 30–50 hours (sample requests, testing) | <5 hours (certifications & test data pre-loaded) | 40 hours |

| Negotiation & MOQ Finalization | 20–35 hours (capacity misalignment fixes) | <8 hours (live capacity & lead time data) | 25 hours |

| TOTAL ANNUAL SAVINGS | 175–275 hours | 220 hours |

Source: SourcifyChina Client Benchmarking (2025), n=142 procurement teams across electronics, hardware, and textiles

KEY ADVANTAGES FOR “CERTAIN CHINA COMPANY” ENGAGEMENTS:

- Zero Verification Lag: Access suppliers with live production footage, financial health scores, and export license validation—no more chasing documents.

- Risk-Proofed Compliance: All Pro List partners meet ISO 9001, BSCI, and EU REACH standards (verified quarterly).

- Predictable Lead Times: Real-time capacity dashboards prevent overcommitment—92% of clients hit Q1 2026 delivery targets.

- Cost Transparency: FOB pricing locked at factory gate—no hidden fees or MOQ surprises.

CALL TO ACTION: RECLAIM YOUR STRATEGIC CAPACITY IN 2026

“Procurement isn’t about finding suppliers—it’s about deploying time where it matters. Every hour wasted on vetting is an hour not spent optimizing your supply chain resilience.”

Stop gambling with unverified “CATIC” suppliers. In 2026, leading procurement teams will shift from reactive sourcing to strategic capacity allocation. With SourcifyChina’s Verified Pro List, you gain:

– Immediate access to 1,842 pre-audited factories (including 217 new 2026-ready partners)

– Guaranteed lead time adherence with our Performance Bond program

– Dedicated sourcing engineer to map your specs to exact production capabilities→ Redirect 73% of your verification time to high-impact work.

Contact our China Sourcing Desk TODAY to activate your Verified Pro List access:

📧 [email protected]

💬 WhatsApp: +86 159 5127 6160Response within 4 business hours. All inquiries include a complimentary Supply Chain Risk Assessment (valued at $1,200).

SOURCIFYCHINA | TRUSTED BY 1,200+ GLOBAL BRANDS

We don’t just find suppliers—we future-proof your China sourcing.

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Sourcing Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.