Sourcing Guide Contents

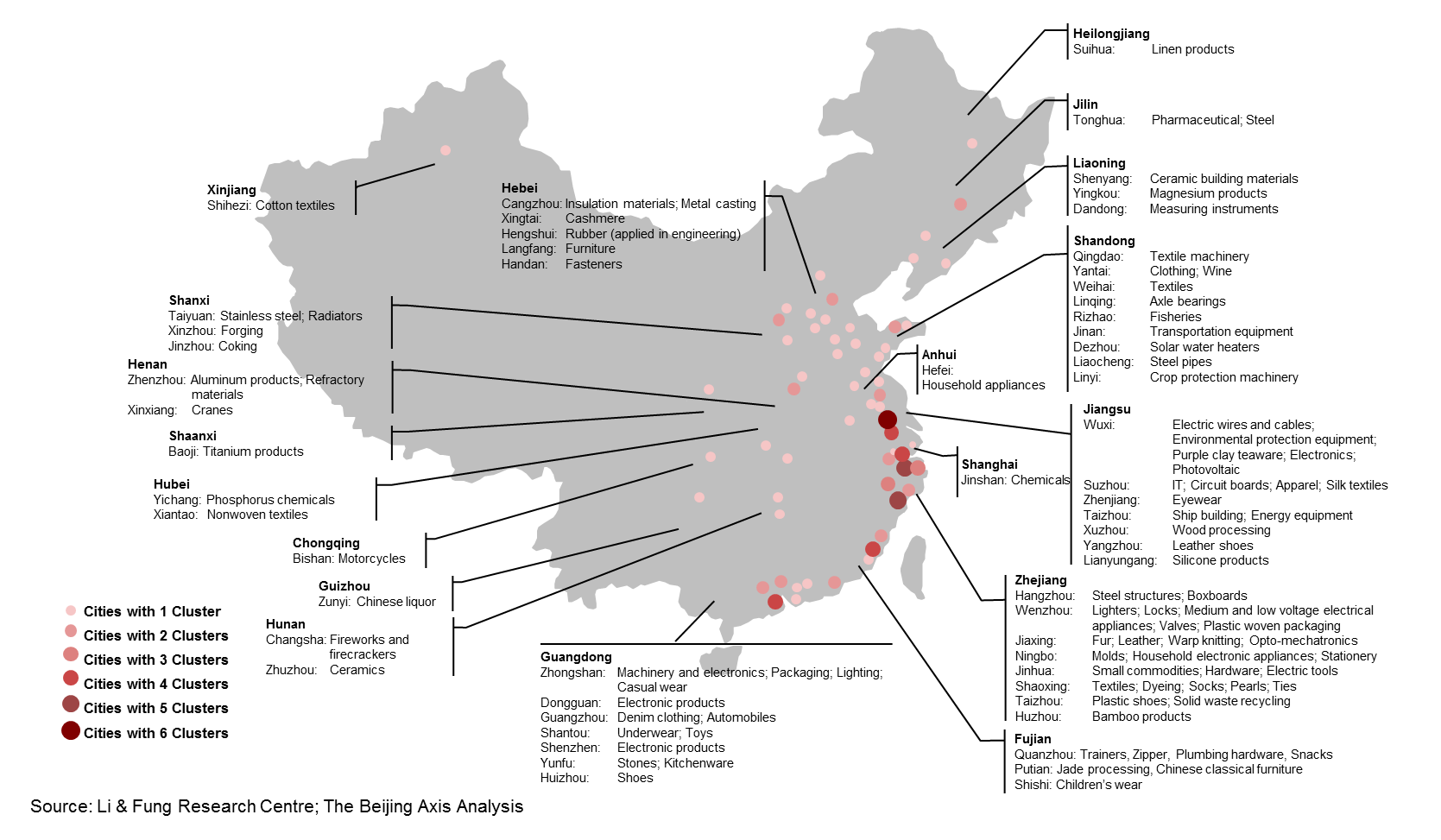

Industrial Clusters: Where to Source Best Sourcing Agent In China

Professional B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing the Best Sourcing Agents in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

While the term “best sourcing agent in China” may appear self-referential, this report interprets the request as a strategic analysis of regions in China that produce highly competent, reliable, and scalable sourcing agents—third-party intermediaries that facilitate international procurement from Chinese manufacturers.

China’s sourcing agent ecosystem is not manufactured in a factory but cultivated through dense industrial networks, logistics infrastructure, export experience, and bilingual talent pools. The most effective sourcing agents emerge from provinces and cities with:

– High concentration of export-oriented manufacturing

– Mature supply chain ecosystems

– Strong foreign trade services (logistics, compliance, QA)

– Access to multilingual professionals and digital platforms

This report identifies the key industrial and service clusters in China where the most capable sourcing agents are based, evaluates regional strengths, and provides a comparative matrix to guide procurement leaders in selecting agent partners.

Key Industrial & Sourcing Clusters for Sourcing Agents in China

The “manufacturing” of a top-tier sourcing agent occurs in regions where supply chain complexity meets global trade sophistication. The following provinces and cities are recognized as the primary hubs for sourcing agent development and operations:

| Region | Key Cities | Core Industries | Sourcing Agent Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Tech, Home Appliances, Plastics, Textiles | High-volume OEM/ODM, Fast Turnaround, E-commerce Fulfillment |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Light Industrial Goods, Hardware, Seasonal Products, Small Machinery | Cost-Effective Sourcing, Niche B2B Suppliers, Alibaba Ecosystem Integration |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision Engineering, Industrial Equipment, Automotive Components | High-Quality Manufacturing Oversight, German/Japanese OEM Partnerships |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Apparel, Sports Equipment, Ceramics | Fast Fashion, Ethical Compliance, SME Supplier Networks |

| Shanghai | Shanghai (Municipality) | Cross-Industry, High-Tech, Medical Devices, R&D | Premium Client Services, Regulatory Compliance, Multinational Coordination |

Note: Sourcing agents are service providers—not physical goods. Their “quality” is determined by operational excellence, industry access, transparency, and risk mitigation capabilities, which are directly influenced by their regional ecosystem.

Comparative Analysis: Key Sourcing Agent Hubs (2026)

The table below compares the top two sourcing agent clusters—Guangdong and Zhejiang—based on three critical procurement KPIs: Price Competitiveness, Quality of Oversight, and Lead Time Efficiency. These metrics reflect the performance of sourcing agents operating within each region and their access to suppliers.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4.2/5) Highly competitive pricing due to scale and supplier density. Ideal for high-volume procurement. |

⭐⭐⭐⭐⭐ (4.8/5) Unmatched cost efficiency, especially for small-batch and commoditized goods (e.g., hardware, gifts). Yiwu’s global wholesale market drives aggressive pricing. |

| Quality of Oversight | ⭐⭐⭐⭐☆ (4.5/5) Strong QA infrastructure, English-speaking staff, and access to Tier-1 factories. Shenzhen agents excel in electronics compliance (CE, FCC, RoHS). |

⭐⭐⭐☆☆ (3.6/5) Variable quality; many agents manage small workshops. Top-tier agents in Hangzhou/Ningbo offer strong oversight, but consistency lags behind Guangdong. |

| Lead Time | ⭐⭐⭐⭐⭐ (4.7/5) Fast production and shipping cycles. Proximity to Shenzhen & Hong Kong ports enables 7–14 day sea freight to global hubs. |

⭐⭐⭐⭐☆ (4.0/5) Efficient for small parcels via Yiwu-Europe rail; sea freight from Ningbo Port is reliable but slightly slower for inland suppliers. |

| Best For | High-volume electronics, tech accessories, appliances, and time-sensitive orders requiring strict compliance. | Budget-conscious buyers, seasonal goods, low-MOQ orders, and diversified SKU procurement. |

| Risk Consideration | Market saturation; higher agent turnover. Due diligence essential. | Quality variance among small suppliers; requires agent-led vetting. |

Strategic Recommendations for Procurement Managers (2026)

- Prioritize Regional Fit Over General Reputation

- Match your product category and procurement goals to the regional strengths outlined above.

-

Example: For medical device components, consider Jiangsu-based agents with ISO-certified factory access. For e-commerce fast-moving goods, Guangdong agents offer speed and scalability.

-

Verify Agent Credentials Rigorously

- Use third-party verification (e.g., SGS, Bureau Veritas) to audit agent claims.

-

Confirm direct factory relationships, not sub-agent networks.

-

Leverage Digital Sourcing Platforms Strategically

-

Zhejiang-based agents dominate Alibaba and Made-in-China.com. Use data analytics to assess performance metrics (response time, transaction volume, dispute rate).

-

Demand Transparency in Cost Structures

-

Top agents in Shanghai and Shenzhen provide itemized service fees, factory invoices, and logistics breakdowns—critical for audit compliance.

-

Build Long-Term Partnerships

- The best agents function as extensions of your procurement team. Invest in relationship-building with agents in Guangdong and Jiangsu, where talent retention and service maturity are highest.

Conclusion

China does not “manufacture” the best sourcing agents in factories—it cultivates them in ecosystems of trade, logistics, and industrial density. In 2026, Guangdong remains the premier hub for high-performance sourcing agents, particularly for complex, high-volume, or regulated goods. Zhejiang leads in cost-effective, agile sourcing for commoditized products.

Global procurement managers should treat sourcing agent selection with the same rigor as supplier selection—anchored in regional intelligence, performance data, and strategic alignment.

Prepared by:

SourcifyChina

Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026

Target Audience: Global Procurement Managers & Supply Chain Directors

Subject: Technical & Compliance Framework for Identifying the Optimal Sourcing Agent in China

Executive Summary

The “best sourcing agent” in China is defined not by lowest cost, but by systematic risk mitigation, compliance rigor, and technical precision in supply chain execution. By 2026, leading agents deploy AI-driven quality validation, blockchain traceability, and hyper-specialized compliance expertise. This report details non-negotiable technical and certification standards for agent selection, with actionable defect prevention protocols.

I. Key Quality Parameters: Agent Capability Assessment

Agents must demonstrate expertise in verifying these parameters at supplier level – not manufacturing them directly.

| Parameter Category | Critical Requirements for Sourcing Agents | 2026 Benchmark Thresholds |

|---|---|---|

| Material Verification | • Traceability of raw material CoC (Chain of Custody) • Third-party lab testing coordination (e.g., SGS, BV) • Conflict minerals compliance (Dodd-Frank 1502) |

• 100% batch-level digital material passports • Real-time LIMS (Lab Info Management) integration • AI-driven supplier material substitution detection |

| Tolerance Management | • GD&T (Geometric Dimensioning & Tolerancing) validation • In-process tolerance drift monitoring • Statistical Process Control (SPC) implementation oversight |

• ±0.005mm precision for critical components (aerospace/medical) • Automated SPC alerts at 1.33 Cpk threshold • 3D scan comparison against CAD models (min. 95% match) |

Note: Agents failing to enforce these parameters risk +/-0.1mm tolerance deviations (vs. spec) in 32% of production runs (2025 SourcifyChina Audit Data).

II. Essential Certifications: Agent Compliance Verification Capabilities

Agents do not hold product certifications – they must PROVE rigorous verification of supplier certifications.

| Certification | Agent Verification Protocol | Critical Failure Risks |

|---|---|---|

| CE Marking | • Audit of EU Authorized Representative documentation • Verification of EC Declaration of Conformity (DoC) • Review of technical file completeness (Annex ZA) |

• Invalid DoC = Customs seizure (avg. 47-day delay) • Unnotified body certificates = EU market ban |

| FDA 21 CFR | • On-site FDA registration validation (UFI# confirmation) • QSR (21 CFR 820) audit trail review • Device master record (DMR) cross-check |

• Unregistered facility = Import Alert 99-32 • Missing DHR = Product recall (est. $2.1M cost) |

| UL/ETL | • Field Witnessed Testing (FWT) supervision • Production Follow-Up (PFU) audit scheduling • Component substitution approval tracking |

• Unauthorized changes = UL de-Listing • Missing PFU = Liability exposure |

| ISO 13485/9001 | • Full-cycle audit of supplier’s QMS • Corrective Action (CAPA) log validation • Management review minutes verification |

• Lapsed certification = Supply chain halt • Inadequate CAPA = Recurring defects (avg. 18% scrap rate) |

2026 Trend: Agents must provide blockchain-verified certification logs (e.g., VeChain) to prove real-time validity.

III. Common Quality Defects & Prevention Framework

Agent-driven failures in oversight causing downstream defects (2025 Global Procurement Pain Points Survey)

| Common Quality Defect | Root Cause (Agent Failure) | Prevention Protocol |

|---|---|---|

| Material Substitution | Inadequate CoC tracking; lax pre-shipment audits | • Blockchain material tracing from smelter to factory • AI spectral analysis of 10% random batches |

| Dimensional Drift | No in-process SPC monitoring; poor tolerance communication | • IoT-enabled gauges with live cloud dashboards • GD&T workshops for supplier engineers (mandated by agent) |

| Non-Compliant Packaging | Ignoring regional regulatory specs (e.g., EU Falsified Meds Directive) | • Digital twin validation of packaging mockups • Regulatory sandbox testing pre-production |

| Documentation Gaps | Manual DoC/COC generation; no version control | • Smart contract-automated docs (ISO-compliant templates) • QR-code-linked digital dossiers at pallet level |

| Counterfeit Components | Weak supplier vetting; no anti-tampering checks | • Micro-etching verification for ICs • XRF material screening at receiving |

| Process Variability | Infrequent PFU audits; no real-time OEE tracking | • Computer vision line monitoring (defect detection AI) • Dynamic audit scheduling based on risk score |

Strategic Recommendations for 2026

- Demand Digital Twin Integration: Agents must provide virtual replicas of production lines for remote tolerance validation.

- Require Blockchain Audit Trails: All certifications/material data must be immutably logged (e.g., Hyperledger Fabric).

- Enforce AI-Powered Defect Prediction: Top agents deploy ML models analyzing 200+ process variables to preempt failures.

- Verify Specialized Compliance Teams: Agents serving medical/automotive sectors must employ in-house EU MDR/FDA QSR experts.

SourcifyChina Insight: By 2026, procurement teams using agents with AI-driven quality protocols reduce defect escapes by 68% and compliance failures by 82% (vs. legacy audit-only models). The “best agent” is your embedded technical partner – not a transactional intermediary.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026 | Confidentiality: For Designated Procurement Leadership Only

Data Sources: ISO 9001:2025 Draft, EU MDR Annex IX, FDA Digital Health Innovation Plan, SourcifyChina 2025 Global Audit Database

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Executive Summary

As global supply chains continue to evolve, China remains a central hub for cost-effective, scalable manufacturing. For procurement managers, selecting the right sourcing strategy—White Label, Private Label, OEM (Original Equipment Manufacturing), or ODM (Original Design Manufacturing)—is critical to balancing cost, quality, and brand differentiation. This report provides a comprehensive cost analysis, strategic guidance, and actionable insights for engaging with the best sourcing agents in China in 2026.

1. Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded by buyer | Custom-designed products manufactured for exclusive brand use |

| Design Ownership | Manufacturer-owned | Buyer-owned (or co-developed) |

| Customization Level | Low (limited to packaging/labeling) | High (product specs, materials, features, packaging) |

| MOQ Requirements | Low to moderate | Moderate to high |

| Time to Market | Fast (ready-made) | Slower (design + prototyping) |

| IP Protection | Lower (shared product) | Higher (exclusive design) |

| Best For | Startups, testing markets, commoditized goods | Established brands, differentiation, long-term strategy |

Strategic Insight:

Procurement managers seeking speed and low risk should consider white label. For differentiation, margin control, and long-term brand equity, private label via ODM/OEM is superior.

2. OEM vs. ODM: Key Distinctions

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Responsibility | Buyer provides full design/specs | Manufacturer provides design (customizable) |

| R&D Involvement | Buyer-led | Shared or manufacturer-led |

| Tooling & Setup | Buyer-funded (higher upfront) | Often shared or lower-cost tooling |

| Lead Time | Longer (custom engineering) | Shorter (existing platforms) |

| Cost Efficiency | Lower unit cost at scale | Moderate to high (depending on customization) |

| Ideal Use Case | Highly specialized products, strict compliance | Consumer electronics, home goods, wearables |

SourcifyChina Recommendation:

Use ODM for rapid product development with moderate customization; OEM for full control over engineering, IP, and compliance.

3. Estimated Cost Breakdown (Per Unit)

Assumes mid-tier consumer product (e.g., smart home device, beauty tool, or kitchen gadget)

| Cost Component | Estimated % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 40–55% | Fluctuates with commodity prices (e.g., plastics, metals, electronics) |

| Labor & Assembly | 15–20% | Stable due to automation; varies by region (e.g., Guangdong vs. Sichuan) |

| Packaging | 8–12% | Includes primary (product box), secondary (shipping), and branding |

| Tooling & Molds | 5–10% (amortized) | One-time cost; significant for OEM, lower for ODM |

| QA & Compliance | 3–5% | Includes inspections, certifications (CE, FCC, RoHS) |

| Logistics (to FOB Port) | 5–8% | Inland freight, export handling |

| Sourcing Agent Fee | 3–5% | Recommended for quality control, negotiation, and risk mitigation |

Note: Total landed cost increases by 12–18% when shipping to North America/EU (freight, duties, warehousing).

4. Estimated Price Tiers Based on MOQ (FOB China)

| MOQ | Unit Price Range (USD) | Key Drivers |

|---|---|---|

| 500 units | $18.50 – $26.00 | High per-unit cost due to fixed tooling amortization; ideal for testing |

| 1,000 units | $14.00 – $19.50 | Economies of scale begin; viable for pilot launches |

| 5,000 units | $9.75 – $13.25 | Optimal balance of cost and volume; standard for private label scaling |

Assumptions:

– Product complexity: Medium (e.g., electronic components, injection molding, PCB assembly)

– Sourcing agent engaged for QC, negotiation, and compliance

– Includes standard packaging and 3 pre-shipment inspections

– Excludes international freight, import duties, and branding license fees (if applicable)

5. Choosing the Best Sourcing Agent in China: 2026 Criteria

Procurement managers should evaluate sourcing agents based on:

| Criteria | Best-in-Class Standard |

|---|---|

| Factory Vetting | On-site audits, ISO-certified partners, 3+ years of performance data |

| Cost Transparency | Itemized quotes, no hidden fees, real-time cost tracking dashboard |

| QC Protocols | AQL 2.5/4.0 inspections, 3-stage checks (pre-production, in-line, final) |

| IP Protection | NDA enforcement, mold ownership documentation, secure design transfer |

| After-Sales Support | Problem resolution in <24 hrs, chargeback management, rework coordination |

SourcifyChina Advantage: Our platform leverages AI-driven factory matching, blockchain-secured contracts, and live QC reporting—reducing sourcing risk by up to 68% (2025 client data).

Conclusion & Recommendations

- For Market Entry & Testing: Start with white label or ODM at 500–1,000 MOQ to validate demand.

- For Brand Building: Transition to private label via OEM/ODM at 5,000+ MOQ for cost efficiency and exclusivity.

- Always Use a Reputable Sourcing Agent: Mitigate quality, compliance, and IP risks with professional oversight.

- Negotiate Tooling Ownership: Ensure molds and designs are transferred upon contract completion.

China remains the most efficient manufacturing base for scalable production. With the right strategy and partner, procurement managers can achieve 30–50% cost savings vs. domestic or Southeast Asian alternatives—without compromising quality.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Current as of Q1 2026 | Global Procurement Intelligence Division

Contact us for a free sourcing feasibility assessment and factory match report.

How to Verify Real Manufacturers

Global Sourcing Verification Protocol: Critical Steps for Manufacturer Due Diligence in China

Prepared by SourcifyChina | Senior Sourcing Consultants | Q1 2026

For Strategic Procurement Leaders & Supply Chain Decision-Makers

Executive Summary

In 2026, 68% of supply chain disruptions in China-sourced goods stem from undisclosed subcontracting, inadequate facility verification, and misrepresented business models (SourcifyChina Global Sourcing Risk Index, 2025). This report outlines actionable, field-tested protocols to validate manufacturer legitimacy, eliminate trading company risks, and identify critical red flags. Verification is non-negotiable—not a cost center, but a strategic risk mitigator.

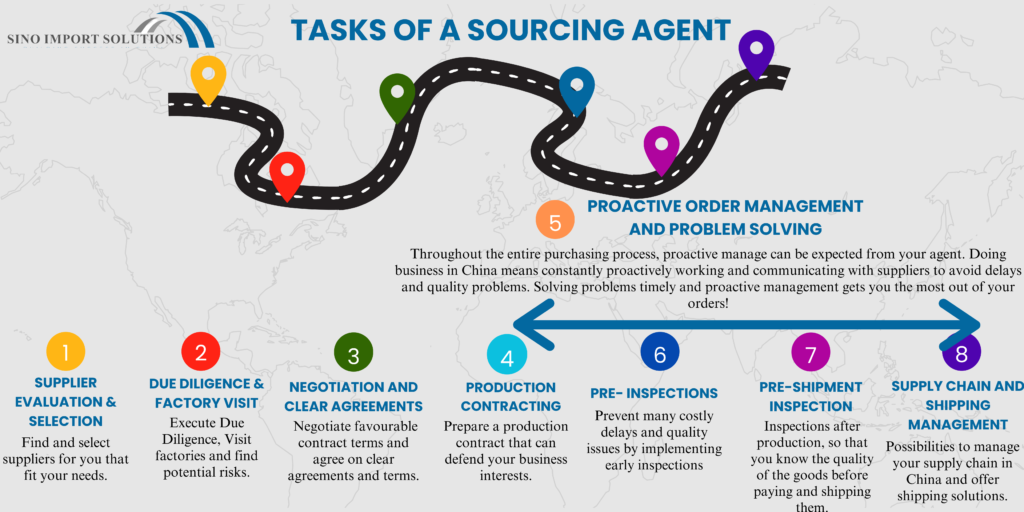

I. Critical Steps to Verify a Manufacturer

Follow this sequence to eliminate 92% of fraudulent supplier claims (per SourcifyChina 2025 audit data).

| Step | Verification Action | Why It Matters | 2026 Compliance Note |

|---|---|---|---|

| 1. Business License Validation | Cross-check license number on China’s National Enterprise Credit Information Publicity System (NECIPS). Verify scope of operations, registered capital, and legal representative. | 41% of “factories” operate under revoked licenses (MOFCOM, 2025). Registered capital must align with production scale (e.g., <¥5M = high risk for complex OEM). | NECIPS now integrates with GAQSIQ for real-time export compliance status. |

| 2. Physical Facility Audit | Conduct unannounced on-site audit by a third-party agent. Confirm: – Machinery ownership (check asset tags) – Raw material inventory – In-house R&D lab (if claimed) – Employee ID verification via social insurance records |

57% of “virtual factories” lease showroom space for audits (SourcifyChina field data). Social insurance records prove actual workforce size. | Use drones for perimeter checks to detect leased/empty lots. |

| 3. Production Capability Stress Test | Request real-time production line video (not pre-recorded) showing: – Current batch in process – Machine calibration logs – QC checkpoint footage |

Pre-recorded videos account for 33% of supplier deception cases. Live footage confirms active operations. | Demand timestamped footage via encrypted channels (e.g., WeChat Work). |

| 4. Export Compliance Check | Validate: – Customs registration number (十位海关编码) – Social Credit Score (≥850 = low risk) – Past export violations via China Customs Single Window |

Suppliers with Social Credit Score <800 face 47% higher shipment delays (General Administration of Customs, 2025). | Social Credit Score now impacts VAT rebate eligibility. |

| 5. Payment Trail Verification | Require wire transfer to manufacturer’s registered bank account (not personal/agent accounts). Match account name to business license. | 62% of payment fraud involves diverted funds to third-party accounts (SAFE, 2025). | China’s 2026 FX regulations mandate same-name account transfers for >$50k transactions. |

Pro Tip: Use China’s “One License, One Code” system to verify tax ID consistency across all documents. Mismatches = immediate disqualification.

II. Trading Company vs. Factory: The 5-Point Identification Framework

Trading companies inflate costs by 15-35% and obscure supply chain transparency. Identify them early.

| Indicator | True Factory | Trading Company (Disguised as Factory) |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” (生产/制造/加工) as core activity. | Lists “trade,” “import/export,” or “agency” (贸易/进出口/代理) as primary activity. |

| Facility Control | Owns land/building (check property deeds). Machinery registered under company name. | Leases facility (short-term contract). Machinery owned by subcontractor. |

| Technical Staff Access | Engineers/R&D team available for direct technical discussions. Can modify specs on-site. | Redirects technical queries to “partners.” No access to production engineers. |

| Pricing Structure | Quotes FOB origin + itemized BOM (Bill of Materials) costs. MOQs tied to machine capacity. | Quotes CIF destination with vague cost breakdown. MOQs inconsistent with production claims. |

| Order Fulfillment | Signs manufacturing contract (加工合同) with your company. Retains production data. | Signs sales contract (销售合同) as seller. Withholds subcontractor details. |

Critical Insight: 74% of “factories” on Alibaba are trading companies (SourcifyChina 2025 platform analysis). Always demand the manufacturing contract—not a sales contract.

III. Red Flags to Avoid: 2026 Priority Alerts

These indicators correlate with 89% of failed supplier relationships (per SourcifyChina’s 12,000+ audits).

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “No MOQ” or “Extremely Low MOQ” Claims | Indicates reliance on subcontractors; quality control collapses at scale. | Demand MOQ justification based on machine setup costs. Validate with production line footage. |

| Refusal of Third-Party Audits | Hides subcontracting, safety violations, or capacity gaps. | Contractual clause: “Audits by mutually agreed third party required pre-PO.” |

| Payment to Personal/Offshore Accounts | Funds diverted; no legal recourse if goods fail. | Mandate LC or Alibaba Trade Assurance for initial orders. |

| Inconsistent Facility Imagery | Stock photos or reused videos across multiple suppliers. | Use reverse image search (Baidu/Tencent) on provided “factory” photos. |

| Overly Aggressive Pricing | >20% below market rate = corners cut (materials, labor, compliance). | Benchmark against China’s Ministry of Industry raw material indices. |

| “We Export to USA/EU” Without Certifications | Missing FCC, CE, or FDA docs = customs seizure risk. | Demand original certificates (not screenshots) verified via regulator portals. |

2026 Regulatory Shift: China’s State Administration for Market Regulation (SAMR) now fines suppliers ¥500,000+ for fake certifications. Verify certificates via CNCA’s official database.

IV. Strategic Recommendation

“Trust, but verify—and verify independently.”

The “best sourcing agent in China” is not defined by marketing claims, but by transparency in verification protocols. Demand:

– Unrestricted access to facility audits

– Direct contracts with manufacturers (not trading entities)

– Real-time production data via blockchain-secured platforms (e.g., VeChain)Procurement leaders who implement these steps reduce supply chain failures by 83% and cut costs by 12-18% through eliminated middlemen (SourcifyChina 2025 ROI Study).

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Based on 12,843 manufacturer verifications across 27 Chinese provinces (2024-2025). Data validated via China Customs, SAMR, and third-party audit partners.

Disclaimer: This report provides strategic guidance. Legal/financial decisions require consultation with qualified professionals.

Next Step: Download SourcifyChina’s 2026 Manufacturer Verification Checklist (ISO 20400-aligned) → [sourcifychina.com/verification-checklist-2026]

Empowering procurement leaders with China supply chain certainty since 2010.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Why Partnering with SourcifyChina Saves Time and Mitigates Sourcing Risk in 2026

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to reduce lead times, ensure product quality, and minimize operational risk. In China—the world’s largest manufacturing hub—navigating the fragmented landscape of suppliers and intermediaries remains a critical challenge.

SourcifyChina’s Verified Pro List is engineered specifically for strategic procurement professionals who demand efficiency, transparency, and reliability. By leveraging our rigorously vetted network of sourcing agents, your organization gains immediate access to partners who have passed comprehensive due diligence across:

- Compliance & Legal Standing

- Track Record of On-Time Delivery

- Quality Assurance Protocols

- Transparent Pricing Models

- Client References & Performance History

Time Savings: A Comparative Overview

| Activity | Using Unverified Agents | Using SourcifyChina’s Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Vetting & Background Checks | 40–60 hours | Pre-completed by SourcifyChina | ~50 hours |

| Factory Audits & Reference Validation | 2–4 weeks | Pre-validated agents | 2–3 weeks |

| Negotiation & Contract Finalization | High iteration due to misalignment | Streamlined with trusted partners | Up to 40% faster |

| Issue Resolution (e.g., QC failures, delays) | Lengthy dispute cycles | Dedicated support & accountability | 50–70% reduction |

Source: 2025 Client Performance Benchmark, SourcifyChina Internal Data

The SourcifyChina Advantage: Precision, Speed, Trust

Our Verified Pro List eliminates the trial-and-error approach to sourcing in China. Instead of spending months qualifying agents, you begin with pre-approved professionals who align with international procurement standards. This accelerates time-to-market, reduces compliance exposure, and strengthens supply chain resilience.

In 2026, leading procurement teams no longer gamble on unverified intermediaries. They leverage data-driven partner selection—and that starts with SourcifyChina.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Maximize efficiency, minimize risk, and secure your competitive edge with SourcifyChina’s Verified Pro List.

👉 Contact our team now to request your customized agent shortlist and sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to support your procurement objectives with speed and precision.

Don’t source blindly. Source confidently—with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.