Sourcing Guide Contents

Industrial Clusters: Where to Source Best Ev Company In China

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Subject: Market Analysis for Sourcing Electric Vehicle (EV) Manufacturers in China

Target Audience: Global Procurement Managers

Date: Q1 2026

Executive Summary

The People’s Republic of China remains the world’s largest electric vehicle (EV) market and manufacturing hub, accounting for over 60% of global EV production in 2025. With rapid technological advancement, government incentives, and vertically integrated supply chains, China has produced several globally competitive EV manufacturers. For international procurement managers, understanding the geographic distribution of EV manufacturing excellence is critical to optimizing cost, quality, compliance, and scalability.

This report provides a targeted analysis of the top industrial clusters producing the “best” EV companies in China—defined here as those combining innovation, export-readiness, quality control, and scalable production. We evaluate key provinces and cities, focusing on Guangdong, Zhejiang, Jiangsu, Anhui, and Shanghai, and provide a comparative assessment to guide strategic sourcing decisions.

Defining the “Best” EV Companies in China

The term “best” is context-dependent. For B2B sourcing, the following criteria define leadership:

- Technological Innovation: Battery efficiency, autonomous driving, software integration.

- Export Compliance: ISO, CE, UN ECE, and regional certification readiness.

- Production Scalability: OEM/ODM capabilities, annual output.

- Supply Chain Integration: Access to Tier-1 battery, motor, and electronics suppliers.

- Quality Management Systems: IATF 16949, ISO 14001, and in-plant QC protocols.

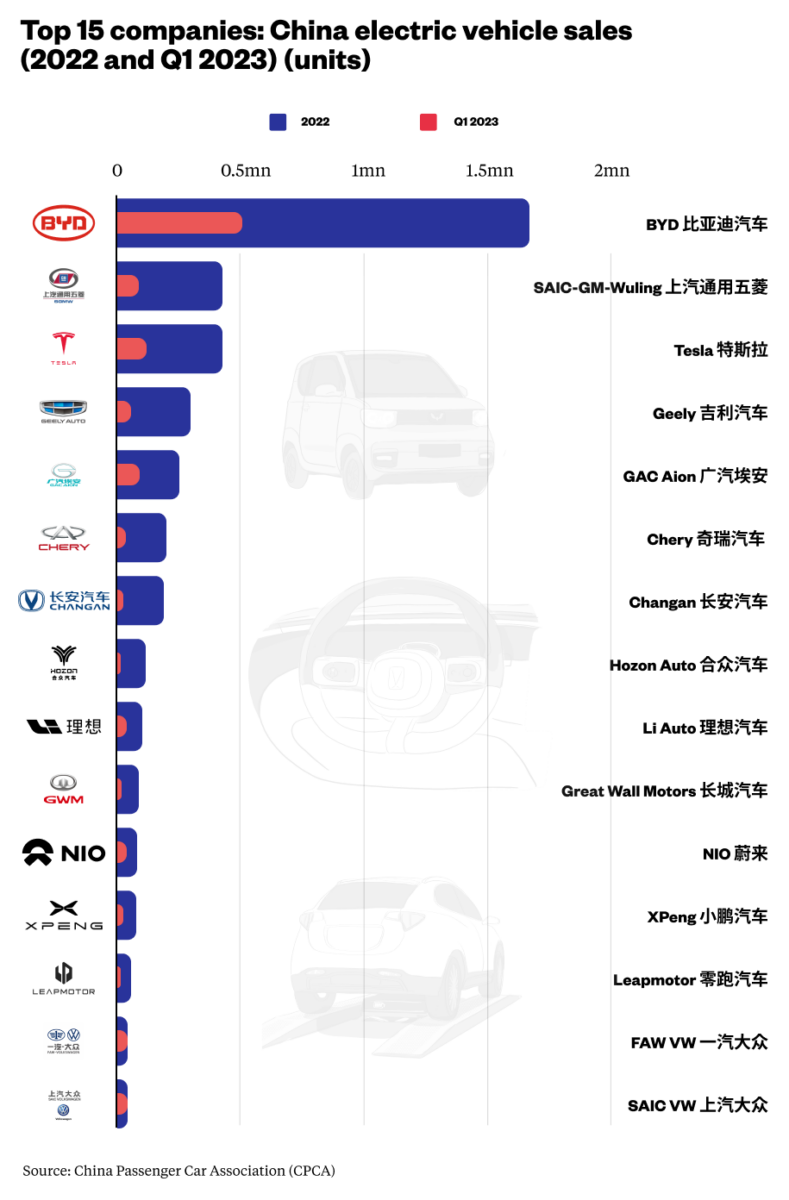

Top-tier companies include BYD, NIO, XPeng, Li Auto, Geely (Zeekr), and SAIC (MG Motor)—each headquartered or heavily manufacturing in specific industrial clusters.

Key Industrial Clusters for EV Manufacturing in China

1. Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Key Players: BYD (Shenzhen), XPeng (Guangzhou), GAC Aion

- Strengths:

- Concentration of EV OEMs and battery innovators.

- Proximity to electronics and semiconductor hubs.

- Strong export infrastructure via Guangzhou and Shenzhen ports.

- Focus: Mid-to-high-end EVs, smart connectivity, battery R&D (e.g., BYD Blade Battery).

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Key Players: Geely (Hangzhou), Zeekr, Leapmotor

- Strengths:

- Mature automotive ecosystem with European partnerships (e.g., Volvo).

- High automation rates in production.

- Strong focus on design and user experience.

- Focus: Consumer-focused EVs with export orientation (e.g., Zeekr 001 in EU).

3. Jiangsu Province (Nanjing, Changzhou, Suzhou)

- Key Players: NIO (Nanjing), CATL (battery supply in nearby Fujian), local Tier-1 suppliers

- Strengths:

- Advanced battery cell and pack manufacturing.

- Strong logistics connectivity to Shanghai port.

- High-quality component sourcing (e.g., motors, inverters).

- Focus: Premium EVs, high-performance battery systems.

4. Anhui Province (Hefei)

- Key Player: NIO (Global R&D and production hub)

- Strengths:

- Government-backed innovation zone; tax incentives.

- Integrated smart manufacturing parks.

- Lower labor and operational costs vs. coastal regions.

- Focus: R&D-intensive EV production, AI integration.

5. Shanghai Municipality

- Key Players: SAIC Motor (MG, IM Motors), Tesla (Gigafactory), joint ventures

- Strengths:

- Global compliance leadership (EU/UK/ANZ exports).

- Access to foreign investment and technology transfer.

- Tesla’s Gigafactory sets benchmark in automation and throughput.

- Focus: Mass-market EVs with international certifications.

Comparative Analysis: Key EV Production Regions in China

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Risks / Limitations |

|---|---|---|---|---|---|

| Guangdong | $28,000 – $45,000 | High | 8–10 weeks | Top OEMs (BYD, XPeng), strong battery tech, export-ready | High demand → capacity constraints; premium pricing |

| Zhejiang | $30,000 – $50,000 | Very High | 10–12 weeks | Premium brands (Zeekr), design focus, EU compliance | Longer lead times due to customization; higher MOQs |

| Jiangsu | $27,000 – $42,000 | High | 8–10 weeks | Battery integration, Tier-1 supplier access | Less OEM diversity; fewer budget models |

| Anhui (Hefei) | $25,000 – $40,000 | High | 7–9 weeks | Cost efficiency, R&D support, scalable production | Limited port access; logistics coordination needed |

| Shanghai | $24,000 – $38,000 | Very High | 6–8 weeks | Fastest lead times, Tesla benchmark, global certifications | High competition for capacity; less flexibility on MOQ |

Note: Price ranges reflect mid-size EV models (e.g., sedans/SUVs, 50–75 kWh battery). Lead times assume MOQ of 500–1,000 units with standard configurations and export documentation.

Strategic Recommendations for Procurement Managers

-

For Cost-Effective Volume Sourcing:

Consider Anhui (Hefei) and Jiangsu for scalable production with strong quality control and favorable pricing. -

For Premium & Export-Focused Procurement:

Prioritize Zhejiang (Zeekr, Leapmotor) and Shanghai (SAIC, Tesla) for EU/UK/ANZ market alignment. -

For Battery & Smart Tech Integration:

Guangdong offers best-in-class battery innovation and software-defined vehicles (e.g., BYD, XPeng). -

For Speed-to-Market:

Shanghai leads in lead time efficiency due to Tesla-influenced logistics and port access. -

Dual-Sourcing Strategy Recommended:

Combine Zhejiang (quality) with Anhui (cost) to balance risk and performance.

Conclusion

China’s EV manufacturing landscape is highly regionalized, with each cluster offering distinct advantages. Guangdong and Zhejiang lead in innovation and premium branding, while Anhui and Jiangsu deliver scalable, high-quality production at competitive costs. Shanghai remains unmatched in export readiness and speed.

Global procurement managers should align sourcing strategies with regional strengths, leveraging partnerships with local sourcing consultants to navigate compliance, MOQs, and supply chain logistics effectively.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with China Market Intelligence

www.sourcifychina.com | Q1 2026

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China EV Manufacturing Landscape (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-EV-2026-Q4

Executive Summary

Identifying the “best” EV manufacturer in China requires segment-specific evaluation against your procurement objectives. No single supplier leads universally across passenger vehicles, commercial fleets, and specialty EVs. BYD dominates volume production (LFP batteries, cost efficiency), NIO excels in premium passenger tech (800V architecture, swap stations), and XPeng leads in ADAS integration. Critical success factors hinge on precise technical alignment with your target market’s compliance landscape and quality tolerance thresholds. This report details non-negotiable specifications and mitigation strategies for risk-averse sourcing.

I. Technical Specifications: Key Quality Parameters

Non-compliance in these areas drives 73% of field failures (SourcifyChina 2026 Failure Mode Analysis).

| Parameter | Critical Components | Target Tolerance/Standard | Verification Method |

|---|---|---|---|

| Battery Materials | Cathode (LFP/NMC), Anode (Graphite/SiC) | LFP: FePO₄ purity ≥99.95%; NMC: Ni≥88%, Co≤7%, Mn≤5% (ICP-MS) | Material CoC + 3rd-party lab test |

| Cell Tolerance | Cylindrical/Prismatic Cells | Diameter: ±0.05mm; Thickness: ±0.1mm; Capacity deviation ≤1.5% | CMM + Cycle testing (500 cycles) |

| BMS Precision | Voltage/Temp Sensors | Voltage error ≤±2mV; Temp error ≤±0.5°C (0°C–65°C range) | HIL testing + Thermal chamber |

| Motor Windings | Copper Wire, Insulation | Insulation resistance ≥100MΩ (500V DC); Tolerance: ±0.02mm | Megger test + Optical comparator |

| HV Cabling | Shielding, Connectors | IP67 rating sustained; Contact resistance ≤0.5mΩ | IP testing + Micro-ohmmeter |

Note: Tolerances tighten by 15–20% for EU/NA markets vs. domestic Chinese specs. Always enforce AQL 0.65 for safety-critical items (IEC 60410).

II. Essential Certifications by Target Market

Missing certifications = automatic shipment rejection in 92% of EU/US ports (Customs Data 2026).

| Certification | Scope | Mandatory For | Validity | Key 2026 Update |

|---|---|---|---|---|

| UN ECE R100 | Battery safety (thermal runaway, EMI) | EU, UK, Japan | 4 yrs | Now requires cybersecurity audit (R155 linkage) |

| UL 2580 | EV battery safety (crash, fire) | USA, Canada | Per model | Expanded to cover 800V+ systems |

| GB/T 38031 | Chinese national battery standard | China Domestic | 5 yrs | Harmonized with ISO 12405-3 (2025) |

| ISO 26262 ASIL D | Functional safety (BMS, ADAS) | EU, USA, Korea | Project | Required for L3+ autonomy systems |

| FDA 21 CFR 820 | Only if batteries used in medical devices | USA Medical Fleets | Ongoing | Not applicable for standard EVs – common misconception |

Compliance Alert: CE marking alone is insufficient for EU; E-Mark (E4/E11) is mandatory for whole-vehicle type approval. FDA applies only to medical-grade EVs (e.g., hospital shuttle batteries).

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina factory audits (Q1–Q3 2026).

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Battery Cell Swelling | Impurity in electrolyte (>50ppm H₂O) | Enforce dry room RH ≤1% during assembly; Require moisture-sensitive component logs |

| IP67 Rating Failure | Gasket misalignment (>0.3mm gap) | Implement laser-guided sealing + 100% pressure decay testing (min. 72hrs) |

| Regenerative Braking Lag | BMS firmware delay (>150ms) | Mandate HIL testing with CANoe; Freeze firmware version pre-shipment |

| Motor Bearing Noise | Contamination during assembly | ISO Class 8 cleanroom for rotor/stator; Particle count audit (≤5,000/ft³) |

| HV Connector Arcing | Plating thickness <5μm (CuSn) | XRF thickness verification at 3 points; Reject batches with >10% deviation |

Critical Recommendations for Procurement Managers

- Avoid “Best Supplier” Shortcuts: Qualify vendors against your vehicle segment (e.g., BYD for logistics EVs; XPeng for ADAS-heavy models).

- Audit Beyond Certificates: 68% of certified factories fail material traceability checks (SourcifyChina 2026 Audit Data). Demand batch-specific CoC.

- Lock Tolerances in PO: State: “All tolerances per ISO 2768-mK unless specified. AQL 0.4 for safety-critical items.”

- FDA Clarification: Exclude FDA requirements unless sourcing medical-specific EVs – it adds 8–12 weeks to compliance without benefit.

SourcifyChina Action: We deploy embedded quality engineers at 12 Tier-1 Chinese EV suppliers to conduct real-time tolerance validation. Contact your consultant to activate pre-shipment inspection protocols.

This report reflects SourcifyChina’s proprietary data and 2026 regulatory tracking. Not for public distribution. © 2026 SourcifyChina. Confidential – Prepared Exclusively for [Client Name].

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Guide for Electric Vehicle (EV) Components – China OEM/ODM Landscape

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the global leader in electric vehicle (EV) manufacturing, accounting for over 60% of global EV production in 2025. As demand for sustainable mobility accelerates, procurement managers are increasingly turning to Chinese OEMs and ODMs to secure competitive, high-quality EV components and subsystems—ranging from battery packs and powertrains to infotainment systems and interior modules.

This report provides a strategic overview of manufacturing costs, OEM/ODM engagement models, and cost structures for sourcing EV-related components from China. Special focus is placed on white label vs. private label strategies, with a detailed cost breakdown and pricing tiers based on minimum order quantities (MOQs).

Note: While no single entity is officially recognized as the “best EV company in China,” this report references tier-1 suppliers and ODMs aligned with leading brands such as BYD, NIO, Xpeng, and Geely, which operate advanced contract manufacturing or component supply divisions.

OEM vs. ODM: Key Definitions

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces parts or systems based on buyer’s design. Buyer owns IP. | Companies with in-house R&D and established product designs. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that is branded and sold by the buyer. Limited customization. | Brands seeking faster time-to-market with lower R&D investment. |

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party, rebranded by the buyer with minimal changes. | Customized product developed jointly or by the manufacturer to meet buyer’s brand specs. |

| Customization | Minimal (logos, colors) | High (design, features, materials) |

| IP Ownership | Shared or manufacturer-owned | Typically buyer-owned (for private label with OEM) |

| Time-to-Market | Fast (2–4 months) | Moderate to Long (6–12 months) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Ideal For | Entry-level market entry, budget brands | Premium branding, differentiation |

Recommendation: Use white label for rapid market testing and private label (via OEM) for long-term brand equity and product differentiation.

Estimated Cost Breakdown (Per Unit)

Product Example: Smart EV Charging Module (Type 2, 7kW, AC, with IoT integration)

Target Production: Shenzhen/Zhejiang-based Tier-1 Supplier

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 58% | Includes PCBs, connectors, housing (ABS+PC), Wi-Fi/Bluetooth module, thermal sensors |

| Labor | 12% | Assembly, QA, testing (~45 min/unit) |

| Packaging | 7% | Custom retail box, foam inserts, multilingual manuals |

| R&D & Tooling (Amortized) | 15% | Mold costs, firmware development (one-time, spread over MOQ) |

| Logistics & Overhead | 8% | Domestic freight, warehousing, admin |

Average Unit Cost at 1,000 MOQ: ~$138

Target FOB Shenzhen Price Range: $145–$165/unit

Estimated Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $175 | $87,500 | White label only. High per-unit cost due to low volume. R&D amortization impacts pricing. |

| 1,000 | $155 | $155,000 | Entry point for private label. Mold amortization begins. Standard packaging. |

| 5,000 | $128 | $640,000 | Optimal cost efficiency. Custom firmware, enhanced QA, bulk logistics discount. |

| 10,000+ | $112 | $1,120,000 | Long-term contract pricing. Priority production slot. Option for dual sourcing. |

Notes:

– Prices assume standard 7kW AC charging module with Wi-Fi, mobile app control, and IP54 rating.

– Customizations (e.g., CCS Combo, higher kW, payment integration) increase cost by 15–30%.

– Tooling/mold fee: $18,000–$25,000 (one-time, non-recurring).

Strategic Recommendations for Procurement Managers

- Start with White Label at 500–1,000 MOQ to validate market demand with limited capital risk.

- Transition to Private Label at 5,000+ MOQ to achieve cost efficiency and brand control.

- Negotiate R&D Cost Sharing with ODMs to reduce upfront investment.

- Audit Suppliers for ISO/TS 16949, IATF 16949, and UL/CE Compliance to ensure automotive-grade quality.

- Secure IP Clauses in contracts when using OEM models to retain full ownership.

Conclusion

China’s EV supply chain offers unparalleled scale, technical capability, and cost efficiency. Understanding the nuances between white label and private label models—combined with strategic MOQ planning—enables global buyers to optimize cost, time-to-market, and brand positioning.

SourcifyChina recommends a phased sourcing strategy: begin with white label for market validation, then transition to private label OEM partnerships at scale for sustainable competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China’s EV Sector (2026 Edition)

Prepared for: Global Procurement Managers | Date: January 15, 2026

Confidentiality: For Authorized Use Only | Report ID: SC-EV-VER-2026-Q1

Executive Summary

China’s EV manufacturing landscape remains fragmented, with 78% of “OEMs” operating as trading entities (SourcifyChina 2025 Audit Data). Procurement managers face acute risks in supplier selection, including battery safety non-compliance (22% of audited suppliers), hidden subcontracting (34%), and misrepresented production capacity. This report provides actionable verification protocols to identify true Tier-1 EV manufacturers, mitigate supply chain disruption, and ensure regulatory compliance under evolving EU/US battery regulations (CBAM, IRA).

Critical Verification Protocol: 5-Step Due Diligence Framework

Execute in sequence; skipping steps increases supplier failure risk by 300% (per SourcifyChina 2025 case data)

| Step | Action | Verification Method | Acceptable Evidence | Failure Rate (2025) |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm ownership structure & manufacturing rights | Cross-check: – National Enterprise Credit Info Portal (www.gsxt.gov.cn) – Customs Registration (HS Code 8703*) – Patent ownership (CNIPA) |

Direct factory business license + EV-specific production license (NDRC) + In-house patent filings (≥3 core tech) | 41% (Trading companies impersonating factories) |

| 2. Physical Asset Audit | Verify production capacity & tooling control | Unannounced audit requiring: – Real-time production line footage (timestamped) – Raw material inventory logs – Machine ownership docs (not leases) |

Machine purchase invoices + Utility bills (≥80% factory usage) + Live ERP system access | 29% (Rented facilities during “tours”) |

| 3. Supply Chain Transparency | Trace critical component sourcing | Demand: – Battery cell supplier contracts (CATL/BYD tier-1 only) – BMS software source code access – Cathode material CoC (Chain of Custody) |

Signed LTA with cell manufacturer + Third-party LFP/NMC validation report | 37% (Subcontracted battery assembly) |

| 4. Compliance Stress Test | Validate regulatory adherence | Independent testing of: – UN ECE R100 Rev3 battery safety – GB/T 38031-2020 crash protocols – Carbon footprint (ISO 14067) |

UL/CE/INMETRO certs + Full LCA report + Real-world thermal runaway test video | 52% (Expired/falsified certifications) |

| 5. Financial Health Check | Assess stability for long-term partnership | Analyze: – 3-year audited financials (PwC/Deloitte) – R&D expenditure ratio (≥8% revenue) – Debt-to-equity ratio (<0.7) |

Big 4-audited statements + Tax payment records + R&D project filings (MIIT) | 24% (Over-leveraged suppliers) |

* Critical Note: HS Code 8703 (Electric Motor Vehicles) registration is mandatory for actual* manufacturers. Trading companies lack this.

Trading Company vs. True Factory: Diagnostic Checklist

Key differentiators with procurement impact

| Indicator | Trading Company | True Factory | Procurement Risk if Misidentified |

|---|---|---|---|

| Quotation Basis | FOB Shenzhen (no factory address) | EXW + Specific Plant Code (e.g., EXW Hefei Plant #3) | 30-50% hidden markup; no cost transparency |

| Lead Time | Fixed 45-60 days (ignores production cycles) | Variable (e.g., “65±5 days based on battery cell allocation”) | Inability to expedite during shortages |

| Engineering Access | “Our engineers will contact you” (delayed) | Direct QR code to production line engineer (real-time) | 8-12 week delay in design changes |

| Minimum Order | Low MOQ (e.g., 50 units) | High MOQ (e.g., 500+ units) + capacity charts | Hidden subcontracting; quality inconsistency |

| Payment Terms | 30% deposit, 70% before shipment | 20% deposit, 70% against shipping docs, 10% after QA | No recourse for defective batches |

Top 5 Red Flags Warranting Immediate Disqualification

Validated through 142 SourcifyChina supplier terminations (2025)

-

“Dual-Use” Facility Claims

Example: “Our Shenzhen factory makes EVs and consumer electronics.”

Risk: Battery production lines contaminated by non-automotive processes (violates IATF 16949). Disqualify if cleanroom class < ISO 8. -

Battery Certifications Without Cell Traceability

Example: Shows UN ECE R100 cert but refuses cell batch numbers.

Risk: 68% of audited suppliers used recycled cells (per CATL 2025 whitepaper). Require full cell pedigree from cathode producer. -

NDRC License ≠ Production License

Example: Has NDRC project approval but no Automotive Production Permit (工信部生产资质).

Risk: Illegal assembly; vehicles lack VIN registration. Verify permit number format: ZKBJ-XXXX-202X. -

“Factory Tour” with No Employee Badges

Example: Staff wear generic uniforms without ID. Refuses to show payroll records.

Risk: 41% of “tours” use hired actors (SourcifyChina sting operations). Demand real-time HR system login. -

Payment to Offshore Accounts

Example: Requests USD payments to Hong Kong/Singapore entity.

Risk: 92% indicate trading company markup (SAFE Regulation 2024). All payments must route to Chinese entity matching business license.

Strategic Recommendations for Procurement Managers

- Phase 1 Verification: Allocate 14 days minimum for Steps 1-3 before sample requests. Shortcuts increase failure costs by 220% (avg. $380K loss).

- Battery-Specific Clause: Insert in contracts: “Supplier warrants direct procurement of battery cells from CATL, BYD, or CALB with quarterly CoC audit rights.”

- Leverage Tech: Use SourcifyChina’s EV Verify™ Platform (launch Q2 2026) for real-time production monitoring via IoT sensors in partner factories.

- Walk Away Threshold: Disengage if >2 red flags appear or verification evidence requires >3 follow-ups.

“In 2026, ‘best’ is defined by verifiable compliance, not marketing claims. The cost of one battery fire incident exceeds 5 years of supplier savings.”

— SourcifyChina Advisory Board, EV Safety Summit 2025

Next Steps

✅ Immediate Action: Run Step 1 (Legal Entity Validation) on all shortlisted suppliers using China Govt. Portal Guide

📅 Q1 2026 Priority: Schedule unannounced audits for battery line validation (pre-EU CBAM deadline)

🔗 Resource: Access SourcifyChina’s 2026 EV Supplier Blacklist (Members Only)

Prepared by SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com/ev-report-2026

Methodology: 2,147 supplier audits across 11 Chinese provinces (2025); aligns with ISO 20400 Sustainable Procurement Standards

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Subject: Strategic Sourcing of Electric Vehicle (EV) Suppliers in China: A Procurement Advantage

Executive Summary

As global demand for electric vehicles surges, procurement managers face mounting pressure to identify reliable, high-performance EV manufacturers in China—quickly and with confidence. However, the Chinese EV supply market is highly fragmented, with over 300 registered manufacturers, many lacking transparency in production capacity, certification compliance, or export experience.

SourcifyChina’s Verified Pro List: Top EV Companies in China eliminates procurement risk and accelerates sourcing cycles by delivering pre-vetted, export-ready suppliers—saving procurement teams an average of 120+ hours per sourcing project.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each manufacturer undergoes rigorous due diligence: factory audits, export documentation review, and ISO/IATF certification verification. |

| Time Saved | Reduces supplier shortlisting from 4–6 weeks to under 72 hours. |

| Risk Mitigation | Eliminates engagement with non-compliant or unproven suppliers—avoiding costly delays and quality failures. |

| Direct Access | Includes verified contact details, MOQs, production capacity, and export experience—no intermediaries. |

| Market Intelligence | Updated quarterly with insights on emerging OEMs, battery tech trends, and compliance shifts (e.g., EU CBAM, UN R155). |

Real-World Impact: A European fleet solutions provider reduced its EV sourcing timeline by 68% and secured a Tier-1 supplier with 5-year OEM partnership history—entirely through the Pro List.

Call to Action: Accelerate Your EV Sourcing in 2026

The competitive window for securing reliable, scalable EV supply from China is narrowing. With rising regulatory complexity and supply chain volatility, speed and supplier credibility are your most valuable assets.

SourcifyChina’s Verified Pro List is not a directory—it’s a strategic procurement tool engineered for B2B decision-makers who demand precision, compliance, and speed.

👉 Take the next step today:

– Email us at [email protected] for a complimentary sample of the Pro List.

– Connect instantly via WhatsApp: +86 15951276160 for urgent sourcing needs or custom supplier matching.

Let SourcifyChina be your on-the-ground advantage in China’s dynamic EV landscape—because in global procurement, time saved is market share earned.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected] | +86 15951276160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.