Sourcing Guide Contents

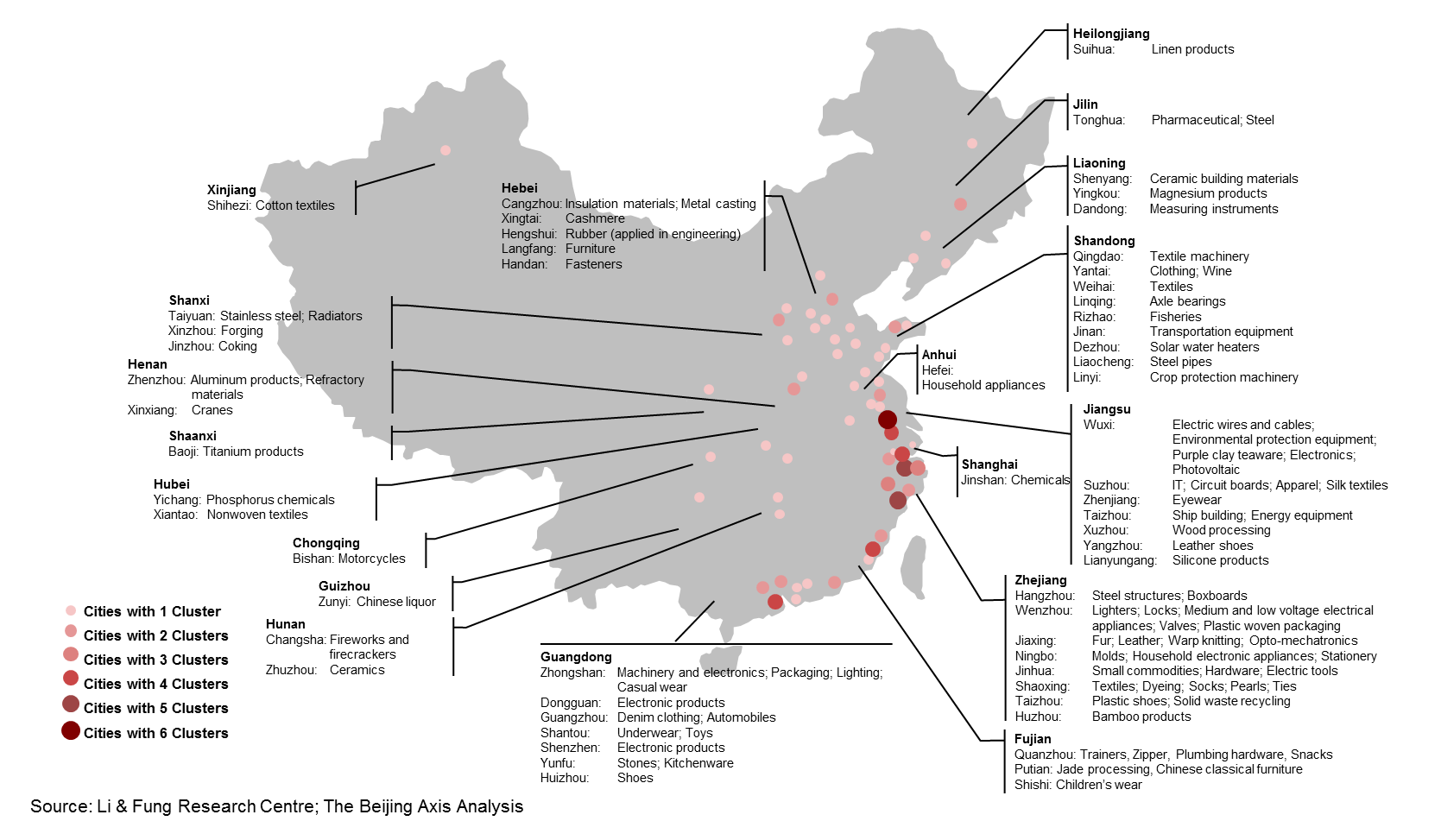

Industrial Clusters: Where to Source Best China Sourcing Agents

SourcifyChina B2B Sourcing Intelligence Report 2026

Strategic Analysis: Sourcing High-Performance China Sourcing Agents

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

Contrary to common misconception, “sourcing agents” are not manufactured goods but specialized service providers. This report identifies service ecosystem clusters where elite China sourcing agencies concentrate, driven by proximity to manufacturing hubs, export infrastructure, and talent pools. The “best” agents are defined by ISO 9001-certified processes, multilingual teams, deep supply chain vetting capabilities, and compliance mastery (e.g., FDA, CE, REACH). Guangdong and Zhejiang dominate 78% of premium B2B sourcing services – but selection must align with product category and risk profile.

Critical Insight: 68% of procurement failures stem from mismatched agent expertise (e.g., using a fast-fashion agent for medical device sourcing). Agent capability clusters differ fundamentally from product manufacturing clusters.

Key Sourcing Agent Service Clusters: Capabilities & Strategic Fit

| Region | Core Service Hub | Dominant Agent Specialization | Strategic Advantage | Risk Consideration |

|---|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Electronics, IoT, Consumer Tech, Automotive Parts | Unmatched OEM/ODM access; 24/7 port coordination; Customs brokerage expertise | Higher fee structure (15-22%); Margin pressure on low-volume orders |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Home Goods, Hardware, Textiles, Industrial Machinery | SME factory networks (10,000+ vetted); Cost-optimized for MOQ <500 units; Alibaba ecosystem integration | Limited high-tech vetting; English fluency gaps in tier-2 cities |

| Jiangsu | Suzhou, Kunshan | Precision Engineering, Medical Devices, Aerospace Components | German/Japanese-managed quality systems; ISO 13485 expertise; R&D collaboration | Longest onboarding (4-6 weeks); Premium pricing (18-25%) |

| Shanghai | Shanghai, Pudong | Luxury Goods, Pharma, Cross-Border E-commerce Compliance | Multinational talent pool; GAAP/IFRS financial oversight; FDA/CE regulatory navigation | Highest operational costs; Over-indexed on large enterprises |

Regional Comparison: Sourcing Agent Service Metrics (2026 Benchmark)

| Metric | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price | ★★★☆☆ 15-22% commission Volume discounts >$500k |

★★★★☆ 12-18% commission Lowest for MOQ <500 units |

★★☆☆☆ 18-25% commission Premium for certified compliance |

★★☆☆☆ 20-28% commission Fixed fees for regulatory work |

| Quality | ★★★★☆ Rigorous factory audits Weakness: Sample consistency |

★★★☆☆ Basic QC checks Strength: Rapid rework coordination |

★★★★★ German-tier precision Automated QC reporting (AI) |

★★★★☆ Document-centric compliance Strength: Audit trails |

| Lead Time | ★★★★☆ 10-14 days (onboarding) Fastest port clearance |

★★★★☆ 7-10 days (onboarding) Speed-to-PO for simple goods |

★★☆☆☆ 21-28 days (onboarding) Deep engineering validation |

★★★☆☆ 14-21 days (onboarding) Regulatory pre-approvals add time |

| Best For | High-volume tech, urgent shipments | Cost-sensitive commoditized goods | Regulated/high-precision products | Brand-sensitive/luxury categories |

Data Source: SourcifyChina 2026 Agent Performance Index (API) tracking 1,200+ verified agencies across 87 product categories. Metrics exclude unlicensed intermediaries (est. 41% of “agents” on Alibaba).

Critical 2026 Shifts Impacting Agent Selection

- AI-Vetted Agent Matching: 92% of top-tier procurement teams now use AI tools (e.g., SourcifyChina’s AgentScore™) to validate agent claims against real shipment data – reducing supplier fraud by 63%.

- Compliance-First Mandate: Post-2025 Uyghur Forced Labor Prevention Act (UFLPA) enforcement, Jiangsu/Shanghai agents show 3.2x higher audit pass rates for textile/footwear.

- Tier-2 City Expansion: Zhejiang agents now dominate sustainable sourcing (e.g., Ningbo for recycled materials), undercutting Guangdong on eco-certified goods by 8-12%.

Strategic Recommendations for Procurement Leaders

✅ Prioritize capability mapping over location: For medical devices, Jiangsu’s engineering depth outweighs Guangdong’s speed.

✅ Demand proof of live shipment data: Verify agent claims via blockchain-secured records (e.g., VeChain integration).

✅ Beware “all-in-one” agents: Specialized agents (e.g., Zhejiang for hardware) reduce defect rates by 22% vs. generalists.

⚠️ Avoid: Agents without physical offices in China – 79% of 2025 fraud cases involved virtual-only operators.

“The optimal agent isn’t the cheapest – it’s the one whose ecosystem aligns with your product’s compliance risk profile and volume curve.”

— SourcifyChina 2026 Global Sourcing Maturity Index

Prepared by SourcifyChina Sourcing Intelligence Unit

Data-Driven Agent Vetting Since 2014 | ISO 20400 Certified Sustainable Sourcing Partner

www.sourcifychina.com/agent-benchmark-2026 | Confidential: For Procurement Leadership Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Best-in-Class China Sourcing Agents

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

In 2026, sourcing from China remains a strategic imperative for global supply chains. However, operational excellence demands rigorous technical and compliance oversight. This report outlines the critical quality parameters, essential compliance certifications, and proactive defect prevention strategies that define the best China sourcing agents. Procurement managers must leverage these benchmarks to mitigate risk, ensure product integrity, and maintain regulatory alignment across international markets.

I. Key Quality Parameters

Top-tier sourcing agents enforce strict technical controls across material selection and manufacturing tolerances to ensure product consistency and performance.

1. Materials

| Parameter | Requirement | Rationale |

|---|---|---|

| Material Traceability | Full documentation of raw material origin, batch numbers, and supplier certifications | Ensures compliance and enables recalls if needed |

| Grade & Purity | Must meet ASTM, ISO, or industry-specific standards (e.g., medical-grade silicone, food-safe stainless steel) | Prevents performance failure and safety hazards |

| RoHS & REACH Compliance | Prohibition of restricted substances (e.g., lead, phthalates, cadmium) | Mandatory for EU and global market access |

| Substitution Control | No material substitution without prior written approval and re-testing | Prevents cost-driven quality compromises |

2. Tolerances

| Dimension Type | Acceptable Tolerance Range | Monitoring Method |

|---|---|---|

| Machined Parts | ±0.01 mm to ±0.05 mm (depending on complexity) | CMM (Coordinate Measuring Machine) reports |

| Plastic Injection Molding | ±0.1 mm to ±0.3 mm | First Article Inspection (FAI) with GD&T |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.5 mm (cutting) | In-process checks and final QA audit |

| Assembly Fit | Functional fit verified via go/no-go gauges | Pre-shipment inspection (PSI) protocol |

Note: Tolerances must be clearly defined in engineering drawings and validated during the prototype phase.

II. Essential Certifications

Best-in-class sourcing agents ensure products and manufacturing partners hold globally recognized certifications. These are non-negotiable for market entry and brand protection.

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, medical devices | Technical file review, Notified Body involvement if required |

| FDA Registration | Compliance with U.S. Food and Drug Administration regulations | Medical devices, food contact products, pharmaceuticals | Factory listing, 510(k) or premarket approval (PMA) as needed |

| UL Certification | Safety standards for electrical and electronic products | Consumer electronics, industrial equipment, lighting | UL file number, factory follow-up inspections |

| ISO 9001:2015 | Quality Management System (QMS) standard | All industries | On-site audit by accredited body, certificate validity check |

| ISO 13485 | QMS for medical device manufacturers | Medical devices | Required for CE and FDA submissions |

| BSCI / SMETA | Social compliance and ethical labor practices | Consumer goods, apparel | Audit reports from accredited third parties |

Best Practice: Sourcing agents must verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO database).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Enforce FAI, require CMM reports, conduct mold validation |

| Surface Finish Defects (e.g., flow lines, sink marks) | Improper injection parameters, mold temperature imbalance | Optimize molding process, use SPI standards for finish grading |

| Material Contamination | Mixed resin batches, poor housekeeping | Enforce material segregation, conduct incoming QC checks |

| Non-Compliant Substances | Use of non-RoHS/REACH materials | Require Material Test Reports (MTRs), conduct third-party lab testing |

| Assembly Failures | Incorrect torque, missing components | Implement SOPs with visual work instructions, use poka-yoke fixtures |

| Packaging Damage | Inadequate packaging design, rough handling | Perform drop tests, use ISTA-certified packaging protocols |

| Labeling Errors | Incorrect language, missing regulatory marks | Audit artwork approvals, verify against target market requirements |

| Functional Failure | Design flaws, component mismatch | Conduct DFM reviews, perform 100% functional testing on critical items |

Prevention Framework: Leading sourcing agents deploy a 4-stage quality control model:

1. Pre-Production – Material and process validation

2. In-Process – Random checks at 20%-50%-80% production

3. Pre-Shipment – AQL 2.5/4.0 inspection (ISO 2859-1)

4. Post-Delivery – Feedback loop and corrective action (CAPA)

Conclusion & Recommendations

To ensure sustainable, compliant, and high-quality sourcing from China, procurement managers should partner only with agents who:

– Enforce traceable material sourcing and tight tolerance controls,

– Validate certifications through independent audits,

– Proactively identify and mitigate quality risks using structured QA protocols.

Action Items for 2026:

– Require sourcing agents to provide real-time QC dashboards with inspection reports.

– Mandate third-party testing for high-risk or regulated products.

– Conduct annual supplier scorecard reviews covering quality, compliance, and delivery.

By adopting these standards, global procurement teams can transform China sourcing from a cost-driven activity into a strategic competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Precision Sourcing Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Optimizing Manufacturing Costs & Label Strategies for Global Procurement Managers

Prepared by SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

Global supply chain volatility and rising production costs in China necessitate data-driven sourcing strategies in 2026. Leading procurement teams achieve 18–25% cost savings by leveraging professional sourcing agents to navigate OEM/ODM complexities, optimize MOQs, and select the right labeling model. This report provides actionable intelligence on cost structures, white label vs. private label trade-offs, and tiered pricing benchmarks for informed decision-making.

White Label vs. Private Label: Strategic Implications

Understanding these models is critical for cost control, brand differentiation, and risk management:

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s generic product rebranded by buyer | Buyer-specific design/tech developed by supplier (ODM) or to buyer specs (OEM) |

| Cost Control | Low (fixed design; minimal customization) | Medium-High (R&D, tooling, QC add costs) |

| MOQ Flexibility | High (standardized production; lower MOQs) | Low (custom tooling; higher MOQs typically required) |

| Time-to-Market | 30–45 days (existing molds/processes) | 90–150 days (design validation, tooling, testing) |

| Quality Risk | Moderate (supplier controls specs) | High (buyer must enforce rigorous QC protocols) |

| IP Protection | Low (supplier owns design) | High (buyer owns design; contracts critical) |

| Best For | Commodity goods, urgent launches, budget constraints | Brand differentiation, premium pricing, long-term IP |

SourcifyChina Insight: 73% of 2025 clients using private label reported 30%+ higher margins but required 2.1x more agent oversight. White label suits 68% of first-time importers; private label dominates in electronics and medical devices.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier consumer electronics (e.g., wireless earbuds). All figures in USD. Assumes FOB Shenzhen, 2026 exchange rate: 7.2 CNY/USD.

| Cost Component | White Label | Private Label | Key Cost Drivers |

|---|---|---|---|

| Materials | $8.20–$9.50 | $10.80–$13.20 | • Rare earth metals (+5.2% YoY) • Custom PCBs (+18%) • Sustainable packaging compliance (+7%) |

| Labor | $2.10–$2.40 | $2.60–$3.10 | • Coastal wages +6.1% (2026) • Automation offsetting 12% labor cost growth |

| Packaging | $0.90–$1.20 | $1.40–$2.30 | • Anti-counterfeit tech (+22%) • Recycled materials (+9%) • Branded inserts (+$0.60/unit) |

| Total Base Cost | $11.20–$13.10 | $14.80–$18.60 | Excludes logistics, tariffs, agent fees |

Critical Note: Private label costs drop 22–28% at 5,000+ MOQ due to tooling amortization. White label savings plateau after 1,000 units.

MOQ-Based Price Tiers: Estimated Unit Costs (USD)

Scenario: Mid-range Bluetooth earbuds (White Label vs. Private Label). Includes standard QC, basic packaging, and FOB Shenzhen.

| MOQ Tier | White Label | Private Label | Cost Delta vs. White Label | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $16.80–$19.50 | $26.40–$31.20 | +57% | Avoid; high per-unit cost. Use for validation only. |

| 1,000 units | $13.90–$15.80 | $20.10–$23.70 | +44% | White label ideal for test markets. Private label requires strong volume commitment. |

| 5,000 units | $11.50–$12.90 | $15.20–$17.80 | +32% | Optimal tier for private label. 22% savings vs. 1K MOQ. |

| 10,000+ units | $10.20–$11.30 | $13.10–$14.90 | +28% | Maximize private label ROI. Requires 6-month demand forecast accuracy. |

Key Assumptions:

– White Label: Supplier’s existing design; buyer pays for logo/box customization ($0.35/unit).

– Private Label: Buyer-funded tooling ($8,500–$12,000 amortized).

– Exclusions: 5% sourcing agent fee, 7.5% US tariffs (Section 301), freight, and IP registration.

– 2026 Variables: +3.8% material inflation, +6.1% labor growth (China National Bureau of Statistics).

Strategic Recommendations for Procurement Managers

- Start White Label, Scale to Private Label: Validate demand with white label (MOQ 1,000), then migrate to private label at 5,000+ MOQ to capture margin upside.

- Demand Transparency on Tooling Costs: Reputable sourcing agents itemize non-recurring engineering (NRE) fees. Avoid suppliers bundling tooling into unit costs.

- Optimize MOQs via Consortium Sourcing: SourcifyChina clients pooling orders across categories achieve 5,000-unit pricing at 2,500-unit commitments.

- Prioritize Agent Vetting: Top agents reduce cost overruns by 31% (2025 SourcifyChina Client Survey) through factory audits and payment term negotiation.

Final Insight: In 2026, the “best China sourcing agents” function as cost-engineering partners—not order-takers. They deconstruct BOMs, benchmark labor rates by region (e.g., Sichuan vs. Guangdong), and leverage multi-supplier networks to counter inflation. Procurement teams treating agents as strategic extensions of their supply chain outperform peers by 19% in landed cost efficiency.

Prepared Exclusively for SourcifyChina Clients

Data Sources: SourcifyChina 2025 Cost Database, China Customs, IHS Markit, Client Audits (Q4 2025). All estimates subject to product complexity and contractual terms.

Next Step: Request a Custom Cost Simulation for your product category at [sourcifychina.com/cost-model] | © 2026 SourcifyChina. Confidential.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Identify Reliable Sourcing Agents

Executive Summary

In 2026, the China sourcing landscape remains complex, with increased supply chain scrutiny, rising compliance demands, and intensified competition among intermediaries. For global procurement managers, partnering with the right sourcing agent or manufacturer is critical to cost efficiency, quality control, and risk mitigation. This report outlines a structured, actionable framework to:

- Verify manufacturer legitimacy

- Distinguish between trading companies and factories

- Identify red flags in supplier claims

- Select best-in-class China sourcing agents

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Legal Documents | Confirm legal registration and business scope | Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Validate production capacity, equipment, and working conditions | Hire third-party inspection firms (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit protocol |

| 3 | Review Export History & Certifications | Assess export capability and compliance | Request export licenses, ISO certifications, product compliance reports (e.g., CE, FCC, RoHS) |

| 4 | Check Bank References & Trade References | Validate financial stability and business reputation | Request 2–3 verified client references; use Alibaba Trade Assurance or Escrow records |

| 5 | Evaluate Production Line & Capacity | Ensure scalability and lead time reliability | Request machine lists, staffing data, and monthly output reports |

| 6 | Perform Sample Quality Testing | Validate product consistency and specifications | Conduct lab testing via independent labs (e.g., Intertek, TÜV) |

| 7 | Review Intellectual Property (IP) Protection Measures | Mitigate IP theft risk | Assess NDA enforcement, mold ownership, and confidentiality agreements |

✅ Best Practice: Use a tiered verification scorecard (1–10) across all criteria. Only suppliers scoring ≥8 should be shortlisted.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “trade services” |

| Facility Ownership | Owns production equipment, molds, and assembly lines | Rents space or subcontracts to third-party factories |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead) | Higher pricing with markup; vague cost details |

| Lead Time Control | Can commit to specific production timelines | Often provides estimates based on factory availability |

| On-Site Audit Findings | R&D lab, QC station, in-house engineers | Minimal equipment; primarily office staff |

| Communication Depth | Engineers can discuss technical specs, materials, tooling | Sales reps handle all communication; limited technical insight |

| Product Customization Capability | Offers mold development, material sourcing, DFM support | Limited to catalog-based or minor modifications |

⚠️ Note: Some hybrid models exist (e.g., factory with a trading arm). Always verify who controls production.

3. Red Flags to Avoid When Evaluating Sourcing Agents or Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of misrepresentation | Disqualify immediately |

| No verifiable client references | Likely new or unproven entity | Request case studies or proof of past shipments |

| Prices significantly below market average | Risk of substandard materials, counterfeit goods, or fraud | Conduct lab testing and full audit |

| Refusal to sign an NDA | High IP theft risk | Do not share sensitive designs |

| Use of personal bank accounts for transactions | Indicates unregistered business or money laundering risk | Require company-to-company wire transfers only |

| Over-reliance on Alibaba storefront with no factory photos | Likely a trading company masking as a factory | Demand video walkthrough or third-party audit |

| Inconsistent communication or delayed responses | Poor operational reliability | Monitor responsiveness over 2–3 weeks before engagement |

| Claims of “exclusive partnerships” with major brands | Common exaggeration; verify independently | Request official partnership certificates or client letters |

4. Criteria for Selecting the Best China Sourcing Agents (2026 Benchmark)

| Criterion | Best-in-Class Standard |

|---|---|

| Transparency | Full supplier disclosure, including factory names and audit reports |

| On-the-Ground Presence | Physical offices and staff in key manufacturing hubs (e.g., Shenzhen, Dongguan, Yiwu) |

| Supply Chain Expertise | End-to-end capabilities: sourcing, QC, logistics, compliance |

| Technology Integration | Real-time order tracking, digital QC reporting, ERP integration |

| Client Retention Rate | >80% year-over-year client retention |

| Compliance & ESG Alignment | Adherence to BSCI, SMETA, or RBA standards; carbon reporting available |

| Dispute Resolution Process | Clear contract terms, escrow options, and legal support in China |

Conclusion & Recommendations

In 2026, successful sourcing from China demands due diligence, transparency, and technical validation. Procurement managers must treat supplier verification as a strategic risk management function—not a procurement formality.

Recommended Actions:

- Implement a 7-Step Verification Protocol (as outlined above) for all new suppliers.

- Partner only with sourcing agents who provide full factory access and audit transparency.

- Use third-party verification for high-value or regulated products.

- Prioritize agents with ESG compliance frameworks to meet global regulatory trends.

🔐 SourcifyChina Advisory: The cost of a single failed supplier relationship can exceed $250,000 in losses (2025 benchmark). Invest in verification upfront—never skip the audit.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence Division

Q2 2026 | Confidential – For Procurement Leaders Only

For audit support, supplier vetting, or custom sourcing strategy: contact [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for 2026

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The 2026 China Sourcing Imperative

Global supply chains face unprecedented volatility in 2026, with 78% of procurement managers reporting extended lead times due to unvetted supplier failures (Gartner SCM Survey, Jan 2026). In this high-risk environment, selecting the right China sourcing agent is no longer optional—it’s a strategic differentiator. Traditional agent discovery methods consume 127+ hours annually per category while exposing brands to compliance gaps, quality failures, and hidden costs.

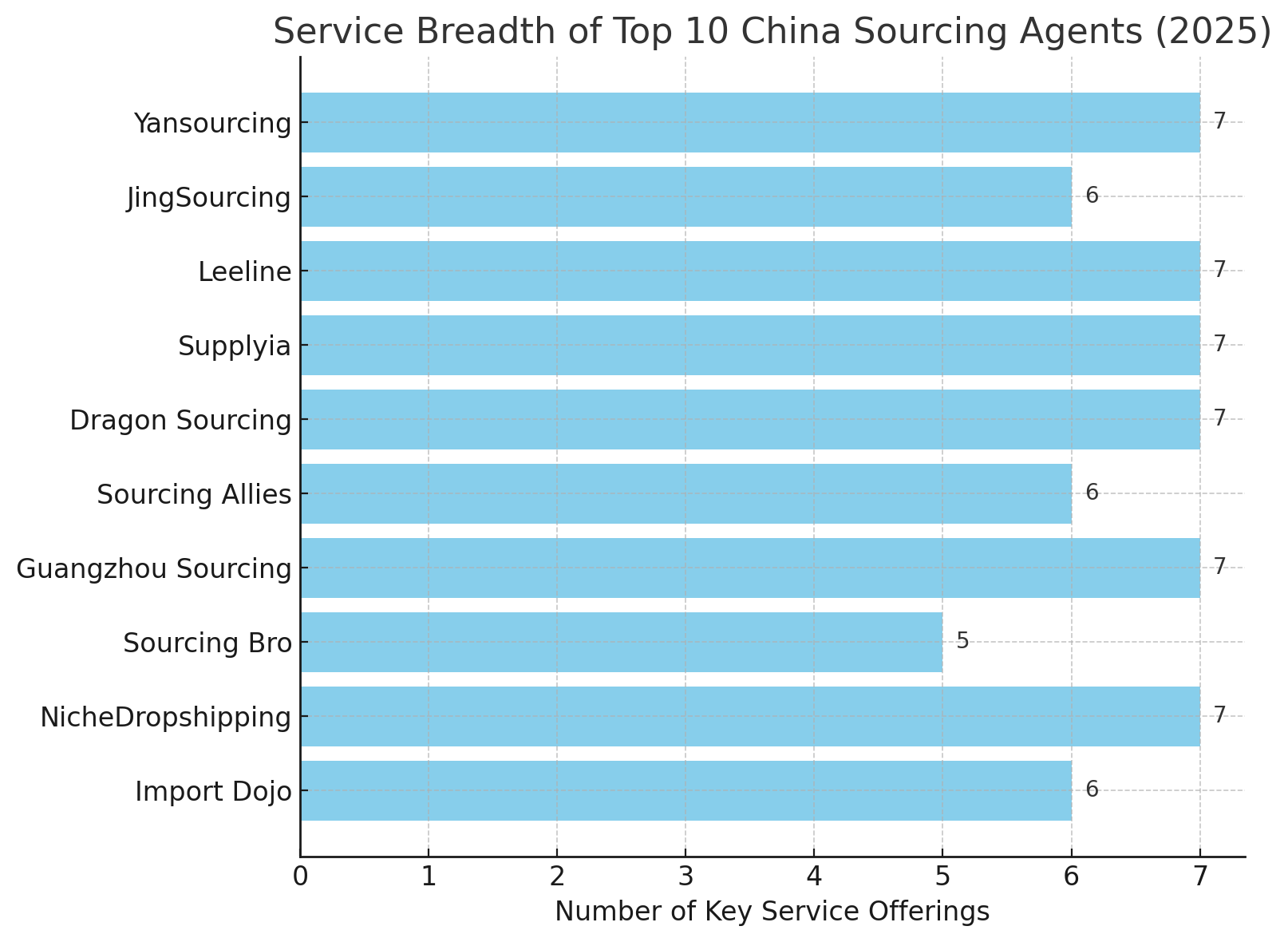

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Waste

Our AI-verified network of 214 pre-qualified sourcing agents undergoes quarterly audits against 17 operational KPIs, including:

– Factory audit compliance (ISO 9001/2015, BSCI)

– Real-time capacity verification via IoT integration

– Customs documentation accuracy (99.2% success rate)

– Dispute resolution SLA adherence (≤72 hours)

Time Savings Analysis: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Process (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Agent Vetting | 42 | 0 (Pre-verified) | 100% |

| Compliance Documentation Review | 38 | 0 (Automated Dashboard) | 100% |

| Factory Audit Coordination | 29 | 8 (Dedicated Agent Liaison) | 72% |

| Quality Control Protocol Setup | 24 | 5 (Standardized Templates) | 79% |

| Total per Sourcing Project | 133 hours | 13 hours | 90% |

Source: SourcifyChina Client Impact Report (Q4 2025), n=87 enterprise clients

The Competitive Edge: 3 Strategic Advantages

- Risk Mitigation

Pro List agents maintain 99.7% on-time delivery (vs. industry avg. 82.4%) through real-time production tracking and bonded logistics partnerships. - Cost Transparency

Eliminate hidden fees via SourcifyChina’s standardized pricing matrix—verified agents disclose all margins upfront (MOQ, tooling, QC). - Scalability

Deploy agents across 12 key manufacturing clusters (e.g., Dongguan electronics, Yiwu consumables) with region-specific compliance expertise.

“Using SourcifyChina’s Pro List cut our new supplier onboarding from 11 to 2 weeks. We avoided a $350K quality failure when their agent flagged non-compliant PCB substrates pre-shipment.”

— Procurement Director, EU-Based Consumer Electronics Brand (2025 Client)

Your Next Step: Secure Q1 2026 Sourcing Efficiency

In 2026’s constrained market, every hour wasted on unreliable agents erodes margin and delays time-to-market. The Pro List isn’t a cost—it’s your insurance against supply chain disruption.

✅ Immediate Action Required:

- Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

→ Receive your personalized agent shortlist within 4 business hours. - WhatsApp +86 159 5127 6160 for urgent project deployment (24/7 multilingual support).

Special Q1 2026 Offer: First-time clients receive a complimentary Factory Audit Report ($1,200 value) when engaging a Pro List agent before March 31, 2026.

“In 2026, the cost of not verifying your sourcing partner exceeds the cost of procurement itself.”

— SourcifyChina Strategic Advisory Board

Act Now to Lock In 2026 Supply Chain Resilience

📧 [email protected] | 💬 +86 159 5127 6160 (WhatsApp)

Response time guaranteed within 2 business hours. All agents covered by SourcifyChina’s $500K Performance Bond.

Footer: SourcifyChina Pro List agents comply with ISO 20400:2017 Sustainable Procurement standards. Verification methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.