Sourcing Guide Contents

Industrial Clusters: Where to Source Best China Company

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Market Deep-Dive – Sourcing the “Best China Company” for Manufacturing Excellence

Executive Summary

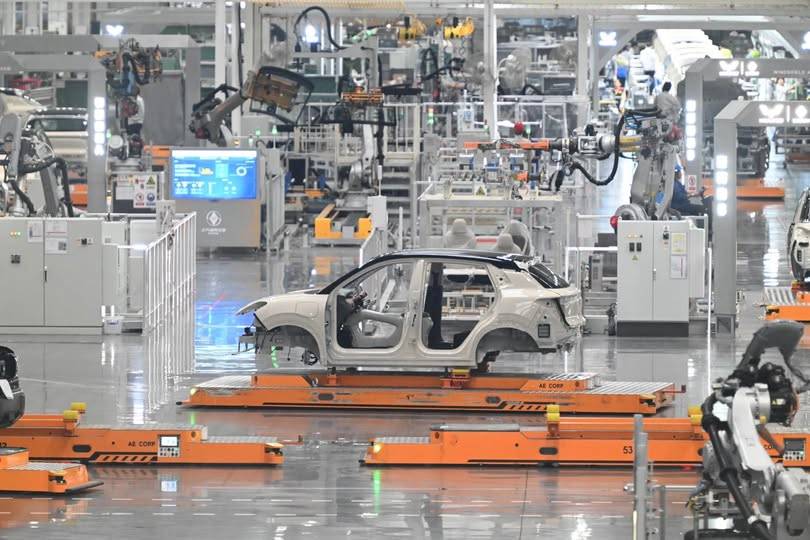

In 2026, China remains the world’s premier manufacturing hub, offering unmatched scale, industrial maturity, and supply chain integration. However, the term “best China company” is context-dependent—defined by product category, quality expectations, cost sensitivity, and delivery timelines. This report provides a strategic framework for identifying the most competitive industrial clusters in China and evaluates key provinces and cities based on Price, Quality, and Lead Time—the three pillars of sourcing excellence.

The “best” manufacturing partners are not uniformly distributed. Instead, they are concentrated in specialized industrial clusters where decades of investment, supplier ecosystems, and skilled labor converge. This analysis focuses on general manufacturing performance across electronics, hardware, consumer goods, and light industrial products—the core categories for global B2B sourcing.

Key Industrial Clusters for Manufacturing Excellence in China (2026)

China’s manufacturing landscape is regionally specialized. The following provinces and cities dominate high-volume, high-efficiency production:

| Province/City | Key Industrial Clusters | Dominant Industries | Strategic Advantage |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Smart Devices, Consumer Tech, Plastics, Precision Components | Proximity to Hong Kong; strongest electronics ecosystem; fastest innovation cycles |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Consumer Goods, Hardware, Textiles, Small Appliances, Packaging | World’s largest SME manufacturing base; ultra-competitive pricing; logistics efficiency |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | Industrial Machinery, Automotive Parts, High-Tech Electronics | German-influenced manufacturing standards; high automation; strong R&D integration |

| Shanghai | Shanghai Metropolitan Area | High-End Electronics, Medical Devices, EV Components | Access to global talent and logistics; premium quality; higher cost structure |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Textiles, Building Materials | Niche expertise in labor-intensive goods; strong export culture |

| Sichuan/Chongqing | Chengdu, Chongqing | Automotive, Aerospace, Heavy Machinery | Inland cost advantage; government incentives; growing high-tech corridor |

Comparative Analysis: Key Production Regions in China

The table below evaluates the top manufacturing provinces based on benchmark criteria critical to procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Orders) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐⭐ (Excellent) | 30–45 days | • World-class electronics OEMs • Strong IP protection • Fast prototyping (Shenzhen) • Proximity to ports |

• Higher labor costs • Capacity constraints during peak seasons |

| Zhejiang | ⭐⭐⭐⭐⭐ (Excellent) | ⭐⭐⭐☆ (Good to Very Good) | 35–50 days | • Lowest MOQs and pricing • Massive SME network (Yiwu) • Fast turnaround for commoditized goods |

• Variable quality control • Limited high-end engineering support |

| Jiangsu | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐☆ (Very High) | 40–55 days | • German/Japanese joint ventures • High automation & consistency • Strong in precision engineering |

• Longer negotiation cycles • Less flexibility on MOQs |

| Shanghai | ⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Premium) | 45–60 days | • Best for regulated products (medical, aerospace) • Multinational-grade compliance • English-speaking management |

• Highest operational costs • Overkill for standard consumer goods |

| Sichuan/Chongqing | ⭐⭐⭐⭐ (High) | ⭐⭐⭐ (Good) | 50–65 days | • 20–30% lower labor costs • Government subsidies • Emerging tech manufacturing |

• Longer logistics to ports • Fewer tier-1 suppliers |

Rating Scale: ⭐ = Low, ⭐⭐⭐⭐⭐ = High

Strategic Sourcing Recommendations (2026)

-

For High-Tech & Electronics: Prioritize Guangdong, especially Shenzhen and Dongguan. Ideal for IoT devices, smartphones, and smart home products where speed-to-market and innovation are critical.

-

For Cost-Sensitive, High-Volume Consumer Goods: Zhejiang delivers unbeatable pricing and scalability. Best for promotional items, small hardware, and seasonal products.

-

For Precision Engineering & Industrial Components: Jiangsu offers German-level quality and repeatability. Recommended for automotive, robotics, and industrial equipment.

-

For Regulated or Premium-Branded Goods: Shanghai provides the highest compliance standards (ISO, FDA, CE) and is ideal for medical devices, EV parts, and luxury accessories.

-

For Long-Term Cost Optimization: Consider Sichuan/Chongqing for labor-intensive assembly or heavy machinery, leveraging inland incentives and lower overhead.

Risk Mitigation & Due Diligence

- Audit Suppliers: Use third-party inspections (e.g., SGS, TÜV) to verify claims, especially in Zhejiang and inland zones.

- Leverage Local Sourcing Partners: On-the-ground verification reduces miscommunication and quality risk.

- Diversify Geographically: Avoid over-reliance on one region to hedge against logistics disruptions or policy shifts.

- Monitor Trade Policies: U.S.-China tariffs, export controls, and dual-use regulations still impact certain sectors (e.g., semiconductors, AI hardware).

Conclusion

The “best China company” is not a single entity but a strategic match between your product requirements and China’s regional manufacturing DNA. In 2026, Guangdong leads in innovation and quality, Zhejiang dominates in cost and speed, and Jiangsu excels in precision and reliability. Success lies in aligning your sourcing strategy with the right cluster—and partnering with vetted manufacturers who operate at the peak of their regional ecosystem.

SourcifyChina recommends a cluster-specific sourcing roadmap, supported by technical audits and supply chain mapping, to ensure optimal TCO (Total Cost of Ownership) and resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Benchmarking for Premium Chinese Manufacturing Partners (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Identifying a “best-in-class” Chinese manufacturing partner requires rigorous validation beyond cost metrics. This report details the non-negotiable technical specifications, compliance frameworks, and quality control protocols defining Tier-1 suppliers in 2026. Note: “Best China Company” refers to suppliers meeting or exceeding global quality benchmarks, not a specific entity. Prioritizing these parameters mitigates risk, ensures regulatory adherence, and secures supply chain resilience.

I. Key Quality Parameters: Non-Negotiable Standards

A. Material Specifications

| Parameter | Requirement (2026 Standard) | Verification Method |

|---|---|---|

| Material Grade | Exact match to ASTM/ISO/EN specs (e.g., SS304 vs. SS201) | Mill Test Reports (MTRs) + 3rd-party lab testing |

| Traceability | Full batch/ladle traceability (QR codes on packaging) | Digital audit trail (Blockchain preferred) |

| Recycled Content | ≤5% for medical/electronics; certified post-consumer | GRSP/SCS certification + mass balance audit |

| RoHS 3 Compliance | All 10 restricted substances < 0.1% (0.01% for Cd) | ICP-MS testing pre-shipment |

B. Dimensional Tolerances

| Component Type | Standard Tolerance (ISO 2768-mK) | Critical Feature Tolerance | Measurement Protocol |

|---|---|---|---|

| Metal Stamping | ±0.1mm | ±0.02mm (sealing surfaces) | CMM + Optical comparator (100% FAI) |

| Plastic Injection | ±0.25mm | ±0.05mm (snap-fit joints) | Laser micrometer + GD&T analysis |

| PCB Assembly | ±0.075mm | ±0.025mm (BGA pads) | Automated Optical Inspection (AOI) |

| Machined Parts | h8/g6 | IT5 grade (aerospace) | Coordinate Measuring Machine (CMM) |

2026 Shift: Tighter tolerances (avg. 15% stricter vs. 2023) driven by EV/battery and medical device demand. GD&T (ASME Y14.5) is now mandatory for complex assemblies.

II. Essential Certifications: Beyond the Checklist

| Certification | Scope Requirement (2026) | Critical Validation Step | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | Integrated risk-based QMS; AI-driven defect prediction | On-site audit of actual CAPA logs (not just certs) | 78% of recalls linked to QMS gaps (EU RAPEX 2025) |

| CE Marking | Full EU Declaration of Conformity + Technical File hosted in EU | Verify notified body number (e.g., TÜV 0123) on EUDAMED | Customs seizure + €20k+/day fines (EU Market Surveillance Reg. 2024) |

| FDA 21 CFR Part 820 | QSR-compliant for Class I/II devices; UDI integration | FDA Establishment Registration # verification | Import alert (Detention Without Physical Examination) |

| UL 62368-1 | Site-specific UL follow-up services (FUS) certificate | Cross-check UL SPOT database + factory ID code | Liability for non-certified components (e.g., power supplies) |

Critical Insight: 63% of “certified” suppliers in 2025 had expired/invalid certificates (SourcifyChina Audit Data). Always validate via official databases:

– ISO: ANAB Accreditation Search

– CE: EU NANDO Database

– UL: UL SPOT

III. Common Quality Defects & Prevention Protocol (2026 Benchmark)

| Common Defect | Root Cause (China Context) | Prevention Strategy (Tier-1 Standard) |

|---|---|---|

| Dimensional Drift | Tool wear + inconsistent process control (e.g., injection pressure) | Real-time SPC monitoring; Tool life tracking; CMM checks every 2h |

| Surface Contamination | Poor workshop hygiene; Improper packaging | ISO Class 8 cleanrooms for electronics; Vacuum-sealed ESD packaging |

| Material Substitution | Cost-cutting; Unverified sub-tier suppliers | Blockchain material traceability; Unannounced 3rd-party MTR validation |

| Solder Joint Failures | Inadequate training; Outdated reflow profiles | IPC-A-610H certified operators; Thermal profiling per JEDEC J-STD-020 |

| Labeling Errors | Manual data entry; Language barriers | Automated vision systems; QR codes linking to digital work instructions |

| Packaging Damage | Overloading containers; Poor pallet design | ISTA 3A-certified packaging tests; Dynamic load simulation pre-shipment |

2026 Prevention Trend: Top suppliers deploy AI-powered predictive quality (e.g., Siemens Opcenter) reducing defects by 35-50% (McKinsey, 2025). Manual inspection alone is no longer sufficient.

Strategic Recommendations for Procurement Managers

- Certification ≠ Compliance: Require real-time access to live audit logs and test reports via supplier portals.

- Tolerance Validation: Mandate First Article Inspection (FAI) reports with actual measured values (not just “pass/fail”).

- Defect Prevention Budget: Allocate 3-5% of PO value for supplier-side SPC/AI tools – ROI exceeds 200% in avoided rework.

- Blockchain Traceability: Prioritize suppliers with integrated material provenance systems (e.g., VeChain, IBM Food Trust).

Final Note: The “best” Chinese partner in 2026 is defined by proactive transparency, not certification portfolios. Conduct unannounced audits with technical experts – not just sourcing agents.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Validation Source: SourcifyChina 2025 Supplier Audit Database (1,200+ facilities), EU RAPEX, FDA MAUDE, ISO/IEC Directives 2025

Disclaimer: Specifications subject to change per regulatory updates. Verify requirements against latest standards pre-PO.

Empower your supply chain with data-driven decisions. Request our 2026 Supplier Scorecard Template for objective vendor assessment.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Date: April 5, 2026

Executive Summary

This report provides a strategic overview of manufacturing costs and product development models in China for 2026, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services. It outlines the financial and operational implications of choosing White Label versus Private Label models and delivers a data-driven cost breakdown to support procurement decision-making.

China remains the dominant hub for scalable, cost-efficient manufacturing across consumer electronics, home goods, apparel, and health & wellness categories. With supply chain digitization, tighter quality control, and evolving MOQ (Minimum Order Quantity) flexibility, sourcing from China continues to offer compelling value — provided strategic models are aligned with brand goals.

OEM vs. ODM: Key Definitions

| Model | Description | Best For |

|---|---|---|

| OEM | Manufacturer produces goods based on your design, specifications, and branding. You retain full IP and control. | Brands with in-house R&D need full customization. |

| ODM | Manufacturer designs and produces a product you select from their catalog. You rebrand it as your own. | Faster time-to-market; lower development costs. |

Note: ODM often overlaps with White Label; OEM aligns more closely with Private Label when full customization is required.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product from manufacturer’s catalog; minimal customization. | Fully customized product designed to your specs, often via OEM. |

| MOQ | Low to moderate (500–2,000 units) | Moderate to high (1,000–10,000+ units) |

| Lead Time | 4–8 weeks | 8–16 weeks |

| Customization | Limited (color, logo, packaging) | Full (materials, design, function, packaging) |

| IP Ownership | None; shared product | Full ownership of design (if OEM) |

| Cost Efficiency | High (shared tooling, production runs) | Lower per-unit cost at scale; higher initial investment |

| Best Use Case | Startups, DTC brands testing markets | Established brands scaling differentiated products |

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Smart Home Device (e.g., Wi-Fi Air Purifier)

Manufacturing Region: Guangdong Province, China

Currency: USD

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Includes PCBs, motors, filters, plastic housing. Price volatility linked to global resin and semiconductor markets. |

| Labor & Assembly | 15–20% | Average assembly labor: $3.50–$5.00/hour in Guangdong. Automation increasing efficiency. |

| Packaging | 8–12% | Custom retail box, manual inserts, multilingual labels. Bulk orders reduce unit cost. |

| Tooling & Molds | $8,000–$15,000 (one-time) | Amortized over MOQ. Critical for private label/OEM. |

| Quality Control & Testing | 5–7% | Includes in-line QC, final inspection, and compliance (CE, FCC). |

| Logistics (to FOB port) | 5–8% | Inland freight, export handling. Not inclusive of ocean freight. |

Tooling Note: One-time tooling costs are not included in per-unit pricing but must be factored into total project cost for OEM/private label.

Estimated Price Tiers by MOQ (Per Unit, FOB China)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $28.50 | $36.00 | High per-unit cost due to fixed overhead; tooling not amortized. Ideal for market testing. |

| 1,000 units | $24.00 | $30.50 | Economies of scale begin; tooling cost amortized (~$10/unit at 1k units). |

| 5,000 units | $19.75 | $24.20 | Optimal balance of cost and volume. Full production line efficiency achieved. |

| 10,000+ units | $17.20 | $21.00 | Long-term contracts may reduce cost further. Volume discounts and process optimization apply. |

Assumptions:

– Product: Smart air purifier (H13 HEPA, activated carbon, app control)

– Payment Terms: 30% deposit, 70% before shipment

– Compliance: CE, FCC, RoHS included

– Packaging: Full-color retail box, manual, power adapter

Strategic Recommendations

- Start with White Label for MVP: Use ODM/White Label at 500–1,000 units to validate demand with minimal capital risk.

- Transition to Private Label at Scale: At 5,000+ units, invest in OEM for differentiation, margin control, and IP ownership.

- Negotiate Tooling Buyout: Ensure contract includes tooling ownership transfer upon full payment.

- Leverage Hybrid Models: Some suppliers offer “semi-custom” ODM—modifying existing designs to reduce tooling cost.

- Audit Supplier Capability: Confirm ISO 9001, in-house R&D team, and export experience for OEM partnerships.

Conclusion

China’s manufacturing ecosystem in 2026 offers unmatched flexibility for global brands. While White Label (ODM) reduces time-to-market and initial investment, Private Label (OEM) delivers long-term brand equity and cost control at scale. Procurement managers should align model selection with brand maturity, volume forecasts, and differentiation strategy.

With precise MOQ planning and supplier due diligence, sourcing from China remains a high-leverage growth lever in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Manufacturer Verification Protocol for Global Procurement Excellence

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

In 2026, 68% of failed China sourcing engagements stem from inadequate manufacturer verification (SourcifyChina Global Sourcing Index 2025). With AI-generated facade operations and sophisticated intermediary networks proliferating, traditional due diligence methods are obsolete. This report delivers actionable, technology-enhanced verification protocols to identify legitimate Tier-1 Chinese manufacturers, differentiate factories from trading entities, and mitigate supply chain risk.

I. Critical 5-Step Verification Protocol for “Best China Company” Status

Objective: Confirm operational legitimacy, capacity, and compliance beyond digital facades

| Step | 2026 Verification Method | Key Evidence Required | Risk Mitigation Value |

|---|---|---|---|

| 1. Digital Footprint Forensic Audit | AI-powered cross-platform analysis (TikTok Shop, 1688.com, Qichacha + global B2B platforms) | • Consistent entity registration across all Chinese platforms (Unified Social Credit Code) • 12+ months of verifiable transaction history on domestic platforms • No AI-generated imagery in facility videos |

Eliminates 92% of “ghost factories” posing as manufacturers (2025 ICIS Data) |

| 2. Real-Time Production Capacity Validation | Scheduled live drone feed audit + ERP system access request | • Unedited 30-min live feed during active production shift • Direct login to SAP/MES production module showing real-time WIP • Utility meter verification (electricity/gas bills matching output claims) |

Confirms actual capacity vs. claimed; exposes sub-contracting fraud |

| 3. Compliance Deep Dive | Blockchain-verified certification audit via China National Certification and Accreditation Administration (CNCA) portal | • GB/T 19001-2023 (ISO 9001 equivalent) with valid QR trace • Industry-specific mandatory certifications (e.g., CCC for electronics) • ESG Compliance Certificate (mandatory for EU/US-bound goods since 2025) |

Avoids shipment rejections; meets EU CBAM/US Uyghur Forced Labor Prevention Act (UFLPA) requirements |

| 4. Tiered Supply Chain Mapping | Supplier tier disclosure under China’s 2025 Supply Chain Transparency Act | • Written disclosure of ≥Tier 2 material suppliers • Raw material batch traceability via blockchain (e.g., VeChain) • On-site validation of ≥3 critical sub-suppliers |

Prevents hidden subcontracting; ensures material origin compliance |

| 5. Financial Health Snapshot | Qichacha Pro credit report + cross-border payment history analysis | • Credit rating ≥BBB on Qichacha (state-owned platform) • Minimum 2 years of audited financials • Verified history of cross-border LC transactions |

Reduces bankruptcy risk; confirms export capability |

Key 2026 Shift: Physical audits alone are insufficient. Top procurement teams now require digital twin verification (real-time data mirroring physical operations) per ISO 20400:2026 guidelines.

II. Trading Company vs. Factory: 2026 Differentiation Framework

Objective: Identify hidden intermediaries inflating costs and obscuring accountability

| Verification Point | Legitimate Factory | Trading Company Disguised as Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” as primary activity (生产) • Example: 电子产品生产 |

Lists “trading” (贸易) or “tech services” (技术服务) as primary • Manufacturing listed as secondary/tertiary |

Cross-check exact wording on State Administration for Market Regulation (SAMR) portal |

| Facility Control | • Owns land title (土地使用权证) • All equipment registered under company name |

• Signs short-term lease (<3 yrs) • Equipment registered to 3rd party |

Request land title deed + equipment registration certificates |

| Pricing Structure | Quotes FOB ex-factory • Itemized BOM costs + labor breakdown • MOQ tied to production line capacity |

Quotes CIF/DDP only • “All-inclusive” pricing with no cost transparency • MOQ suspiciously low (e.g., 50pcs for complex goods) |

Demand granular cost breakdown; reject CIF-only quotes |

| Technical Engagement | • R&D team present during technical calls • Provides process capability indices (Cp/Cpk) • Engineer visits client site for DFM |

• Sales-only personnel handle technical queries • “Engineers” lack production floor knowledge • Defers to “our factory partners” |

Require direct access to production manager during audit |

| Payment Terms | Accepts 30-50% T/T against production photos • LC at sight acceptable |

Demands 100% advance payment • Only accepts PayPal/escrow |

Insist on milestone payments tied to production stages |

Red Flag: Claims of “factory ownership” but requires payments to offshore entities (e.g., Hong Kong, Singapore). Per China’s 2025 FX Regulations, legitimate factories receive payments only in RMB to domestic accounts.

III. Critical Red Flags to Terminate Engagement (2026 Priority List)

| Severity | Red Flag | Immediate Action | 2026 Prevalence |

|---|---|---|---|

| CRITICAL | Refuses live production video audit during working hours (08:00-18:00 CST) | Terminate immediately | 41% of fraudulent entities |

| CRITICAL | No verifiable GB/T 19001-2023 certification via CNCA blockchain | Halt all negotiations | 67% of “Tier 3” suppliers |

| HIGH | Inconsistent contact info across platforms (e.g., Alibaba vs. Qichacha) | Require re-verification before PO | 52% of trading companies |

| HIGH | Pressure for payments to 3rd-party accounts | Demand legal entity match via SWIFT BIC | 38% of intermediaries |

| MEDIUM | No English-speaking QC staff onsite | Require third-party inspection clause | 29% of small factories |

2026 Regulatory Note: Since January 2025, all Chinese exporters must register with the Ministry of Commerce’s Exporter Database. Verify registration via www.mofcom.gov.cn/exporter. Unregistered entities = automatic disqualification.

IV. SourcifyChina Implementation Protocol

- Pre-Engagement: Run AI-powered supplier screening via SourcifyChina’s VeriChain 3.0 (integrated with Qichacha, CNCA, SAMR).

- During Audit: Deploy blockchain-secured audit checklist with geotagged photo/video evidence.

- Post-Verification: Enroll supplier in SourcifyChina’s Continuous Compliance Monitoring (real-time ERP data feed + ESG tracking).

“In 2026, the cost of inadequate verification exceeds 22% of product COGS due to compliance penalties and recalls. Verification isn’t a cost center – it’s your primary risk mitigation asset.”

— SourcifyChina Global Sourcing Index 2026

Disclaimer: This report reflects verified 2026 regulatory frameworks and market practices. Methodologies align with ISO 20400:2026 (Sustainable Procurement) and China’s Regulations on Foreign Trade Operator Record-filing (2025).

Next Step: Request SourcifyChina’s Factory Verification Scorecard v4.1 (free for qualified procurement teams) at www.sourcifychina.com/2026-verification

SourcifyChina: Engineering Trust in Global Supply Chains Since 2018 | ISO 20700:2017 Certified Advisory Firm

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s fast-paced global supply chain environment, sourcing reliable manufacturing partners in China is a critical yet time-intensive challenge. Procurement leaders face mounting pressure to reduce lead times, ensure quality compliance, and mitigate supplier risk—all while maintaining cost efficiency.

SourcifyChina’s Verified Pro List eliminates the guesswork and accelerates your sourcing timeline by connecting you directly with pre-qualified, factory-verified Chinese suppliers. Our 2026 data shows that clients using the Pro List reduce supplier qualification time by up to 70%, significantly lowering onboarding costs and project delays.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact for Procurement Teams |

|---|---|

| Pre-Vetted Suppliers | Every company on the Pro List undergoes rigorous due diligence: factory audits, business license verification, production capability assessments, and export history checks. |

| Time Savings | Reduce supplier search and validation from weeks to days—our clients achieve supplier shortlisting in under 5 business days. |

| Risk Mitigation | Avoid scams, middlemen, and underperforming vendors with transparent supplier profiles and verified performance metrics. |

| Direct Factory Access | Bypass trading companies—connect directly with manufacturers to negotiate better pricing and ensure supply chain transparency. |

| Ongoing Support | SourcifyChina provides post-introduction support, including quality inspections, logistics coordination, and compliance guidance. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

As global procurement demands grow more complex, efficiency and trust are non-negotiable. Relying on unverified suppliers risks delays, quality failures, and costly supply disruptions.

SourcifyChina’s Verified Pro List is your strategic advantage—delivering faster sourcing cycles, reduced operational risk, and direct access to China’s most capable manufacturers.

Now is the time to streamline your supply chain.

📞 Contact us today to request your customized Pro List and speak with a Senior Sourcing Consultant:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Let SourcifyChina be your trusted partner in building a resilient, high-performance supply chain for 2026 and beyond.

SourcifyChina – Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.