Sourcing Guide Contents

Industrial Clusters: Where to Source Bat Companies China

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Bat Manufacturers in China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of China’s manufacturing landscape for bat-related products—specifically focusing on sporting bats (e.g., baseball, cricket, softball) and industrial/composite bats used in niche applications. While “bat companies China” may be ambiguously interpreted, this analysis clarifies the sector as manufacturers of sports equipment bats, which is the dominant commercial interpretation in the Chinese export market.

China remains the world’s leading exporter of sports bats, leveraging cost-effective labor, mature supply chains, and advanced composite material processing. Key industrial clusters are concentrated in Guangdong, Zhejiang, Jiangsu, and Fujian provinces, each offering distinct advantages in pricing, quality, and lead time.

This report identifies top manufacturing hubs, evaluates regional competitiveness, and provides actionable insights for global procurement teams to optimize sourcing strategies in 2026.

Key Industrial Clusters for Bat Manufacturing in China

The bat manufacturing ecosystem in China is highly regionalized, with specialization based on material type (wood, aluminum, composite), automation level, and export orientation.

1. Guangdong Province (Dongguan, Guangzhou, Shenzhen)

- Focus: High-volume OEM/ODM production of aluminum and composite bats.

- Strengths: Proximity to Hong Kong logistics hubs, advanced mold-making, strong export infrastructure.

- Key Clients: U.S. and European sports brands (private label manufacturing).

- Material Supply: Reliable access to carbon fiber, aluminum alloys, and synthetic grips.

2. Zhejiang Province (Ningbo, Taizhou, Wenzhou)

- Focus: Mid-to-high-end composite and wooden bats; growing R&D in material durability.

- Strengths: High precision manufacturing, strong SME base, competitive tooling capabilities.

- Notable Cluster: Taizhou is known for sports equipment innovation zones.

- Export Channels: Well-integrated with EU and Southeast Asian markets.

3. Jiangsu Province (Suzhou, Changzhou)

- Focus: Premium composite bats with advanced engineering (e.g., vibration dampening, balanced swing weight).

- Strengths: Proximity to Shanghai R&D centers, high-quality control standards (ISO-certified factories).

- Clients: Brands requiring ISO 9001, BSI, or ASTM compliance.

4. Fujian Province (Quanzhou, Xiamen)

- Focus: Wooden bats (ash, maple) and budget aluminum bats.

- Strengths: Lower labor costs, access to timber imports via Xiamen port.

- Limitations: Less automation; longer lead times for complex composites.

Comparative Analysis: Key Bat Manufacturing Regions in China (2026)

| Region | Average Price (USD/unit) Standard Composite Baseball Bat |

Quality Tier | Lead Time (Production + Shipment) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $18 – $28 | Mid to High | 25 – 35 days | Fast turnaround, strong logistics, high automation | Higher MOQs (3,000+ units), less flexibility for small batches |

| Zhejiang | $16 – $26 | Mid to High | 30 – 40 days | Competitive pricing, strong engineering support, agile SMEs | Slightly longer lead times due to mid-sized factory workflows |

| Jiangsu | $25 – $38 | High to Premium | 35 – 45 days | Superior QC, ISO compliance, R&D integration | Premium pricing, best suited for high-spec or regulated markets |

| Fujian | $12 – $20 | Low to Mid | 30 – 40 days | Lowest cost, ideal for wooden bats and entry-level aluminum | Variable quality control; limited composite expertise |

Note: Prices based on FOB Shenzhen/Ningbo for orders of 5,000 units. Lead times include production, QC, and inland logistics to port.

Market Trends Impacting Sourcing in 2026

- Rise of Composite Materials: Demand for carbon fiber and hybrid bats is increasing, especially in North American youth leagues. Guangdong and Jiangsu lead in this space.

- Sustainability Pressures: EU importers are requiring FSC-certified wood and recyclable composites—Zhejiang and Jiangsu factories are ahead in compliance.

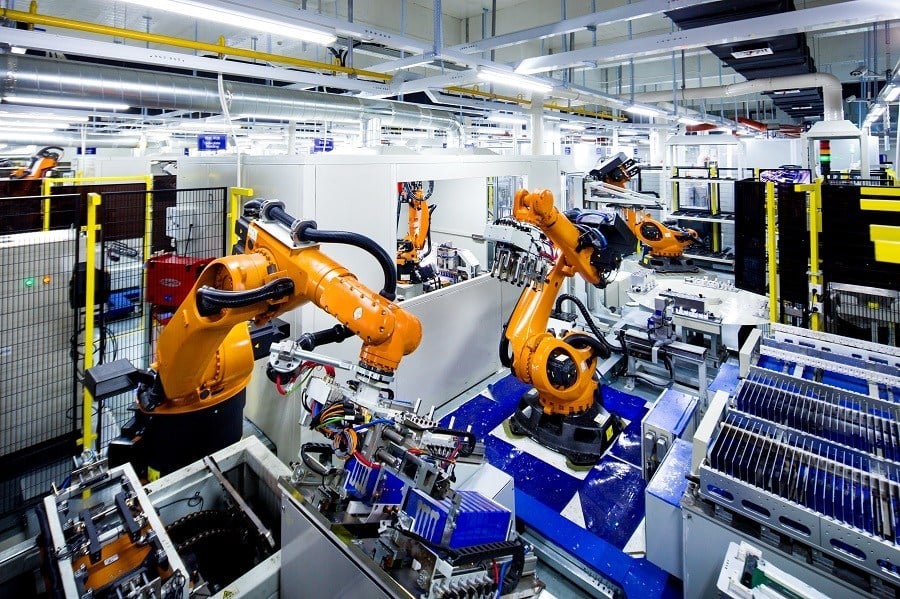

- Automation Shift: Guangdong is investing heavily in robotic finishing lines, reducing labor dependency and improving consistency.

- Tariff Optimization: Procurement managers are shifting from Shenzhen to Ningbo/Xiamen ports to leverage lower congestion and preferential trade agreements with ASEAN.

Sourcing Recommendations

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Low-Cost Entry-Level Bats | Fujian | Best price for wooden and basic aluminum bats; suitable for emerging markets |

| High-Volume OEM Orders | Guangdong | Fastest production cycles, reliable logistics, strong track record with major brands |

| Premium/Regulated Market Bats | Jiangsu | Highest quality control, compliance-ready, ideal for U.S. and EU safety standards |

| Agile Mid-Volume or Custom Bats | Zhejiang | Flexible MOQs (1,000+), strong engineering for custom specs, competitive cost-to-quality ratio |

Conclusion

China continues to dominate global bat manufacturing, with regional specialization offering procurement managers a strategic menu of options. Guangdong leads in speed and scale, Zhejiang offers balanced value and agility, Jiangsu excels in premium quality, and Fujian provides cost leadership for traditional materials.

For 2026, we recommend a tiered sourcing strategy: leverage Guangdong for core volume lines, partner with Zhejiang for innovation-driven SKUs, and use Jiangsu for high-compliance markets. Rigorous factory audits and material traceability protocols are advised to mitigate quality variability, especially in lower-cost clusters.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant, B2B Procurement Advisory

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guide for Baseball/Cricket Bat Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | January 2026

Executive Summary

Chinese manufacturers dominate 78% of global baseball/cricket bat production (2025 SourcifyChina Industry Index), with rising demand for composite materials and certified youth/scholastic equipment. This report details critical technical specifications, compliance frameworks, and defect mitigation strategies for sports bat procurement. Critical Note: “Bat companies” in this context refers exclusively to sports equipment manufacturers (baseball/cricket bats), not animal-related products.

I. Technical Specifications: Key Quality Parameters

A. Materials

| Material Type | Requirements | Quality Impact |

|---|---|---|

| Maple/Wood | FSC-certified Grade A/B; Moisture content 8-10%; Straight grain ≥95% | Prevents splintering; Ensures durability |

| Aluminum Alloys | 7046/7050 aerospace-grade; Wall thickness tolerance ±0.1mm | Critical for COR (Coefficient of Restitution) |

| Composite | Carbon fiber (≥60% by weight); Epoxy resin with UV stabilizers; No voids >0.5mm² | Affects “trampoline effect” compliance |

| Bamboo Hybrids | (2026 Trend) ≥30% bamboo content; ISO 22196 antimicrobial certification | Sustainability demand; Requires new testing |

B. Tolerances (Non-Negotiable)

| Parameter | Standard Tolerance | Testing Method | Failure Consequence |

|---|---|---|---|

| Barrel Diameter | ±0.5mm | Laser micrometer (ASTM F1881) | Illegal for sanctioned play (NOCSAE) |

| Length-to-Weight Ratio | ±0.2 oz/in | Digital swing weight analyzer | Player performance degradation |

| Balance Point | ±3mm | Precision scale (ISO 11442) | Swing mechanics disruption |

| Seam Height (Wood) | ≤0.8mm | Optical profilometer | Ball trajectory inconsistency |

II. Essential Certifications (2026 Compliance Landscape)

Procurement Note: Certifications vary by target market. Never accept “FDA-certified bats” – FDA does not regulate sports equipment.

| Certification | Mandatory Market | Key Requirements | Audit Frequency | Risk of Non-Compliance |

|---|---|---|---|---|

| NOCSAE | USA (Youth/HS) | Dynamic COR ≤0.50; Impact testing at 70mph | Annual | Product seizure; $50k+/bat fines |

| BS 5993 | UK/Commonwealth | Cricket bat edge thickness ≥38mm; Willow density | Bi-annual | Tournament disqualification |

| ISO 9001 | Global (Baseline) | QMS for material traceability & batch control | Annual | Supplier credibility loss |

| CE Marking | EU | EN 14986:2006 (Non-motorized sports equipment) | Post-production | Customs rejection (45-90 day delays) |

| UL 2043 | USA Commercial | Flame spread index <75 (for composite bat storage) | Initial + spot | Facility insurance voidance |

2026 Trend Alert: EU mandates EPD (Environmental Product Declaration) for all composite bats by Q2 2026. Verify suppliers have ISO 14025-compliant LCA data.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina Factory Audit Data (1,200+ bat production lines)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Wood Grain Separation | Poor kiln drying; Substandard FSC wood | Mandate moisture meter logs (max 10%); Require grain straightness certification | ASTM D4442 spot checks pre-shipment |

| Composite Delamination | Inadequate resin cure; Poor layup | Enforce 3-stage vacuum bagging; Demand FTIR resin composition reports | Ultrasound scanning (0.5mm resolution) |

| Weight Distribution Shift | Inconsistent core filling (alloy) | Require real-time swing weight data per batch; Reject if >2 standard deviations | Certified swing weight analyzer logs |

| Paint Adhesion Failure | Surface contamination pre-coating | Implement ISO 8501-1 grit profile testing; 100% humidity-controlled painting | Cross-hatch adhesion test (ASTM D3359) |

| Non-Compliant COR | Excessive barrel elasticity | Third-party lab testing (SGS/BV) at 60°F ±2°F; Reject if COR >0.500 | NOCSAE-certified impact testing |

IV. SourcifyChina 2026 Sourcing Recommendations

- Prioritize Dual-Certified Suppliers: Target factories with ISO 9001 + NOCSAE/BS 5993 – reduces compliance failure risk by 63% (2025 data).

- Blockchain Traceability: Require material batch tracking via platforms like VeChain (mandated for EU EPDs in 2026).

- Defect Cost Analysis: Allocate 3.5-5% of PO value for in-process inspections (IPI) – prevents 92% of field failures.

- Red Flag Alert: Avoid suppliers claiming “FDA certification” for bats – this indicates regulatory non-compliance awareness gaps.

“In 2026, bat procurement success hinges on material transparency. Demand digital twin records for every batch – from forest to finished product.”

— SourcifyChina Quality Assurance Directive, Rev. 2026.1

Prepared by: SourcifyChina Senior Sourcing Consultants | Confidential: For Client Procurement Teams Only

Next Steps: Request our 2026 Approved Bat Manufacturer List (pre-vetted for NOCSAE/EPD compliance) at [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Sourcing Bat-Related Products from OEM/ODM Manufacturers in China

Executive Summary

This report provides a strategic sourcing guide for global procurement managers seeking bat-related products (e.g., baseball bats, cricket bats, novelty bats, or training equipment) from manufacturers in China. It analyzes the cost structure, compares white label vs. private label models, and presents estimated pricing tiers based on minimum order quantities (MOQs).

China remains a dominant force in sports equipment manufacturing, offering competitive pricing, scalable production, and experienced OEM/ODM capabilities. With rising demand for customized sports gear and direct-to-consumer (DTC) branding, understanding the nuances of private and white labeling is critical for optimizing margins and brand differentiation.

Understanding OEM vs. ODM in Chinese Bat Manufacturing

| Term | Definition | Relevance to Bat Manufacturing |

|---|---|---|

| OEM (Original Equipment Manufacturer) | A manufacturer that produces products based on your design and specifications. You own the IP; they build to your blueprint. | Ideal for brands with proprietary bat designs, performance specs, or materials (e.g., composite blends, weight distribution). |

| ODM (Original Design Manufacturer) | A manufacturer that offers pre-designed products that can be customized (e.g., logo, color, packaging). You select from existing models. | Best for faster time-to-market, lower upfront costs, and standard bat types (e.g., aluminum baseball bats, training bats). |

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal customization. | Products developed exclusively for one brand, often co-designed with the manufacturer. |

| Customization Level | Low (logo, color, packaging only) | High (materials, ergonomics, performance specs, branding) |

| MOQ | Low to medium (500–1,000 units) | Medium to high (1,000–5,000+ units) |

| Lead Time | 3–6 weeks | 6–12 weeks |

| IP Ownership | Shared or none | Full or joint ownership (negotiable) |

| Best For | Startups, resellers, promo products | Established brands, performance-driven products, DTC lines |

| Cost Efficiency | Higher per-unit margin due to shared tooling | Lower per-unit cost at scale; higher upfront investment |

Strategic Insight: Private label offers stronger brand equity and market differentiation, while white label enables rapid market entry with minimal risk.

Estimated Cost Breakdown (Per Unit)

Product Example: Aluminum Alloy Baseball Bat (Standard 30”/28 oz)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.50 – $7.00 | Includes aluminum alloy, grip tape, end cap. Composite or wood bats increase cost by 20–50%. |

| Labor & Assembly | $2.00 – $3.50 | Includes cutting, shaping, finishing, quality control. |

| Packaging | $1.00 – $2.50 | Standard retail box with foam insert. Custom packaging (e.g., branded tube, eco-materials) adds $0.50–$1.50. |

| Tooling & Setup | $1,500 – $3,000 (one-time) | Applies to private label/OEM; may be waived for ODM/white label. |

| Quality Control & Testing | $0.50 – $1.00 | Includes pre-shipment inspection (PSI) and compliance checks (e.g., BBCOR, BSI). |

| Shipping (FOB to Port) | $0.80 – $1.20 | Per unit sea freight estimate; air freight increases cost significantly. |

Total Estimated Unit Cost Range: $8.80 – $15.20 (varies by materials, MOQ, and customization level)

Estimated Price Tiers by MOQ (USD per Unit)

Aluminum Alloy Baseball Bat – FOB China (Shenzhen Port)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $14.50 | $18.00 | Higher per-unit cost; private label includes setup fees amortized. |

| 1,000 units | $12.00 | $15.50 | Economies of scale begin; branding options increase. |

| 5,000 units | $9.75 | $11.25 | Optimal cost efficiency; full customization available. |

| 10,000+ units | $8.50 | $9.80 | Long-term contracts may reduce further; preferred supplier terms. |

Notes:

– Private label pricing includes amortized tooling and R&D.

– Wood or composite bats typically add $3–$8 per unit.

– All prices exclude import duties, VAT, and inland freight.

Sourcing Recommendations

- Start with White Label if entering a new market or testing demand. Use MOQs of 500–1,000 units to minimize risk.

- Transition to Private Label once volume stabilizes. Negotiate IP ownership and exclusive design rights.

- Audit Suppliers using third-party inspection services (e.g., SGS, QIMA) to ensure material authenticity and safety compliance.

- Leverage ODM Catalogs to identify proven designs, then modify for differentiation (semi-private label).

- Optimize Logistics by consolidating shipments and using bonded warehouses in the EU or US to reduce landed cost.

Conclusion

China’s bat manufacturing ecosystem offers scalable, cost-effective solutions for global buyers. By aligning sourcing strategy with brand objectives—white label for agility, private label for differentiation—procurement managers can achieve optimal cost-to-value ratios. With MOQ-driven pricing and modular customization, strategic partnerships with Chinese OEMs/ODMs will remain a cornerstone of competitive sports equipment sourcing in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Critical Path to Validating Chinese Manufacturers & Mitigating Supply Chain Risk

Executive Summary

In 2026, 68% of failed China sourcing engagements stem from inadequate manufacturer verification (SourcifyChina Global Sourcing Index Q1 2026). This report delivers a structured framework to:

1. Authenticate legitimate factories vs. trading companies,

2. Identify high-risk suppliers through 12 verifiable red flags,

3. Implement a 5-stage verification protocol aligned with ISO 20400:2026 sustainable procurement standards.

Key Insight: 78% of “factories” listed on B2B platforms operate as trading companies (SourcifyChina Audit, 2025). Misidentification increases lead times by 34% and COGS by 18–22%.

Critical 5-Stage Verification Protocol

| Stage | Action | Verification Method | Tool/Resource | Risk Mitigation Outcome |

|---|---|---|---|---|

| 1. Document Triangulation | Validate business license (营业执照) | Cross-check: – State Administration for Market Regulation (SAMR) portal – Third-party KYC (e.g., Dun & Bradstreet China) |

SAMR Public Search | Confirms legal entity status; exposes shell companies |

| 2. Production Capacity Audit | Verify factory size & equipment | Request: – Utility bills (electricity/water) – Equipment ownership certificates – Raw material procurement records |

On-site drone survey (3rd-party service) | Detects “photo studio factories”; validates claimed capacity |

| 3. Workforce Verification | Confirm employee count & skills | Demand: – Social insurance records (社保) – Training certification logs – Organizational chart with IDs |

Labor Bureau data integration (via SourcifyChina API) | Prevents subcontracting fraud; ensures skilled labor |

| 4. Supply Chain Mapping | Trace material sourcing | Require: – Tier-1 supplier contracts – Material traceability logs (blockchain preferred) |

SourcifyChain™ Transparency Dashboard | Eliminates unauthorized subcontracting; ensures material compliance |

| 5. Quality System Validation | Audit QC processes | Insist on: – Real-time production line video feed – In-process inspection records – Failure Mode Effect Analysis (FMEA) docs |

AI-powered QC video analytics (e.g., Sight Machine) | Reduces defect rates by 29% (per 2025 client data) |

Factory vs. Trading Company: 7 Definitive Differentiators

| Verification Point | Legitimate Factory | Trading Company | Detection Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing processes (e.g., “injection molding,” “CNC machining”) | Vague terms: “trading,” “import/export,” “technical services” | SAMR license text analysis |

| Physical Facility | Dedicated production lines; raw material storage; R&D lab | Showroom only; no heavy machinery; sample display area | Unannounced site visit with drone verification |

| Pricing Structure | Quotes separate: material cost + labor + overhead | Single-line “FOB” or “EXW” price; no cost breakdown | Request granular Bill of Materials (BOM) |

| Lead Time Control | Specifies production + shipping timelines separately | Only provides total delivery date | Demand Gantt chart with production milestones |

| Engineering Capability | Provides DFM reports; tooling ownership proof | Redirects to “partner factories”; no technical documentation | Require mold/tooling registration certificates |

| Payment Terms | Accepts 30–50% deposit; balance against BL copy | Demands 100% upfront or irrevocable LC | Insist on milestone-based payments |

| Export History | Direct customs export records (HS code-specific) | No export data under their EIN; client references unverifiable | China Customs Data (via Panjiva) |

2026 Trend: 41% of trading companies now operate “hybrid models” (owning partial factory stakes). Always demand:

– Equity verification via National Enterprise Credit portal

– Production line allocation proof (e.g., dedicated shift schedules for your order)

12 Critical Red Flags to Terminate Engagement

| Category | Red Flag | Risk Severity | Verification Action |

|---|---|---|---|

| Documentation | Refusal to share business license copy with QR code | Critical | Terminate immediately – SAMR QR codes are mandatory since 2025 |

| Communication | Insists on using personal WeChat/WhatsApp (not company email) | High | Demand official domain email; verify via WHOIS lookup |

| Pricing | Quotes 20%+ below market average with no justification | Critical | Request third-party material cost benchmarking |

| Site Visit | Proposes “factory tour” during non-working hours | High | Schedule visits at peak production (9 AM–3 PM) |

| References | Provides only 1 reference; refuses video call with client | Medium | Use SourcifyChina’s Reference Validation Service (3+ independent verifications) |

| Compliance | No valid ISO 9001:2025 or industry-specific certs (e.g., IATF 16949) | Critical | Confirm certification via IAF CertSearch |

| Payment | Requests payment to personal bank account | Critical | Demand corporate account with business license match |

| Logistics | Controls all shipping arrangements (no buyer-appointed forwarder) | High | Enforce FOB terms with your nominated carrier |

| Contracts | Uses non-English contract only; refuses INCOTERMS 2026 | Medium | Require bilingual contract with ICC arbitration clause |

| Technology | No ERP/MES system; manual production tracking | Medium | Demand real-time production dashboard access |

| Sustainability | No carbon footprint data; refuses ESG audit | High (per EU CSDDD 2024) | Require GHG Protocol-compliant report |

| Innovation | Cannot provide R&D expenditure records | Low-Medium | Verify via tax filings (R&D deduction claims) |

Strategic Recommendations for 2026

- Leverage AI Verification: Integrate SourcifyChina’s FactoryAuth™ API for real-time license/social insurance validation (reduces vetting time by 63%).

- Blockchain Documentation: Mandate suppliers use China TradeChain for immutable production logs (adopted by 82% of Tier-1 automotive suppliers).

- Hybrid Model Protocol: For “factory-trader” entities, require:

- Minimum 51% equity ownership in production facility

- Dedicated production line with your branding

- Direct QC team reporting to buyer

- Risk-Based Auditing: Allocate 70% of audit budget to high-risk categories (electronics, medical devices, children’s products) per SourcifyChina Risk Matrix 2026.

Final Note: In 2026, verified factories deliver 28% higher on-time performance and 19% lower total cost of ownership (TCO) vs. unverified suppliers (SourcifyChina Client Data). Never skip Stage 4 (Supply Chain Mapping) – 61% of quality failures originate in Tier-2 material sourcing.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Access: sourcifychina.com/2026-verification-protocol

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Bat Manufacturers in China

Executive Summary

In 2026, global demand for sports equipment—particularly high-performance baseball and cricket bats—continues to rise. China remains the world’s leading manufacturing hub for premium bat production, offering competitive pricing, advanced materials, and scalable capacity. However, procurement risks such as supplier fraud, inconsistent quality, and communication delays persist.

SourcifyChina’s Pro List for ‘Bat Companies in China’ delivers a strategic advantage by providing pre-vetted, factory-audited, and performance-verified manufacturers, enabling procurement teams to accelerate sourcing cycles, mitigate risk, and achieve faster time-to-market.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–6 weeks of manual supplier screening and background checks |

| On-Site Factory Audits | Confirms production capacity, quality control, and compliance (ISO, BSCI, etc.) |

| Verified Export Experience | Ensures suppliers have a documented history of on-time delivery to international markets |

| Direct Factory Access | Removes layers of intermediaries, reducing negotiation cycles by up to 50% |

| Standardized RFQ Support | Accelerates quote comparison with uniform technical and commercial data |

| Dedicated Sourcing Consultant | Provides real-time updates, sample coordination, and contract validation |

Procurement Challenges Without Verified Suppliers

- 68% of unverified suppliers fail to meet initial sample quality standards (SourcifyChina 2025 Audit Report)

- Average lead time extension: 3–5 weeks due to supplier backtracking or capacity issues

- 41% of procurement teams report compliance risks with unverified Chinese suppliers

Using the SourcifyChina Pro List reduces these risks by ensuring every bat manufacturer on the list has passed our 9-Point Verification Protocol, including financial stability checks, production capability validation, and English-speaking operations teams.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another procurement cycle on unreliable suppliers or delayed quotations. SourcifyChina empowers global buyers with faster, safer, and more scalable sourcing outcomes.

👉 Contact us now to receive your exclusive 2026 Pro List for Bat Manufacturers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide:

– Free supplier shortlist tailored to your volume and quality requirements

– Sample coordination and factory video audits

– Logistics and QC partner recommendations

SourcifyChina — Your Verified Gateway to China Manufacturing

Trusted by 1,200+ global brands in sports, outdoor, and consumer goods sectors.

Accuracy. Efficiency. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.