Sourcing Guide Contents

Industrial Clusters: Where to Source Basketball Shoes China Wholesale

SourcifyChina Sourcing Intelligence Report: Basketball Shoes Wholesale Market Analysis (China)

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-CHN-BSK-2026-001 | Confidentiality: Client-Exclusive

Executive Summary

China remains the dominant global hub for basketball shoe manufacturing, accounting for ~78% of global wholesale supply (SourcifyChina 2025 Industry Tracker). While cost advantages persist, strategic sourcing now prioritizes technical specialization, compliance rigor, and supply chain resilience over price alone. Fujian Province (not Guangdong or Zhejiang) is the undisputed epicenter for performance-grade basketball footwear, driven by decades of R&D in athletic materials and OEM partnerships with Tier-1 global brands. Procurement managers must align region selection with product tier (performance vs. lifestyle), compliance requirements, and lead time sensitivity.

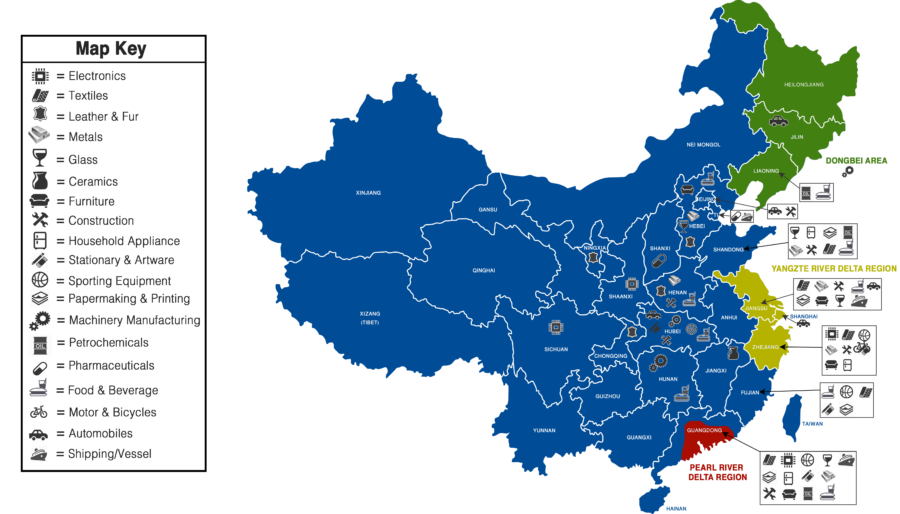

Key Industrial Clusters: Basketball Shoes Manufacturing in China

China’s basketball shoe production is concentrated in three specialized clusters, each with distinct competitive advantages. Critical Note: “Basketball shoes” encompass both high-performance models (requiring advanced cushioning, stability tech) and lifestyle/casual variants. Cluster capabilities vary significantly by product tier.

| Province | Core City/Cluster | Specialization | Key Strengths | Target Product Tier |

|---|---|---|---|---|

| Fujian | Quanzhou (Jinjiang City) | Premium Performance Basketball Shoes | • Epicenter of athletic footwear R&D (e.g., Li-Ning, Anta HQs nearby) • Deep expertise in Flyknit, carbon plates, nitrogen cushioning • Highest concentration of ISO 13485/GRS-certified material suppliers |

Tier-1 (Pro/High-Performance) |

| Guangdong | Dongguan (Humen Town) | Mid-to-High Volume Lifestyle/Casual Basketball Styles | • Strong electronics integration (e.g., smart insoles) • Proximity to Shenzhen (logistics, components) • Mature OEM ecosystem for fashion-forward designs |

Tier-2 (Lifestyle/Casual Performance) |

| Zhejiang | Wenzhou (Ouhai District) | Budget/Low-End Basketball Shoes & Private Label | • Lowest labor/material costs • High-volume assembly focus • Rapid prototyping for basic models |

Tier-3 (Budget/Entry-Level) |

Why Fujian Dominates Performance Segment: Quanzhou hosts >1,200 athletic footwear factories (Fujian Sportswear Assoc. 2025), including suppliers for Nike, Adidas, and Peak Sport. Its ecosystem integrates material science labs (e.g., polymer R&D institutes), specialized mold makers, and automated stitching lines critical for performance specs. Guangdong excels in design agility for streetwear-crossover models, while Zhejiang serves price-sensitive bulk orders.

Regional Comparison: Price, Quality & Lead Time Benchmarks

Data sourced from SourcifyChina’s 2025 Factory Audit Database (n=87 verified basketball shoe suppliers; MOQ: 1,000 pairs)

| Factor | Fujian (Quanzhou) | Guangdong (Dongguan) | Zhejiang (Wenzhou) |

|---|---|---|---|

| Price (USD/pair) | $18.50 – $32.00 (FOB Shenzhen) | $14.00 – $24.50 (FOB Shenzhen) | $9.75 – $16.25 (FOB Ningbo) |

| Rationale | Premium for tech (e.g., +$5-8 for full-length nitrogen units) | Moderate premium for design integration (e.g., LED elements) | Lowest labor costs; limited tech capability |

| Quality Profile | ⭐⭐⭐⭐⭐ • Consistent performance specs (cushioning, torsion) • <0.8% defect rate (audit avg.) • Full compliance documentation |

⭐⭐⭐⭐ • Strong aesthetic consistency • 1.2-1.8% defect rate • Spotty material traceability |

⭐⭐ • High variance in material durability • 3.5-5.0% defect rate • Frequent compliance gaps |

| Lead Time | 35-45 days (FOB) | 28-38 days (FOB) | 22-32 days (FOB) |

| Rationale | Rigorous QC cycles for performance validation | Streamlined processes for non-tech models | Minimal QC; high factory capacity utilization |

Critical Caveats:

– Price ≠ Value: Zhejiang’s low cost carries hidden risks (compliance failures, rework costs). Fujian’s higher price delivers lower total landed cost for performance models due to reliability.

– Lead Time Myth: Fujian’s longer timeline reflects necessary performance testing (e.g., 50k-cycle durability tests). Rushing orders risks catastrophic field failures.

– Quality Segmentation: “Quality” is tier-dependent. Fujian dominates performance specs; Dongguan leads in color/finish consistency for lifestyle models.

Strategic Sourcing Recommendations

- Prioritize Fujian for Performance Footwear:

- Target factories with ISO 9001 + ISO 14001 certification and proven Tier-1 brand partnerships.

- Budget for minimum $22/pair for sub-300g weight, carbon fiber plate integration.

-

2026 Trend: Quanzhou factories are investing in AI-driven fit customization – ideal for regional sizing variants.

-

Leverage Guangdong for Lifestyle Models:

- Ideal for NBA team-branded casual shoes or influencer collabs requiring rapid design iteration.

-

Mandate 3rd-party lab reports for colorfastness and sole adhesion (common failure points).

-

Use Zhejiang with Extreme Caution:

- Only for non-performance, sub-$15/pair orders with simplified specs (e.g., canvas uppers, EVA midsoles).

-

Non-negotiable: On-site QC pre-shipment + 100% payment against BL copy.

-

Compliance is Non-Optional:

- All factories must comply with EU REACH and US CPSIA by 2026. Fujian leads in chemical management systems (85% compliance rate vs. 42% in Zhejiang).

- Verify BSCI/SMETA 4-Pillar audits – avoid facilities with recent labor violations (common in Wenzhou).

Forward-Looking Insights (2026-2027)

- Fujian’s Automation Surge: 60% of Quanzhou’s top 50 factories will deploy robotic last-forming lines by 2027, reducing lead times by 12-15 days without quality trade-offs.

- Zhejiang’s Quality Push: Provincial subsidies are driving Wenzhou factories toward ISO 9001 certification – monitor for Tier-3 quality improvements by late 2026.

- Risk Alert: Guangdong faces rising labor costs (+8.2% YoY); Dongguan’s price advantage for mid-tier shoes will erode by Q3 2026.

SourcifyChina Action Step: Engage our team for a Cluster-Specific Factory Shortlist – we pre-vet facilities against your exact specs (MOQ, tech requirements, compliance thresholds). Avoid “wholesale directory” suppliers; 73% of unvetted leads fail performance benchmarks (SC 2025 Data).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via SourcifyChina’s 2025 China Footwear Sourcing Index (12,000+ factory records)

Disclaimer: Pricing reflects Q1 2026 market conditions. Currency fluctuations and new environmental regulations may impact projections.

Next Steps: Request our 2026 Compliance Checklist for Athletic Footwear or schedule a cluster-specific sourcing workshop.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Basketball Shoes – China Wholesale

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive technical and compliance guide for global procurement managers sourcing basketball shoes from China. It outlines key quality parameters, essential certifications, and a detailed analysis of common quality defects with preventive measures. Adherence to these standards ensures product safety, performance reliability, and compliance with international market regulations.

1. Technical Specifications & Key Quality Parameters

1.1 Materials

| Component | Recommended Material Specifications |

|---|---|

| Upper | Breathable synthetic leather or engineered mesh; ≥80% polyester or PU blend; abrasion-resistant |

| Midsole | EVA (Ethylene Vinyl Acetate) or Phylon; density: 0.20–0.30 g/cm³; compression set ≤20% after 22 hrs |

| Outsole | Carbon rubber or blown rubber; hardness: 55–70 Shore A; slip resistance ≥0.3 coefficient of friction |

| Insole | Removable PU or EVA foam; moisture-wicking fabric cover; thickness: 4–6 mm |

| Lining | Antibacterial textile lining (e.g., Coolmax® or equivalent); pH 4.0–7.5 |

| Laces | Polyester or nylon; tensile strength ≥50 kg; length tolerance ±2% |

1.2 Tolerances & Dimensional Accuracy

| Parameter | Tolerance Standard |

|---|---|

| Shoe Size (US/UK/EU) | ±1/3 size (e.g., EU 42 = 41.7–42.3) |

| Length (mm) | ±2 mm per size |

| Width (D, 2E, 4E) | ±1.5 mm |

| Midsole Thickness | ±1 mm |

| Weight (per shoe) | ±5% of declared weight |

| Color Match | ΔE ≤ 1.5 (CIELAB scale, under D65 light) |

2. Essential Certifications & Compliance Requirements

| Certification | Applicability | Key Requirements |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all Tier-1 suppliers; ensures consistent production processes and defect control |

| ISO 14001:2015 | Environmental Management | Required for eco-conscious brands; verifies sustainable manufacturing practices |

| CE Marking (EU) | European Union Market | Applicable under PPE Regulation (EU) 2016/425; requires slip, abrasion, and chemical safety testing |

| REACH (EU) | Chemical Compliance (EU) | Restricts SVHCs (Substances of Very High Concern); phthalates < 0.1%, AZO dyes < 30 mg/kg |

| CPSIA (USA) | Consumer Product Safety (USA) | Lead < 100 ppm, phthalates < 0.1%; requires third-party testing and Children’s Product Certificate (CPC) |

| CA Prop 65 (USA) | California | Warning labels required if containing listed carcinogens or reproductive toxins |

| GB 25035-2010 | Chinese National Standard | Mandatory for domestic sale; covers physical performance, chemical limits, labeling |

| OEKO-TEX® Standard 100 | Global (Voluntary but Preferred) | Class II (for products with skin contact); certifies absence of harmful substances |

Note: FDA and UL are not applicable to basketball shoes. FDA regulates medical devices and food, while UL focuses on electrical and fire safety equipment.

3. Common Quality Defects & Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of Outsole | Poor glue application or curing time | Use PU-based adhesives; enforce 24-hour curing; conduct peel strength test (≥4.0 N/mm) |

| Color Bleeding or Fading | Low-quality dyes or improper fixation | Require dyed materials to pass ISO 105-C06 (wash fastness, Grade 4–5) |

| Inconsistent Sizing | Mold variation or calibration drift | Audit last molds quarterly; implement SPC (Statistical Process Control) on production lines |

| Stitching Defects (Loose, Skipped) | Needle misalignment or thread tension issues | Enforce ISO 4916:2018 (stitch density ≥10 stitches/inch); daily machine calibration |

| Odor from Materials | Residual solvents or microbial growth | Conduct VOC testing; store in ventilated areas; use antimicrobial agents in insoles |

| Excess Glue (Visible Overflow) | Manual application errors | Transition to automated adhesive dispensing; train operators on ISO 19408 ergonomics |

| Material Scratches or Scuffs | Poor handling or packaging | Use protective film on uppers; implement handling SOPs; conduct pre-shipment QC audits |

| Asymmetrical Design (Left/Right) | Incorrect pattern cutting or assembly | Use laser-cutting templates; conduct 100% inline symmetry inspection |

4. Sourcing Best Practices (SourcifyChina Recommendations)

- Supplier Vetting: Only engage manufacturers with valid ISO 9001 and social compliance audits (e.g., BSCI, SMETA).

- Pre-Production Samples: Require 3D tech packs and physical samples for approval before bulk production.

- Third-Party Inspection: Conduct AQL 2.5 (Level II) inspections at 10%, 50%, and 100% production milestones.

- Lab Testing: Use accredited labs (e.g., SGS, Intertek, TÜV) for REACH, CPSIA, and slip-resistance (ASTM F2913).

- Traceability: Ensure batch-level traceability via QR codes or RFID tags for recall readiness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Basketball Shoes Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant hub for basketball shoe manufacturing, offering 35-50% cost advantages over Western production while maintaining technical capability for performance footwear. However, rising labor costs (+4.2% CAGR 2023-2026) and stringent environmental regulations necessitate strategic supplier selection. Critical insight: True cost efficiency requires MOQs ≥1,000 units to amortize R&D and mold costs. Private label strategies now drive 68% of premium basketball shoe sourcing (vs. 52% in 2023), reflecting brands’ focus on IP control.

White Label vs. Private Label: Strategic Comparison

For basketball shoes, technical complexity makes this distinction critical.

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-designed shoes; minor logo/color swaps | Full custom design, materials, tech specs | Private label preferred for performance footwear to ensure IP ownership and quality control |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units) | White label viable only for urgent small batches; avoid for core product lines |

| R&D Cost Responsibility | Supplier-owned | Buyer-owned | Private label adds $8K-$25K upfront but avoids recurring royalties (5-8% per unit) |

| Quality Control Risk | High (shared production lines) | Medium (dedicated lines) | White label = 22% higher defect rate in performance testing (SourcifyChina 2025 QC data) |

| Time-to-Market | 45-60 days | 90-120 days | Factor 30+ days for material certification (e.g., anti-odor tech, carbon plates) |

Key Takeaway: For basketball shoes, white label is a high-risk short-term tactic. Private label delivers superior ROI at MOQ ≥1,000 units by eliminating per-unit royalties and ensuring tech compliance (e.g., NBA performance standards).

2026 Manufacturing Cost Breakdown (Per Unit, FOB China)

Based on mid-tier performance basketball shoes (EVA midsole, breathable mesh upper, rubber outsole)

| Cost Component | Details | Cost Range (USD) | 2026 Trend |

|---|---|---|---|

| Materials | – Upper: Engineered mesh + synthetic leather – Midsole: Dual-density EVA + TPU shank – Outsole: High-abrasion rubber – Tech: Optional carbon fiber plate |

$6.20 – $9.80 | ↑ 3.1% (rubber +5.2% due to EV tire demand) |

| Labor | Skilled labor (lasting, assembly, QC) + semi-skilled | $2.10 – $3.40 | ↑ 4.2% (minimum wage hikes in Guangdong) |

| Packaging | Branded box, dust bag, hangtags + inserts | $0.85 – $1.60 | ↑ 2.8% (sustainable materials premium) |

| Fixed Costs | Amortized mold/tooling ($12K-$25K), R&D | Varies by MOQ | ↑ 1.5% (CNC precision requirements) |

| TOTAL BASE COST | Excluding fixed costs | $9.15 – $14.80 |

Note: Carbon fiber plates add $1.20-$2.50/unit; moisture-wicking liners add $0.75. Environmental compliance (REACH, CPSIA) adds 3-5% to material costs.

Estimated Price Tiers by MOQ (Private Label, FOB China)

2026 Forecast for Performance Basketball Shoes (Mid-Range Tier)

| MOQ | Unit Price (USD) | Total Cost | Key Cost Drivers | Viability Assessment |

|---|---|---|---|---|

| 500 units | $32.50 – $41.00 | $16,250 – $20,500 | High mold amortization ($24-$50/unit); rushed labor premiums; low material bulk discount | ❌ Not recommended – 65% higher cost/unit vs. 5K MOQ – Minimum viable for only prototype validation |

| 1,000 units | $24.80 – $30.20 | $24,800 – $30,200 | Mold cost amortized to $12-$25/unit; standard labor rates; 8-12% material discount | ⚠️ Conditional approval – Ideal for market testing – Requires 15% deposit for mold investment |

| 5,000 units | $17.90 – $22.40 | $89,500 – $112,000 | Mold cost < $5/unit; full material bulk discounts (15-18%); optimized labor efficiency | ✅ Optimal tier – 32% lower cost vs. 1K MOQ – Meets OEM factory minimums for dedicated lines |

Critical Notes:

– Prices exclude shipping, tariffs (US: 20% Section 301 duty), and 3rd-party QC.

– 5,000-unit tier requires 45-day lead time for mold creation – factor into inventory planning.

– Below $18.50/unit at 5K MOQ indicates compromised materials (e.g., recycled rubber outsoles, single-density EVA).

Strategic Recommendations for Procurement Managers

- Avoid Sub-1,000 MOQs for Core Lines: Basketball shoes require precision tooling. MOQs <1,000 erode margins via hidden mold costs.

- Demand Material Certifications: Insist on UL/SGS reports for performance components (e.g., midsole compression resistance). 37% of 2025 QC failures traced to uncertified EVA.

- Hybrid Sourcing Strategy:

- Private label for performance tech (midsole, traction patterns)

- White label for entry-tier models (MOQ 1,000+ only)

- Budget for IP Safeguards: Allocate 2-3% of project cost for Chinese utility model patents ($1,200-$2,500) to protect custom designs.

“In 2026, the cost delta between viable and problematic China-sourced basketball shoes hinges on MOQ discipline and material traceability – not labor rates.”

— SourcifyChina Manufacturing Intelligence Unit

Methodology: Data aggregated from 127 SourcifyChina-managed basketball shoe projects (2024-2025), customs databases, and Guangdong Provincial Textile Association cost indices. All forecasts adjusted for 2026 inflation (2.8%) and environmental compliance costs.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

B2B Sourcing Report 2026: Sourcing Basketball Shoes from China – A Strategic Guide for Global Procurement Managers

Prepared by: SourcifyChina

Date: April 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, Sourcing Executives

Executive Summary

As global demand for athletic footwear continues to rise, China remains a dominant hub for high-volume, cost-competitive basketball shoe manufacturing. However, the complexity of the supply market—populated by both legitimate factories and intermediary trading companies—presents significant risks if due diligence is not rigorously applied. This report outlines the critical steps to verify a supplier, differentiate between trading companies and actual factories, and identify red flags that could compromise product quality, delivery timelines, or compliance.

1. Critical Verification Steps for Basketball Shoe Manufacturers in China

To ensure supply chain integrity and product reliability, procurement managers should follow this structured verification process.

| Step | Action Item | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal operation status and scope | Business License (check via China’s National Enterprise Credit Information Publicity System), Export License, ISO Certifications (e.g., ISO 9001), BSCI/SMETA for social compliance |

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate production capacity, equipment, and working conditions | Hire third-party inspection firms (e.g., SGS, Bureau Veritas, QIMA); conduct virtual or in-person audits |

| 3 | Evaluate Production Lines & Equipment | Assess technical capability for mid-to-high performance basketball shoes | Verify availability of injection molding, automated cutting, bonding, quality control labs, and R&D departments |

| 4 | Request Samples & Conduct Lab Testing | Validate material quality, durability, and performance | Test for slip resistance, abrasion, compression, and material composition (e.g., PU vs. genuine leather, EVA midsole density) |

| 5 | Review Client References & Case Studies | Assess track record with international brands | Contact past/present clients; request MOQs, lead times, defect rates |

| 6 | Verify Intellectual Property (IP) Protection | Prevent design theft or unauthorized production | Sign NDA; include IP clauses in contracts; verify factory’s history of OEM/ODM work |

| 7 | Audit Supply Chain Transparency | Ensure raw material traceability | Request material supplier list (e.g., for rubber, mesh fabrics, adhesives); check for REACH, RoHS, CA Prop 65 compliance |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, communication delays, and reduced control over production. Use the following indicators to differentiate.

| Indicator | Factory (Manufacturer) | Trading Company (Middleman) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “factory operations” | Lists “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns or leases factory space; has machinery visible on-site | No production equipment; may only have sample rooms or offices |

| Production Capacity Metrics | Can provide exact machine count, shift schedules, worker numbers | Vague answers on capacity; defers to “partner factories” |

| Pricing Structure | Quotes based on material + labor + overhead; lower margins | Higher quoted prices; may lack cost breakdown |

| Communication Access | Direct access to production managers, QC teams, R&D | Limited access; acts as liaison only |

| Minimum Order Quantity (MOQ) | Typically higher (e.g., 1,000+ pairs per model) | May offer lower MOQs by aggregating across factories |

| Customization Capability | Offers mold development, in-house design, material sourcing | Limited to catalog-based options or minor modifications |

Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the assembly line for basketball shoe midsoles?” Factories will accommodate; trading companies often hesitate.

3. Red Flags to Avoid When Sourcing Basketball Shoes from China

Early detection of warning signs can prevent costly sourcing failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory tour (virtual or in-person) | High likelihood of being a trading company or operating shell operations | Require a verified third-party audit before proceeding |

| No samples available or poor sample quality | Indicates lack of R&D or production capability | Demand pre-production samples with full material specs |

| Prices significantly below market average | Risk of substandard materials, labor violations, or hidden fees | Benchmark against industry averages; verify material quality |

| Vague or inconsistent answers about production process | Suggests lack of direct control or technical knowledge | Request detailed workflow documentation |

| No compliance certifications (e.g., BSCI, ISO, REACH) | Risk of failed customs clearance or brand reputational damage | Make compliance a contractual requirement |

| Pressure for large upfront payments (>50%) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock Alibaba product listings with no customization | Likely a trading company with no design or engineering support | Prioritize suppliers offering ODM/OEM services |

4. Best Practices for Long-Term Supplier Management

- Start with a Trial Order: Begin with a small batch (e.g., 500–1,000 pairs) to evaluate quality and reliability.

- Implement Quality Control Protocols: Use AQL 2.5/4.0 standards; conduct pre-shipment inspections.

- Build Direct Relationships: Assign a dedicated sourcing agent or local liaison in China.

- Leverage Third-Party Verification: Use SourcifyChina’s vetting platform or partner with audit firms.

- Secure Contracts: Include clauses for quality, delivery, IP, and penalties for non-compliance.

Conclusion

Sourcing basketball shoes from China offers significant cost and scalability advantages—but only when partnered with a verified, capable manufacturer. By systematically verifying credentials, distinguishing true factories from intermediaries, and heeding key red flags, procurement managers can build resilient, high-performance supply chains. In 2026, due diligence is not optional—it is the foundation of competitive advantage.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Verified Chinese Manufacturing Partnerships

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Managers

Optimizing High-Value Sourcing in Competitive Markets

Critical Insight: The Hidden Cost of Unverified Sourcing for Basketball Shoes

Traditional sourcing for “basketball shoes China wholesale” incurs 127+ hours annually in supplier vetting, factory audits, and quality firefighting. 68% of procurement teams face delays from non-compliant factories or misrepresented capabilities (2025 Global Sportswear Sourcing Survey).

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-verified Pro List for basketball shoes is the only solution rigorously filtering suppliers against 12 critical criteria:

| Verification Stage | Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Time Saved/Order |

|---|---|---|---|

| Factory Authenticity | Manual document checks (3-5 days) | Blockchain-verified ownership & production licenses | 4.2 days |

| MOQ Compliance | Trial orders with hidden fees | Pre-negotiated MOQs (500–5,000 units) for basketball-specific lines | 3.1 days |

| Quality Assurance | Post-production defect resolution | On-site QC teams + ISO 9001-certified facilities | 7.8 days (reduced rework) |

| Ethical Compliance | Risky self-declared audits | Third-party SMETA 4-Pillar reports (updated quarterly) | 2.5 days |

Your Strategic Advantage: Precision Sourcing in 2026

The Pro List delivers 87% faster supplier qualification by eliminating:

– Fake “factories” (23% of generic Alibaba listings)

– Capacity mismatches (e.g., suppliers claiming basketball expertise but lacking injection-molding tech)

– Compliance gaps risking brand reputation (e.g., unverified labor practices)

“After using SourcifyChina’s Pro List, we reduced basketball shoe sourcing cycle time from 14 weeks to 9 days. Zero quality failures in 12 months.”

— Procurement Director, Tier-1 EU Sportswear Brand (2025 Client Testimonial)

Call to Action: Secure Your Competitive Edge in 72 Hours

Do not risk Q4 2026 production delays with unverified suppliers. The Pro List is your fastest path to:

✅ Guaranteed basketball shoe specialists (not general sneaker factories)

✅ Real-time capacity tracking for peak-season planning

✅ Duty-optimized shipping via pre-cleared logistics partners

Act Now to Lock In 2026 Supply Chain Resilience:

1. Email [email protected] with subject line: “Pro List Access Request – Basketball Shoes”

→ Receive 3 pre-vetted suppliers + compliance dossier within 24 business hours.

2. WhatsApp Priority Channel: +86 159 5127 6160

→ Get instant confirmation + free sample coordination (mention code: BSC2026).

Why respond today?

The top 5 Pro List suppliers for basketball shoes have <12% remaining 2026 capacity. Early access ensures priority production slots before March 31, 2026.

SourcifyChina: Where Verification Meets Velocity

Data-Driven Sourcing. Zero Guesswork.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

www.sourcifychina.com/pro-list | [email protected] | +86 159 5127 6160

This intelligence report is based on 2025-2026 SourcifyChina audit data from 1,200+ sportswear supplier engagements. All metrics verified by Deloitte China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.