Introduction: Navigating the Global Market for online general shop

In today’s hyper-connected global economy, procuring products efficiently and competitively can define a business’s success—especially when operating across diverse markets such as Africa, South America, the Middle East, and Europe. The evolution of the online general shop has transformed the B2B landscape, offering unparalleled access to a vast range of goods, suppliers, and fulfillment solutions. Whether sourcing for retail chains in Nigeria, distribution networks in Brazil, or independent wholesalers in France, international buyers now face both unprecedented opportunities and unique complexities.

Online general shops, powered by robust digital platforms, facilitate real-time supplier discovery, transparent pricing, and swift procurement—shrinking lead times and enabling data-driven decisions. Yet, navigating this ecosystem demands strategic insight: from choosing between wholesale, dropshipping, or white/private label manufacturing, to evaluating different materials, vetting suppliers, and understanding fluctuating global costs. Challenges such as regulatory compliance, quality control, and dynamic market trends are particularly acute for buyers handling cross-border logistics and working within varied regulatory frameworks.

This guide delivers a comprehensive roadmap to sourcing from online general shops at scale. It covers the main sourcing models and product types, explores key materials and manufacturing considerations, outlines supplier evaluation and quality assurance strategies, and delves into cost structures, market dynamics, and frequently asked questions—all tailored for ambitious international buyers. With actionable insights and expert strategies, you’ll be empowered to make informed, risk-mitigated decisions that drive profitability and long-term business growth in any global market segment.

Understanding online general shop Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| B2B Marketplace | Aggregates multiple suppliers, diverse product categories | Bulk sourcing, supplier comparison | Wide selection and competitive pricing; may require careful supplier vetting |

| Wholesaler Online Store | Sells goods in large quantities directly from stock | Inventory replenishment, distributor sourcing | Fast fulfillment and volume discounts; less flexibility in order customization |

| Dropshipping Platform | No inventory held by buyer; supplier ships directly to end customer | Test markets, minimize capital outlay | Low upfront cost, reduced logistics; less control over stock and delivery |

| Vertical/Niche General Shop | Focused on industry-specific or category-specific products | Sector-sourced supplies (e.g., medical, auto) | Specialized offerings, higher quality; limited range may impact consolidation |

| Manufacturer Direct Shop | Direct factory interface, customization and private/white labeling offered | Bespoke goods, branding initiatives | Custom products, cost savings on high volume; higher MOQs, longer lead times |

B2B Marketplace

A B2B marketplace is a platform hosting numerous suppliers and buyers, typically across various product categories. These sites enable buyers to compare suppliers, negotiate in bulk, and access a broad selection on a single channel. For B2B buyers, this is especially valuable when sourcing for multi-category inventory or managing multiple supplier relationships. However, due diligence in supplier vetting is essential due to varying quality standards and potential logistical complexities.

Wholesaler Online Store

Wholesaler online stores stock and sell products in large volumes, often directly from warehouses or distribution hubs. They’re ideal for B2B buyers needing consistent restocks or large volumes—such as retailers, resellers, or office supply purchasers. Pros include reliable inventory availability and competitive bulk pricing; however, order flexibility can be limited, and buyers must manage their own warehousing and logistics.

Dropshipping Platform

Dropshipping platforms let B2B buyers sell goods without owning inventory; products are shipped directly from supplier to the end customer. This enables businesses to experiment with new product lines or serve niche markets with minimal risk and investment. For B2B buyers in Africa, South America, or new market entrants, this reduces capital and warehousing needs but limits control over delivery speed, packaging, and potential returns.

Vertical/Niche General Shop

Vertical or niche general shops specialize in products tailored to a specific sector or category, such as medical supplies, automotive parts, or hospitality goods. These shops are particularly efficient for buyers seeking sector-aligned products with expertise and quality assurance. Buyers gain from curated quality and reliability but may face limited product diversity, requiring separate sourcing for other categories.

Manufacturer Direct Shop

Manufacturer direct shops provide a direct line from factory to buyer, offering private or white-label capabilities and customization options. This is advantageous for businesses seeking unique branding, higher margins, or specific material standards. While these arrangements typically promise cost savings on higher volumes and enhanced quality control, they also come with higher minimum order quantities and longer lead times—important factors in managing cash flow and inventory planning.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of online general shop

| Industry/Sector | Specific Application of online general shop | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Retail & Wholesale | Bulk procurement of fast-moving consumer goods (FMCG) | Streamlined supply chain, better pricing, wider assortment | Supplier reliability, delivery timelines, regional compliance |

| Construction & Building | Sourcing of building materials & equipment | On-demand access, cost control, specification matching | Material standards, bulk discounts, logistics/delivery capability |

| Healthcare & Medical | Acquisition of medical supplies & devices | Rapid sourcing, compliance, traceability | Regulatory certifications, supplier vetting, cold chain needs |

| Hospitality (Hotels, Restaurants) | Procurement of furniture, appliances, consumables | Centralized purchasing, quality options, cost savings | Minimum order quantities, after-sales support, customization |

| Manufacturing | Sourcing maintenance, repair, and operations (MRO) supplies | Improved uptime, quick restocking, spend transparency | Inventory management, supplier diversity, contract terms |

Retail & Wholesale: Bulk Procurement of FMCG

Online general shops are vital to retail and wholesale buyers aiming to streamline procurement of everyday goods, especially in markets with fragmented supply chains such as Africa and South America. Buyers gain access to a broad assortment of products—from packaged foods to personal care items—at competitive rates. This approach enables greater price negotiation power, more transparent supplier vetting, and improved lead time management. For international buyers, it’s key to evaluate supplier reliability, ensure that imported goods comply with regional standards, and verify consistent delivery performance.

Construction & Building: Sourcing of Building Materials & Equipment

The construction sector relies on online general shops to source everything from basic fasteners to complex machinery. These platforms consolidate suppliers and enable buyers to compare prices, review technical specifications, and order in bulk, which is essential for multi-site projects in Europe, the Middle East, and rapidly developing areas in Africa. Challenges include verifying local compliance (e.g., CE, ISO standards), coordinating bulk shipments, and ensuring real-time communication with suppliers to avoid project delays.

Healthcare & Medical: Acquisition of Medical Supplies & Devices

Procurement teams in hospitals and clinics leverage online general shops for medical supplies, PPE, and devices—an application underscored by recent global health emergencies. Benefits include rapid stock replenishment, broad market access, and compliance documentation at purchase. Buyers, especially in regions with strict regulatory frameworks like Europe or emerging markets with evolving standards, must thoroughly vet suppliers for licensing, regulatory adherence, and the ability to handle specialized logistics such as temperature-controlled shipping.

Hospitality: Procurement of Furniture, Appliances, and Consumables

Hotels and restaurants, particularly those expanding or upgrading in tourism hubs like the UAE, Brazil, or the UK, use online general shops to centralize procurement of goods such as furnishings, kitchen appliances, and consumables. The ability to compare multiple suppliers improves quality selection and pricing transparency. Key concerns include ensuring minimum order quantities match project needs, after-sales support for technical items, and the availability of customization for branding purposes.

Manufacturing: Sourcing Maintenance, Repair, and Operations (MRO) Supplies

Manufacturing facilities across diverse geographies depend on online general shops for timely procurement of MRO items—critical to minimizing downtime. General shops provide consolidated access to hundreds of SKUs, enabling plant managers to replenish stock quickly and maintain operational continuity. For international buyers, evaluating suppliers for inventory management capabilities, contract flexibility, and delivery speed is crucial to navigate logistics challenges and unplanned maintenance demands.

Related Video: FANUC Industrial Robots | AUDI Case Study

Strategic Material Selection Guide for online general shop

Analysis of Common Materials Used in Online General Shop Products

Selecting the right material is crucial for any B2B buyer sourcing products via an online general shop. Your choices directly affect product durability, performance, compliance, total landed cost, and end-user satisfaction, especially given the diverse market conditions and regulations across Africa, South America, the Middle East, and Europe. Below, four widely used materials are analyzed from a practical, B2B sourcing perspective.

1. Polypropylene (PP) Plastics

Key Properties:

Polypropylene is a thermoplastic polymer known for its impressive chemical resistance, moderate impact resistance, and low moisture absorption. It offers a broad operating temperature range (typically up to 100°C), making it appropriate for various consumer and industrial products.

Pros & Cons:

PP is lightweight, cost-effective, and easy to mold into complex shapes, which keeps manufacturing and shipping costs down. However, it’s not as strong as some other plastics and can degrade if exposed to UV light for extended periods without stabilizers.

Impact on Application:

PP is highly compatible with everyday goods—storage containers, household items, packaging, and even certain valves or fittings for non-critical applications. Its resistance to common chemicals makes it ideal in regions with variable water quality or cleaning agents.

Regional Considerations:

International buyers should check for compliance with food-contact (e.g., EU Regulation 10/2011, FDA) or environmental safety standards, as products may require recycling marks or certificates depending on destination markets. European and Middle Eastern markets often demand REACH and RoHS compliance.

2. Stainless Steel (e.g., AISI 304/316)

Key Properties:

Stainless steel grades (304 and 316) are renowned for corrosion resistance, high mechanical strength, and the ability to withstand both high and low temperatures. 316 offers superior performance in saline or acidic environments due to added molybdenum.

Pros & Cons:

Stainless steel is durable and has a prestigious, hygienic appearance suitable for premium goods. Nevertheless, it has higher material and processing costs and is heavier (increasing shipping expenses).

Impact on Application:

Whether for kitchenware, tools, display racks, or fittings, stainless steel offers longevity and brand assurance. It is especially relevant where hygiene (food/contact surfaces) or harsh usage environments are priorities.

Regional Considerations:

Stainless steel products must meet recognized international standards (ASTM A240, EN 1.4301/1.4401). European and UK buyers may require CE marking for specific end-use, while Middle Eastern buyers may expect GCC standards compliance. As a non-tariff barrier, traceability of origin and composition can impact customs clearance in Africa and South America.

3. High-Density Polyethylene (HDPE)

Key Properties:

HDPE is a robust, lightweight thermoplastic offering excellent impact strength, low moisture absorption, and chemical resistance. It remains flexible at lower temperatures, making it adaptable to varying climates.

Pros & Cons:

Its cost is relatively low, and it’s widely available for use in bottles, storage bins, plumbing parts, and children’s products. However, it is sensitive to UV (unless modified) and generally has lower maximum use temperatures compared to other engineering plastics.

Impact on Application:

HDPE’s non-reactive nature suits packaging, piping for potable water, and outdoor goods. In regions with unreliable supply chains or infrastructure, its durability and repairability make it attractive for B2B buyers.

Regional Considerations:

International buyers must ensure compliance with potable water contact standards (e.g., NSF, WRAS in the UK, local approvals in Africa and the Middle East). For food-related goods, certification to relevant standards is needed for EU and GCC entry.

4. Carbon Steel (e.g., ASTM A36 or equivalent)

Key Properties:

Carbon steel is valued for its strength, machinability, and moderate cost. However, it is vulnerable to corrosion unless coated or treated, and not as ductile as stainless varieties.

Pros & Cons:

This material’s primary advantage is affordability and suitability for high-strength applications such as shelving, hardware, machine parts, and furniture frames. Its main drawback is corrosion risk, particularly in humid or marine climates.

Impact on Application:

When surface treated (galvanized or painted), carbon steel products are widely used in infrastructure and durable goods, including products requiring load-bearing properties.

Regional Considerations:

Conformity with ASTM, JIS, or DIN specifications may be requested by buyers, with Africa and South America often favoring cost-efficiency over corrosion resistance. UK and EU markets may require REACH compliance for coatings/paints and evidence of sustainable sourcing.

Summary Table: Material Selection for Online General Shop

| Material | Typical Use Case for online general shop | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene (PP) | Storage containers, household items, basic plumbing parts | Lightweight, chemically resistant, low cost | UV degradation, moderate mechanical strength | Low |

| Stainless Steel (AISI 304/316) | Kitchenware, tools, high-end fittings, racks | Excellent corrosion resistance, premium appearance | Higher cost, heavy (increases shipping cost) | High |

| High-Density Polyethylene (HDPE) | Packaging, water piping, bins, outdoor goods | Durable, impact resistant, suitable for food/water | Sensitive to UV unless stabilized, moderate heat resistance | Low |

| Carbon Steel (e.g., ASTM A36) | Structural components, hardware, shelving, frames | Strong, cost-effective for structural use | Prone to corrosion if uncoated; less ductile than stainless | Low |

This strategic review allows global B2B buyers to compare materials in terms of performance, application suitability, compliance requirements, and total cost—essential for making informed procurement decisions adapted to regional demands.

In-depth Look: Manufacturing Processes and Quality Assurance for online general shop

Understanding the End-to-End Production and Quality Workflow in Online General Shop Sourcing

Selecting the right manufacturing partners and ensuring robust quality assurance is crucial for B2B buyers sourcing through online general shops—especially when dealing with complex, multi-category assortments destined for diverse global markets. This section unpacks the main stages of manufacturing, the critical elements of quality control (QC), and actionable steps international buyers can take to ensure product reliability, compliance, and consistency.

Key Stages of the Manufacturing Process

The manufacturing pipeline for general online shop goods—spanning consumer electronics, textiles, homewares, tools, and more—is anchored on four core stages:

1. Material Preparation and Sourcing

- Supplier Qualification: Reliable manufacturers begin with vetted, traceable raw materials. Leading suppliers often maintain long-term relationships with certified upstream vendors.

- Material Inspection: Incoming batches undergo verification via standard tests (dimensional checks, purity analysis, visual inspections).

- Documentation: Batch numbers, COAs (Certificates of Analysis), and sustainability credentials are recorded—a critical step for importers needing traceability or eco-certification.

2. Forming and Primary Processing

- Key Techniques: Depending on the category, this includes cutting, molding, casting, extrusion, or weaving. In plastics, injection molding dominates; for textiles, automated cutting and sewing lines are standard.

- Automation vs. Manual: Advanced plants use robotics and CNC machinery to deliver consistency. Manual or semi-automated processes persist in some lower-cost facilities, which can affect repeatability and unit-to-unit quality.

3. Assembly and Secondary Processing

- Component Integration: Products are assembled—either on progressive lines (ideal for electronics/toys) or in station-based setups (common for furniture and apparel).

- Secondary Operations: Surface treatments (painting, plating), stitching, or testing for electronics functionality are added at this stage.

4. Finishing, Packaging, and Logistics Prep

- Finishing: Surface quality inspections, edge trimming, labeling, and application of localizations (e.g., multi-language manuals or power plugs for destination regions).

- Packaging: Designed for protection in transit—must comply with import/export requirements (such as ISPM-15 for wood, or REACH for chemical safety).

- Final Kitting: Products consolidated into wholesale or retail-ready formats before shipping.

Quality Control: Frameworks and Practices that Safeguard B2B Buyers

Maintaining product quality throughout the entire production chain is non-negotiable in cross-border commerce. For international B2B buyers, attention to globally recognized standards and robust checkpoint practices is key.

International Standards & Certifications

- ISO 9001 (Quality Management Systems): The global baseline for manufacturing and process QA. A certified supplier demonstrates standardized processes, corrective action protocols, and continuous improvement.

- Industry-Specific Certifications:

- CE Mark: Required for products entering the EU/UK, especially electronics, toys, and machinery.

- RoHS: For electronics, ensuring restrictions of hazardous substances.

- API, ASTM, EN: Relevant for mechanical products, construction materials, or PPE.

- SASO, SONCAP, NRCS, INVIMA: Local certifications mandatory for certain Middle East, African, or South American markets.

B2B buyers should request up-to-date certificates, verifying their authenticity with issuing bodies to avoid fraudulent documentation.

The Three Pillars of Quality Control: IQC, IPQC, FQC

A mature factory’s QC system involves checkpoints at distinct production stages:

1. IQC – Incoming Quality Control

- Purpose: Ensures that raw materials and components meet specifications before entering production.

- Methods: AQL (Acceptance Quality Limit) sampling, supplier batch records, laboratory verification.

- Documentation: IQC reports with batch numbers, photos, and rejection rates; crucial for traceability.

2. IPQC – In-Process Quality Control

- Purpose: Monitors key production processes to catch deviations early.

- Methods: In-line sampling, real-time data collection (e.g., torque, tension, temperature readings), visual inspections.

- Benefits to Buyers: Early detection prevents wastage, reworks, or downstream defects, reducing delivery risks.

3. FQC – Final Quality Control

- Purpose: Verifies that finished goods conform to agreed standards before shipment.

- Methods: Functionality tests (for electronics), appearance grading, safety checks, packaging integrity audits.

- Documentation: FQC checklists, product photos, batch approval records—often required for customs clearance or distributor acceptance.

Common Testing and Inspection Methods

B2B buyers should be aware of, and specify, testing aligned with product type and destination regulations:

- Mechanical/Physical Testing: Load/endurance tests, abrasion/impact resistance (applicable to tools, hardware, furniture).

- Electrical Testing: Voltage/current integrity, insulation, EMC compliance (for electronics).

- Chemical Testing: Heavy metal content, phthalates, and compliance with REACH or California Proposition 65.

- Functional Testing: Routine measurement to verify product works as specified under typical user conditions.

- Sampling Protocols: Adopt AQL levels appropriate to order value and risk (e.g., stricter AQL for medical or safety products).

Verifying Supplier Quality Assurance: Due Diligence for International B2B Buyers

Relying solely on supplier promises is a pitfall. Buyers from Africa, South America, the Middle East, and Europe must proactively verify QC robustness:

1. Factory Audits

- What to Do: Arrange for on-site or virtual audits (directly or via an accredited third party) before committing to large orders.

- What to Assess: Management systems, process flows, traceability from raw material to finished product, maintenance and calibration logs, staff training records.

2. Review of QC Documentation

- Essential Docs to Request:

- QC process flowcharts and SOPs (Standard Operating Procedures)

- Sample IQC/IPQC/FQC reports from past orders

- Up-to-date certificates (ISO, CE, etc.)

- Lab test reports—preferably from certified international labs (e.g., SGS, TÜV, Intertek)

3. Third-Party Inspections

- Benefits: Neutral parties carry out product inspections at pre-shipment or random production stages, reducing buyer risk.

- Typical Providers: Global testing companies (SGS, Bureau Veritas) or local agencies with international accreditation.

4. Ongoing Performance Monitoring

- For Repeat Orders: Monitor consistency through periodic re-audits, inspection reports, and tracking shipment defect rates.

- Build a Supplier Scorecard: Grade vendors on quality, delivery punctuality, documentation accuracy, and compliance.

Regional Nuances and Best Practices for Cross-Border B2B Buyers

Buyers in emerging markets (Africa, South America) or stringent-regulation markets (EU, UK, GCC) encounter unique challenges:

- Documentation: Certain regions may have language requirements (Arabic labeling in the Middle East, Spanish/Portuguese in Latin America, French in parts of Africa/Europe). Confirm that supplier packaging/documentation complies.

- Product Adaptation: Check for region-specific requirements—voltage, plug type, climate resistance, or packaging robustness for longer logistics chains.

- Certification Transfers: Some import authorities do not recognize certifications from non-accredited labs; confirm that certificates are accepted by local regulators before shipment.

- Customs and Compliance: Work with customs brokers or legal consultants to verify documentation sufficiency for destination country entry—especially for regulated products (food, electronics, medical).

Action Steps for B2B Buyers

- Specify Quality Standards in PO/Contract: Clearly detail certificates required, inspection methods, and QC checkpoints.

- Budget for Inspection: Allocate 1-2% of order value for third-party quality checks on mid-to-high value orders.

- Leverage Digital Tools: Use B2B platforms offering verified supplier profiles, digital audit records, or built-in inspection services for streamlined oversight.

Through a structured understanding of production and quality workflows, international B2B buyers can mitigate risk, protect brand reputation, and meet both local and global compliance demands—transforming the online general shop from a simple sourcing portal into a reliable, scalable supply solution.

Related Video: Most Amazing Factory Manufacturing Process Videos | Factory Mass Production

Comprehensive Cost and Pricing Analysis for online general shop Sourcing

Understanding the True Cost Structure of Sourcing from Online General Shops

Sourcing products via online general shop platforms for B2B operations requires a deep dive into the underlying cost structure to secure competitive pricing and sustainable margins. To make informed decisions, international buyers should first dissect the components that make up the total landed cost and then factor in market-specific pricing influencers.

Breakdown of Key Cost Components

1. Materials:

The largest and most variable cost driver. Material selection (plastic, metal, organic fabrics, etc.) directly affects unit price. Sourcing from regions with abundant raw materials can lower costs but may come with trade-offs in quality or lead time.

2. Labor:

Labor costs fluctuate by production country and complexity of the work. Labor-intensive goods sourced from Asia typically offer lower input costs compared to those produced in Europe or North America, but buyers should consider local labor standards and compliance requirements.

3. Manufacturing Overhead (Utilities & Operations):

Encompasses factory running costs—energy, water, equipment wear and tear, and general administration. Overhead typically scales with production volume, but smaller orders may bear disproportionally higher overhead allocations.

4. Tooling & Setup Fees:

For new or custom products, initial molds, dies, or setup runs may add significant upfront costs. These are often amortized over large order volumes, giving buyers leverage to negotiate per-unit reductions at higher MOQs.

5. Quality Control (QC) & Testing:

Inspections, certifications, and compliance testing (e.g., CE, ISO, FDA) are necessary, especially for European and Middle Eastern markets. Costs grow with stricter regulatory requirements or demanding product categories.

6. Logistics & Shipping:

Freight charges vary greatly depending on Incoterms (EXW, FOB, CIF, DDP), distance, mode (air/sea/rail), and shipment size. Duties, customs clearance, and insurance should also be included in the total landed cost calculation.

7. Supplier Margin:

General shop vendors bake their margin into quotations. Margins can be narrower for high-volume, repeat business, or more substantial for small, riskier, or highly customized orders.

Primary Price Influencers in International B2B Sourcing

- Order Quantity & Minimum Order Quantity (MOQ): Larger volumes almost always translate to lower per-unit pricing due to economies of scale and shared fixed costs.

- Customization & Specifications: Unique branding, packaging, or product modifications often command higher price tiers due to extra labor, materials, or setup costs.

- Material Grade & Source: Premium or certified materials—required for certain markets (like the EU or UK)—raise base costs but may be non-negotiable for market access.

- Quality Standards & Certifications: Higher QC standards, third-party audits, or safety certifications add cost, but are essential for compliance in the Middle East, Europe, and increasingly in Africa and South America.

- Supplier Location & Reliability: Local suppliers may allow for faster delivery and reduced logistics costs but might charge a premium. Conversely, remote suppliers could offer attractive prices but trigger higher logistics expenses and currency risk.

- Incoterms: Who shoulders which logistics cost drastically changes end pricing. DDP (Delivered Duty Paid) is worry-free for buyers, while EXW (Ex Works) requires the buyer to control—and pay for—more of the supply chain.

Actionable Tips for Cost-Efficient Sourcing

- Negotiate Holistically: Look beyond the sticker price. Seek bundled discounts (e.g., including QC or freight), long-term contracts for stable pricing, or deferred tooling costs with larger commitments.

- Calculate Total Cost of Ownership (TCO): Factor in all parts of the supply chain, from raw material to door delivery—including insurance, customs, and warehousing costs. This is especially crucial for buyers in Africa, South America, and the Middle East, where freight and last-mile delivery can dramatically affect the TCO.

- Request Detailed Quotations: Insist on itemized pro forma invoices, breaking out all cost contributors. This facilitates benchmarking across suppliers from the UK, France, China, Turkey, or Brazil.

- Validate Suppliers: Ensure your partner is legitimate and capable—supplier audits, business licenses, and references help reduce the risk of costly disruptions.

- Assess Local Regulatory Needs: Align product specs and certifications to local import regulations early to avoid border rejections and unexpected compliance costs.

Disclaimer: All sample prices or costs referenced in B2B sourcing guides are indicative; actual pricing fluctuates due to market, material, labor, and geopolitical shifts. Buyers are strongly advised to solicit up-to-date, written quotations and consult local customs or regulatory experts before finalizing orders.

By approaching cost analysis and price negotiations strategically, international B2B buyers set the stage for resilient and profitable supply chains across diverse markets.

Spotlight on Potential online general shop Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘online general shop’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

20 Online Wholesale Marketplaces You Should Know (info.1688order.com)

20 Online Wholesale Marketplaces You Should Know offers a curated overview of the world’s leading B2B wholesale trading platforms, helping buyers source products from trusted sectors like fashion, electronics, home goods, health, and industrial supplies. These marketplaces connect retailers and manufacturers through verified networks, enabling efficient, bulk procurement with order minimums tailored for business-scale transactions. Many featured platforms employ rigorous supplier verification measures, such as multi-point checks and manufacturer certifications, enhancing trust for buyers from diverse regions including Africa, South America, the Middle East, and Europe. With their broad international scope and support for major trading partners, these marketplaces are positioned to streamline sourcing for online general shops seeking flexibility, competitive pricing, and access to global inventories.

25 Best Wholesale Websites to Find Suppliers (codesupply.co)

With a focus on facilitating online general shop procurement, “25 Best Wholesale Websites to Find Suppliers” acts as a comprehensive aggregator of top-tier wholesale platforms geared toward global B2B buyers. The company delivers access to extensive product ranges, notably spanning furniture, cleaning supplies, food, and specialized Mexican imports such as authentic artwork and hot sauces. By maintaining direct partnerships with reputable manufacturers and suppliers, it helps buyers secure competitive pricing and simplifies the vetting process. Designed for international reach, the platform supports seamless sourcing for buyers in Africa, South America, the Middle East, and Europe, while emphasizing efficiency through curated supplier lists, compliance insights, and informative user reviews. While direct certifications or quality standards are not highlighted, its robust selection and market-oriented guidance offer a strong starting point for B2B procurement across diverse categories.

10 Best Wholesale Suppliers for Sourcing Products in 2025 (fitsmallbusiness.com)

Faire stands out as a leading online wholesale marketplace, connecting over 100,000 independent brands with B2B buyers globally. Tailored to the needs of online general shops, Faire offers a broad portfolio spanning apparel, novelty items, kids and baby goods, jewelry, home decor, pet products, food and drink, and beauty. The platform is recognized for curating high-quality, trendy, and unique merchandise, making it ideal for businesses seeking to differentiate their offerings. With strong support for small and medium enterprises, Faire simplifies product discovery, order management, and international logistics—features especially beneficial for buyers in Africa, South America, the Middle East, and Europe. While specific certifications and manufacturing details are not listed, the platform’s reputation is built on a commitment to quality, rigorously vetted suppliers, and innovative sourcing solutions.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 20 Online Wholesale Marketplaces You Should Know | Curated top global wholesale B2B platforms. | info.1688order.com |

| 25 Best Wholesale Websites to Find Suppliers | Aggregator of top wholesale sourcing platforms. | codesupply.co |

| 10 Best Wholesale Suppliers for Sourcing Products in 2025 | Curated global marketplace, unique general shop goods. | fitsmallbusiness.com |

Essential Technical Properties and Trade Terminology for online general shop

Key Technical Properties When Sourcing for an Online General Shop

To optimize procurement and mitigate risks, international B2B buyers should assess several core technical properties when evaluating suppliers and products for an online general shop. Paying close attention to these factors is essential for ensuring product quality, compliance, and seamless fulfillment.

1. Material Specifications and Grade

Specifying the material type (e.g., stainless steel, organic cotton, ABS plastic) and grade is fundamental across product categories. Material grade establishes durability, safety, and regulatory compliance—crucial for meeting the expectations of both business buyers and end customers. For example, electrical goods shipped to Europe must comply with EU material standards, while textiles for Africa or South America may require climate-resilient or specific organic certifications.

2. Dimensional Accuracy and Tolerances

Dimensional specifications—length, width, height, and diameter—must be detailed, accompanied by acceptable tolerance ranges (e.g., ±1 mm). Tight tolerances are vital for products like machine parts or modular displays, which demand precise fit. For general merchandise, clear dimensional data supports accurate product descriptions, minimizes disputes, and reduces costly returns.

3. Packaging Standards

Packaging requirements influence logistics, shelf presentation, and product protection. Factors such as carton size, weight per unit, labeling, and protection (e.g., moisture-proof bags) must align with international shipping standards. In the Middle East and Europe, strict packaging standards may also tie into customs clearance and environmental regulations.

4. Minimum Order Quantity (MOQ) and Batch Consistency

MOQ indicates the smallest batch a supplier will accept, affecting cash flow, inventory risk, and negotiation leverage. Consistency of quality across batches—often documented through certificates or sample approvals—ensures repeat orders satisfy the same standards, reducing disappointment and supply chain friction.

5. Compliance and Certifications

International buyers must ensure products comply with target market regulations. Certification properties like CE (Europe), FDA (USA), or CCC (China) prove conformance and ease import procedures. Documentation such as test reports or safety data sheets (SDS) should be readily available. For buyers in Africa and South America, verifying the authenticity of such certifications minimizes regulatory and reputational risk.

6. Lead Time and Fulfillment Capacity

Lead time is the expected duration from order placement to delivery. Explicit timelines covering production, quality inspection, export documentation, and shipping are essential—especially for season-sensitive or promotional stock. A supplier’s fulfillment capacity (order volume per month) also matters for scaling and reliability.

Core Trade Terms and Jargon in B2B Sourcing

B2B commerce for online general shops features distinct terminology that frames negotiations, contracts, and fulfillment. Understanding these terms empowers buyers to communicate effectively and make informed decisions.

1. RFQ (Request for Quotation)

An RFQ is a formal process where buyers request pricing, lead times, and technical details from potential suppliers. Typically, it’s the first step in supplier engagement, enabling buyers to compare offers efficiently based on documented requirements.

2. MOQ (Minimum Order Quantity)

MOQ defines the lowest number of units a supplier is willing to produce or sell per order. High MOQs can impact inventory levels and working capital—important when entering new markets or testing new lines. Negotiating the MOQ can often yield better flexibility or improved pricing structures.

3. OEM (Original Equipment Manufacturer) / ODM (Original Design Manufacturer)

OEMs manufacture products to the buyer’s exact specifications—often using the buyer’s branding. ODMs, conversely, offer pre-designed products that can be customized. For general shops aiming to differentiate or private-label goods, understanding the distinction aids in supplier selection and IP protection.

4. Incoterms (International Commercial Terms)

Widely recognized trade terms published by the International Chamber of Commerce, Incoterms define respective roles, responsibilities, and risks between buyers and sellers for the shipping of goods. Common terms include EXW (Ex Works), FOB (Free On Board), and DDP (Delivered Duty Paid). Selecting the right Incoterm impacts landed cost, insurance, customs duties, and logistical planning.

5. Lead Time

This refers to the period from purchase order issuance to receipt of goods. It encompasses production, quality control, packaging, and shipping. Accurate lead time estimates enable better inventory planning and help meet market demand, particularly in regions with complex import infrastructures.

6. Sample/Prototype Approval

Before mass production, suppliers may provide samples or prototypes for approval. This mitigates risk by confirming that product specifications and quality meet requirements before financial commitment to a full order.

Actionable Insights for International B2B Buyers

- Prioritize detailed specifications: Communicate clear, written requirements for every technical property. This counters misinterpretation, especially across languages and regions.

- Request certification documentation upfront: For target markets, proactively verify compliance to avoid customs delays and regulatory penalties.

- Leverage trade terms in negotiations: Use a solid grasp of Incoterms, MOQ, and lead times to structure contracts that safeguard ROI and supply chain continuity.

- Test suppliers with sample orders: Batch consistency and packaging adherence are best assessed through small preliminary orders before scaling.

- Optimize for local standards: Recognize that markets in Africa, the Middle East, South America, and Europe have unique regulatory and consumer expectations—tail

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the online general shop Sector

Global Market Overview and Key Trends

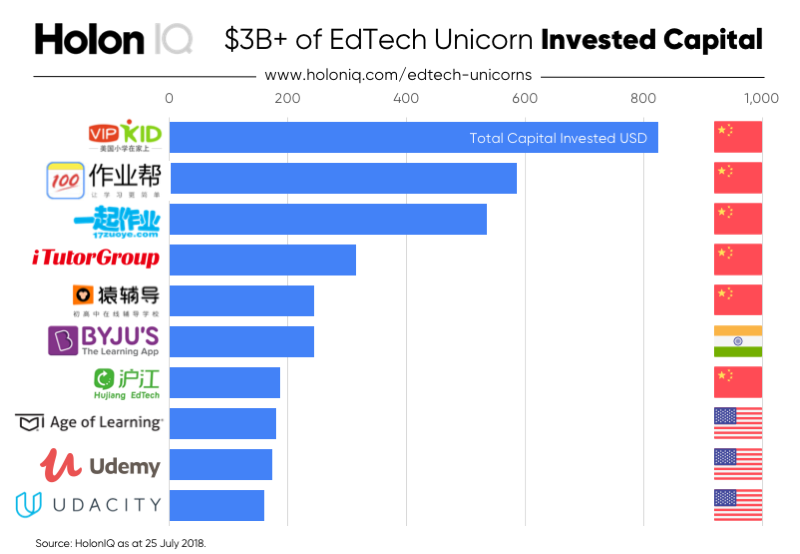

The online general shop sector has undergone rapid globalization, fueled by advancements in digital commerce platforms and evolving B2B procurement strategies. For international buyers in Africa, South America, the Middle East, and Europe, this sector provides unparalleled access to a vast and diverse product range—from consumer electronics and apparel to home goods and industrial supplies. Several dynamics are shaping these markets. First, the explosion of B2B procurement marketplaces like Alibaba, Amazon Business, and eWorldTrade has simplified cross-border transactions, enabling buyers to source directly from manufacturers, wholesalers, and trading companies. This transformation has been accelerated by AI-driven supplier matching, dynamic pricing algorithms, and integrated logistics services, which collectively streamline sourcing workflows and mitigate traditional barriers such as language, payment risks, and quality assurance.

Another prominent trend is the increasing reliance on flexible fulfillment models. Dropshipping and hybrid inventory solutions allow B2B buyers to manage cash flow prudently by minimizing the need for large upfront investment in stock and warehouse infrastructure. This proves particularly advantageous for smaller businesses and startups, or enterprises expanding into new markets across Africa and Latin America, allowing them to scale operations with reduced financial risk.

Market fragmentation is giving way to platform consolidation, fostering more transparent pricing and standardized quality controls. Mobile commerce is especially crucial in regions with widespread smartphone usage but limited desktop access—such as parts of Africa and South America—making mobile-first procurement platforms essential. Additionally, as consumer demand rapidly evolves, international B2B buyers seek platforms with real-time insights on trending products, allowing for nimble adaptation and competitive differentiation, especially in highly price-sensitive environments.

Sustainability and Ethical Sourcing in B2B

Environmental and social responsibility are now top decision criteria for B2B buyers in the general shop sector. Increasingly, procurement policies across Europe and parts of the Middle East require verifiable adherence to sustainability standards. This includes responsible sourcing of raw materials, minimized carbon footprints, fair labor practices, and the use of recyclable or bio-based packaging. For buyers in Africa and Latin America, certifications such as ISO 14001 (environmental management), Fairtrade, Forest Stewardship Council (FSC), and EcoVadis rating can be essential tools for supplier vetting and risk mitigation.

Implementing a green supply chain is not only a regulatory requirement in many European contexts, but also an opportunity to attract eco-conscious clients and differentiate in crowded markets. This involves prioritizing suppliers who embrace renewable energy, optimize transportation routes to reduce emissions, and transparently report on their sustainability metrics. For many B2B buyers, building traceability into supply chains has become a non-negotiable—leveraging blockchain and digital ledgers to track product origins, labor conditions, and environmental impact throughout the entire procurement cycle.

Ethical sourcing is also critical in regions where social and labor standards may vary, such as parts of Asia or Africa. Comprehensive supplier audits, third-party verification, and the adoption of universally recognized green certifications help to limit brand risk and ensure regulatory compliance across jurisdictions. Ultimately, sustainable sourcing practices enhance brand value, reduce supply chain vulnerabilities, and support access to new markets where environmental and ethical accreditation is a prerequisite for business partnerships.

Brief Evolution of the General Shop B2B Sector

Historically, sourcing for general shops involved fragmented, manual processes—lengthy negotiations, physical trade shows, and reliance on local intermediaries. The digital revolution fundamentally redefined the landscape, moving procurement online and giving rise to global B2B marketplaces equipped with advanced search, instant communication, and automated order management tools. This shift not only democratized access for international buyers from regions like Africa and South America but also increased price transparency, supplier competition, and supply chain resilience.

Today, the sector is marked by sophisticated data analytics, mobile-first solutions, and a strong emphasis on ethical procurement. The rise of integrated logistics, real-time inventory monitoring, and direct-from-manufacturer sourcing continues to break down historic barriers, empowering buyers of all sizes to operate at a truly global scale with confidence and agility.

Related Video: Incoterms® 2020 Explained for Import Export Global Trade

Frequently Asked Questions (FAQs) for B2B Buyers of online general shop

-

How should I evaluate and vet suppliers on an online general shop platform?

Thorough supplier vetting is crucial for mitigating risk in international B2B sourcing. Begin by reviewing supplier profiles for company background, certifications, and business licenses—most reputable platforms verify basic credentials. Seek out detailed transaction histories, third-party references, and ratings from past buyers, especially those in your region. Don’t hesitate to request samples or arrange video calls with the supplier’s sales or quality teams. For large-volume or sensitive orders, consider using independent third-party verification services. Regular, transparent communication and careful contract documentation further enhance trust and minimize surprises. -

Is product customization possible when sourcing through online general shops, and what’s the process?

Most established B2B platforms offer customization options, ranging from branding/packaging changes to entirely bespoke products. Start by shortlisting suppliers who advertise customization capabilities or provide “OEM/ODM” services. Share clear technical specifications, design files, and expected quality standards early in discussions. Obtain prototype samples for evaluation before confirming mass orders to avoid miscommunication. Custom projects usually require longer lead times and higher minimum order quantities (MOQs). Make sure all customization agreements—down to packaging details—are documented in the purchase contract to avoid disputes later. -

What are typical minimum order quantity (MOQ), lead times, and payment methods when buying internationally?

MOQs vary widely depending on product type, customization, and supplier policies—ranging from as low as 10 units to thousands. Lead times for stock items are typically 7-30 days, while customized orders may require 30-90 days. International suppliers usually accept bank wire transfers (T/T), Letters of Credit (L/C), PayPal or platform-managed escrow services for payment security. For new relationships, use staged payments: a deposit to start production, with the balance paid post-quality approval or upon shipment. Clarifying these key terms in advance streamlines fulfilment and reduces financial risk. -

How can I verify the quality and compliance of products before shipment?

Product quality assurance is essential for international B2B buyers. Request comprehensive documentation, such as product specifications, material data sheets, and samples. For regulated items, insist on internationally recognized certifications (e.g., CE, ISO, FDA) relevant to your target market. Engage third-party inspection agencies to audit factories or inspect goods before shipment; many B2B platforms offer integrated inspection services. Incorporate clear acceptance criteria in your contract, stipulating repercussions if products fail to meet specifications or compliance standards. This preempts misunderstandings and costly returns. -

What shipping and logistics solutions are available for large B2B orders, and how can I optimize costs?

Online general shops typically offer choices like courier, air freight, and sea freight for varying urgency and cost. For larger shipments, sea freight (FCL or LCL) is the most economical, but slower. Work with freight forwarders who understand your destination’s customs regulations, especially in regions with complex import duties like Africa and South America. Negotiate Incoterms (e.g., EXW, FOB, CIF) that best suit your supply chain control and risk appetite. Bundling orders or coordinating group shipments with other importers in your region can further reduce logistics expenses. -

How are disputes, damages, or non-conformance issues typically resolved in international B2B transactions?

Best practice is to use platform-managed dispute resolution processes, which provide some level of buyer protection—these often require evidence such as inspection reports, correspondence records, and product photos. Ensure your trading contract specifies dispute procedures, remedies, and jurisdictions, as legal recourse can be challenging across borders. For large contracts, consider independent third-party trade assurance or escrow solutions. Early, constructive communication is vital—most disputes can be resolved amicably if documented evidence and clear agreements are in place from the start. -

What are the key import regulations and compliance checks for B2B buyers in Africa, South America, the Middle East, and Europe?

Each region has unique regulatory frameworks. For instance, Europe (including the UK and France) is strict on CE marking, REACH chemicals compliance, and documentation. African and South American countries often require import licenses, inspection certificates, and compliance with local standards. The Middle East, especially GCC countries, has specific labeling and conformity requirements. Before purchase, research your country’s import regulations, required certifications, and documentation not only for customs clearance but also to avoid penalties or shipment delays. Your freight forwarder or local chamber of commerce can be invaluable for up-to-date advice. -

What emerging digital tools or practices should I leverage to improve my B2B sourcing experience?

International B2B buyers should harness digital procurement tools that streamline supplier discovery, negotiation, and order tracking. Marketplace platforms increasingly use AI to match buyers with reliable suppliers and offer analytics-driven insights for pricing and inventory planning. Use secure messaging and document sharing features for audit trails, and adopt trade assurance or escrow solutions for secure transactions. Blockchain-based solutions are gaining traction for enhanced transparency, especially for high-value or sensitive goods. Staying current with digital innovations not only boosts sourcing efficiency but also reduces operational risks.

Strategic Sourcing Conclusion and Outlook for online general shop

Strategic sourcing in the world of online general shops has evolved into a competitive necessity for international B2B buyers. Whether you’re navigating the complexities of supplier selection, balancing inventory management with cost optimization, or adapting to shifting consumer demands, the fundamentals remain clear: robust sourcing strategies drive profitability, resilience, and long-term business growth. Leveraging wholesale, dropshipping, manufacturing, and professional procurement marketplaces enables buyers from Africa, South America, the Middle East, and Europe to access diverse product ranges, streamline operations, and respond agilely to market changes.

Key takeaways for forward-thinking buyers include:

- Utilize digital procurement platforms for transparent, efficient supplier vetting and negotiation.

- Mix sourcing models—from dropshipping for flexibility to direct-from-manufacturer for margin control—to match evolving business needs.

- Prioritize supplier reliability and ethical standards, ensuring quality and sustainability as you scale.

- Leverage data and automation, incorporating AI-driven insights to anticipate demand and enhance sourcing accuracy.

As global B2B e-commerce accelerates, buyers who adapt and invest in strategic sourcing will unlock new market opportunities and strengthen competitive positioning. Now is the time to build dynamic supplier partnerships, integrate digital sourcing tools, and move decisively toward smarter, more resilient procurement. Embrace these strategies to future-proof your online general shop and capture growth on the international stage.