Introduction: Navigating the Global Market for how to create my own product

Bringing a unique product to market on the global stage is both a formidable challenge and a rewarding opportunity—especially for B2B buyers navigating dynamic landscapes in Africa, South America, the Middle East, and Europe. Whether you are sourcing innovations to meet unmet needs, customizing for regional preferences, or searching for reliable international partners, understanding the intricacies of product creation is central to unlocking market potential and securing a competitive edge.

The global B2B environment demands more than just good ideas. Mastery of the product development process—spanning ideation, material selection, manufacturing, quality control, and supplier management—is crucial for commercial success. B2B buyers must evaluate cost efficiency, regulatory compliance, and supplier credibility while considering complex supply chain issues across borders and cultures.

This guide delivers a comprehensive, step-by-step framework tailored for organizations ready to transform concepts into tangible, profitable products. Buyers will gain actionable insight into:

– Choosing the right product type for diverse market needs

– Selecting and sourcing materials with quality, sustainability, and cost in mind

– Navigating manufacturing methods—from prototyping to scalable production

– Evaluating and managing suppliers for reliability and partnership

– Implementing quality control measures to meet international standards

– Understanding total cost structures and risk factors

– Strategizing for successful market entry

– Frequently asked questions that address practical challenges from sourcing to distribution

With a solution-oriented approach, this resource empowers B2B buyers to make informed, confident decisions—aligning product vision with operational realities, and ensuring successful outcomes in today’s fast-evolving global markets.

Understanding how to create my own product Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Custom Manufactured | Completely new product manufactured to buyer’s specifications | Unique retail lines, industrial equipment | Tailored to precise needs; higher cost, longer lead times |

| White Label | Pre-made products branded and customized with buyer’s logo, packaging, or minor features | Consumer goods, cosmetics, electronics | Fast to market, lower MOQ; limited scope for deep differentiation |

| Private Label | Existing base product with more significant customization (formulation, features, design tweaks) | Food & beverage, apparel, specialty products | Mid-level customization;, better brand control; may require minimum orders, IP negotiation |

| Modular/Configurable | Product built from standardized modules/parts that can be mixed for various function, size, or finish variations | Machinery, electronics, office furniture | Flexible product offerings; may face integration challenges, inventory complexity |

| Hybrid Sourcing | Combination of custom and standard components, leveraging off-the-shelf parts plus unique elements | Automotive, industrial components, tech gear | Balance of cost efficiency and customization; supply chain juggling required |

Custom Manufactured

Custom manufacturing allows B2B buyers to develop a product entirely tailored to specific requirements, from material selection to functional performance. This route is ideal for organizations seeking exclusive innovations or proprietary solutions, such as OEMs or startups introducing a disruptive offering. Buyers should be prepared for higher tooling costs, rigorous prototyping, and longer development cycles, but will gain IP ownership and market differentiation. Detailed design documentation, clear specifications, and robust supplier vetting processes are essential for success.

White Label

White label products are pre-existing goods produced by a manufacturer and sold to buyers for rebranding and resale under their own trade name. This approach suits companies looking for speed to market and minimal upfront R&D, such as distributors entering new regions or retailers expanding product lines. While white labeling minimizes development time and lowers minimum order quantities, customization is generally limited to superficial changes like packaging or colors, so direct competition may be higher. Assessing supplier reliability and logistics support is crucial.

Private Label

Private labeling enables deeper customization than white label, allowing changes to formulations, features, or design elements on an existing product base. This strategy is favored in highly competitive markets where differentiation is critical, such as specialty food, personal care, or apparel. Buyers benefit from increased brand control and product uniqueness without the full investment of custom manufacturing. Key considerations include negotiating exclusivity terms, clear communication of modifications, and diligent management of minimum order volumes and quality standards.

Modular/Configurable

With modular or configurable products, buyers choose from a set of standardized modules to assemble products tailored to specific use cases or client preferences, common in machinery, electronics, and furniture. This model offers scalability and flexibility, enabling companies to address diverse market needs with limited SKU proliferation. However, integrating modules from different sources can introduce complexity in procurement, assembly, and after-sales service. Evaluate component compatibility, supplier lead times, and inventory management solutions when adopting this approach.

Hybrid Sourcing

Hybrid sourcing integrates both custom and standardized product strategies by combining readily-available parts with unique, custom-fabricated components. This approach is prevalent in automotive, industrial, and tech sectors, where speed and cost efficiency are balanced against the need for differentiation. Hybrid solutions can speed up timelines and reduce costs but may involve challenging supplier coordination and quality control across multiple vendors. Effective communication, transparent supply chains, and contingency planning are vital for risk mitigation and on-time delivery.

Related Video: Introduction to large language models

Key Industrial Applications of how to create my own product

| Industry/Sector | Specific Application of how to create my own product | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Consumer Goods | White-label product development (e.g., food, cosmetics) | Brand differentiation, rapid market entry | Regulatory compliance, flexible MOQs, packaging customization |

| Agriculture | Custom agri-inputs/tools design | Tailored farm solutions, improved yields | Adaptation to local crops, quality standards, after-sales support |

| Industrial Equipment | Bespoke machinery part fabrication | Increased efficiency, minimized downtime | Precision, material durability, availability of technical drawings |

| Healthcare | Private-label medical devices | Market exclusivity, compliance personalization | Certifications (ISO, CE), sterility, technical documentation |

| Construction | Custom building material or prefab component creation | Cost control, project-specific adaptation | Structural certification, supply lead times, customization capabilities |

Consumer Goods: White-label Product Development

Businesses across Africa, South America, the Middle East, and Europe increasingly leverage white-label product development to introduce locally tailored food, beverage, or cosmetic lines. By specifying formulations, packaging, and branding, companies can quickly access new markets and adapt to regional consumer preferences. This approach addresses gaps where imported products lack cultural or regulatory fit. International buyers must evaluate suppliers for regulatory compliance, MOQ flexibility, and private-label capabilities to ensure seamless go-to-market execution.

Agriculture: Custom Agri-inputs and Tools Design

Agricultural enterprises often require crop-specific fertilizers, pest control solutions, or bespoke handling equipment to address local farming realities. Creating proprietary products allows B2B buyers to directly target distinct soil, climate, or crop needs—particularly relevant for diverse regions such as sub-Saharan Africa or Latin America. Key considerations include ensuring compatibility with regional agricultural conditions, adherence to local standards, and access to technical support for sustained value delivery.

Industrial Equipment: Bespoke Machinery Part Fabrication

Manufacturers and processors may need customized spare parts or machinery modifications to improve operational uptime and efficiency. Custom product creation enables adaptation to legacy systems, variable power sources, or extreme climate conditions, which are common challenges for B2B buyers in emerging markets. Buyers should prioritize suppliers offering high-precision manufacturing, robust materials, and the capability to work from technical drawings or reverse engineering, ensuring fit-for-purpose solutions.

Healthcare: Private-label Medical Devices

Healthcare organizations seeking to expand their device portfolios or meet localized regulatory requirements often turn to custom/private-label medical product creation. This can include specialized disposables or diagnostic equipment tailored for regional health challenges. Compliance is paramount—buyers must ensure their manufacturing partners have international certifications (such as ISO 13485, CE mark), strong sterility protocols, and provision of comprehensive documentation to satisfy often stringent import regulations.

Construction: Custom Building Material or Prefab Component Creation

In infrastructure and property development, project-specific needs frequently demand non-standard components—such as customized prefab walls, specialized coatings, or modular solutions. The ability to create bespoke products allows construction firms to manage costs, address regulatory codes, and deliver unique architectural specifications, key for projects in fast-growing cities across the Middle East, Africa, or Eastern Europe. Critical factors include sourcing partners with proven customization capability, structural certification, and reliable lead times to avoid project delays.

Related Video: How to Create, Design and Manufacture a Product from Scratch

Strategic Material Selection Guide for how to create my own product

Understanding material selection is a cornerstone for B2B buyers aiming to successfully launch a new product across diverse international markets. The choice of material directly influences not only product functionality and longevity but also affects manufacturing complexity, regulatory compliance, and total landed cost. Below, we analyze four widely used product materials from a B2B standpoint: Stainless Steel, Polypropylene (PP) Plastic, Aluminium, and Natural Rubber. Each is discussed regarding their practical properties, manufacturing impact, and international considerations for Africa, South America, the Middle East, and Europe (including Australia and Thailand).

Stainless Steel

Key Properties:

Stainless steel is renowned for its excellent corrosion resistance, strength-to-weight ratio, high temperature and pressure tolerance, and ease of sanitation. These characteristics make it a default choice for products in the food, beverage, medical, and chemical sectors.

Pros & Cons:

Pros: Highly durable, long-lasting, and resistant to a broad range of chemicals, making it ideal for markets with fluctuating environmental conditions. It requires minimal maintenance and supports hygienic applications.

Cons: Greater upfront cost and higher weight compared to alternatives. Machining and fabrication are also more complex, potentially increasing production time and cost.

Impact on Application:

Due to its inertness, stainless steel is suitable for products exposed to aggressive media (e.g., cleaning agents, acids, or salty environments) and temperature extremes. Critical for use-cases demanding strict hygiene or repeated sterilization.

International B2B Considerations:

Compliance with international standards such as ASTM (U.S.), DIN (Europe), and JIS (Asia) is essential. European and Middle Eastern buyers often require traceability and certification (e.g., EN 10204 3.1). In Africa and South America, consider local logistics, as stainless steel may entail higher import duties or longer lead times.

Polypropylene (PP) Plastic

Key Properties:

Polypropylene is a lightweight thermoplastic known for high chemical resistance, good impact strength, moderate thermal resistance (up to ~100°C), and electrical insulating properties.

Pros & Cons:

Pros: Cost-effective for mass production using injection molding; facilitates intricate designs. Resistant to many acids, alkalis, and organic solvents—excellent for containers, caps, automotive, and consumer board products.

Cons: Lower strength compared to metals, limited UV resistance without stabilizers, and suboptimal for high-temperature/high-pressure applications.

Impact on Application:

Well-suited for high-volume products or single-use/disposable goods (packaging, fluid containers, medical components), especially where light weight is prioritized. Material recycling streams for PP are increasingly common, addressing sustainability needs in European and Australian markets.

International B2B Considerations:

Conforms to standards like ASTM D4101 and ISO 19069. Regulatory compliance for food or potable water contact varies by region; check for REACH (EU), FDA (U.S.), or GCC (Middle East) approvals. In Africa and South America, local manufacturing capabilities may favor PP over higher-cost polymers.

Aluminium

Key Properties:

Aluminium offers high strength-to-weight ratio, excellent thermal and electrical conductivity, and strong resistance to atmospheric corrosion. Easy to machine, extrude, and form into complex shapes.

Pros & Cons:

Pros: Lightweight, non-magnetic, and recyclable. Good for portable or transportable products and heat exchangers.

Cons: Softer than steel, thus more susceptible to surface scratches and dents. Some aluminium alloys are less resistant to certain chemicals and seawater without anodizing.

Impact on Application:

Frequently used where weight savings are critical (aerospace, transport, electronics enclosures). Surface treatments like anodizing or powder coating may be required for environments prone to corrosion (e.g., coastal Middle East, Australia).

International B2B Considerations:

Aluminium products must often meet EN (Europe), ASTM B221, or JIS H4000 standards. European buyers may insist on sourcing recycled aluminium for sustainability. Exporters to Africa and South America should review infrastructure limitations—aluminium is less susceptible to rust during shipping but may attract import tariffs.

Natural Rubber

Key Properties:

Natural rubber provides excellent elasticity, resilience, and low-temperature flexibility, along with good abrasion and impact resistance.

Pros & Cons:

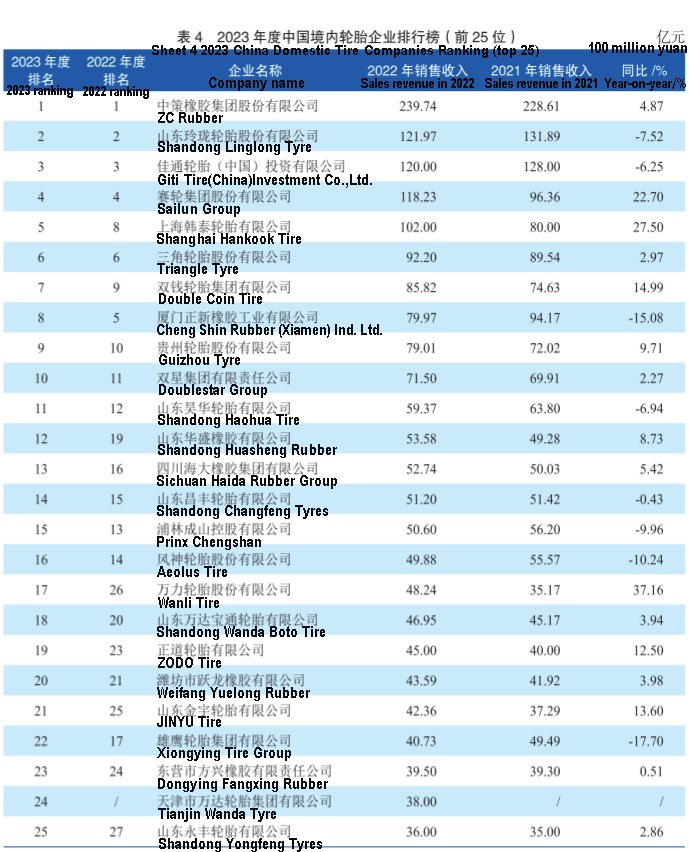

Pros: Ideal for dynamic applications—seals, gaskets, vibration dampers, tires. Locally sourced in many equatorial nations, lowering supply risk for African and South American buyers.

Cons: Susceptibility to ozone, oil, and UV degradation without special treatments. Not suitable for applications needing high chemical or temperature resistance.

Impact on Application:

Preferred when shock absorption and flexibility are needed. Not advisable for exposure to petroleum products or harsh sunlight, as in certain Middle Eastern or Australian climates, unless compounded for added resistance.

International B2B Considerations:

Complies with ASTM D2000, ISO 3302-1 standards. Product acceptance in European Union often requires REACH compliance. Local labor and raw material access in Africa and South America can reduce cost, but buyers must ensure ethical latex sourcing and environmental protections.

Comparative Material Selection Table

| Material | Typical Use Case for how to create my own product | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel | Food processing, medical tools, chemical equipment | High corrosion resistance, durable | Higher material and processing cost | High |

| Polypropylene (PP) | Packaging, consumer goods, medical disposables | Lightweight, chemically inert, cost-effective | Lower strength, limited for high temp/pressure | Low |

| Aluminium | Lightweight enclosures, electronics, automotive parts | Lightweight, corrosion resistant, easy to shape | Softer, prone to dents, requires finishing | Medium |

| Natural Rubber | Seals, gaskets, vibration isolators, consumer durability items | Elastic, excellent shock absorption | UV/ozone sensitivity, poor chemical resistance | Low to Medium (Varies) |

In-depth Look: Manufacturing Processes and Quality Assurance for how to create my own product

Manufacturing Process Fundamentals for Custom Product Creation

Bringing a new product to market as an international B2B buyer involves much more than simply finding a supplier and placing an order. Understanding core manufacturing processes and establishing robust quality controls is essential for ensuring the end product meets your standards, regulatory requirements, and customer expectations. Below is a comprehensive walkthrough of typical manufacturing stages, critical QC checkpoints, and practical action items for global B2B buyers from diverse regions such as Africa, South America, the Middle East, and Europe.

Key Stages of the Manufacturing Process

Manufacturing workflows will differ depending on the type of product (consumer goods, industrial components, electronics, textiles, etc.), but most involve several essential stages:

1. Material Preparation

- Raw Material Sourcing: Selection of appropriate, consistent-quality materials is foundational. It’s crucial to verify that suppliers meet regulatory standards and certifications in your destination market.

- Testing & Verification: Materials are tested for properties (composition, strength, purity, etc.) according to your product specifications and any relevant international standards.

2. Forming and Shaping

- Processes Used: Depending on the product, this might include injection molding, die casting, CNC machining, cutting, stamping, or textile weaving.

- Tooling & Prototyping: Custom tooling is created, and prototypes are produced to confirm the manufacturing process will deliver the required form and function before mass production begins.

3. Assembly & Integration

- Manual vs. Automated Assembly: Assembly can be manual, semi-automated, or fully automated. The choice often depends on product complexity, volume, and cost considerations.

- Component Integration: Parts sourced from different suppliers may be combined; ensuring interface compatibility and quality at this stage is vital.

4. Finishing & Treatments

- Surface Finishing: Processes such as painting, plating, coating, deburring, or polishing are applied for protection and aesthetics.

- Functional Testing: The product may undergo functional validation—e.g., pressure testing for valves, electrical testing for devices, or waterproof tests for apparel.

5. Packaging and Pre-shipment

- Custom Packaging: Packaging designed to withstand transport and meet destination regulations, including labeling requirements.

- Final Inspection: A thorough visual and functional check before the product leaves the factory.

Advanced Manufacturing Techniques

Innovative buyers increasingly seek factories with cutting-edge capabilities:

- Automated Quality Control: Vision systems, inline sensors, and AI-based inspection for defect reduction.

- Lean Manufacturing: Reduces waste, shortens production cycles, and improves consistency.

- Additive Manufacturing (3D printing): For rapid prototyping, customized components, and small-batch runs.

- Traceability Systems: Ensuring component-level traceability, which is critical for industries like automotive, aerospace, and medical devices.

Quality Assurance: Standards, Checkpoints, and Verification

Establishing and maintaining high product quality is fundamental for global competitiveness and regulatory compliance. B2B buyers must build multi-layered quality assurance (QA) protocols into supplier agreements from day one.

International Quality Standards and Certifications

- ISO 9001: The global baseline for quality management systems (QMS); ensures consistency, documentation, and continual improvement across production.

- CE Marking: Required for many product types sold in the European Economic Area (EEA); indicates product meets EU safety, health, and environmental requirements.

- Industry-Specific Certifications: For example:

- API (American Petroleum Institute): For oil & gas equipment.

- FDA: For medical and food-contact products entering the US.

- RoHS/REACH: For electronics and chemicals sold in Europe.

- GCC Mark: For regulated products in Gulf Cooperation Council (GCC) states.

- SABS: For South Africa, and equivalents in other regions.

Regional Note: Buyers from Africa, South America, and the Middle East must ensure suppliers comply with destination-specific standards. Products destined for Europe and Australia face stricter regulatory scrutiny; pre-emptive compliance reduces customs delays and potential rejections.

Critical Quality Control (QC) Checkpoints

Robust QC happens at several stages throughout manufacturing. The standard checkpoints are:

- Incoming Quality Control (IQC): Inspection of raw materials and components before they enter the production process. Catching defects at this stage saves significant time and resources.

- In-Process Quality Control (IPQC): Regular checks during manufacturing—sample-based or inline automated inspection. This can cover dimensional accuracy, assembly integrity, function, and safety.

- Final Quality Control (FQC): End-of-line inspection of finished products before shipping. This typically includes visual inspection, function testing, and verification against product specifications.

Special Note: For high-volume or high-value orders, pre-shipment inspection (PSI) and container loading checks are common. These can be scheduled with or without the manufacturer’s knowledge to discourage last-minute “quality swaps”.

Common Testing Methods Used

- Destructive & Non-Destructive Testing: For instance, bend tests for metal components, X-ray for welded joints, or dye penetrant testing for cracks.

- Dimensional Measurement: Using calipers, micrometers, gauges, or coordinate measuring machines (CMM) for precision parts.

- Performance Testing: Load, pressure, endurance, electrical, or thermal cycling—depending on the product’s intended use.

- Sample Checks: Statistically random samples are drawn and tested to assess overall batch quality.

How B2B Buyers Can Verify Supplier Quality Control

Global buyers cannot rely solely on a factory’s assurances. To mitigate risks:

-

Supplier Audits

– Conduct initial factory audits (onsite or remote) to assess the supplier’s QMS, capabilities, and certifications.

– Request a list of key processes and audit their documentation and calibration procedures. -

Third-party Inspections

– Engage independent QC specialists (e.g., SGS, Bureau Veritas, Intertek) for pre-shipment, in-process, or container loading inspections.

– Insist on comprehensive inspection reports, including defect photos, test results, and corrective recommendations. -

Production Documentation

– Request and review certificates of conformity, material test reports, and manufacturing records.

– For regulated markets, ensure supporting documentation aligns with destination regulatory frameworks (e.g., Declarations of Conformity, test certificates). -

QC Agreements and Penalties in Contracts

– Your contract should specify defect thresholds, sampling plans (e.g., AQL standards), and remediation steps for non-conforming goods.

– Include penalties or return policies for missed quality targets.

Navigating International and Regional QC Nuances

- Diverse Infrastructure: QC capabilities can vary widely between countries and regions. Buyers from Africa or South America sourcing from newer manufacturing hubs should pay extra attention to supplier stability and infrastructure.

- Custom Regulations: Each territory (including the EU, GCC, Mercosur, and African Continental Free Trade Area) imposes unique standards, markings, and compliance paperwork requirements. Non-compliance can result in costly border delays and legal liability.

- Language & Communication: Ensure technical documents and QC checklists are translated correctly and understood by factory staff. Misinterpretation can lead to costly errors or non-conformance.

- Ethical and Sustainability Audits: Certain buyers—particularly in Europe—will require environmental, social, and governance (ESG) verifications, such as SMETA or BSCI audits.

Action Points for International B2B Buyers

- Due Diligence: Never skip background checks and audits on new suppliers. Verify certifications and ask for recent QC records.

- Clear Specifications: Provide detailed technical drawings, standards, and documented requirements—including tolerances and test methods.

- Inspection Scheduling: Strategically plan for multiple inspections throughout the production cycle, not just at the end.

- Continuous Communication: Maintain active, structured communication with your supplier’s QA team, and build feedback channels for quick corrective action.

Taking an active, structured approach to manufacturing and quality assurance will not only protect your reputation in your local market but also safeguard your international investments—ensuring compliant, reliable, and market-ready products that stand up to global competition.

Related Video: Product Design & Manufacturing Collection workflows: Factory

Comprehensive Cost and Pricing Analysis for how to create my own product Sourcing

Breaking Down the Cost Structure of Product Sourcing

When launching a new product, especially as an international B2B buyer, understanding the complete cost structure is essential for accurate pricing, negotiation, and long-term profitability. Every stage—from initial sourcing to final delivery—impacts your total expenditure and thus, your competitiveness in target markets. Below is a detailed overview of the key cost components involved in creating your own product.

Major Cost Components

-

Raw Materials: The foundational expense. Material quality, grade, and source (e.g., local vs. imported) directly affect both your unit cost and final product performance. Fluctuating commodity prices and global supply chain dynamics often cause significant variability.

-

Labor: Includes wages for skilled and unskilled workers during manufacturing. Labor costs can differ dramatically between countries, impacting total landed cost especially for buyers from regions such as Africa, South America, or the Middle East who may be sourcing from Asia or Europe.

-

Manufacturing Overhead: Encompasses utilities, machine maintenance, plant rent, and other indirect production expenses. Overhead tends to scale with order size, but initial smaller orders may absorb a higher percentage.

-

Tooling and Setup: Custom molds, dies, or fixtures needed for unique product designs incur upfront costs. While these are amortized over large volumes, buyers requesting low minimum order quantities (MOQs) or customizations should expect higher per-unit tooling charges.

-

Quality Control: Includes inspection, sampling, lab testing, and compliance certifications. For exports to Europe or Australia, rigorous QC and certifications may be non-negotiable, increasing upfront and unit costs but reducing future liabilities.

-

Logistics: Transportation (air, sea, land), insurance, duties, warehousing, and last-mile delivery form a significant portion of total costs—especially relevant for cross-continental trade. Incoterms (e.g., FOB, CIF, DDP) dictate which party bears these expenses.

-

Supplier Margin: Manufacturers add their profit margins, often adjustable based on anticipated order volumes, payment terms, or long-term partnership potential.

Influencers That Shape Final Pricing

Numerous factors can heavily alter final sourcing prices in international B2B transactions:

-

Order Volume / MOQs: Larger orders usually attract volume discounts, lower per-unit overhead, and better priority in production scheduling. Insufficient volume can lead to surcharges.

-

Customization & Specifications: Highly customized products (size, branding, packaging, materials) demand greater engineering, specialized components, or unique tooling—raising both setup and unit costs.

-

Material Selection: Premium, certified, or sustainably sourced materials elevate both material and QC costs but can justify higher retail pricing. Standard-grade materials offer cost efficiency for volume-driven markets.

-

Quality & Certifications: Meeting rigorous safety, environmental, or industry standards (CE, ISO, FDA, RoHS) may be necessary for access to EU, Australian, or Middle Eastern markets—expect additional costs for compliance and documentation.

-

Supplier Location & Capabilities: Proximity to ports, infrastructure, and experience with international export processes can substantially affect both cost reliability and delivery timelines.

-

Incoterms: Terms like EXW, FOB, CIF, or DDP clarify which party handles shipping, insurance, taxes, and customs—which directly impact your bottom line.

-

Currency Fluctuations: Volatile exchange rates (especially for buyers sourcing outside their home currency) can cause cost overruns or windfall savings. Hedging strategies or buying in stable currencies can reduce this risk.

Strategies & Tips for International B2B Buyers

-

Negotiate All Cost Elements: Don’t focus solely on unit price. Break down quotes into line items (materials, labor, tooling, QC, shipping, etc.) for better negotiation and to identify hidden savings or risks.

-

Optimize Order Volumes: Where possible, consolidate orders or collaborate with regional partners to hit higher MOQs and unlock better pricing tiers.

-

Compare Total Cost of Ownership (TCO): Consider all associated costs, not just factory gate prices. Compare landed costs (including freight, taxes, insurance) across multiple sourcing options before finalizing suppliers.

-

Clarify Incoterms: Ensure clarity on delivery terms, documentation requirements, and who bears which risks and costs. This is especially crucial for buyers in Africa or South America where in-country logistics can be complex.

-

Plan for Quality Assurance: Invest in pre-shipment inspections and, where necessary, arrange for third-party audits—this is especially important for regulated markets like the EU or for first-time supplier relationships.

-

Leverage Payment Terms: Balance upfront payments with performance-based milestones, letters of credit, or escrow arrangements to manage cash flow and minimize risk.

-

Monitor Local Import Duties: In regions such as the Middle East or Africa, import duties, and compliance fees can add up quickly—factor these in during your initial price benchmarking to avoid surprises.

Disclaimer: All costs are indicative and subject to market and regional fluctuations. Always request up-to-date, detailed quotations from shortlisted suppliers to inform final negotiations.

By proactively understanding these cost drivers and pricing nuances, international buyers can source more competitively, avoid hidden expenses, and build sustainable supplier partnerships, regardless of sourcing destination or target market.

Spotlight on Potential how to create my own product Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘how to create my own product’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

How to Design and Produce Products from Scratch (www.entrepreneur.com)

How to Design and Produce Products from Scratch, featured on Entrepreneur.com, positions itself as an expert guide and resource in the product development space, particularly for businesses aiming to launch original products globally. Their framework emphasizes rigorous market research, consumer-driven innovation, and validated prototyping, supporting clients from initial concept to full market launch. With documented experience guiding brands through ideation, design, and multiple production iterations, they specialize in refining custom solutions that address specific B2B and consumer pain points. While direct manufacturer certifications and factory capabilities are not publicly detailed, the company’s influence and proven methodologies are tailored for businesses seeking end-to-end support, making them a reputable partner for international buyers across emerging markets in Africa, South America, the Middle East, and Europe.

From Idea to Reality: How to Create a Product from Scratch (supliful.com)

From Idea to Reality: How to Create a Product from Scratch, accessible at Supliful’s blog, is a knowledge-driven resource focused on demystifying the product development process for entrepreneurs and B2B buyers. The company emphasizes practical, step-by-step methodologies for taking concepts from initial idea to viable, market-ready products. Specializing in guiding businesses through ideation, market research, prototyping, testing, and refinement, they are recognized for encouraging flexible, iterative development and continuous improvement based on real-market feedback. Quality is reinforced through detailed stages involving design validation and workflow optimization, ensuring that each product iteration is thoroughly evaluated before market entry. While specific manufacturing certifications or in-house production capabilities are not publicly detailed, the provider demonstrates clear expertise in streamlining product launch for new and international market entrants. Their global perspective makes them particularly well-suited for B2B partners from Africa, South America, the Middle East, and Europe seeking structured support in bringing original products to life.

How to Find a Factory to Manufacture Your Product (www.uschamber.com)

How to Find a Factory to Manufacture Your Product serves as an authoritative guide and resource hub for B2B buyers seeking manufacturing partners to bring new product ideas to market. The platform is designed to help international businesses, including those from Africa, South America, the Middle East, and Europe, navigate the complexities of identifying and selecting the right factory. It offers insights into distinguishing among direct manufacturers, wholesalers, and trading companies, empowering buyers to optimize supply chain relationships and cost structures. While the site focuses primarily on education and matchmaking rather than factory operation, it emphasizes due diligence, quality assurance, and partner vetting—critical pain points for global sourcing. Although detailed public data on specific certifications or industry verticals is limited, the platform is noted for its relevance in the early stages of product manufacturing and vendor selection.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| How to Design and Produce Products from Scratch | End-to-end product development consulting | www.entrepreneur.com |

| From Idea to Reality: How to Create a Product from Scratch | End-to-end product development guidance | supliful.com |

| How to Find a Factory to Manufacture Your Product | Global guide for choosing manufacturers | www.uschamber.com |

Essential Technical Properties and Trade Terminology for how to create my own product

Key Technical Properties for B2B Product Creation

When developing a new product for international B2B markets, understanding and specifying core technical properties is vital. These specifications ensure product quality, performance, and suitability for both your business needs and the requirements of your buyers or end-users. Below are several critical technical properties to consider and communicate clearly with suppliers and manufacturing partners:

- Material Grade

- Definition: The specific classification or quality level of materials used in your product (e.g., stainless steel 304 vs. 316).

-

B2B Impact: Impacts product durability, compliance with regulations (such as food grade or medical grade), and positioning in your target markets. Higher material grades can justify premium pricing, while lower grades may reduce costs but could affect reputation and resale.

-

Dimensional Tolerances

- Definition: The allowable variance in physical dimensions (length, width, thickness) of components or finished products.

-

B2B Impact: Tight tolerances are essential where components must fit or function together precisely (e.g., machinery parts, modular construction). Misaligned tolerances often lead to quality issues, elevated returns, or delays in assembly further down the supply chain.

-

Surface Finish

- Definition: The texture or smoothness of a product’s surface, often measured in microns or described using standards (e.g., brushed, polished, matte).

-

B2B Impact: Critical for products with strict aesthetic or functional requirements (e.g., medical devices or consumer electronics). Surface finish influences perception, performance (e.g., corrosion resistance), and even safety.

-

Product Certification and Compliance

- Definition: Adherence to relevant regional or industry standards (e.g., CE in Europe, FDA in the US, ISO certification).

-

B2B Impact: Certifications are often a pre-qualification for market entry and large-scale buyers. Non-compliance can result in customs holds, fines, or loss of major contracts. African, Middle Eastern, and South American buyers may also need to consider local regulatory nuances.

-

Packaging Specifications

- Definition: Details about how a product is packed for storage and transport (e.g., type of carton, moisture barriers, palletization).

-

B2B Impact: Proper packaging ensures product integrity during shipping, minimizes damage, and affects shipment cost. Align packaging specs with Incoterms and import/export regulations for smoother logistics.

-

Functional Lifespan or Durability

- Definition: The expected working life of the product under defined conditions, often measured in cycles, years, or hours of use.

- B2B Impact: Affects warranty terms, replacement cycles, and long-term customer satisfaction. Especially critical for industrial buyers and public sector tenders.

Common Trade Terms and Their Relevance in B2B Product Creation

A solid grasp of international trade terminology empowers B2B buyers to communicate clearly, secure favorable deals, and avoid costly misunderstandings.

- OEM (Original Equipment Manufacturer)

- Meaning: A supplier that produces products based on your design/branding, or to your exact specifications.

-

Why It Matters: Engaging an OEM is ideal for custom products or private label needs. This term clarifies who owns the design and establishes expectations for exclusivity, IP rights, and branding.

-

MOQ (Minimum Order Quantity)

- Meaning: The lowest number of units a manufacturer will produce or sell in one batch.

-

Why It Matters: Affects your initial investment and inventory holding costs. Understanding MOQ is central when scaling up, negotiating for samples, or testing new SKUs in African or Middle Eastern markets with evolving demand.

-

RFQ (Request for Quotation)

- Meaning: A formal document or process for soliciting price quotes and lead times from suppliers.

-

Why It Matters: Using a clear RFQ process ensures accurate price comparison and sharpens your negotiating position. Essential for transparency and competitive sourcing—especially across borders where direct meetings may be rare.

-

Incoterms (International Commercial Terms)

- Meaning: Globally recognized rules that define the responsibilities of buyers and sellers for delivery, insurance, duties, and risks in international transactions (e.g., FOB, CIF, DAP).

-

Why It Matters: Misunderstood or vague Incoterms often cause disputes over who pays for shipping, insurance, or customs. Ensuring all parties use and understand the right Incoterms reduces uncertainty in cross-continental trades.

-

Lead Time

- Meaning: The span from order confirmation to delivery at your chosen location.

-

Why It Matters: Vital for inventory planning and fulfilling commitments to your own customers, especially if you operate in regions subject to longer shipping routes or customs clearance challenges.

-

QC (Quality Control)

- Meaning: Procedures, inspections, or tests to assure product quality meets defined standards before shipment or after delivery.

- Why It Matters: Well-defined QC processes prevent defective products, ensure that technical specifications are met, and help maintain your reputation across diverse B2B markets.

By mastering these essential technical properties and trade terms, international B2B buyers can bridge communication gaps with global suppliers, make smarter sourcing decisions, and reduce commercial risk when creating new products for their markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the how to create my own product Sector

Market Overview & Key Trends

The landscape for creating custom products has transformed dramatically in recent years, driven by advances in technology, shifting consumer preferences, and globalization. International B2B buyers—especially those from Africa, South America, the Middle East, and Europe—are encountering both new opportunities and challenges as they engage in product creation.

Global Drivers & Market Dynamics

The rise of digital platforms, cloud-based design tools, and on-demand manufacturing has lowered barriers to entry for businesses looking to bring new products to market. E-commerce integration and rapid prototyping technologies, such as 3D printing, have significantly reduced lead times and development costs. For B2B buyers, this means faster time-to-market and greater flexibility when testing and iterating products for different regions or market segments.

Demand for localized and differentiated products is particularly strong in emerging markets, where businesses are seeking to respond to unique cultural preferences and regional needs. In Africa and South America, there is heightened interest in leveraging local resources and knowledge to design products tailored for local environments, often blending global best practices with indigenous innovation. Meanwhile, buyers in the Middle East and Europe (including dynamic markets like Australia and Thailand) are prioritizing traceability, compliance, and scalability, pushing suppliers to adhere to international standards and deliver consistent quality at scale.

Key Sourcing Trends

– Nearshoring is gaining traction as companies look to mitigate supply chain risks and improve responsiveness. African and European buyers, for example, are increasingly sourcing components and manufacturing services from neighboring countries to reduce logistical complexities and tariffs.

– Digital Sourcing Platforms—such as Alibaba, ThomasNet, and regional B2B marketplaces—offer broader supplier access but require sophisticated vetting processes. Successful buyers are leveraging data-driven tools for supplier comparison, quality assurance, and cost optimization.

– Agile Product Development is becoming mainstream. Buyers are adopting iterative development cycles, incorporating customer feedback through rapid prototyping and minimal viable product (MVP) launches before committing to large-scale production.

Challenges and Considerations

Variations in infrastructure, regulatory environments, and access to skilled labor demand localized strategies. For new entrants, understanding local consumer behavior and business norms is critical. Building strong manufacturer relationships and establishing clear communication channels remain essential in preventing costly production errors, especially when operating across regions with linguistic and regulatory disparities.

Sustainability & Ethical Sourcing in B2B

Sustainability has evolved from a niche concern to a central decision criterion for B2B buyers in the product creation sector. Global supply chain scrutiny, consumer activism, and tightening environmental regulations are compelling businesses to reevaluate how and where their products are made.

Environmental Impact & Corporate Responsibility

Minimizing environmental footprint—through responsible material selection, energy-efficient manufacturing, and waste reduction—has become a priority. International buyers, particularly those targeting European, Middle Eastern, or Australian markets, must anticipate stringent compliance requirements related to packaging, chemical content, and lifecycle emissions.

- Green Certifications: ISO 14001 (Environmental Management), FSC/PEFC (for wood products), and Fairtrade or Rainforest Alliance labels are now integral to winning contracts and building brand trust, especially in Europe and Australia.

- Material Innovation: There is a growing emphasis on the use of recycled, upcycled, or biodegradable materials. B2B buyers are increasingly requesting verifiable environmental claims—from carbon-neutral production to closed-loop manufacturing processes—to address both compliance and brand positioning goals.

Ethical Supply Chains

Transparency in sourcing is essential. Diverse markets, especially in Africa and South America, are witnessing government-led and NGO-supported initiatives to clamp down on unethical labor practices, unsafe working conditions, and environmental abuses. Comprehensive supplier audits, third-party certifications, and continuous monitoring are best practices for ensuring ethical compliance and reducing reputational risks.

B2B buyers are also supporting community-based initiatives and fair trade practices to enhance local economic impact, which not only aligns with global sustainability goals but also strengthens supplier relationships and fosters long-term operational resilience.

A Brief Evolution of Product Creation in B2B Context

Historically, creating a new product required substantial upfront investment, with limited flexibility for iteration and high risks due to long supply chains. The dominance of mass manufacturing, especially in Asia, meant that only large organizations could compete globally. However, the last decade has seen a democratization of product development—driven by digital design ecosystems, modular manufacturing, and transparent global logistics.

Today, businesses of all sizes can access global talent, crowdsource designs, and work with agile manufacturing partners. The B2B sector has responded by establishing collaborative ecosystems, integrating real-time data analytics for forecasting and sourcing, and prioritizing sustainability at every stage. This ongoing evolution continues to open doors, reduce costs, and create new possibilities for buyers worldwide seeking to create their own unique products while balancing profitability with purpose.

Related Video: Made in the world: Better understanding global trade flows

Frequently Asked Questions (FAQs) for B2B Buyers of how to create my own product

-

How can I effectively vet potential suppliers or manufacturers for my new product, especially when dealing internationally?

Thorough supplier vetting is essential to avoid costly missteps. Start by researching industry-specific directories (like Alibaba, Global Sources), and always request company profiles, certifications, and references from past B2B clients—ideally those in your region. Verify legal business registration and assess their communication responsiveness. Arrange video calls or onsite visits if possible, and request product samples to check quality. Utilize trade chambers or local embassies for additional background checks. A comprehensive vetting process reduces risk, especially when sourcing from unfamiliar markets. -

What should I know about customizing products for my local or regional market needs?

Customization ensures your product aligns with local consumer preferences, regulatory standards, and branding requirements. Before negotiations, provide detailed specifications, including materials, technical requirements, and packaging. Discuss options for private labeling, unique features, or tweaks relevant to your target market. Ensure the supplier can meet these needs by reviewing their past customization projects. Also, understand any extra costs or time required for customization and get all product modifications documented in the purchase agreement to avoid miscommunication. -

What are typical minimum order quantities (MOQ), lead times, and payment terms with international manufacturers?

MOQs vary depending on the manufacturer and product complexity; established suppliers may have higher MOQs, while newer or smaller factories may be more flexible. Lead times typically range from 30-90 days for most custom projects but can be longer for intricate products or during peak demand. Standard payment terms often include a deposit (30%) with the balance due pre-shipment, though letters of credit and escrow services are also common for enhanced security. Always clarify timeframes and payment milestones before finalizing orders. -

How can I ensure consistent product quality when producing overseas?

Implement rigorous quality assurance (QA) protocols: conduct pre-production sample approval, request regular photographic updates, and use third-party inspection agencies to audit factories or test batches. Specify international or local standards (such as ISO certificates or CE markings) required for your market, and integrate clear defect tolerances in contracts. Establish communication channels for ongoing QA monitoring and clarify the corrective action process for issues. Prioritize suppliers with a documented QA system and proven track record. -

What certifications, standards, or compliance documents do I need for importing my product into Africa, South America, the Middle East, or Europe?

Requirements differ by region and product category. Generally, products must comply with local regulations (e.g., CE for Europe; SONCAP for Nigeria; SASO for Saudi Arabia). Ask suppliers for up-to-date compliance certificates, test reports, and documentation (such as MSDS for chemicals or FCC for electronics). Verify the authenticity of documents before shipping. Engage customs brokers or regulatory consultants early to avoid unexpected delays or import rejections, and stay informed on evolving import laws in your target market. -

How do I manage logistics, shipping, and customs clearance for my custom product?

Decide on suitable Incoterms (e.g., FOB, CIF, DDP), which define responsibilities between you and your supplier. Work with experienced freight forwarders who understand your product and destination market. Prepare all necessary shipping documents—commercial invoice, packing list, bill of lading, and certificates of origin. Familiarize yourself with customs procedures in your region to anticipate duties, taxes, or special clearance requirements. Maintain communication with your logistics partners to track shipments and address issues proactively. -

What should I do if I encounter product defects, delivery delays, or contractual disputes with my overseas supplier?

Include clear terms regarding defect resolution, replacements, or refunds in your supply contract. Maintain detailed records of all communications and transactions. If disputes arise, attempt resolution directly with the supplier first. If unresolved, involve third-party mediators, trade associations, or arbitration bodies. Consider escrow services for payment protection, and explore legal recourse as a last resort. Establishing clear contract terms and dispute processes in advance significantly reduces risk. -

How can I protect my product design or intellectual property (IP) when working with international manufacturers?

Prioritize sharing proprietary information only after signing a properly drafted Non-Disclosure Agreement (NDA). Register your IP rights (patents, trademarks, design rights) in both your home and manufacturing countries. Limit sensitive information shared to what’s necessary for production. Audit suppliers for their own IP track record, and consider working with manufacturers who have experience with international brands. Proactively monitoring the market for copies and acting against infringements is vital, as enforcement varies by jurisdiction.

Strategic Sourcing Conclusion and Outlook for how to create my own product

Key Takeaways and Forward Path for International B2B Buyers

Bringing a new product to market is a structured journey that demands precision, collaboration, and adaptability—particularly for B2B buyers seeking to serve diverse international markets such as Africa, South America, the Middle East, and Europe. The foundation lies in thorough market and competitor research, followed by disciplined product planning and validation to mitigate risk and optimize for local market conditions.

Strategic sourcing stands out as a critical driver of commercial success. By carefully selecting suppliers and manufacturers who offer quality, reliability, and scalability, B2B buyers can protect supply chains and maintain consistent product standards across borders. Open, proactive communication with partners, coupled with diligent due diligence—such as vetting credentials and testing samples—enables smoother negotiation, innovation, and long-term growth.

Looking ahead, B2B buyers who embrace a continuous improvement mindset and stay attuned to evolving customer needs will be best positioned to succeed. Leverage regional knowledge, build agile partnerships, and stay alert to new production and supply chain technologies. Now is the time to act: use strategic sourcing as a competitive advantage to transform bold product ideas into market-leading solutions tailored for global consumers.