The global alumina market is witnessing steady expansion, driven by rising demand across industries such as aerospace, automotive, and advanced ceramics, where high yield strength materials are critical for performance and reliability. According to a 2023 report by Mordor Intelligence, the global alumina market was valued at approximately USD 19.8 billion and is projected to grow at a CAGR of over 4.5% during the forecast period 2023–2028. This growth is largely fueled by increasing investments in lightweight, high-strength materials to enhance fuel efficiency and reduce emissions. Alumina, particularly in its high-purity forms, exhibits exceptional mechanical properties—including high yield strength—making it indispensable in wear-resistant components, cutting tools, and structural applications. As manufacturers strive to meet stringent performance standards, innovations in sintering techniques and grain refinement have significantly boosted the yield strength of alumina ceramics, pushing top-tier producers to achieve values exceeding 400 MPa. With demand escalating across high-tech sectors, identifying manufacturers at the forefront of material performance has become essential for procurement and engineering decision-making.

Top 10 Yield Strength Of Alumina Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

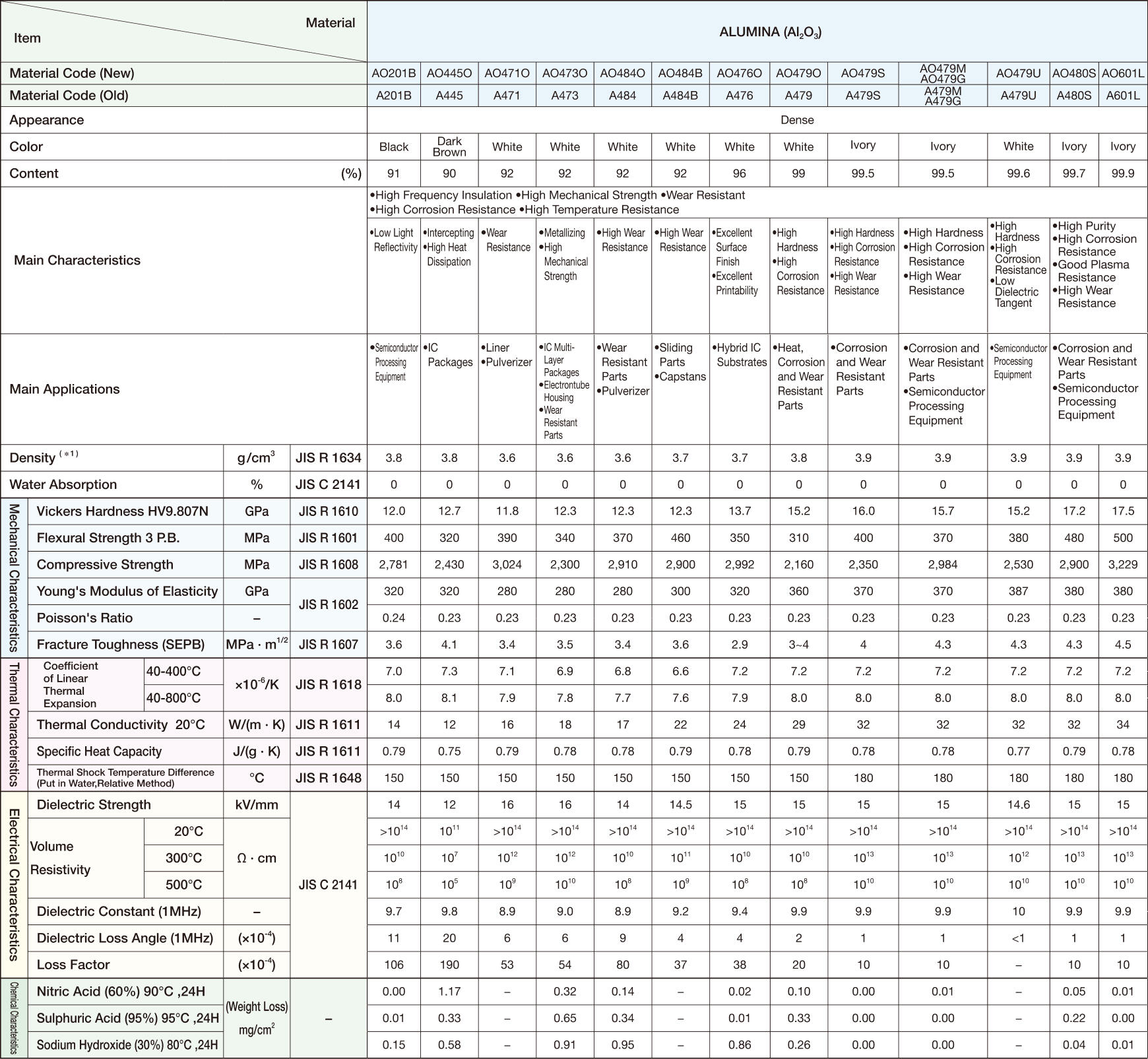

#1 Alumina (Al2O3)

Domain Est. 1993

Website: global.kyocera.com

Key Highlights: Alumina (Al2O3) is material of Fine Ceramics. KYOCERA is the global leading manufacturer of superior precision Fine Ceramics (Advanced Ceramics) products….

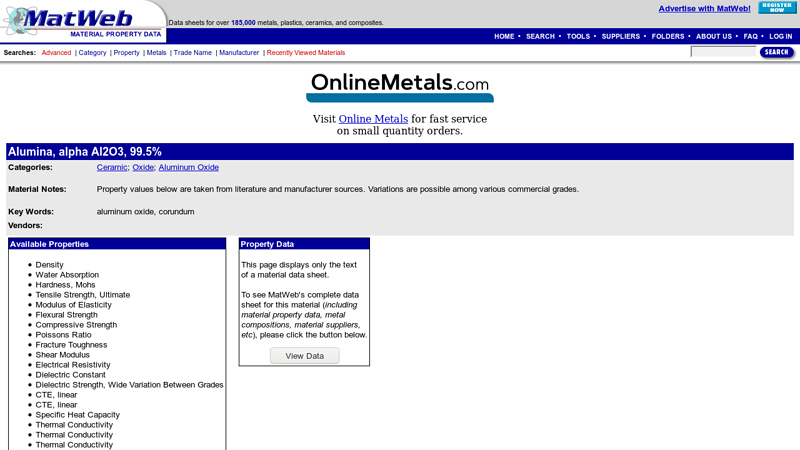

#2 Alumina, alpha Al2O3, 99.5%

Domain Est. 1997

Website: matweb.com

Key Highlights: Alumina, alpha Al2O3, 99.5% on small quantity orders. Material Notes: Property values below are taken from literature and manufacturer sources….

#3 Alumina Oxide (Al2O3)

Domain Est. 2002

Website: ortechceramics.com

Key Highlights: This material has superb material characteristics such as high electrical insulation, high mechanical strength, high wear and chemical resistance. Ortech ……

#4 Alumina – IBUpart®AL2O3

Domain Est. 2008

Website: ibu-tec.com

Key Highlights: IBUpart®Al2O3 is an aluminum oxide with high specific surface area, produced with years of thermal process technology experience at IBU-tec….

#5 Aluminum Oxide

Domain Est. 1997

Website: accuratus.com

Key Highlights: Alpha phase alumina is the strongest and stiffest of the oxide ceramics. Its high hardness, excellent dielectric properties, refractoriness and good thermal ……

#6 Aluminas

Domain Est. 1997

Website: ceramics.net

Key Highlights: Alumina’s material properties offer electrical isolation, wear resistance, high temperature resistance, and good mechanical strength. STC’s fully dense ……

#7 Alumina 99.5%

Domain Est. 1998

Website: ferroceramic.com

Key Highlights: Alumina represents the most commonly utilized ceramic material in industry. Purity levels are available from 85% through 99.9%….

#8 Alumina

Domain Est. 1999

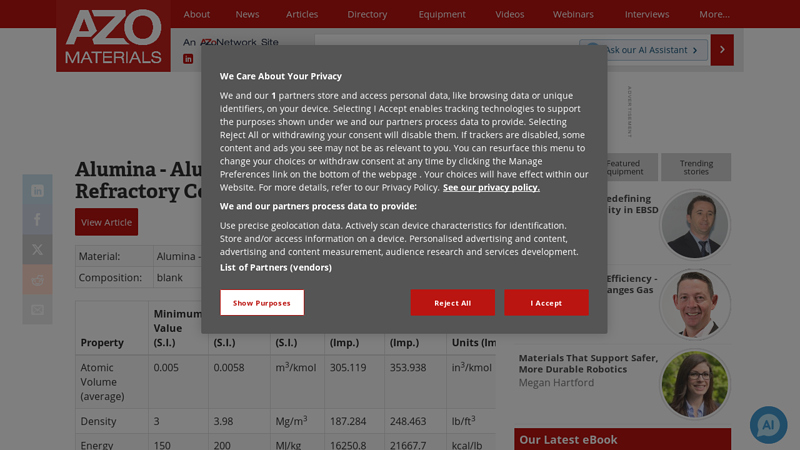

Website: azom.com

Key Highlights: Alumina – Aluminium Oxide – Al2O3 – A Refractory Ceramic Oxide ; Shear Modulus, 88, 165 ; Tensile Strength, 69, 665 ; Young’s Modulus, 215, 413 ; Glass Temperature ……

#9 Alumina

Domain Est. 1999

Website: coorstek.com

Key Highlights: Alumina ceramics are commonly subdivided according to their alumina content ranging from 80% to more than 99%….

#10 90

Domain Est. 2004

Website: morgantechnicalceramics.com

Key Highlights: This 94% Al 2 O 3 material has an excellent combination of mechanical, thermal, electrical and chemical properties which are well suited to applications within ……

Expert Sourcing Insights for Yield Strength Of Alumina

H2: Projected Market Trends for Yield Strength of Alumina in 2026

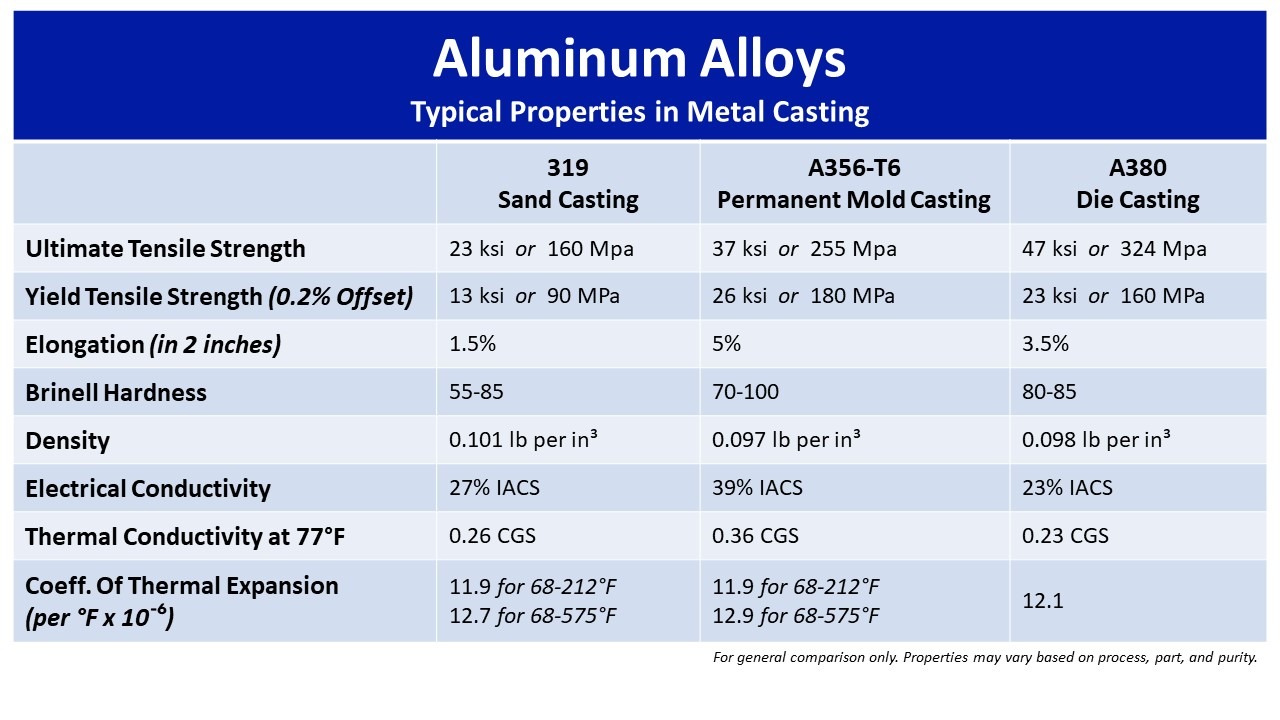

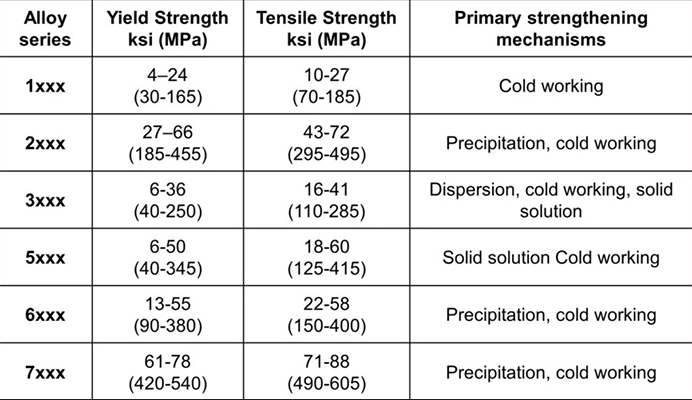

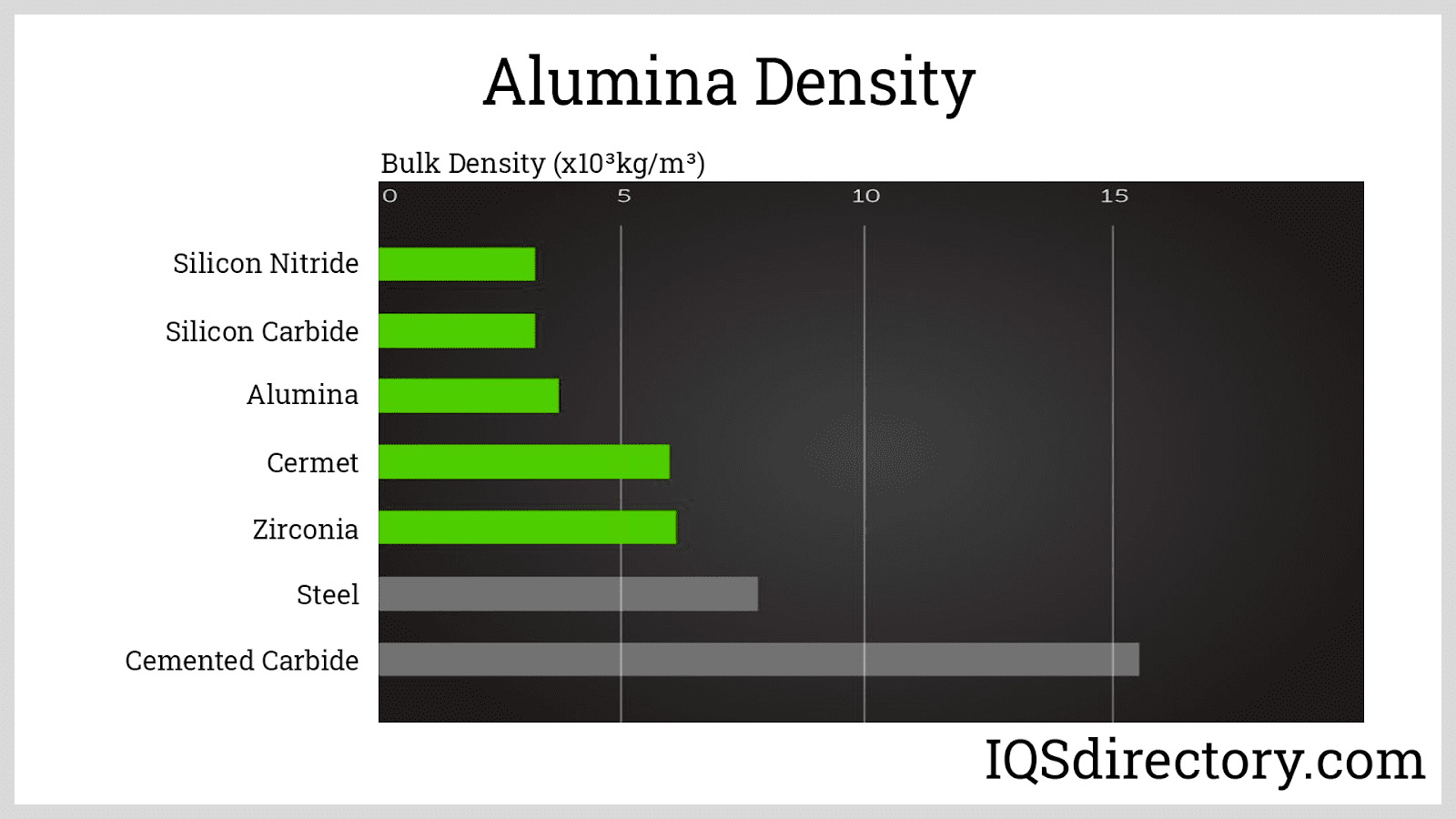

By 2026, the market for high-yield-strength alumina ceramics is expected to experience significant growth, driven by increasing demand across advanced industrial, aerospace, defense, and medical sectors. Alumina (aluminum oxide, Al₂O₃), known for its excellent mechanical properties, chemical resistance, and high yield strength—typically ranging from 300 MPa to over 1,000 MPa depending on purity and microstructure—is being optimized through advanced manufacturing techniques to meet stringent performance requirements.

Key trends shaping the 2026 market include:

-

Advancements in Material Processing: Innovations in sintering technologies—such as spark plasma sintering (SPS) and hot isostatic pressing (HIP)—are enabling finer grain structures and higher density in alumina ceramics. These processes enhance yield strength and reliability, making alumina more competitive with alternative ceramics like zirconia and silicon carbide.

-

Growing Demand in Electronics and Semiconductor Manufacturing: Alumina components with high yield strength are critical in semiconductor fabrication equipment due to their thermal stability and electrical insulation. As global semiconductor production expands, especially in Asia and North America, demand for high-performance alumina parts (e.g., wafer chucks, insulators) will rise, influencing material specifications toward higher mechanical strength.

-

Aerospace and Defense Applications: Lightweight, high-strength ceramic components are increasingly used in armor systems, missile guidance units, and turbine engines. By 2026, defense modernization programs in the U.S., Europe, and Asia are expected to boost procurement of alumina-based structural and protective components, emphasizing materials with yield strength exceeding 500 MPa.

-

Medical Device Innovation: Alumina’s biocompatibility and high yield strength make it ideal for orthopedic implants such as hip joint heads. Ongoing R&D aims to improve fracture toughness without compromising strength. The aging global population and rising joint replacement surgeries will sustain market growth, with premium-grade alumina commanding higher prices.

-

Sustainability and Recycling Initiatives: As industries focus on circular economy models, efforts to recycle alumina from industrial waste (e.g., grinding sludge, used refractories) are gaining traction. While recycled alumina may have slightly reduced yield strength, new purification and reprocessing methods are narrowing the performance gap, offering cost-effective and eco-friendly alternatives.

-

Regional Market Dynamics: Asia-Pacific, led by China, Japan, and South Korea, is projected to dominate the high-strength alumina market due to robust manufacturing bases and investments in advanced ceramics. North America and Europe will follow, supported by R&D in next-generation materials and stringent regulatory standards requiring reliable, high-performance ceramics.

-

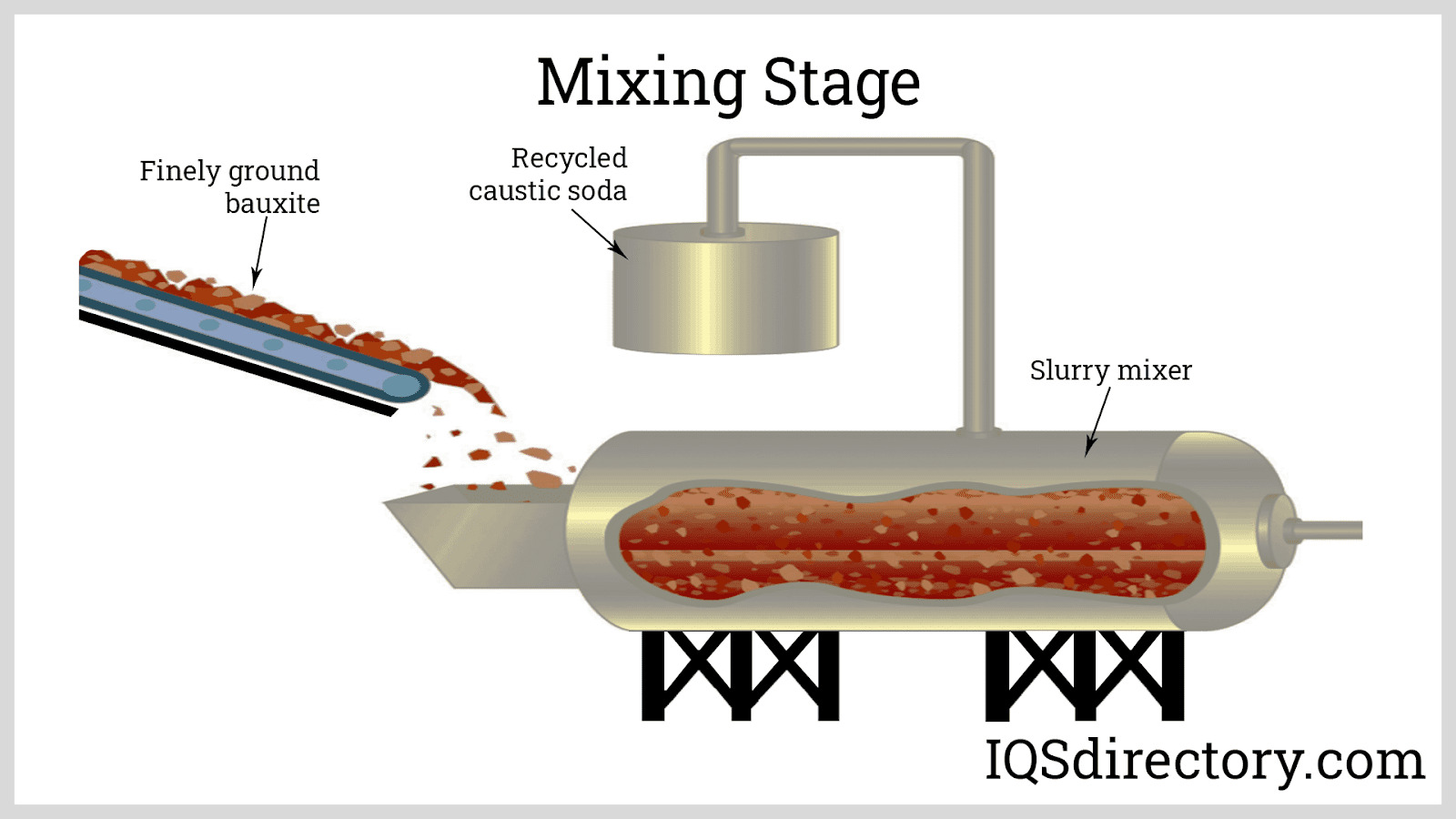

Price and Supply Chain Considerations: Fluctuations in raw bauxite prices and energy costs for high-temperature processing may impact alumina ceramic pricing. However, economies of scale and localized production are expected to stabilize supply chains by 2026, ensuring consistent availability of high-yield-strength alumina products.

In summary, the 2026 market for yield strength of alumina will be shaped by material innovation, expanding application sectors, and regional industrial growth. As performance requirements intensify, alumina ceramics with enhanced yield strength will play a pivotal role in enabling next-generation technologies across multiple high-value industries.

Common Pitfalls in Sourcing Yield Strength of Alumina: Quality and Intellectual Property Concerns

Sourcing reliable data on the yield strength of alumina (Al₂O₃) is critical for engineering design, particularly in demanding applications like aerospace, medical implants, and advanced electronics. However, this process is fraught with potential pitfalls related to material quality and intellectual property (IP) that can lead to significant design failures or legal complications.

Quality-Related Pitfalls

Inconsistent Material Specifications

Alumina’s mechanical properties, including yield strength, are highly sensitive to purity, grain size, density, and manufacturing process (e.g., hot-pressed vs. sintered). Sourcing data without precise material specifications—such as Al₂O₃ content (e.g., 99.5% vs. 96%), sintering method, or grain morphology—can result in data that is not representative of the actual material being considered. Relying on generic “alumina” properties often leads to inaccurate predictions.

Lack of Traceability and Testing Standards

Many suppliers or secondary sources provide yield strength values without citing the testing methodology (e.g., ASTM C1328 or ISO 14704 for flexural strength, often used as a proxy) or environmental conditions (temperature, loading rate). Without traceability to recognized standards, the data may not be reproducible or reliable, increasing the risk of component failure under load.

Overreliance on Theoretical or Idealized Data

Some sources present theoretical yield strength values derived from perfect crystal structures, neglecting real-world defects such as microcracks, porosity, and grain boundaries. These idealized numbers are typically much higher than experimentally measured values and can mislead engineers into overestimating performance.

Intellectual Property-Related Pitfalls

Use of Proprietary Data Without Authorization

Certain high-performance alumina formulations—especially those with dopants or advanced processing techniques—are protected by patents or trade secrets. Sourcing yield strength data from proprietary technical documents, research papers, or supplier datasheets without proper licensing or permission may violate intellectual property rights, exposing the user to legal risk.

Misattribution or Unverified Claims

Some vendors or open-access databases may present performance data that originates from patented technologies without proper attribution. Using such data in commercial product development could inadvertently infringe on existing IP, particularly if the mechanical properties are tied to a specific, protected manufacturing process.

Insufficient Due Diligence in Supplier Vetting

Failing to verify whether a supplier’s performance claims (including yield strength) are based on in-house testing or derived from third-party, potentially protected research can lead to compliance issues. It is essential to request documentation and confirm the legitimacy and origin of mechanical property data.

Best Practices to Avoid Pitfalls

- Demand full material specifications alongside mechanical data.

- Verify testing standards and conditions used to determine yield strength.

- Cross-reference multiple reputable sources, such as peer-reviewed journals or certified material databases (e.g., MatWeb, Granta MI).

- Conduct independent testing when high reliability is required.

- Consult IP databases (e.g., USPTO, Espacenet) to ensure that material properties are not tied to active patents.

- Establish clear agreements with suppliers regarding data usage rights and confidentiality.

By proactively addressing quality and IP concerns, engineers and procurement teams can ensure the safe, legal, and effective use of alumina in critical applications.

Logistics & Compliance Guide for Yield Strength of Alumina

The yield strength of alumina (Al₂O₃) is a critical mechanical property that influences its handling, shipping, storage, and regulatory compliance—particularly when used in high-performance industrial, aerospace, or medical applications. While alumina itself is a ceramic material and not classified as hazardous, its physical form (powder, sintered components, etc.) and end-use applications impose specific logistical and compliance requirements. This guide outlines key considerations related to the logistics and compliance aspects involving the yield strength of alumina, especially when performance specifications must be maintained.

Understanding Yield Strength in Alumina

Yield strength, although typically defined for ductile materials, is approximated in ceramics like alumina through parameters such as compressive strength or fracture strength due to their brittle nature. High-purity alumina (e.g., 99.5% Al₂O₃) can exhibit flexural strength values ranging from 300 to 500 MPa, with compressive strength exceeding 2,000 MPa. These values are crucial for applications requiring structural integrity under load. Ensuring that the material maintains its specified mechanical properties—including effective yield behavior—throughout the supply chain is essential for compliance with industry standards.

Material Handling and Transportation

Proper handling is vital to preserve the structural integrity of alumina components, especially those engineered to meet precise strength requirements. Mechanical shock, vibration, and improper packaging can introduce microcracks or surface defects that compromise yield performance. Sintered alumina parts must be cushioned using non-abrasive materials (e.g., foam inserts, corrugated fiberboard) and shipped in rigid containers to prevent chipping or fracture during transit. For powdered alumina, anti-static and moisture-resistant packaging may be necessary to maintain purity and prevent caking, which could affect downstream processing and final strength.

Storage Conditions

Alumina ceramics are chemically stable and resistant to moisture, but optimal storage conditions help preserve dimensional accuracy and surface quality. Store components in a dry, temperature-controlled environment (15–25°C, <60% RH) to prevent thermal stress or contamination. Powdered alumina should be sealed in airtight containers to avoid moisture absorption and dust dispersion. Clearly label all materials with batch numbers, purity grades, and certified mechanical properties (including flexural or compressive strength data) to support traceability and quality compliance.

Regulatory and Industry Compliance

Depending on the application, alumina products may be subject to various regulatory standards. For example:

- Medical Devices (ISO 13485, FDA 21 CFR Part 820): Alumina used in implants (e.g., hip joint components) must meet strict biocompatibility and mechanical performance standards. Documentation must include certified test reports for strength properties, often derived from standardized tests (e.g., ISO 6474-1 for dense aluminum oxide ceramics).

- Aerospace (AS9100, NADCAP): Components must undergo rigorous quality control, including non-destructive testing (NDT) and traceable material certifications that validate mechanical properties such as strength and fracture toughness.

- Industrial Manufacturing (ISO 9001): General quality management systems require documented conformity to specified material properties, including yield or flexural strength, especially when used in wear-resistant or insulating applications.

Documentation and Certifications

Suppliers must provide Material Test Reports (MTRs) or Certificates of Conformance (CoC) that include measured mechanical properties relevant to yield behavior. Standard test methods such as ASTM C1161 (flexural strength) or ASTM C773 (compressive strength) should be referenced. For high-reliability applications, statistical process control (SPC) data and lot traceability are often required to ensure consistency in strength performance.

Environmental, Health, and Safety (EHS) Considerations

While solid alumina ceramics pose minimal health risks, powdered forms can be a respiratory hazard if inhaled. In compliance with OSHA and GHS standards, alumina powder must be handled in controlled environments with appropriate personal protective equipment (PPE), ventilation, and dust collection systems. Safety Data Sheets (SDS) must be available and include guidance on handling, exposure controls, and disposal. Though alumina is generally inert and non-toxic, proper EHS protocols ensure workplace safety and regulatory compliance.

Conclusion

Maintaining the specified yield strength (or equivalent mechanical performance) of alumina throughout the logistics chain requires careful handling, storage, and comprehensive documentation. Compliance with industry-specific regulations ensures that alumina components perform reliably in demanding applications. By integrating material performance data into logistics planning and quality systems, organizations can ensure both safety and functional integrity from production to end use.

In conclusion, sourcing the yield strength of alumina requires careful consideration of material composition, microstructure, testing conditions, and application requirements. Alumina, being a brittle ceramic, does not exhibit a distinct yield point like ductile metals, making its mechanical behavior challenging to characterize. Reported yield strength values can vary significantly—typically ranging from 300 MPa to over 600 MPa—depending on factors such as purity, grain size, porosity, and temperature. Therefore, reliable sourcing should involve consulting peer-reviewed literature, material databases (e.g., MatWeb, AZoM), or technical data sheets from reputable manufacturers, while also accounting for environmental and loading conditions relevant to the intended application. When precise values are critical, experimental validation under representative conditions is recommended to ensure accuracy and performance reliability.