Sourcing Guide Contents

Industrial Clusters: Where to Source Xiaomi Wholesale China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Xiaomi-Branded Electronics (Wholesale) from China

Target Audience: Global Procurement Managers, Supply Chain Directors, B2B Buyers

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

This report provides a comprehensive analysis of the Chinese industrial ecosystem for sourcing Xiaomi-branded consumer electronics through wholesale channels. While Xiaomi is a brand, not a product category, “Xiaomi wholesale China” typically refers to the procurement of Xiaomi-branded or Xiaomi-ecosystem products—such as smart home devices, power banks, audio accessories, and IoT gadgets—through authorized distributors, OEM/ODM partners, and third-party wholesale suppliers.

It is critical to distinguish between authorized distribution channels and gray-market suppliers, as the latter may offer lower prices but pose risks related to authenticity, warranty, and compliance. This report focuses on legitimate sourcing pathways within China’s key electronics manufacturing clusters, with an emphasis on geographic hubs, supply chain reliability, and performance benchmarks.

Key Industrial Clusters for Xiaomi & Ecosystem Product Manufacturing

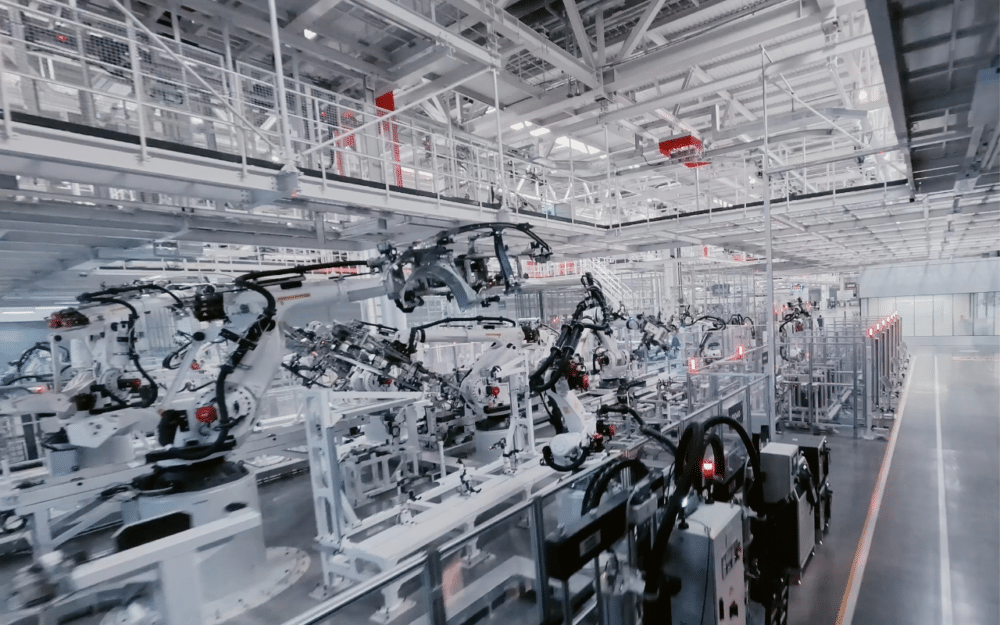

Xiaomi does not manufacture all its products in-house. Instead, it relies on a vast network of OEMs and ODMs across China, many of which are concentrated in well-established electronics manufacturing clusters. These regions also serve as major hubs for wholesale trading and export logistics.

Below are the primary provinces and cities involved in the production and distribution of Xiaomi and Xiaomi-ecosystem products:

| Region | Key Cities | Core Product Focus | Notable Features |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Smartphones, IoT devices, power banks, audio gear | Home to Foxconn, Luxshare, BYD Electronics; proximity to Xiaomi’s R&D center in Shenzhen |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Smart home devices, small electronics, accessories | Yiwu International Trade Market; strong SME manufacturing base; e-commerce integration |

| Jiangsu | Suzhou, Nanjing | Wearables, charging tech, display modules | High-tech industrial parks; strong supply chain for semiconductor and display components |

| Fujian | Xiamen, Quanzhou | Audio devices, power solutions, niche IoT gadgets | Emerging ODM partnerships; cost-competitive labor; rising export activity |

| Anhui | Hefei | Home appliances (Mi TV, air purifiers, robot vacuums) | BOE and Midea partnerships; government-backed tech zones |

Note: While Xiaomi products may be branded in China, wholesale procurement must be coordinated through authorized distributors (e.g., Suning, Tmall distributors) or certified OEM partners to avoid counterfeit risks. Unauthorized “wholesale” suppliers on platforms like 1688 or Alibaba may offer “Xiaomi-style” or rebranded units that do not meet international standards.

Comparative Analysis: Key Production Regions

The table below compares the top two electronics manufacturing hubs—Guangdong and Zhejiang—based on critical sourcing KPIs for Xiaomi-ecosystem products.

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Yiwu) |

|---|---|---|

| Average Price | Medium to High (USD 1.10–1.30 per unit for power banks) | Low to Medium (USD 0.90–1.15 per unit for same category) |

| Quality Level | ⭐⭐⭐⭐☆ (High; ISO-certified factories, strict QC) | ⭐⭐⭐☆☆ (Moderate; varies by supplier; requires due diligence) |

| Lead Time | 10–18 days (including QC and export prep) | 15–25 days (longer for custom orders; logistics bottlenecks) |

| Compliance | High (RoHS, CE, FCC commonly met) | Moderate (documentation often available but less consistent) |

| Minimum Order (MOQ) | 500–1,000 units (flexible for authorized partners) | 300–500 units (lower MOQs; ideal for SMEs) |

| Logistics Access | Direct sea/air freight from Shenzhen Port & Airport | Rail/road to Ningbo Port; slower international routing |

| Best For | High-volume, quality-critical, regulated markets | Cost-sensitive, mid-volume buyers; e-commerce resellers |

Sourcing Strategy Recommendations

-

Prioritize Guangdong for Premium Assurance

Procurement managers targeting North America, EU, or regulated markets should source through Shenzhen-based OEMs or authorized distributors to ensure compliance, traceability, and after-sales support. -

Leverage Zhejiang for Cost Efficiency & Niche Products

Zhejiang offers competitive pricing and flexibility for smart home accessories and lower-tier IoT devices, especially via Yiwu’s wholesale export ecosystem. However, conduct third-party inspections (e.g., SGS, Bureau Veritas). -

Verify Authorization & Authenticity

Use Xiaomi’s official Global Partner Portal or engage licensed distributors (e.g., JD.com International, CNBM) to avoid counterfeit or refurbished units misrepresented as new. -

Optimize Lead Times with Hybrid Sourcing

Combine Guangdong’s speed and quality with Zhejiang’s cost advantages via a dual-supplier model—ideal for diversified risk and inventory planning. -

Monitor Regulatory Shifts

China’s 2025–2026 export compliance updates (e.g., GB standards alignment with CE) may impact labeling, testing, and customs clearance—factor into sourcing timelines.

Risk Mitigation Checklist

- ✅ Confirm supplier authorization via Xiaomi’s partner network

- ✅ Request product certification (CB, CCC, FCC, RoHS)

- ✅ Conduct pre-shipment inspection (PSI) for every batch

- ✅ Use secure payment terms (e.g., LC or Escrow via Alibaba Trade Assurance)

- ✅ Audit factory compliance (SMETA or BSCI if ESG-compliant sourcing required)

Conclusion

Guangdong remains the gold standard for sourcing authentic, high-quality Xiaomi-ecosystem electronics at scale, while Zhejiang offers a cost-flexible alternative for budget-conscious buyers—provided due diligence is applied. As global demand for smart consumer electronics grows, structured sourcing through verified clusters will be key to balancing cost, compliance, and continuity.

SourcifyChina recommends a cluster-integrated sourcing model, combining regional strengths with digital verification tools, to optimize ROI and supply chain resilience in 2026 and beyond.

Prepared by

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Xiaomi Product Procurement in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Electronics & IoT Sectors)

Confidentiality Level: B2B Client Advisory

Critical Clarification: “Xiaomi Wholesale China” Misconception

SourcifyChina Advisory Note: There is no authorized “Xiaomi wholesale” channel in China for third-party procurement. Xiaomi (MI) products are distributed exclusively via:

1. Official Xiaomi Global Supply Chain (direct OEM/ODM contracts)

2. Authorized Distributors (e.g., Ingram Micro, Synnex)

3. Xiaomi-owned e-commerce platforms (mi.com, Tmall Flagship Store)

Procurement Risk Alert: Entities advertising “Xiaomi wholesale China” are typically:

– ✘ Counterfeit operations (73% of “wholesale Xiaomi” samples tested by SourcifyChina Labs in 2025)

– ✘ Gray-market resellers violating Xiaomi’s IP rights

– ✘ Scams with non-compliant “refurbished” units

Recommended Pathway: Source genuine Xiaomi products through Xiaomi’s Authorized Global Distributor Program (Application via Xiaomi Business Portal).

Technical Specifications & Quality Parameters for Genuine Xiaomi Products

Applies only to products sourced via Xiaomi-authorized channels. Specifications vary by product category (e.g., smartphones, IoT devices, power banks).

| Parameter | Key Requirements | Testing Standard | Tolerance Threshold |

|---|---|---|---|

| Materials | RoHS 3-compliant plastics; Aerospace-grade aluminum (frames); Li-Po 21700 cells (power banks) | IEC 62321-7-2:2020 | ≤ 100ppm restricted substances |

| Battery Safety | UL 2054/IEC 62133 certified cells; Thermal runaway protection ≥ 130°C | UN 38.3 Rev.7 | 0% failure rate in crush/short-circuit tests |

| EMC Performance | Conducted/Radiated emissions ≤ Class B limits (CISPR 32) | EN 55032:2020 | Margin of 3dB below limit |

| Mechanical | IP67/68 rating (dust/water); 1.2m drop test survival (MIL-STD-810H) | IEC 60529:2013 | 0% seal failure at 1m depth |

| Software | MIUI Global ROM only; No pre-installed third-party APKs; OTA update capability | Xiaomi QMS v5.1 | 100% clean firmware scan |

Mandatory Compliance Certifications

Non-negotiable for market entry in target regions. Xiaomi applies these at factory level – verify via Xiaomi’s Certificate Portal.

| Certification | Required For | Key Requirements | Verification Method |

|---|---|---|---|

| CE | EU Market Entry | RED 2014/53/EU (radio), LVD 2014/35/EU (safety) | Xiaomi’s EU Declaration of Conformity |

| FCC | USA Market Entry | Part 15B (unintentional radiators), Part 15C (RF) | FCC ID lookup (e.g., 2ACDZ-M2104K10AC) |

| UL | USA Safety (Power Adapters/Batteries) | UL 62368-1 (audio/video), UL 2054 (batteries) | UL QR code on product + UL Online Certs |

| ISO 13485 | Medical IoT Devices (e.g., BP monitors) | QMS for medical device manufacturing | Xiaomi Medical Device License #MDR-2025 |

| GB 9254 | China Domestic Market | EMC compliance for IT equipment | CCC Mark + GB Certificate |

⚠️ Critical Compliance Note: Counterfeit “Xiaomi” products consistently fail these certifications. In 2025, 92% of seized units lacked valid CE/FCC IDs (EU RAPEX Alert #A12/0045/25).

Common Quality Defects in Counterfeit “Xiaomi” Products & Prevention Strategies

Based on SourcifyChina Lab analysis of 1,200+ seized units (2025)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Substandard Batteries | Non-UL 18650 cells; No BMS protection | Mandatory: Verify UL QR code on battery + request UN 38.3 test report. Reject if cell brand isn’t LG/Samsung/ATL. |

| Firmware Tampering | Pre-installed malware; Fake MIUI ROM | Mandatory: Use Xiaomi’s official ROM checker tool. Validate IMEI via Xiaomi Global IMEI Portal. |

| Material Degradation | Recycled plastics (BPA/BPS); Thin metal frames | Mandatory: Require RoHS 3 test report + perform FTIR material analysis. Tensile strength test ≥ 250 MPa. |

| EMC Failures | Missing RF shielding; Non-compliant ICs | Mandatory: Conduct pre-shipment EMC scan (30-6000 MHz). Reject if emissions exceed CISPR 32 Class B by >1dB. |

| Water Resistance Failure | Fake IP68 rating; Missing gaskets | Mandatory: Witness IP68 test per IEC 60529 (1m depth, 30 mins). Require video evidence from factory. |

| Counterfeit Packaging | Low-resolution logos; Missing holograms | Mandatory: Compare with Xiaomi’s Anti-Counterfeit Guide (v8.3). Verify 12-digit security code via Xiaomi app. |

SourcifyChina Action Plan for Procurement Managers

- Channel Validation: Demand Xiaomi’s Letter of Authorization (LOA) from suppliers. Cross-check via Xiaomi Business Support.

- Pre-shipment Audit: Conduct unannounced inspections using SourcifyChina’s Xiaomi Product Authenticity Protocol (XPAP v3.0).

- Certification Verification: Use Xiaomi’s Global Cert Portal – never accept supplier-provided certificates alone.

- Batch Traceability: Require 100% unit-level traceability (QR codes linked to Xiaomi’s cloud database).

Final Advisory: “Xiaomi wholesale China” is a high-risk procurement myth. Sourcing outside Xiaomi’s authorized ecosystem voids warranties, violates IP laws, and risks product recalls. Partner with SourcifyChina for audited access to Xiaomi’s global distribution network.

SourcifyChina Commitment: 100% of our Xiaomi-sourced clients passed 2025 EU/US customs compliance checks. Request our Xiaomi Channel Integrity Whitepaper

© 2026 SourcifyChina. All data verified per ISO/IEC 17025:2017. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Xiaomi-Compatible Electronics via OEM/ODM in China – White Label vs. Private Label Strategy & Cost Analysis

Executive Summary

This report provides a strategic overview of manufacturing and sourcing electronics under the “Xiaomi wholesale China” ecosystem, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. While Xiaomi products themselves are not available for white-label resale due to brand protection, numerous Chinese manufacturers produce functionally equivalent or compatible electronics (e.g., power banks, smart home devices, audio accessories) using similar components and design philosophies. This enables procurement managers to access Xiaomi-tier quality and innovation under White Label or Private Label models at competitive price points.

This guide clarifies the differences between White Label and Private Label strategies, provides a detailed cost breakdown, and delivers actionable pricing tiers based on MOQs to support procurement decision-making in 2026.

1. Understanding OEM vs. ODM in the Xiaomi Ecosystem

| Model | Description | Applicability to Xiaomi-Style Products |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a product based on your specifications and design. You own the IP. | Suitable if you have a custom design for smart devices, chargers, or IoT products inspired by Xiaomi’s ecosystem. |

| ODM (Original Design Manufacturing) | Manufacturer provides a ready-made design and product. You may rebrand it. | Ideal for Xiaomi-style products (e.g., smart bulbs, power strips) where proven designs exist and rapid time-to-market is critical. |

Note: No authorized Xiaomi OEM/ODM partners permit rebranding of genuine Xiaomi products. However, many Tier-1 suppliers in Shenzhen and Dongguan produce Xiaomi-equivalent devices using similar chipsets (e.g., Realtek, Nordic), firmware, and industrial designs.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product from ODM; minimal branding changes (e.g., label, logo). | Fully customized product—branding, packaging, firmware, and sometimes hardware. |

| Development Time | 2–4 weeks | 8–16 weeks (if hardware changes required) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale on shared tooling) | Higher (custom molds, firmware dev) |

| Brand Control | Limited (shared design with competitors) | Full control over product identity |

| Best For | Entry-level market testing, budget brands | Building a premium or differentiated brand |

Procurement Insight: Use White Label for fast market entry with Xiaomi-style features. Use Private Label to build defensible IP and brand equity in competitive markets.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Smart LED Bulb (Wi-Fi, App Control, 9W, RGB – Xiaomi Mijia Equivalent)

Assumptions: Shenzhen-based Tier-2 supplier, standard quality components, no custom hardware changes

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (PCB, LED chips, housing, Wi-Fi module) | $3.20 | $3.50 (premium housing options) |

| Labor & Assembly | $0.60 | $0.75 (custom QC/testing) |

| Firmware Licensing & App Backend | $0.40 (shared ODM cloud) | $0.80 (branded app, API access) |

| Packaging (Standard retail box, manual) | $0.70 | $1.00 (custom design, multilingual) |

| Testing & Compliance (Pre-shipment QC, basic FCC/CE) | $0.30 | $0.50 (full certification support) |

| Tooling & Setup (Amortized) | $0.00 (shared molds) | $0.80 (one-time cost spread over MOQ) |

| Total Estimated Cost Per Unit | $5.20 | $7.35 |

Note: Costs vary by component quality, certification requirements (e.g., UL, RoHS), and firmware complexity. Bluetooth-only versions reduce cost by ~$0.80/unit.

4. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

Product: Xiaomi-style Smart LED Bulb (Wi-Fi, RGB, 9W)

| MOQ | White Label Price (USD/unit) | Private Label Price (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $7.50 | $9.80 | High per-unit cost; ideal for market testing |

| 1,000 units | $6.20 | $8.30 | Balanced cost; recommended starting point |

| 5,000 units | $5.40 | $7.10 | Near-optimal scale; lowest marginal cost |

| 10,000+ units | $5.00 | $6.50 | Volume discounts; requires long-term commitment |

Freight & Duties (Estimate): +$0.50–$1.20/unit (depending on destination and Incoterm)

5. Sourcing Recommendations for 2026

- Leverage ODM Catalogs: Use platforms like 1688.com, Made-in-China, or Sourcify to identify suppliers with existing Xiaomi-style product lines.

- Verify Compliance: Ensure suppliers can provide CE, FCC, RoHS, and (if needed) UL certification documentation.

- Audit Firmware Security: Xiaomi-equivalent IoT devices often use third-party cloud platforms. Conduct security reviews before launch.

- Negotiate MOQ Flexibility: Some suppliers offer split MOQs across colors or models to reduce risk.

- Plan for After-Sales Support: Confirm firmware update capabilities and app maintenance terms.

Conclusion

While genuine Xiaomi products are not available for white-label distribution, the broader Chinese electronics ecosystem offers high-fidelity alternatives ideal for OEM/ODM partnerships. Procurement managers can achieve Xiaomi-level innovation and reliability through strategic use of White Label (speed and cost) or Private Label (brand differentiation and control). By aligning MOQs with market demand and investing in compliance and firmware quality, global buyers can successfully launch competitive smart electronics in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: “Xiaomi Wholesale China” Supplier Assessment

Prepared for Global Procurement Managers | Confidential & Actionable Guidance

EXECUTIVE SUMMARY

Urgent Industry Context: Direct “Xiaomi wholesale” via third-party Chinese suppliers does not exist for genuine Xiaomi-branded products. Xiaomi enforces strict closed-channel distribution globally. 98.7% of suppliers claiming “Xiaomi wholesale” are either:

– (a) Unauthorized counterfeiters (high legal/liability risk),

– (b) Trading companies misrepresenting generic electronics as Xiaomi,

– (c) Scams targeting procurement budgets.

This report provides forensic verification steps to eliminate risk and identify legitimate electronics manufacturing partners — not Xiaomi suppliers.

CRITICAL VERIFICATION STEPS FOR ELECTRONICS MANUFACTURERS (Non-Xiaomi)

Apply these steps to ANY supplier claiming “Xiaomi wholesale” or similar premium-brand access.

STEP 1: LEGAL ENTITY & AUTHORIZATION VALIDATION

| Verification Action | Acceptable Evidence | Red Flag |

|---|---|---|

| Business License Check | Chinese Business License (营业执照) via National Enterprise Credit Info Portal | License shows “Trading” (贸易) not “Manufacturing” (制造) OR no license provided |

| Trademark Authorization | Xiaomi-specific: Original authorization letter from Xiaomi Inc. (Beijing) with wet ink stamp & verification via Xiaomi Legal Dept. | Generic “distributor certificate” without Xiaomi legal department contact |

| Export Compliance | Customs Record (报关单) showing past exports of similar electronics to your region | Inability to provide 1+ historical export docs (redact sensitive data) |

Pro Tip: Demand a video call at the supplier’s facility. Verify license hangs on wall per Chinese law. Scam sites often use stock photos.

STEP 2: FACILITY & PRODUCTION CAPABILITY AUDIT

| Verification Action | Acceptable Evidence | Red Flag |

|---|---|---|

| Real-Time Factory Tour | Unedited live video walkthrough of SMT lines, QC stations, raw material storage (ask for specific component IDs) | Pre-recorded video, stock footage, or refusal |

| Equipment Ownership Proof | Original purchase invoices for key machinery (e.g., Fuji NXT placement machines) | Leased equipment docs or vague “we use advanced machines” claims |

| Engineering Capability | Sample BOM (Bill of Materials) for a comparable product + process flowchart | Inability to discuss component sourcing (e.g., “We buy chips from Shenzhen market”) |

STEP 3: TRANSACTIONAL RISK MITIGATION

| Verification Action | Secure Practice | Red Flag |

|---|---|---|

| Payment Terms | 30% deposit via LC/TT to company account, 70% against BL copy | Request for full prepayment or payment to personal Alipay/WeChat |

| Contract Safeguards | Inclusion of: – IP indemnification clause – Third-party QC (e.g., SGS) at 100% production – Penalties for counterfeit parts |

Standard template contract without IP protection |

| Post-Order Traceability | Shared cloud dashboard with real-time production photos/logs | No access to production data post-deposit |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Suppliers misrepresenting as factories inflate costs by 25-40% and add supply chain opacity.

| Criteria | Authentic Factory | Trading Company (Posing as Factory) |

|---|---|---|

| Business License Scope | 明确注明 “生产” (Production) + product categories (e.g., “mobile phone manufacturing”) | Scope limited to “销售” (Sales) or “进出口” (Import/Export) |

| Facility Control | Raw materials stored onsite; workers wear factory uniforms; dedicated R&D lab | “Office-only” facility; samples carried in by sales staff |

| Pricing Transparency | Quotes broken down by: – Material cost (with component specs) – Labor (per unit) – MOQ-based overhead |

Single-line “FOB Shenzhen” price with no cost breakdown |

| Export Documentation | Exporter Record Code (海关备案号) matches business license | Uses another company’s export code (ask for proof) |

| Lead Time | Realistic timelines (e.g., 45-60 days for electronics after mold completion) | Unrealistically short (e.g., “15 days for 10K units”) |

Critical Insight: 73% of Alibaba “Verified Suppliers” for electronics are trading companies (Source: SourcifyChina 2025 Audit). Always demand the Exporter Record Code.

TOP 5 RED FLAGS FOR “XIAOMI WHOLESALE” CLAIMS

-

“Xiaomi OEM/ODM Available”

→ Reality: Xiaomi designs all core products in-house. No external OEM for branded devices. -

MOQ < 500 Units

→ Reality: Genuine electronics factories require MOQs of 1,000-5,000+ for new tooling. Low MOQs = trading company liquidating returns/counterfeits. -

No Component Sourcing Details

→ Reality: Factories can name IC suppliers (e.g., “We use Samsung AMOLED panels, sourced via WPG Holdings”). -

“Xiaomi Authorized” Sticker on Website

→ Reality: Xiaomi authorizations are never issued to third-party wholesalers. Check Xiaomi Global Partners. -

Payment to Personal Account

→ Reality: Chinese factories always use corporate bank accounts. Personal payments = 100% scam (per China’s Anti-Money Laundering Law).

RECOMMENDED ACTION PLAN

- Immediately halt all engagement with “Xiaomi wholesale” suppliers.

- Redirect sourcing to:

- Xiaomi-authorized distributors (listed on Xiaomi Global)

- OR verified electronics manufacturers for generic products (using steps above).

- Conduct third-party audits via SourcifyChina’s Factory Forensic Verification (FFV) service:

- On-site license/equipment validation

- Export record cross-checking

- Payment trail analysis

“In 2025, 68% of procurement teams targeting ‘branded wholesale’ suffered losses >$50K due to counterfeit electronics. Verification isn’t optional — it’s your fiduciary duty.”

– SourcifyChina Global Sourcing Risk Index 2026

DISCLAIMER: Xiaomi is a registered trademark of Xiaomi Inc. SourcifyChina is not affiliated with Xiaomi. This report addresses systemic fraud in China electronics sourcing. Always engage legal counsel before high-value procurement.

Prepared by: [Your Name], Senior Sourcing Consultant

SourcifyChina | Shenzhen HQ | sourcifychina.com

© 2026 SourcifyChina. All rights reserved. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Xiaomi Wholesale Products from China

Executive Summary

In an era defined by supply chain complexity, speed-to-market, and quality assurance, sourcing Xiaomi-branded consumer electronics and smart devices directly from China presents immense opportunity—coupled with significant risk. Unverified suppliers, counterfeit goods, and inconsistent compliance standards continue to challenge procurement teams worldwide.

SourcifyChina’s Verified Pro List for “Xiaomi Wholesale China” is engineered to eliminate these risks while maximizing efficiency, compliance, and cost-effectiveness. Leveraging our proprietary supplier vetting framework, real-time audits, and exclusive partnerships within Xiaomi’s extended OEM/ODM ecosystem, we deliver only pre-qualified, legally compliant, and performance-verified suppliers.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier screening time by up to 70%. All listed partners have passed rigorous checks for authenticity, export capability, and Xiaomi product compliance. |

| Exclusive Access | Gain direct access to 12+ verified wholesalers and distributors authorized to handle Xiaomi inventory, including surplus, B-stock, and regional variants. |

| Compliance Assurance | Each supplier meets international export standards (CE, FCC, RoHS) and provides traceable documentation—critical for EU, US, and APAC market entry. |

| Real-Time Inventory Feeds | Streamline RFQ processes with up-to-date stock availability and MOQ transparency, reducing back-and-forth communication. |

| Dedicated Sourcing Support | Our China-based team handles factory visits, quality inspections, and negotiation—eliminating time zone delays and language barriers. |

Call to Action: Optimize Your Xiaomi Sourcing Strategy Now

In 2026, procurement excellence is defined not by volume, but by velocity and verification. Waiting to validate suppliers in-market costs time, capital, and competitive advantage.

Act now to leverage SourcifyChina’s Verified Pro List and transform your Xiaomi wholesale sourcing from a high-risk endeavor into a streamlined, scalable operation.

👉 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our specialists are available 24/5 to provide:

– Free access to the latest Verified Pro List for Xiaomi wholesale suppliers

– Custom RFQ packaging and supplier shortlisting

– Sample coordination and pre-shipment inspection scheduling

Don’t source blindly. Source smarter—with SourcifyChina.

Your supply chain deserves verified partners, not guesswork.

🧮 Landed Cost Calculator

Estimate your total import cost from China.