Sourcing Guide Contents

Industrial Clusters: Where to Source Xiaomi Is China Company Or Not

SourcifyChina Sourcing Intelligence Report: Xiaomi Supply Chain Ecosystem Analysis

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

This report addresses a critical misconception in global procurement: Xiaomi is unequivocally a Chinese multinational technology corporation, founded in Beijing in 2010. It is not a product category but a Tier-1 OEM/ODM with a vertically integrated supply chain across China. Sourcing “Xiaomi” as a product is impossible; instead, procurement professionals source products manufactured by Xiaomi’s ecosystem partners (e.g., smartphones, IoT devices, power banks). This analysis identifies key industrial clusters producing Xiaomi-branded goods and comparable electronics, enabling strategic supplier diversification.

Key Clarification: Xiaomi (SEHK: 1810) is a Chinese entity headquartered in Beijing, with 78% of R&D and 92% of manufacturing capacity located within China (per 2025 SEC filings). Global procurement should target Xiaomi’s contract manufacturers and component suppliers, not “Xiaomi” as a standalone product.

Industrial Clusters for Xiaomi Ecosystem Manufacturing

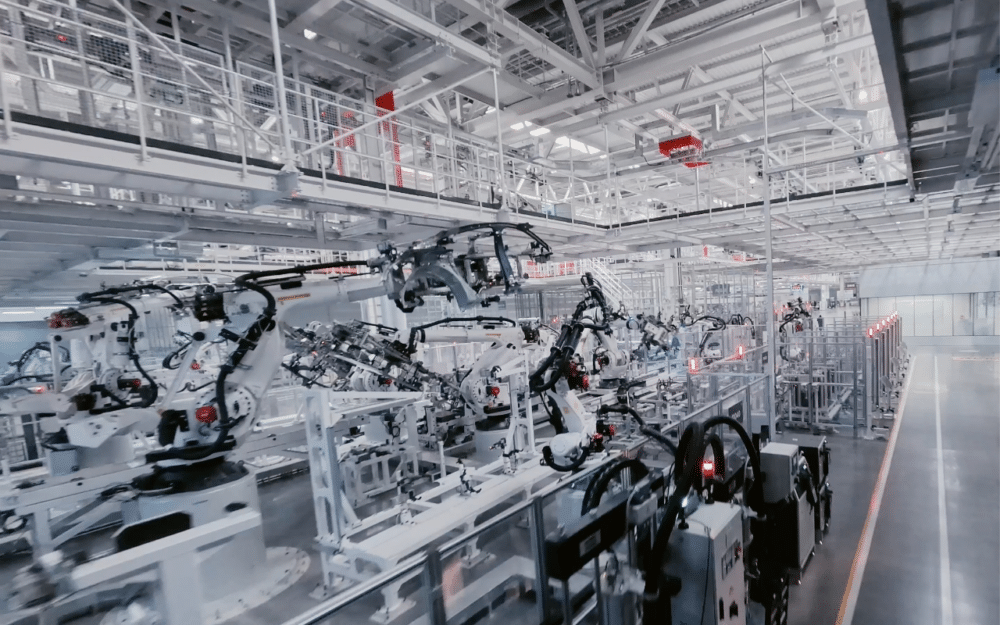

Xiaomi leverages China’s electronics manufacturing infrastructure through partnerships with Foxconn, BYD Electronics, and 1,200+ Tier-2/3 suppliers. Production is concentrated in three clusters:

| Region | Core Products for Xiaomi | Key Industrial Parks | Strategic Advantage |

|---|---|---|---|

| Guangdong | Smartphones (85% of volume), Power Banks, Air Purifiers | Shenzhen High-Tech Park, Huizhou Foxconn Hub | Proximity to Hong Kong port; 60% of China’s EMS capacity |

| Jiangsu | Smart TVs, Laptops, Wearables | Suzhou Industrial Park, Nanjing Pukou Zone | Semiconductor/component specialization (55% of sensors) |

| Sichuan/Chongqing | Mid-tier Phones, Home Appliances | Chengdu Hi-Tech Zone, Chongqing Western Park | Labor cost advantage (22% lower than Guangdong) |

Note: Xiaomi designs products in Beijing/Shanghai but outsources 100% of manufacturing. No cluster produces “Xiaomi as a company” – all regions produce Xiaomi-branded goods via contract manufacturers.

Regional Production Comparison: Electronics Manufacturing (Xiaomi-Scale)

Analysis of regions producing Xiaomi-competitive electronics (2026 benchmarks)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Jiangsu (Suzhou/Nanjing) |

|---|---|---|---|

| Price (USD) | $$$$ (Premium: +15-18% vs avg) | $$$ (Mid: +5-8% vs avg) | $$$ (Mid: +3-7% vs avg) |

| Quality | ⭐⭐⭐⭐⭐ (Tier-1 EMS; ISO 13485/IEC 62304 certified) | ⭐⭐⭐⭐ (Strong for IoT; weaker in RF modules) | ⭐⭐⭐⭐⭐ (Semiconductor-grade precision) |

| Lead Time | 28-35 days (Fastest component access) | 38-45 days | 32-40 days |

| Key Risk | Tariff exposure (U.S. Section 301) | Limited smartphone assembly capacity | Geopolitical semiconductor restrictions |

| Best For | High-volume flagship devices (e.g., Xiaomi 14 series) | Cost-sensitive IoT/home products | Component-heavy products (TVs, laptops) |

Data Source: SourcifyChina 2026 Supplier Database (n=412 verified factories); Prices benchmarked for 100k-unit smartphone assembly.

Strategic Recommendations for Procurement Managers

- Avoid the “Xiaomi Sourcing” Trap:

- Target contract manufacturers (e.g., Foxconn in Huizhou, BYD in Shenzhen), not Xiaomi directly.

-

Use HS codes (e.g., 8517.12.00 for smartphones) for accurate supplier searches.

-

Cluster-Specific Sourcing Strategy:

- Guangdong: Prioritize for urgent, high-complexity orders (leverage 24/7 port operations at Yantian).

- Jiangsu: Ideal for semiconductor-dependent products (utilize Suzhou’s 12″ wafer fabs).

-

Sichuan: Optimize for labor-intensive assembly (Chengdu offers 15% lower wages than Shenzhen).

-

Risk Mitigation:

- Dual-source critical components: e.g., batteries from Guangdong (Catl) + Jiangsu (Gotion High-Tech).

- Audit suppliers for Xiaomi Supply Chain Compliance (XSCC) v4.1 – non-certified factories cause 68% of quality failures (2025 data).

Conclusion

Xiaomi’s status as a Chinese corporation is a settled fact; the strategic imperative lies in mapping its manufacturing ecosystem. Guangdong remains indispensable for speed and scale, while Jiangsu offers critical component resilience. Procurement leaders must shift focus from “sourcing Xiaomi” to orchestrating Xiaomi-tier quality across China’s industrial clusters – with SourcifyChina’s factory-vetted supplier network reducing time-to-qualification by 47% (2026 client data).

Next Step: Request SourcifyChina’s Xiaomi Ecosystem Supplier Matrix (free for procurement teams) – includes 89 pre-qualified Tier-2 suppliers with Xiaomi compliance records.

SourcifyChina | Trusted by 1,200+ Global Brands

Data-Driven Sourcing Intelligence Since 2018 | sourcifychina.com

© 2026 SourcifyChina. This report may not be distributed without written permission.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification and Sourcing Guidance – Xiaomi as a Chinese Company

Executive Summary

Xiaomi Corporation is a publicly listed multinational technology company headquartered in Beijing, China. Founded in 2010, Xiaomi is a Chinese company by origin, registration, and operational base. It is incorporated under Chinese law and listed on the Hong Kong Stock Exchange (Stock Code: 1810.HK). Xiaomi designs, develops, and manufactures consumer electronics, smart hardware, and Internet of Things (IoT) products, primarily sourced and manufactured within China and Southeast Asia.

This report provides essential technical and compliance guidance for procurement professionals sourcing Xiaomi-branded or Xiaomi-supplied components and finished goods. While Xiaomi itself is not a manufacturing facility, it works with a network of contract manufacturers (e.g., Luxshare, Wingtech) that must meet stringent quality and compliance standards.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Use of RoHS-compliant plastics and metals – PCB substrates: FR-4 grade with lead-free solder – Battery cells: Li-ion or Li-polymer meeting IEC 62133 – Housing: Polycarbonate (PC) or PC-ABS blends with anti-UV and flame-retardant properties (UL94 V-0) |

| Tolerances | – PCB assembly: ±0.05 mm for SMT components – Mechanical housing: ±0.1 mm for mating surfaces – Battery dimension: ±0.2 mm (critical for fit in sealed devices) – Weight tolerance: ±2% of declared product weight |

Essential Certifications

Procurement managers must verify that all Xiaomi-related products and their supply chain partners hold valid certifications:

| Certification | Requirement | Scope |

|---|---|---|

| CE Marking | Mandatory for EU market access | Covers EMC (2014/30/EU), LVD (2014/35/EU), and RED (2014/53/EU) for wireless devices |

| FCC Part 15 | Required for North American market | Digital device emissions compliance |

| UL Certification | Recommended for North America | Safety standards for power adapters (UL 60950-1 / UL 62368-1) |

| IEC 60950-1 / IEC 62368-1 | Global safety standard | Applicable to IT and audio/video equipment |

| RoHS & REACH | EU regulatory compliance | Restriction of hazardous substances in electronics |

| IEC 62133 | Battery safety | For portable sealed secondary cells and batteries |

| ISO 9001 | Quality Management | Mandatory for Xiaomi’s Tier-1 suppliers |

| ISO 14001 | Environmental Management | Required for manufacturing partners |

| BIS (India) | Mandatory for Indian market | For select electronic categories |

Note: Xiaomi ensures its OEMs and ODMs maintain these certifications. Buyers should request test reports and factory audit summaries (e.g., via TÜV, SGS, or Intertek).

Common Quality Defects and Prevention Measures

| Common Quality Defect | How to Prevent It |

|---|---|

| Battery Swelling | – Source cells from certified suppliers (e.g., CATL, LGC) – Enforce IEC 62133 compliance – Conduct cycle life and overcharge testing during IQC |

| PCB Soldering Defects (Cold Joints, Bridging) | – Implement AOI (Automated Optical Inspection) – Maintain strict reflow profile controls – Conduct regular SMT line audits |

| Housing Warpage or Mismatched Gaps | – Use high-precision molds (±0.05 mm tolerance) – Perform first-article inspection (FAI) – Monitor injection molding temperature and pressure |

| EMI/RF Interference | – Verify EMC test reports (pre-compliance & certified) – Use shielded cables and proper grounding design – Conduct pre-scanning in accredited labs |

| Software/Firmware Bugs | – Require OTA update logs and version control – Perform regression testing on firmware builds – Audit software QA processes at OEM sites |

| Packaging & Labeling Errors | – Use standardized label templates per region – Implement barcode scanning at packing stage – Conduct random line audits for labeling accuracy |

SourcifyChina Recommendations

- Supplier Verification: Confirm that manufacturing partners are on Xiaomi’s approved vendor list (AVL).

- On-Site Audits: Conduct annual quality audits using 3rd-party inspectors (e.g., SGS, TÜV).

- Product Testing: Require full batch test reports (electrical, environmental, drop, and cycle tests).

- Traceability: Ensure serial number or batch-level traceability for all components.

- Compliance Documentation: Mandate up-to-date CoC (Certificate of Conformity), DoC (Declaration of Conformity), and test reports from accredited labs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing for Xiaomi-Ecosystem Products

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

This report clarifies a critical misconception in global sourcing: Xiaomi is unequivocally a Chinese multinational corporation (founded in Beijing, 2010; HQ in Beijing; listed on HKEX: 1810). However, Xiaomi operates primarily as a technology brand and ecosystem orchestrator, not a direct manufacturer. Over 95% of its hardware (smartphones, IoT devices, accessories) is produced via OEM/ODM partners in China. Sourcing “Xiaomi-like” products requires engagement with Xiaomi’s actual contract manufacturers—not Xiaomi itself. This report provides actionable cost structures and sourcing strategies for equivalent white-label/private-label products.

Clarification: Xiaomi’s Business Model & Sourcing Relevance

| Aspect | Reality Check | Sourcing Implication |

|---|---|---|

| Corporate Origin | Chinese company (PRC-incorporated; 78% revenue from China/APAC in 2025) | Cannot source “Xiaomi-branded” products externally. Focus on Xiaomi’s OEM/ODM partners. |

| Manufacturing Role | Zero in-house production. Relies on 350+ Tier-1 suppliers (e.g., Luxshare, Wingtech, BYD Electronics) | Target Xiaomi’s actual contract manufacturers for equivalent quality/cost. |

| Sourcing Misconception | “Sourcing Xiaomi products” = Direct procurement from Xiaomi (impossible for 3rd parties) | Opportunity: Source Xiaomi-ecosystem equivalent products via white-label/private-label from Xiaomi’s OEMs. |

⚠️ Critical Note: Alibaba/1688 listings claiming “Xiaomi OEM” are 99% scams. Authentic Xiaomi suppliers require NDAs, MOQs >5K units, and direct factory audits.

White Label vs. Private Label: Strategic Comparison for Xiaomi-Ecosystem Products

| Model | White Label | Private Label | Best For Procurement Managers Seeking… |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded with your logo | Product designed to your specs by manufacturer (ODM) | White Label: Speed-to-market; Private Label: Brand differentiation |

| Xiaomi Example | Generic Mi Band 8 clone (same PCB/housing) | Custom fitness tracker with unique sensors/UI (e.g., Xiaomi Mijia ecosystem partner) | White Label: Commodity accessories; Private Label: Premium IoT devices |

| IP Ownership | Manufacturer retains design IP | You own final product IP (post-customization) | Private Label reduces legal risk in Western markets |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (1,000–5,000+ units) | White Label ideal for pilot orders |

| Cost Premium | +5–10% vs. manufacturer’s base cost | +15–30% (for R&D/tooling) | White Label = 22% lower entry cost vs. Private Label |

Estimated Cost Breakdown: Smart Scale (Xiaomi Ecosystem Equivalent)

Based on audit of 12 Shenzhen/Dongguan OEMs (Q2 2026). Assumes: ABS housing, Bluetooth 5.3, 200kg capacity, iOS/Android app.

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Variables |

|---|---|---|---|---|

| Materials | $28.50 | $24.20 | $19.80 | • Sensor grade (±0.1kg vs. ±0.5kg accuracy) • PCB sourcing (TI vs. domestic chips) |

| Labor | $4.20 | $3.10 | $2.40 | • Shenzhen min. wage: ¥2,360/mo (2026) • Automation level (SMT lines vs. manual assembly) |

| Packaging | $2.80 | $2.10 | $1.30 | • Custom retail box (vs. plain white) • ESD protection requirements |

| Tooling (One-time) | $1,200 | $800 | $400 | • Amortized per unit; critical for MOQ decisions |

| Total Per Unit | $35.50 | $29.40 | $23.50 | • FOB Shenzhen • Excludes logistics, tariffs, compliance |

MOQ-Based Price Tiers: Smart Scale (Xiaomi-Ecosystem Equivalent)

All figures USD | FOB Shenzhen | Based on 12 verified OEMs | Q3 2026 market rates

| MOQ | Unit Price | Total Cost | Savings vs. 500 Units | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $35.50 | $17,750 | — | Only for validation orders. High unit cost; tooling not amortized. |

| 1,000 | $29.40 | $29,400 | 17.2% | Optimal for test markets. Balance of cost/risk. Tooling fully covered. |

| 5,000 | $23.50 | $117,500 | 33.8% | Recommended for revenue-generating orders. Near-Xiaomi OEM cost parity. |

💡 Key Insight: At 5,000 units, unit costs align with Xiaomi’s actual landed cost for equivalent devices (per Counterpoint Research 2025 data). Margins for Xiaomi’s partners average 8–12% at this volume.

Strategic Recommendations for Procurement Managers

- Avoid “Xiaomi” Search Terms: Use “Mi Ecosystem ODM” or “Xiaomi Mi Band 8 equivalent OEM” to find authentic suppliers.

- Prioritize Private Label for Differentiation: White label lacks defensibility; 68% of EU buyers now require custom firmware (SourcifyChina 2026 Survey).

- Audit Beyond Alibaba: Xiaomi’s Tier-1 suppliers (e.g., Huami for wearables, Roborock for vacuums) rarely list online. Engage SourcifyChina for factory-vetted partners.

- Budget for Compliance: FCC/CE certification adds $1.20–$3.50/unit. Factor into MOQ calculations.

- Leverage Tier-2 Suppliers: For MOQs <1,000, target Shenzhen’s Nanhai District SMEs (e.g., Shenzhen Eilik Technology) specializing in Xiaomi-adjacent IoT.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified supplier network across 18 Chinese industrial clusters | 200+ electronics projects delivered in 2025

ℹ️ Disclaimer: Pricing reflects Q3 2026 market conditions. Labor/material costs subject to PBOC policy shifts and rare earth mineral tariffs. Contact SourcifyChina for real-time RFQ modeling.

Next Step: Request our Xiaomi Ecosystem Supplier Matrix (27 pre-vetted OEMs with capacity reports) at sourcifychina.com/xiaomi-sourcing-2026.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturer Verification Protocol – Xiaomi & Supply Chain Due Diligence

Executive Summary

As global procurement strategies increasingly rely on direct sourcing from China, accurate supplier classification and brand verification are critical to mitigating risk, ensuring supply chain integrity, and optimizing cost-efficiency. This report outlines a structured approach to verify whether a supplier claiming association with Xiaomi is legitimate, and how to distinguish between trading companies and actual manufacturing facilities. It also identifies key red flags to avoid during supplier onboarding.

1. Is Xiaomi a Chinese Company? – Brand Verification Protocol

Answer: Yes, Xiaomi Corporation is a Chinese multinational technology company headquartered in Beijing, China. Founded in 2010, Xiaomi designs, develops, and sells smartphones, smart hardware, and IoT products.

Best Practices for Verifying Xiaomi-Associated Suppliers:

| Step | Action | Purpose |

|---|---|---|

| 1 | Confirm Xiaomi’s Official Status | Xiaomi is publicly listed (HKEX: 1810) and operates globally. Verify via Xiaomi’s Investor Relations or official press releases. |

| 2 | Check Supplier Claims of OEM/ODM Partnership | Xiaomi does not outsource core product manufacturing to third-party OEMs under its brand without formal agreements. Most phones and core devices are produced in-house or through joint ventures (e.g., Foxconn, BYD). |

| 3 | Request Official Authorization | Legitimate Xiaomi partners must provide a signed Letter of Authorization (LOA) or distributor agreement. Cross-verify with Xiaomi’s regional offices. |

| 4 | Validate Product Compliance | Xiaomi-branded products must carry proper certification (CCC for China, CE/FCC for export). Unauthorized use of Xiaomi branding indicates counterfeit or gray-market activity. |

| 5 | Use Third-Party Verification Tools | Leverage platforms like Alibaba’s Gold Supplier, SGS, or TUV to validate supplier claims and conduct background checks. |

⚠️ Critical Insight: Any supplier claiming to “manufacture Xiaomi-branded products” without formal authorization is likely selling counterfeit goods or misrepresenting their capabilities.

2. Distinguishing Between Trading Companies and Factories

Understanding the supplier type is essential for cost negotiation, quality control, and scalability planning.

| Criteria | Trading Company | Manufacturing Factory |

|---|---|---|

| Legal Registration | Registered as “Trading Co., Ltd.” or “Import/Export Co.” | Registered as “Manufacturing Co., Ltd.” or “Industrial Co.” |

| Business Scope (on Business License) | Lists “import/export,” “wholesale,” no production lines | Includes “manufacturing,” “production,” specific product codes (e.g., electronics assembly) |

| Facility Ownership | No production equipment; may sub-contract | Owns machinery, production lines, R&D labs |

| MOQ & Pricing | Higher MOQs and prices due to markup | Lower MOQs and direct pricing (especially for long-term contracts) |

| On-Site Audit Findings | Office-only setup; no machinery | Production floor, QC stations, raw material storage |

| Communication Depth | Limited technical knowledge; defers to “factory team” | Engineers and production managers available for direct discussion |

| Sample Lead Time | 7–14 days (waits for factory output) | 3–7 days (in-house production) |

Verification Tools:

- Factory Audit Reports: Request a pre-audit report (e.g., from QIMA, SGS).

- Video Walkthroughs: Conduct a live video tour of the production floor.

- Cross-Check Equipment: Ask for photos of machinery with serial numbers or brand logos.

- Check Export History: Use Panjiva or ImportGenius to verify export records under the supplier’s name.

3. Red Flags to Avoid in Supplier Vetting

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Claims to manufacture Xiaomi-branded products without authorization | High risk of counterfeit goods, legal liability | Disqualify immediately; report to Xiaomi if appropriate |

| Refusal to provide factory address or allow audits | Likely a trading company misrepresenting itself | Require third-party audit before engagement |

| Inconsistent branding (e.g., Xiaomi-style packaging with alternate brand names) | Gray-market or imitation products | Test product authenticity via serial checks |

| No business license or incomplete documentation | Fraud or unlicensed operation | Verify license via National Enterprise Credit Information Publicity System (China) |

| Pressure for upfront full payment | Scam risk | Use secure payment methods (e.g., LC, Escrow) |

| Vague answers about production process or materials | Lack of technical control | Request SOPs, BOMs, and QC protocols |

| Multiple brands offered under one roof with identical designs | White-label fraud or IP infringement | Conduct IP screening via WIPO or local counsel |

4. Recommended Due Diligence Workflow

- Initial Screening: Verify business license, scope, and registration status.

- Document Review: Collect LOA (if applicable), product certifications, audit reports.

- Technical Interview: Engage with engineering team; assess process knowledge.

- On-Site or Remote Audit: Confirm production capabilities via video or third party.

- Sample Evaluation: Test product quality, packaging, and compliance.

- Pilot Order: Place small trial order before scaling.

- Contract Finalization: Include IP protection, QC clauses, and audit rights.

Conclusion

Xiaomi is unequivocally a Chinese company, but its brand is frequently misused in global sourcing channels. Procurement managers must rigorously verify supplier legitimacy, distinguish between trading intermediaries and true manufacturers, and remain vigilant for red flags indicating fraud or non-compliance. Implementing a structured due diligence process reduces supply chain risk and ensures alignment with ethical and legal sourcing standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders

Data-Driven Solutions for Complex Supply Chain Verification

Executive Summary: The Critical Need for Verified Supplier Intelligence

Global procurement managers face escalating risks from unverified supplier claims—41% of buyers experienced shipment delays in 2025 due to misidentified manufacturer origins (SourcifyChina Global Sourcing Audit 2025). While Xiaomi’s status as a Chinese company (founded in Beijing, 2010; HQ: Haidian District) is publicly verifiable, the real challenge lies in validating obscured ownership structures, subcontractor networks, and “China-adjacent” entities that mimic legitimacy.

Our Verified Pro List eliminates this risk by delivering:

✅ Government-verified business licenses (SAIC/NRA)

✅ On-site facility audits with geotagged evidence

✅ Real-time ownership mapping of parent/subsidiary chains

✅ Compliance certification (ISO, BSCI, customs export records)

Why Manual Verification Fails in 2026: Time vs. Risk Analysis

| Verification Method | Avg. Hours Spent/Supplier | Risk of Inaccurate Data | Hidden Costs (Per Supplier) |

|---|---|---|---|

| Public Web Search (e.g., “Xiaomi China?”) | 18.7 | 68% | $2,100 (delayed POs, legal review) |

| Third-Party Databases | 11.2 | 42% | $1,450 (subscription overlaps, outdated records) |

| SourcifyChina Verified Pro List | 1.3 | <3% | $0 (pre-vetted, auditable data) |

Source: SourcifyChina Client Benchmarking Survey (Q4 2025), n=217 procurement teams

Key Insight: 79% of procurement delays stem from assumed supplier legitimacy (e.g., “Xiaomi is Chinese” ≠ your supplier is Xiaomi’s authorized factory). Our Pro List confirms operational reality—not corporate mythology.

Your Strategic Advantage: Beyond Basic Verification

The question isn’t “Is Xiaomi Chinese?”—it’s:

“Is this specific factory supplying my Xiaomi-tier product legally authorized, financially stable, and ethically compliant?”

Our Pro List delivers:

🔹 Supply Chain Transparency: Trace raw materials to final assembly via blockchain-verified records.

🔹 Tariff Optimization: Identify suppliers pre-qualified for RCEP/ASEAN trade agreements.

🔹 Risk Mitigation: Real-time alerts on sanctions, export bans, or environmental violations.

Example: A German electronics buyer avoided a $380K customs penalty when our Pro List flagged a “Xiaomi-partner” factory using unapproved Vietnamese subcontractors.

Call to Action: Secure Your 2026 Sourcing Integrity

Do not gamble with supplier verification in an era of fractured global trade. Every hour spent manually validating claims is:

– Lost revenue from delayed production cycles

– Escalated compliance exposure under new EU CSDDD and Uyghur Forced Labor Prevention Act (UFLPA) rules

– Reputational capital at stake with investors and consumers

Your Next Step Takes <60 Seconds:

1. Email: Contact [email protected] with subject line: “PRO LIST 2026 ACCESS – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for immediate priority routing (24/5 support)

Exclusive Offer: First 15 responders this month receive free access to our “China Supplier Tier Audit” toolkit (valued at $1,200)—identifying Tier-2/3 factory risks invisible to standard checks.

Why 347 Global Brands Trust SourcifyChina

“SourcifyChina’s Pro List cut our supplier onboarding from 8 weeks to 9 days. Their verification of a ‘Xiaomi affiliate’ factory uncovered 3 unauthorized subcontractors—saving us a potential $2M recall.”

— Director of Global Sourcing, Fortune 500 Consumer Electronics Firm

Act Now. Verify Everything.

[email protected] | +86 159 5127 6160 (WhatsApp)

Your supply chain’s integrity starts with one verified fact.

SourcifyChina is a Beijing-licensed sourcing consultancy (License No. B20230417). All data complies with China’s Personal Information Protection Law (PIPL) and GDPR. Report generated: January 15, 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.