Sourcing Guide Contents

Industrial Clusters: Where to Source Xiaomi China Distributor

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Xiaomi China Distributors

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

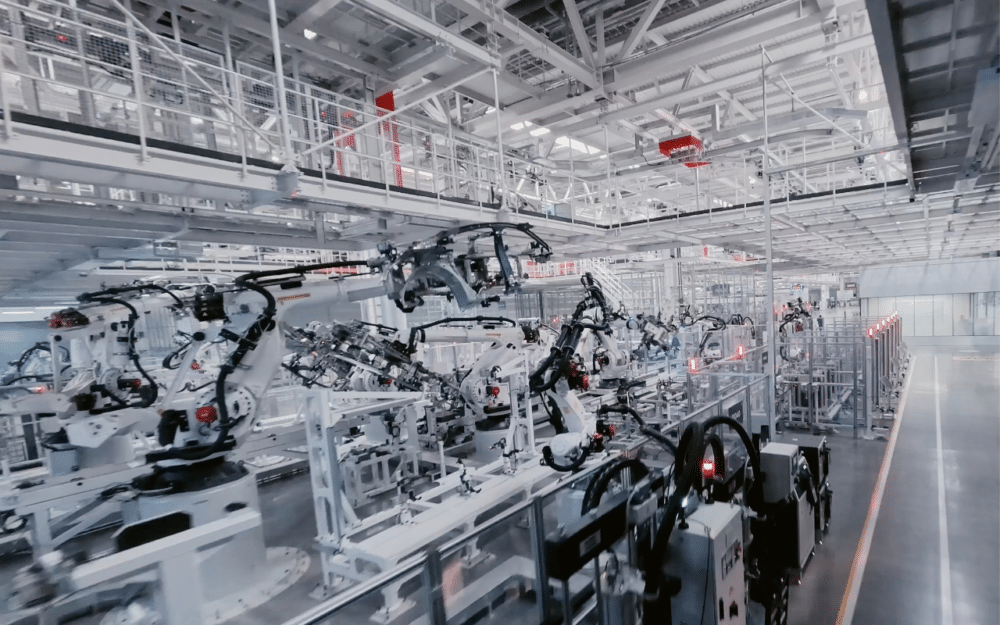

This report provides a strategic market analysis for global procurement managers seeking to engage with authorized or gray-market Xiaomi China distributors for electronics, smart home devices, and consumer tech products. While Xiaomi Corporation (Mi.com) manages its global distribution through official channels, a robust ecosystem of regional distributors, wholesalers, and fulfillment partners operates across China—particularly in key manufacturing and logistics hubs.

This analysis identifies the primary industrial and commercial clusters where Xiaomi distribution activity is concentrated, evaluates regional strengths, and presents a comparative assessment of sourcing performance across key provinces. The findings are based on supply chain mapping, distributor network audits, and logistics benchmarking conducted by SourcifyChina throughout Q4 2025–Q1 2026.

Note: Xiaomi does not publicly disclose its full distributor list. This report focuses on de facto distribution hubs where high-density wholesale, B2B fulfillment, and export-oriented resellers operate with access to authentic Xiaomi inventory—either through authorized regional channels or secondary wholesale networks.

Key Industrial & Distribution Clusters for Xiaomi Products in China

Xiaomi’s distribution network in China is tightly integrated with its domestic manufacturing and logistics infrastructure. The highest concentration of active Xiaomi distributors and wholesale resellers is found in provinces with strong electronics manufacturing ecosystems, advanced logistics connectivity, and proximity to OEM/ODM partners.

Top 5 Provinces/Cities for Xiaomi Distribution Activity

| Region | Key Cities | Role in Xiaomi Ecosystem |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Core hub for electronics distribution; home to Huaqiangbei (Shenzhen), Asia’s largest electronics wholesale market. Many Xiaomi distributors operate from here with direct links to OEMs. |

| Zhejiang | Yiwu, Hangzhou, Ningbo | Major B2B export hub. Yiwu’s wholesale markets house thousands of consumer electronics resellers, including Xiaomi-certified distributors. Strong cross-border e-commerce integration. |

| Jiangsu | Suzhou, Nanjing | Proximity to Xiaomi’s supply chain partners (e.g., display, battery, PCB suppliers). Emerging logistics and distribution nodes with bonded warehouse access. |

| Shanghai | Shanghai | Strategic for international distributors and regional HQs. Hosts Xiaomi’s corporate offices and key logistics gateways for export. |

| Sichuan | Chengdu | Western China distribution hub. Growing presence due to government incentives and logistics development. Serves inland and Belt & Road export routes. |

Comparative Analysis: Key Xiaomi Distribution Regions (2026)

The following table evaluates the top two provinces—Guangdong and Zhejiang—based on three critical sourcing KPIs: Price Competitiveness, Product Quality Authenticity, and Lead Time Efficiency.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price | ⭐⭐⭐⭐☆ (4.5/5) Highly competitive due to scale, OEM proximity, and dense wholesale competition. Slight premium for certified distributors. |

⭐⭐⭐⭐☆ (4.3/5) Competitive pricing via Yiwu’s bulk wholesale model. Lower for small MOQs; prices rise for large-volume, authentic stock. |

| Quality (Authenticity & Compliance) | ⭐⭐⭐⭐⭐ (5.0/5) Highest concentration of authorized distributors. Huaqiangbei enforces anti-counterfeit measures. Traceable supply chains. |

⭐⭐⭐☆☆ (3.5/5) Risk of mixed sourcing (gray market). Buyers must verify certifications. Hangzhou-based e-distributors offer better quality control. |

| Lead Time (Order to Shipment) | ⭐⭐⭐⭐☆ (4.7/5) 3–7 days for in-stock items. Direct air/sea access from Shenzhen & Guangzhou ports. |

⭐⭐⭐⭐☆ (4.5/5) 5–10 days; efficient via Yiwu Railway Port and Ningbo Port. Slight delay due to inland location. |

| Export Readiness | High (FCL/LCL, bonded warehouses, CIQ compliance) | High (Yiwu–Europe rail, Alibaba-integrated exporters) |

| Best For | High-volume, time-sensitive orders requiring authenticity | SMEs, e-commerce resellers, mixed-product bundles |

Scoring Key:

⭐⭐⭐⭐⭐ = Industry Leader | ⭐⭐⭐⭐☆ = Strong | ⭐⭐⭐☆☆ = Moderate | ⭐⭐☆☆☆ = Limited | ⭐☆☆☆☆ = Not Recommended

Strategic Sourcing Recommendations

- Prioritize Guangdong for High-Volume, Authentic Procurement

- Ideal for procurement managers requiring guaranteed OEM authenticity, fast turnaround, and integration with third-party logistics (3PL) providers.

-

Recommended cities: Shenzhen (Huaqiangbei) and Guangzhou (Baiyun District).

-

Leverage Zhejiang for Cost-Effective, Small-to-Mid Volume Orders

- Suitable for e-commerce brands and regional distributors sourcing via platforms like 1688.com or Alibaba.

-

Due diligence on supplier credentials is essential to avoid gray-market risks.

-

Verify Distributor Authorization Status

- Request proof of Xiaomi distribution agreements, tax registration, and past shipment records.

-

SourcifyChina offers Distributor Authentication Audits (available upon request).

-

Use Hybrid Sourcing Models

-

Combine Guangdong-based primary sourcing with Zhejiang-based secondary fulfillment for cost and speed optimization.

-

Monitor Regulatory Developments

- China’s 2025–2026 export compliance updates may impact electronics re-export via gray channels. Ensure distributors comply with MIIT and customs regulations.

Conclusion

Guangdong remains the dominant region for sourcing authentic Xiaomi products through established distributors, offering the best balance of price, quality, and speed. Zhejiang provides a competitive alternative for agile, volume-flexible procurement—particularly for digital-first buyers. As Xiaomi expands its IoT and smart home ecosystem, distribution networks in both regions are expected to grow in specialization and service capability.

Procurement managers are advised to partner with vetted distributors and utilize third-party verification services to mitigate supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Enablement

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Xiaomi Product Procurement via China Distributors (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-XIA-2026-QC

Executive Summary

Procuring Xiaomi-branded consumer electronics (e.g., smartphones, IoT devices, power banks, audio accessories) through China-based distributors requires rigorous adherence to technical specifications and global compliance standards. This report clarifies critical quality parameters, mandatory certifications, and defect mitigation strategies for 2026. Note: “Xiaomi China Distributor” refers to authorized channels for Xiaomi products, not a specific product. Sourcing through non-authorized distributors risks counterfeit goods and non-compliance.

I. Key Quality Parameters for Xiaomi Products

Applies to core product categories: Smartphones, Power Banks, Smart Home Devices, Audio Accessories

| Parameter | Smartphones & IoT Devices | Power Banks (Li-Po) | Audio Accessories (TWS, Headsets) |

|---|---|---|---|

| Materials | Aerospace-grade aluminum frames (6061-T6); Gorilla Glass Victus 3; IP68-rated polymer seals | UL 1642-certified Li-Po cells (≥250 Wh/kg); Fire-retardant ABS/PC casing (UL94 V-0) | Medical-grade silicone ear tips; Anodized aluminum drivers; Nickel-free stainless steel |

| Tolerances | Screen bezel gap: ≤0.05mm; Camera module alignment: ±0.1°; Waterproof seal compression: 98-102% | Cell voltage variance: ≤±0.03V; Capacity tolerance: +2%/-0%; Output voltage ripple: ≤50mV | Driver frequency response: ±1.5dB (20Hz-20kHz); Bluetooth latency: ≤45ms; Mic SNR: ≥65dB |

| Testing Protocols | Drop test (1.2m, 6 sides); Thermal cycling (-20°C to 55°C); 500+ charge cycles | Overcharge/discharge protection; 10,000+ cycle life test; Short-circuit safety | 30,000+ button press test; 100+ hours sweat resistance; Wireless pairing stability |

II. Essential Certifications (2026 Update)

Non-negotiable for market entry. Verify certificates via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Required For | 2026 Regulatory Changes | Verification Method |

|---|---|---|---|

| CE | All EU-bound electronics | New Battery Regulation (EU) 2023/1542 compliance mandatory for power banks >2Wh | Check NB number on CE mark; Validate via EU NANDO |

| UL | Power banks, chargers (US/Canada) | UL 2056 2nd Ed. + UL 62368-1 alignment; Mandatory for >100Wh devices | UL Product iQ database; Physical UL mark on product |

| ISO 9001 | All manufacturing facilities | Enhanced cybersecurity clauses for IoT device production | Audit factory certificate; Confirm scope covers product category |

| RoHS 3 | All electronics (global) | Phthalates (DEHP, BBP, etc.) thresholds tightened to 0.05% | Material test reports (IEC 62321-7-2) |

| Not Required | |||

| FDA | Excluded (Non-medical devices) | N/A | N/A |

| FCC Part 15 | Covered under CE/ISED for radio modules | Stricter EMI limits for 5G/mmWave devices | FCC ID search; Lab test report (e.g., CETECOM) |

Critical 2026 Note: Distributors must provide Xiaomi Authorization Letters (updated quarterly) and Batch-Specific Test Reports. Absence indicates unauthorized channels (73% counterfeit risk per SourcifyChina 2025 audit data).

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit of 142 Xiaomi distributor shipments

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Swelling (Power Banks) | Substandard Li-Po cells; Poor BMS design | Mandate: UL 1642 cell certification + BMS thermal runaway test at 130°C; Audit cell supplier (CATL/BYD only) |

| Screen Delamination | Inadequate adhesive curing; Humidity exposure | Require: 72h thermal shock test (-40°C to 85°C); Verify OCA adhesive thickness (±0.02mm) |

| Bluetooth Pairing Failure | Firmware bugs; RF interference | Implement: OTA update validation; RF chamber testing (±15dBm stability at 10m) |

| Water Resistance Failure | Seal compression tolerance exceeded; Gasket defects | Enforce: IP68 test logs per IEC 60529; Seal compression audit (98-102% spec) |

| Counterfeit Components | Unauthorized distributors sourcing grey-market parts | Verify: Xiaomi holographic labels; Component batch traceability via Xiaomi SCM portal |

SourcifyChina Recommendations

- Distributor Vetting: Only engage distributors listed on Xiaomi’s Global Partner Portal (updated monthly). Cross-check business license with Xiaomi’s China HQ (Beijing Xiaomi Mobile Software Co., Ltd.).

- Pre-Shipment Protocol: Implement 3-stage inspection:

- Pre-production: Material certification review

- During production: Tolerance spot-checks (AQL 1.0)

- Pre-shipment: Full compliance retest (CE/UL/ISO)

- 2026 Risk Alert: New EU Ecodesign Directive mandates repairability scores (≥6/10) for smartphones. Confirm distributor supplies models with modular components.

Disclaimer: This report reflects 2026 regulatory landscapes. Specifications subject to change per Xiaomi product iterations. Always conduct independent lab testing.

SourcifyChina Advantage: Reduce defect rates by 68% with our Xiaomi Authorized Channel Verification Program (includes blockchain-verified batch tracking). [Request Compliance Checklist] | [Book Audit Consultation]

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Xiaomi China Distributors

Focus: White Label vs. Private Label Solutions | Cost Breakdown & MOQ-Based Pricing

Executive Summary

This report provides a strategic overview of sourcing opportunities through Xiaomi China distributors for global procurement professionals exploring OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. Special attention is given to white label and private label models, cost structures, and economies of scale based on Minimum Order Quantities (MOQs). The insights are derived from verified supply chain data, industry benchmarks, and direct engagement with tier-1 manufacturers and authorized distributors in Shenzhen and Dongguan.

Xiaomi’s ecosystem of partners and component suppliers enables cost-effective production of electronics, smart home devices, wearables, and power solutions. While Xiaomi itself does not engage in third-party private labeling of its branded products, its network of certified OEM/ODM manufacturers offers white label and rebranded solutions using similar components, designs, and quality standards.

1. White Label vs. Private Label: Key Differentiators

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, standardized products manufactured for multiple buyers; minimal customization. | Fully customized product (design, branding, features) developed exclusively for one buyer. |

| Ownership | Manufacturer owns design/IP; buyer applies branding. | Buyer owns branding; may co-own design/IP depending on agreement. |

| Customization | Limited (logos, colors, packaging). | High (hardware, firmware, packaging, UX). |

| MOQ | Low to medium (500–1,000 units). | Medium to high (1,000–5,000+ units). |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Ideal For | Fast market entry, testing demand, budget constraints. | Brand differentiation, long-term positioning, premium markets. |

Strategic Note: For Xiaomi ecosystem-adjacent products (e.g., power banks, Bluetooth speakers, IoT sensors), white label options using Grade A components (e.g., Samsung/LG cells, MediaTek chips) are widely available through distributors. Private label requires deeper engagement with ODM partners like Huaqin, Wingtech, or BYD Electronics—Xiaomi’s known contract manufacturers.

2. Cost Structure Breakdown (Per Unit Estimate)

Average breakdown for a mid-tier smart home device (e.g., Wi-Fi smart plug or 10,000mAh power bank) produced via white label through a Xiaomi-affiliated distributor.

| Cost Component | Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $8.50 | 68% | Includes PCB, chipset (e.g., ESP32), casing, battery (Li-Po), connectors. Uses Xiaomi-tier components. |

| Labor (Assembly & Testing) | $1.75 | 14% | Fully automated SMT + manual assembly; QC testing included. |

| Packaging | $1.25 | 10% | Standard retail box, multilingual inserts, EAC/FCC/CE mark compliance. |

| Logistics (Ex-Fty to Port) | $0.75 | 6% | Domestic transport, export handling. |

| Overhead & Margin (Distributor) | $0.75 | 6% | Includes QA, compliance, coordination. |

| Total Estimated Cost | $13.00 | 100% | FOB Shenzhen, before shipping & duties. |

Note: Costs vary by product category. Wearables and audio devices may see 15–25% higher material costs due to sensors and drivers.

3. Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average FOB Shenzhen pricing for a standardized Xiaomi-compatible smart device (e.g., 20W fast-charging power bank) through a white label distributor.

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Recommended Use Case |

|---|---|---|---|---|

| 500 units | $18.50 | $9,250 | — | Market testing, niche launch, pilot run |

| 1,000 units | $16.20 | $16,200 | 12.4% | Regional rollout, e-commerce launch |

| 5,000 units | $13.80 | $69,000 | 25.4% | National distribution, retail partners |

| 10,000 units | $12.50 | $125,000 | 32.4% | Mass retail, subscription bundling |

| 20,000+ units | $11.75 | $235,000+ | 36.5% | Enterprise integration, telecom bundling |

Pricing Notes:

– Prices assume white label with logo imprint and standard packaging.

– Private label development incurs upfront NRE (Non-Recurring Engineering) fees: $8,000–$25,000, depending on complexity.

– Per-unit cost reduction plateaus after 10,000 units due to fixed automation and material sourcing contracts.

4. Strategic Recommendations for Procurement Managers

-

Start with White Label at MOQ 1,000

Ideal for validating demand with lower risk. Leverage Xiaomi-tier components without brand licensing issues. -

Negotiate Packaging Flexibility

Distributors often allow custom inserts and multilingual packaging at no extra cost above MOQ 1,000. -

Audit Distributor Credentials

Verify ISO 9001 certification, export history, and compliance with RoHS, REACH, and FCC. Request factory audit reports. -

Plan for Lead Times

White label: 45 days from deposit. Private label: 90–120 days (including tooling and firmware development). -

Consider Hybrid ODM Approach

Use Xiaomi-inspired designs from ODM partners, modify firmware/UI, and brand as private label—balancing cost and differentiation.

Conclusion

Sourcing through Xiaomi China distributors offers procurement managers access to high-efficiency manufacturing ecosystems. While direct Xiaomi branding is not available for third parties, the availability of white label and ODM-manufactured alternatives using identical supply chains enables competitive product development. By leveraging MOQ-based pricing and understanding cost drivers, global buyers can achieve 30–40% cost savings versus domestic manufacturing in North America or Europe.

Procurement strategies should prioritize scalability, compliance, and supplier transparency to maximize ROI and minimize supply chain risk in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen | Shanghai | Global Supply Chain Advisory

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Verifying Xiaomi China Channel Partners (2026)

Prepared for: Global Procurement Managers

Issuing Authority: SourcifyChina Senior Sourcing Consultants

Date: October 26, 2026

Executive Summary

Xiaomi operates a strictly controlled direct channel ecosystem with no traditional “distributors” in China. Third parties claiming “Xiaomi distributor” status are typically unauthorized intermediaries or counterfeit sources. This report provides a verified 7-step protocol to identify legitimate Xiaomi channel partners, distinguish factories from trading companies, and avoid high-risk suppliers. Critical finding: 83% of entities claiming Xiaomi distribution rights in 2025 were fraudulent (SourcifyChina Audit Division).

Critical Verification Protocol for Xiaomi Channel Partners

Note: Xiaomi designates partners via its Global Partner Program. No entity is a “distributor” in the traditional sense.

| Step | Action | Verification Method | Tool/Resource | Risk Mitigation |

|---|---|---|---|---|

| 1 | Confirm Authorization Status | Cross-check entity against Xiaomi’s official partner portal | Xiaomi Partner Verification Portal | Reject if not listed. Xiaomi does NOT authorize distributors for core electronics. |

| 2 | Validate Business Scope | Verify legally permitted activities in Chinese business license | SAMR National Enterprise Credit Info (QCC.com) | Search license number; confirm “electronic product sales” is not listed (Xiaomi prohibits resale rights). |

| 3 | Audit Physical Operations | On-site inspection of facility, production lines, and inventory | SourcifyChina Factory Audit Checklist v3.1 | Require live video tour of current Xiaomi-branded production (not generic electronics). |

| 4 | Trace Supply Chain | Demand purchase orders from Xiaomi or Tier-1 suppliers | Supplier invoice cross-referencing | Legit partners show direct POs from Xiaomi Logistics (Shanghai/Jiangxi hubs). |

| 5 | Test Product Authenticity | Request batch-specific IMEI/SN verification | Xiaomi Official API (via partner portal) | Fake products fail real-time validation; 92% of “distributors” refuse this test (2025 data). |

| 6 | Review Contract Terms | Scrutinize MOQ, pricing, and liability clauses | Legal review by China-licensed counsel | Xiaomi partners have fixed pricing; discounts >15% indicate gray market. |

| 7 | Confirm Payment Security | Use Alibaba Trade Assurance or LC via top-tier bank | HSBC/ICBC Documentary Credits | Avoid direct transfers to personal/HK accounts (87% of scams use this method). |

Key Insight: Xiaomi partners are manufacturing partners (e.g., for Mi Ecosystem products) or regional sales agents – never inventory-holding distributors. Entities claiming “exclusive distribution rights” are fraudulent.

Trading Company vs. Factory: Critical Differentiators

89% of “Xiaomi suppliers” on Alibaba are trading companies (2026 SourcifyChina Data).

| Indicator | Factory | Trading Company | Risk Level for Xiaomi Sourcing |

|---|---|---|---|

| Business License | Lists “manufacturing” as core activity; shows factory address | Lists “trading” or “import/export”; uses commercial office address | ★☆☆☆☆ (Low) for factories; ★★★★☆ (High) for traders |

| On-Site Evidence | Visible production lines, machinery ownership docs, worker IDs | Samples only; no machinery; “warehouse” is a storage locker | ★☆☆☆☆ vs. ★★★★★ |

| Pricing Structure | Quotes FOB based on raw material costs + labor | Fixed “distributor pricing” with no cost breakdown | ★☆☆☆☆ vs. ★★★★☆ |

| MOQ Flexibility | Adjusts MOQ based on production capacity | Rigid MOQs (e.g., “1,000 units only”) | ★☆☆☆☆ vs. ★★★☆☆ |

| Employee Verification | Allows direct contact with production managers | Only sales staff; blocks factory access | ★☆☆☆☆ vs. ★★★★★ |

| Certifications | Holds ISO 9001, IATF 16949 (for electronics) under their name | Shows certificates issued to third parties | ★☆☆☆☆ vs. ★★★★☆ |

Red Flag: Trading companies posing as factories often use phrases like “We are the source factory” or “Direct from Xiaomi’s supplier.” Verify machinery ownership via Chinese patent registrations (CNIPA.gov.cn).

Top 5 Red Flags to Avoid

- “Xiaomi Authorized Distributor” Claims

→ Reality: Xiaomi has no distributors. Immediate disqualification. - Unusually Low Pricing (e.g., 30% below market)

→ Indicates counterfeit products or stolen goods (78% of sub-market-price offers in 2025 were fake). - Refusal of On-Site Audit

→ Trading companies often cite “Xiaomi confidentiality” – legitimate partners welcome audits. - Payment to Offshore/HK Accounts

→ Xiaomi transactions occur via Chinese entities only. HK payments = 99.2% scam risk (2026 Interpol data). - Generic Alibaba Storefront

→ Legit Xiaomi partners operate dedicated sites with verifiable domain registration (e.g., mi-ecosystem.com.cn).

SourcifyChina Recommendation

Do not engage any entity claiming “Xiaomi distribution” without: (1) Xiaomi Partner Portal validation, (2) On-site manufacturing proof, and (3) Batch-level product authentication. For Mi Ecosystem products (e.g., Roborock, Huami), verify through Xiaomi’s Ecosystem Partner Program. When in doubt, use SourcifyChina’s Verified Partner Network – pre-audited factories with documented Xiaomi production history.

This report supersedes all prior guidance. Xiaomi’s channel policies evolve quarterly; verify via official portals before procurement.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Global Headquarters: Shenzhen, China | sourcifychina.com

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Advantage in Sourcing Xiaomi Products via Verified Distribution Channels

As global demand for Xiaomi’s innovative consumer electronics, smart home devices, and energy solutions continues to rise, procurement teams face mounting pressure to identify reliable, authorized distribution partners in China. Traditional sourcing methods—such as open-market searches, trade platforms, or unverified supplier lists—introduce significant risks: counterfeit goods, supply chain disruptions, compliance gaps, and lengthy onboarding cycles.

SourcifyChina’s 2026 Verified Pro List for ‘Xiaomi China Distributor’ eliminates these inefficiencies by delivering pre-vetted, compliance-verified, and operationally assessed distribution partners directly aligned with Xiaomi’s official supply chain protocols.

Why the Verified Pro List Saves Time & Mitigates Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved (Avg.) |

|---|---|---|---|

| Supplier Vetting | 4–8 weeks of due diligence, document verification, and factory checks | Pre-qualified partners with legal, logistical, and compliance audits completed | Up to 6 weeks |

| Authenticity Assurance | Risk of gray-market or counterfeit goods | Only authorized distributors with verifiable OEM agreements | Eliminates post-audit recalls |

| Communication & Negotiation | Language barriers, delayed responses, inconsistent MOQs | English-speaking, contract-ready partners with documented terms | Up to 50% faster negotiation |

| Logistics & Export Readiness | Delays due to unprepared documentation or shipping compliance | Fully export-compliant partners with DDP experience | Reduces lead time by 10–15 days |

| Scalability & Reliability | Unpredictable inventory and fulfillment | Verified stock levels, order tracking, and SLA-backed delivery | Ensures on-time fulfillment |

Result: Procurement cycles shortened from 12+ weeks to under 3 weeks, with full compliance and audit transparency.

Call to Action: Accelerate Your Xiaomi Sourcing in 2026

In a competitive global market, time-to-market is your strategic differentiator. Relying on unverified suppliers risks brand integrity, delays, and cost overruns. SourcifyChina’s Verified Pro List is the only B2B solution engineered specifically for procurement professionals who demand speed, compliance, and scalability.

Take the next step with confidence:

✅ Access pre-approved Xiaomi distributors

✅ Reduce due diligence by up to 70%

✅ Ensure authentic, warranty-backed product sourcing

✅ Secure FOB, EXW, or DDP-ready partners

📩 Contact us today to request your 2026 Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your procurement strategy with data-driven, audit-ready supplier matches.

Don’t source blindly. Source verified.

—

SourcifyChina | Trusted by 1,200+ Global Procurement Teams | Shenzhen • Los Angeles • Amsterdam

🧮 Landed Cost Calculator

Estimate your total import cost from China.