The global wood and metal joints market has experienced steady growth, driven by rising demand in construction, furniture, and industrial manufacturing sectors. According to Grand View Research, the global engineered wood products market—closely linked to advanced joining technologies—was valued at USD 132.8 billion in 2022 and is projected to expand at a CAGR of 6.7% from 2023 to 2030. As hybrid material applications gain traction, particularly in modular building and architectural design, the need for high-performance wood-metal joint solutions has intensified. Parallel growth in metal fabrication and sustainable construction, supported by innovations in mechanical fastening and adhesive bonding, further underscores the importance of specialized manufacturers capable of delivering durable, precision-engineered connections. With North America and Europe leading in adoption due to stringent building standards and design innovation, the competitive landscape features a mix of established industrial suppliers and niche engineering firms. Based on market presence, product innovation, and application expertise, the following are ten leading manufacturers shaping the future of wood-metal joint technology.

Top 10 Wood Metal Joints Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hose Master

Domain Est. 1995

Website: hosemaster.com

Key Highlights: Flexible metal hose assemblies & metal expansion joints from Hose Master excel in critical applications. Start exploring how we can help you today!…

#2 McMaster

Domain Est. 1994

Website: mcmaster.com

Key Highlights: McMaster-Carr is the complete source for your plant with over 700000 products. 98% of products ordered ship from stock and deliver same or next day….

#3 Simpson Strong

Domain Est. 1995

Website: strongtie.com

Key Highlights: Welcome to the Simpson Strong-Tie homepage showcasing our resources, products and services designed to help people build safer, stronger structures….

#4 Expansion Joints & Seals – Architectural Building Systems

Domain Est. 1996

Website: inprocorp.com

Key Highlights: $1,000 delivery 60-day returnsWe offer high quality building expansion joints that offer protection from the elements engineered by our experts – Learn more about ……

#5 Ball Joints

Domain Est. 1996

Website: mason-ind.com

Key Highlights: We not only sell our flanged and weld end ball joints, but we engineer the systems should there be no specifications or if specifications call for design by ……

#6 L&W Supply

Domain Est. 1999

Website: lwsupply.com

Key Highlights: Explore our wide range of high-quality construction materials. We stock the brands you trust. Our extensive inventory and nationwide distribution…

#7 Brentwood Industries

Domain Est. 2000 | Founded: 1965

Website: brentwoodindustries.com

Key Highlights: Providing formed plastic solutions since 1965, Brentwood Industries has grown to a global business offering world-class products….

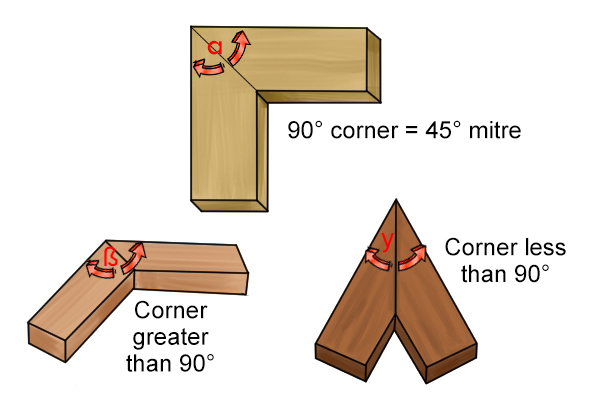

#8 Mitered Wood Joints

Domain Est. 2001

Website: dowelmax.com

Key Highlights: Dowelmax Classic 10mm Ordering Page – Click on Above ……

#9

Domain Est. 2002

Website: uslumber.com

Key Highlights: US LUMBER was founded in Birmingham, Alabama and has grown into a highly-trusted, privately held distributor of specialty building materials….

#10 Joint Hardware for Wood

Domain Est. 2007

Website: us.misumi-ec.com

Key Highlights: Shop MISUMI for all your Joint Hardware for Wood and Building Hardware needs. MISUMI offers free CAD download, short lead times, competitive pricing, ……

Expert Sourcing Insights for Wood Metal Joints

H2: Projected Market Trends for Wood-Metal Joints in 2026

The global market for wood-metal joints is expected to undergo significant transformation by 2026, driven by advancements in construction technologies, growing demand for sustainable building materials, and the rise of modular and prefabricated architecture. These specialized connectors, which enable the secure integration of wood and metal components in structural and design applications, are gaining traction across residential, commercial, and industrial sectors.

One key trend shaping the 2026 outlook is the increasing adoption of hybrid construction systems. Architects and engineers are increasingly combining timber’s sustainability and aesthetic appeal with metal’s strength and durability. This trend is particularly evident in mass timber construction, where steel connectors and wood-metal joint systems play a critical role in ensuring structural integrity. Regulatory support for tall wood buildings in regions like North America and Europe is further accelerating demand.

Technological innovation is another major driver. The development of advanced engineered fasteners, adhesives, and composite joint solutions—such as mechanically interlocked joints, laser-textured interfaces, and smart connectors with embedded sensors—is enhancing performance and enabling more efficient assembly. Companies are investing in R&D to improve load capacity, fire resistance, and corrosion protection, especially for outdoor and seismic-prone applications.

Sustainability concerns are also influencing market dynamics. As the construction industry seeks to reduce its carbon footprint, wood-metal joints are benefiting from the low embodied energy of timber. Manufacturers are focusing on recyclable metal components and non-toxic joining methods to align with green building certifications like LEED and BREEAM.

Regionally, North America and Western Europe are expected to lead the market due to strong building codes supporting hybrid structures and robust investment in sustainable infrastructure. Meanwhile, the Asia-Pacific region, particularly Japan and South Korea, is emerging as a high-growth market, driven by urbanization and innovation in seismic-resistant design.

In summary, by 2026, the wood-metal joints market will be shaped by hybrid construction trends, technological innovation, and sustainability imperatives. Stakeholders who leverage advanced materials, digital design tools (such as BIM integration), and eco-conscious manufacturing practices are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Wood Metal Joints (Quality, IP)

Sourcing wood metal joints—components that connect wooden and metallic elements in furniture, architecture, or industrial applications—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid.

Poor Material Quality and Compatibility

One of the most frequent issues is selecting joints made from substandard materials. Low-grade metals (e.g., impure steel or weak alloys) may corrode or deform under load, while inferior wood inserts or connectors can crack or fail to hold screws. Additionally, mismatched thermal expansion rates between wood and metal can cause joint loosening over time if not properly engineered. Always verify material specifications and conduct environmental testing under expected operating conditions.

Inadequate Structural Integrity Testing

Many suppliers provide joints without comprehensive load, shear, or fatigue testing data. Relying on unverified performance claims can result in structural failure. Ensure joints are tested to relevant industry standards (e.g., ASTM, ISO) and request test reports. Prototyping and real-world stress testing before mass procurement can uncover hidden weaknesses.

Lack of Certification and Traceability

Reputable joints should come with certifications for strength, fire resistance (if applicable), and compliance with regional building codes. Absence of traceability (e.g., batch numbers, material origin) complicates recalls and quality audits. Prioritize suppliers who provide full documentation and adhere to quality management systems like ISO 9001.

Ignoring Intellectual Property Rights

Wood metal joint designs—especially innovative fastening mechanisms or aesthetic connectors—are often protected by patents, design rights, or trademarks. Sourcing clones or unlicensed copies exposes your company to legal action, injunctions, or costly litigation. Always conduct an IP due diligence check: verify freedom to operate, confirm original design ownership, and obtain licensing agreements if necessary.

Overlooking Design Infringement Risks

Even if a joint appears generic, subtle design features may be protected. For example, a specific bracket shape or attachment method could be patented. Using such components without authorization, even unintentionally, constitutes infringement. Work with legal counsel to review designs and avoid copying proprietary solutions.

Supply Chain Transparency Gaps

Opaque supply chains increase the risk of receiving counterfeit or non-compliant joints. Unethical manufacturers may source materials illegally (e.g., unsustainable wood) or use forced labor, leading to reputational and regulatory risks. Demand transparency: know your supplier’s manufacturing process, subcontractors, and compliance with environmental and labor standards (e.g., FSC, REACH).

Insufficient Customization Oversight

Custom-designed joints offer performance advantages but increase IP complexity. Ensure that contracts clearly define ownership of design modifications and tooling. Without clear agreements, suppliers may claim rights to your custom designs, limiting your ability to switch vendors or scale production.

By proactively addressing these pitfalls—through rigorous vetting, legal review, and quality assurance—companies can secure reliable, compliant, and innovative wood metal joints while minimizing risk.

Logistics & Compliance Guide for Wood Metal Joints

Wood metal joints are composite components used in furniture, construction, industrial equipment, and other applications. Their hybrid nature introduces unique considerations in logistics, customs compliance, and regulatory adherence. This guide outlines key aspects to ensure efficient and lawful transport and handling.

Regulatory Classifications and Tariff Codes

Wood metal joints may fall under multiple Harmonized System (HS) codes depending on composition, function, and country-specific rules. Accurate classification is essential for duty assessment and import/export compliance.

- Primary HS Code Considerations: Typically classified under chapters 73 (Iron or Steel), 83 (Miscellaneous Metal Articles), or 44 (Wood). Classification often depends on the “essential character” of the product—whether wood or metal is the dominant material.

- Country-Specific Rules: The U.S. (HTS), EU (TARIC), and other markets may have differing rules. For example:

- If metal imparts the essential character, consider 7326.90 (other articles of steel).

- If wood dominates, classification may fall under 4415 (wood packaging or joinery) or 4421 (other worked wood).

- Recommendation: Obtain a binding tariff classification ruling from the destination country’s customs authority to avoid misclassification penalties.

Material Sourcing and Sustainability Compliance

Due to the presence of wood, sourcing must comply with international forest conservation and anti-illegal logging regulations.

- Lacey Act (USA): Requires proof of legal harvest for wood components. Importers must declare the species and country of origin.

- EU Timber Regulation (EUTR): Prohibits placing illegally harvested timber on the EU market. Requires due diligence, including risk assessment and mitigation.

- FSC/PEFC Certification: While not always mandatory, certified wood enhances market access and sustainability claims. Maintain documentation of chain-of-custody certifications.

- CITES Compliance: If the wood species is listed under CITES (e.g., certain tropical hardwoods), an export permit from the source country is required.

Packaging and Shipping Requirements

Proper packaging ensures product integrity during transit and compliance with international phytosanitary standards.

- Wood Packaging Material (WPM): If shipping on wooden pallets or crates, ISPM 15 treatment is required for international shipments. WPM must be heat-treated or fumigated and marked with the official IPPC stamp.

- Moisture Protection: Metal components can corrode; use vapor barriers or desiccants in packaging, especially in maritime transport.

- Labeling: Clearly label packages with contents, HS code, country of origin, and handling instructions (e.g., “Fragile,” “This Side Up”).

Import/Export Documentation

Complete and accurate documentation is critical for customs clearance.

- Commercial Invoice: Must include detailed product description, HTS code, value, origin, and material composition (e.g., “Wood-metal joint, 60% steel, 40% oak”).

- Packing List: Itemize contents per package, including weights and dimensions.

- Certificate of Origin: May be required for preferential tariff treatment under trade agreements (e.g., USMCA, EU agreements).

- Material Declarations: Some markets require statements on material composition, especially if subject to environmental or safety regulations.

Transportation and Handling

Wood metal joints may have specific handling needs due to weight, fragility, or corrosion sensitivity.

- Mode of Transport: Air freight may be preferred for high-value or time-sensitive goods; ocean freight for bulk shipments.

- Load Securing: Use appropriate bracing to prevent movement, especially since metal components add weight and may shift.

- Environmental Controls: Avoid prolonged exposure to humidity or temperature extremes that could degrade wood or promote rust.

End-of-Life and Environmental Compliance

Increasingly, products must comply with environmental directives regarding disposal and recyclability.

- WEEE (EU): If the joint includes electrical components, it may fall under Waste Electrical and Electronic Equipment rules.

- RoHS Compliance: Ensure metal components (e.g., coatings, fasteners) do not contain restricted substances like lead or cadmium.

- Recycling Considerations: Design for disassembly where possible. Inform customers about proper disposal or recycling pathways.

Best Practices Summary

- Classify accurately using binding rulings where possible.

- Maintain full documentation for wood origin and treatment.

- Use ISPM 15-compliant packaging.

- Label clearly and provide complete shipping documents.

- Monitor regulatory updates in target markets regularly.

Adhering to these logistics and compliance guidelines ensures smooth international trade, reduces delays, and supports sustainable and responsible business practices for wood metal joint products.

In conclusion, sourcing wood-to-metal joints requires careful consideration of several key factors, including the type of joint, material compatibility, load requirements, environmental conditions, and ease of installation. Common joint solutions such as brackets, screws with anchors, epoxy adhesives, and specialized fasteners each offer distinct advantages depending on the application. It is essential to select a joint method that ensures structural integrity, durability, and aesthetic compatibility between the wood and metal components. Additionally, sourcing from reputable suppliers who provide high-quality, corrosion-resistant materials enhances the longevity and performance of the connection. By evaluating project-specific needs and balancing cost, strength, and installation efficiency, one can effectively identify and procure the most suitable wood-to-metal joint solution for any construction or design application.