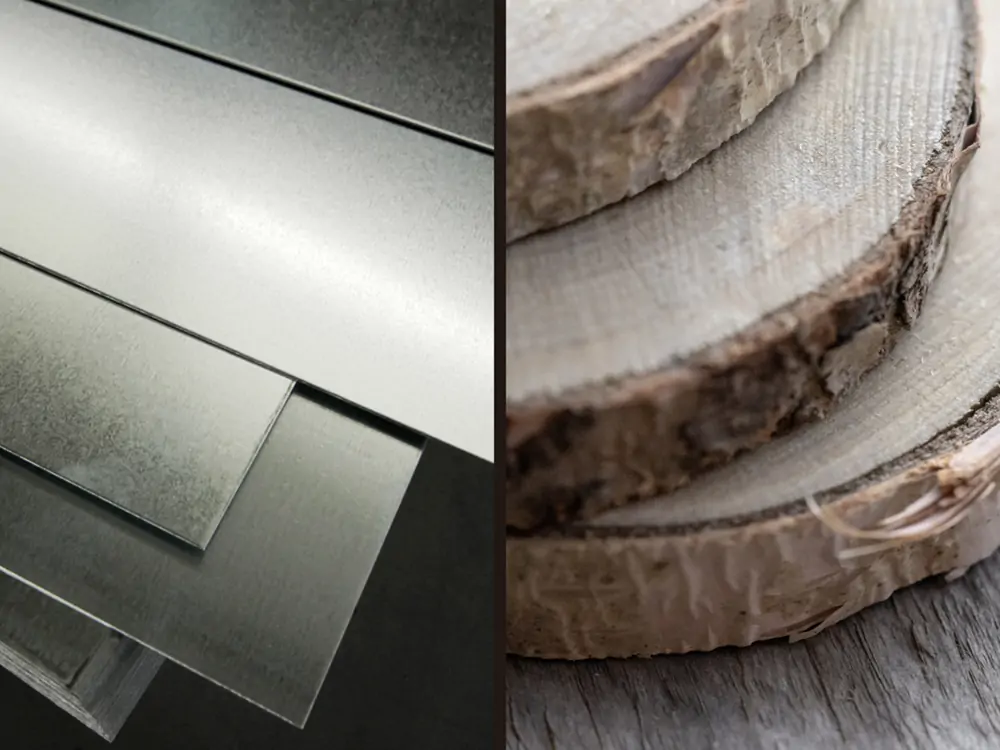

The global adhesive market, particularly in industrial and specialty segments, is witnessing robust growth driven by increasing demand across construction, automotive, and furniture industries. According to Grand View Research, the global adhesives and sealants market was valued at USD 68.9 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. With wood-to-metal bonding requirements becoming more prevalent in manufacturing and DIY applications, the need for high-performance wood metal glues has surged. This demand is further amplified by advancements in hybrid material usage and a growing emphasis on durable, eco-friendly bonding solutions. As innovation accelerates, several manufacturers have emerged as leaders, leveraging R&D investments and strategic partnerships to capture market share. Based on market traction, product performance, and global reach, the following ten companies represent the forefront of wood metal glue manufacturing worldwide.

Top 10 Wood Metal Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DAP Global Inc.

Domain Est. 1995

Website: dap.com

Key Highlights: Founded in 1865, DAP is a leading manufacturer and supplier of caulks, sealants, foam, adhesives, and patch and repair products with a history of ……

#2 Jowat Adhesives

Domain Est. 1996

Website: jowat.com

Key Highlights: Jowat SE with headquarters in Detmold is one of the world’s leading suppliers of industrial adhesives. These are mainly used in woodworking and furniture ……

#3 Permabond Adhesive

Domain Est. 1996

Website: permabond.com

Key Highlights: Permabond manufactures many types of industrial adhesive products to suit the varied needs of a number of different industries….

#4 High

Domain Est. 2016

Website: astraladhesives.com

Key Highlights: Astral Adhesives offers top bonding solutions, sealants &adhesive products designed for durability and performance in diverse industrial applications….

#5 J

Domain Est. 1995

Website: jbweld.com

Key Highlights: Discover the world’s strongest bond with J-B Weld products. Sort by and find the perfect solution for your job. Need help? We’ve got you covered….

#6 Sikaflex® – The Leading Brand for Sealants and Adhesives

Domain Est. 1995

Website: sika.com

Key Highlights: Sikaflex is known as the world’s leading brand for elastic one-component adhesives and sealants based on polyurethane (PU) or silane-terminated polymer (STP)….

#7 Titebond

Domain Est. 1996

Website: titebond.com

Key Highlights: Titebond offers the right mix of products and technical advice to help homeowners, hobbyists and DIYers of all skill levels achieve the best results possible….

#8 Rhino Glue

Domain Est. 2001

Website: rhinoglue.com

Key Highlights: We offer our Rhino Tough One Formula solution that will bond the same or dissimilar surfaces like plastics, vinyl’s, woods, rubber, ceramics, metals, glass, ……

#9 Adhesive Products Overview

Domain Est. 2001

Website: supergluecorp.com

Key Highlights: Our product overview page covers instant glues, tapes, expoxies, specialty glues, stationary, mounting, and much more for your glue and adhesive needs….

#10 Materials

Domain Est. 2007

Website: kohburg.com

Key Highlights: Kohburg uses E-Zero Organic Glue instead of traditional toxic wood glue to assemble and combine furniture parts. E-Zero Organic Glue is all natural and produced ……

Expert Sourcing Insights for Wood Metal Glue

H2: 2026 Market Trends for Wood Metal Glue

The global wood metal glue market is poised for significant evolution by 2026, shaped by technological innovation, sustainability demands, and shifting industrial applications. As industries seek stronger, more durable bonds between dissimilar materials like wood and metal—common in furniture, construction, automotive, and renewable energy sectors—the demand for high-performance adhesives continues to rise. Key trends influencing the 2026 landscape include:

-

Growing Emphasis on Sustainable and Eco-Friendly Formulations

Environmental regulations and consumer preferences are driving the development of low-VOC (volatile organic compound), bio-based, and recyclable wood metal adhesives. Manufacturers are investing in water-based and formaldehyde-free formulations to meet green building standards such as LEED and BREEAM. This trend is particularly strong in Europe and North America, where regulatory pressures are most stringent. -

Advancements in Hybrid and Reactive Adhesive Technologies

Epoxy, polyurethane, and cyanoacrylate-based adhesives are being enhanced with hybrid polymers that offer superior bonding strength, thermal resistance, and flexibility. Reactive adhesives that cure under moisture or heat are gaining traction for industrial applications, offering faster processing times and improved durability—critical for automation in manufacturing. -

Rise in Cross-Material Bonding in Furniture and Construction

Modern design trends favor mixed-material structures combining wood’s aesthetic appeal with metal’s structural strength. This is increasing the need for specialized wood metal glues that can withstand mechanical stress, temperature fluctuations, and moisture exposure. The modular construction and prefabricated housing sectors are key growth areas. -

Expansion in Asian and Emerging Markets

Rapid urbanization and infrastructure development in countries like India, Vietnam, and Indonesia are fueling demand for construction and industrial adhesives. Local production and cost-effective formulations are helping global and regional players capture market share in these high-growth regions. -

Integration with Industry 4.0 and Smart Manufacturing

Adhesive application processes are becoming more automated and precise, with robotics and IoT-enabled dispensing systems requiring consistent, high-performance glues. Manufacturers are tailoring wood metal adhesives for compatibility with automated assembly lines, especially in automotive and aerospace where lightweight composite structures are on the rise. -

Increased R&D Investment and Strategic Partnerships

Leading chemical companies are collaborating with material scientists and end-users to develop next-generation adhesives. Focus areas include improved cure speed, enhanced adhesion to treated or coated surfaces, and compatibility with recycled materials. Patents in nanotechnology-enhanced adhesives suggest further performance breakthroughs by 2026.

In conclusion, the 2026 wood metal glue market will be defined by innovation, sustainability, and adaptability to evolving industrial needs. Companies that prioritize eco-conscious development, technical performance, and market-specific solutions are likely to lead in this competitive and expanding sector.

Common Pitfalls When Sourcing Wood Metal Glue (Quality & Intellectual Property)

Sourcing wood-to-metal adhesives involves navigating both technical quality concerns and potential intellectual property (IP) risks. Overlooking these areas can lead to product failure, legal disputes, or supply chain vulnerabilities. Below are key pitfalls to avoid:

Poor Adhesive Performance Due to Inadequate Quality Assessment

Many buyers focus solely on cost and overlook critical performance metrics, resulting in bond failures under real-world conditions. Common quality-related pitfalls include:

-

Mismatched Substrate Compatibility: Not verifying that the adhesive is specifically formulated for both the type of wood (e.g., hardwood, softwood, treated lumber) and metal (e.g., aluminum, steel, stainless steel) being bonded. Surface energy and porosity differences can drastically affect adhesion.

-

Insufficient Environmental Resistance Testing: Failing to test performance under expected environmental stresses such as humidity, temperature cycling, UV exposure, or chemical contact. Some adhesives degrade rapidly in outdoor or industrial environments.

-

Overreliance on Manufacturer Claims Without Independent Verification: Accepting datasheet values at face value without conducting in-house or third-party testing under actual application conditions (e.g., shear strength, peel strength, creep resistance).

-

Inconsistent Batch-to-Batch Quality: Working with suppliers who lack robust quality control systems, leading to variability in viscosity, cure time, or bond strength across production runs.

Intellectual Property Risks in Sourcing and Use

Using or replicating adhesives without due diligence on IP rights can expose companies to legal liability, especially when sourcing from low-cost or offshore manufacturers.

-

Infringement of Patented Formulations: Sourcing generic or unbranded adhesives that replicate patented chemistries (e.g., specific epoxy or polyurethane blends) without a license. This is common with suppliers in regions with weak IP enforcement.

-

Unauthorized Use of Proprietary Brands or Trade Dress: Purchasing counterfeit or re-labeled products that falsely claim to be from a well-known brand (e.g., J-B Weld, Loctite), leading to trademark infringement.

-

Lack of IP Indemnification in Supply Contracts: Failing to include clauses where the supplier assumes liability for IP infringement claims, leaving the buyer exposed to lawsuits from patent holders.

-

Reverse Engineering Without Legal Clearance: Attempting to duplicate a competitor’s adhesive performance without ensuring that the reverse-engineered product does not infringe on existing patents or trade secrets.

Mitigation Strategies

- Demand Full Technical Data Sheets (TDS) and Safety Data Sheets (SDS), and request batch-specific certificates of analysis.

- Conduct Application-Specific Testing under realistic conditions before full-scale adoption.

- Audit Suppliers for quality certifications (e.g., ISO 9001) and traceability practices.

- Perform IP Due Diligence, including patent landscape searches, especially when sourcing private-label or custom-formulated products.

- Include Strong IP Warranty and Indemnification Clauses in procurement contracts.

Avoiding these pitfalls ensures not only reliable performance but also legal and operational security in the supply chain.

Logistics & Compliance Guide for Wood Metal Glue

Product Overview

Wood Metal Glue is a high-performance adhesive formulated to bond wood and metal substrates effectively. It typically contains synthetic resins, solvents, and additives designed to ensure strong, durable bonds in industrial, construction, and DIY applications. Due to its chemical composition, proper handling, storage, transportation, and disposal procedures must be followed to ensure safety and regulatory compliance.

Hazard Classification

Wood Metal Glue may be classified under the following GHS (Globally Harmonized System) hazard categories:

– Flammable Liquid (Category 2 or 3) – if solvent-based

– Skin Irritation (Category 2)

– Eye Damage (Category 1)

– Specific Target Organ Toxicity (Single Exposure) – Respiratory Irritation (Category 3)

– Harmful if swallowed or inhaled

Check the Safety Data Sheet (SDS) provided by the manufacturer for exact classification based on formulation.

Storage Requirements

- Temperature Control: Store in a cool, dry, well-ventilated area away from direct sunlight and heat sources. Recommended storage temperature: 10°C to 25°C (50°F to 77°F).

- Container Integrity: Keep containers tightly closed when not in use to prevent evaporation and contamination.

- Segregation: Store away from oxidizers, strong acids, and bases. Do not store near flammable materials if the glue is solvent-based.

- Fire Safety: Store in a flammable storage cabinet if applicable. Ensure fire extinguishers (e.g., CO₂ or dry chemical) are accessible.

Transportation Guidelines

- Regulatory Compliance: Comply with transportation regulations such as:

- ADR (Europe – Road)

- IMDG Code (Maritime)

- IATA DGR (Air)

- 49 CFR (USA – DOT)

- Packaging: Use UN-certified packaging suitable for flammable liquids or adhesives. Ensure seals are leak-proof and containers are secured to prevent movement.

- Labeling: Packages must display:

- Proper shipping name (e.g., “Adhesive, flammable, containing flammable liquid”)

- UN Number (e.g., UN1133, Class 3)

- GHS pictograms (Flame, Exclamation Mark, Corrosion)

- Hazard statements and precautionary phrases

- Documentation: Include Safety Data Sheet (SDS) and transport documents with hazard class, packing group (typically II or III), and emergency response information.

Handling Procedures

- Personal Protective Equipment (PPE):

- Chemical-resistant gloves (e.g., nitrile)

- Safety goggles or face shield

- Respiratory protection (e.g., N95 mask or organic vapor respirator) in poorly ventilated areas

- Protective clothing to prevent skin contact

- Ventilation: Use in well-ventilated areas or with local exhaust ventilation. Avoid inhalation of vapors or mists.

- Spill Prevention: Use drip trays and secondary containment. Avoid contact with eyes, skin, and clothing.

Spill Response

- Containment: Stop the leak if safe to do so. Contain spill with absorbent materials (e.g., sand, vermiculite, or commercial absorbents).

- Cleanup: Collect spilled material in a properly labeled container. Do not flush into sewers or waterways.

- Disposal: Treat as hazardous waste according to local regulations.

- Personal Safety: Evacuate area if vapors are present. Use PPE during cleanup.

Waste Disposal

- Dispose of waste glue, containers, and contaminated materials as hazardous waste in accordance with local, national, and international regulations (e.g., RCRA in the USA, Waste Framework Directive in the EU).

- Do not pour down drains or dispose of in regular trash.

- Consult licensed waste disposal contractors for proper treatment and disposal methods.

Regulatory Compliance

- REACH (EU): Ensure substances are registered and comply with SVHC (Substances of Very High Concern) requirements.

- TSCA (USA): Confirm all chemical components are listed on the TSCA Inventory.

- CLP Regulation (EU): Classify, label, and package according to Regulation (EC) No 1272/2008.

- OSHA (USA): Comply with Hazard Communication Standard (29 CFR 1910.1200); provide SDS and employee training.

Safety Data Sheet (SDS) Management

- Maintain up-to-date SDS for Wood Metal Glue accessible to all handlers and emergency responders.

- The SDS must be in the local language(s) of the country of use.

- Review SDS annually or when formulation changes occur.

Training & Emergency Preparedness

- Employee Training: Conduct regular training on safe handling, storage, emergency response, and PPE use.

- Emergency Procedures: Establish protocols for fire, spill, exposure, and first aid:

- Inhalation: Move to fresh air; seek medical attention if symptoms persist.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Rinse thoroughly with water for at least 15 minutes; seek medical advice.

- Ingestion: Do not induce vomiting; rinse mouth and seek immediate medical help.

- Display emergency contact numbers and first aid instructions in work areas.

Environmental Considerations

- Prevent release into the environment. Adhesives may be toxic to aquatic life.

- Use closed systems or containment measures during application and cleaning.

- Recycle packaging where possible through approved channels.

Audit & Documentation

- Maintain records of:

- SDS versions

- Training logs

- Spill and incident reports

- Waste disposal manifests

- Conduct periodic audits to ensure compliance with internal policies and external regulations.

By adhering to this guide, organizations can ensure the safe and compliant logistics handling of Wood Metal Glue across the supply chain. Always consult the manufacturer’s SDS and local regulatory authorities for product- and region-specific requirements.

In conclusion, sourcing the right wood-to-metal glue requires careful consideration of several key factors, including bond strength, durability, resistance to environmental conditions (such as moisture, heat, and UV exposure), curing time, and ease of application. Epoxy adhesives are often the preferred choice due to their exceptional strength and versatility, while polyurethane and cyanoacrylate (super glue) options can also provide reliable performance depending on the specific project requirements.

When selecting a wood-to-metal adhesive, it is essential to evaluate the substrate materials, intended use (indoor vs. outdoor, structural vs. decorative), and load-bearing demands. Additionally, proper surface preparation—cleaning, sanding, and ensuring compatibility—is critical to achieving a long-lasting bond.

Sourcing should prioritize reputable suppliers and high-quality brands known for consistent performance and technical support. Whether for industrial applications or DIY projects, investing time in selecting the appropriate adhesive ensures durability, safety, and optimal results. Ultimately, the successful bonding of wood to metal hinges on matching the right glue to the job, backed by reliable sourcing and best application practices.