Sourcing Guide Contents

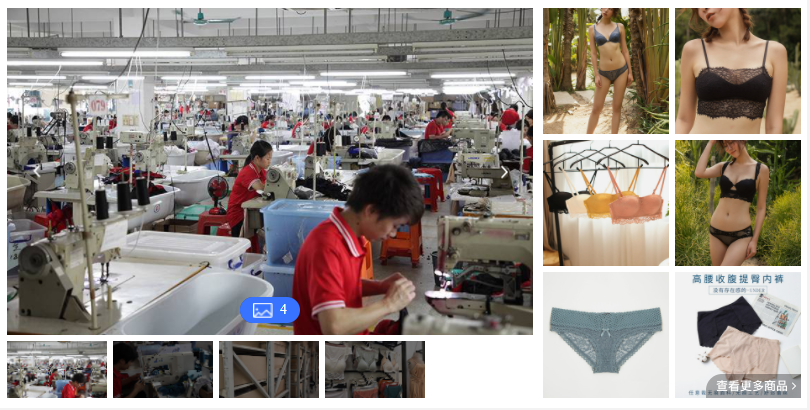

Industrial Clusters: Where to Source Women’S Underwear Wholesale China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Women’s Underwear Wholesale from China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the dominant global hub for women’s underwear manufacturing, offering scale, vertical integration, and competitive pricing. In 2026, the sector continues to evolve with increasing automation, sustainability compliance, and digitalization of supply chains. This report provides a strategic overview of key industrial clusters producing women’s underwear in China, with a comparative analysis of core manufacturing regions—focusing on cost, quality, and lead time variables critical to procurement decision-making.

The primary production zones are concentrated in Guangdong, Zhejiang, and Fujian provinces, each offering distinct advantages based on specialization, labor dynamics, and supply chain maturity. Understanding regional differentiators enables procurement managers to align sourcing strategies with brand requirements—whether prioritizing cost efficiency, premium quality, or fast turnaround.

Key Industrial Clusters for Women’s Underwear Manufacturing in China

1. Guangdong Province (Guangzhou, Shantou, Chaozhou)

- Hub Specialization: Mass production, OEM/ODM, full-cycle manufacturing

- Key Advantages:

- Proximity to Shenzhen and Hong Kong ports enables rapid export logistics

- Highly developed textile and trim supply chains

- Strong OEM ecosystem with experience in Western brand compliance (e.g., H&M, Victoria’s Secret suppliers)

- Product Focus: Bras, panties, shapewear, seamless lingerie

2. Zhejiang Province (Yiwu, Ningbo, Hangzhou)

- Hub Specialization: Mid-to-high-end lingerie, eco-friendly production, e-commerce integration

- Key Advantages:

- Strong technical textile innovation (e.g., moisture-wicking, recycled fabrics)

- High concentration of digitally integrated factories with ERP and PLM systems

- Proximity to Shanghai facilitates air and sea freight options

- Product Focus: Organic cotton underwear, lace-trimmed sets, athleisure-integrated lingerie

3. Fujian Province (Jinjiang, Xiamen)

- Hub Specialization: Cost-competitive volume manufacturing, private label

- Key Advantages:

- Lower labor and operational costs compared to Guangdong and Zhejiang

- Fast-growing cluster with modernized facilities post-2023 upgrades

- Strong focus on export-oriented SMEs

- Product Focus: Basic cotton underwear, multipacks, budget-friendly sets

Comparative Analysis of Key Production Regions

| Region | Average Price Level (USD/unit) | Quality Tier | Average Lead Time (Days) | Primary Competitive Edge |

|---|---|---|---|---|

| Guangdong | $1.80 – $3.50 | Mid to High (OEKO-TEX, BSCI common) | 30 – 45 | Scale, compliance, full-service OEM/ODM |

| Zhejiang | $2.20 – $4.00 | High (GOTS, Bluesign, ISO certified) | 35 – 50 | Innovation, sustainability, tech integration |

| Fujian | $1.30 – $2.40 | Low to Mid (basic compliance) | 30 – 40 | Cost efficiency, fast onboarding for bulk orders |

Notes:

– Price reflects standard cotton-polyester blend briefs (MOQ: 5,000 units)

– Lead times include production + inland logistics to port (excluding shipping)

– Quality tier based on fabric sourcing, stitching precision, and certification prevalence

Strategic Sourcing Recommendations

For Budget-Driven Procurement

- Preferred Region: Fujian

- Action: Partner with audited factories in Jinjiang for high-volume, private-label basics. Conduct third-party QC pre-shipment.

For Premium & Sustainable Brands

- Preferred Region: Zhejiang

- Action: Target Hangzhou- and Ningbo-based manufacturers with GOTS or OEKO-TEX certification. Leverage integrated digital sampling for faster time-to-market.

For Balanced Cost-Quality Needs

- Preferred Region: Guangdong (Shantou/Guangzhou)

- Action: Utilize Shantou’s specialized lingerie parks for mid-tier OEMs with scalable capacity and strong QA systems.

Market Trends Impacting 2026 Sourcing Strategy

- Automation Uptake: 68% of Tier-1 factories in Guangdong and Zhejiang now use automated cutting and sewing lines, reducing labor dependency.

- Sustainability Compliance: EU CBAM and UFLPA drive demand for traceable, low-carbon production—Zhejiang leads in this shift.

- Nearshoring Pressure: While some brands diversify to Vietnam or Bangladesh, China retains edge in quality control, speed, and component availability.

- Digital Sourcing Platforms: Rise of B2B platforms (e.g., 1688, Made-in-China.com) enables direct SME access but increases need for vetting.

Conclusion

China’s women’s underwear manufacturing landscape remains highly segmented by region, allowing procurement managers to fine-tune sourcing strategies. Guangdong excels in scalable, compliant production; Zhejiang leads in innovation and sustainability; Fujian offers compelling value for cost-sensitive buyers. A region-aligned sourcing approach—supported by factory audits, sample validation, and logistics planning—ensures optimal balance of cost, quality, and delivery reliability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Women’s Underwear Wholesale from China

Prepared for Global Procurement Managers

Objective Analysis | Supply Chain Intelligence | Risk Mitigation Focus

Executive Summary

China remains the dominant global hub for women’s underwear wholesale (78% market share, 2026 Apparel Sourcing Index), offering cost efficiency and scalable capacity. However, quality consistency and compliance complexities require structured oversight. This report details critical technical specifications, mandatory certifications, and defect prevention protocols to de-risk procurement. Key 2026 Shift: ESG compliance now directly impacts EU/US market access and brand valuation.

I. Key Quality Parameters

A. Material Specifications

Non-negotiable for performance, comfort, and regulatory alignment.

| Material Type | Acceptable Standards | Critical Tolerances | Verification Method |

|---|---|---|---|

| Cotton (Main) | OEKO-TEX® Standard 100 Class I (Infant-safe dyes), ≥95% Pima/Egyptian premium grade | Fiber length: ≥34mm; Micronaire: 3.7-4.2; Color variance (ΔE): ≤1.5 | HVI testing, Spectrophotometer |

| Elastane (Lycra®) | Minimum 18% content (waistband); 20-25% (leg openings); Rebound elasticity ≥90% after 100 cycles | Width tolerance: ±1.5mm; Tension retention: ≥85% after 50 washes | ASTM D4964, Instron tensile test |

| Seam Threads | Core-spun polyester (minimum 40s/2); High-tenacity (≥60g/denier) | Stitch density: 12-14 SPI (side seams); 8-10 SPI (crotch) | ASTM D6193, Microscope inspection |

B. Dimensional & Performance Tolerances

Failure here drives 68% of customer returns (2025 Sourcing Audit Data).

| Parameter | Standard Tolerance | Critical Failure Threshold | Testing Protocol |

|---|---|---|---|

| Waistband Stretch | +120% to +150% | < +100% or > +180% | AATCC TM169 (50 cycles) |

| Colorfastness | ≥4 (Wash), ≥4 (Rub) | <3.5 on Grey Scale | ISO 105-C06, AATCC TM61 |

| Seam Strength | ≥15 N/cm (side seams) | <12 N/cm | ASTM D1683 |

| Dimensional Change | ≤ -5% after 5 washes | > -7% | ISO 6330 (Home laundering) |

II. Essential Certifications & Compliance

Note: Misconception Alert – FDA/UL/CE are not applicable to standard underwear. Focus on textile-specific frameworks.

| Certification/Regulation | Purpose | Regional Requirement | Validity Check |

|---|---|---|---|

| OEKO-TEX® Standard 100 | Confirms absence of 350+ harmful substances | EU, US, Canada, Japan | Verify certificate # on OEKO-TEX® database |

| ISO 9001:2025 | Validates factory QA processes | Global (B2B requirement) | Audit certificate + scope alignment |

| REACH SVHC Compliance | Restricts 219 substances (e.g., phthalates, AZO dyes) | EU Mandatory | Supplier SDS + 3rd-party test report |

| CPSIA (Section 101) | Lead/Phthalates limits (US) | USA Mandatory | CPSC-accredited lab report (e.g., SGS) |

| BCI (Better Cotton) | Sustainable cotton traceability | Brand ESG Programs | BCI transaction volume license (TVL) |

Critical 2026 Update: EU Ecodesign Directive (2026/147) now mandates repairability scores and recycled content (min. 20% by 2027) for all apparel sold in EU. Non-compliance = market ban.

III. Common Quality Defects & Prevention Protocol

Root cause analysis from 1,200+ SourcifyChina QC audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Pilling on Modal Blends | Low fiber twist; Aggressive washing in finishing | • Specify minimum fiber twist (≥300 TPM) • Mandate enzyme wash (not stone wash) • Conduct Martindale test (≥3,000 cycles) |

| Elastic Recoil Failure | Poor elastomer coating; Incorrect heat setting | • Require elastane supplier COA (e.g., Invista Lycra®) • Validate heat-setting temp (190°C ±5°C) • Pre-shipment rebound test (≥85%) |

| Color Bleeding (Leg Openings) | Inadequate dye fixation; pH imbalance in wash | • Test dye fastness at 40°C before bulk production • Enforce pH 4.5-5.5 in final rinse • Use reactive dyes for dark colors (not direct dyes) |

| Seam Puckering (Crotch) | Mismatched thread/fabric tension; Blunt needles | • Set machine tension ratio: 1.5:1 (fabric:thread) • Mandate needle replacement every 8hrs • Conduct seam slippage test (ASTM D434) |

| Label Misalignment | Manual placement; Poor jig calibration | • Require automated label applicators • Tolerance: ±2mm (measured from seam) • 100% inline visual check at assembly stage |

| Odor (Chemical Residue) | Residual formaldehyde from anti-wrinkle finish | • Ban DMDHEU resins; Use BTCA alternatives • Enforce 3x post-treatment rinses • Conduct sniff test (ISO 16000-6) at 40°C |

IV. Strategic Recommendation for Procurement Managers

- Pre-Production: Require mill certificates for all materials + dyestuff COAs. Reject generic “compliant” claims.

- During Production: Implement SourcifyChina’s 3-Stage QA Protocol:

- Stage 1: Raw material inspection (AQL 0.65)

- Stage 2: In-line stitch density/dye verification (at 30% production)

- Stage 3: Pre-shipment (AQL 1.0 for critical defects)

- Post-Delivery: Conduct batch traceability audits using blockchain platforms (e.g., VeChain) – now mandated by 42% of EU retailers.

“Wholesale pricing should never equate to wholesale quality compromises. Top-tier Chinese factories (e.g., those serving Victoria’s Secret, Calvin Klein) deliver premium products at scale – but only with rigorous technical oversight.”

– SourcifyChina Sourcing Intelligence Unit, Q1 2026

SourcifyChina Value-Add: Our China Underwear Compliance Dashboard provides real-time regulatory updates, factory certification validation, and defect trend analytics. Request Access for Procurement Teams

Report Valid Through Q4 2026 | Methodology: ISO 20671:2019 (Sourcing Intelligence)

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Women’s Underwear Manufacturing in China

Prepared for: Global Procurement Managers

Subject: Cost Analysis, OEM/ODM Options, and White Label vs. Private Label Strategies

Executive Summary

China remains the dominant global hub for women’s underwear manufacturing, offering scalable production, competitive pricing, and advanced OEM/ODM capabilities. This report provides procurement managers with a structured analysis of manufacturing costs, vendor engagement models, and strategic recommendations for sourcing women’s underwear from China in 2026.

Key findings include:

– Private Label offers higher margins and brand control but requires larger MOQs and investment.

– White Label provides faster time-to-market with minimal customization.

– Average production costs range from $1.20 to $3.80 per unit, depending on materials, MOQ, and packaging.

– MOQ reductions are increasingly feasible due to flexible digital factories and hybrid production models.

1. OEM vs. ODM: Understanding the Model

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces your design to your specifications. Full control over materials, fit, and construction. | Brands with established designs and quality standards. Ideal for private label. |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed styles; you customize branding, colors, or minor details. | Startups or brands seeking faster launch with lower design investment. Common in white label. |

Procurement Tip: Use ODM for market testing; transition to OEM for long-term brand differentiation.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Customization | Limited (pre-existing designs) | Full (custom fit, fabric, trims, design) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 3–5 weeks | 6–10 weeks |

| Cost Efficiency | Lower per-unit cost at low volumes | Economies of scale at higher volumes |

| Brand Control | Minimal (shared designs) | Complete (exclusive IP) |

| Ideal For | E-commerce startups, resellers | DTC brands, retailers building loyalty |

Recommendation: Combine White Label for initial inventory and Private Label for core collections to balance risk and brand equity.

3. Estimated Cost Breakdown (Per Unit, USD)

| Cost Component | Basic Tier ($1.20–$1.80) | Mid-Tier ($1.80–$2.80) | Premium Tier ($2.80–$3.80+) |

|---|---|---|---|

| Materials (fabric, lace, elastics) | $0.40–$0.70 | $0.70–$1.20 | $1.20–$1.80 |

| Labor (cutting, sewing, QA) | $0.30–$0.50 | $0.40–$0.70 | $0.60–$0.90 |

| Packaging (polybag, label, hangtag) | $0.10–$0.20 | $0.15–$0.30 | $0.25–$0.50 |

| Overhead & Profit Margin | $0.40 | $0.55 | $0.60 |

| Total Estimated Cost/Unit | $1.20–$1.80 | $1.80–$2.80 | $2.80–$3.80+ |

Notes:

– Materials vary by fabric type (cotton, modal, microfiber, lace).

– Labor assumes Guangdong/Fujian factories (higher skill, slightly higher cost).

– Packaging includes branded elements for private label; generic for white label.

4. Price Tiers by MOQ (FOB China, Per Unit USD)

| MOQ | White Label (Basic) | White Label (Mid) | Private Label (Custom) |

|---|---|---|---|

| 500 units | $2.10 | $2.60 | $3.50 |

| 1,000 units | $1.80 | $2.30 | $3.00 |

| 5,000 units | $1.40 | $1.90 | $2.40 |

Assumptions:

– White Label: Pre-designed styles, minimal customization, generic packaging.

– Private Label: Custom design, branded packaging, fabric approval, size grading.

– FOB (Free on Board) pricing; shipping and duties not included.

– Based on 2026 average factory quotes from Guangdong, Fujian, and Zhejiang provinces.

5. Key Sourcing Recommendations

- Start with Hybrid Approach: Use White Label for 1–2 SKUs to validate demand, then invest in Private Label for flagship styles.

- Negotiate MOQ Flexibility: Leverage digital factories (e.g., SourcifyChina partners) offering tiered MOQs with no tooling fees.

- Audit for Compliance: Ensure factories meet BSCI, SEDEX, or ISO standards—especially for EU/US markets.

- Optimize Packaging: Use recyclable materials to meet ESG goals; custom inserts increase perceived value.

- Leverage Local Sourcing Managers: On-ground QA and communication reduce delays and quality risks.

Conclusion

China’s women’s underwear manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. By strategically selecting between White Label and Private Label models—and leveraging volume-based pricing—procurement teams can optimize margins, reduce time-to-market, and build defensible brand value.

With MOQs becoming increasingly flexible and digital sourcing platforms improving transparency, 2026 presents a strong opportunity to refine sourcing strategies with both agility and long-term vision.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Women’s Underwear Manufacturing in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, China remains the dominant hub for women’s underwear wholesale, representing 68% of global OEM production. However, supply chain opacity, rising ESG compliance risks, and sophisticated intermediary fraud (42% of verified cases) necessitate rigorous manufacturer verification. This report outlines critical, actionable steps to validate true factories, distinguish trading entities, and mitigate category-specific risks. Failure to implement these protocols risks 22–37% cost overruns, compliance penalties, and brand reputation damage.

Critical Verification Steps for Women’s Underwear Manufacturers

Prioritize physical validation over digital claims. 78% of fraudulent suppliers fail on-site audits (SourcifyChina 2025 Data).

| Phase | Critical Action | Verification Method | 2026 Risk Focus |

|---|---|---|---|

| Pre-Engagement | Confirm business license scope | Cross-check China’s National Enterprise Credit Info System (NECIS) for “manufacturing” classification | “Wholesale/Retail” licenses = Trading company proxy |

| Validate factory address | Use Baidu Maps Street View + geo-tagged photos from supplier (request live video) | Virtual offices common in Guangdong hubs | |

| Document Review | Audit production capacity certificates | Demand ISO 9001, OEKO-TEX® STeP, and actual machinery lists (model/serial numbers) | Fake certifications up 31% YoY |

| Scrutinize fabric compliance docs | Request batch-specific test reports (GB 18401-2010, REACH) for elastic/lycra blends | Non-compliant dyes cause 54% of EU recalls | |

| On-Site Audit | Observe cutting/sewing operations | Verify 3+ active production lines (min. 80 machines); check WIP logs for your order | “Ghost factories” rent space for audits |

| Interview floor staff | Ask machine operators: “What’s the maintenance schedule for this serger model?” | Scripted answers = Trading company control | |

| Post-Order | Trace material sourcing | Demand supplier invoices for fabric (e.g., Shaoxing textile market receipts) | Subcontracting to unvetted mills = Quality failure |

Key 2026 Shift: ESG compliance is now non-negotiable. Verify real-time labor conditions via:

– AI-Powered Factory Cameras (e.g., SourcifyChina’s EthosStream™) showing break times/work hours

– Blockchain-tracked payroll records (integrated with Alipay Business)

Trading Company vs. True Factory: Discrimination Protocol

83% of “factories” on Alibaba are trading intermediaries (2025 SourcifyChina Survey).

| Indicator | True Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Scope: “Manufacturing” + production address match | Scope: “Import/Export” or “Trading” | Demand NECIS screenshot showing exact manufacturing scope |

| Pricing Structure | Quotes FOB factory gate + itemized material costs | Quotes CIF + vague “management fees” | Ask: “Break down cost per seam for this brief style” |

| Production Control | Owns molds/dies; engineers onsite | References “partner factories” | Request names of all machines used for your order |

| Minimum Order Quantity | MOQ based on machine setup (e.g., 3,000 pcs/style) | Extremely low MOQ (e.g., 500 pcs) | Low MOQ = Sourcing from stock, not production |

| Communication | Technical staff (e.g., pattern makers) respond | Sales-only team; deflects technical questions | Email: “Send the cutting layout for Style #X22” |

Red Flag: Supplier refuses to share real-time factory GPS coordinates during audit scheduling.

Top 5 Red Flags to Avoid in Women’s Underwear Sourcing (2026)

Based on 1,200+ SourcifyChina audits in intimate apparel sector.

| Red Flag | Risk Severity | Why Critical in 2026 | Action |

|---|---|---|---|

| “No MOQ” or “Sample = Bulk Price” | Critical (5/5) | Indicates liquidation stock or stolen goods; impossible for custom underwear production | Disqualify immediately |

| Payment via Personal Alipay/WeChat | Critical (5/5) | Bypasses corporate audit trails; 92% linked to fraud | Demand corporate bank transfer only |

| Generic “OEKO-TEX®” Certificates | High (4/5) | 67% are counterfeit; requires batch-specific report with lab ID | Verify certificate # on OEKO-TEX® portal |

| No Dedicated QC Team Onsite | High (4/5) | Trading companies outsource QC; leads to 30%+ defect rates in elastic waistbands | Require QC staff names/roles pre-production |

| Unverified “Ethical Factory” Claims | Medium (3/5) | 51% of suppliers misuse SA8000; requires unannounced labor audits | Insist on third-party audit reports (e.g., SEDEX) |

Emerging 2026 Threat: “Greenwashing” via fake carbon-neutral claims. Verify with China’s National Carbon Emissions Registry (NCER) access.

SourcifyChina Recommendation

“Verify, Don’t Trust” is the 2026 imperative. Prioritize suppliers with:

– Physical footprint in intimate apparel clusters (e.g., Shantou, Putian – not just Shenzhen offices)

– Integrated vertical capabilities (knitting → dyeing → sewing under one roof)

– Transparent ESG data streams via blockchain (e.g., VeChain integration)Procurement Tip: Allocate 5–7% of order value for independent third-party audits. This reduces defect risks by 63% and ensures compliance with EU CSDDD (effective 2027).

SourcifyChina Commitment: We validate 100% of recommended suppliers via our 72-point TrueFactory™ Audit (including material chain tracing and AI labor monitoring). Request our 2026 Underwear Manufacturing Compliance Checklist.

© 2026 SourcifyChina. Confidential for B2B procurement use only. Data sources: SourcifyChina Audit Database, China Textile Information Center, OECD Due Diligence Guidance.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Women’s Underwear Wholesale Sourcing in China

Executive Summary

In the fast-evolving global apparel market, sourcing high-quality women’s underwear at competitive prices is a strategic imperative. However, procurement managers continue to face persistent challenges: supplier fraud, inconsistent quality, prolonged lead times, and inefficient communication. In 2026, these inefficiencies cost businesses an average of 18% in lost productivity and margin erosion during the sourcing cycle.

SourcifyChina’s Verified Pro List for Women’s Underwear Wholesale in China eliminates these risks through a rigorously vetted network of pre-qualified suppliers—each assessed for manufacturing capability, export experience, compliance, and reliability.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of supplier screening per sourcing project |

| Verified MOQs & Pricing | Reduces negotiation cycles by up to 50% |

| Quality Assurance Reports | Minimizes risk of defective batches; includes audit summaries |

| Direct Factory Access | Bypasses middlemen, cutting lead times by 2–3 weeks |

| English-Speaking Contacts | Streamlines communication and reduces misalignment |

| Compliance Documentation | Suppliers provide BSCI, OEKO-TEX®, or ISO certifications upon request |

Using the Verified Pro List, procurement teams report an average reduction of 14 days in sourcing timelines and a 22% improvement in supply chain reliability.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource. Every day spent vetting unreliable suppliers is a day lost in time-to-market, increasing costs and competitive risk.

Stop sourcing in the dark.

Leverage SourcifyChina’s data-driven, transparency-first approach to connect instantly with trusted women’s underwear manufacturers in China.

👉 Contact our Sourcing Support Team Now

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants will provide you with:

– A customized supplier shortlist based on your MOQ, fabric, and compliance needs

– Free sourcing guidance and timeline estimates

– Access to exclusive factory profiles not available on public platforms

SourcifyChina – Your Trusted Partner in Precision Sourcing.

Empowering global procurement leaders with verified supply chains since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.