The global industrial valve market is experiencing robust growth, driven by rising demand across oil & gas, power generation, water treatment, and chemical processing sectors. According to Grand View Research, the global valve market size was valued at USD 78.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is further fueled by increasing investments in infrastructure, stricter regulatory standards for safety and efficiency, and a shift toward automation in industrial operations. Within this expanding landscape, WOG (Water, Oil, Gas) valves—specifically designed for on-off control in non-corrosive media—have become essential components in critical applications. As demand intensifies, manufacturers that combine engineering precision, material durability, and compliance with international standards are gaining prominence. Based on market presence, product range, global reach, and technological capabilities, the following nine companies stand out as leading WOG valve manufacturers shaping the future of fluid control systems.

Top 9 Wog Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Keckley Company

Domain Est. 1998 | Founded: 1914

Website: keckley.com

Key Highlights: Established in 1914, Keckley Company is the premier manufacturer of high-quality Ball Valves, Pipeline Strainers, Check Valves, Float and Lever Valves….

#2 Full Port Seal Weld 2000PSI WOG Ball Valve [Series 115]

Domain Est. 2001

Website: valtorc.com

Key Highlights: Full port industrial grade series ball valves available in sizes 1/4″ – 2″ in stainless steel body, WOG rated with a 2000PSI working pressure….

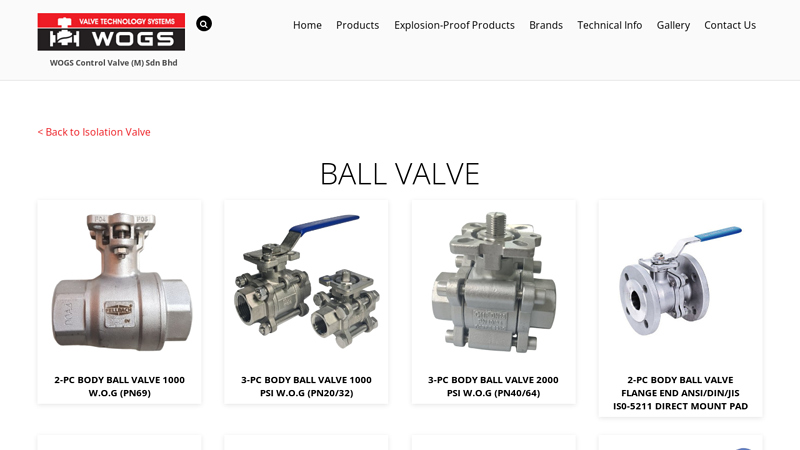

#3 Ball Valve

Domain Est. 2005

Website: wogscontrol.com

Key Highlights: At WOGS, we supply a wide range of high-quality ball valves designed to provide fast, secure, and long-lasting shutoff in demanding industrial environments….

#4 RED-WHITE VALVE CORP.

Domain Est. 2008

Website: redwhitevalvecorp.com

Key Highlights: RED-WHITE VALVE CORP. manufactures a wide range of standard brass and bronze alloy valves as well as thermoplastic valves for use in many commercial and ……

#5 Valve Manufacturer and Supplier

Domain Est. 2009

Website: valveman.com

Key Highlights: ValveMan delivers reliable valve solutions for every industry. Find top-quality ball valves, check valves, and more with fast shipping and expert support….

#6 Introduction

Domain Est. 2013

Website: wogvalve.com

Key Highlights: WOG Valves is a specialist manufacturer of valves for the petrochemical industries and onshore and offshore oil and gas industries, power plant etc….

#7 China Ball Valve, Gate Valve, Globe Valve, Check Valve, Butterfly …

Domain Est. 2019

Website: wog-valve.com

Key Highlights: As one of the biggest valve factory in china, we make ball valves, butterfly valves, gate valves, globe valves and check valves….

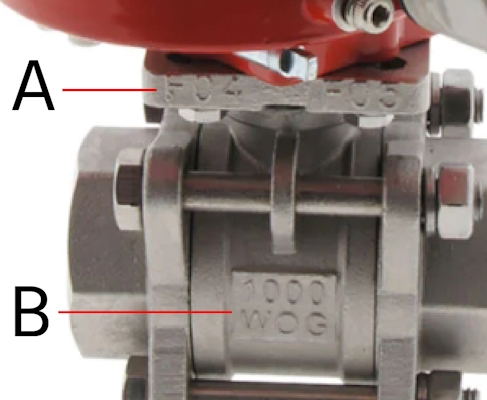

#8 How to Read Ball Valve Markings

Domain Est. 1996

Website: geminivalve.com

Key Highlights: What do the most common ball valve markings mean? We explain WOG, CWP, WSP, PSI and more to help you identify the right valve for your application….

#9 138

Domain Est. 2007

Website: blog.qrfs.com

Key Highlights: Fire safety valve pressure ratings matter in fire sprinklers and standpipes. QRFS reviews differences between WOG, WSP, PSI & more….

Expert Sourcing Insights for Wog Valve

H2: Market Trends for Wog Valve in 2026

As the global industrial sector continues to evolve, WOG Valve—a manufacturer and supplier of valves primarily used in oil and gas, petrochemical, water treatment, and industrial applications—is poised to experience significant shifts in market dynamics by 2026. The following analysis outlines key trends expected to influence WOG Valve’s market position, demand, and strategic opportunities during this period.

-

Increased Demand in Energy Transition Projects

By 2026, the global energy transition will accelerate, with growing investments in clean energy infrastructure, including hydrogen production, carbon capture and storage (CCS), and LNG (liquefied natural gas). WOG valves, particularly ball and check valves known for reliability in high-pressure environments, will see rising demand in these emerging segments. Their compatibility with alternative fuels and retrofit applications gives WOG a competitive edge in hybrid energy systems. -

Expansion in Emerging Markets

Infrastructure development in Asia-Pacific, the Middle East, and parts of Africa will drive demand for industrial valves. Countries like India, Indonesia, and Saudi Arabia are investing heavily in water management and downstream oil & gas projects, creating opportunities for WOG Valve to expand its footprint. Localization strategies and partnerships with regional EPC (Engineering, Procurement, and Construction) firms will be critical. -

Digitalization and Smart Valve Integration

The industrial automation trend will push valve manufacturers toward smart solutions. By 2026, WOG is expected to adopt IoT-enabled valve monitoring systems—offering predictive maintenance, real-time diagnostics, and remote operation. While WOG has traditionally focused on mechanical reliability, integrating digital features will be essential to remain competitive against smart valve leaders. -

Sustainability and Regulatory Pressure

Stricter environmental regulations, particularly around fugitive emissions (e.g., EPA Subpart W, EU F-gas regulations), will require valves with higher sealing performance and leak-tight certifications. WOG’s focus on full-port, fire-safe, and low-emission (Low-E) valve designs aligns with this trend. Compliance with ISO 15848 and API 644 standards will become a market differentiator. -

Supply Chain Resilience and Nearshoring

Ongoing geopolitical tensions and supply chain disruptions have prompted industrial buyers to favor suppliers with regional manufacturing and inventory hubs. By 2026, WOG may benefit from nearshoring trends in North America and Europe, especially if it enhances local production or distribution networks to reduce lead times and logistics costs. -

Competition from Chinese and European Manufacturers

While WOG maintains a reputation for quality and durability, low-cost Chinese alternatives and high-tech European brands (e.g., SAMSON, Neles) will continue to pressure margins. WOG’s ability to balance cost-efficiency with performance—through lean manufacturing and value engineering—will determine its market share retention. -

Growing Importance of After-Sales Services

By 2026, customers will increasingly value integrated service offerings, including valve repair, inventory management, and lifecycle support. WOG can strengthen customer loyalty by expanding its service network and offering digital service platforms.

Conclusion:

In 2026, WOG Valve is well-positioned to capitalize on energy transition initiatives, infrastructure growth, and regulatory shifts—provided it embraces digital innovation and enhances its service capabilities. Strategic investments in sustainability, regional presence, and smart valve technology will be key to maintaining competitiveness in a dynamic global market.

Common Pitfalls When Sourcing WOG Valves (Quality and Intellectual Property)

Sourcing WOG (Water, Oil, Gas) valves—typically referring to small-bore, high-pressure valves used in instrumentation and process control—can present several challenges, particularly concerning quality assurance and intellectual property (IP) risks. Being aware of these pitfalls helps mitigate supply chain vulnerabilities and ensures long-term operational reliability.

Poor Quality Control and Non-Compliance

One of the most significant pitfalls in sourcing WOG valves is encountering substandard products that fail to meet required industry standards. Many suppliers, especially in low-cost manufacturing regions, may produce valves that appear compliant but lack proper testing, materials certification, or traceability.

- Inadequate Material Certification: Suppliers may provide falsified or incomplete Material Test Reports (MTRs), leading to valves made from inferior alloys that corrode or fail under pressure.

- Lack of Pressure Testing: Reputable WOG valves must undergo rigorous hydrostatic and pneumatic testing. Some vendors skip or falsify these tests, increasing the risk of in-service failures.

- Non-Compliance with Standards: Valves may be labeled as meeting ASME, API, or ISO standards without actual certification. This can lead to safety hazards and non-compliance during audits.

To avoid this, buyers should require third-party inspection reports, conduct factory audits, and insist on full traceability from certified mills.

Intellectual Property Infringement and Counterfeiting

Another critical risk when sourcing WOG valves is intellectual property (IP) violation, particularly with well-known brands like Swagelok, Parker, or Festo. Unauthorized manufacturers often produce counterfeit or “look-alike” valves that mimic patented designs, fittings, and trademarks.

- Counterfeit Products: These valves may use inferior materials and designs, posing safety risks and potentially voiding equipment warranties.

- Patent and Trademark Infringement: Sourcing from suppliers that copy protected designs exposes the buyer to legal liability, especially in regulated industries or export markets.

- Interchangeability Issues: Even if a look-alike valve fits, it may not perform to the same specifications, leading to leaks, maintenance issues, or system downtime.

To mitigate IP risks, buyers should:

– Source only from authorized distributors or manufacturers with verified IP rights.

– Conduct due diligence on supplier legitimacy, including checking trademark registrations and licensing agreements.

– Avoid suppliers offering “exact replicas” or “compatible with [branded product]” at suspiciously low prices.

Inadequate Documentation and Traceability

Poor record-keeping is a common issue, especially with offshore suppliers. Lack of proper documentation—such as test reports, heat numbers, or compliance certificates—can lead to compliance failures during inspections or audits.

- Missing Certifications: Without proper documentation, valves cannot be verified for use in regulated environments (e.g., oil & gas, pharmaceuticals).

- Traceability Gaps: In the event of a failure, inability to trace components back to raw materials hampers root cause analysis and recall processes.

Always require full documentation packages and verify that suppliers adhere to quality management systems like ISO 9001.

Conclusion

Sourcing WOG valves requires diligence to avoid quality lapses and IP-related risks. Prioritizing certified suppliers, demanding full traceability, and verifying intellectual property compliance are essential steps to ensure safety, reliability, and legal protection in critical applications.

Logistics & Compliance Guide for Wog Valve

This guide outlines the essential logistics and compliance considerations for handling, shipping, and managing Wog Valve products in accordance with regulatory standards and best practices.

Product Classification and Specifications

Wog Valves, typically referring to “Work on Gas” valves or quarter-turn ball valves used in gas and fluid control systems, are critical components in industrial, commercial, and residential applications. Understanding valve type (e.g., stainless steel, brass, PVC), pressure ratings (e.g., 6,000 PSI), temperature range, and applicable standards (e.g., API, ASME, ISO) is essential for proper handling and compliance.

Regulatory Compliance Requirements

Wog Valves must comply with regional and international regulations depending on the application and destination. Key compliance standards include:

- ASME B16.34: For valve pressure and temperature ratings.

- API 6D: Specification for pipeline valves, especially for oil and gas applications.

- CE Marking (European Union): Required for valves sold in the EU, indicating conformity with health, safety, and environmental protection standards.

- CRN (Canadian Registration Number): Required in Canada for pressure equipment.

- PED (Pressure Equipment Directive 2014/68/EU): Mandatory for valves in the EU based on pressure and fluid type.

- NSF/ANSI 61: For valves used in potable water systems.

Ensure all valves are certified and properly documented before shipment.

Packaging and Handling Standards

Proper packaging is critical to prevent damage during transit:

- Valves must be sealed with protective end caps to prevent contamination.

- Use moisture-resistant wrapping for corrosion-sensitive materials (e.g., stainless steel).

- Secure packaging in sturdy, labeled crates or cartons with cushioning materials.

- Clearly mark packages with handling instructions (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”).

Shipping and Transportation Logistics

- Domestic Shipments (US/Canada): Use carriers compliant with DOT (Department of Transportation) regulations if transporting pressurized or hazardous fluid components. Provide accurate shipping descriptions and classifications.

- International Shipments: Comply with IMDG (maritime), IATA (air), or ADR (road) regulations where applicable. Include accurate HS codes (e.g., 8481.80 for ball valves) for customs clearance.

- Documentation: Include commercial invoice, packing list, certificate of conformity, material test reports (MTRs), and any required permits (e.g., export licenses).

Import/Export Compliance

- Verify if Wog Valves require export controls under EAR (Export Administration Regulations) or ITAR (International Traffic in Arms Regulations), particularly for military or dual-use applications.

- Utilize proper export classification (ECCN) and obtain necessary licenses if required.

- Ensure compliance with destination country import regulations (e.g., INMETRO in Brazil, GOST in Russia).

Inventory and Traceability Management

Maintain full traceability through lot numbers, heat numbers, and serialized tracking where applicable. Use inventory systems that support compliance reporting, warranty tracking, and recall readiness. Retain compliance documentation for a minimum of 10 years.

Environmental, Health, and Safety (EHS) Considerations

- Dispose of packaging materials in accordance with local environmental regulations.

- Train warehouse and logistics personnel on safe handling procedures.

- Ensure valves intended for hazardous media are stored and transported in accordance with OSHA and local safety standards.

Quality Assurance and Audits

Regular internal and external audits should verify compliance with ISO 9001, ISO 14001, or industry-specific quality management systems. Audit records should include inspection reports, non-conformance logs, and corrective action plans.

Conclusion

Adhering to this logistics and compliance guide ensures that Wog Valve products are handled, transported, and documented in full compliance with global regulatory requirements, minimizing risk and enhancing supply chain reliability.

Conclusion for Sourcing WOG Valve:

Sourcing WOG (Water, Oil, Gas) valves requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. After evaluating suppliers, material specifications, certifications (such as API, ASME, and NACE), and performance requirements, it is clear that selecting the right WOG valve involves more than just price comparison. Factors such as application environment, pressure and temperature ratings, material compatibility, and long-term maintenance needs must be prioritized.

Partnering with reputable manufacturers and suppliers who adhere to international standards ensures product durability and operational safety. Additionally, considering lead times, technical support, warranty, and after-sales service contributes to minimizing downtime and maximizing efficiency.

In conclusion, a well-informed sourcing decision for WOG valves—based on thorough technical evaluation, supplier reliability, and total cost of ownership—will enhance system integrity, reduce operational risks, and support the long-term success of industrial operations in oil and gas, water treatment, and related sectors.

![Full Port Seal Weld 2000PSI WOG Ball Valve [Series 115]](https://www.fobsourcify.com/wp-content/uploads/2026/01/full-port-seal-weld-2000psi-wog-ball-valve-series-115-400.jpg)