The global wireless video transmission market is experiencing robust growth, fueled by rising demand for seamless multimedia sharing across consumer electronics, smart home systems, and commercial AV applications. According to a 2023 report by Mordor Intelligence, the wireless display market was valued at USD 14.7 billion in 2022 and is projected to grow at a CAGR of 9.8% from 2023 to 2028. Similarly, Grand View Research reports that the broader wireless communication market—driven by advancements in Wi-Fi 6/6E, 5G, and low-latency streaming technologies—is expected to expand significantly, with video transmission technologies playing a key role. This surge in adoption is prompting innovation among manufacturers specializing in wireless video senders and receivers, as businesses and consumers alike prioritize high-definition, low-latency, and secure video streaming solutions. In this evolving landscape, nine manufacturers have emerged as market leaders, combining technical excellence, product scalability, and global reach to shape the future of wireless video transmission.

Top 9 Wireless Video Sender And Receiver Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Extron

Domain Est. 1995

Website: extron.com

Key Highlights: Discover the innovative world of Extron and learn about the latest in Pro AV integration products, software, news updates, and expert system support….

#2 Wireless Video Transmitter and Receiver Expert

Domain Est. 2016

Website: taisync.com

Key Highlights: Taisync provides off-the shelf and OEM integrated long-range wireless video transmitter and receiver solutions to companies in the unmanned vehicle….

#3 Wireless Video System

Domain Est. 1996

Website: arri.com

Key Highlights: The ARRI Wireless Receivers are simple and easy to use with phenomenal signal range and have the added bonus of a V Mount plate and two SDI outputs. They are ……

#4 Wireless Video Transmitter and Receiver

Domain Est. 1997

#5 Atomos Introduces TX

Domain Est. 2000

Website: atomos.com

Key Highlights: Atomos TX-RX: Go Wireless On-Set. New Transmitter and Receiver Set Delivers Low-Latency HD-SDI and Stunning 4K HDMI Video for Wireless ……

#6 ARIES Pro+ Wireless HD Video Transmitter & Receiver

Domain Est. 2003

Website: nyrius.com

Key Highlights: The Nyrius ARIES Pro+ Transmitter and Receiver (NPCS650) allows you to wirelessly transmit video content from any HDMI source to a TV, projector or conference ……

#7 Ace 750 Wireless HDMI Video Transmission with Zero

Domain Est. 2008

Website: teradek.com

Key Highlights: Ace 750 ensures wireless HDMI video transmission with less than 0.01 seconds of latency, sending true zero-delay video to up to six receivers up to 750 feet ……

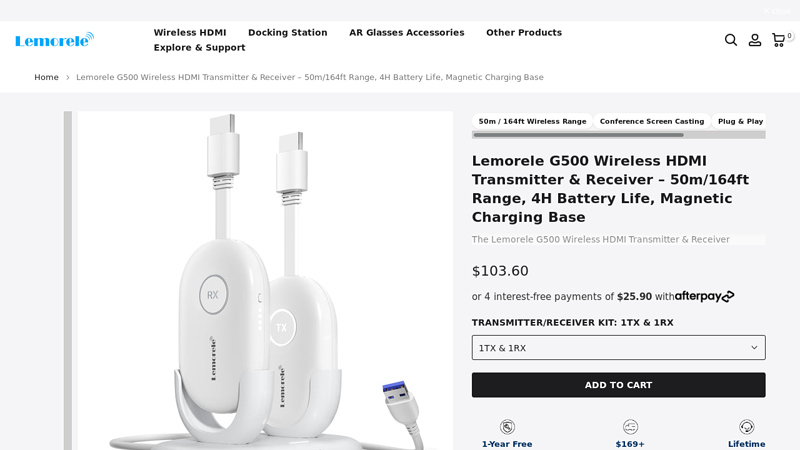

#8 Lemorele G500 Wireless HDMI Transmitter & Receiver

Domain Est. 2014

Website: us.lemorele.com

Key Highlights: Lemorele G500 Wireless HDMI Transmitter & Receiver offers 50m range, 4-hour battery life, and smart charging. Perfect for seamless presentations and ……

#9 Accsoon Wireless Video Transmitter and Receiver for Camera …

Domain Est. 2016

Website: accsoon.com

Key Highlights: Accsoon provides reliable wireless video transmitter, professional camera slider and iPhone monitoring solution for various video production applications….

Expert Sourcing Insights for Wireless Video Sender And Receiver

2026 Market Trends for Wireless Video Sender and Receiver

Market Growth and Expansion

The global wireless video sender and receiver market is projected to experience steady growth by 2026, driven by increasing demand for seamless, high-definition content sharing across industries. The market is expected to benefit from the rising adoption of smart home systems, commercial AV installations, and digital signage. With a compound annual growth rate (CAGR) estimated at 7.2% from 2022 to 2026, the market is anticipated to surpass $2.4 billion by 2026, according to industry forecasts.

Advancements in Wireless Technology

By 2026, technological innovations such as Wi-Fi 6E and 5G integration will significantly enhance the performance of wireless video transmission systems. These technologies enable lower latency, higher bandwidth, and improved reliability—critical factors for real-time video streaming in applications like gaming, conferencing, and industrial monitoring. Additionally, the adoption of HEVC (H.265) and AV1 video compression standards will allow for efficient 4K and 8K video transmission with reduced bandwidth consumption.

Rising Demand in Commercial and Residential Applications

The commercial sector—including corporate offices, educational institutions, and hospitality—will continue to adopt wireless video solutions to support collaboration and digital presentations. In the residential market, the proliferation of smart TVs, home theaters, and multi-room entertainment systems will drive consumer demand for plug-and-play wireless senders and receivers. Solutions that support HDMI 2.1 specifications, including Dynamic HDR and eARC, will become increasingly standard.

Integration with IoT and Smart Ecosystems

Wireless video transmitters and receivers are expected to be more deeply integrated into broader IoT ecosystems by 2026. Compatibility with voice assistants (e.g., Amazon Alexa, Google Assistant) and smart home platforms (e.g., Apple HomeKit, Samsung SmartThings) will enhance usability and automation. This integration will allow users to stream content across rooms or devices using simple voice commands or mobile apps.

Focus on Security and Encryption

As wireless video systems transmit sensitive data, security will become a top priority. By 2026, manufacturers will emphasize end-to-end encryption, secure pairing protocols (e.g., WPA3), and firmware updates to protect against cyber threats. Enterprises and government institutions will demand certified secure solutions, particularly for surveillance and teleconferencing applications.

Regional Market Dynamics

North America and Europe will remain dominant markets due to early technology adoption and high infrastructure investment. Meanwhile, the Asia-Pacific region—especially China, India, and South Korea—is expected to witness the fastest growth, fueled by rapid urbanization, expanding smart city projects, and increasing consumer spending on electronics.

Challenges and Competitive Landscape

Despite growth, the market faces challenges such as signal interference in dense environments, high costs of premium 4K/8K systems, and compatibility issues across devices. However, increasing competition among key players—including ActionTec, IOGEAR, Azden, and Samsung—will drive innovation and price competitiveness, ultimately benefiting end users.

Conclusion

By 2026, the wireless video sender and receiver market will be shaped by technological advancements, expanding use cases, and deeper integration into smart ecosystems. As demand for high-quality, flexible video sharing grows across residential, commercial, and industrial sectors, manufacturers that prioritize performance, security, and interoperability will lead the market.

Common Pitfalls When Sourcing Wireless Video Sender and Receiver (Quality and IP Considerations)

Logistics & Compliance Guide for Wireless Video Sender and Receiver

This guide outlines essential logistics and compliance considerations for importing, exporting, distributing, and using wireless video sender and receiver systems. Adhering to these guidelines ensures regulatory compliance, smooth supply chain operations, and product safety.

Regulatory Compliance

Wireless video transmission devices are subject to strict regulations due to their use of radio frequency (RF) spectrum. Compliance varies by region and is mandatory for legal sale and operation.

Radio Frequency and Telecommunications Regulations

- FCC (USA): Devices must comply with Part 15 of the FCC Rules. Most wireless video senders operate under §15.247 (spread spectrum) or §15.249 (general ISM band). Certification (FCC ID) is required before marketing.

- CE (Europe): Must meet the Radio Equipment Directive (RED) 2014/53/EU. Testing includes EMC, safety (LVD), and RF performance (ETSI EN 300 328 or EN 300 440, depending on frequency band).

- ISED (Canada): Devices require certification under RSS-247 (for 2.4 GHz/5 GHz) and must display an IC ID.

- Other Regions: Countries such as Japan (MIC/TELEC), Australia (RCM), and South Korea (KCC) have specific certification requirements. Always verify local regulations.

Electromagnetic Compatibility (EMC)

All electronic devices must demonstrate minimal interference with other equipment and immunity to common electromagnetic disturbances. Testing per standards such as:

– FCC Part 15 (USA)

– EN 55032 / EN 55035 (Europe)

– CISPR 32 (International)

Electrical Safety Standards

Ensure compliance with low-voltage directives and safety standards:

– UL 62368-1 (North America)

– EN 62368-1 (Europe)

– IEC 62368-1 (International)

Power adapters and internal circuitry must be evaluated for fire, electric shock, and energy hazards.

Product Labeling and Documentation

- Include required certification marks (FCC, CE, ISED, RCM, etc.) on product and packaging.

- Provide user manuals in local languages, including safety warnings, compliance statements, and proper disposal information (WEEE).

- Include RF exposure information if applicable (e.g., SAR for body-worn devices).

Import and Export Logistics

Efficient logistics depend on accurate classification and documentation.

Harmonized System (HS) Code

- Typical HS code: 8528.59 (Transmission apparatus for television) or 8517.62 (Wireless network devices), depending on primary function.

- Confirm with local customs authorities, as classification may vary.

Customs Documentation

- Commercial invoice with detailed product description, value, and country of origin.

- Packing list.

- Certificate of Origin (if required for trade agreements).

- Compliance certificates (FCC, CE, ISED, etc.).

Restricted Components and Materials

- Ensure no use of prohibited substances per RoHS (EU), REACH, or similar regulations.

- Declare presence of batteries (if included); lithium batteries require UN 38.3 testing and proper shipping labels (IATA/DOT for air transport).

Shipping and Handling

Packaging Requirements

- Use anti-static packaging for electronic components.

- Include cushioning to prevent physical damage during transit.

- Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”).

Battery Shipping Regulations

- If product contains lithium-ion or lithium-metal batteries:

- Follow IATA Dangerous Goods Regulations for air freight.

- Ship at ≤30% state of charge where possible.

- Affix appropriate UN3480/3481 labels and documentation.

Environmental and Disposal Compliance

WEEE (Waste Electrical and Electronic Equipment)

- In the EU and other regions, producers must register and finance take-back programs for end-of-life electronics.

- Include WEEE symbol on product and packaging: 🗑️

RoHS (Restriction of Hazardous Substances)

- Prohibits use of lead, mercury, cadmium, hexavalent chromium, PBB, and PBDE.

- Applies in EU, China, India, and other markets.

Quality Assurance and Traceability

- Implement serial number or batch tracking for product recalls and warranty support.

- Maintain compliance documentation (test reports, certificates) for at least 5–10 years, depending on jurisdiction.

Summary

Successfully managing logistics and compliance for wireless video senders and receivers requires:

– Pre-market certification in target regions.

– Accurate product classification and customs documentation.

– Safe packaging and shipping practices, especially for batteries.

– Adherence to environmental regulations (RoHS, WEEE).

– Comprehensive labeling and user instructions.

Failure to comply can result in shipment delays, fines, product recalls, or market bans. Always consult with regulatory experts or authorized conformity assessment bodies before entering new markets.

Conclusion for Sourcing Wireless Video Sender and Receiver:

Sourcing a wireless video sender and receiver requires careful evaluation of technical specifications, application needs, budget constraints, and long-term reliability. Key factors such as transmission range, resolution support (e.g., 1080p, 4K), latency, connectivity options (HDMI, USB, IP-based), and compatibility with existing systems play a crucial role in selecting the right solution. Additionally, considerations like interference resistance, ease of installation, security features, and scalability are essential—especially for commercial or industrial environments.

After assessing various suppliers and products, it is recommended to prioritize vendors offering proven reliability, strong technical support, and scalable solutions that can adapt to future requirements. Whether for home entertainment, conference rooms, digital signage, or surveillance, choosing a robust and flexible wireless video transmission system ensures seamless performance and minimizes operational disruptions. In conclusion, a well-researched sourcing strategy that balances performance, cost, and vendor reputation will lead to a successful deployment and long-term satisfaction.