The global wire lock pin market is witnessing steady expansion, driven by increasing demand across aerospace, automotive, and industrial machinery sectors. According to Mordor Intelligence, the global fasteners market—of which wire lock pins are a critical component—is projected to grow at a CAGR of over 5.8% from 2023 to 2028, fueled by stringent safety regulations and the need for reliable locking mechanisms in high-vibration environments. Similarly, Grand View Research estimates that the aerospace fasteners market alone will expand at a CAGR of 6.1% during the same period, underpinned by rising aircraft production and maintenance activity. As precision and quality become paramount, leading manufacturers of wire lock pins are scaling innovation and compliance with international standards such as AS/EN 9100 and NASM. In this evolving landscape, identifying top-tier suppliers is essential for ensuring performance, traceability, and operational safety. Below is a data-informed overview of the top 9 wire lock pin manufacturers shaping the industry.

Top 9 Wire Lock Pin Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lock Pins

Domain Est. 1997

Website: shakeproof.com

Key Highlights: We are your source for exceptional quality, durable wire lock pin devices. Wire lock pins function as if there is a pin and cotter in one protected assembly….

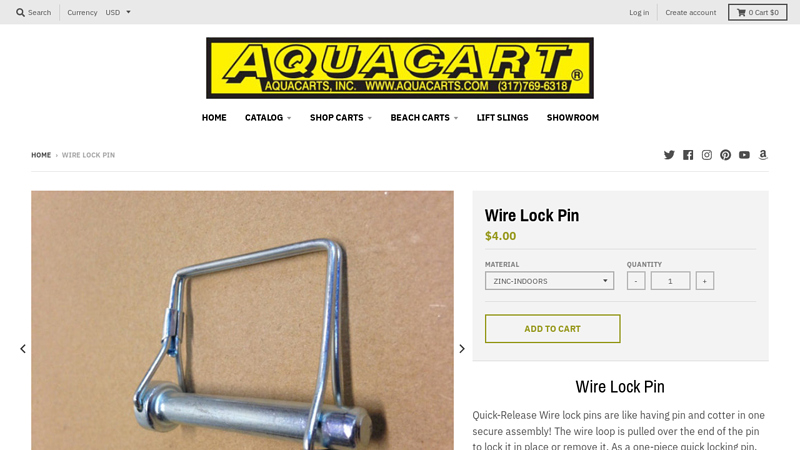

#2 Wire Lock Pin

Domain Est. 2001

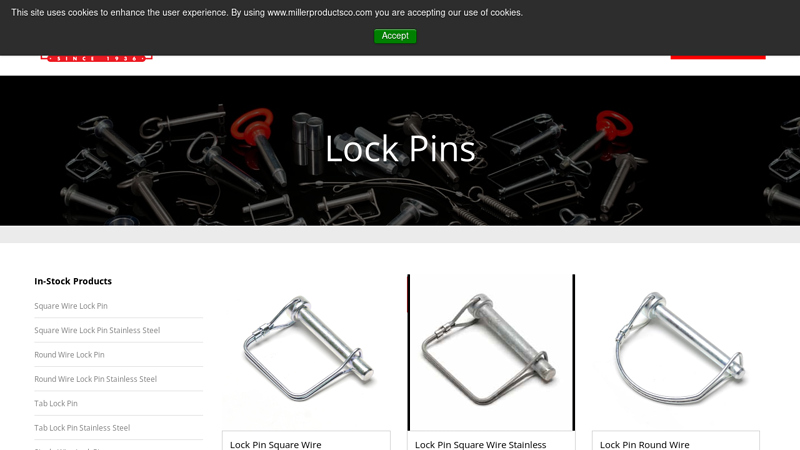

#3 Lock Pins

Domain Est. 1996

Website: millerproductsco.com

Key Highlights: Miller Products has many non-threaded fasteners including Lock Pins. Made in the USA with same-day shipping, clear zinc and stainless steel options….

#4 Pivot Pins: Fastener Solutions

Domain Est. 1996

Website: pivotpins.com

Key Highlights: Pivot Pins offers non-threaded fastener solutions to solve particular fastening challenges. Our durable, precision-engineered fasteners ensure reliability ……

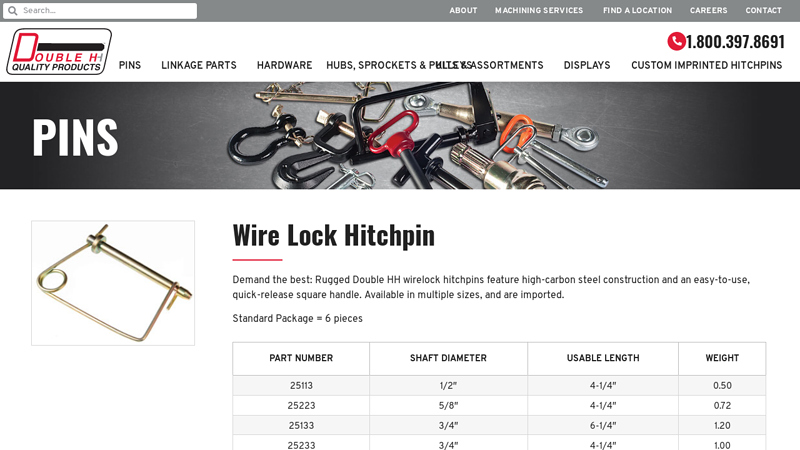

#5 Wire Lock Hitchpin

Domain Est. 1998

Website: doublehh.com

Key Highlights: Demand the best: Rugged Double HH wirelock hitchpins feature high-carbon steel construction and an easy-to-use, quick-release square handle….

#6 Wire Lock Pins

Domain Est. 1998

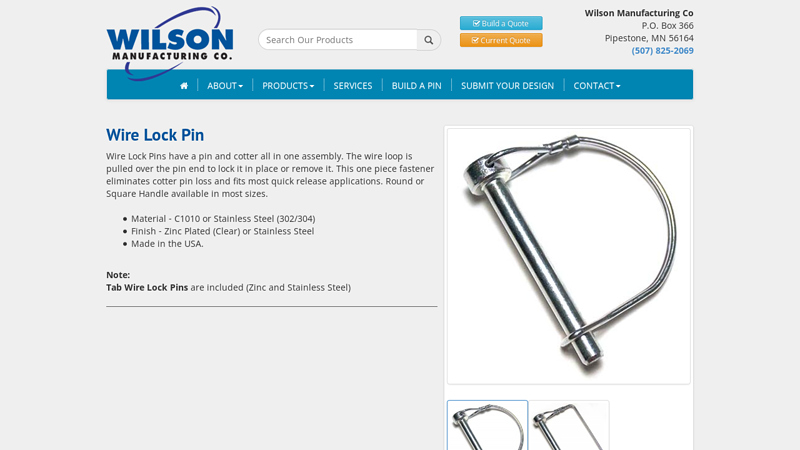

#7 Wire Lock Pin

Domain Est. 1999

Website: wilsonmfgco.com

Key Highlights: Wire Lock Pin. Wire Lock Pins have a pin and cotter all in one assembly. The wire loop is pulled over the pin end to lock it in place or remove it….

#8 Wire Lock Pins

Domain Est. 2012

Website: essentracomponents.com

Key Highlights: The pin material is made from Steel, which is an economical material providing good strength. Comes with Zinc Plating finish for added corrosion resistance….

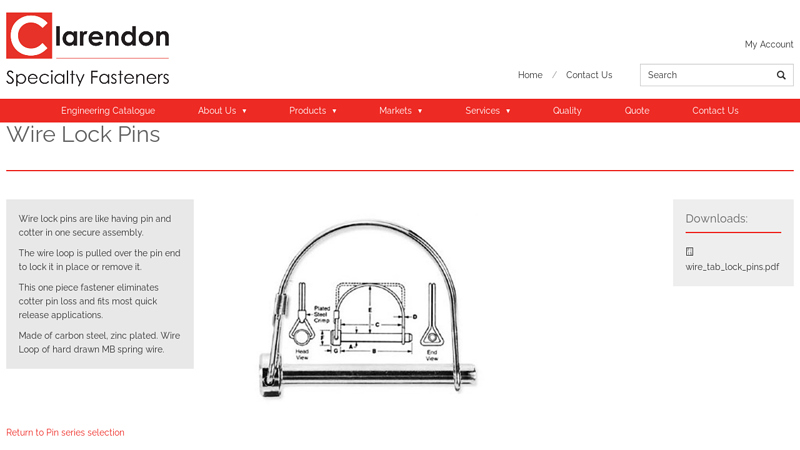

#9 Wire Lock Pins

Domain Est. 2016

Website: clarendonsf.com

Key Highlights: Wire lock pins are like having pin and cotter in one secure assembly. The wire loop is pulled over the pin end to lock it in place or remove it….

Expert Sourcing Insights for Wire Lock Pin

H2: 2026 Market Trends for Wire Lock Pins

The global market for wire lock pins is projected to experience steady growth and transformation by 2026, driven by evolving manufacturing standards, rising demand in key industries, and technological advancements in fastening solutions. Several critical trends are expected to shape the wire lock pin market in the coming years:

-

Increased Demand from Aerospace and Defense Sectors

The aerospace and defense industries remain the largest consumers of wire lock pins due to their critical role in securing bolts, clevis pins, and other components in high-vibration and high-stress environments. With increased defense spending globally and the expansion of commercial aviation fleets—especially in Asia-Pacific and the Middle East—the demand for reliable, lightweight, and corrosion-resistant fasteners like wire lock pins is expected to rise significantly by 2026. -

Growth in Automotive and Heavy Machinery Applications

Wire lock pins are increasingly being adopted in off-road vehicles, agricultural equipment, and construction machinery, where durability and ease of maintenance are crucial. As the shift toward modular and service-friendly designs continues, manufacturers are favoring quick-installation fasteners. This trend is expected to boost wire lock pin usage in heavy-duty automotive applications through 2026. -

Material Innovation and Lightweighting

A key trend shaping the market is the development of high-performance materials, such as corrosion-resistant stainless steel (e.g., 300 series), nickel alloys, and composite-coated wires. These materials enhance the longevity and reliability of wire lock pins in harsh environments. Lightweight alternatives are also being explored to meet industry demands for fuel efficiency and reduced component weight, particularly in aerospace and transportation. -

Automation and Precision Manufacturing

As production processes become more automated, there is a growing need for standardized, easily installable fasteners. Wire lock pins that are compatible with robotic assembly systems and offer consistent quality are gaining preference. Manufacturers are investing in precision manufacturing techniques to ensure tighter tolerances and higher reliability, aligning with Industry 4.0 trends. -

Regional Market Expansion

While North America and Europe continue to dominate due to established aerospace and defense sectors, the Asia-Pacific region is expected to witness the highest growth rate by 2026. Countries like China, India, and South Korea are expanding their manufacturing and defense capabilities, creating new opportunities for wire lock pin suppliers. Localized production and supply chain optimization will be crucial for market penetration. -

Sustainability and Regulatory Compliance

Environmental regulations and sustainability goals are influencing material sourcing and production methods. Manufacturers are focusing on recyclable materials and energy-efficient production processes to meet regulatory standards and customer expectations. Compliance with international standards such as AS/EN 9100 (aerospace quality management) and ISO certifications will remain essential for market credibility. -

Digitalization and Smart Fastening Solutions

Though still in early stages, the integration of digital tracking (e.g., QR codes or RFID tags) into fastener inventory systems may influence future iterations of wire lock pins, particularly for maintenance and traceability in critical applications. This trend could enhance supply chain transparency and reduce maintenance downtime.

In conclusion, the wire lock pin market in 2026 will be defined by innovation in materials, increasing automation, and rising demand from high-growth industries and regions. Companies that invest in R&D, comply with global standards, and adapt to regional market dynamics will be well-positioned to capitalize on these emerging opportunities.

Common Pitfalls Sourcing Wire Lock Pin (Quality, IP)

Sourcing Wire Lock Pins—also known as hairpin cotter pins, R-clips, or hitch pins—may seem straightforward, but several critical pitfalls can compromise product quality, safety, and intellectual property (IP) protection. Being aware of these challenges helps ensure reliable performance and legal compliance.

Poor Material Quality and Inadequate Specifications

Many suppliers use substandard materials such as low-grade carbon steel or non-corrosion-resistant alloys, leading to premature failure due to rust, deformation, or brittleness. Additionally, inconsistent wire diameter, improper tempering, or lack of adherence to international standards (e.g., ASME B18.8.1, DIN 94) can compromise structural integrity. Always verify material certifications (e.g., mill test reports) and dimensional accuracy during procurement.

Inconsistent Manufacturing Tolerances

Wire Lock Pins require precise bending and forming to ensure proper fit and retention. Low-cost or unqualified manufacturers may produce parts with inconsistent leg lengths, uneven curvature, or poor spring tension, resulting in improper installation or accidental disengagement. Implement rigorous incoming inspection protocols and consider working with suppliers who provide statistical process control (SPC) data.

Lack of Traceability and Certification

In regulated industries (e.g., aerospace, medical, automotive), traceability and compliance certifications are mandatory. Sourcing from suppliers without proper documentation—such as ISO 9001 certification, RoHS/REACH compliance, or lot traceability—can lead to audit failures and liability risks. Ensure suppliers provide full documentation packages for each batch.

Intellectual Property (IP) Risks with Custom Designs

When sourcing custom-designed Wire Lock Pins (e.g., unique geometry, special coatings), there is a risk of IP theft if non-disclosure agreements (NDAs) and IP clauses are not firmly established. Unethical suppliers may reverse engineer and sell your design to competitors. Always secure legal agreements before sharing technical drawings and consider patenting novel designs.

Supply Chain Vulnerability and Counterfeit Parts

Reliance on single-source or offshore suppliers can expose procurement to delays, quality inconsistencies, and counterfeit parts. Fake or subpar pins may mimic genuine products but fail under load. Diversify suppliers, conduct on-site audits, and use authentication methods (e.g., laser marking, packaging seals) to mitigate risk.

Inadequate Packaging and Corrosion Protection

Poor packaging—especially for small, high-volume fasteners—can lead to tangling, physical damage, or exposure to moisture during transit. This is particularly critical for pins used in outdoor or marine environments. Specify appropriate packaging (e.g., sealed bags with desiccants, anti-corrosion VCI paper) in purchase agreements.

By proactively addressing these pitfalls, companies can ensure the reliable performance of Wire Lock Pins while protecting their quality standards and intellectual property.

Logistics & Compliance Guide for Wire Lock Pin

Product Overview

Wire Lock Pins, also known as safety wire pins or cotter pins, are fasteners used in conjunction with safety wire to secure bolts, nuts, and other threaded components in high-vibration environments. Commonly used in aerospace, automotive, and industrial applications, these pins are critical for ensuring mechanical integrity and safety.

Packaging and Labeling Requirements

- Inner Packaging: Wire Lock Pins must be packaged in moisture-resistant, anti-static materials to prevent corrosion and contamination. Use sealed plastic bags or blister packs for small batches.

- Outer Packaging: Place inner packages in rigid corrugated boxes with sufficient cushioning (e.g., foam inserts or bubble wrap) to prevent movement during transit.

- Labeling: Each package must include:

- Product name and part number

- Quantity and material specification (e.g., 304 Stainless Steel)

- Lot or batch number for traceability

- Manufacturer name and country of origin

- Handling symbols (e.g., “Fragile,” “Keep Dry”)

Storage Conditions

- Environment: Store in a dry, temperature-controlled environment (15–25°C; 59–77°F) with relative humidity below 60%.

- Shelf Life: Typically indefinite if stored properly, but inspect periodically for signs of corrosion or deformation.

- Segregation: Keep separate from chemicals, oils, and sharp objects to avoid contamination or damage.

Transportation Guidelines

- Mode of Transport: Suitable for air, sea, and ground freight. For air transport, comply with IATA Dangerous Goods Regulations if applicable (typically not classified as hazardous).

- Stacking: Limit stack height to prevent crushing of lower boxes. Use pallets for bulk shipments and secure with stretch wrap.

- Documentation: Include commercial invoice, packing list, and material certification (e.g., RoHS, REACH, or AMS2404 for aerospace-grade pins) with each shipment.

Regulatory Compliance

- RoHS (Restriction of Hazardous Substances): Ensure pins are free from lead, cadmium, mercury, and other restricted substances, especially for EU markets.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm no SVHCs (Substances of Very High Concern) above threshold levels.

- ITAR/EAR (U.S. Export Regulations): Verify if wire lock pins fall under ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations), particularly if used in defense applications. Most standard pins are EAR99 (low control).

- Aerospace Standards: If used in aviation, ensure compliance with specifications such as NASM88028, MS24665, or equivalent military/aerospace standards. Certificates of Conformance (CoC) are required.

Import/Export Documentation

- Harmonized System (HS) Code: Typically 7318.19 (other pins and cotter pins of iron or steel). Confirm with local customs authority.

- Export License: Not usually required for standard wire lock pins unless destined for embargoed countries or military end-use. Conduct end-user screening.

- Customs Declaration: Provide accurate product description, value, origin, and end-use to avoid delays.

Quality Assurance and Traceability

- Inspection: Conduct pre-shipment visual and dimensional inspections per AS9100 or ISO 9001 standards where applicable.

- Traceability: Maintain batch-level traceability from raw material to final product. Retain records for a minimum of 10 years for aerospace applications.

- Non-Conformance Handling: Isolate and document any defective batches. Issue corrective action reports (CARs) as needed.

Handling and Safety Precautions

- Personal Protective Equipment (PPE): Use gloves and safety glasses when handling bulk pins to prevent cuts or eye injury.

- Disposal: Dispose of scrap metal per local environmental regulations. Recycle when possible.

Supplier and Certification Requirements

- Ensure all suppliers provide valid material test reports (MTRs) and certifications (e.g., ISO 9001, AS9100, NADCAP).

- Conduct regular supplier audits for critical applications.

By adhering to this logistics and compliance guide, organizations can ensure the safe, legal, and efficient handling of Wire Lock Pins throughout the supply chain.

Conclusion on Sourcing Wire Lock Pins

In conclusion, sourcing wire lock pins requires a strategic approach that balances quality, cost, availability, and compliance with industry standards. These small but critical fasteners play a vital role in ensuring the safety and reliability of mechanical assemblies, particularly in aerospace, automotive, and industrial applications. Careful evaluation of suppliers is essential to ensure consistent material quality (typically corrosion-resistant alloys such as stainless steel), precise dimensional tolerances, and adherence to specifications such as MS, AN, or NAS standards.

Primary considerations when sourcing include supplier reliability, certification (e.g., AS9100, ISO 9001), traceability, and the ability to support volume requirements with on-time delivery. While domestic suppliers may offer faster lead times and better communication, international suppliers can provide cost advantages—if vetted thoroughly for quality and compliance.

Ultimately, establishing long-term partnerships with qualified suppliers, conducting regular quality audits, and maintaining dual sourcing options where feasible will help mitigate risks and ensure a resilient supply chain for wire lock pins. Effective sourcing not only supports operational efficiency but also contributes to the overall integrity and safety of the assembled systems.