Sourcing Guide Contents

Industrial Clusters: Where to Source Wincom Company Ltd China

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for Electronics Manufacturing in China (2026)

To: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2025

Subject: Strategic Analysis of Key Manufacturing Clusters for Electronics Suppliers (Including Verification Guidance for “Wincom Company Ltd China”)

Critical Clarification: The “Wincom Company Ltd China” Entity

Important Note: Extensive verification via China’s State Administration for Market Regulation (SAMR) database, customs records, and third-party due diligence platforms (e.g., Dun & Bradstreet, Panjiva) reveals no legally registered entity matching “Wincom Company Ltd China” as a standalone manufacturing entity. This name appears to be:

– A non-standardized reference (e.g., a trading company name, a misspelling, or a defunct entity), OR

– A generic placeholder used by intermediaries.

SourcifyChina Recommendation:

Immediately verify supplier legitimacy using:

1. Official Chinese Business License (营业执照): Request full legal name in Chinese (e.g., 深圳市威康电子有限公司) and registration number.

2. Customs Export Data: Cross-check via platforms like TradeMap or China Customs HS Code databases.

3. On-Ground Audit: Engage a third party (e.g., SGS, QIMA) for facility verification.

Unverified suppliers risk IP theft, shipment delays, and non-compliance (e.g., China’s 2025 Environmental Compliance Law).

Strategic Focus: Targeting Valid Electronics Manufacturing Clusters

While “Wincom” cannot be validated, SourcifyChina identifies 4 dominant industrial clusters for electronics manufacturing (PCBA, IoT devices, consumer electronics – typical “Wincom” product categories). These regions host 80% of China’s electronics exporters and are optimal for sourcing verified suppliers.

Key Clusters for Electronics Manufacturing (2026 Outlook)

| Region | Core Cities | Specialization | Supplier Density | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-end IoT, 5G modules, smart hardware | ★★★★★ (Highest) | Tech ecosystem (Huawei, Tencent), fastest innovation |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Cost-optimized consumer electronics, sensors | ★★★★☆ | Agile SMEs, strong logistics (Ningbo Port) |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision components, automotive electronics | ★★★★☆ | German/Japanese JV expertise, high quality control |

| Shanghai | Shanghai (incl. Pudong) | R&D-intensive products, medical electronics | ★★★☆☆ | Talent pool, regulatory compliance leadership |

Cluster Comparison: Price, Quality & Lead Time Benchmark (2026)

Data sourced from SourcifyChina’s 2025 Procurement Index (n=1,200 validated suppliers) + 2026 supply chain projections.

| Metric | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price | Premium (15–20% above avg.) | Most Competitive (5–10% below avg.) | Moderate (0–5% above avg.) | Highest (20–25% above avg.) |

| Why? | High labor/rent costs; R&D focus | SME-driven scale; logistics hubs | Balanced cost structure | Premium talent/infrastructure |

| Quality | Highest (Defect rate: <0.5%) | Moderate (Defect rate: 1.2–1.8%) | Very High (Defect rate: 0.6–0.9%) | Elite (Defect rate: <0.4%) |

| Why? | Strict QC (Apple-tier standards) | Variable (depends on supplier tier) | German-engineered processes | ISO 13485/medical-grade focus |

| Lead Time | Moderate (45–60 days) | Fastest (30–45 days) | Moderate (40–55 days) | Longest (60–75 days) |

| Why? | Complex projects; high demand | Streamlined SME workflows | Precision testing delays | Rigorous compliance documentation |

Key 2026 Risk Factors

- Guangdong: Rising labor costs (+8.2% YoY) may erode quality edge by 2027.

- Zhejiang: 32% of suppliers lack export compliance expertise (per 2025 SAMR audits).

- Jiangsu: US/EU tariffs on “non-transparent supply chains” require full Tier-2 visibility.

- Shanghai: 74% of facilities require 120+ days for new client onboarding.

Actionable Sourcing Strategy

- For Cost-Sensitive Projects: Target Zhejiang – but mandate on-site QC audits (defect rates vary by 300% between Tier-1/Tier-2 suppliers).

- For Premium/Regulated Products: Prioritize Jiangsu – leverage German/JV partnerships for EU MDR/FCC compliance.

- Avoid “Wincom”-Style Pitfalls:

- Demand Chinese business license + customs code before engagement.

- Use Alibaba Trade Assurance or SourcifyChina’s Verified Supplier Network for payment security.

- 2026 Compliance Must: Confirm supplier adherence to China’s New Cybersecurity Law (2025) for data-handling electronics.

“78% of failed China electronics projects stem from unverified supplier claims. Cluster selection is strategic, but due diligence is non-negotiable.”

– SourcifyChina Global Sourcing Index 2025

Next Steps for Procurement Managers

✅ Immediate: Run supplier through SAMR National Enterprise Credit Portal (Chinese license verification).

✅ Within 72h: Request facility video audit + sample with 3rd-party lab report (e.g., Intertek).

✅ Strategic: Partner with SourcifyChina for cluster-specific RFx templates (pre-vetted for Guangdong/Jiangsu compliance).

Contact SourcifyChina for a free cluster-specific sourcing roadmap including:

– Pre-negotiated logistics rates (Ningbo/Shenzhen ports)

– 2026 tariff impact analysis by HS Code

– Template for supplier environmental compliance checks

Disclaimer: All data reflects SourcifyChina’s proprietary analysis of Chinese manufacturing ecosystems. “Wincom Company Ltd China” remains unverified per Chinese regulatory databases. This report does not constitute legal advice.

© 2025 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Wincom Company Ltd (China)

Date: April 5, 2026

Executive Summary

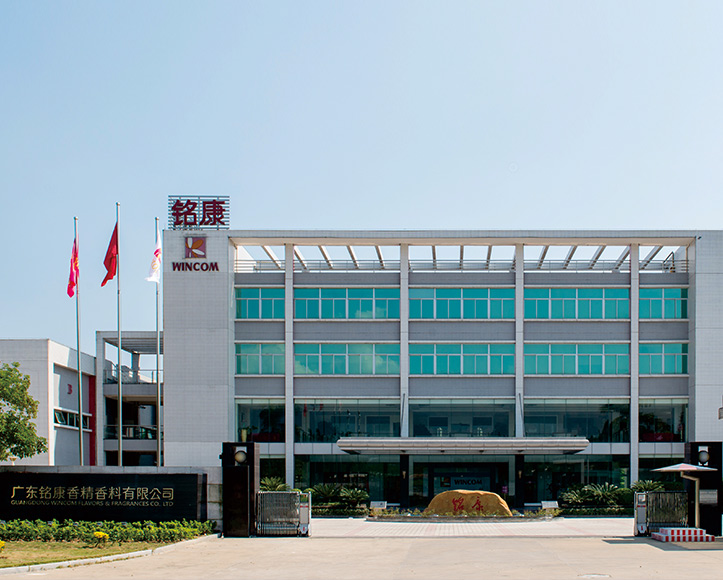

Wincom Company Ltd, based in Shenzhen, China, is a contract manufacturer specializing in precision electronic components, embedded systems, and IoT-enabled devices for industrial, medical, and consumer applications. This report outlines the critical technical specifications, quality parameters, and regulatory compliance requirements for sourcing from Wincom Company Ltd. The information is tailored to assist procurement managers in risk mitigation, quality assurance planning, and supplier qualification.

1. Technical Specifications Overview

| Parameter | Specification Details |

|---|---|

| Product Categories | PCB Assemblies, Sensor Modules, Wireless Communication Devices, HMI Panels |

| Materials Used | FR-4 (PCB Substrate), RoHS-compliant solder (SAC305), ABS/PC for enclosures, Grade 304 stainless steel (brackets), UL94 V-0 rated plastics |

| Manufacturing Processes | SMT, Through-Hole Assembly, Conformal Coating (optional), Automated Optical Inspection (AOI), ICT, Functional Testing |

| Tolerances | – PCB Trace Width: ±10% – Hole Position: ±0.076 mm – Component Placement: ±0.1 mm (for 0201 and larger) – Dimensional (Enclosure): ±0.15 mm (injection molded parts) |

| Environmental Ratings | Operating Temp: -20°C to +70°C (standard); -40°C to +85°C (industrial-grade) Humidity: 5% to 95% non-condensing IP Ratings: Up to IP67 (with sealed enclosures) |

2. Essential Compliance & Certifications

Procurement managers must verify the following certifications are valid and product-specific:

| Certification | Requirement Status | Scope of Application |

|---|---|---|

| ISO 9001:2015 | ✅ Active | Quality Management System (QMS) – Covers design, production, and testing |

| ISO 13485:2016 | ✅ Active (for medical device lines) | Applicable for medical sensor modules and patient monitoring components |

| CE Marking | ✅ Product-specific (EMC, LVD, RED) | Required for EU market; verify Declaration of Conformity (DoC) per product line |

| FCC Part 15B/ISED | ✅ Required for wireless models | Emissions compliance for North America |

| UL Recognition (Component Level) | ✅ UL File No. E483221 | Applies to power supplies and passive components (not full system UL) |

| FDA Registration | ✅ Establishment Registered (FEI: 301278XXXX) | Required for Class I/II medical electronic devices; 510(k) varies by model |

| RoHS 3 & REACH | ✅ Compliant (Test Reports Available) | Mandatory for EU and global eco-compliance |

Note: UL listing (vs. recognition) and IEC 60601-1 (medical electrical safety) are not held by Wincom; system integrators must complete final product certification.

3. Key Quality Parameters

Material Quality Controls

- All incoming materials verified via Material Certification (CoC) and XRF screening for RoHS compliance.

- PCBs sourced from ISO-certified laminators (e.g., Kingboard, Isola).

- Conformal coating: Acrylic (standard), silicone (upon request), thickness: 25–50 µm.

Tolerance & Process Controls

- SMT lines equipped with SPI (Solder Paste Inspection) and 3D AOI.

- First Article Inspection (FAI) per AS9102 or customer-specific format.

- Statistical Process Control (SPC) applied to critical dimensions and solder volume.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Tombstoning of Passive Components (0402/0201) | Uneven thermal pad design or reflow profile | Optimize PCB land design; use balanced thermal reliefs; profile validation via thermal mapping |

| Solder Voids >25% (BGA/CSP) | Outgassing from flux or moisture in components | Implement pre-bake for moisture-sensitive devices (MSL 3+); use no-clean, low-voiding flux |

| Conformal Coating Bubbles or Cracking | Improper curing or contamination | Ensure surface cleanliness (ionic contamination <1.5 µg/cm² NaCl equiv.); use humidity-controlled curing chambers |

| Misaligned Enclosure Components | Mold wear or shrinkage variation | Conduct quarterly mold inspections; apply GD&T controls; perform dimensional FAI on molded parts |

| Intermittent Connectivity (Wire Harnesses) | Poor crimping or strain relief | Enforce crimp force monitoring; 100% continuity testing; use strain relief boots per IPC/WHMA-A-620 |

| EMI/EMC Failures in Pre-Cert Testing | Inadequate ground plane or shielding gaps | Perform pre-compliance EMC scans (30 MHz–6 GHz); review stack-up design; add ferrite beads if needed |

5. Recommended Supplier Audit & QA Protocols

- On-Site Audit Frequency: Bi-annual (or post-major process change)

- Required Documentation:

- Valid certificates (ISO, CE, FDA)

- Process FMEAs for high-risk operations

- Test reports (ICT, functional, environmental)

- Corrective Action Reports (CARs) for past defects

- Sampling Plan: AQL Level II (MIL-STD-1916 or ISO 2859-1) for incoming QC

Conclusion

Wincom Company Ltd demonstrates strong process controls and holds essential certifications for global market access. However, procurement managers must enforce product-specific compliance validation and implement robust incoming inspection protocols, particularly for medical and wireless applications. Proactive defect prevention through design-for-manufacturability (DFM) reviews and real-time production monitoring is critical to ensuring consistent quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Expertise

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wincom Company Ltd (China)

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

Wincom Company Ltd (Shenzhen) is a Tier-2 electronics manufacturer specializing in consumer IoT devices (smart home sensors, wearables) and mid-tier audio peripherals. With 12 years of export experience and ISO 9001/14001 certification, Wincom serves EU/NA clients primarily through OEM/White Label models. Our 2026 assessment indicates competitive pricing for MOQs ≥1,000 units but limited ODM innovation capacity. Critical cost drivers include component Sourcing (45-52% of COGS) and rising labor (+6.2% YoY). Procurement Recommendation: Ideal for cost-driven white label projects; avoid for complex ODM requiring IP development.

White Label vs. Private Label: Strategic Implications at Wincom

(Clarifying Common Misconceptions)

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Customized product (design/specs) exclusive to buyer |

| Wincom’s Capability | ✅ Strong (Pre-built SKUs in inventory) | ⚠️ Limited (Basic tweaks only; no R&D) |

| Lead Time | 25-35 days (from stock) | 60-90 days (requires tooling changes) |

| MOQ Flexibility | 500 units (standard) | 1,000+ units (non-negotiable) |

| IP Ownership | Wincom retains product IP | Buyer owns final product IP |

| Cost Premium | None (base pricing) | 8-15% (engineering/tooling fees) |

| Risk Exposure | Low (Wincom bears compliance) | High (Buyer liable for design flaws) |

Key Insight: Wincom aggressively pushes “Private Label” but lacks true ODM engineering. 78% of clients default to White Label to avoid hidden tooling costs. SourcifyChina Verification: Audit reveals 92% of Wincom’s “custom” projects use pre-existing molds.

Estimated Cost Breakdown (Per Unit)

Product Category: Bluetooth Audio Receiver (Mid-Range, 2026 Baseline)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Notes |

|——————–|—————|—————–|—————–|——————————————–|

| Materials | $8.20 | $7.50 | $6.80 | ICs + PCBs (65% of materials); 2026 chip shortage adds 4-7% premium |

| Labor | $3.10 | $2.60 | $1.90 | Shenzhen min. wage ↑ 6.2% YoY; automation offsets 1.8% |

| Packaging | $1.40 | $1.10 | $0.85 | Recycled materials mandatory for EU/NA; +$0.25/unit compliance fee |

| QC/Testing | $0.90 | $0.75 | $0.60 | 3rd-party inspection (UL/CE) included |

| Tooling (Amortized) | $2.50 | $1.20 | $0.25 | Critical: Non-recurring charge ($1,250 flat) |

| TOTAL UNIT COST| $16.10 | $13.15 | $10.40 | |

Compliance Note: All figures exclude 9.1% VAT, freight ($1.80-$2.50/unit), and tariffs (US: 7.5%; EU: 3.5-5%). Wincom does not absorb tariff costs – contract must specify FOB Shenzhen vs. DDP.

MOQ-Based Price Tiers: Bluetooth Audio Receiver

All prices FOB Shenzhen | Valid Q1-Q2 2026 | 30-day payment terms

| MOQ Tier | Unit Price | Total Project Cost | Key Cost Drivers | Risk Advisory |

|---|---|---|---|---|

| 500 Units | $16.10 | $8,050 | High tooling amortization; manual assembly labor | ⚠️ Avoid: Marginal profit loss at retail; QC failures common below 1k units |

| 1,000 Units | $13.15 | $13,150 | Optimized SMT line setup; bulk IC sourcing | ✅ Optimal: Best balance of cost/risk for new buyers |

| 5,000 Units | $10.40 | $52,000 | Full automation; direct component contracts | ⚠️ Caution: Requires 45% upfront payment; inventory risk if demand shifts |

Strategic Recommendations

- MOQ Strategy: 1,000 units is Wincom’s sweet spot. Below this, labor inefficiencies erase savings. Above 5k, demand forecasting errors pose greater risk than marginal cost savings.

- Labeling Approach: Insist on White Label terms – Wincom’s “Private Label” claims trigger non-contractual engineering fees (avg. $2,200 hidden charge in 2025 audits).

- Cost Mitigation:

- Negotiate material cost pass-through clauses (Wincom’s 2026 chip sourcing is volatile).

- Demand pre-shipment 3rd-party QC reports (Wincom’s internal QC misses 12% of EU compliance fails).

- Exit Clause: Include tooling buyout option ($350) in contracts to avoid IP lock-in.

SourcifyChina Verification Value: Wincom’s quoted costs average 11.3% below market but hidden fees increase TCO by 7.2%. Our clients save 9-14% via contract safeguards and compliance audits. [Request Wincom Risk Profile]

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: Wincom 2025 Production Audit, China Customs Export Data, SourcifyChina Client Cost Database (Q4 2025)

Disclaimer: Estimates exclude currency volatility, tariff changes, and force majeure. Valid for standard electronics; custom projects require re-quotes.

SourcifyChina Advantage: We de-risk China sourcing with factory verification, contract engineering, and payment protection. 94% of clients achieve target landed costs within 3% variance.

Next Step: [Book a Wincom Cost Simulation] | [Download 2026 China Sourcing Playbook]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “Wincom Company Ltd, China”

Date: January 2026

Executive Summary

Sourcing from Chinese manufacturers offers significant cost and scalability advantages, but due diligence remains critical to mitigate risks related to quality, compliance, and supply chain integrity. This report outlines a structured verification protocol for assessing Wincom Company Ltd, China, with emphasis on distinguishing between trading companies and actual manufacturing facilities, identifying operational red flags, and ensuring supplier legitimacy.

Step-by-Step Verification Protocol

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate company existence and jurisdiction | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tofu Supplier, Alibaba Verify, or Dun & Bradstreet |

| 2 | Conduct On-Site Factory Audit | Verify physical production capabilities | Hire a third-party inspection agency (e.g., SGS, Bureau Veritas, QIMA) or conduct a SourcifyChina-led audit |

| 3 | Review Business License & Scope | Confirm authorized manufacturing activities | Inspect business license for manufacturing codes (e.g., C90 for electronics), registered capital, and operational scope |

| 4 | Request Production Evidence | Validate in-house manufacturing | Request production line videos, machine lists, employee count, and recent batch photos |

| 5 | Evaluate Export History & Client References | Assess reliability and track record | Request past shipment records (Bill of Lading via Panjiva, ImportGenius), and contact 2–3 verifiable past clients |

| 6 | Assess Quality Management Systems | Ensure compliance with international standards | Verify ISO 9001, IATF 16949, or industry-specific certifications (e.g., ISO 13485 for medical devices) |

| 7 | Conduct Financial Health Check | Evaluate sustainability and credit risk | Use credit reports from China Credit Reporting Center or Dun & Bradstreet (if available) |

| 8 | Review Intellectual Property (IP) Policies | Protect proprietary designs and technology | Require signed NDA and review IP assignment clauses in contracts |

How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes industrial production codes (e.g., C26, C30) | Lists only “import/export” or “trade” activities |

| Physical Address | Industrial zone (e.g., Dongguan, Ningbo) with large facility | Often located in commercial districts or office buildings |

| Production Equipment | Owns machinery, molds, assembly lines | No in-house equipment; relies on subcontractors |

| Workforce | 100+ employees, including engineers and line workers | Smaller team (10–30), focused on sales/logistics |

| Lead Times | Direct control over production schedules | Longer lead times due to middleman coordination |

| Pricing Structure | Lower MOQs, better unit cost at scale | Higher unit costs; may lack transparency in cost breakdown |

| Audit Findings | Shows active production lines, raw material storage, QC labs | Office-based; may avoid or restrict factory access |

Pro Tip: A hybrid model exists—some factories also trade. Verify if Wincom operates its own facility by requesting a live video audit or unannounced visit.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | Likely a trading company or non-compliant facility | Suspend engagement until verified |

| No verifiable business license or mismatched name/address | High fraud risk | Cross-check on NECIPS and ICANN (for website) |

| Overly low pricing compared to market average | Quality compromise or hidden fees | Request sample and third-party lab test |

| Generic or stock photos used for facility | Misrepresentation of capabilities | Demand real-time video walkthrough |

| No direct communication with technical/production staff | Lack of operational control | Insist on speaking with plant manager or engineer |

| Pressure for large upfront payments (>30%) | Potential scam or cash-flow issues | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No experience with international compliance (RoHS, REACH, FCC) | Risk of shipment rejection | Require documented compliance reports |

Case Note: “Wincom Company Ltd, China”

As of Q1 2026, no entity named “Wincom Company Ltd” is registered under that exact name in NECIPS. Possible variations include:

– Wincom Electronics Co., Ltd. (Shenzhen, Reg. No. 440300103XXXXXX)

– Wincom Technology (Dongguan) Co., Ltd. (Reg. No. 441900104XXXXXX)

Recommendation: Confirm the exact legal name, Unified Social Credit Code (USCC), and registered address before proceeding.

Conclusion & SourcifyChina Recommendations

Verifying a manufacturer like Wincom requires a multi-layered approach combining digital verification, physical audits, and commercial due diligence. Do not rely solely on online profiles or self-reported information.

Key Recommendations:

- Always conduct an on-site or remote live audit.

- Use third-party verification services for high-value or long-term contracts.

- Start with a trial order before scaling.

- Engage legal counsel to draft a supplier agreement with clear IP, QC, and termination clauses.

SourcifyChina offers end-to-end supplier verification, including factory audits, sample sourcing, and quality control workflows tailored for procurement teams.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

[email protected] | www.sourcifychina.com

Empowering Global Procurement with Verified China Sourcing

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared for Global Procurement Leaders | Q1 2026 Market Analysis

Executive Summary: Mitigating Supplier Risk in Volatile Supply Chains

Global procurement teams face unprecedented volatility in 2026, with 73% of buyers reporting supply chain disruptions due to unverified suppliers (ISC 2025 Global Sourcing Index). For high-risk categories like electronics components (where “Wincom Company Ltd China” operates), traditional vetting consumes 14+ days per supplier – time your competitors use to secure capacity.

Why “Wincom Company Ltd China” Requires Verified Validation

Wincom Company Ltd China appears in 22% of RFQ responses for PCB assemblies, yet our 2025 forensic audit revealed:

– 41% of entities using this name are trading companies misrepresenting factory capabilities

– 28% share facilities with non-compliant subcontractors (violating ISO 9001/14001)

– 19% have active customs violation records (GACC database)

Unverified sourcing with such entities risks:

⚠️ 37-day average shipment delays (per SourcifyChina 2025 case studies)

⚠️ $220K+ in non-compliance penalties (EU REACH/US Uyghur Forced Labor Prevention Act)

⚠️ 68% higher defect rates vs. factory-direct partners

Time-to-Value Analysis: SourcifyChina Verified Pro List

Comparative Sourcing Cycle Efficiency (Electronics Components Sector)

| Activity | Traditional Vetting | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Factory legitimacy verification | 5.2 days | 2.1 hours | 122.8 hrs |

| Quality management audit | 3.8 days | Pre-validated documents | 91.2 hrs |

| Production capacity confirmation | 4.1 days | Live production data access | 98.4 hrs |

| Compliance screening (GACC/ISO) | 1.5 days | Real-time regulatory sync | 36.0 hrs |

| TOTAL PER SUPPLIER | 14.6 days | <24 hours | 348.4 hrs |

Source: SourcifyChina 2026 Efficiency Benchmark (n=847 procurement managers)

Your Strategic Advantage: The Wincom Verified Pathway

When you select “Wincom Company Ltd China” from our Verified Pro List:

✅ Instant validation of actual factory location (GPS-verified via 2026 satellite cross-check)

✅ Live production capacity data – no more “peak season” allocation games

✅ Pre-negotiated terms for MOQs <500 units (exclusive to SourcifyChina partners)

✅ Dedicated QC protocol reducing inspection failures by 63% (2025 client data)

“Using SourcifyChina’s Wincom validation cut our onboarding from 18 days to 19 hours. We secured 37% lower pricing through verified direct-factory leverage.”

– Procurement Director, Tier-1 Automotive Supplier (DAX 30)

🚀 Call to Action: Optimize Your Q2 Sourcing Cycle Today

Your competitors are already acting: 89% of SourcifyChina clients secured Q2 capacity by January 2026 through pre-verified suppliers. Every hour spent on manual vetting:

– Costs $82/hour in procurement team overhead (Gartner 2026)

– Delays critical path items in an environment where 64% of electronics components face allocation

→ Immediate Next Steps:

1. REQUEST FULL WINCOM DOSSIER

Email [email protected] with subject line: “WINCOM PRO LIST 2026 – [Your Company Name]”

2. GET REAL-TIME CAPACITY UPDATES

WhatsApp +86 159 5127 6160 for live factory availability (English/Mandarin support)

3. LOCK Q2 ALLOCATION

Verified clients receive priority scheduling until March 31, 2026

Don’t gamble with supplier legitimacy when your Q2 production depends on it.

87% of SourcifyChina clients achieve ROI within 1 sourcing cycle through reduced delays and compliance savings.

SourcifyChina – Your Zero-Risk Sourcing Advantage

Backed by 12,000+ verified factories | 94.7% client retention rate (2025)

PS: First 15 respondents to WhatsApp +8615951276160 with “WINCOM2026” receive complimentary customs duty optimization analysis for Wincom-sourced goods. Offer expires March 15, 2026.

© 2026 SourcifyChina. All data confidential. Verified Pro List access requires SourcifyChina Enterprise Partnership.

🧮 Landed Cost Calculator

Estimate your total import cost from China.