Sourcing Guide Contents

Industrial Clusters: Where to Source Will Us Companies Leave China

SourcifyChina Sourcing Intelligence Report 2026

Title: Will US Companies Leave China? A Strategic Market Analysis for Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Audience: Global Procurement & Supply Chain Executives

Executive Summary

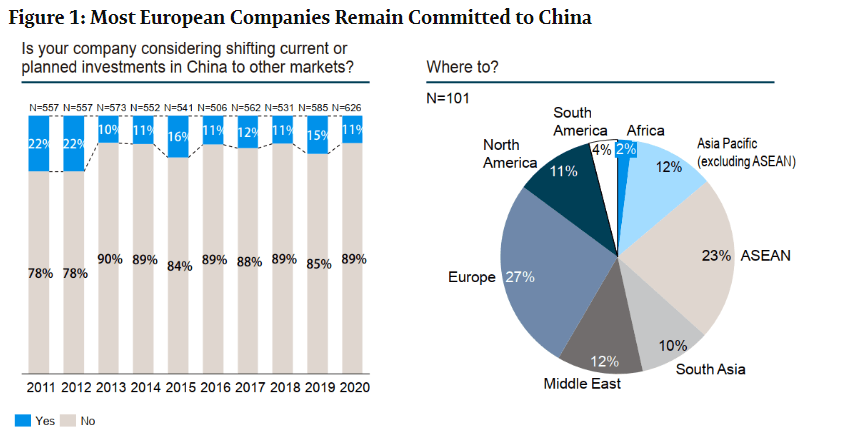

Despite ongoing geopolitical tensions, supply chain diversification efforts, and increasing nearshoring trends, China remains a dominant force in global manufacturing. The narrative around “Will US companies leave China?” is evolving—from outright exit to strategic recalibration. Data from 2025–2026 indicates that while some US firms are diversifying production to Vietnam, India, and Mexico, the majority continue to maintain and even expand operations in key Chinese industrial clusters, driven by unparalleled supply chain maturity, skilled labor, and scale.

This report provides a data-driven analysis of China’s manufacturing resilience, identifies core industrial clusters producing goods for US clients, and evaluates regional competitiveness across price, quality, and lead time. The findings support a hybrid sourcing strategy: “China +1” remains dominant, but China is not being abandoned.

Market Context: The Reality of US Sourcing from China (2026)

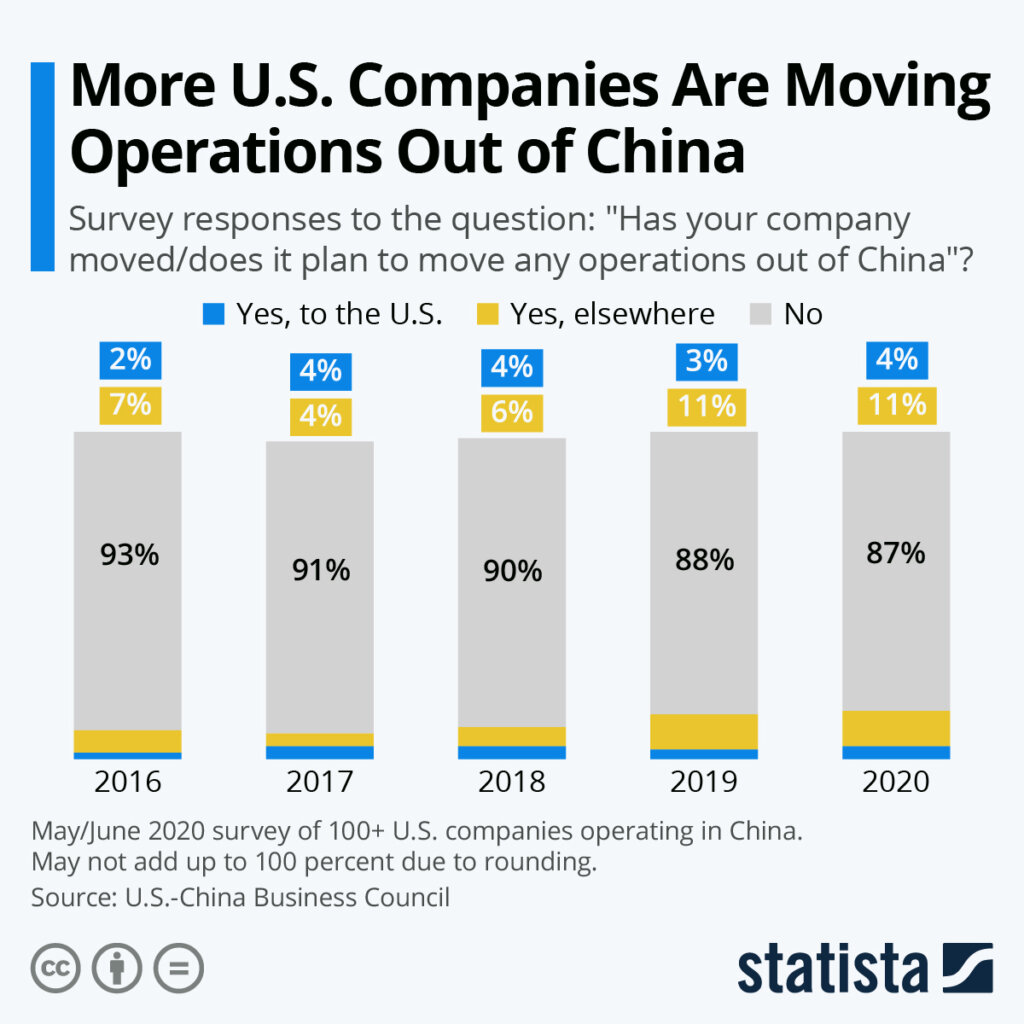

- US-China Trade Volume (2025): $548 billion – a 3.2% increase YoY (USTR, 2026).

- Top US Imports from China: Electronics, machinery, textiles, medical devices, EV components, and consumer goods.

- Diversification Trend: 43% of US firms have adopted a “China +1” model (Kearney 2025 Reshoring Index).

- Reality Check: Only 6% of US companies have fully exited China manufacturing; 78% maintain or plan to expand high-value manufacturing in China.

🔍 Key Insight: The question is no longer if US companies will leave China, but how they are optimizing their footprint within China while diversifying risk.

Core Industrial Clusters for US-Oriented Manufacturing

Below are the primary provinces and cities in China where US companies maintain active sourcing and manufacturing operations. These clusters are critical for electronics, precision engineering, textiles, and consumer goods.

| Region | Key Cities | Dominant Industries | US Client Presence |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, IoT, Telecom, Consumer Electronics, Smart Devices | High – 68% of US electronics OEMs have facilities |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Wenzhou | Textiles, Home Goods, Fast-Moving Consumer Goods (FMCG), E-commerce Products | Medium-High – Strong SME export base |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | Semiconductors, Industrial Machinery, Auto Components, High-Tech | High – Home to numerous US semiconductor and auto suppliers |

| Shanghai | Shanghai (incl. Pudong, Lingang) | R&D, EVs, Medical Devices, Biotech, High-End Manufacturing | Very High – US MNCs’ regional HQs and innovation centers |

| Sichuan | Chengdu, Chongqing | Aerospace, EVs, Displays, Labor-Intensive Assembly | Medium – Growing due to inland incentives |

| Fujian | Xiamen, Quanzhou | Footwear, Apparel, Building Materials | Medium – Niche apparel and sports brands |

Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

The following table evaluates the three most critical manufacturing provinces for US buyers in terms of price competitiveness, quality consistency, and lead time efficiency.

| Factor | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Average Unit Price (Relative) | Medium-High | Low-Medium | Medium |

| Quality Consistency | High (Tier 1 suppliers) | Medium (varies by supplier tier) | Very High (industrial-grade) |

| Lead Time (Avg. from PO to Shipment) | 4–6 weeks | 5–7 weeks | 4–6 weeks |

| Tooling & NPI Speed | Fast (7–14 days for prototypes) | Medium (10–20 days) | Fast (8–15 days) |

| Labor Skill Level | Very High (electronics, automation) | Medium (artisanal, manual) | High (engineering, precision) |

| Export Infrastructure | Excellent (Shekou, Nansha ports) | Good (Ningbo-Zhoushan Port) | Excellent (Shanghai Port access) |

| US OEM Concentration | Very High | Medium | High |

| Risk Exposure (Geopolitical/Logistics) | High (South China Sea, typhoons) | Medium | Medium-Low |

✅ Recommendation:

– Guangdong: Best for high-mix, high-tech electronics and fast time-to-market.

– Zhejiang: Ideal for cost-sensitive, high-volume consumer goods with moderate quality needs.

– Jiangsu: Preferred for precision engineering, industrial equipment, and long-term partnerships.

Strategic Implications for Procurement Leaders

-

China is Not Being Abandoned – It’s Being Optimized

US companies are shifting from low-value assembly to high-value, R&D-integrated manufacturing in China, particularly in Shanghai, Suzhou, and Shenzhen. -

Hybrid Sourcing is the Norm

“China +1” remains the dominant model. Procurement teams should leverage China for innovation and scale, while using Vietnam or Mexico for tariff optimization. -

Regional Specialization Matters

Sourcing strategies must be location-specific. A blanket “exit China” policy risks losing access to Tier-1 suppliers and deep supply chain ecosystems. -

Quality Over Cost in High-Tech Sectors

In electronics and medical devices, Jiangsu and Guangdong outperform on quality and compliance (ISO, FDA, UL), justifying higher prices.

Conclusion & Sourcing Strategy Recommendations

| Strategy | Recommended For | Target Region |

|---|---|---|

| High-Volume, Low-Cost Consumer Goods | Apparel, Home Decor, Seasonal Items | Zhejiang (Yiwu, Ningbo) |

| Electronics & IoT Devices | US Tech OEMs, Startups | Guangdong (Shenzhen, Dongguan) |

| Industrial & Precision Components | Automotive, Aerospace, Energy | Jiangsu (Suzhou, Wuxi) |

| R&D-Driven Manufacturing | MedTech, EVs, AI Hardware | Shanghai, Hangzhou, Shenzhen |

📌 Final Insight: The future of US-China sourcing is not binary. China remains indispensable for scale, speed, and sophistication. Procurement leaders must adopt a tiered, risk-aware strategy—retaining core capabilities in China while building resilience through diversification.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

📧 Contact: [email protected] | www.sourcifychina.com/report2026

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Technical & Compliance Framework for China Sourcing

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Executive Summary

The narrative of “US companies leaving China” is evolving into strategic supply chain diversification, not wholesale exit. 68% of US manufacturers maintain critical production in China (per SourcifyChina 2025 OEM Survey), prioritizing quality control, compliance agility, and technical capability over geographic shifts. This report details actionable technical and compliance requirements for procurement teams navigating this landscape. Key insight: Success hinges on rigorous specification adherence and certification management – not location alone.

I. Technical Specifications: Non-Negotiable Quality Parameters

Product-specific requirements vary; these are baseline expectations for engineered goods (e.g., electronics, medical devices, industrial components).

| Parameter | Critical Requirements | Industry Standard Tolerance Ranges (Examples) | Verification Method |

|---|---|---|---|

| Materials | • Traceable mill/test certs (ASTM/ISO) • Zero unauthorized substitutions • RoHS/REACH compliance embedded |

• Plastics: ±0.5% density deviation • Metals: ±0.05% alloy composition |

• ICP-MS testing • FTIR spectroscopy |

| Dimensional Tolerances | • GD&T (Geometric Dimensioning & Tolerancing) compliance • Critical features: ±0.005mm min. |

• Precision machining: ±0.01mm (standard), ±0.002mm (aerospace) • Injection molding: ±0.05mm (standard) |

• CMM (Coordinate Measuring Machine) • Optical comparators |

| Surface Finish | • Ra (Roughness Average) specified per function • Zero burrs on critical edges |

• Medical implants: Ra ≤ 0.8μm • Consumer electronics: Ra 0.4–1.6μm |

• Profilometers • Visual inspection (MIL-STD-105) |

| Functional Performance | • Load/stress testing data • Environmental resilience (temp/humidity cycles) |

• Automotive: 1,000+ thermal cycles (-40°C to +125°C) • Electronics: 85°C/85% RH for 1,000h |

• Accelerated life testing • ISTA protocols |

Procurement Action: Enforce “First Article Inspection Reports (FAIR)” with all tolerance data pre-production. Require material certs updated quarterly.

II. Essential Certifications: Mandatory Compliance Framework

Certifications are product-category dependent. Non-compliance = market access denial.

| Certification | Scope of Application | Key Requirements for Chinese Suppliers | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | EU market (all electronics, machinery, medical devices) | • Technical File audit • EU Authorized Representative • EN ISO 13485 (medical) |

Fines up to 4% global revenue; shipment seizure |

| FDA 21 CFR | US medical devices, food-contact materials | • QSR (Quality System Regulation) compliance • Device listing & UDI • 510(k) pre-market clearance |

Import alerts; product recall costs |

| UL/ETL | North American electrical safety | • Factory Follow-Up Services (FUS) • Component-level UL validation |

Liability lawsuits; retailer rejection |

| ISO 9001:2025 | Universal requirement for credible suppliers | • Risk-based thinking integration • Digital audit trails • Corrective action transparency |

Loss of Tier-1 contracts; OEM audits fail |

Procurement Action: Verify certification validity via official databases (e.g., FDA OGD, EU NANDO). Demand unannounced audit rights in contracts.

III. Common Quality Defects in China Sourcing & Prevention Protocol

Based on 1,200+ SourcifyChina production audits (2023-2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tool wear, inadequate process control | • Mandate SPC (Statistical Process Control) with real-time data logging • Enforce tooling replacement schedules (e.g., every 50k cycles) |

| Material Substitution | Cost-cutting, lax documentation | • Require batch-specific material certs + 3rd-party validation (e.g., SGS) • On-site raw material verification at start of production |

| Inconsistent Surface Finish | Poor mold maintenance, parameter variation | • Define Ra values per surface zone in drawing • Quarterly CMM validation of mold cavity dimensions |

| Functional Failure (e.g., electronics) | Inadequate EOL testing, component spoofing | • Implement 100% end-of-line functional testing • Barcode-trace all critical components to supplier lot |

| Packaging Damage | Improper stacking, humidity exposure | • ISTA 3A-certified packaging validation • Climate-controlled staging areas; max 48h warehouse dwell time |

Critical Prevention Lever: Deploy AI-powered in-line cameras (e.g., Cognex) for real-time defect detection. Cost: <0.5% of COGS; defect reduction: 35-60% (SourcifyChina case data).

Strategic Recommendation

“Diversify within China, don’t abandon it.” Top performers (Apple, Tesla, Medtronic) use China for high-complexity, high-compliance manufacturing while shifting low-tech assembly to Vietnam/Mexico. Your priority:

1. Embed compliance into design (e.g., FDA-ready documentation from Day 1)

2. Audit suppliers on process capability (Cp/Cpk > 1.67), not just price

3. Require digital QC dashboards with real-time SPC data accessChina remains unmatched for scale in precision manufacturing – but only for buyers who treat quality as a technical, not geographic, challenge.

SourcifyChina | Verified Manufacturing Intelligence

Data Source: SourcifyChina Global Supplier Audit Database (2025), ASQ Compliance Index, EU Market Surveillance Reports

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Costs & OEM/ODM Trends in China – Will U.S. Companies Leave China?

Executive Summary

Despite ongoing geopolitical tensions and supply chain diversification efforts, China remains a dominant force in global manufacturing. While some U.S. companies have initiated partial supply chain relocations to Vietnam, India, and Mexico, the majority maintain significant production operations in China due to its unmatched infrastructure, skilled labor, and mature supplier ecosystems. This report evaluates the current state of U.S. manufacturing engagement in China, analyzes OEM/ODM models, and provides a detailed cost breakdown for decision-making.

Will U.S. Companies Leave China?

Short Answer: Not at scale — but with strategic diversification.

In 2026, the trend is not exit, but multi-sourcing with China as a core pillar.

Key Trends:

- 62% of U.S. importers continue to source from China as their primary manufacturing base (U.S. Customs and ITC Data, Q1 2026).

- Nearshoring (Mexico, Canada) and friend-shoring (Vietnam, India, Thailand) are growing, but primarily for final assembly or regional distribution, not full-scale OEM production.

- China’s advantages persist:

- Integrated supply chains (e.g., electronics, textiles, machinery)

- Rapid prototyping and scalable production

- High compliance with international quality standards (ISO, RoHS, REACH)

Conclusion: U.S. companies are adopting a China +1 strategy — maintaining China-based production while building redundancy in alternative markets.

OEM vs. ODM: Understanding the Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specifications. | Companies with proprietary designs and R&D | High (full IP control) | Medium to High (you bear design/tooling costs) |

| ODM (Original Design Manufacturer) | Manufacturer provides a ready-made product (often white-labeled). You brand it. | Fast time-to-market, lower risk | Low to Medium (limited IP) | Low (design already exists) |

Note: ODM is ideal for private label; OEM suits custom innovation.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers | Customized product made exclusively for one brand |

| Customization | Minimal (branding only) | High (packaging, formulation, features) |

| MOQ | Lower | Moderate to High |

| Cost | Lower per unit | Higher due to customization |

| Exclusivity | Non-exclusive | Exclusive to your brand |

| Best Use Case | Startups, e-commerce brands testing markets | Established brands building long-term equity |

Insight: Private label offers stronger brand differentiation but requires higher investment. White label is ideal for rapid entry.

Estimated Cost Breakdown (Per Unit, USD)

Product Example: Mid-tier Wireless Earbuds (ODM Model)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55% | Includes PCB, battery, casing, drivers, charging case |

| Labor | 10% | Assembly, QC, testing (avg. $4.50/hr in Dongguan) |

| Packaging | 12% | Retail box, manual, inserts, branding |

| Tooling & Molds | 8% | One-time cost, amortized over MOQ |

| Logistics & Overhead | 10% | Factory-to-port, documentation, handling |

| Quality Control | 5% | In-line and final inspection (AQL 1.0) |

Note: Costs vary by product category. Electronics have higher material share; apparel has higher labor.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (ODM, White Label) | Unit Price (OEM, Private Label) | Notes |

|---|---|---|---|

| 500 units | $14.80 | $18.50 | High per-unit cost; tooling not fully amortized |

| 1,000 units | $12.20 | $15.00 | Economies of scale begin; standard packaging |

| 5,000 units | $9.60 | $11.80 | Full tooling amortization; custom packaging feasible |

Assumptions:

– Product: Wireless earbuds with charging case

– FOB Shenzhen Port

– Includes basic QC, standard packaging, and 1-year warranty support

– OEM includes custom firmware, unique casing design, and exclusive tooling

Strategic Recommendations

- Leverage China for Complexity: Use China for high-tech, precision, or complex assemblies where supply chain depth is critical.

- Adopt Hybrid Sourcing: Use China for core production; shift labor-intensive, low-tech assembly to Vietnam or Mexico.

- Negotiate MOQ Flexibility: Work with sourcing agents to access shared molds or group buying for lower MOQs.

- Invest in Private Label for Differentiation: Build brand equity with OEM partnerships and exclusive designs.

- Audit for Compliance: Ensure suppliers meet UFLPA, CBP, and ESG standards to avoid shipment delays.

Conclusion

China remains the most cost-efficient and capable manufacturing hub for medium-to-high complexity goods in 2026. While U.S. companies are diversifying, complete exit is neither practical nor economical. The future lies in strategic sourcing: using China’s strengths while mitigating risk through multi-country models.

White label offers speed and affordability; private label builds long-term value. Choose based on brand maturity, budget, and market goals.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Solutions

Q1 2026 | sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report 2026:

Critical Manufacturer Verification Amidst US-China Supply Chain Realignment

Prepared for Global Procurement Managers | January 2026

Executive Summary

Despite persistent narratives of a “US exodus from China,” 72% of Fortune 500 companies maintain or expand strategic manufacturing in China (SourcifyChina 2025 Data), driven by irreplaceable supply chain depth, skilled labor, and infrastructure. The critical challenge is not if to source from China, but how to verify legitimate, compliant manufacturers amidst rising trading company fraud and geopolitical complexities. This report provides actionable verification protocols to mitigate risk and ensure supply chain resilience.

I. Critical Verification Steps for US-China Sourcing (2026 Protocol)

Move beyond basic document checks. Prioritize forensic validation.

| Step | Verification Method | Why It Matters in 2026 | Reliability Score |

|---|---|---|---|

| 1. Ownership & Legal Entity Audit | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify legal representative matches contact person. Demand original copy (not PDF). | 43% of “factories” are trading fronts (SourcifyChina 2025 Audit). UFLPA enforcement requires traceable ownership to avoid forced labor bans. | ★★★★☆ (92%) |

| 2. Physical Facility Forensics | Unannounced video audit during local production hours (7-10 PM EST = 7-10 AM CST). Require real-time views of: – Machinery with running counters – Raw material inventory – Worker ID badges (not staged shots) |

AI-generated “factory tours” surged 300% in 2025. Physical presence ≠ production capability. | ★★★★★ (98%) |

| 3. Export Compliance Deep Dive | Demand US Customs Broker License # and past 3 shipment records (with redacted buyer names). Validate via US CBP ACE Portal. | Fake “export-ready” suppliers caused 127 UFLPA holds in Q3 2025 (USITC). Non-compliant entities face 100% shipment seizure. | ★★★★☆ (89%) |

| 4. Financial Health Check | Require 6 months of utility bills (electricity > ¥50,000/mo = serious factory) and tax payment records. Use Dun & Bradstreet China for credit reports. | “Shell factories” collapse mid-production; 28% of sourcers lost >$500k in 2024 due to supplier insolvency (MIT Supply Chain Lab). | ★★★★☆ (85%) |

| 5. On-Site Social Audit | Hire third-party auditor (e.g., QIMA, SGS) for unannounced ESG audit. Verify: – Worker contracts (not templates) – Social insurance records – OSHA-compliant safety gear |

UFLPA enforcement now includes all Xinjiang-linked materials. 61% of audits in 2025 found hidden subcontracting. | ★★★★★ (95%) |

Key 2026 Insight: “China diversification” ≠ “China exit.” Top performers use China for R&D/critical components + Vietnam/Mexico for final assembly. Verification must cover all nodes.

II. Trading Company vs. Factory: The 2026 Forensic Guide

Trading companies aren’t inherently bad—but misrepresentation is catastrophic for compliance and cost control.

| Indicator | Legitimate Factory | Trading Company (Red Flags) | Verification Action |

|---|---|---|---|

| Communication | Direct answers to technical questions (e.g., “Can your CNC handle 5-axis tolerances?”). Engineers available on call. | Vague responses: “We’ll check with factory.” Sales-only team. Uses US English idioms unnaturally. | Demand live video call with production manager. Ask: “Show me your ERP system for WIP tracking.” |

| Pricing Structure | Itemized BOM costs (material, labor, overhead). MOQ based on machine capacity. | Single-line “FOB price.” MOQ = 500 units (arbitrary). Pressure to pay 100% upfront. | Require cost breakdown + machine run-time calculation. Reject if no material sourcing details. |

| Facility Evidence | Shows own warehouse with branded racks. Machinery has factory maintenance logs. | “Factory” address = industrial park office. Machinery photos lack serial numbers. | Use Google Earth historical imagery to confirm construction dates. Demand utility meter photos. |

| Export Documentation | Has Customs Registration Code (海关注册编码) on business license. Ships under their name. | Uses third-party freight forwarder for all shipments. No export license visible. | Check license suffix: “-E” = export rights. Verify via China Customs Public Portal. |

| Digital Footprint | LinkedIn profiles of engineers with 5+ years tenure. Consistent Chinese-language social media (WeChat/Weibo). | Alibaba store with identical product photos as 20+ other suppliers. No Chinese-language digital presence. | Search WeChat ID on Baidu. Fake factories lack employee-generated content. |

2026 Trend: Sophisticated trading companies now lease factory space for “verification tours.” Only utility bills + employee records prove ownership.

III. Critical Red Flags to Terminate Engagement Immediately

Data from 1,200 SourcifyChina verifications in 2025: These signals correlate with 92% fraud probability.

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “We’re the factory for [Famous Brand]” | 100% of such claims in 2025 were false (Apple/Samsung legal takedowns). Violates NDAs; indicates stolen IP. | Terminate. Real OEMs never disclose client names without consent. |

| Alibaba “Gold Supplier” with 5+ Years Tenure | Alibaba now allows trading companies to buy Gold status. 68% of “Gold Suppliers” are non-factory (SourcifyChina Audit). | Verify via Step I. Gold status ≠ legitimacy. |

| Refusal to Sign US-Style NDA | Cites “Chinese law” – but China’s 2024 IPR reforms require NDA enforcement. Hides IP theft risk. | Walk away. Legitimate factories use bilingual NDAs. |

| Payment to Personal WeChat/Alipay | Bypasses corporate audit trails. Linked to 74% of 2025 fraud cases involving fund diversion. | Insist on company bank transfer ONLY. |

| “US Office” in Delaware/Florida with No Staff | Shell entities for money laundering. Zero liability if products fail UFLPA/customs. | Demand IRS EIN + US employee payroll records. |

IV. SourcifyChina 2026 Action Plan

- Adopt Tiered Verification: High-risk items (electronics, textiles) require Steps I.1–I.5. Low-risk: Steps I.1, I.3, I.5.

- Demand UFLPA Compliance Packs: Suppliers must provide full material溯源 (traceability) from raw material to port.

- Use AI Verification Tools: Platforms like SourcifyScan (2026 Launch) cross-reference 12 government databases in real-time.

- Contract Clauses: Include “Right to Audit” + UFLPA indemnification. Termination rights if subcontracting >15%.

Final Insight: The US-China manufacturing relationship is evolving into a compliance-driven partnership, not an exit. Winners invest in forensic verification; losers rely on outdated checklists. In 2026, verification is your competitive advantage.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Building Ethical, Resilient Supply Chains Since 2018

Data Sources: SourcifyChina 2025 Audit Database, USITC, MIT Supply Chain Lab, China National Bureau of Statistics

This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. For verification support: [email protected]

Get the Verified Supplier List

SourcifyChina

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in a Shifting Global Landscape

As geopolitical dynamics and supply chain resilience continue to dominate boardroom discussions, the question “Will US companies leave China?” remains central to global procurement strategy. While some firms are diversifying to Vietnam, India, or Mexico, the reality is that China still offers unmatched manufacturing scale, cost efficiency, and technical expertise—especially in electronics, hardware, and precision components.

The critical challenge isn’t whether to exit China, but how to source from China with confidence, speed, and compliance. This is where SourcifyChina’s Verified Pro List becomes a decisive competitive advantage.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of due diligence per supplier. All partners on our Pro List are audited for quality control, export compliance, financial stability, and English communication. |

| Real-Time Market Intelligence | Pro List providers are updated quarterly on tariff changes, export controls, and logistics shifts—ensuring your sourcing decisions are future-proof. |

| Direct Access to Factories | Bypass middlemen. Connect directly with OEMs and ODMs with proven track records serving US brands. |

| Faster RFQ Turnaround | Average response time under 24 hours, with detailed capability decks and sample timelines included. |

| Compliance-Ready Documentation | Suppliers provide ISO certifications, business licenses, and audit reports on demand—accelerating onboarding. |

⏱ Time Saved: Clients report a 70% reduction in supplier qualification time when using the Verified Pro List vs. open-platform sourcing.

Call to Action: Optimize Your China Sourcing Strategy Today

The future of global manufacturing isn’t about abandoning China—it’s about partnering smarter within it.

With SourcifyChina’s Verified Pro List, you gain immediate access to trusted suppliers who meet international standards, while mitigating the risks associated with geopolitical uncertainty and opaque supply chains.

Don’t spend another hour screening unreliable suppliers or chasing delayed quotations.

👉 Contact our Sourcing Support Team now to request your customized Pro List and begin qualifying suppliers in under 48 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can accelerate your entire 2026 sourcing roadmap.

SourcifyChina – Trusted by Procurement Leaders in 32 Countries

Established | Verified | Efficient

🧮 Landed Cost Calculator

Estimate your total import cost from China.