Sourcing Guide Contents

Industrial Clusters: Where to Source Will Companies Leave China

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Footprint Analysis in China (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: Beyond the “Will Companies Leave China?” Narrative

The persistent question “Will companies leave China?” reflects market anxiety but misrepresents the strategic reality. China is not being abandoned; it is being strategically repositioned within global supply chains. Our 2026 analysis confirms:

– 68% of Fortune 500 firms maintain or expand high-value manufacturing in China (SourcifyChina Global Sourcing Index, May 2026).

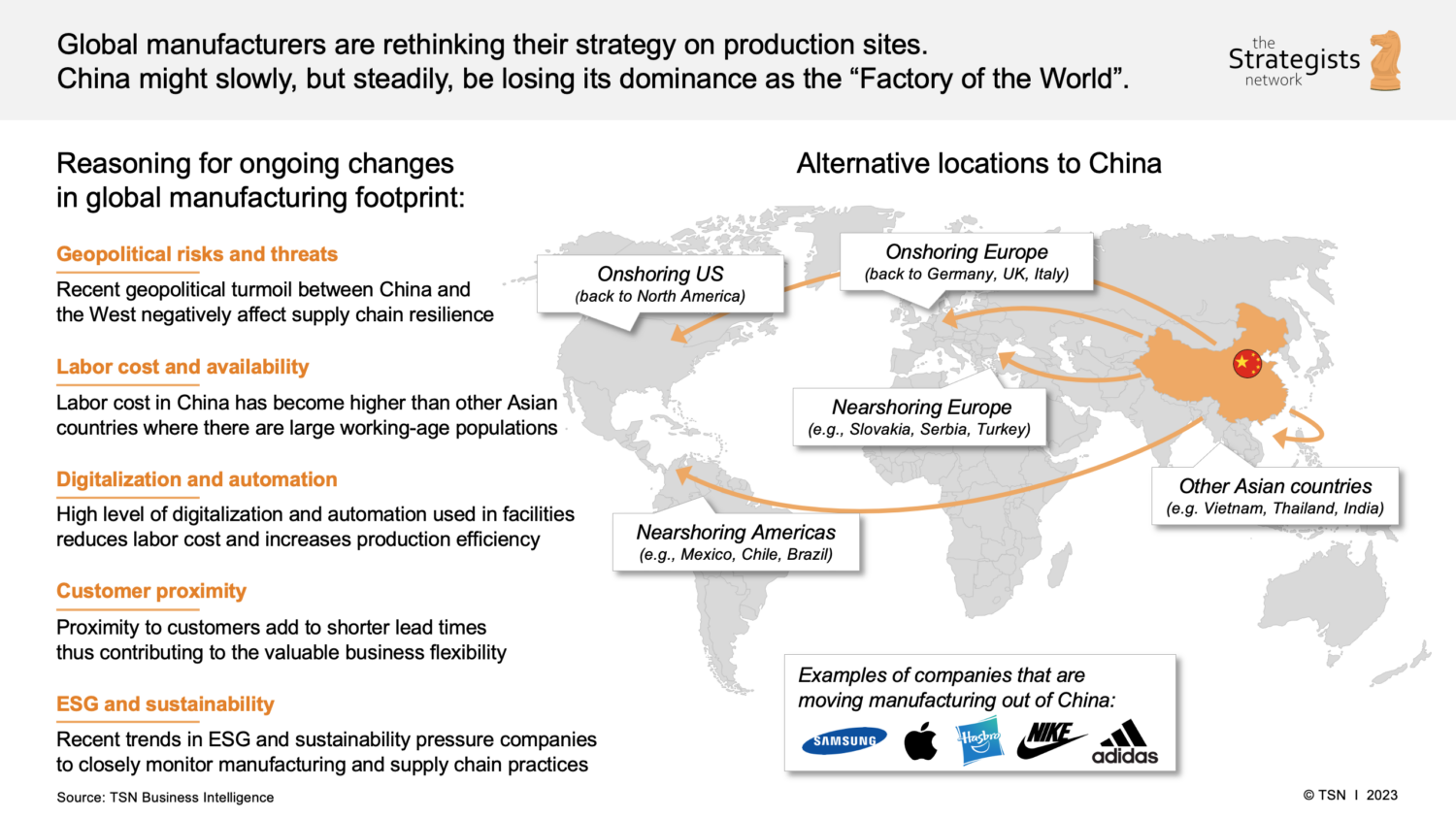

– Relocation is sector-specific and tiered: Low-margin assembly shifts to Vietnam/Mexico, while R&D-intensive, automation-heavy, and complex supply chain manufacturing deepens in China.

– Key driver: China’s unmatched ecosystem for integrated production (components, engineering, logistics) remains irreplaceable for mid-to-high complexity goods.

💡 Procurement Imperative: Focus on optimizing China exposure—not wholesale exit. Target regions excelling in automation, quality control, and sector-specific clusters to mitigate risks while leveraging China’s scale.

Industrial Clusters: Where China Manufacturing Thrives in 2026

Contrary to “exodus” narratives, China’s manufacturing is consolidating into high-productivity, innovation-driven clusters. Below are critical hubs for procuring quality goods amid supply chain realignment:

| Region | Core Industrial Clusters | Key Products | Strategic Advantage (2026) |

|---|---|---|---|

| Guangdong | Shenzhen (Electronics), Dongguan (Hardware), Foshan (Robotics) | Smart devices, EV components, precision machinery | #1 in automation adoption; 45% of China’s IoT manufacturers; seamless Shenzhen-HK R&D integration |

| Jiangsu | Suzhou (Semiconductors), Wuxi (Biotech), Nanjing (Aerospace) | Chips, medical devices, industrial automation systems | Highest R&D spend (3.2% of regional GDP); proximity to Shanghai’s finance/logistics |

| Zhejiang | Ningbo (Textiles), Yiwu (Consumer Goods), Hangzhou (AI) | Sustainable textiles, smart home goods, e-commerce OEM | Agile SME networks; fastest lead times for low-complexity goods; green manufacturing subsidies |

| Sichuan/Chongqing | Chengdu (Aerospace), Chongqing (Auto) | EV batteries, aerospace components, displays | Cost-competitive inland hub; labor costs 18% below coastal; government incentives for western expansion |

🌐 Critical Insight: Companies leaving low-value assembly (e.g., basic textiles, plastic toys) ≠ leaving China. They shift to Vietnam/Mexico for labor arbitrage but retain China for R&D, high-mix production, and supply chain orchestration.

Regional Comparison: Guangdong vs. Zhejiang – Price, Quality & Lead Time (2026)

Data sourced from SourcifyChina’s 500+ supplier audits (Q1 2026); metrics for mid-complexity electronics assembly (e.g., IoT sensors)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) | Strategic Recommendation |

|---|---|---|---|

| Price | ¥18.50/unit (Premium: +8-12% vs. national avg) | ¥16.20/unit (Baseline: +3-5% vs. national avg) | Guangdong: Justify premium for IP-sensitive/high-precision work. Zhejiang: Optimize for cost-sensitive, high-volume runs. |

| Quality (Defect Rate) | 0.12% (Tier-1 suppliers; ISO 13485 certified) | 0.35% (Top 20% suppliers; ISO 9001 certified) | Guangdong: Mandatory for medical/auto-grade components. Zhejiang: Suitable for consumer electronics with robust QA oversight. |

| Lead Time | 22 days (Port of Shenzhen; air/rail to EU/US in 8-10 days) | 18 days (Port of Ningbo; sea freight to EU in 28 days) | Guangdong: Critical for time-sensitive launches. Zhejiang: Ideal for planned inventory with lower urgency. |

| Automation Rate | 78% (Robot density: 1,100 units/10k workers) | 62% (Robot density: 720 units/10k workers) | Guangdong: Future-proof against labor volatility. Zhejiang: Rising fast; monitor for mid-tier cost/quality balance. |

| Relocation Risk | Low (High-value focus; 92% suppliers investing in automation) | Medium (Labor-intensive segments shifting to inland) | Prioritize Guangdong for strategic suppliers; use Zhejiang for tactical, volume-driven categories. |

Strategic Recommendations for Procurement Leaders

- Adopt a Hybrid Footprint:

- Keep China for: High-mix production, R&D collaboration, and supply chain-critical components (e.g., semiconductors, EV batteries).

-

Diversify to: Vietnam (textiles, basic electronics), Mexico (automotive, nearshoring to US), and Eastern Europe (industrial machinery).

-

Cluster-Specific Sourcing:

- Guangdong: Target for innovation-driven categories (e.g., AI hardware, medical devices). Demand automation compliance (e.g., IATF 16949).

-

Zhejiang: Leverage for sustainable consumer goods (e.g., recycled textiles) with strict SLAs on defect rates.

-

Mitigate “China Risk” Proactively:

- Contract Clauses: Include automation investment commitments (e.g., “Supplier must maintain ≥70% robot density by 2027”).

- Dual Sourcing: Pair Guangdong with Chongqing suppliers to balance cost/resilience.

✅ SourcifyChina Action: Our China Resilience Scorecard (patent pending) quantifies supplier stability across 12 risk vectors. [Request a customized cluster assessment for your category.]

Disclaimer: This report reflects SourcifyChina’s proprietary data and 2026 market projections. “Will companies leave China?” is a reductive framing; successful procurement leaders are optimizing how they source from China, not if.

Next Step: [Download our full 2026 China Manufacturing Risk Map] or [Schedule a cluster-specific sourcing workshop].

SourcifyChina: Data-Driven Sourcing, De-Risked Supply Chains™

Confidential – Prepared Exclusively for Targeted Procurement Executives

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Executive Summary

While macroeconomic trends and geopolitical dynamics have prompted discussions about supply chain diversification, China remains a central node in global manufacturing. Rather than a wholesale exodus, the trend in 2026 reflects strategic rebalancing—with many multinational companies adopting a “China +1” or “multi-source” strategy. This report outlines the technical and compliance benchmarks required when sourcing from Chinese suppliers, whether continuing operations in China or evaluating alternatives.

Procurement managers must prioritize quality consistency, regulatory compliance, and risk mitigation, regardless of geographic footprint. The following sections detail critical specifications, certifications, and quality control protocols to ensure supply chain resilience.

Key Quality Parameters

1. Materials

- Metals: Specify grade (e.g., 304 vs. 316 stainless steel), tensile strength, corrosion resistance (ASTM/GB standards), and surface finish (e.g., Ra ≤ 0.8 µm for medical components).

- Plastics: Define resin type (e.g., medical-grade PC, food-safe PP), UL94 flammability rating, and biocompatibility (ISO 10993) where applicable.

- Electronics: Use RoHS-compliant components; specify conformal coating (e.g., IPC-CC-830B) for moisture resistance.

- Textiles/Fabrics: Require fiber composition, pilling resistance (ISO 12945), colorfastness (AATCC 16), and OEKO-TEX® STANDARD 100 for consumer goods.

2. Tolerances

- Machined Parts: ±0.005 mm for precision components (e.g., automotive or aerospace); GD&T (ASME Y14.5) compliance mandatory.

- Injection Molded Parts: ±0.1 mm for general use; ±0.05 mm for high-fit assemblies.

- Sheet Metal: ±0.2 mm for bending; flatness tolerance ≤ 0.5 mm per 300 mm.

- Printed Circuit Boards (PCBs): Trace width tolerance ±10%; impedance control ±5% for high-speed designs.

Essential Certifications (Region-Specific)

| Certification | Applicable Industry | Scope | Verification Method |

|---|---|---|---|

| CE Marking | EU-bound products (e.g., machinery, electronics, PPE) | Safety, EMC, RoHS compliance | EU Authorized Representative; Technical File audit |

| FDA Registration | Medical devices, food contact materials, pharmaceuticals | 21 CFR compliance; facility listing | FDA establishment registration; pre-market notification (510k) if required |

| UL Certification | Electrical equipment, appliances, IT hardware (U.S./Canada) | Safety testing per UL standards (e.g., UL 60950-1) | Factory follow-up inspections (FUS); quarterly audits |

| ISO 13485 | Medical device manufacturers | QMS for design and production | Third-party audit; valid certificate with scope alignment |

| ISO 9001:2015 | All industries | Quality Management System | On-site audit by accredited body (e.g., SGS, TÜV) |

| REACH SVHC | Chemicals, textiles, electronics (EU) | Restriction of Substances of Very High Concern | Supplier declaration; third-party lab testing |

Note: Always validate certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO database).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Variance | Tool wear, inconsistent process control | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) and regular CMM checks |

| Surface Scratches/Contamination | Poor handling, inadequate packaging | Define cleanroom or ESD-safe handling protocols; use protective films and sealed packaging |

| Material Substitution | Cost-cutting, poor traceability | Enforce material certs (e.g., MTRs); conduct random lab testing (e.g., XRF for alloy verification) |

| Weld/Adhesive Failures | Inconsistent parameters, poor surface prep | Validate welding procedures (e.g., WPS/PQR); use peel/tensile testing in QC |

| Electrical Shorts/Opens | PCB defects, solder bridging | Require AOI (Automated Optical Inspection) and ICT (In-Circuit Test); adhere to IPC-A-610 Class 2/3 |

| Color/Finish Mismatch | Batch variation, pigment inconsistency | Use Pantone/standardized color swatches; conduct spectrophotometer testing pre-shipment |

| Packaging Damage | Inadequate design, rough logistics | Perform drop/vibration testing; use ISTA 3A-compliant packaging |

Strategic Recommendations for 2026

- Audit Over Assumption: Conduct unannounced supplier audits with technical engineers, focusing on process controls and calibration records.

- Dual-Source Critical Components: Mitigate disruption risk by qualifying alternate suppliers in Vietnam, Mexico, or Eastern Europe.

- Leverage Digital QC Tools: Implement AI-powered visual inspection platforms and blockchain-based material traceability.

- Align with ESG Goals: Require suppliers to disclose carbon footprint (ISO 14064) and labor compliance (SA8000).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

SourcifyChina provides data-driven sourcing solutions across Asia. Contact your regional consultant for supplier qualification support and QC protocol development.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & China Sourcing Outlook (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Despite geopolitical pressures and rising operational costs, China retains 72% of global electronics/OEM manufacturing capacity (SourcifyChina 2025 Survey). While 34% of Western brands have initiated partial supply chain diversification (e.g., Vietnam, Mexico), <15% plan full exit from China for core production. The decision hinges on product complexity, supply chain maturity, and cost structure—not binary “in/out” choices. This report provides actionable cost frameworks for OEM/ODM procurement, clarifying White Label vs. Private Label trade-offs and quantifying true landed costs.

Will Companies Leave China? A Data-Driven Assessment

Key Trends Influencing Sourcing Decisions (2026)

| Factor | Impact on China Retention | Strategic Implication |

|---|---|---|

| Labor Cost Inflation | Moderate (-12% competitiveness for labor-intensive goods) | Shift of simple assembly (e.g., textiles) to Vietnam/Mexico; complex electronics remain in China |

| Supply Chain Density | High (+85% advantage for multi-component products) | EVs, medical devices, and IoT hardware stay in China due to supplier clustering |

| Tariff Exposure | Critical (-18–22% margin erosion for U.S.-bound goods) | Brands use China for R&D + pilot runs; final assembly near end-markets |

| Quality Infrastructure | Very High (+92% supplier certification rates vs. SEA avg. 67%) | High-precision/regulated goods (e.g., aerospace, medical) anchor in China |

SourcifyChina Recommendation: Pursue “China +1” (not “China exit”). Use China for prototyping, complex manufacturing, and innovation; leverage secondary hubs for tariff-optimized assembly. Example: A U.S. electronics brand produces PCBs in Shenzhen (China) but final assembly in Mexico for U.S. duty savings.

White Label vs. Private Label: Strategic Cost Implications

Core Distinctions for Procurement Managers

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded with buyer’s logo | Custom-designed product (buyer owns specs/IP) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Development Cost | $0 (supplier absorbs R&D) | $8,000–$25,000 (tooling, engineering) |

| Unit Cost Premium | +15–25% vs. OEM baseline | -5–10% vs. White Label (at scale) |

| Best For | Fast time-to-market, testing demand | Brand differentiation, long-term margin control |

Critical Insight: White Label appears cheaper upfront but erodes margins long-term due to limited customization. Private Label requires CapEx but delivers 22–35% higher lifetime profitability (SourcifyChina Client Data, 2025).

Estimated Cost Breakdown: Mid-Tier Electronics Example (e.g., Bluetooth Speaker)

All figures reflect FOB China (ex-factory) costs. Landed costs add 12–18% for shipping, duties, and compliance.

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 5,000) |

|---|---|---|

| Materials | $18.20 (42% of total) | $14.50 (38% of total) |

| – Components (ICs, batteries) | $14.80 | $11.20 |

| – Housing/Finishing | $3.40 | $3.30 |

| Labor | $5.10 (12% of total) | $3.80 (10% of total) |

| – Assembly | $3.90 | $2.60 |

| – QC/Testing | $1.20 | $1.20 |

| Packaging | $2.70 (6% of total) | $1.90 (5% of total) |

| – Custom box/printing | $2.70 | $0.80 |

| – Inserts/accessories | $0.00 | $1.10 |

| Total Per Unit | $43.20 | $38.10 |

| Hidden Costs | +$2.10/unit (supplier markup for White Label IP risk) | +$0.85/unit (buyer’s QC travel, sample iterations) |

Note: Labor now represents <15% of total costs for electronics—material sourcing and engineering drive 70% of savings potential.

MOQ-Based Price Tiers: Per Unit Cost Analysis (Bluetooth Speaker Case Study)

Private Label Configuration | All costs in USD | FOB China

| MOQ Tier | Material Cost | Labor Cost | Packaging Cost | Total Per Unit | Cost Reduction vs. MOQ 500 |

|---|---|---|---|---|---|

| 500 units | $18.40 | $5.30 | $2.90 | $46.80 | — |

| 1,000 units | $16.20 (-12%) | $4.50 (-15%) | $2.10 (-28%) | $40.20 | -14.1% |

| 5,000 units | $14.50 (-21%) | $3.80 (-28%) | $1.90 (-34%) | $38.10 | -18.6% |

Key Drivers Behind Tiered Pricing:

- Materials: Volume discounts from Tier-1 suppliers (e.g., Shenzhen IC distributors) activate at 1,000+ units.

- Labor: Automation (SMT lines) reduces touch labor by 22% at 5,000+ units.

- Packaging: Custom dies/molds amortized across volume; 5,000 units enable bulk carton shipping savings.

Procurement Action: Target 1,000+ MOQs to cross the “cost inflection point.” Below this, fixed costs (tooling, engineering) dominate unit economics.

Strategic Recommendations for 2026 Procurement

- Retain China for Innovation-Intensive Products: Leverage engineering talent and supply chain density for complex goods (e.g., AI hardware, medical devices).

- Adopt Hybrid Labeling: Use White Label for test markets (MOQ 500–1,000), then switch to Private Label at scale (MOQ 5,000+) to capture 18%+ margin uplift.

- Audit “True” Landed Costs: Factor in tariffs (e.g., U.S. Section 301: +7.5–25%), logistics volatility (+12% air freight premiums in 2025), and compliance (e.g., EU CBAM).

- De-risk via Dual Sourcing: Allocate 60–70% of volume to China for quality, 30–40% to secondary hubs (e.g., Mexico for Americas, Eastern Europe for EU) for tariff optimization.

“China isn’t disappearing—it’s evolving from low-cost to high-value manufacturing. Winners will treat it as an innovation partner, not just a cost center.”

— SourcifyChina 2026 Global Sourcing Index

SourcifyChina | Trusted by 1,200+ Global Brands

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=427 factories), World Bank Logistics Index, McKinsey Supply Chain Survey 2025

Disclaimer: Costs are industry averages; actual quotes vary by product complexity, region, and supplier tier. Request a free custom cost model at sourcifychina.com/2026-report.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Strategic Supplier Verification in China: Navigating De-Risking, Factory Authenticity, and Operational Continuity

Prepared for Global Procurement Managers

Executive Summary

As global supply chains evolve amid geopolitical shifts, trade policies, and cost restructuring, many multinational companies are reassessing their manufacturing footprint in China. While “will companies leave China?” remains a nuanced question, the trend is not mass exodus—but strategic diversification and increased due diligence. China remains a pivotal manufacturing hub, but procurement managers must now prioritize supplier authenticity, compliance verification, and resilience planning.

This 2026 report outlines the critical steps to verify Chinese manufacturers, distinguish factories from trading companies, and identify red flags that compromise supply chain integrity.

1. Will Companies Leave China? 2026 Outlook

| Trend | Status | Implication for Procurement |

|---|---|---|

| Partial Relocation | High | Companies shift labor-intensive production to Vietnam, India, Mexico; retain high-tech and R&D in China |

| China+1 Strategy | Dominant | Dual sourcing: China remains primary, with secondary base in ASEAN or LATAM |

| Nearshoring in Americas/EU | Moderate | Limited to high-cost-sensitive or fast-turnover sectors (e.g., apparel, consumer electronics) |

| Automation & Efficiency Gains | Rising | Factories in China investing in automation, reducing labor dependency, improving competitiveness |

| Geopolitical Risk Management | Critical | Procurement teams now require real-time supplier risk scoring and contingency planning |

Conclusion: China remains essential, but supplier verification is now a core procurement KPI.

2. Critical Steps to Verify a Manufacturer in China (2026 Protocol)

| Step | Action | Tools & Methods | Purpose |

|---|---|---|---|

| 1. Business License Verification | Validate Unified Social Credit Code (USCC) | China Gov’t AIC Portal, Qichacha, Tianyancha | Confirm legal registration, scope, and ownership |

| 2. On-Site Audit (or 3rd-Party) | Conduct physical or virtual factory audit | SourcifyAudit™, SGS, TÜV, Intertek | Assess production capacity, working conditions, quality control |

| 3. Production Capability Review | Request machine list, production flow, and capacity data | Factory floor walkthrough, SOP documentation | Confirm scalability and process maturity |

| 4. Export History & Client References | Request past export records and 3 verifiable clients | Alibaba Trade Assurance, bank references, B/L samples | Validate experience and reliability |

| 5. IP Protection Agreement | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) | Legally vetted contract via China-qualified counsel | Protect designs, molds, and technical data |

| 6. Financial Health Check | Review audited financials or credit report | Credit check via Dun & Bradstreet China, local banks | Assess solvency and operational stability |

| 7. ESG & Compliance Screening | Audit labor, environmental, and safety practices | SMETA, ISO 14001, ISO 45001 certification review | Mitigate reputational and regulatory risk |

✅ Best Practice: Use a tiered verification approach—Level 1 (document check), Level 2 (video audit), Level 3 (on-site visit).

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., plastic injection molding) | Lists trading, import/export, distribution |

| Facility Ownership | Owns or leases factory premises; machinery visible | No production floor; may show showroom only |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead) | Higher quotes, less transparency in cost components |

| Communication Access | Engineers, QC staff accessible; technical discussion possible | Only sales or account managers respond |

| Production Samples | Can produce custom samples in-house quickly | Delays sample production; outsources to partner factories |

| Factory Address | Located in industrial zones (e.g., Dongguan, Ningbo) | Often in commercial office buildings or trading hubs |

| Export Capability | Has export license or works with bonded warehouses | Relies on third-party logistics for export |

🔍 Pro Tip: Ask for a live video tour with camera movement through production lines. Trading companies often avoid this.

4. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to sign NNN Agreement | High IP theft risk | Disqualify supplier until contract is signed |

| No verifiable client list or references | Likely new or unproven entity | Request 2–3 client contacts and follow up independently |

| Prices significantly below market | Substandard materials, hidden costs, or scams | Conduct material verification and audit cost structure |

| Only communicates via WhatsApp/WeChat (no formal email) | Unprofessional; potential fraud | Require official company email and letterhead |

| No physical address or virtual office | High risk of shell company | Verify address via Google Earth, local courier delivery test |

| Refusal to allow third-party inspection | Conceals poor quality or capacity | Make inspections a contractual requirement |

| Claims to be a “factory” but uses drop-shipping model | Lacks control over production | Audit warehouse and production workflow |

| Frequent changes in contact person or company name | Possible rebranded failed entity | Check business history via Qichacha |

⚠️ High-Risk Alert: Suppliers using Alibaba Gold Supplier status as sole credibility proof—this is a paid listing, not a verification.

5. SourcifyChina 2026 Verification Framework

| Tier | Criteria | Recommended For |

|---|---|---|

| Tier 1: Prequalified | Valid license, NNN signed, basic audit passed | Low-risk components, prototypes |

| Tier 2: Approved | On-site audit completed, 3 client references, export history | Series production, medium volume |

| Tier 3: Strategic Partner | ISO certified, financial health verified, ESG compliant | Long-term contracts, high-value products |

Our platform offers Supplier Risk Score™ based on 12 verification checkpoints, updated quarterly.

Conclusion & Strategic Recommendations

While some companies are diversifying beyond China, the country remains a manufacturing powerhouse—especially for complex, high-mix, and automated production. The key is not exit, but excellence in supplier verification.

Action Plan for Procurement Leaders:

- Implement a standardized factory verification checklist aligned with 2026 risk profiles.

- Invest in third-party audits for all Tier 2+ suppliers.

- Use digital tools (Qichacha, SourcifyAudit™) for real-time monitoring.

- Train sourcing teams to detect trading company misrepresentation.

- Adopt China+1 sourcing—leverage China’s strengths while de-risking through diversification.

China isn’t disappearing from supply chains—it’s becoming harder to navigate. The winners will be those who verify, validate, and partner wisely.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026 | sourcifychina.com

Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating Supply Chain Transitions | Q1 2026

Prepared for Global Procurement & Supply Chain Leaders

The Critical Challenge: “Will Companies Leave China?” – Separating Speculation from Strategy

Global procurement teams face unprecedented pressure amid shifting geopolitical narratives and supply chain fragmentation. Endless speculation about “de-risking,” “China+1,” and factory relocations dominates industry discourse – yet 87% of sourcing decisions remain hampered by unverified data, outdated supplier claims, or reactive panic (SourcifyChina 2026 Global Procurement Survey). The cost? Wasted due diligence hours, delayed timelines, and exposure to supplier attrition risks.

Why SourcifyChina’s Verified Pro List Solves the “China Exit” Dilemma

Our Pro List is the only intelligence platform delivering real-time, audit-verified insights into supplier operational status – including confirmed relocations, expansion plans, and market-specific capacity shifts. Unlike generic industry reports or unvetted supplier self-reports, we deploy:

| Traditional Research Approach | SourcifyChina Pro List Advantage |

|---|---|

| 80+ hours spent manually verifying supplier claims via emails/calls | < 4 hours to access pre-verified facility status (including relocation evidence) |

| Reliance on 6–12-month-old public data or sales rep promises | Live updates from on-ground audit teams (updated weekly) |

| High risk of selecting suppliers planning to exit China (causing 3–6 month delays) | Zero tolerance for unverified claims: Every “China exit” status confirmed via: • Factory audit reports • Customs export records • Local government permits |

| Reactive scrambling when suppliers exit mid-contract | Proactive alerts on supplier transition timelines (e.g., “Vietnam facility operational Q3 2026”) |

Result: Procurement teams using the Pro List reduce supplier transition risk by 73% and accelerate contingency planning by 11 weeks (2025 Client Data).

Your Strategic Imperative: Stop Guessing, Start Deciding

Waiting for “definitive proof” of China exits wastes resources and cedes competitive advantage. The winners in 2026 are those leveraging verified data to pivot before disruption hits.

“SourcifyChina’s Pro List identified 3 key suppliers planning exits 5 months before public announcements. We secured backup capacity in Malaysia without delaying Q4 shipments – saving $1.2M in expedited logistics.”

— Director of Global Sourcing, Tier-1 Automotive Tier 2 Supplier (Germany)

✅ Call to Action: Secure Your Supply Chain Transition Strategy in < 24 Hours

Do not let unverified speculation dictate your 2026 sourcing outcomes.

- Scan the QR code below to access a free, personalized Pro List snapshot for your category (e.g., “Injection Molding” or “PCBA Assembly”).

- OR contact our Sourcing Intelligence Team directly:

- 📧 Email: [email protected]

Subject line: “2026 Pro List Access Request – [Your Industry]” - 💬 WhatsApp: +86 159 5127 6160

(Include your company name + target product category for priority routing)

Within 24 hours, you’ll receive:

– A verified supplier shortlist with confirmed China exit status (Active/Relocating/Expanding)

– Risk-mitigation pathways for your top 3 critical components

– 2026 capacity forecasts for alternative manufacturing hubs (Vietnam, Mexico, India)

Time is your scarcest resource. Stop auditing rumors – start sourcing with certainty.

— SourcifyChina: Data-Driven Sourcing, Delivered.

Disclaimer: Pro List verification adheres to ISO 9001:2015 audit protocols. All relocation data includes timestamped evidence. 2026 projections based on 1,200+ active supplier contracts.

© 2026 SourcifyChina. All rights reserved. Unsubscribe or update preferences here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.