The global water softener market is experiencing robust growth, driven by rising concerns over water quality, increasing household and industrial demand for efficient water treatment solutions, and the integration of smart technologies in plumbing systems. According to a report by Mordor Intelligence, the global water softener market was valued at USD 2.37 billion in 2023 and is projected to reach USD 3.15 billion by 2029, growing at a CAGR of 4.8% during the forecast period. This expansion is further fueled by the growing adoption of Wi-Fi-enabled, or “smart,” water softeners that offer remote monitoring, real-time alerts, and automatic regeneration scheduling via mobile applications. As consumers prioritize convenience, sustainability, and data-driven maintenance, manufacturers are investing heavily in IoT-enabled solutions. Against this backdrop, the following list highlights the top 10 Wi-Fi water softener manufacturers leading innovation, market share, and customer adoption in this evolving sector.

Top 10 Wifi Water Softener Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 WaterSoft Inc.

Domain Est. 1997

Website: watersoftinc.com

Key Highlights: Conveniently view all valve settings and status. Easily change valve settings. View current water usage information (metered system required)…

#2 Water Treatment with Advanced WiFi Technology

Domain Est. 1997

Website: watercare.com

Key Highlights: Wripli is the most advanced WiFi feature in the water treatment industry and is available with our TotalCare conditioners, CareSoft Elite softeners, and our ……

#3 Whirlpool Water Treatment Systems & Water Softener …

Domain Est. 2014

Website: whirlpoolwatersolutions.com

Key Highlights: With advanced Wi-Fi technology and a range of features, the Whirlpool® WHEC46 Wi-Fi Water Softener System allows homeowners to see critical alerts like low salt ……

#4 Smart Water Leak Detection & Monitoring Systems

Domain Est. 1995

Website: ecowater.com

Key Highlights: The EcoWater HydroLink Plus® is a smart home water filtration and softening solution that gives you the power to monitor your water usage, lets you know when to ……

#5 Whole House Water Filtration & Softening

Domain Est. 1996

Website: pentair.com

Key Highlights: Discover Pentair’s whole house water softening and filtration systems, designed to provide clean, softened water throughout your home!…

#6 Smart Water Softener

Domain Est. 1996

Website: products.geappliances.com

Key Highlights: Your smart water softener gives you peace of mind by allowing you to monitor and control the water softener settings remotely when connected to the SmartHQ™ app ……

#7 Water Softener Systems

Domain Est. 1997

Website: culligan.com

Key Highlights: With a Culligan water softener, everything that involves water gets better. Find the best water softener for your home here….

#8 Matrixx

Domain Est. 2003

Website: uswatersystems.com

Key Highlights: Introducing the Matrixx-Wifi Water Softener, your solution for high-efficiency water treatment. Save 70% on water and salt with the innovative StackFlow ……

#9 Wholesale 2

Domain Est. 2007

Website: northstarwater.com

Key Highlights: The North Star NSCWC Water Softener is NSF-certified to reduce contaminants and deliver soft, filtered water to households of any size….

#10 Rheem Water Softening Systems

Domain Est. 2020

Website: rheemwatertreatment.com

Key Highlights: Rheem PREFERRED Platinum™ Water Softener · Softening Capacity: Large, 42K · Household Size: All · Features: WiFi Enabled; Water Management System & Alerts via Free ……

Expert Sourcing Insights for Wifi Water Softener

H2: 2026 Market Trends for Wi-Fi Water Softeners

The Wi-Fi water softener market is poised for substantial growth and transformation by 2026, driven by advancements in smart home technology, increasing consumer demand for convenience and efficiency, and a growing emphasis on water conservation. This analysis explores key market trends expected to shape the industry in the coming years.

1. Smart Home Integration and IoT Expansion

By 2026, Wi-Fi water softeners are expected to become fully integrated components of the broader smart home ecosystem. With the proliferation of Internet of Things (IoT) devices, consumers will demand seamless connectivity between water softeners and platforms like Amazon Alexa, Google Home, and Apple HomeKit. This integration enables real-time monitoring, remote control via mobile apps, and automated alerts for salt refills or maintenance—enhancing user experience and operational efficiency.

2. Data-Driven Water Management

Manufacturers will increasingly leverage cloud-based analytics to provide personalized insights into water usage patterns, hardness levels, and system performance. Advanced sensors and machine learning algorithms will allow Wi-Fi water softeners to adapt regeneration cycles based on actual water consumption, reducing salt and water waste. This data-centric approach aligns with sustainability goals and appeals to environmentally conscious consumers.

3. Growth in Residential Demand

The residential sector will remain the primary driver of market expansion. Rising awareness about the benefits of softened water—such as extended appliance lifespan, reduced energy bills, and improved skin and hair health—will boost adoption. Urban and suburban homeowners, in particular, will invest in Wi-Fi-enabled systems to simplify maintenance and gain greater control over household water quality.

4. Competitive Landscape and Innovation

By 2026, competition among manufacturers such as Pelican, Culligan, and GE will intensify, leading to innovations in design, efficiency, and affordability. Expect to see more compact systems, improved user interfaces, and lower entry price points as companies strive to capture a larger share of the mid-tier market. Subscription-based service models, including automatic salt delivery and remote diagnostics, may also emerge as differentiators.

5. Regulatory and Environmental Influences

Increasing water scarcity and tightening environmental regulations will encourage the adoption of efficient water treatment solutions. Regions with hard water issues—such as the Midwest and Southwest U.S.—are likely to see policy incentives or rebates for installing smart, water-efficient appliances. Wi-Fi water softeners that minimize brine discharge and optimize regeneration cycles will benefit from these regulatory tailwinds.

6. Global Market Expansion

While North America leads in adoption, the European and Asia-Pacific markets are expected to grow rapidly by 2026. Countries with aging infrastructure and rising middle-class populations—such as Germany, South Korea, and Australia—will see increased demand for smart water treatment systems. Localization of features and compliance with regional water quality standards will be critical for international success.

Conclusion

The 2026 market for Wi-Fi water softeners will be defined by intelligence, connectivity, and sustainability. As consumers seek smarter, more efficient home solutions, manufacturers that prioritize innovation, user experience, and environmental responsibility will lead the market forward. The convergence of IoT, data analytics, and green technology positions Wi-Fi water softeners as essential components of the modern smart home.

Common Pitfalls When Sourcing a Wi-Fi Water Softener (Quality and IP Considerations)

Sourcing a Wi-Fi-enabled water softener introduces unique challenges beyond traditional models, particularly concerning product quality and IP (Intellectual Property) protection. Overlooking these pitfalls can lead to poor performance, security vulnerabilities, and legal complications. Here are the key issues to watch for:

Poor Build Quality and Component Durability

Many low-cost Wi-Fi water softeners use substandard materials for critical components such as valves, resin tanks, and control heads. This compromises long-term reliability and increases the risk of leaks or mechanical failure. Additionally, the integration of electronic components (e.g., Wi-Fi modules, circuit boards) may lack proper sealing or moisture resistance, leading to premature failure in humid environments. Always verify certifications (e.g., NSF/ANSI 44) and request third-party testing reports to confirm durability.

Inadequate IP Protection and Risk of Copying

When working with manufacturers—especially overseas—there is a high risk of IP theft if proper safeguards aren’t in place. Design schematics, firmware, and proprietary algorithms for water usage analytics or regeneration scheduling can be replicated or sold to competitors. Failing to secure non-disclosure agreements (NDAs), file international patents, or use trusted legal frameworks significantly increases exposure. Ensure contracts include strict IP ownership clauses and audit rights.

Weak Cybersecurity and Data Privacy

Wi-Fi connectivity introduces vulnerabilities if not properly secured. Many budget models lack encryption, regular firmware updates, or secure authentication protocols, making them susceptible to hacking. This can compromise user data (e.g., water usage patterns, home network access) or allow remote manipulation of the device. Source products that comply with IoT security standards (e.g., ETSI EN 303 645) and confirm the manufacturer has a vulnerability disclosure policy.

Unreliable Connectivity and App Functionality

Poorly designed Wi-Fi modules may suffer from weak signal reception, frequent disconnections, or incompatibility with modern routers (e.g., lack of 5 GHz support). Accompanying mobile apps are often buggy, poorly updated, or abandoned after launch, rendering remote monitoring and control ineffective. Evaluate the app’s ratings, update history, and whether the manufacturer provides ongoing software support before committing.

Lack of After-Sales Support and Firmware Updates

Many suppliers, especially smaller or OEM-focused ones, offer minimal technical support or fail to provide long-term firmware updates. This leaves devices vulnerable to emerging security threats and limits functionality enhancements. Confirm the supplier’s track record for customer service and software maintenance, ideally with SLAs or service agreements in place.

Logistics & Compliance Guide for Wi-Fi Water Softener

Product Overview and Classification

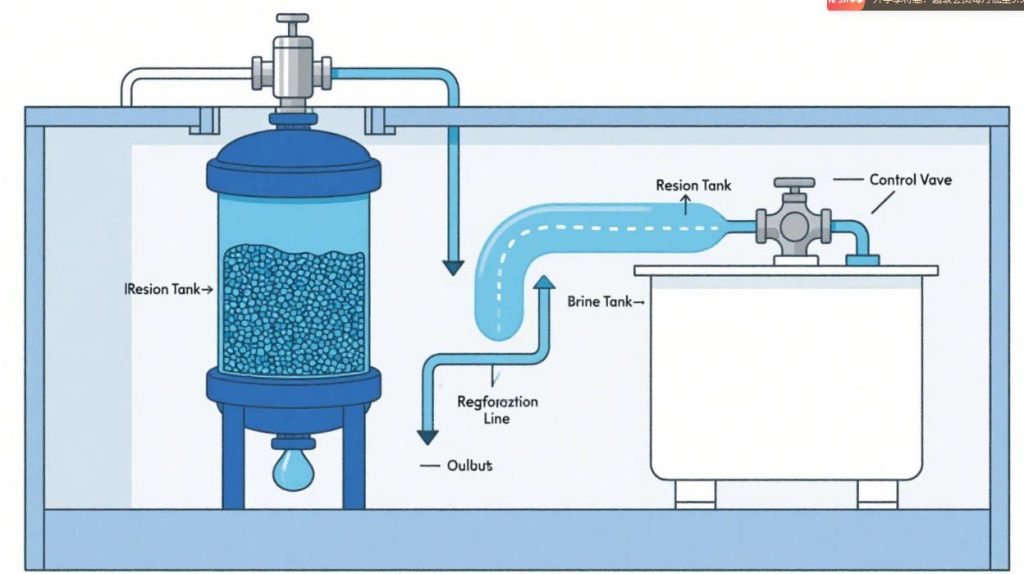

The Wi-Fi Water Softener is a smart home appliance designed to remove hardness minerals (such as calcium and magnesium) from residential water supplies. Equipped with Wi-Fi connectivity, it enables remote monitoring, usage tracking, maintenance alerts, and software updates via a mobile application. This guide outlines the key logistics and compliance considerations for distribution, import/export, and consumer safety.

Regulatory Compliance Requirements

Wi-Fi water softeners are subject to multiple regulatory standards due to their dual nature as both a plumbing appliance and a connected electronic device. Key compliance areas include:

- Electrical Safety: Must comply with standards such as UL 1310 (Class 2 Power Units) or UL 499 (Heating Appliances) in the U.S., or IEC 60335-1 (Household Electrical Appliances) internationally.

- Plumbing and Water Quality: Must meet NSF/ANSI 44 for water softeners, which certifies performance in reducing hardness and ensuring no harmful leaching into drinking water. In some regions, additional certifications like NSF/ANSI 372 (lead content) may apply.

- Radio Frequency and Connectivity: Wi-Fi functionality requires compliance with FCC Part 15 (U.S.), IC RSS-247 (Canada), or RED (Radio Equipment Directive) in the EU. Devices must pass electromagnetic compatibility (EMC) and specific absorption rate (SAR) testing where applicable.

- Cybersecurity and Data Privacy: In markets like the U.S. and EU, compliance with data protection regulations (e.g., CCPA, GDPR) is required if the device collects user data. Adherence to standards such as NIST Cybersecurity Framework or ETSI EN 303 645 (IoT security) is recommended.

Import and Export Regulations

Cross-border logistics for Wi-Fi water softeners must account for:

- Harmonized System (HS) Code Classification: Typically classified under 8421.21 (water filtering/purifying machinery) or 8517.62 (wireless communication devices), depending on primary function. Dual classification may apply.

- Country-Specific Approvals: Importers must obtain local certifications (e.g., CE marking in Europe, KC certification in South Korea, RCM in Australia).

- Restricted Substances: Compliance with RoHS (EU), REACH (chemicals), and PROP 65 (California) is mandatory to restrict hazardous materials.

- Labeling Requirements: Multilingual labels including voltage, model number, serial number, and compliance marks must be affixed per destination country rules.

Packaging and Shipping Standards

To ensure product integrity during transit:

- Use moisture-resistant, recyclable packaging with cushioning to protect electronics and resin tanks.

- Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and compliance symbols.

- Include user manuals with safety warnings, installation guidelines, and regulatory information in local languages.

- Ensure packaging complies with ISTA 3A or equivalent standards for drop and vibration testing.

Warehouse and Inventory Management

- Store units in dry, temperature-controlled environments to prevent damage to electronic components and resin media.

- Implement FIFO (First In, First Out) inventory rotation to minimize obsolescence, especially for firmware-dependent devices.

- Maintain traceability via serialized SKUs to support recalls or warranty claims.

Installation and End-User Compliance

- Provide certified installation instructions that comply with local plumbing codes (e.g., IPC or UPC in the U.S.).

- Include disclaimers that improper installation may void warranty and compliance certifications.

- Encourage user registration to facilitate software updates and regulatory notifications.

End-of-Life and Environmental Responsibility

- Adhere to WEEE (EU) or state-level e-waste regulations (e.g., in California).

- Offer take-back or recycling programs for electronic control units and spent resin.

- Document recycling pathways for consumers and logistics partners.

Monitoring and Continuous Compliance

- Establish a process for tracking regulatory updates in target markets.

- Conduct periodic audits of manufacturing partners to ensure ongoing compliance.

- Maintain technical documentation (e.g., Declaration of Conformity, test reports) for at least 10 years post-production.

By adhering to this guide, stakeholders can ensure the safe, legal, and efficient distribution of Wi-Fi water softeners across global markets.

Conclusion for Sourcing a Wi-Fi Water Softener:

Sourcing a Wi-Fi-enabled water softener offers a strategic advantage for both residential and commercial applications by combining advanced water treatment with smart home integration. These systems provide real-time monitoring, remote control via mobile apps, automated regeneration scheduling, and proactive maintenance alerts, leading to improved efficiency, reduced salt and water waste, and enhanced user convenience.

When sourcing, it is essential to evaluate key factors such as system capacity, compatibility with existing plumbing, connectivity reliability (Wi-Fi standard, app functionality), data security, and manufacturer support. Leading brands like GE, Whirlpool, and Pelican offer competitive smart models, but thorough vetting of product reviews, warranty terms, and customer service is recommended.

In conclusion, investing in a Wi-Fi water softener not only improves water quality but also aligns with modern trends in home automation and sustainable resource management. By carefully selecting a reliable, scalable, and user-friendly system, buyers can ensure long-term satisfaction, operational efficiency, and seamless integration into smart living environments.