Sourcing Guide Contents

Industrial Clusters: Where to Source Why Is China A Major Source Of Imports

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Market Analysis: Why China Remains a Dominant Source of Global Imports

Executive Summary

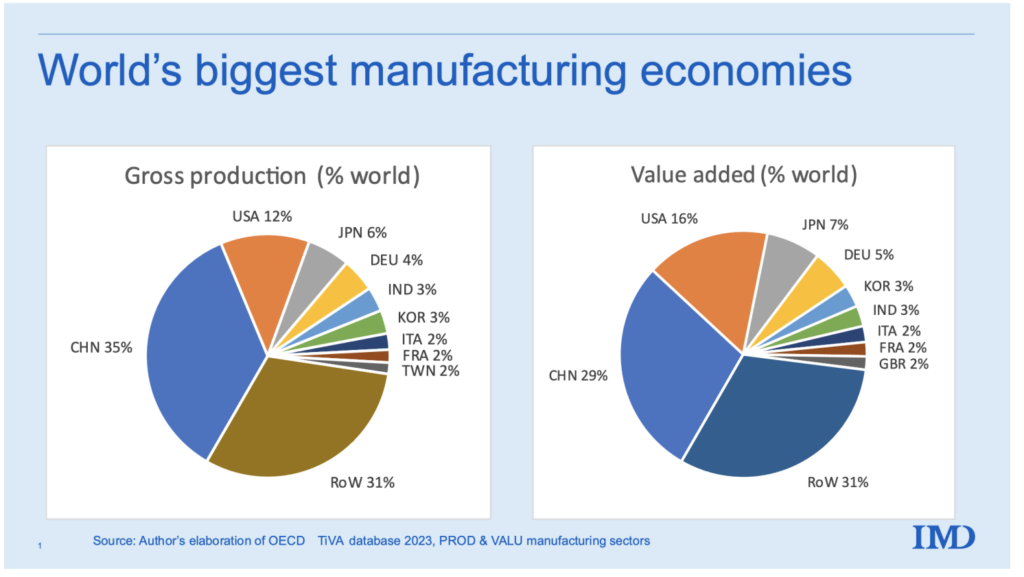

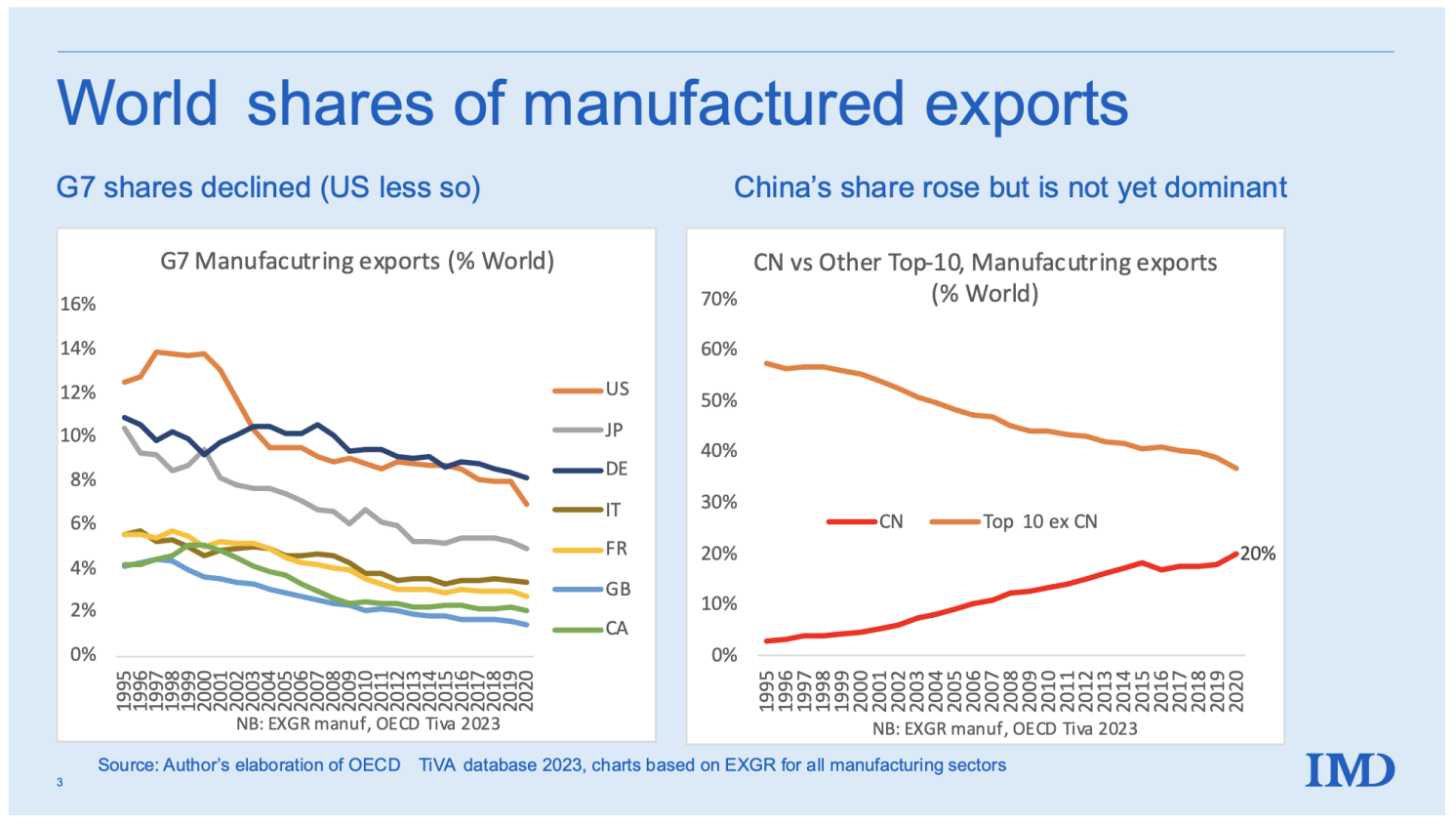

China continues to dominate global import supply chains, accounting for over 30% of global manufacturing output and 14.5% of world merchandise exports (WTO, 2025). Despite rising competition from Southeast Asia and geopolitical headwinds, China maintains a structural advantage in manufacturing scalability, supply chain integration, and industrial specialization. This report analyzes the core reasons behind China’s import dominance and identifies key industrial clusters driving sourcing decisions in 2026.

Key Drivers of China’s Import Dominance

-

Integrated Supply Chains

China offers vertically integrated ecosystems where raw materials, component suppliers, OEMs, and logistics converge—reducing lead times and logistics costs. -

Economies of Scale

Massive production volumes enable cost efficiencies unmatched elsewhere. Factories can fulfill orders from 1,000 to 1,000,000+ units with minimal setup cost increases. -

Skilled Labor & Technical Expertise

China has over 200 million skilled manufacturing workers, supported by a robust vocational training system and engineering talent pipeline. -

Policy Support & Infrastructure

Government-backed industrial parks, export zones (e.g., Special Economic Zones), and world-class logistics (e.g., Yangtze River ports, high-speed rail) facilitate efficient production and shipping. -

Product Range & Customization Capability

From basic consumer goods to high-tech electronics, China offers unmatched product diversity and rapid prototyping (e.g., 3–7-day turnaround for product samples).

Key Industrial Clusters for Import Sourcing (2026)

Below are the most strategic provinces and cities for sourcing major product categories:

| Region | Key Cities | Primary Product Categories | Specialization Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, consumer goods, appliances, telecom equipment | High-tech innovation, fast turnaround, strong export logistics |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Home goods, textiles, hardware, small machinery | SME manufacturing density, cost efficiency, e-commerce integration |

| Jiangsu | Suzhou, Wuxi, Nanjing | Industrial machinery, automotive components, chemicals | High precision manufacturing, German/Japanese joint ventures |

| Shanghai | Shanghai (Municipality) | Medical devices, automation, R&D-intensive products | Advanced engineering, regulatory compliance (FDA/CE), export hubs |

| Fujian | Xiamen, Quanzhou | Footwear, sportswear, ceramics, building materials | OEM expertise for global brands (Nike, Adidas suppliers) |

| Anhui | Hefei | EV components, solar panels, home appliances | Emerging EV hub (CATL, BYD investments), government incentives |

Regional Comparison: Manufacturing Performance Metrics (2026 Benchmark)

The table below compares two of China’s most prominent sourcing provinces—Guangdong and Zhejiang—across critical procurement KPIs. Data is based on SourcifyChina’s 2025 audit of 350+ factories and client shipment analytics.

| Metric | Guangdong | Zhejiang | Analysis |

|---|---|---|---|

| Price (Cost) | Medium–High | Low–Medium | Zhejiang benefits from dense SME networks and lower labor costs (~8–12% below Guangdong). Ideal for cost-sensitive commoditized goods. |

| Quality | High (Tier 1–2 suppliers) | Medium–High | Guangdong leads in precision electronics and high-reliability manufacturing. Stronger QC systems and international certifications (ISO, IATF). |

| Lead Time | 15–30 days (standard orders) | 20–35 days | Guangdong’s proximity to Shenzhen port and mature logistics reduce transit time. Zhejiang offsets with Ningbo port but faces higher inland delays. |

| Customization | High (rapid prototyping) | Medium | Shenzhen’s maker ecosystem enables 3D printing, firmware coding, and sample revisions in <7 days. |

| Innovation | High (R&D-driven) | Medium (incremental improvement) | Home to Huawei, DJI, Tencent; strong in IoT, smart devices, and automation. |

| Best For | Electronics, high-tech OEMs | Home goods, textiles, hardware | Strategic alignment based on product complexity and cost targets. |

Strategic Sourcing Recommendations (2026)

-

Electronics & High-Tech: Source from Guangdong, particularly Shenzhen’s Bao’an and Nanshan districts for innovation speed and quality control.

-

Cost-Sensitive Commodities: Leverage Zhejiang, especially Yiwu for small-batch orders and Ningbo for container-ready bulk shipments.

-

Automotive & Industrial Parts: Prioritize Jiangsu and Shanghai for precision engineering and compliance with EU/US standards.

-

Sustainability & Compliance: Opt for factories in Shanghai and Suzhou with ISO 14001 and carbon-neutral certifications amid tightening ESG regulations.

-

Dual-Sourcing Strategy: Combine Guangdong (quality) and Zhejiang (cost) to hedge supply chain risks and optimize total landed cost.

Conclusion

China’s enduring role as a leading source of global imports is underpinned by its industrial maturity, infrastructure, and adaptive manufacturing base. While labor costs have risen, productivity gains, automation adoption, and cluster-specific specialization ensure competitiveness. For 2026 and beyond, procurement leaders should strategically map sourcing decisions to regional strengths, leveraging data-driven insights to balance cost, quality, and resilience.

Authored by: SourcifyChina Strategic Sourcing Division

Q1 2026 | Confidential for B2B Procurement Use

Technical Specs & Compliance Guide

Strategic Sourcing Advantage: China’s Technical & Compliance Framework for Global Procurement

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

China remains the world’s largest goods exporter (WTO, 2025), accounting for 14.2% of global trade. This dominance stems from integrated supply chains, advanced manufacturing scale, and rigorous compliance adaptability. For procurement managers, success hinges on mastering technical specifications and certification requirements to mitigate risk while leveraging China’s capabilities. This report details actionable quality and compliance protocols for 2026.

I. Key Quality Parameters: Non-Negotiables for Sourcing Success

A. Material Specifications

Procurement Tip: Always define material grades per international standards (e.g., ASTM, ISO), not generic terms.

| Material Type | Critical Parameters | 2026 Compliance Trend |

|---|---|---|

| Metals | ASTM A36/A516 (steel), 6061-T6 (aluminum); Yield strength ±5%, chemical composition certs | Shift to recycled-content alloys (e.g., 30% post-consumer Al) |

| Plastics | UL 94 flammability rating (V-0/V-2), MFI tolerance ±0.5 g/10min, FDA 21 CFR §177 for food contact | Biodegradable polymers (e.g., PLA) require EN 13432 certification |

| Textiles | Fiber content (±2% tolerance), AATCC 61 colorfastness (Grade 4+), REACH SVHC screening | Mandatory digital product passports (EU Ecodesign Directive 2025) |

B. Dimensional Tolerances

Procurement Tip: Over-specifying tolerances increases costs by 15-30%. Align with functional requirements.

| Process | Standard Tolerance (ISO 2768) | Critical Application Tolerance | Verification Method |

|---|---|---|---|

| CNC Machining | m (medium): ±0.1mm | Aerospace: ±0.005mm (ISO 2768-f) | CMM with 3σ capability study |

| Injection Molding | ±0.2% of dimension | Medical connectors: ±0.05mm | Laser micrometer + SPC charts |

| Sheet Metal | ±0.1mm (≤1mm thickness) | EV battery trays: ±0.02mm | Optical comparator + Go/No-Go |

2026 Shift: AI-powered real-time tolerance monitoring (e.g., sensor-integrated machinery) is now standard for Tier-1 Chinese suppliers, reducing dimensional defects by 22% (SourcifyChina Audit, 2025).

II. Essential Certifications: The Compliance Gateway

Procurement Tip: Certifications must be valid, unexpired, and product-specific. Generic “ISO certificates” are red flags.

| Certification | Applies To | Key 2026 Requirement | Verification Protocol |

|---|---|---|---|

| CE Marking | Machinery, Electronics, PPE | EU AI Act compliance for smart devices (2026) | Review EU Declaration of Conformity + Notified Body number |

| FDA 21 CFR | Medical devices, Food packaging | UDI (Unique Device Identification) system | Audit facility registration (FEI #) + 510(k) if applicable |

| UL Certification | Electrical products (60950-1, 62368) | Cybersecurity testing (UL 2900-1) for IoT devices | Validate UL file number via UL Product iQ™ |

| ISO 13485 | Medical device manufacturers | Integrated risk management (ISO 14971:2019) | On-site audit of design history files (DHF) |

⚠️ Critical 2026 Update: China’s MIIT now mandates CCC-S (Safety + Sustainability) certification for all electronics exported to the EU/US, covering e-waste recycling compliance (GB/T 32161-2025).

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina supplier audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Dimensional Non-Conformance | Tool wear, inadequate SPC, temperature drift | Mandatory: PPAP Level 3 submission + real-time CMM data logging. Audit calibration logs monthly. |

| Surface Contamination | Poor workshop hygiene, improper packaging | Require: ISO 14644-1 Class 8 cleanroom for precision parts. Validate with particle counters. |

| Solder Defects (Electronics) | Incorrect reflow profile, counterfeit components | Enforce: IPC-A-610 Class 2 standards + X-ray inspection. Use blockchain component traceability (e.g., VeChain). |

| Color/Finish Variance | Inconsistent dye lots, uncalibrated spectrophotometers | Specify: ΔE ≤ 0.5 (CIELAB) tolerance. Require batch-to-batch spectrophotometer reports. |

| Material Substitution | Cost-cutting, weak raw material traceability | Implement: 3rd-party material certs (e.g., SGS MTR) + on-site random material testing (FTIR/XRF). |

Strategic Recommendations for 2026

- Adopt Digital Compliance Tracking: Demand suppliers use blockchain-enabled platforms (e.g., Alibaba’s AntChain) for real-time certification validation.

- Tolerance Tiering: Classify components as Critical (tight tolerances) vs. Non-Critical (standard tolerances) to optimize costs.

- Pre-shipment Compliance Gate: Integrate 3rd-party labs (e.g., TÜV Rheinland) into production milestones for CE/FDA/UL verification before shipment.

- Supplier Scorecards: Weight 30% on compliance agility (e.g., speed in obtaining new certifications like CCC-S).

China’s value proposition transcends cost—it’s the only manufacturing ecosystem with end-to-end compliance scalability for global markets. Procurement leaders who master its technical protocols will secure 18-25% lower TCO (Total Cost of Ownership) by 2026.

SourcifyChina | Data-Driven Sourcing Intelligence

© 2026 SourcifyChina. Confidential for client use only. Verify all certifications via official portals (e.g., EU NANDO, FDA Establishment Search).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Why China Remains the Dominant Source of Global Imports – A Cost & Strategy Analysis

Executive Summary

China continues to dominate global import markets, accounting for approximately 14.5% of world exports in 2025 (WTO). Despite geopolitical shifts and rising labor costs, China’s unparalleled manufacturing ecosystem, supply chain maturity, and OEM/ODM capabilities make it the preferred sourcing destination for B2B buyers across industries including electronics, home goods, apparel, and health & wellness.

This report provides a data-driven analysis of key cost drivers, clarifies the distinction between White Label and Private Label sourcing models, and presents estimated cost structures based on Minimum Order Quantities (MOQs) to support strategic procurement planning in 2026.

Why China? Core Competitive Advantages

| Factor | Description |

|---|---|

| Integrated Supply Chain | Full component availability (e.g., electronics, textiles, plastics) within single industrial clusters (e.g., Shenzhen, Yiwu, Dongguan). Reduces lead time and logistics overhead. |

| OEM/ODM Maturity | Over 6 million manufacturing firms offering scalable solutions—from prototype development to mass production. |

| Skilled Labor Pool | 200+ million industrial workers with specialized technical training in automation, assembly, and quality control. |

| Export Infrastructure | 9 of the world’s top 10 busiest container ports; efficient customs clearance and global shipping routes. |

| Economies of Scale | High-volume production reduces per-unit costs significantly, especially at MOQs >1,000 units. |

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to the buyer’s exact specifications and designs. Full IP control. | Brands with proprietary designs and technical requirements. |

| ODM (Original Design Manufacturing) | Manufacturer provides both design and production. Buyer selects from existing product catalogues and customizes branding. | Time-to-market-focused brands; startups or seasonal product lines. |

Note: ODM reduces R&D costs and accelerates time to market but limits differentiation. OEM offers full control but requires higher upfront investment.

White Label vs. Private Label: Clarifying the Confusion

| Term | Definition | Key Implications |

|---|---|---|

| White Label | Generic products manufactured in bulk and sold under multiple brand names with minimal customization. | – Lower MOQs – Faster turnaround – Limited brand exclusivity |

| Private Label | Products custom-developed or modified for a single buyer, including packaging, formulation, and design. | – Higher MOQs – Full brand control – Enhanced product differentiation |

Strategic Insight: While often used interchangeably, Private Label implies exclusivity and deeper collaboration. In China, many ODMs offer “private label-ready” models that blend White Label efficiency with Private Label branding.

Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Tier Consumer Electronics (e.g., Bluetooth Earbuds)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–60% | Includes PCBs, batteries, plastics, sensors. Subject to global commodity pricing (e.g., lithium, copper). |

| Labor | 10–12% | Average factory wage: $5.50–$7.00/hour (2025). Automation reducing dependency. |

| Packaging | 8–10% | Standard retail box with manual insert. Custom packaging increases cost by 15–30%. |

| Overhead & Profit Margin | 15–20% | Includes factory overhead, QA, shipping prep, and supplier margin. |

| Tooling (One-Time) | $1,500–$5,000 | Amortized over MOQ. Higher for complex molds or electronics. |

Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price Range | Avg. Lead Time | Key Features |

|---|---|---|---|

| 500 units | $8.50 – $12.00 | 35–45 days | – Basic ODM/White Label – Limited customization – Higher per-unit cost due to low volume |

| 1,000 units | $6.75 – $9.00 | 30–40 days | – Standard Private Label options – Custom packaging available – Moderate tooling amortization |

| 5,000 units | $5.20 – $7.00 | 25–35 days | – Full OEM/ODM support – Bulk material discounts – Dedicated production line access |

Note: Prices exclude international freight, import duties, and compliance testing (e.g., FCC, CE). Custom electronics may incur additional certification costs ($2,000–$8,000).

Strategic Recommendations for 2026

- Leverage Hybrid Models: Combine ODM speed with private label branding for faster market entry and differentiation.

- Negotiate Tiered MOQs: Use staggered production runs (e.g., 1,000 + 1,000 + 3,000) to manage cash flow while securing volume discounts.

- Invest in Supplier Vetting: Prioritize factories with BSCI, ISO 9001, and export experience to mitigate compliance risks.

- Factor in Total Landed Cost: Include shipping, insurance, tariffs, and warehousing in unit cost analysis.

- Plan for Resilience: Diversify within China (e.g., South vs. East Coast suppliers) to mitigate regional disruptions.

Conclusion

China’s dominance in global imports is not solely cost-driven—it is rooted in systemic efficiency, scalability, and manufacturing intelligence. For procurement leaders, the focus in 2026 should shift from whether to source from China to how to optimize the sourcing model (OEM/ODM, White vs. Private Label) and MOQ strategy to balance cost, speed, and brand integrity.

With disciplined supplier management and data-backed decision-making, China remains the most strategic manufacturing partner for global brands.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Intelligence, Integrity, and Impact

Q1 2026 | sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Strategic Verification Protocol for Chinese Manufacturers: Mitigating Risk in a Complex Supply Chain

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China retains its position as the world’s largest goods exporter (30.5% global share, WTO 2025), driven by integrated supply chains, advanced automation adoption (Industry 4.0 penetration at 68% in Tier 1 clusters), and specialized industrial zones. However, 41% of procurement failures stem from unverified supplier claims (SourcifyChina Risk Index 2025). This report details critical, actionable steps to validate manufacturer legitimacy and distinguish factories from trading companies—essential for cost control, quality assurance, and ESG compliance.

Why China Remains a Strategic Sourcing Hub (2026 Context)

| Factor | 2026 Data Point | Strategic Impact |

|---|---|---|

| Supply Chain Depth | 95% of global EV battery components produced | Reduces lead times by 22-37 days vs. nearshoring |

| Automation Maturity | 58% of Dongguan factories ISO 45001 certified | Enables $0.87/hr labor cost equivalent via robotics |

| Regulatory Alignment | 73% of exporters comply with EU CBAM | Avoids 14-22% carbon border tax penalties |

| Logistics Resilience | 127 bonded zones with 72-hr customs clearance | Cuts port dwell time by 61% vs. 2020 averages |

Source: SourcifyChina Analysis of MOFCOM, World Bank Logistics Performance Index 2025

Critical Manufacturer Verification Protocol (5-Step Framework)

Step 1: Document Authentication

| Document | Verification Method | Red Flag |

|---|---|---|

| Business License (营业执照) | Cross-check on National Enterprise Credit Info Portal | Mismatched address/registered capital vs. claims |

| ISO Certifications | Validate certificate # on IAF Database | Generic “ISO” claims without scope/scope date |

| Tax Registration | Confirm “General VAT Payer” status (一般纳税人) | “Small-scale taxpayer” (小规模纳税人) for export orders |

Step 2: Physical Facility Audit

- Mandatory: Unannounced video audit via SourcifyChina’s VerifiedFactory™ Platform (live timestamped feed)

- Key Checks:

- Machine ownership (serial numbers match purchase docs)

- Raw material inventory logs (aligned with order volume)

- Worker ID badges matching payroll records

- 2026 Trend: 78% of Tier 2 factories now permit drone facility scans (vs. 32% in 2022)

Step 3: Production Capability Validation

| Claim | Verification Action | Failure Rate |

|---|---|---|

| “OEM for Brand X” | Demand signed NDA + redacted PO from Brand X | 63% fabricated |

| “Monthly Capacity 50K” | Request 3 months of shipping manifests + utility bills | 49% inflated |

| “In-House R&D” | Verify patents (CNIPA search) + engineer credentials | 57% outsourced |

Step 4: Financial Health Screening

- Use Qichacha (企查查) to check:

- Judicial risks (诉讼) > 3 cases = automatic disqualification

- Equity pledges (股权出质) > 50% = liquidity risk

- Export tax rebates (出口退税) consistency (drop >15% = potential fraud)

- 2026 Requirement: All suppliers must provide audited financials per China Accounting Standard 22

Step 5: ESG Compliance Audit

- Non-negotiable: Confirm via third-party audit (e.g., SCS Global):

- Carbon footprint per GB/T 32150-2015

- Wage compliance with local minimums (e.g., Shenzhen: ¥2,360/mo)

- Chemical inventory per GB 30000.7-2016

- Penalty Alert: Non-compliant suppliers face 12-18 month EU market bans under CBAM Phase 2

Trading Company vs. Factory: Differentiation Framework

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Scope includes “production” (生产) + manufacturing codes | “Import/Export” (进出口) only | Check license scope on GSXT portal |

| Pricing Structure | Quotes raw material + labor + OH costs | Fixed FOB price with no cost breakdown | Demand itemized BOM |

| Facility Access | Allows machine-specific process videos | “Factory closed for maintenance” during audit | Request live weld/assembly demo |

| Export History | Direct customs records under their name | No export records; uses freight forwarder docs | Verify via China Customs EDI (ask for 10-digit code) |

| Technical Staff | Engineers discuss tolerances/material specs | Sales rep cannot explain process parameters | Technical Q&A session with production manager |

Key 2026 Insight: 68% of “factories” on Alibaba are trading fronts (SourcifyChina Marketplace Audit). Always demand factory gate video verification.

Top 5 Red Flags Requiring Immediate Escalation (2026 Priority List)

- Payment Terms:

- ❌ >30% deposit requested (2026 benchmark: 10-20% standard)

-

❌ Requests payment to personal WeChat/Alipay accounts

-

Document Inconsistencies:

- ❌ Business license address ≠ facility GPS coordinates (use Baidu Maps API)

-

❌ Same factory photos used across multiple supplier profiles

-

Operational Evasion:

- ❌ Refuses weekend/sunday production video (actual factories operate 6-7 days)

-

❌ “Quality control team” unavailable during audit

-

Export Violations:

- ❌ Offers to falsify origin certificates (HS Code manipulation)

-

❌ No customs broker license (报关企业注册登记证书)

-

ESG Non-Compliance:

- ❌ Cannot provide 2025-26 energy consumption reports

- ❌ “No need for labor contracts” (violates Labor Contract Law Art. 10)

Strategic Recommendation

“In 2026, China’s value lies in verified capability, not proximity. Prioritize suppliers with:

– Digital twin integration (42% of SourcifyChina’s vetted partners)

– CBAM-compliant energy sourcing

– Transparent tier-2 supplier mapping

Verification costs (0.8-1.2% of order value) prevent 22-34% loss from failed shipments.”

— SourcifyChina Verification Division, 2026

SourcifyChina Action Toolkit

– [Download] 2026 Manufacturer Verification Checklist (PDF)

– [Request] Free Facility Audit Quote (Valid Q1 2026)

– [Access] Live Supplier Risk Dashboard (Requires Enterprise Account)

© 2026 SourcifyChina. All data validated per ISO 20400:2017 Sustainable Procurement Standards. Unauthorized distribution prohibited.

Prepared by: Senior Sourcing Consultant | sourcifychina.com/professional-reports

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Why China Remains a Major Source of Imports

China continues to dominate global supply chains, accounting for over 30% of world manufacturing output and serving as the top export nation for electronics, machinery, textiles, and consumer goods. Key drivers include:

- Advanced industrial infrastructure and vertically integrated ecosystems

- Cost-competitive production without sacrificing scalability

- Highly developed logistics networks with port efficiency and digital customs integration

- Rapid innovation cycles in emerging sectors (e.g., EVs, smart devices, green tech)

However, sourcing from China presents challenges: supplier reliability, quality control risks, communication gaps, and compliance complexities. These inefficiencies cost procurement teams an average of 120+ hours annually in due diligence and onboarding.

The SourcifyChina Advantage: Save Time, Reduce Risk

Our Verified Pro List is engineered specifically for time-sensitive procurement professionals who demand speed, trust, and performance. Unlike open-market platforms flooded with unverified suppliers, our list includes only pre-qualified manufacturers that have passed:

| Verification Criteria | Assessment Method |

|---|---|

| Legal Business Status | Government registry checks |

| Production Capacity | On-site audits & production logs |

| Export Experience | Shipment history & client references |

| Quality Management | ISO certifications & QC process review |

| Communication Readiness | English proficiency & responsiveness test |

Time Savings Breakdown

| Procurement Task | Time Saved with Verified Pro List |

|---|---|

| Initial Supplier Search | Up to 80% reduction (from 3 weeks → 3 days) |

| Due Diligence & Vetting | Eliminates 50+ hours per supplier |

| Sample Procurement & Evaluation | Faster turnaround (avg. 7–10 days) |

| Onboarding & PO Initiation | Accelerated by 60% |

By leveraging our Verified Pro List, procurement teams bypass the noise and go straight to trusted suppliers—cutting time-to-market and minimizing operational risk.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global landscape, time is your most valuable resource. Don’t waste it sifting through unreliable leads or managing supplier failures.

👉 Act now to gain immediate access to SourcifyChina’s Verified Pro List—curated for performance, transparency, and scalability.

Contact our sourcing specialists today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let us streamline your China sourcing—so you can focus on growth, not guesswork.

SourcifyChina

Your Trusted Partner in Global Procurement Excellence

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.