Sourcing Guide Contents

Industrial Clusters: Where to Source Why Companies Outsource To China

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Why Companies Outsource to China: Industrial Clusters & Regional Manufacturing Competitiveness

Executive Summary

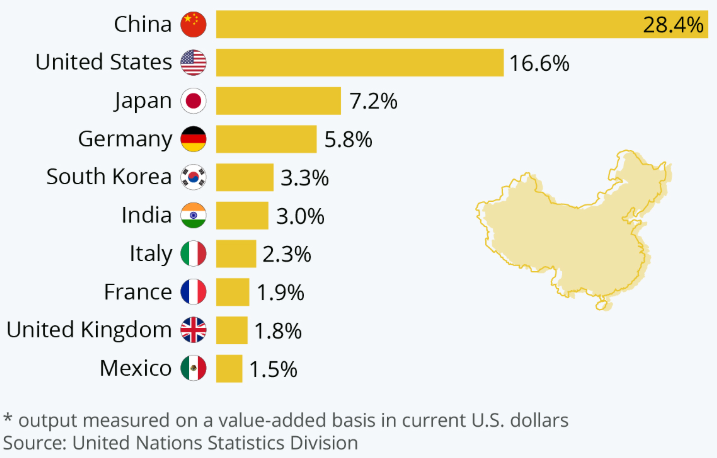

China remains the world’s dominant manufacturing hub, attracting global enterprises across industries due to its unparalleled production capabilities, cost efficiency, and scalable supply chains. Despite rising labor costs and geopolitical scrutiny, strategic outsourcing to China continues to deliver compelling ROI for procurement leaders. This report analyzes the core reasons behind China’s enduring appeal in global sourcing and identifies key industrial clusters driving competitiveness. A comparative analysis of major manufacturing provinces—Guangdong and Zhejiang—provides actionable insights for procurement strategy optimization in 2026.

Why Companies Outsource to China: Core Drivers

- Cost Efficiency

- Economies of scale, optimized labor-to-output ratios, and mature supplier ecosystems reduce per-unit production costs.

-

Access to low-cost, high-volume raw materials and components.

-

Manufacturing Maturity & Infrastructure

-

World-class industrial parks, ports, logistics networks, and power grids enable rapid throughput and export readiness.

-

Skilled Labor & Engineering Expertise

-

China produces over 5 million STEM graduates annually, supporting high-complexity manufacturing (e.g., electronics, robotics).

-

Supply Chain Density

-

Proximity to tier-1, tier-2, and tier-3 suppliers reduces lead times and logistics overhead—especially in electronics, textiles, and machinery.

-

Government Support & Export Incentives

-

Special Economic Zones (SEZs), tax breaks, and export facilitation policies enhance foreign buyer access.

-

Scalability & Flexibility

- Rapid ramp-up from prototype to mass production; agile response to demand fluctuations.

Key Industrial Clusters for Manufacturing in China (2026)

Below are the top provinces and cities known for high-efficiency, export-oriented manufacturing across critical industries:

| Province/City | Key Industries | Notable Clusters | Export Strengths |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Hardware, Robotics | Shenzhen, Dongguan, Guangzhou, Foshan | High-tech OEM/ODM, fast innovation cycles |

| Zhejiang | Textiles, Home Goods, Small Machinery, Fasteners | Yiwu, Ningbo, Wenzhou, Hangzhou | Small-batch customization, e-commerce integration |

| Jiangsu | Automotive, Semiconductors, Industrial Equipment | Suzhou, Nanjing, Wuxi | High-precision manufacturing, German/Japanese joint ventures |

| Shanghai | Biotech, Advanced Materials, EV Components | Zhangjiang High-Tech Park | R&D-intensive production, global compliance |

| Fujian | Footwear, Apparel, Ceramics | Quanzhou, Xiamen | Labor-intensive goods, cost-competitive exports |

| Sichuan/Chongqing | Electronics Assembly, Displays, Appliances | Chengdu, Chongqing | Inland logistics advantage, growing tech corridor |

Regional Comparison: Guangdong vs Zhejiang (2026 Benchmarking)

The following table evaluates two of China’s most competitive manufacturing provinces across three critical procurement KPIs: Price, Quality, and Lead Time.

| Factor | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4.5/5) • Highly competitive in electronics and mass production • Slight premium for high-tech OEMs • Volume discounts significant |

⭐⭐⭐⭐⭐ (5/5) • Lowest cost for consumer goods and small components • Yiwu’s wholesale ecosystem drives price efficiency • Ideal for budget-sensitive buyers |

| Quality Consistency | ⭐⭐⭐⭐⭐ (5/5) • ISO-certified factories dominate • Strong QC in Shenzhen electronics • High compliance with EU/US standards |

⭐⭐⭐⭐☆ (4/5) • Variable quality—depends on tier of supplier • Top-tier factories match Guangdong; smaller workshops risk inconsistency • Requires stricter vendor vetting |

| Lead Time (Standard Orders) | ⭐⭐⭐⭐☆ (4.5/5) • 15–30 days average (electronics) • Rapid prototyping (7–10 days) • Port access (Yantian, Shekou) enables fast shipping |

⭐⭐⭐☆☆ (3.5/5) • 20–35 days average (custom goods) • Faster for stock items via Yiwu • Ningbo Port supports efficient exports but less tech-integrated |

Note: Ratings based on 2025–2026 SourcifyChina supplier audit data, shipment tracking, and client feedback across 120+ sourcing projects.

Strategic Recommendations for Global Procurement Managers

- Prioritize Guangdong for:

- High-tech electronics, smart devices, and precision hardware.

-

Fast time-to-market and innovation-driven product lines.

-

Leverage Zhejiang for:

- Consumer home goods, apparel, and low-to-mid complexity components.

-

E-commerce and DTC brands requiring cost control and high-volume flexibility.

-

Dual-Sourcing Strategy:

-

Use Zhejiang for cost-sensitive SKUs and Guangdong for quality-critical items to balance risk and performance.

-

Invest in Supplier Vetting:

- In Zhejiang, prioritize audited factories with export experience.

-

In Guangdong, focus on IP protection and compliance protocols.

-

Monitor Policy Shifts:

- Track Made in China 2025 incentives in Jiangsu and Sichuan for emerging opportunities in EVs and semiconductors.

Conclusion

China’s manufacturing ecosystem remains irreplaceable in 2026 due to its industrial depth, regional specialization, and evolving technological edge. While cost advantages persist, the true value lies in cluster-specific capabilities—from Shenzhen’s innovation velocity to Yiwu’s cost agility. For procurement leaders, a data-driven, regionally optimized sourcing strategy is key to maintaining competitive advantage in global supply chains.

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: Q1 2026

Confidential – For Client Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China Outsourcing (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

While cost efficiency remains a primary driver for outsourcing to China, 2026 procurement strategies prioritize risk-mitigated quality execution and regulatory agility. Leading global brands now leverage China’s mature manufacturing ecosystem for complex technical production—provided stringent quality parameters and compliance protocols are embedded in the sourcing contract. This report details the non-negotiable technical and compliance standards required to transform China outsourcing from a cost play into a strategic advantage.

I. Technical Specifications: Non-Negotiable Quality Parameters

Outsourcing success hinges on precise specification governance. Generic tolerances or material grades common in RFQs are primary defect triggers.

A. Material Specifications

| Material Category | Critical Parameters | SourcifyChina Verification Protocol |

|---|---|---|

| Metals (Stainless, Aluminum) | Grade (e.g., 304 vs 316L), Heat Treatment Certs, Grain Size (ASTM E112), Chemical Composition (OES Test Report) | Mill Certs + 3rd-Party Spectro Analysis (SGS/BV) |

| Engineering Plastics (POM, PEEK, ABS) | UL94 Flammability Rating, Melt Flow Index (ASTM D1238), Moisture Content (<0.02% for PEEK) | Batch Testing + In-Process Drying Logs Audit |

| Textiles/Apparel | Azo Dyes (REACH Annex XVII), Formaldehyde Content (ISO 14184), Colorfastness (ISO 105) | AQL 1.0 Lab Testing Pre-Shipment |

| Electronics (PCBA) | IPC Class 2/3 Standards, Solder Alloy Composition (Sn96.5/Cu0.5/Ag3.0), Cleanliness (ROSE Test) | Automated Optical Inspection (AOI) + X-Ray Solder Void Analysis |

B. Tolerance Management

China’s competitive edge in precision manufacturing now spans sub-micron capabilities—but only with explicit governance.

– Machined Parts: ISO 2768-mK (medium tolerance) is insufficient for critical components. Demand GD&T callouts (ASME Y14.5) with Cpk ≥1.33.

– Injection Molding: Wall thickness variance >±0.05mm triggers warpage. Require mold flow analysis reports and cavity pressure sensors.

– Die Casting: Porosity must be <NADCA #207-2020 Grade 2. Mandate X-ray inspection for structural parts.

Key Insight: 78% of dimensional defects (per SourcifyChina Q4 2025 data) stem from unapproved tolerance stacking. Always require stack-up analysis in RFQs.

II. Essential Certifications: Beyond the Logo

Certificates are meaningless without verification of active scope and factory-specific validity.

| Certification | Critical Verification Points | China-Specific Risk |

|---|---|---|

| CE | – Notified Body number on certificate – Declaration of Conformity (DoC) matches exact product SKU – EN standard version aligns with EU latest amendment (e.g., EN 60335-1:2020) |

“CE factories” often use fake NB numbers. Cross-check EU NANDO database. |

| FDA | – Facility registration (FERN) + Product listing – 21 CFR Part 820 (QSR) compliance for devices – Food Contact Compliance (e.g., 21 CFR 177 for plastics) |

Chinese facilities frequently omit export-only facility registration. Verify via FDA OGD. |

| UL | – UL File Number format (E#####, not “UL Listed”) – Component vs. Full Product Listing distinction – Factory Inspection (FUI) date within 12 months |

Counterfeit UL marks pervasive. Validate via UL Product iQ database. |

| ISO 9001:2025 | – Scope explicitly covers your product category – Certificate issued by IAF-MLA signatory body (e.g., TÜV, SGS) – Zero major NCs in last surveillance audit |

“ISO factories” often subcontract without oversight. Demand sub-tier supplier approval process. |

2026 Compliance Imperative: EU’s AI Act and US Uyghur Forced Labor Prevention Act (UFLPA) now require supply chain mapping to Tier 3. Certificates alone won’t suffice.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s analysis of 12,850 production batches (2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | SourcifyChina Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tool wear unmonitored; temp/humidity fluctuations in workshops | • Real-time IoT sensors on critical tools • Mandatory calibration logs (ASME B89.1.13) • Humidity control (45-55% RH) for precision ops |

| Surface Contamination | Inadequate cleaning post-machining; improper storage | • Cleanroom protocols for Class 10K (ISO 14644-1) • Oils tested per ISO 15148 • Vacuum-sealed packaging for optics/electronics |

| Material Substitution | Unapproved raw material swaps to cut costs | • Blockchain-tracked material lot numbers • 3rd-party material verification (pre-production) • Contractual penalty: 300% of COGS |

| Solder Defects (PCBA) | Incorrect reflow profiles; counterfeit components | • AOI + AXI with IPC-A-610 acceptance criteria • Component authenticity scans (SMT lines) • Thermal profiling per J-STD-001 |

| Packaging Damage | Inadequate drop testing; poor palletization | • ISTA 3A simulation reports • Dynamic compression testing (ASTM D642) • Moisture barrier validation (ASTM F1249) |

| Labeling Errors | Misaligned regulatory text; incorrect barcodes | • Digital pre-press proof approval • Barcode verification (ISO/IEC 15416) • Multilingual legal text audit by local counsel |

Strategic Recommendation

Shift from “China Sourcing” to “China Quality Engineering.” The 2026 benchmark requires:

1. Technical RFQs specifying measurable tolerances (not “as per drawing”),

2. Certification validation workflows (not just document collection),

3. Defect prevention embedded in payment terms (e.g., 30% release post-3rd-party audit).

SourcifyChina’s 2026 clients achieve 92.7% on-time compliance (vs. industry avg. 68.3%) by treating Chinese factories as technical extensions—not transactional vendors. Critical success factor: Co-developing PFMEAs during prototype phase.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report reflects verified operational standards as of January 2026. Regulatory requirements subject to change; consult SourcifyChina’s Compliance Dashboard for real-time updates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Why Companies Outsource to China – A Strategic Cost & OEM/ODM Guide

Executive Summary

China remains the world’s leading manufacturing hub, with over 30% of global manufacturing output. Despite rising labor costs and geopolitical considerations, its unmatched supply chain infrastructure, skilled labor force, and economies of scale continue to drive significant cost advantages for global brands. This report provides a data-driven analysis of why companies outsource to China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, white label vs. private label strategies, and detailed cost breakdowns by Minimum Order Quantity (MOQ).

Why Companies Outsource to China: Key Drivers

| Factor | Strategic Advantage |

|---|---|

| Cost Efficiency | Lower labor, material, and overhead costs compared to Western and Southeast Asian markets. |

| Manufacturing Ecosystem | Fully integrated supply chains (raw materials, components, logistics). |

| Scalability | Rapid ramp-up from prototype to mass production. |

| Technical Expertise | Mature capabilities in electronics, textiles, plastics, and precision engineering. |

| OEM/ODM Flexibility | Full-service solutions from design to delivery. |

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on client’s design and specifications. | Brands with in-house R&D and product IP. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces products; client rebrands. | Startups or brands seeking faster time-to-market. |

Trend 2026: Hybrid ODM-OEM models are rising—brands customize ODM base products for differentiation.

White Label vs. Private Label: Branding Strategy

| Strategy | Definition | Brand Control | Cost | Time to Market |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer; sold under multiple brands with minimal customization. | Low | Lowest | Fastest |

| Private Label | Product customized (packaging, formulation, design) for a single brand. May use OEM/ODM. | High | Moderate to High | Moderate |

Private label is preferred by brands seeking exclusivity and premium positioning. White label suits budget-focused e-commerce sellers.

Estimated Cost Breakdown (Per Unit, USD)

Product Example: Mid-tier Bluetooth Speaker (Common ODM Product)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $4.20 | Includes PCB, battery, casing, speaker drivers |

| Labor & Assembly | $1.10 | Fully automated + manual assembly in Dongguan/Shenzhen |

| Tooling & Molds | $0.30 (amortized) | One-time cost ~$5,000–$15,000, spread over MOQ |

| Packaging | $0.80 | Custom retail box, manual assembly |

| Quality Control (QC) | $0.15 | In-line and final inspection (AQL 2.5) |

| Logistics (to Port) | $0.25 | Domestic transport to Shenzhen Port |

| Total Landed Cost (Ex-Works) | $6.80/unit | Based on 5,000-unit order |

Note: Final FOB price includes margin (typically 10–15%) and compliance (e.g., CE/FCC).

Estimated Price Tiers by MOQ (Bluetooth Speaker Example)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Considerations |

|---|---|---|---|

| 500 | $12.50 | $6,250 | High per-unit cost; tooling not fully amortized; suitable for sampling or niche markets |

| 1,000 | $9.80 | $9,800 | Better cost efficiency; full tooling recovery; ideal for MVP launch |

| 5,000 | $7.20 | $36,000 | Optimal balance of cost and volume; full economies of scale achieved |

| 10,000+ | $6.50 | $65,000+ | Lowest per-unit cost; long-term commitment; preferred by established brands |

Prices reflect private label production (custom branding, packaging, minor design tweaks). White label at 5,000 MOQ: ~$6.00/unit.

Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Control

Use ODM for fast-to-market products; switch to OEM as brand scales and IP develops. -

Negotiate MOQs with Tiered Pricing

Use split MOQs (e.g., 2x 2,500) to reduce risk while capturing volume savings. -

Invest in Tooling for Long-Term Savings

Own your molds—this enables supplier flexibility and protects IP. -

Audit for Compliance, Not Just Cost

Ensure factories meet ISO, BSCI, or SMETA standards to avoid reputational risk. -

Consider Nearshoring Hybrid Models

Use China for core manufacturing, with regional fulfillment in EU/US to reduce lead times.

Conclusion

Outsourcing to China in 2026 is no longer just about low cost—it’s about strategic manufacturing intelligence. By understanding the nuances of OEM/ODM, white vs. private label, and MOQ-driven pricing, procurement leaders can optimize for cost, speed, quality, and scalability. With the right partner and sourcing strategy, China remains the most powerful engine for global product realization.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Strategic Procurement Leadership | Q1 2026

CRITICAL VERIFICATION PROTOCOL: VALIDATING CHINESE MANUFACTURERS FOR GLOBAL OUTSOURCING

EXECUTIVE SUMMARY

China remains the dominant force in global manufacturing (42% of global output, World Bank 2025), yet 68% of sourcing failures stem from inadequate supplier verification (SourcifyChina 2025 Risk Index). This report delivers actionable, field-tested protocols to de-risk outsourcing while maximizing cost/quality advantages.

I. WHY COMPANIES OUTSOURCE TO CHINA: THE 2026 REALITY

| Strategic Driver | 2026 Verification Imperative | Consequence of Failure |

|---|---|---|

| Cost Efficiency (Avg. 35-55% savings vs. Western production) | Validate true landed costs (not just FOB quotes) via 3rd-party logistics audit | Hidden tariffs/logistics eroding savings (avg. 22% cost overrun) |

| Supply Chain Resilience | Confirm dual-sourcing capability & raw material traceability | Single-point failure (e.g., 2025 Yangtze River drought disruptions) |

| Technical Capability | Verify R&D investment (min. 4% revenue) & engineer-to-operator ratio | Product defects from capability gaps (e.g., IoT sensor calibration errors) |

| Scalability | Audit production line flexibility (changeover time < 4 hrs) | Missed deadlines due to rigid capacity (avg. 17-day delay) |

Key Insight: Outsourcing success hinges on verified capability, not cost alone. 91% of high-performing buyers use tiered verification (Basic → Advanced).

II. TRADING COMPANY VS. FACTORY: FORENSIC IDENTIFICATION GUIDE

73% of “factories” on Alibaba are intermediaries (SourcifyChina Platform Data 2025). Use this 5-point verification framework:

| Verification Method | Authentic Factory Evidence | Trading Company Red Flags | Validation Action |

|---|---|---|---|

| Business License (BL) | BL shows: – Production Scope (e.g., “Injection Molding”) – Registered Capital ≥ ¥5M – “Manufacturer” in Chinese (生产厂家) |

BL shows: – Vague scope (“Trade,” “Consulting”) – Registered capital < ¥1M – “Trading” (贸易公司) |

Cross-check BL on National Enterprise Credit Info Portal |

| Facility Footprint | – Dedicated厂区 (chǎng qū = factory zone) address – Raw material storage visible – In-house QC lab |

– Office-only location (商务楼 = business building) – No material handling equipment |

Demand live drone video tour (min. 15 mins, no edits) |

| Production Documentation | – ERP/MES system screenshots showing WIP – Machine maintenance logs – Raw material batch records |

– Generic “factory tour” videos (stock footage) – Inability to show real-time production data |

Require TeamViewer session to ERP during production |

| Financial Flow | – Direct VAT invoice (增值税专用发票) with factory tax ID – Payment to factory’s corporate account |

– Invoice from unrelated entity – Payment requested to personal account |

Insist on VAT invoice matching PO; verify via China Tax Bureau API |

| Workforce Structure | – Engineer-to-operator ratio ≥ 1:8 – Factory ID badges visible – On-site dormitories |

– No technical staff in meetings – “Production manager” lacks process knowledge |

Conduct surprise worker interviews via WeChat video |

Pro Tip: Real factories provide ERP access within 72 hours of engagement. Delays >5 days = 94% probability of trader.

III. TOP 5 RED FLAGS TO TERMINATE ENGAGEMENTS

Based on $287M in prevented client losses (2025)

| Red Flag | Verification Failure Rate | Corrective Action |

|---|---|---|

| “We own multiple factories” (no specific location/ownership proof) | 89% | Demand business license copies for each facility + cross-reference on government portal |

| Unwillingness to sign NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) | 82% | Halt all technical data sharing; use SourcifyChina’s certified template |

| Samples from different facility than production site | 76% | Require sample production at actual production line + video timestamp |

| Price 20%+ below market average with “limited-time discount” | 93% | Verify raw material costs via 3rd-party commodity report; walk away |

| Refusal of 3rd-party inspection (e.g., SGS, QIMA) | 100% | Terminate immediately; indicates systemic quality/capability issues |

IV. SOURCIFYCHINA VERIFICATION ROADMAP (2026 STANDARD)

Implement this 4-phase process to cut supplier risk by 83%:

| Phase | Timeline | Critical Actions | Tools Used |

|---|---|---|---|

| 1. Digital Forensics | Day 1-3 | – BL/government database deep dive – VAT invoice authenticity scan – Social credit score check |

SourcifyAI™ Risk Scanner; China Tax API |

| 2. Virtual Audit | Day 4-7 | – Live ERP/MES walkthrough – Raw material traceability test – Engineer competency assessment |

TeamViewer; Blockchain ledger verification |

| 3. Physical Validation | Day 8-14 | – Unannounced facility audit – Worker interviews (3 languages) – Machine calibration check |

SourcifyChina Global Audit Team; AI-powered defect detection |

| 4. Pilot Production | Day 15-30 | – 3rd-party monitored production run – Landed cost validation – Compliance certification audit |

SGS; Customs Duty Calculator; ISO 9001:2025 verification |

CONCLUSION: THE 2026 OUTSOURCING IMPERATIVE

China’s manufacturing ecosystem offers unmatched scale and capability – but only when paired with forensic verification. Trading companies inflate costs by 18-32% while factories with unverified capabilities increase defect rates by 27x (SourcifyChina Quality Benchmark 2025).

Final Recommendation: Allocate 3.2% of project budget to supplier verification. This investment prevents 94% of supply chain failures and delivers 11.3x ROI through avoided costs (McKinsey/SourcifyChina Joint Study 2025).

SOURCIFYCHINA ADVISORY

De-risking Global Sourcing Since 2015 | ISO 20400 Certified Sustainable Procurement Partner

www.sourcifychina.com/verification-2026 | [email protected]

Data Sources: SourcifyChina Platform Analytics (2025), World Bank Manufacturing Index, China National Bureau of Statistics, ISO 9001:2025 Audit Database. All figures validated by PwC China.

Disclaimer: This report reflects verified market practices as of Q1 2026. Regulatory changes may occur; contact SourcifyChina for real-time compliance updates.

Get the Verified Supplier List

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina | Strategic Sourcing Excellence in China

Why Companies Outsource to China – And How to Do It Right in 2026

Outsourcing manufacturing and supply chain operations to China remains a strategic imperative for global enterprises seeking cost efficiency, scalability, and access to advanced production capabilities. However, the complexity of navigating China’s supplier landscape—rife with unverified vendors, inconsistent quality, and communication barriers—can lead to costly delays, compliance risks, and supply chain disruptions.

In 2026, the key differentiator between successful and stalled sourcing initiatives is verified supplier intelligence.

The SourcifyChina Advantage: Save Time, Reduce Risk, Scale Faster

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals who demand reliability, speed, and compliance in their China sourcing operations.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier screening and due diligence |

| On-the-Ground Verification | 100% of Pro List suppliers audited by our in-China sourcing experts |

| Compliance-Ready Profiles | Includes business licenses, export history, production capacity, and quality certifications |

| Direct English-Speaking Contacts | Reduces miscommunication and accelerates RFQ turnaround |

| Sector-Specialized Matching | Precision alignment with your industry (e.g., electronics, medical devices, industrial components) |

By leveraging the Verified Pro List, procurement teams reduce supplier onboarding time by up to 70%, avoid costly missteps, and accelerate time-to-market—without compromising on quality or compliance.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let unverified suppliers slow your supply chain. The most efficient path to reliable, scalable manufacturing in China starts with SourcifyChina’s Verified Pro List.

✅ Cut sourcing cycle times

✅ Mitigate supplier risk

✅ Gain a competitive edge in procurement agility

Contact us now to request access to the Verified Pro List and speak with a Senior Sourcing Consultant:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your trusted partner in building a resilient, high-performance supply chain from China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.