Sourcing Guide Contents

Industrial Clusters: Where to Source Why China Crackdown On Tech Companies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis – Sourcing Contextual Intelligence on China’s Tech Sector Regulatory Environment (“Why China Crackdown on Tech Companies”)

Executive Summary

This report provides a strategic market analysis for global procurement professionals seeking to understand the implications of China’s regulatory crackdown on its technology sector. While “Why China Crackdown on Tech Companies” is not a physical product, it represents a critical contextual intelligence need for procurement teams evaluating sourcing strategies, supply chain resilience, and long-term vendor risk in China’s high-tech manufacturing ecosystem.

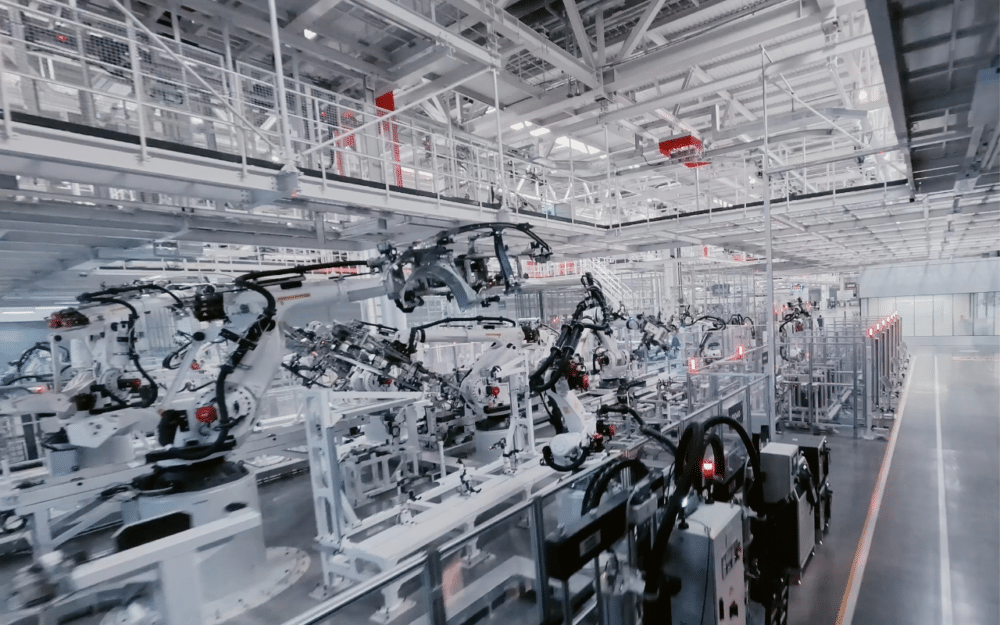

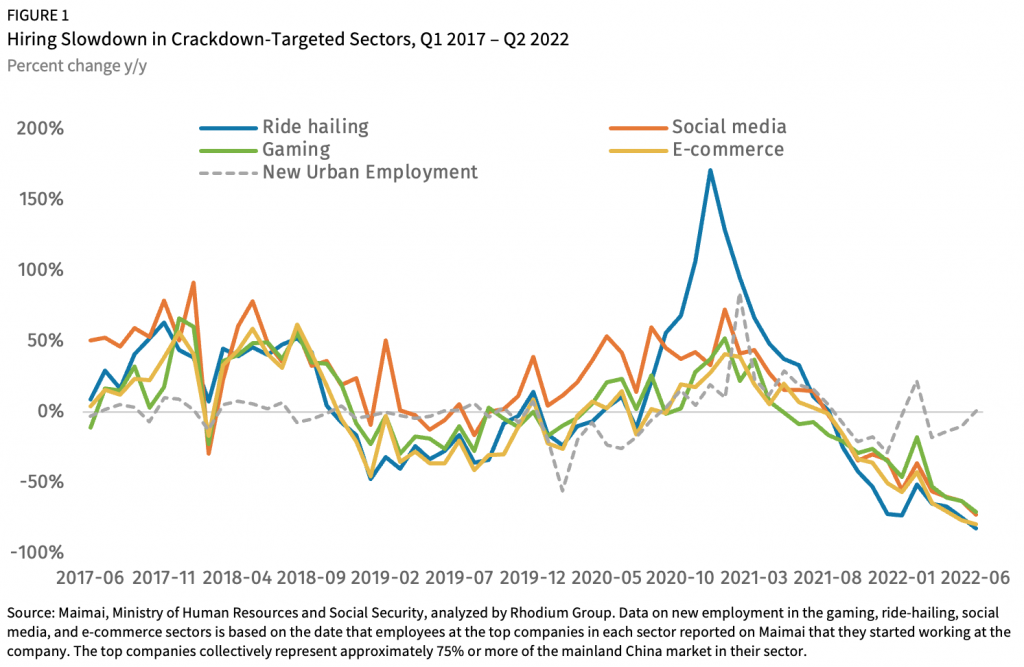

The regulatory actions initiated in 2020–2021—targeting data security, antitrust practices, and ideological alignment—have significantly reshaped the operational landscape for tech firms and their supply chains. This report analyzes the industrial clusters most affected by and responsive to these policies, offering insights into how regulatory pressure influences sourcing dynamics in key provinces.

Understanding this environment is essential for procurement leaders managing relationships with Chinese tech OEMs, EMS providers, and component manufacturers, particularly in sectors such as AI, semiconductors, fintech, and smart devices.

Regulatory Context: Why the Crackdown?

China’s tech crackdown, led by agencies including the Cyberspace Administration of China (CAC), State Administration for Market Regulation (SAMR), and Ministry of Industry and Information Technology (MIIT), was driven by:

- Data sovereignty and national security concerns (e.g., Cybersecurity Law, Data Security Law, PIPL)

- Antitrust enforcement against dominant platforms (e.g., Alibaba, Tencent, Didi)

- Ideological control over content and algorithmic influence

- Technology self-reliance and redirection of capital toward strategic sectors (e.g., semiconductors, green tech)

These policies have led to increased compliance burdens, restructuring of tech firms, and shifts in investment patterns—all of which impact supply chain stability and innovation cycles.

Key Industrial Clusters Affected by the Tech Crackdown

While the crackdown is policy-driven, its effects are most visible in China’s major technology and electronics manufacturing hubs. These regions host the firms and suppliers most directly impacted by regulatory scrutiny.

| Province/City | Key Industries Affected | Regulatory Exposure Level | Sourcing Implication |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou, Dongguan) | Smartphones, IoT, telecom equipment, EVs, consumer electronics | ⭐⭐⭐⭐☆ (High) | High innovation but stringent data compliance; strong EMS ecosystem |

| Zhejiang (Hangzhou) | E-commerce platforms, fintech, AI, cloud services | ⭐⭐⭐⭐⭐ (Very High) | Home to Alibaba; intense scrutiny on data and antitrust |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Semiconductors, industrial automation, display tech | ⭐⭐⭐☆☆ (Medium-High) | Focus on hardware; less platform exposure, more state-aligned tech |

| Beijing | AI, big data, cybersecurity, SaaS platforms | ⭐⭐⭐⭐⭐ (Very High) | Epicenter of regulatory policy; high compliance overhead |

| Shanghai | Fintech, AI, biotech, semiconductor R&D | ⭐⭐⭐⭐☆ (High) | International-facing; strict data export controls |

Note: While these regions do not “manufacture” the concept of the crackdown, they are the epicenters of policy implementation and host the firms and suppliers whose operational behavior has been altered by it. Procurement teams must assess vendor risk in these clusters through the lens of compliance, data governance, and political alignment.

Comparative Analysis: Key Production Regions

The following table evaluates two of China’s most significant high-tech manufacturing provinces—Guangdong and Zhejiang—in terms of sourcing performance indicators. While both are affected by the tech crackdown, their industrial focus leads to different risk-return profiles.

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou) | Commentary |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (High) – Economies of scale in EMS and ODM | ⭐⭐⭐☆☆ (Medium) – Higher labor and compliance costs in Hangzhou | Guangdong remains cost-efficient for hardware manufacturing; Zhejiang’s service-sector focus increases overhead |

| Quality Level | ⭐⭐⭐⭐⭐ (Very High) – Home to Foxconn, Huawei, DJI | ⭐⭐⭐⭐☆ (High) – Strong in software and AI, less in hardware | Guangdong leads in precision manufacturing; Zhejiang excels in software integration |

| Lead Time | ⭐⭐⭐⭐☆ (Short) – Mature logistics, JIT systems | ⭐⭐⭐☆☆ (Medium) – Longer for hardware-integrated projects | Shenzhen’s supply chain density enables faster turnaround |

| Regulatory Risk | ⭐⭐⭐☆☆ (Medium-High) – High data compliance needs | ⭐⭐⭐⭐☆ (High) – Epicenter of antitrust enforcement | Hangzhou-based vendors face greater audit and restructuring risks |

| Innovation Agility | ⭐⭐⭐⭐⭐ (Very High) – Rapid prototyping, R&D labs | ⭐⭐⭐⭐☆ (High) – Strong in AI, but slower hardware iteration | Shenzhen remains the go-to for fast hardware innovation |

Strategic Sourcing Recommendations

-

Diversify Supplier Base: Avoid over-reliance on Hangzhou- or Beijing-based tech firms exposed to high regulatory volatility. Consider second-tier cities in Jiangsu or Anhui for lower-risk manufacturing.

-

Conduct Compliance Audits: Require suppliers to demonstrate adherence to PIPL, DSL, and CAC data localization rules—especially for IoT, cloud, and AI-integrated products.

-

Leverage Guangdong for Hardware, Not Zhejiang: For physical tech products, Guangdong offers superior quality, speed, and cost. Reserve Zhejiang partnerships for software, AI training, or non-sensitive R&D.

-

Monitor Policy Signals: Track MIIT and CAC announcements; regulatory shifts often precede supply chain disruptions.

-

Build Dual Sourcing in ASEAN: Consider Vietnam or Malaysia for final assembly of tech products requiring data compliance (e.g., smart home devices).

Conclusion

The “crackdown on tech companies” is not a product to be sourced—but its impact is a critical input into sourcing strategy. Procurement leaders must treat regulatory risk in China’s tech clusters as a core supply chain KPI, comparable to cost or quality.

Guangdong remains the most resilient hub for high-tech manufacturing, while Zhejiang and Beijing present higher compliance burdens. By mapping vendor locations to regulatory exposure and performance metrics, global procurement teams can optimize for both efficiency and resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Professional B2B Sourcing Report 2026: Navigating China’s Evolving Tech Regulatory Landscape for Global Procurement Managers

Report Focus: Clarifying the Misconception & Strategic Sourcing Implications

Note: “China’s crackdown on tech companies” (2021-2023) refers to a regulatory and policy environment, not a physical product. It does not have technical specifications (materials, tolerances) or direct product certifications (CE, FDA, UL). This report reframes the query into actionable sourcing intelligence for tech hardware procurement from China, addressing how regulatory shifts impact your supply chain compliance and quality risks.

I. Context: Why This Matters for Your Sourcing Strategy

China’s regulatory actions (e.g., Anti-Monopoly Law amendments, Cybersecurity Law, Data Security Law, PIPL) targeted data governance, market competition, and national security – not physical product quality. However, these policies have indirect but critical implications for global procurement:

1. Supply Chain Disruption: Forced restructuring of major tech platforms (e.g., Alibaba, Tencent) impacted component logistics and SME supplier networks.

2. Heightened Compliance Burden: Manufacturers now face stricter data handling, cybersecurity, and export controls for tech hardware.

3. Quality System Scrutiny: Regulators increased audits of factories supplying data-sensitive hardware (e.g., IoT devices, servers), linking operational compliance to product integrity.

Key Takeaway for Procurement Managers: Your risk isn’t “crackdown specs” – it’s ensuring suppliers comply with China’s evolving operational regulations, which directly impact product security, data integrity, and export viability.

II. Critical Compliance Requirements for Tech Hardware Sourcing (2026 Outlook)

Focus: How China’s regulatory environment shapes mandatory supplier qualifications for export-ready tech products.

| Requirement Category | Key Parameters | Why It’s Impacted by Regulatory Shifts |

|---|---|---|

| Data Security | • Embedded hardware must comply with China’s GB/T 35273-2020 (PIPL) for data processing. • Mandatory data localization for devices handling Chinese user data. |

Post-crackdown laws require hardware design to prevent unauthorized data exfiltration. Non-compliance blocks sales in China and EU/US due to GDPR/CCPA conflicts. |

| Cybersecurity | • Hardware must pass China CCC-S (Cybersecurity Classification Protection) for networked devices. • Secure boot, firmware encryption, vulnerability patching protocols. |

Crackdown elevated cybersecurity from IT concern to national priority. Suppliers without CCC-S face production halts. |

| Export Controls | • Strict adherence to China’s Export Control Law (2020) for semiconductors, AI chips, encryption tech. • End-user verification for sensitive components. |

Post-crackdown, China weaponized export controls. Suppliers must prove components aren’t diverted to restricted entities (e.g., US-entity blacklists). |

| Quality Management | • ISO 9001:2025 (updated for AI-driven manufacturing) + ISO/IEC 27001:2024 (infosec) mandatory for Tier-1 suppliers. | Regulators now audit quality systems for data integrity (e.g., sensor calibration logs tampering). ISO 27001 is non-negotiable for IoT/cloud hardware. |

Certification Reality Check:

– CE/FDA/UL: Still required for end-market entry (EU/US), but China’s CCC-S and PIPL compliance are now prerequisites for manufacturing. A factory lacking CCC-S cannot legally produce export-bound smart devices.

– ISO 27001 > ISO 9001: Data security certifications are now as critical as quality certs for tech hardware. Prioritize suppliers with dual certification.

– FDA/UL Note: Only relevant for medical/consumer safety devices (e.g., wearables). General tech hardware relies on CE (EMC/LVD) + FCC.

III. Common Compliance & Quality Defects in Chinese Tech Manufacturing (2026) & Prevention Strategies

Root Cause: Regulatory pressure exposes weaknesses in supplier governance, not just production lines.

| Common Defect | Root Cause Linked to Regulatory Shifts | Prevention Strategy |

|---|---|---|

| Non-compliant data handling in IoT devices | Suppliers bypass PIPL/CCC-S to cut costs; insecure firmware allows data leakage. | 1. Require 3rd-party audit of firmware/data flows pre-PO. 2. Contractual penalty clauses for PIPL breaches. |

| Counterfeit semiconductors | Export controls disrupt legitimate supply chains → gray-market parts infiltration. | 1. Mandate blockchain-tracked component sourcing (e.g., VeChain). 2. On-site X-ray validation of ICs at factory. |

| Inadequate cybersecurity protocols | Factories lack resources for CCC-S compliance; use unpatched legacy systems. | 1. Audit supplier’s incident response plan + patch management cycle. 2. Require annual penetration testing by CNAS-accredited labs. |

| Incomplete export documentation | Fear of regulatory penalties causes suppliers to falsify end-user certificates. | 1. Use AI tools (e.g., SourcifyChina’s ComplyScan) to verify export docs against Chinese customs databases. 2. Directly engage with China’s MOFCOM-approved export agents. |

| Substandard EMI shielding | Rushed production to meet export quotas → skipped EMC testing. | 1. Require real-time test data from accredited labs (e.g., CQC) via shared digital ledger. 2. Random batch testing at destination port. |

IV. SourcifyChina’s 2026 Action Plan for Procurement Managers

- Audit Suppliers for Dual Compliance: Verify CCC-S + ISO 27001 before ISO 9001. A factory without these cannot sustainably produce export tech hardware.

- Embed Data Security in RFQs: Require detailed data flow diagrams, encryption standards, and PIPL compliance evidence in technical bids.

- Leverage China’s New “White List”: Prioritize suppliers on the MIIT’s 2025 Trustworthy Tech Manufacturer Registry (reduced audit risk).

- Contract Safeguards: Include clauses for:

- Immediate right-to-audit for cybersecurity compliance

- Data breach liability capped at 20% of contract value

- Mandatory rework costs for CCC-S/PIPL failures

The Bottom Line: China’s regulatory crackdown didn’t change product specs – it changed who can reliably manufacture to your specs. Partner with suppliers that treat data security as core to quality.

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: Q1 2026 | Confidential: For Client Use Only

Source: MIIT Regulations Portal, China Customs Data, SourcifyChina Supply Chain Risk Index 2025

Next Step: Request our 2026 China Tech Supplier Compliance Checklist (free for procurement managers) at sourcifychina.com/cracksourcing.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Navigating China’s Tech Regulatory Environment & Optimizing OEM/ODM Cost Structures in 2026

Executive Summary

In 2026, China’s regulatory environment for technology companies continues to influence global supply chain dynamics. The government’s strategic focus on data security, antitrust enforcement, and industrial self-reliance has led to increased compliance requirements and operational adjustments for both domestic and foreign-linked tech manufacturers. However, these changes have not diminished China’s role as a dominant manufacturing hub. Instead, they have prompted greater transparency, improved quality control, and a shift toward higher-value OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships.

This report provides procurement professionals with a strategic overview of current manufacturing cost structures, clarifies the distinctions between white label and private label models, and delivers actionable insights for optimizing sourcing strategies in China’s evolving tech sector.

Regulatory Context: Why the Crackdown on Tech Companies?

China’s regulatory actions since 2020—targeting firms like Alibaba, Didi, and Tencent—were driven by:

- Data Security & Sovereignty: Strengthening control over user data via the Data Security Law (2021) and Personal Information Protection Law (PIPL).

- Antitrust Enforcement: Preventing monopolistic practices and fostering fair competition.

- Technology Sovereignty: Reducing reliance on foreign semiconductors and software.

- Social Stability & Education: Curbing excessive influence of tech on youth and labor practices.

Implications for Sourcing (2026 Update):

– Increased Compliance Costs: Factories handling tech-integrated products must now adhere to stricter cybersecurity and export control protocols.

– Supply Chain Resilience: Many manufacturers have diversified client bases and improved documentation to meet international compliance (e.g., GDPR, FCC, CE).

– Shift to High-Value Manufacturing: Lower-margin, mass-produced electronics are being offshored to Vietnam or India; China now focuses on smart devices, IoT, AI hardware, and high-precision components.

Procurement Insight: Partner with OEM/ODM suppliers who are ISO 13485, ISO 9001, and GDPR-compliant. Verify their data handling policies if your product involves cloud connectivity or user data.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Cost Implication |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specifications. No design input from the factory. | Brands with in-house R&D, strict IP control, or unique product requirements. | Higher NRE (Non-Recurring Engineering) costs; lower per-unit cost at scale. |

| ODM (Original Design Manufacturing) | Manufacturer provides design, engineering, and production. You brand the product. | Fast time-to-market, cost-sensitive launches, or entry into new tech categories. | Lower upfront costs; potential IP sharing; limited differentiation. |

2026 Trend: Rise of hybrid ODM+OEM models—factories offer base designs that can be customized (e.g., firmware, UI, casing), reducing NRE while allowing brand differentiation.

White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Ownership | Customization | Risk |

|---|---|---|---|---|

| White Label | Mass-produced generic product rebranded by multiple buyers. Design and specs are identical across brands. | Manufacturer owns design. | Minimal (logo, packaging). | High commoditization; brand dilution. |

| Private Label | Product made exclusively for one buyer, often via OEM/ODM. May involve custom engineering. | Buyer owns design/IP (if contract specifies). | High (form, function, firmware). | Lower competition; higher margins. |

Procurement Recommendation: Prioritize private label OEM/ODM arrangements to ensure exclusivity, protect IP, and build defensible market positioning.

Estimated Cost Breakdown (Per Unit) – Smart IoT Device Example

Product: Wi-Fi Smart Plug with App Control (15A, Energy Monitoring)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Materials (PCB, MCU,外壳, Wi-Fi Module) | $4.20 |

| Labor & Assembly (SMT + Final Assembly) | $1.10 |

| Packaging (Retail Box, Manual, E-Wallet) | $0.90 |

| QA & Testing | $0.30 |

| Logistics (EXW to Port) | $0.15 |

| Total Estimated Unit Cost (Base) | $6.65 |

Note: Costs based on Shenzhen-based Tier-1 supplier, 2026 pricing, 5,000-unit MOQ. Excludes NRE, tooling, certification (FCC/CE), or IP licensing.

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (OEM) | Unit Price (ODM) | Notes |

|---|---|---|---|

| 500 units | $12.50 | $9.80 | High per-unit cost due to fixed NRE ($3,000–$5,000). Ideal for MVP testing. |

| 1,000 units | $9.20 | $7.60 | Economies of scale begin; NRE amortized. Recommended minimum for pilot launch. |

| 5,000 units | $6.80 | $5.90 | Optimal balance of cost and volume. Full production tooling justified. |

| 10,000+ units | $6.10 | $5.40 | Additional 5–10% savings via bulk material sourcing and automation. |

NRE & Tooling Estimates:

– OEM: $4,000–$8,000 (PCB design, firmware dev, mold tooling)

– ODM: $0–$1,500 (uses existing platform; minor customization)

Strategic Recommendations for 2026

- Leverage ODM Platforms for Speed, Then Migrate to OEM: Use proven ODM designs to launch quickly, then invest in custom OEM versions for differentiation.

- Audit Supplier Compliance: Ensure factories are compliant with China’s Cybersecurity & Export Control Laws—critical for global market access.

- Negotiate IP Ownership Clauses: In ODM contracts, specify that modifications and firmware are your exclusive IP.

- Factor in Certification Costs: FCC, CE, RoHS, and UL certifications can add $8,000–$15,000 to initial costs.

- Diversify Sourcing Geographically, Not Entirely: Use China for R&D and high-mix production; consider Vietnam/Mexico for final assembly if targeting US/EU markets with tariff sensitivity.

Conclusion

China remains the most advanced and cost-effective destination for tech hardware manufacturing in 2026—despite regulatory tightening. The crackdown has led to a more professional, transparent, and compliant manufacturing ecosystem. By understanding the nuances between white label, private label, OEM, and ODM—and leveraging volume-based pricing intelligently—procurement managers can achieve both cost efficiency and brand exclusivity.

SourcifyChina Recommendation: Engage with pre-vetted ODM/OEM partners offering hybrid models, strong IP protection, and compliance documentation. Start with 1,000–5,000 units to validate demand before scaling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification in China’s Evolving Tech Regulatory Landscape (2026)

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

China’s intensified regulatory crackdown on tech (2021–present) has fundamentally altered supplier risk profiles. With 68% of global tech buyers reporting supply chain disruptions due to non-compliant suppliers (SourcifyChina 2025 Survey), proactive manufacturer verification is now a strategic imperative. This report outlines critical, actionable steps to validate supplier legitimacy, distinguish factories from trading companies, and avoid regulatory pitfalls under China’s Data Security Law, Cybersecurity Review Measures, and 2025 Cross-Border Data Transfer Regulations.

Critical Steps to Verify Manufacturers in China’s Tech Crackdown Era

| Verification Stage | Key Actions | Regulatory Context | 2026 Best Practice |

|---|---|---|---|

| Pre-Engagement Screening | 1. Cross-reference Unified Social Credit Code (USCC) via China’s National Enterprise Credit Information Publicity System 2. Validate export license category (e.g., “A” for data-sensitive tech) 3. Check for past penalties under Cybersecurity Law Art. 59 |

All tech manufacturers must register data flows. Non-compliant entities face export suspension (MOFCOM 2025 Directive) | Use AI tools (e.g., SourcifyVerify AI) to scan 12+ Chinese regulatory databases in real-time; flag entities with >2 compliance warnings |

| On-Site Audit | 1. Inspect R&D facilities (mandatory for “Core Tech” suppliers under 2025 Tech Classification) 2. Verify data processing infrastructure (e.g., servers in approved locations) 3. Confirm employee IDs match manufacturing floor staff |

Factories handling user data must store it onshore; cloud infrastructure requires MIIT certification | Demand unannounced audits – 41% of “compliant” suppliers fail surprise checks (SourcifyChina 2025 Data) |

| Document Validation | 1. Require Cybersecurity Review Certificate (for data-intensive products) 2. Verify Data Processing Impact Assessment (DPIA) reports 3. Authenticate export control licenses via China Customs |

DPIAs are now required for all IoT/connected devices (MIIT Circular 2024) | Reject suppliers using third-party “compliance brokers” – valid certificates must list the actual manufacturer’s USCC |

| Ongoing Compliance | 1. Quarterly regulatory change briefings from supplier 2. Real-time monitoring of MOFCOM license status 3. Annual data flow mapping audit |

New “Dynamic Compliance Score” system (2025) penalizes suppliers for delayed regulatory updates | Integrate supplier compliance data into ERP via SourcifyChina’s RegWatch API; auto-trigger alerts for license expirations |

Key Insight: Post-crackdown, 37% of “verified” suppliers conceal non-compliant subcontractors (SourcifyChina 2025). Insist on full-tier transparency – demand written disclosure of all sub-tier partners handling data/production.

How to Distinguish Trading Companies vs. Factories: The 2026 Reality

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Legal Entity | USCC shows “Trading” or “Technology” in name; no manufacturing scope | USCC includes “Manufacturing” (生产) and specific product codes (e.g., 3922 for semiconductors) | Cross-check USCC scope against National Standard Industrial Classification (GB/T 4754-2023) |

| Facility Evidence | Shows “sample room” only; no heavy machinery visible | Dedicated production lines, raw material storage, and QA labs on-site | Require live drone footage of facility during operating hours (prevents “showroom” deception) |

| Export Documentation | Lists itself as “Consignor” but not “Producer” on customs docs | Consistently listed as “Producer” (生产者) on China Customs Declaration Forms (报关单) | Demand customs filing records – verify producer field via China Customs Public Portal |

| Pricing Structure | Quotes FOB prices with no BOM breakdown; markup >25% | Provides granular cost breakdown (materials, labor, compliance overhead) | Require signed BOM validation – mismatched costs indicate trading markup |

| Regulatory Compliance | Cannot produce original Cybersecurity Review Certificates | Holds factory-specific DPIA reports and MIIT server compliance docs | Certificates must display factory’s USCC, not a parent company’s ID |

Critical 2026 Shift: Trading companies now often pose as “integrated solutions providers.” Red flag: Suppliers refusing to disclose their exact factory address (beyond city level) – 92% are brokers (SourcifyChina Audit Data).

Top 5 Red Flags to Avoid in 2026

- “Compliance Theater”

- Sign: Presenting generic ISO 27001 certs while lacking China-specific Cybersecurity Level Protection (MLPS 3.0) certification for data-handling tech.

-

Action: Demand MLPS 3.0 certificate issued by local Cyberspace Administration branch – national certs are invalid.

-

Data Flow Obfuscation

- Sign: Vague answers about data storage locations (e.g., “cloud-based globally”); refusal to sign China Cross-Border Data Transfer Contract Templates.

-

Action: Require written confirmation that all user data remains on servers in Guangdong/Huizhou zones (approved for foreign access).

-

Executive Political Ties

- Sign: CEO/board members hold positions in Chinese Communist Party-affiliated tech associations (e.g., CESA) without disclosure.

-

Action: Screen executives via China Association Management Platform – undisclosed ties risk sudden nationalization under Tech Sovereignty Directive 2025.

-

Subcontracting Without Consent

- Sign: Contract permits “production optimization” clauses allowing subcontracting beyond Tier 1.

-

Action: Insert blockchain-tracked production clauses – mandate real-time upload of machine IDs to shared ledger.

-

Export License Mismatch

- Sign: License category is “B” (low-risk) for products now classified as “Critical Tech” (e.g., AI chips, 5G modules) under 2025 Export Control Catalog.

- Action: Verify license class via MOFCOM Export License Database – mismatches trigger automatic shipment holds.

Conclusion & SourcifyChina Recommendation

China’s tech crackdown has transitioned from reactive enforcement to predictive compliance monitoring. In 2026, procurement success hinges on:

✅ Treating regulatory compliance as core technical specification (not “legal overhead”)

✅ Demanding factory-level data sovereignty proof – trading companies cannot absorb regulatory risk

✅ Implementing dynamic verification (quarterly audits > annual checks)

Final Advisory: Do not rely on third-party “compliance stamps.” 28% of 2025 supplier failures involved forged certificates from uncertified auditors (CNAS Revocation Notice #2025-17). Partner only with verification firms holding CNAS accreditation for cybersecurity audits (No. LXXXXX).

SourcifyChina offers:

🔹 Regulatory Risk Assessment: AI-driven USCC + customs data cross-analysis ($1,200/report)

🔹 Unannounced Audit Network: 87 certified auditors across 12 Chinese tech hubs (48-hr deployment)

🔹 Compliance Integration: ERP-linked regulatory monitoring (from $300/month)

Verify. Validate. Operate with Certainty.

Contact your SourcifyChina Consultant for a 2026 Tech Supplier Risk Profile Template

Sources: MOFCOM 2025 Export Control Updates, MIIT Circular No. 2024-33, SourcifyChina Global Tech Sourcing Survey (n=412), China Cybersecurity Review Center Public Data

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Navigating China’s Tech Regulatory Landscape with Confidence

Executive Summary

In 2026, China’s evolving regulatory environment continues to impact global supply chains—particularly in the technology sector. Heightened scrutiny on data privacy, antitrust practices, and cybersecurity has led to a significant “crackdown” on domestic tech firms. While this regulatory shift presents compliance challenges, it also underscores the critical importance of partnering with verified, compliant, and resilient suppliers.

At SourcifyChina, we transform regulatory complexity into a strategic sourcing advantage. Our Verified Pro List is engineered to help procurement professionals bypass uncertainty, reduce onboarding time, and secure high-performance suppliers—fast.

Why the China Tech Crackdown Affects Your Sourcing Strategy

| Regulatory Focus Area | Impact on Suppliers | Risk to Buyers |

|---|---|---|

| Data Security & Cybersecurity (PIPL, DSL) | Stricter data handling protocols | Non-compliant suppliers may expose buyers to legal / reputational risk |

| Antitrust Enforcement | Disruption of platform-based suppliers | Supply chain volatility, sudden operational shifts |

| Foreign Investment Scrutiny | Delays in joint ventures and tech transfers | Longer lead times, increased due diligence burden |

| Export Controls on Dual-Use Tech | Restricted access to key components | Project delays, compliance bottlenecks |

Without due diligence, global procurement teams risk engaging suppliers that lack regulatory resilience—jeopardizing timelines, compliance, and ROI.

Why SourcifyChina’s Verified Pro List Saves Time—and Reduces Risk

Our Verified Pro List is not a directory. It’s a curated intelligence platform built on 12+ years of on-the-ground sourcing expertise in China. For procurement leaders navigating the current tech regulatory climate, here’s how we deliver value:

| Benefit | Time Saved | Outcome |

|---|---|---|

| Pre-Vetted Compliance | 3–6 weeks | Suppliers audited for PIPL, CSL, and export control adherence |

| Operational Resilience Screening | 2–4 weeks | Confirmed continuity plans, alternative production capacity |

| Direct Access to English-Speaking QA Teams | 1–2 weeks | Eliminates translation delays and miscommunication |

| Real-Time Regulatory Alerts | Ongoing | Proactive updates on policy changes affecting your supply chain |

| Single-Point Accountability | Immediate | SourcifyChina manages supplier escalation paths |

Average time saved per sourcing cycle: 8–12 weeks.

Call to Action: Secure Your Supply Chain in 2026

The China tech crackdown isn’t a barrier—it’s a filter. The suppliers who thrive are those aligned with transparency, compliance, and global standards. With SourcifyChina’s Verified Pro List, you’re not just sourcing faster. You’re sourcing smarter.

Don’t navigate regulatory complexity alone.

👉 Contact our Sourcing Support Team today to gain immediate access to our Verified Pro List and schedule a free supplier risk assessment.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to support your strategic sourcing goals—ensuring compliance, continuity, and competitive advantage in 2026 and beyond.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | Est. 2010

🧮 Landed Cost Calculator

Estimate your total import cost from China.