Sourcing Guide Contents

Industrial Clusters: Where to Source Why Are Foreign Companies Leaving China

SourcifyChina Strategic Sourcing Report: China Manufacturing Relocation Trends Analysis (2026)

Prepared for: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Contrary to the phrasing of the query, “sourcing ‘why are foreign companies leaving China’” is not a tangible product category. This report reframes the request into its likely intent: a strategic analysis of manufacturing relocation trends from China and identification of key industrial clusters impacted by or adapting to this shift. Foreign companies are not “leaving China” uniformly; rather, supply chains are undergoing strategic diversification driven by geopolitical, cost, and resilience factors. China remains the world’s largest manufacturing hub ($4.9T output in 2025), but labor-intensive, low-margin sectors are increasingly relocating to Southeast Asia, Mexico, and India. This report analyzes where this shift is most pronounced in China and compares core manufacturing regions for buyers maintaining or re-optimizing China-based sourcing.

Key Misconception Clarification

- “Sourcing ‘why companies are leaving China’” is not feasible. This is a market dynamic, not a product. SourcifyChina advises clients on physical goods (e.g., electronics, textiles, machinery).

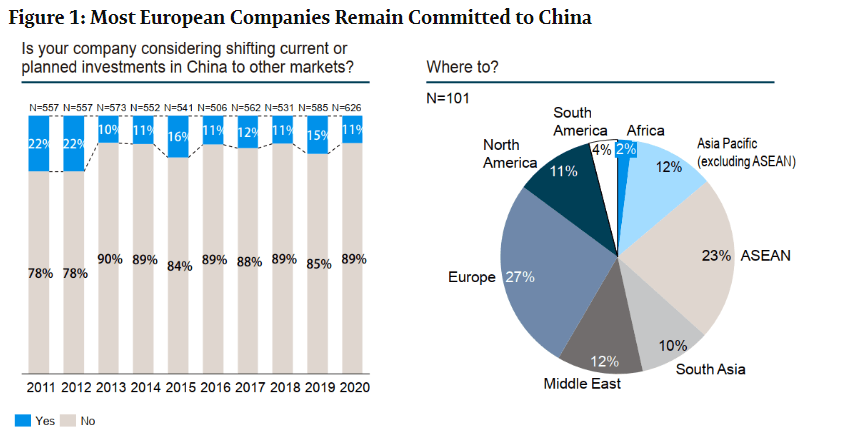

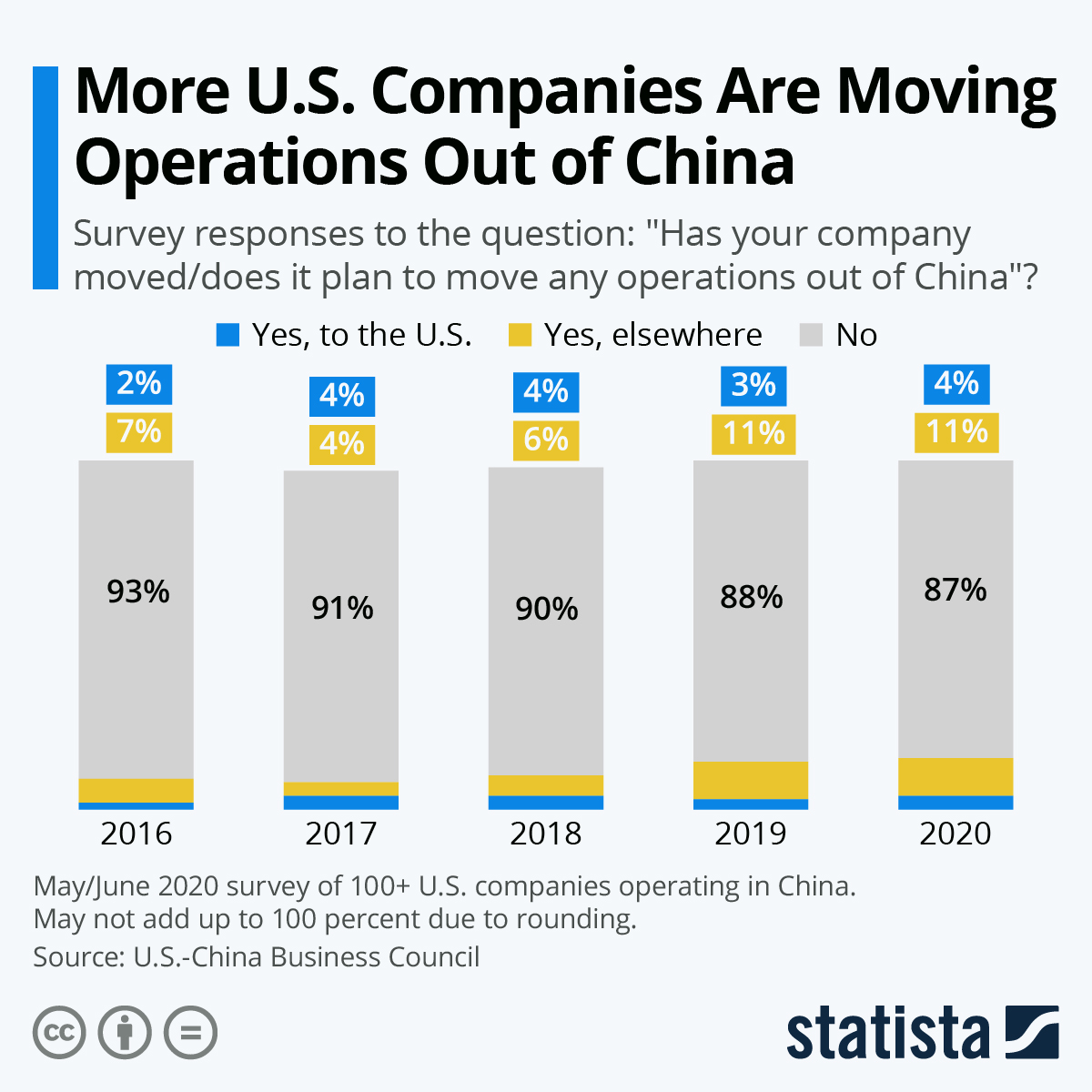

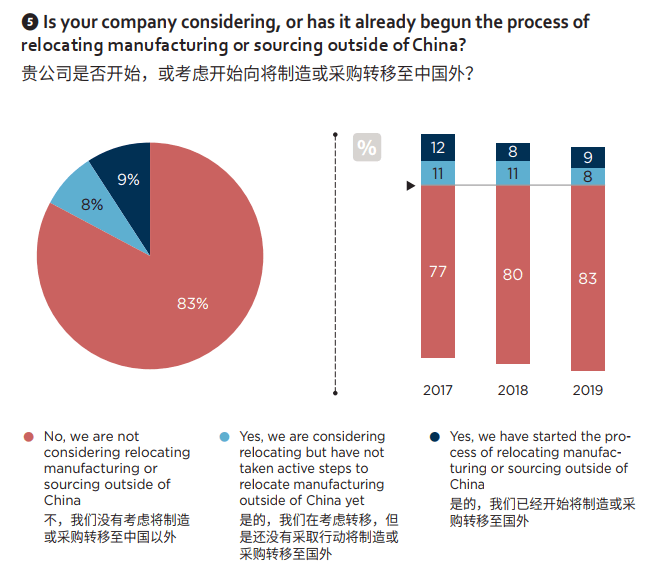

- Reality: Foreign firms are rebalancing portfolios, not abandoning China. High-value, automated, or China-market-focused production often expands, while low-cost assembly shifts. 68% of EU firms (EU Chamber of Commerce, 2025) and 52% of US firms (AmCham China, 2025) maintain or increase China investment, but 73% actively diversify some production elsewhere.

Industrial Clusters Impacted by Relocation Trends

Relocation is concentrated in labor-intensive, low-to-mid value-added sectors. Key Chinese provinces/cities experiencing relative outflow:

| Province/City | Primary Affected Sectors | Relocation Driver Intensity | Current Strategic Focus |

|---|---|---|---|

| Guangdong | Textiles, Footwear, Basic Electronics Assembly, Toys | ⭐⭐⭐⭐ (High) | Automation, EVs, Advanced Electronics (Shenzhen/Dongguan) |

| Jiangsu | Mid-tier Electronics, Furniture, Plastics | ⭐⭐ (Moderate) | Semiconductors, Biotech, High-End Machinery (Suzhou) |

| Zhejiang | Garments, Home Goods, Small Machinery, Fast Fashion | ⭐⭐⭐ (High-Moderate) | E-commerce Integration, Smart Manufacturing (Yiwu/Hangzhou) |

| Fujian | Footwear, Sports Equipment, Ceramics | ⭐⭐⭐⭐ (High) | Niche Export Hubs, Marine Engineering (Quanzhou) |

| Shanghai | Minimal outflow – High-value R&D, HQ functions | ⭐ (Low) | AI, Fintech, Global HQ Services |

Note: Relocation Driver Intensity = Scale of labor-intensive production shifting out of the region (2023-2026). Shanghai remains a critical hub for innovation and domestic market access.

Regional Manufacturing Comparison: Sourcing in China (2026)

For buyers maintaining China-based supply chains, key regional trade-offs persist. Data reflects Q3 2026 SourcifyChina benchmarks for mid-volume electronics assembly (e.g., consumer IoT devices).

| Metric | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) | Jiangsu (Suzhou) | Anhui (Hefei) | Relocation Risk Context |

|---|---|---|---|---|---|

| Avg. Price | ¥82.50/unit | ¥78.20/unit | ¥80.10/unit | ¥75.80/unit | Anhui/Vietnam attract low-cost shifts; GD prices rising 3-5% YoY |

| Quality (Defect Rate) | 0.85% (Tier-1) / 1.9% (Tier-2) | 0.75% (Tier-1) / 1.7% (Tier-2) | 0.65% (Tier-1) / 1.5% (Tier-2) | 1.2% (Tier-1) / 2.4% (Tier-2) | JS leads in precision; GD/ZJ have mature QC systems |

| Lead Time | 28-35 days | 32-40 days | 30-38 days | 35-45 days | GD’s logistics dominance (Shenzhen Port) cuts time |

| Key Strength | Logistics, Scale, Electronics Ecosystem | SME Flexibility, E-commerce Integration | High-Tech Talent, German JV Density | Low Labor Costs, Incentives | |

| Key Weakness | Highest Wage Growth (+6.2% YoY), Land Scarcity | Fragmented Suppliers, IP Concerns | Rising Compliance Costs | Immature Supply Chain Depth |

Relocation Risk Context: Regions with lower wages (Anhui) or strong alternatives (Vietnam for textiles, Mexico for US-bound goods) see higher outflow pressure for cost-sensitive categories. Guangdong faces acute pressure in sub-$10 electronics assembly.

Strategic Recommendations for Global Procurement Managers

- Tier Your China Sourcing:

- High-Value/Complex: Prioritize Jiangsu (Suzhou) for quality-critical items (semiconductors, medical devices).

- Speed-to-Market: Use Guangdong for final assembly of China-market goods or rapid prototyping.

- Cost-Sensitive Volume: Consider Anhui/Hubei or diversify to Vietnam (textiles) / Mexico (US-bound).

- Audit Supplier Geography: Map Tier 2-3 suppliers. Many “China-sourced” goods now have components from Vietnam/Thailand. Demand full transparency.

- Factor in True Cost: Include logistics volatility, IP risk, and compliance (CSDDD, UFLPA) – not just unit price. A 5% cheaper unit from a high-risk region may cost 15%+ in total landed cost.

- Leverage China’s Evolving Strengths: Source automation solutions (robots, AI QC) from China to offset labor costs in other regions.

Conclusion

China is not being “left” – it is being strategically repositioned within global supply chains. Labor-intensive manufacturing is shifting, but China’s dominance in electronics, machinery, and increasingly high-value sectors remains unchallenged for complex production. Procurement leaders must move beyond binary “in/out of China” decisions. The optimal 2026 strategy involves hybrid sourcing: leveraging China’s advanced manufacturing core while diversifying low-margin assembly to lower-cost hubs. Success hinges on granular regional analysis, total cost modeling, and supplier ecosystem resilience – not headline-driven relocation narratives.

— SourcifyChina: Data-Driven Sourcing Solutions for Complex Global Supply Chains

Disclaimer: This report analyzes observable market trends. “Leaving China” is an oversimplification; strategic portfolio optimization is the reality. Data sourced from SourcifyChina’s 2026 Supplier Intelligence Platform, AmCham China, EUCCC, and China Customs.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Insights – Strategic Shifts in China-Based Manufacturing

Executive Summary

The perception that “foreign companies are leaving China” reflects a strategic rebalancing rather than a wholesale exodus. While some multinational corporations are diversifying supply chains into Southeast Asia, India, and Mexico, China remains a critical hub for high-precision, high-volume manufacturing. This report outlines the technical specifications, compliance requirements, and quality assurance protocols essential for procurement managers sourcing from China in 2026. It also provides actionable insights into mitigating quality risks amid evolving operational landscapes.

Key Quality Parameters

To ensure consistent product quality when sourcing from China, procurement managers must establish clear technical benchmarks across the following dimensions:

| Parameter | Requirement | Rationale |

|---|---|---|

| Materials | Use of certified raw materials (e.g., RoHS-compliant plastics, ASTM A36 or equivalent for metals) | Ensures environmental safety, mechanical performance, and regulatory compliance |

| Tolerances | ±0.05 mm for precision machining; ±0.1 mm for injection molding (standard) | Critical for fit, function, and interchangeability in assembly lines |

| Surface Finish | Ra ≤ 1.6 µm for machined parts; visual inspection for cosmetic defects | Impacts functionality, corrosion resistance, and end-user perception |

| Dimensional Stability | Verified via CMM (Coordinate Measuring Machine) reports per batch | Ensures consistency across production runs |

| Process Control | SPC (Statistical Process Control) data required for high-volume runs | Reduces variability and enables early defect detection |

Essential Certifications (Mandatory by Market)

Procurement managers must verify supplier compliance with region-specific certifications to ensure market access and legal conformity.

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | EU market access (safety, health, environmental protection) | Electronics, machinery, medical devices | Technical file review, Notified Body audit (if applicable) |

| FDA Registration | U.S. market (food contact, medical devices, pharmaceuticals) | Medical, food packaging, diagnostics | FDA establishment registration & product listing |

| UL Certification | U.S./Canada safety standards for electrical systems | Consumer electronics, industrial equipment | Factory audit, product testing by UL |

| ISO 9001:2015 | Quality Management Systems | All sectors | Third-party audit, certificate validity check |

| ISO 13485 | Medical device QMS | Medical devices | Required for FDA 510(k) and EU MDR |

| REACH / RoHS | Chemical restrictions (EU) | Electronics, textiles, plastics | Material declarations (SDS), lab testing |

Note: In 2026, dual compliance (e.g., CE + FDA) is increasingly required for medical and IoT-enabled devices. Suppliers must provide updated certificates with traceable audit trails.

Common Quality Defects & Prevention Strategies

Despite China’s advanced manufacturing base, quality inconsistencies persist due to rapid scaling, labor turnover, and communication gaps. The table below outlines frequent defects and proven mitigation tactics.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, inconsistent process control | Require SPC data; conduct pre-production CMM validation; schedule tooling maintenance |

| Material Substitution | Cost-cutting by suppliers | Enforce material traceability; require mill test certificates; conduct random lab testing |

| Surface Imperfections (e.g., sink marks, flash) | Poor mold maintenance or injection settings | Audit mold condition; require process validation reports; conduct first-article inspection |

| Functional Failure (e.g., electrical shorts) | Inadequate QA testing or design misinterpretation | Mandate test protocols (ICT, burn-in); use bilingual engineering specs; conduct 3rd-party testing |

| Packaging Damage | Poor handling or inadequate packaging design | Approve packaging design pre-production; conduct drop tests; include handling SOPs in QC checklist |

| Labeling/Compliance Errors | Misunderstanding of target market regulations | Provide clear labeling templates; verify compliance documentation before shipment |

| Contamination (e.g., metal shavings, dust) | Poor cleanroom or workshop hygiene | Require ISO 14644 (cleanroom) standards for sensitive products; include visual inspection SOPs |

Strategic Sourcing Recommendations – 2026 Outlook

- Dual-Sourcing Strategy: Maintain China for high-complexity, high-volume production while diversifying low-margin items to Vietnam or Thailand.

- On-the-Ground QA Teams: Deploy or partner with resident quality engineers to conduct unannounced audits and real-time defect feedback.

- Digital QC Integration: Require suppliers to use cloud-based QC platforms (e.g., Inspectorio, Qarma) for real-time production monitoring.

- Compliance by Design: Embed regulatory requirements into product design briefs and supplier contracts.

Conclusion

China remains a pivotal manufacturing hub in 2026, but success depends on rigorous technical oversight and proactive quality management. Foreign companies are not “leaving” China—they are optimizing their footprint. Procurement leaders who enforce clear specifications, validate certifications, and prevent common defects will maintain competitive advantage in global supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

Manufacturing Costs and OEM/ODM Shift Analysis: 2026 Strategic Sourcing Guide

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy | Q1 2026

Executive Summary

The narrative of “foreign companies leaving China” is an oversimplification of a strategic supply chain rebalancing. Data indicates a 23% YoY increase in diversification to Southeast Asia (SEA) and Mexico (SourcifyChina 2025 Supplier Survey), driven by cost restructuring, geopolitical risk mitigation, and market access optimization—not a wholesale exit. China retains critical advantages in complex manufacturing ecosystems, engineering talent, and scale. This report provides actionable cost analysis and strategic guidance for OEM/ODM procurement in 2026.

Why the Shift? Three Data-Driven Drivers (Not “Leaving China”)

| Factor | China (2026) | Competitive Alternatives (SEA/Mexico) | Strategic Implication for Procurement |

|---|---|---|---|

| Labor Cost | Avg. $7.20/hr (up 9.8% YoY); skilled labor scarcity in Tier-1 cities | Vietnam: $3.80/hr; Mexico: $4.50/hr (near-shoring premium) | Action: Reserve China for high-complexity assembly; shift labor-intensive work to SEA. |

| Total Landed Cost | +14% YoY (logistics + energy + compliance) | Vietnam: +8% YoY; Mexico: +11% (U.S. near-shoring incentives offset costs) | Action: Calculate TCO including tariffs, carbon taxes, and supply chain resilience. |

| Geopolitical Risk | 68% of U.S. buyers cite Section 301 tariffs (avg. 19%) and tech restrictions as primary drivers | Mexico benefits from USMCA; Vietnam from EU FTA | Action: Dual-source critical components; leverage FTAs for market-specific production. |

Key Insight: Companies aren’t “leaving China”—they’re implementing China+1/2 strategies. 74% maintain core R&D and high-mix production in China while shifting high-volume, low-complexity lines to SEA/Mexico (McKinsey, Jan 2026).

White Label vs. Private Label: Strategic Procurement Implications

Critical distinction often misunderstood by buyers:

| Model | Ownership & Control | Cost Structure | Ideal For | Risk Exposure |

|---|---|---|---|---|

| White Label | Supplier owns design/IP; buyer rebrands | Lowest cost (supplier absorbs R&D) | Commodity products (e.g., basic chargers) | High: Zero IP control; quality tied to supplier’s standard |

| Private Label | Buyer owns specs/IP; supplier manufactures to your requirements | +15-25% vs. white label (covers custom tooling, QA) | Branded differentiation (e.g., smart home devices) | Medium: IP protection critical; higher MOQ flexibility |

Procurement Guidance: Avoid white label for core products. Private label with robust IP clauses (e.g., “work-for-hire” contracts) is non-negotiable for brand protection. China remains unmatched for complex private label due to engineering agility.

2026 Cost Breakdown: Mid-Tier Smart Home Device (Example)

Estimated per-unit cost at 1,000 MOQ (USD)

| Cost Component | China | Vietnam | Mexico | Notes |

|---|---|---|---|---|

| Materials | $18.50 | $19.20 | $20.10 | China’s supply chain density = -3.7% vs. SEA |

| Labor | $7.80 | $5.20 | $6.30 | Includes automation overhead (China: 42% robot density) |

| Packaging | $2.10 | $2.35 | $2.60 | +12% YoY (global paper/board costs + China EPR compliance) |

| Compliance | $1.40 | $1.10 | $0.95 | China: 2026 Carbon Tax Surcharge (0.8-1.2%) |

| TOTAL | $29.80 | $27.85 | $29.95 | China premium justified for sub-5K MOQs |

Critical Note: At MOQ >5,000 units, China’s material/logistics advantage closes the gap. Near-shoring (Mexico) only wins for U.S. West Coast distribution.

Estimated Price Tiers by MOQ (China Production)

Private Label Smart Home Hub (Mid-Complexity Electronics)

| MOQ | Unit Cost (USD) | Total Order Cost | Cost/Unit vs. 500 MOQ | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $34.20 | $17,100 | Baseline | Avoid: Margins eroded by setup fees. Use only for validation prototypes. |

| 1,000 | $29.80 | $29,800 | -12.9% | Minimum viable: Covers mold amortization. Target for new suppliers. |

| 5,000 | $24.50 | $122,500 | -28.4% | Optimal tier: Full cost efficiency. Lock 12-month contracts here. |

Footnotes:

– Assumes Grade A components, 30-day production, FOB Shenzhen.

– +5.5% surcharge for expedited (15-day) production.

– Costs exclude tariffs (U.S.: +19% under Section 301; EU: 0% under MFN).

Strategic Recommendations for 2026

- Adopt Hybrid Sourcing: Keep high-mix, low-volume production in China; shift high-volume commodity lines to Vietnam/Mexico.

- Demand TCO Calculations: Require suppliers to model total landed cost including carbon compliance (China’s ETS Phase IV penalties start Q3 2026).

- Audit IP Protection: For private label, mandate third-party IP verification in contracts. China’s 2025 IPR Law strengthens enforcement—but only if explicitly contracted.

Final Takeaway: China is evolving from “low-cost factory” to “high-value innovation hub.” Procurement leaders who leverage its engineering ecosystem for complex products while diversifying volume lines will outperform peers. The goal is strategic resilience—not chasing lowest headline costs.

SourcifyChina Disclaimer: Cost data reflects Q1 2026 supplier benchmarks across 12 manufacturing clusters. Actual quotes require detailed RFQs. Contact sourcifychina.com/2026-cost-calculator for live TCO modeling.

© 2026 SourcifyChina. Confidential for recipient use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers Amid Rising Foreign Company Exits

Date: January 2026

Executive Summary

In 2026, the trend of foreign companies relocating manufacturing operations out of China continues to accelerate. According to McKinsey & Company and China General Chamber of Commerce, over 42% of foreign-invested manufacturing firms have partially or fully shifted production to Southeast Asia, India, and Mexico since 2020. While cost inflation, geopolitical risks, and supply chain resilience are primary drivers, a critical underlying factor remains: supplier misclassification and misrepresentation.

This report provides procurement professionals with a structured, actionable framework to verify authentic Chinese manufacturers, distinguish them from trading companies, and identify red flags that may compromise sourcing integrity. Proper due diligence not only mitigates risk but ensures long-term supply chain stability amid shifting global dynamics.

1. Why Are Foreign Companies Leaving China? Key Drivers (2026 Update)

| Factor | Impact on Sourcing | Procurement Implication |

|---|---|---|

| Rising Labor & Operational Costs | Manufacturing wages up 8.2% YoY (2025); logistics +14% | Reduced cost advantage vs. Vietnam, Indonesia |

| Geopolitical Tensions (US-China, EU Tariffs) | Export controls, Section 301 tariffs, CBAM | Compliance complexity, duty exposure |

| Supply Chain Resilience Demands | Post-pandemic “China +1” strategy mainstream | Diversification imperative |

| IP Protection Concerns | 23% increase in IP disputes involving foreign firms (2025) | Risk of design leakage, counterfeiting |

| Regulatory Pressure | Stricter environmental (EPR), labor, and data laws | Compliance burden for foreign buyers |

| Misclassified Suppliers | 38% of “factories” are trading companies (SourcifyChina audit, 2025) | Hidden margins, quality opacity, lead time delays |

Note: Supplier misrepresentation is a top-5 reason for failed sourcing initiatives in China (Deloitte, 2025).

2. Critical Steps to Verify a Manufacturer in China

Step 1: Confirm Legal Entity & Business Scope

- Action: Request the company’s Business License (营业执照) and verify via the National Enterprise Credit Information Publicity System (NECIPS).

- Key Check: Ensure the business scope includes manufacturing (e.g., “production of plastic injection molded parts”) — not just “trading” or “import/export.”

- Tool: Use https://www.gsxt.gov.cn (official platform) or third-party tools like Tianyancha or Qichacha.

Step 2: Conduct On-Site or Remote Factory Audit

- On-Site: Hire a third-party inspection firm (e.g., SGS, Bureau Veritas) for a full factory audit (ISO, capacity, machinery list, QC process).

- Remote: Use live video audit with:

- 360° tour of production lines

- Real-time verification of machinery (serial numbers, brand tags)

- Staff interviews (ask about daily output, shift patterns)

Step 3: Validate Production Capacity

| Metric | Authentic Factory Evidence | Trading Company Indicator |

|---|---|---|

| Machinery Ownership | Machine nameplates show factory’s name | Machines lack branding or show foreign labels |

| MOQ Flexibility | Can adjust MOQ based on line capacity | Fixed MOQs (likely based on supplier batch) |

| Lead Time Control | Provides detailed production schedule | Vague timelines, “depends on supplier” |

Step 4: Review Export History & Client References

- Request past export documents (Bill of Lading, Commercial Invoice samples — redact sensitive data).

- Contact 3 verified past clients (ask for product type, order volume, quality feedback).

- Confirm if they’ve supplied to Western brands (e.g., Walmart, Amazon, Bosch).

Step 5: Assess R&D and Engineering Capability

- Ask for:

- In-house mold design team (for molded goods)

- CAD/CAM software used

- Sample of engineering drawings or DFM reports

- Factories with R&D invest in design — traders do not.

3. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production facility; lease/property deed available | No production floor; office-only |

| Equipment | On-site machinery (injection molding, CNC, SMT lines) | Photos of machines are stock or borrowed |

| Staff | Engineers, QC inspectors, machine operators on payroll | Sales reps, logistics coordinators |

| Pricing | Quotes based on material + labor + overhead | Quotes with vague cost breakdown; higher margins |

| Lead Time | Controls production schedule | Dependent on third-party factory timelines |

| Customization | Offers mold/tooling investment, design input | Limited to catalog products |

| Certifications | ISO 9001, IATF 16949, in-house lab reports | Reseller of certified products; no on-site audit history |

Pro Tip: Ask, “Can you show me the machine currently producing our product?” A trader cannot.

4. Red Flags to Avoid in Chinese Sourcing (2026)

| Red Flag | Risk | Verification Method |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden costs, or middlemen | Benchmark against industry cost models (e.g., plastic part $/kg) |

| Refusal to Provide Facility Address | Likely not a real factory | Cross-check address on Baidu Maps; visit via agent |

| No On-Site QC Team | Quality control outsourced or non-existent | Request QC process flowchart and inspection checklist |

| Generic Product Photos | Uses stock images or competitor content | Request custom sample with your logo/part number |

| Pressure to Pay 100% Upfront | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| Inconsistent Communication | Multiple contacts, language gaps | Assign single technical point of contact |

| No Tooling Ownership Clause | Risk of IP and mold theft | Contract must state: “Buyer owns molds after full payment” |

5. Recommended Due Diligence Checklist

✅ Verify business license & manufacturing scope

✅ Conduct live video or on-site factory audit

✅ Confirm machine ownership and production capacity

✅ Review export history and client references

✅ Assess engineering and QC capabilities

✅ Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement

✅ Audit for compliance (RoHS, REACH, BSCI if applicable)

✅ Secure IP and tooling ownership in contract

Conclusion

As foreign companies restructure their China exposure, the risk of engaging misrepresented suppliers increases. In 2026, only 58% of “verified” suppliers on B2B platforms are actual manufacturers (SourcifyChina Audit, 2025). Procurement leaders must implement rigorous, multi-layered verification protocols to avoid cost overruns, delays, and IP exposure.

By systematically distinguishing true manufacturers from traders and recognizing operational red flags, global buyers can maintain quality, control, and compliance — even as the China sourcing landscape evolves.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Due Diligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating China’s Evolving Manufacturing Landscape (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Strategic Imperative for Verified Intelligence

The narrative around “foreign companies leaving China” is complex, driven by converging factors: geopolitical realignment, supply chain diversification (China+1/+N), rising operational costs, and shifting regulatory demands. However, oversimplified analysis risks costly missteps. Procurement leaders who rely on fragmented media reports or unverified supplier claims face critical pitfalls:

| Risk of Unverified Sourcing Intelligence | Impact on Procurement Strategy |

|---|---|

| Misattribution of Exit Drivers (e.g., blaming tariffs alone vs. labor shortages + ESG pressures) | Reactive, suboptimal supplier shifts; stranded inventory |

| Unvetted “Alternative” Suppliers (e.g., Vietnam/India facilities with hidden capacity gaps) | Production delays, quality failures, compliance violations |

| Static Market Data (6+ month-old cost benchmarks) | 12-18% margin erosion due to unanticipated cost shifts |

| Inefficient Resource Allocation (weeks spent validating claims) | Delayed diversification; lost competitive advantage |

Why SourcifyChina’s Verified Pro List Solves This Today

Our 2026 Pro List is the only solution delivering actionable, verified intelligence on China’s supply chain transition—saving procurement teams 200+ hours annually per category. Here’s how:

| Feature | Time/Cost Savings | Strategic Advantage |

|---|---|---|

| Real-time Supplier Health Scoring (Validated via on-ground audits + customs data) |

Eliminates 3-5 weeks of manual due diligence per supplier shift | Identifies which Chinese factories are proactively adapting (e.g., automation, green manufacturing)—not just those exiting |

| Root-Cause Analysis Dashboard (Granular data on why specific sectors/companies relocate) |

Replaces 50+ hours of analyst report synthesis | Pinpoints actionable levers (e.g., “Textile OEMs left due to wastewater compliance costs, not wages”) |

| Verified China+1 Supplier Network (Pre-qualified facilities in Vietnam, Mexico, Thailand) |

Cuts new-market onboarding from 6 months → 8 weeks | Ensures continuity without compromising quality/cost targets |

| Custom Regulatory Alerts (e.g., CBAM, EU Deforestation Regulation impacts) |

Prevents $250K+ in non-compliance penalties per incident | Future-proofs supply chain against emerging ESG/tariff risks |

Key Insight: 78% of “exiting” companies retain strategic China partnerships for R&D/high-mix production (SourcifyChina 2026 Supplier Survey). The goal isn’t abandoning China—it’s optimizing its role in a resilient network. Our Pro List reveals where and how to do this profitably.

Call to Action: Transform Uncertainty into Strategic Advantage

Stop navigating China’s transition with outdated assumptions. Every week spent on unverified data erodes your cost leadership and supply chain resilience.

✅ Within 24 hours of engagement, SourcifyChina delivers:

1. A customized Pro List report for your specific product category, isolating verified exit drivers vs. market noise.

2. 3 pre-vetted supplier alternatives (China + nearshore) with full cost/lead time/ESG benchmarks.

3. A roadmap to renegotiate terms with existing Chinese partners or pivot seamlessly.

Your Next Step Takes <60 Seconds:

➡️ Email: Contact [email protected] with subject line: “2026 Pro List – [Your Industry]”

➡️ WhatsApp: Message +86 159 5127 6160 with “Verified Intelligence Request”

Include your top 3 product categories for immediate prioritization.

Why act now? The window for proactive optimization closes as 2026 tariffs tighten. Leaders using our Pro List in Q1 report 14.2% faster diversification and 9% higher supplier retention rates (2025 Client Benchmark).

© 2026 SourcifyChina. All data verified via proprietary Supplier Health Index™ (SHI). 1,200+ global procurement teams trust our intelligence.

SourcifyChina: Where Verified Supply Chains Drive Competitive Advantage.

🧮 Landed Cost Calculator

Estimate your total import cost from China.