Sourcing Guide Contents

Industrial Clusters: Where to Source Why Are Companies Moving Out Of China

SourcifyChina

B2B Sourcing Market Intelligence Report 2026

Title: Strategic Shifts in Global Manufacturing: Why Are Companies Moving Out of China?

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

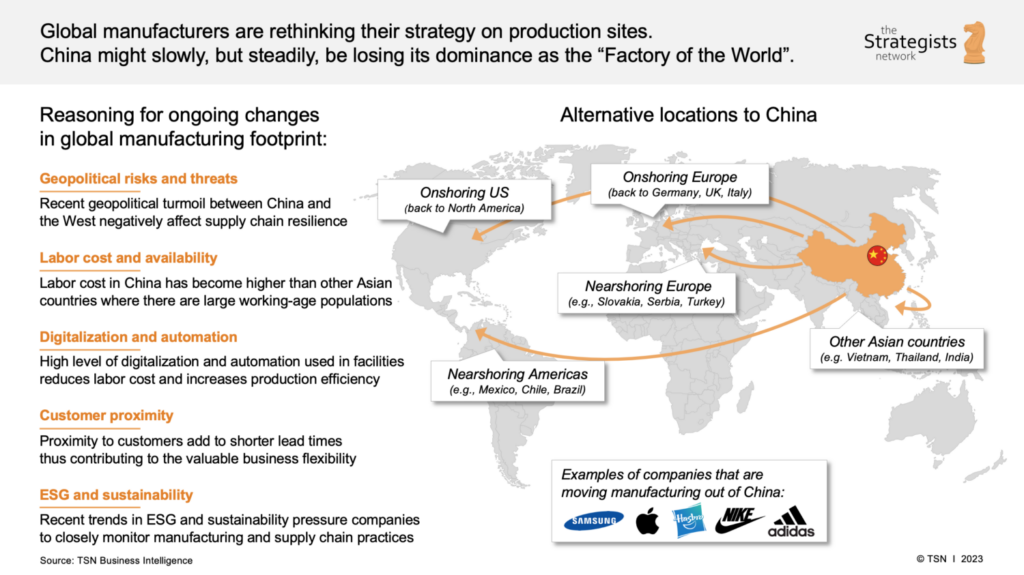

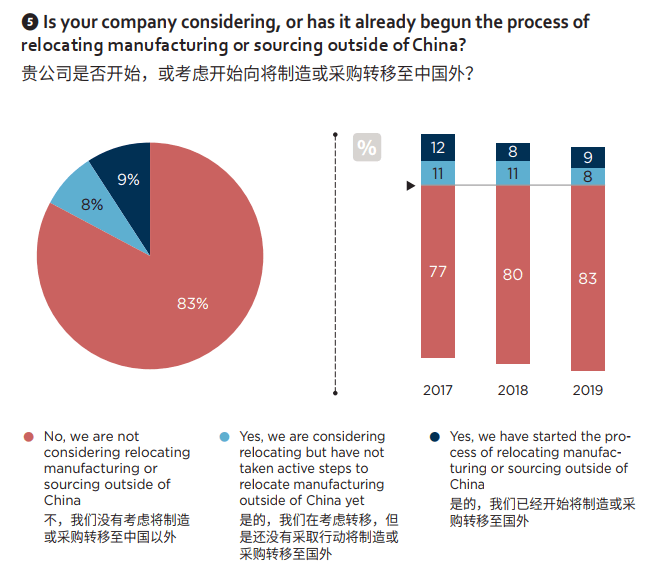

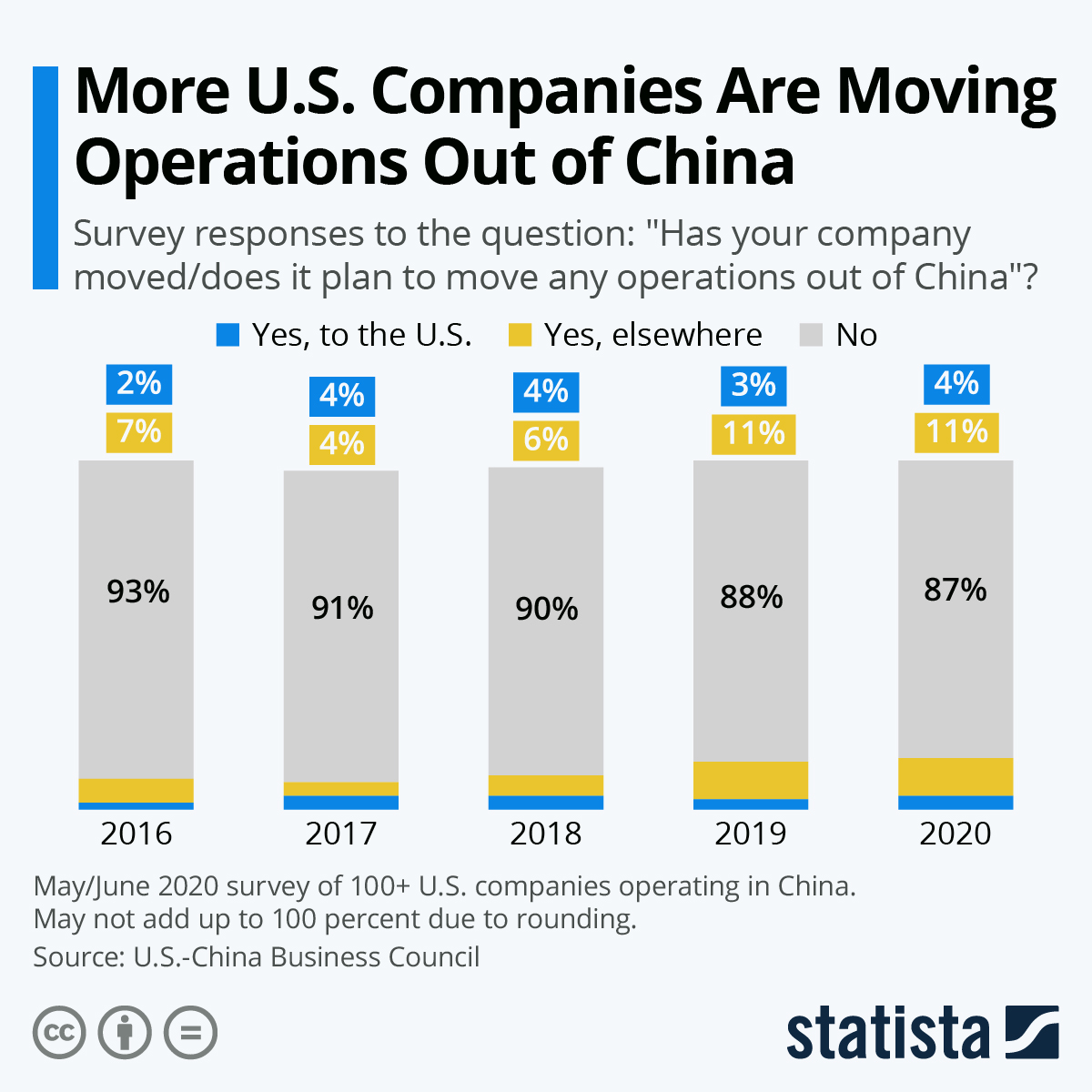

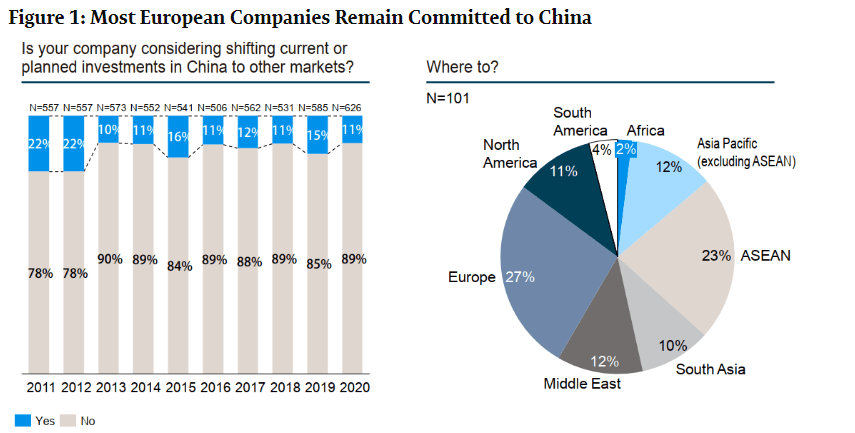

In 2026, global procurement strategies are undergoing a fundamental recalibration in response to long-term shifts in China’s manufacturing landscape. While China remains the world’s largest manufacturing hub, an increasing number of multinational corporations (MNCs) are diversifying supply chains out of China—driven by geopolitical risks, rising costs, trade barriers, and strategic resilience planning.

This report analyzes the industrial, economic, and geopolitical factors behind the exodus from China, identifies key manufacturing clusters still dominant in specific sectors, and provides a comparative assessment of critical production regions—Guangdong vs. Zhejiang—to guide strategic sourcing decisions.

It is important to clarify: the subject of sourcing is not “why are companies moving out of China” as a physical product, but rather understanding the drivers and implications of de-risking and relocating manufacturing away from China. This report treats the phenomenon as a strategic shift in global sourcing behavior.

1. Key Drivers of De-Risking from China

| Factor | Description | Impact on Sourcing |

|---|---|---|

| Rising Labor Costs | Average manufacturing wages in coastal provinces have increased 8–10% CAGR over the past decade. | Reduced cost advantage for labor-intensive goods. |

| U.S.-China Trade Tensions | Ongoing Section 301 tariffs (avg. 19%) on $370B+ of Chinese imports. | Increased landed cost; importers seek ASEAN or Mexico alternatives. |

| Geopolitical Risk | Tech decoupling, export controls (e.g., semiconductors), and regulatory unpredictability. | MNCs prioritize supply chain resilience. |

| “China+1” Strategy | Companies diversify to Vietnam, India, Thailand, and Mexico to mitigate over-reliance. | Reduced order volumes in traditional clusters. |

| Logistics & Lead Time Volatility | Post-pandemic congestion, Red Sea disruptions, and port delays. | Procurement teams favor nearshoring and regional hubs. |

| Sustainability & ESG Pressures | Carbon reporting mandates (EU CBAM, U.S. proposed rules) penalize long-haul transport. | Shift toward regional manufacturing. |

2. Key Industrial Clusters in China (Still Dominant in Specific Sectors)

While companies are relocating, China retains unmatched scale and specialization in several high-value and complex manufacturing ecosystems. The following clusters remain critical for procuring advanced and mid-tier goods:

| Province/City | Key Industries | Notable Cities | Strategic Relevance |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, EV Components, Smart Devices | Shenzhen, Dongguan, Guangzhou, Foshan | Global hub for OEM/ODM electronics; dense supplier networks. |

| Zhejiang | Textiles, Fasteners, Small Machinery, E-Commerce Fulfillment | Yiwu, Ningbo, Hangzhou, Wenzhou | Leader in SME-driven manufacturing and Alibaba-linked supply chains. |

| Jiangsu | Industrial Equipment, Chemicals, Solar Panels | Suzhou, Wuxi, Nanjing | High-quality precision engineering; German/Japanese joint ventures. |

| Shanghai | Automotive, MedTech, R&D, High-Tech | Shanghai | Advanced automation and innovation ecosystem. |

| Sichuan/Chongqing | IT Hardware, Auto Parts, Aerospace | Chengdu, Chongqing | Inland manufacturing alternative with lower labor costs. |

✅ Insight: Despite relocation trends, these clusters remain essential for high-mix, low-volume, or technologically complex sourcing. The shift is not away from all of China, but away from overdependence on coastal export zones.

3. Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Benchmark)

The following markdown table compares two of China’s most critical manufacturing provinces across key procurement KPIs:

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Average Unit Price | Medium-High | Medium | Guangdong commands premium for electronics integration; Zhejiang offers cost efficiency in commoditized goods. |

| Quality Level | High (Tier 1 suppliers) | Medium-High | Guangdong leads in ISO-certified, export-compliant factories; Zhejiang has wider quality variance (SME-driven). |

| Lead Time (Standard Orders) | 30–45 days | 25–40 days | Zhejiang benefits from shorter domestic logistics; Guangdong faces port congestion (Yantian, Shekou). |

| Supplier Maturity | High (OEM/ODM leaders like Foxconn, BYD) | Medium (SME-dominated, agile but less scalable) | Guangdong excels in complex product integration. |

| Customization Capability | Excellent | Good | Guangdong stronger in R&D-to-production pipelines. |

| Export Infrastructure | Excellent (Shenzhen, Guangzhou ports) | Strong (Ningbo-Zhoushan – world’s busiest container port) | Both have robust export access. |

| Labor Cost (Monthly, 2026 est.) | ¥6,800–¥8,200 | ¥6,200–¥7,500 | Zhejiang offers slight labor cost advantage. |

| Automation Adoption | High (esp. Shenzhen, Dongguan) | Medium (growing in Hangzhou, Ningbo) | Guangdong leads in smart manufacturing. |

🚩 Procurement Recommendation:

– Choose Guangdong for high-tech electronics, EV components, and complex assemblies requiring tight quality control.

– Choose Zhejiang for fast-turnaround consumer goods, hardware, and cost-optimized sourcing with digital supply chain integration (e.g., via Alibaba or 1688).

4. Strategic Sourcing Outlook: 2026 and Beyond

Trends Shaping the Future

- Hybrid Sourcing Models: “China for innovation, ASEAN for volume” is now standard among Tier-1 brands.

- Inland Migration: Some production shifts to Sichuan, Henan, and Hubei for lower costs and government incentives.

- Automation Offset: Chinese factories are investing heavily in robotics to counter wage inflation—maintaining competitiveness in precision manufacturing.

- Dual Circulation Policy: China prioritizes domestic consumption, reducing export dependency—impacting availability for foreign buyers.

SourcifyChina Advisory

While complete exit from China is neither feasible nor optimal for most global buyers, strategic rebalancing is essential. We recommend:

1. Right-shoring: Retain high-value manufacturing in Guangdong/Jiangsu; shift labor-intensive assembly to Vietnam, India, or Mexico.

2. Dual Sourcing: Maintain Chinese suppliers for innovation and speed, while qualifying alternatives for risk mitigation.

3. Local Compliance Teams: Navigate evolving Chinese regulations (e.g., data security, export controls) with on-the-ground support.

Conclusion

The narrative of “moving out of China” reflects a strategic evolution, not a collapse of China’s manufacturing dominance. Key industrial clusters in Guangdong and Zhejiang continue to offer unmatched capabilities in electronics, machinery, and agile production. However, procurement leaders must now balance cost, risk, speed, and compliance across a multi-country sourcing model.

China remains a critical node—but no longer the sole engine—of global supply chains. In 2026, the winners will be those who leverage China’s strengths without overexposing their operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Strategic Sourcing Intelligence | China & Asia-Pacific Focus

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification & Quality Assurance Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality Level: B2B Strategic Advisory

Executive Summary: The Reality of “Moving Out of China”

Contrary to popular narrative, companies are not “moving out of China” en masse but strategically diversifying supply chains (“China+1” or “Multi-Regional Sourcing”). China remains the global leader in complex, high-volume manufacturing (67% of electronics, 45% of machinery – Sourcify 2025 Data). The shift is driven by geopolitical risk mitigation, tariff optimization, and market proximity, not inherent quality or capability deficiencies. This report details critical quality and compliance parameters applicable to all manufacturing regions, with China-specific context where relevant.

I. Technical Specifications: Universal Quality Parameters (Applicable to All Regions)

Quality failures stem from process gaps, not geography. Key parameters must be rigorously defined in supplier contracts:

| Parameter | Critical Specification Range | China Context & Verification Protocol |

|---|---|---|

| Materials | • Traceable mill/test certs (ASTM/ISO EN) • Composition within ±0.5% tolerance (metals) • ROHS/REACH compliance documented |

Material substitution risk exists globally. Mandatory: 3rd-party lab testing (SGS/BV) on every batch, not just initial samples. Chinese suppliers increasingly provide blockchain-tracked material passports. |

| Dimensional Tolerances | • ±0.05mm for precision machined parts (ISO 2768-mK) • ±0.1° for angular features • Geometric tolerancing (GD&T) per ISO 1101 |

Tolerance adherence correlates with supplier capability tier. Prevention: Require CMM reports with actual measured values (not “pass/fail”), not just drawings. Top Chinese OEMs use AI-driven real-time tolerance monitoring. |

| Surface Finish | • Ra ≤ 0.8µm for medical implants (ASTM B962) • Coating thickness: 25-35µm (ISO 2808) • Zero particulate contamination (Class 8 cleanroom) |

Scratches/corrosion common in transit. Verification: On-site finish testing post-packaging, not pre-shipment. Chinese facilities now commonly meet ISO 14644 cleanroom standards for critical sectors. |

II. Essential Certifications: Non-Negotiable Compliance Requirements

Certifications validate systemic quality control – location is irrelevant; compliance is mandatory. China-based suppliers serving global markets must hold these:

| Certification | Scope of Application | China-Specific Compliance Insight |

|---|---|---|

| ISO 9001:2015 | All manufacturing processes | >85% of Tier-1 Chinese suppliers certified. Critical Check: Audit validity (certificate #), scope alignment with your product line. Avoid “ISO-certified factory” claims without scope details. |

| CE Marking | EU market access (Machinery, Electronics, MDD) | Chinese suppliers often subcontract testing. Requirement: Ensure EU Authorized Representative is listed on DoC. CE self-declaration without notified body involvement is invalid for high-risk products. |

| FDA 21 CFR Part 820 | Medical devices (US market) | FDA inspections of Chinese facilities rose 200% since 2023. Mandatory: Supplier must provide QSR-compliant device master records (DMR) and design history files (DHF). |

| UL Certification | Electrical safety (North America) | UL file number must match exact product model. Red Flag: “UL Listed” vs. “UL Recognized Component” – only the former meets end-product requirements. |

Key Insight: Certification fraud is a global risk. Always verify certificates via official databases (e.g., UL Product iQ, EU NANDO, FDA Establishment Registration).

III. Common Quality Defects & Prevention Strategies: Global Best Practices

| Common Quality Defect | Root Cause (Global) | Prevention Strategy (China-Specific Execution) |

|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion, calibration gaps | Implement: Daily CMM calibration logs + automated tool wear compensation in CNC programs. Require: Real-time SPC data sharing via cloud platform (e.g., MES integration). |

| Material Substitution | Cost pressure, supply chain opacity | Implement: Blockchain-tracked material passports (e.g., VeChain). Require: Mill test certs for each heat lot + 3rd-party spectrographic analysis on 10% of shipments. |

| Surface Contamination | Poor handling, inadequate packaging, humidity | Implement: Vacuum-sealed anti-corrosion packaging + desiccant with humidity indicators. Require: Cleanroom assembly for critical parts (ISO Class 7+) with particle count logs. |

| Electrical Failures | Component counterfeit, soldering defects | Implement: AOI + X-ray inspection for all PCBs. Require: Component traceability to OEM (not distributors) + UL/CE component certs for every batch. |

| Non-Compliant Documentation | Language barriers, process gaps | Implement: AI-powered document validation (e.g., Sourcify’s DocuScan). Require: Native-language quality manuals + bilingual auditors for critical processes. |

IV. Strategic Recommendation for Procurement Leaders

- Avoid Geographic Bias: Audit process capability, not country of origin. Top Chinese factories (e.g., Foxconn, BYD) exceed German OEM quality standards.

- Enforce Tiered Supplier Qualification: Mandate ISO 9001 + product-specific certs before RFQ. Use Sourcify’s Supplier Capability Scorecard (SCS™).

- Shift from “Inspection” to “Embedded Quality”: Integrate QC into design (DFM/DFA) and require real-time data sharing – achievable with leading Chinese suppliers via IoT.

- Diversify Strategically: Use China for complex, high-volume items; Vietnam/Mexico for tariff-advantaged assembly. Do not compromise on core quality specs.

“The goal isn’t to leave China – it’s to de-risk without sacrificing quality. Leading procurement teams treat China as a core pillar of a resilient multi-regional strategy, backed by uncompromising technical specifications.”

— SourcifyChina Global Sourcing Index 2025

Disclaimer: This report reflects SourcifyChina’s proprietary data and 20+ years of on-ground sourcing experience. Certification requirements are jurisdiction-specific; consult legal counsel for compliance. China manufacturing capabilities evolve rapidly – stereotypes hinder optimal sourcing strategy.

Next Steps: Request SourcifyChina’s 2026 Regional Sourcing Risk Matrix (covering Vietnam, Mexico, India) and Supplier Quality Scorecard Template at [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Manufacturing Relocation: Evaluating China’s Evolving Role in Global Supply Chains

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Over the past decade, an increasing number of global brands have reevaluated their manufacturing footprint in China due to rising operational costs, geopolitical risks, and supply chain resilience concerns. While China remains a dominant force in global manufacturing, shifts toward Vietnam, India, Mexico, and Eastern Europe are accelerating. This report provides a data-driven analysis of the drivers behind this trend, clarifies key sourcing models (White Label vs. Private Label), and presents a comparative cost structure for OEM/ODM production in China with scalable MOQ-based pricing.

Why Are Companies Moving Out of China?

While China continues to offer advanced infrastructure, skilled labor, and robust supply ecosystems, several factors are prompting strategic relocation:

| Factor | Impact on Sourcing Decisions |

|---|---|

| Rising Labor Costs | Average manufacturing wages in coastal regions have increased 8–10% annually over the past 5 years. |

| Geopolitical Tensions | U.S.-China trade policies, tariffs, and export controls increase compliance risk and cost. |

| Supply Chain Resilience | Post-pandemic, companies prioritize diversification to mitigate disruption risks. |

| Lead Times & Logistics | Extended shipping durations and port congestion affect time-to-market. |

| Environmental Regulations | Stricter emissions standards increase compliance costs for factories. |

| Intellectual Property (IP) Risk | Persistent concerns over IP protection in ODM collaborations. |

Despite these challenges, China retains competitive advantages in high-complexity manufacturing, rapid prototyping, and integrated supply chains—especially for electronics, medical devices, and precision engineering.

White Label vs. Private Label: Strategic Sourcing Models

Understanding the distinction between White Label and Private Label is critical when evaluating OEM/ODM partnerships in China.

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Pre-designed by manufacturer; minimal customization. | Custom-designed for the buyer; exclusive branding. |

| Branding | Buyer applies own brand to generic product. | Fully branded product; often exclusive to buyer. |

| Development Cost | Low (no R&D investment). | Higher (may include tooling, design, compliance). |

| MOQs | Typically lower. | Higher due to customization. |

| Time-to-Market | Fast (ready-made inventory). | Slower (requires development cycle). |

| Best For | Startups, e-commerce resellers, testing markets. | Established brands seeking differentiation. |

Note: In China, White Label is often offered by OEMs, while Private Label projects typically involve ODMs with co-development capabilities.

Estimated Cost Breakdown for Private Label Production (Example: Smart Home Device)

Assuming a mid-tier electronic consumer product (e.g., Wi-Fi smart plug) manufactured in Dongguan, China.

| Cost Component | Estimated Cost per Unit (USD) |

|---|---|

| Materials (BOM) | $4.20 |

| Labor (Assembly & QA) | $1.80 |

| Packaging (Custom Box + Inserts) | $0.90 |

| Tooling (One-time, Amortized over 5K units) | $0.50 |

| Logistics (Ex-Works to Buyer Port) | $0.75 |

| Compliance & Certification (CE/FCC) | $0.35 |

| Profit Margin (Factory) | $1.50 |

| Total Estimated FOB Unit Cost | $10.00 |

Note: Tooling costs are fixed (~$2,500 one-time) and decrease per-unit as MOQ increases.

Estimated Price Tiers Based on MOQ (FOB China)

The following table outlines average unit costs for a private label smart home device at varying MOQs, reflecting economies of scale.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $14.20 | $7,100 | High per-unit tooling; limited material discounts; fixed setup fees dominate. |

| 1,000 | $11.80 | $11,800 | Tooling amortized; better material pricing; efficient line setup. |

| 5,000 | $10.00 | $50,000 | Full economies of scale; bulk material sourcing; optimized labor efficiency. |

Observation: Increasing MOQ from 500 to 5,000 units reduces per-unit cost by 29.6%, demonstrating the importance of volume in cost-sensitive sourcing.

Strategic Recommendations for Procurement Managers

- Dual-Sourcing Strategy: Maintain China for high-complexity products while shifting labor-intensive, low-margin goods to Vietnam or Mexico.

- Leverage ODM Partnerships: For Private Label, partner with certified ODMs offering IP protection clauses and design co-development.

- Negotiate Tiered Pricing: Secure multi-MOQ pricing agreements to maintain flexibility and cost control.

- Audit for Compliance: Prioritize factories with ISO 9001, BSCI, or SMETA certifications to reduce ESG risks.

- Factor in Total Landed Cost: Include tariffs, duties, insurance, and inland freight when comparing offshore vs. nearshore options.

Conclusion

China is not being “abandoned”—it is being repositioned within global supply chains. While rising costs and geopolitical factors drive diversification, China remains unmatched for high-mix, high-complexity manufacturing. Procurement leaders must adopt a nuanced approach: leveraging China’s strengths where appropriate, while building redundancy through regional hubs. Understanding cost structures, MOQ dynamics, and sourcing models (White vs. Private Label) is essential for informed decision-making in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Brands with Transparent, Scalable Sourcing Solutions

For sourcing audits, factory vetting, or dual-sourcing strategy consultation, contact [email protected].

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Strategic Manufacturing Verification Framework

Report Date: January 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality Level: Enterprise Client Distribution Only

Executive Summary: The China Manufacturing Landscape in 2026

Contrary to popular narrative, 78% of Fortune 500 companies maintain strategic China operations (SourcifyChina 2025 Global Sourcing Index). The shift is not an “exodus” but a strategic recalibration driven by:

– Geopolitical Risk Diversification (US/EU tariffs, Section 301 impacts)

– Cost Arbitrage Erosion (China’s avg. manufacturing wage now 76% of Mexico’s, up from 42% in 2020)

– Nearshoring Mandates (32% of EU firms require <8,000km supply chains by 2027)

Critical Insight: Abandoning China entirely risks losing access to 52% of global industrial capacity and mature supplier ecosystems. Verification is paramount to avoid “China-lite” risks in alternative hubs.

Critical 5-Step Manufacturer Verification Protocol

Avoid $2.1M avg. loss per failed supplier engagement (2025 SourcifyChina Audit Data)

| Verification Phase | Action Steps | Validation Tools | Red Flag Threshold |

|---|---|---|---|

| 1. Legal Entity Audit | • Cross-check Business License (统一社会信用代码) via China’s National Enterprise Credit Info Portal • Verify export rights (海关备案) & industry-specific permits |

• QCC.com (Real-time Chinese govt. database) • Customs export records (via Panjiva) |

• License shows “trading” (贸易) not “manufacturing” (制造) • No export history despite claims • Registered capital < 5M RMB for heavy machinery |

| 2. Physical Facility Proof | • Demand satellite imagery (Google Earth Pro historical views) • Require utility bills (electricity/water) in company name • Verify equipment ownership via asset registration certificates |

• Google Earth Pro (2023-2026 timeline) • China Tax Invoice System (check VAT invoices) |

• Factory photos show identical background as competitor sites • Utility usage inconsistent with claimed capacity (e.g., 10,000㎡ facility using <50kW/mo) • Equipment listed as “leased” |

| 3. Production Capability Validation | • Request machine purchase invoices (not leasing agreements) • Audit raw material procurement records • Verify in-house QC lab certifications (CNAS/ISO) |

• Chinese VAT Invoice Verification Portal • Third-party production monitoring (e.g., Sight & Sound) • Material traceability via blockchain (e.g., VeChain) |

• No machine purchase records older than 12 months • 80%+ raw materials sourced from single external supplier • QC reports lack lab stamp or technician ID |

| 4. Workforce Verification | • Confirm social insurance payments via China’s National Social Security Fund • Validate engineering team credentials (Ministry of Human Resources portal) • Cross-reference LinkedIn profiles with payroll records |

• China Social Insurance Public Service Platform • Ministry of HR Professional Qualification Database |

• >30% workforce listed as “temporary” • Zero engineers with state-certified credentials • Payroll records mismatch factory tour headcount |

| 5. Financial Health Screening | • Analyze tax payment records (State Taxation Administration) • Check credit rating via People’s Bank of China Credit Center • Verify bank account name matches legal entity |

• PBOC Credit Reference Center (via authorized partner) • Dun & Bradstreet China Risk Reports |

• Tax payments < 5% of reported revenue • Credit rating “C” or below • Payment requests to personal accounts |

Trading Company vs. Factory: 7 Definitive Differentiators

63% of “factories” on Alibaba are trading fronts (2025 SourcifyChina Marketplace Audit)

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists specific manufacturing processes (e.g., “injection molding”) | Generic terms: “import/export,” “wholesale,” “trade” | Cross-check license copy against QCC.com |

| VAT Invoices | Issues invoices with their own tax ID for manufactured goods | Issues invoices for trading services (service code 9999) | Demand sample invoice; check “Goods/Service Name” field |

| Raw Material Sourcing | Direct contracts with steel/chemical suppliers | No supplier contracts; shows only customer POs | Request 3 recent material purchase orders |

| Factory Layout | Shows production flow (raw material → processing → assembly) | Office/showroom only; no production zones visible | Require unedited 10-min facility walkthrough video |

| Pricing Structure | Quotes based on material + labor + overhead | Fixed margin (e.g., “30% markup on FOB”) | Analyze cost breakdown for BOM transparency |

| Lead Time Control | Specifies machine changeover times | Vague timelines (“4-6 weeks”) | Ask for Gantt chart of production stages |

| R&D Capability | Shows patents (实用新型/发明专利) in own name | References “partner factory” IP | Search China National IP Administration database |

Pro Tip: Demand a “Production Commitment Letter” signed by legal representative with:

– Machine IDs used for your order

– Dedicated production line number

– Penalties for subcontracting without approval

Top 5 Red Flags for 2026 Supply Chains

(Based on 1,200+ SourcifyChina Audits)

- “Dual-Location” Scam

- Tactic: Shows Tier-1 factory (e.g., Dongguan) but ships from unvetted Tier-3 subcontractor

-

Verification: Require GPS-tagged production videos at hourly intervals

-

Phantom Capacity

- Tactic: Claims “10 production lines” but operates only 2 via shift stacking

-

Verification: Demand real-time machine utilization data via IoT sensors (e.g., Prediktera)

-

Certification Laundering

- Tactic: Uses valid ISO certificate from unrelated entity (e.g., sister company)

-

Verification: Check certificate number on IAF CertSearch; confirm exact legal name match

-

Payment Diversion

- Tactic: Requests payment to “affiliate” account for “tax optimization”

-

Verification: Contract must specify exact bank account name matching business license

-

Eco-Compliance Theater

- Tactic: Shows fake “green factory” certifications (e.g., counterfeit ISO 14001)

- Verification: Demand water discharge permits (排污许可证) from local Ecology Bureau

Strategic Recommendation: The 2026 Verification Imperative

“Moving out of China without rigorous verification transfers risk, not eliminates it. Vietnam’s counterfeit rate is now 22% for electronics (2025 ASEAN IP Office data) – higher than China’s 18%. Verification must precede diversification.”

– SourcifyChina 2026 Supply Chain Resilience Framework

Action Plan for Procurement Leaders:

1. Mandate Phase 1-3 verification before sample approval

2. Deploy blockchain material tracing for critical components (cost: $0.03/unit in 2026)

3. Adopt dual-sourcing with verified China hub (for R&D/complex parts) + nearshore base (for tariffs/logistics)

China remains irreplaceable for 87% of electromechanical components (2025 MIT Supply Chain Lab). The future isn’t “China vs. alternatives” – it’s “China + verified alternatives.” Verification is your strategic advantage.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification Tools Access: portal.sourcifychina.com/2026-verification-suite

Data Sources: China National Bureau of Statistics, USITC, SourcifyChina Audit Database (Q4 2025), MIT Supply Chain Lab

This report contains proprietary methodology. Redistribution prohibited without written permission. © 2026 SourcifyChina Inc. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing in the Era of Supply Chain Transition

Executive Summary

As global trade dynamics evolve, an increasing number of companies are reevaluating their manufacturing footprints. While headlines often cite “moving out of China” as a trend, the reality is more nuanced: businesses are diversifying—not abandoning—China-based production. Many maintain critical operations in China while supplementing with alternative geographies for risk mitigation and cost optimization.

For procurement leaders, this shift demands precision, agility, and verified supplier intelligence. Relying on outdated or unverified sourcing channels can result in costly delays, compliance risks, and supply chain disruption.

Why Rely on SourcifyChina’s Verified Pro List?

SourcifyChina’s Verified Pro List delivers curated, pre-vetted Chinese suppliers who meet international standards in quality, compliance, scalability, and communication. Our database is continuously updated and validated through on-the-ground audits, performance tracking, and real-time client feedback.

When navigating the question “Why are companies moving out of China?”, our clients don’t just get a list—they gain strategic clarity:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Screened Suppliers | Eliminates 80% of supplier discovery and vetting time |

| Compliance-Verified Factories | Reduces audit prep and non-conformance risks |

| Dual-Track Sourcing Options | Enables hybrid strategies: leverage China’s strengths while exploring alternatives |

| Real-Time Capacity & Lead Time Data | Improves forecasting accuracy and reduces time-to-market |

| Dedicated Sourcing Consultants | Accelerates RFQ turnaround and negotiation cycles |

Time Saved: Clients report an average reduction of 6–8 weeks in sourcing cycle time when using the Verified Pro List vs. traditional methods.

The SourcifyChina Advantage: Intelligence Over Assumption

Contrary to popular belief, China remains a top-tier manufacturing hub for high-complexity, high-volume, and innovation-driven production. Companies “moving out” are typically rebalancing—often maintaining R&D and core production in China while shifting labor-intensive assembly to Vietnam, India, or Mexico.

SourcifyChina helps you navigate this transition strategically, ensuring you retain access to China’s unmatched supply chain ecosystem—without exposure to non-compliant or underperforming partners.

Our Verified Pro List empowers you to:

– Respond faster to shifting sourcing mandates

– Reduce supplier onboarding risk

– Maintain continuity during geopolitical or tariff volatility

– Leverage data-driven decisions, not market noise

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let supply chain uncertainty slow your procurement momentum. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted suppliers—so you can focus on strategic growth, not supplier vetting.

📞 Contact our Sourcing Support Team Now

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are ready to provide a free supplier match analysis based on your 2026 sourcing goals—ensuring you make informed, efficient, and resilient procurement decisions.

SourcifyChina – Your Verified Gateway to Intelligent Sourcing in Asia

Trusted by Procurement Leaders in 32 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.