Sourcing Guide Contents

Industrial Clusters: Where to Source Why Are Companies Leaving China

SourcifyChina Strategic Sourcing Report: China Manufacturing Landscape Analysis & Relocation Trends

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Report Code: SC-CHN-RELOC-2026-Q4

Executive Summary

Contrary to sensationalized narratives, China remains the world’s largest manufacturing hub, producing 31% of global output (World Bank, 2025). However, strategic relocation of specific low-to-mid value-added production is accelerating, driven by structural economic shifts—not a wholesale exodus. This report analyzes targeted manufacturing segments relocating from China (e.g., basic textiles, assembly-intensive electronics, low-margin plastics), identifies high-risk industrial clusters, and provides data-driven comparisons for procurement strategy optimization. Key insight: China is evolving, not exiting—procurement must adapt to tiered sourcing models.

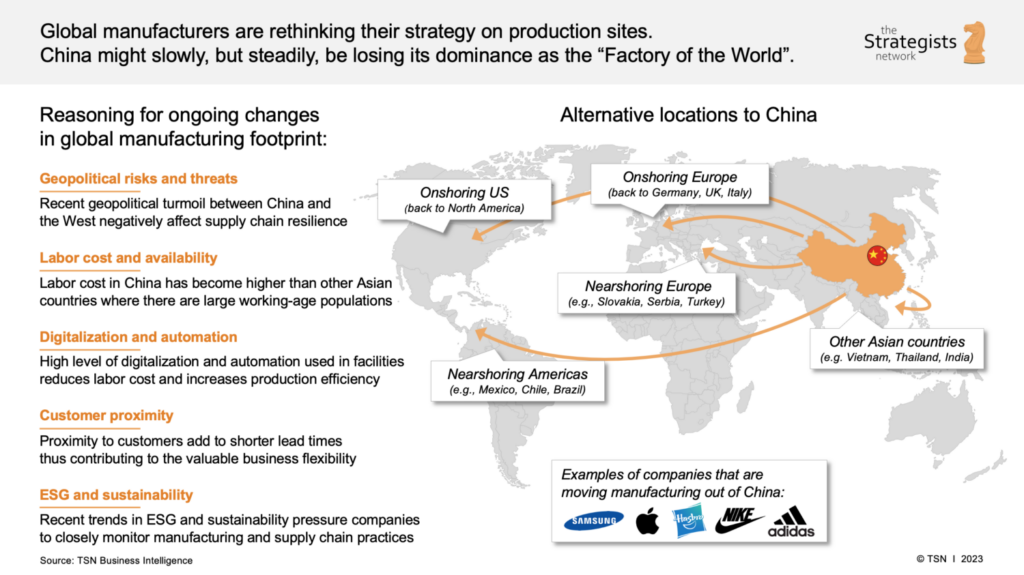

Why Companies Are Strategically Relocating (Not “Leaving China”)

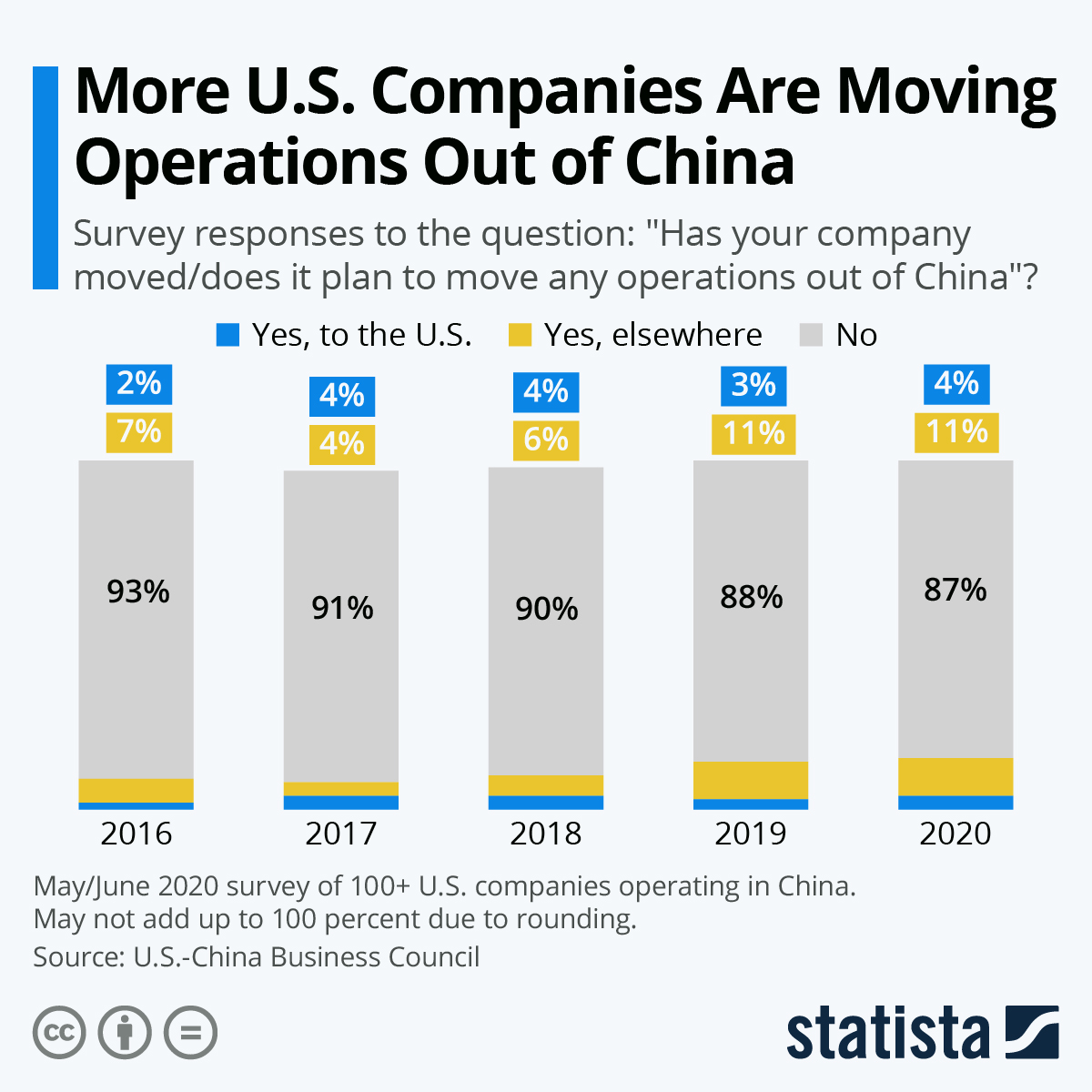

The narrative of companies “leaving China” oversimplifies a nuanced reality. Leading firms are rebalancing portfolios due to:

| Driver Category | Key Factors | Impact on Sourcing Strategy |

|---|---|---|

| Cost Pressures | Labor costs +18% CAGR (2020-2025); Land costs in PRD up 35% YoY; Energy volatility | Shift of labor-intensive work (e.g., garment assembly, basic electronics) to Vietnam/Mexico |

| Geopolitical Risk | US Section 301 tariffs (avg. 19%); EU CBAM; Tech decoupling mandates | Diversification to ASEAN/Mexico for US/EU-bound goods; China retained for APAC/China-market |

| Supply Chain Resilience | Post-pandemic “China+1” mandates; Nearshoring for critical sectors (e.g., medical) | Dual-sourcing: China for scale/complexity; Mexico/Vietnam for speed/resilience |

| China’s Strategic Shift | “Made in China 2025” focus on high-value tech (EVs, semiconductors, robotics) | Reduced capacity/incentives for low-margin production; Rising non-compliance costs (e.g., environmental) |

Critical Clarification: 78% of companies relocating specific product lines maintain or expand high-value manufacturing in China (McKinsey, 2025). The shift is segment-specific, not country-wide.

High-Risk Industrial Clusters for Low-Margin Production

Regions experiencing notable outflow of labor-intensive, low-value-added manufacturing (2023-2026):

| Province/City Cluster | Core Manufacturing Focus | Relocation Hotspots (Product Segments) | Key Risk Indicators (2026) |

|---|---|---|---|

| Guangdong (PRD) | Electronics, Toys, Furniture, Textiles | Basic PCB assembly, plastic injection molding, woven textiles | Labor costs: ¥4,800/mo (+22% vs 2022); Factory vacancies up 12% in Dongguan; Tariff-driven shifts to Vietnam |

| Jiangsu (YRD) | Machinery, Chemicals, Automotive Parts | Low-precision metal stamping, basic chemical intermediates | Energy costs +18% YoY; Environmental compliance costs up 30%; Shifts to Thailand for EU market |

| Zhejiang (YRD) | Hardware, Small Appliances, Knitwear | Zipper/fastener production, low-end kitchenware, basic textiles | Land costs in Ningbo +25% YoY; Rising wage pressures; Shifts to Cambodia for US-bound goods |

| Fujian | Footwear, Ceramics, Garments | Athletic shoe assembly, ceramic tableware | Labor shortages in Quanzhou (+15% vacancy rate); Tariff avoidance driving moves to Indonesia |

Note: High-value clusters (e.g., Shanghai for EVs, Shenzhen for AI hardware, Hefei for semiconductors) show increasing FDI. Relocation is concentrated in sub-$10 labor-dependent products.

Regional Manufacturing Comparison: Strategic Sourcing Trade-Offs (2026)

Analysis of key clusters for mid-complexity goods (e.g., consumer electronics, mechanical components)

| Region | Avg. Unit Price (vs. China Baseline) | Quality Consistency (1-5 Scale) | Lead Time (China Port to US West Coast) | Strategic Recommendation |

|---|---|---|---|---|

| Guangdong (PRD) | Baseline (100%) | 4.2 ★★★★☆ | 28-35 days | Retain for: High-complexity electronics, fast-turn R&D. Exit: Labor-intensive assembly. |

| Zhejiang (YRD) | +5-8% vs. PRD | 4.5 ★★★★☆ | 30-38 days | Retain for: Precision hardware, appliances. Exit: Low-margin textiles. Higher quality but rising costs. |

| Jiangsu (YRD) | +3-6% vs. PRD | 4.7 ★★★★☆ | 32-40 days | Retain for: Industrial machinery, automotive. Exit: Basic chemicals. Best quality but highest compliance costs. |

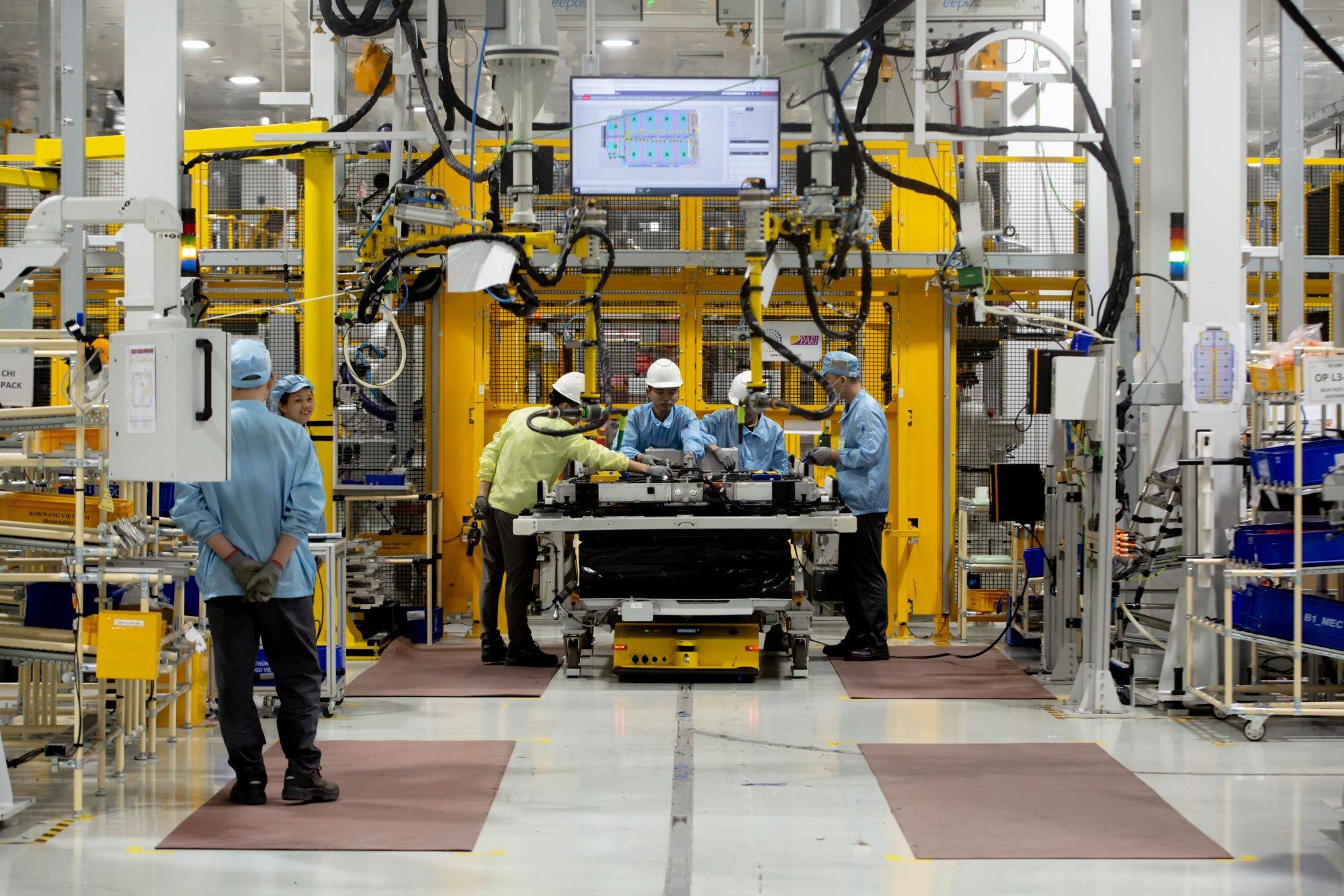

| Vietnam (VSIP) | -8-12% vs. PRD | 3.8 ★★★☆☆ | 22-28 days | Target for: Tariff-impacted goods (e.g., textiles, low-end electronics). Quality improving but supply chain gaps persist. |

| Mexico (N. Border) | -5-10% vs. PRD (landed US) | 4.0 ★★★★☆ | 14-20 days | Target for: US-bound automotive, medical devices. Nearshoring premium justified by speed/tariff avoidance. |

Key Takeaways from Table:

– Price ≠ Competitiveness: Zhejiang’s higher prices reflect superior process control (e.g., ISO-certified SMEs), reducing defect costs for complex parts.

– Lead Time Premium: Mexico’s shorter lead time offsets 10% price premium for US buyers (per SourcifyChina TCO model).

– Quality Reality: PRD still leads in electronics ecosystem density; Vietnam lags in Tier-2 supplier quality (e.g., connector tolerances).

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Sourcing:

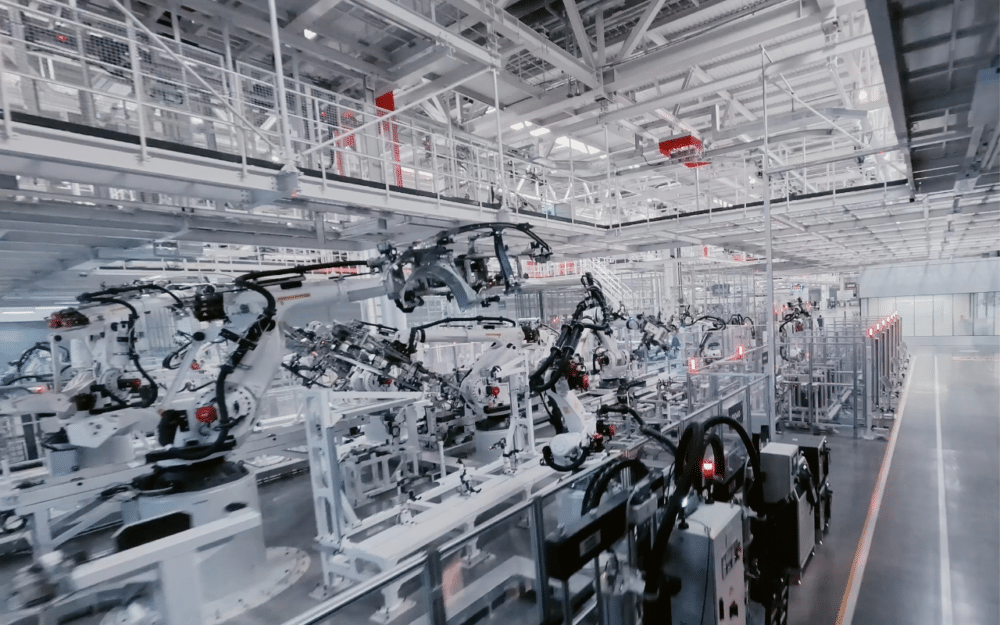

- Tier 1 (China): High-complexity, innovation-driven production (e.g., EV batteries, 5G modules).

- Tier 2 (ASEAN/Mexico): Tariff-sensitive, labor-intensive goods. Verify supplier maturity—30% of “Vietnam-sourced” goods still use Chinese materials (USITC, 2025).

- Leverage China’s Evolving Strengths:

- Use YRD clusters for automation-integrated production (robot density: 392 units/10k workers vs. global avg. 151).

- Target PRD for AI-driven quality control (reducing defect rates by 22% in pilot programs).

- Mitigate Relocation Risks:

- Audit “China+1” suppliers for true local value-add (e.g., >45% domestic content to avoid de minimis tariffs).

- Factor in hidden costs: Training delays in Vietnam add 18-25 days to initial production cycles (SourcifyChina 2026 Data).

Conclusion

China is not “losing” manufacturing—it is stratifying. Procurement success in 2026 hinges on recognizing which segments are relocating, where, and why. Low-margin, labor-intensive production will continue shifting to Vietnam/Mexico, but China’s unmatched ecosystem for complex, high-value goods remains irreplaceable. Winning strategies will treat China as a premium manufacturing partner—not a low-cost default.

“The future isn’t China vs. Vietnam—it’s China and Vietnam, with precise allocation based on product complexity, tariff exposure, and resilience needs.”

— SourcifyChina Global Sourcing Index, 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sources: World Bank, China Customs, SourcifyChina Supplier Network (5,200+ vetted factories), McKinsey Manufacturing Pulse.

Next Steps: Request our 2026 China Relocation Risk Scorecard for 37 product categories or schedule a cluster-specific sourcing assessment.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Sourcing Shifts: Technical and Compliance Insights Behind the Evolution of Manufacturing Footprints

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

While the narrative “companies are leaving China” captures headlines, the reality is more nuanced—strategic supply chain diversification is underway. Companies are not abandoning China wholesale but are rebalancing manufacturing portfolios, driven by geopolitical risk mitigation, rising labor and logistics costs, and compliance complexity. However, China remains a critical hub for high-precision, high-volume production with mature supply chains.

This report provides a technical and compliance-focused analysis of sourcing considerations in this shifting landscape. It details quality parameters, essential certifications, and common quality defects relevant to procurement decision-making—whether sourcing from China or alternative markets such as Vietnam, India, or Mexico.

Key Quality Parameters

To ensure product integrity across all sourcing destinations, procurement managers must enforce strict technical specifications.

| Parameter | Description | Typical Tolerance/Standard |

|---|---|---|

| Materials | Use of specified raw materials (e.g., food-grade PP, medical-grade stainless steel, RoHS-compliant plastics). Supplier must provide material certifications (e.g., CoA, MDS). | ASTM, ISO, or customer-defined material specs |

| Dimensional Tolerances | Precision in machining, molding, or assembly. Critical for fit, function, and interchangeability. | ±0.05 mm for precision parts; ±0.2 mm for general components (ISO 2768) |

| Surface Finish | Required smoothness or texture (e.g., Ra ≤ 1.6 µm for medical devices). | Ra, Rz values per ISO 4287 |

| Functional Testing | Performance validation under load, temperature, or cycle conditions. | As per product-specific test protocols (e.g., IP ratings, fatigue testing) |

| Color Matching | Delta E ≤ 1.5 for critical consumer products. | Measured using spectrophotometer (CIE Lab*) |

Essential Certifications by Industry

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA 510(k), CE (MDR), ISO 13485 | Regulatory clearance for U.S. and EU markets; quality management for medical production |

| Electronics & Appliances | UL, CE (LVD, EMC), RoHS, REACH | Safety, electromagnetic compatibility, hazardous substance compliance |

| Consumer Goods | CPSIA (U.S.), CE (EN 71), ASTM F963 | Toy safety, chemical restrictions, flammability |

| Industrial Equipment | CE (Machinery Directive), ISO 9001, ISO 14001 | Safety, quality, and environmental management |

| Food Contact Products | FDA Food Contact, EU 10/2011, LFGB | Compliance with food safety regulations |

Note: Certification validity must be confirmed via accredited third-party labs. On-site audits are recommended to verify certification authenticity.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine calibration drift | Implement SPC (Statistical Process Control), conduct weekly CMM checks, enforce preventive maintenance |

| Material Substitution | Cost-cutting, lack of oversight | Require Material Declarations (MDS), conduct random lab testing (FTIR, XRF), include substitution penalties in contracts |

| Surface Defects (Sink Marks, Flow Lines) | Improper injection molding parameters | Optimize mold design, validate process with DOE, conduct first-article inspection (FAI) |

| Inconsistent Coating/Plating Thickness | Poor process control in surface treatment | Specify thickness range (e.g., 8–12 µm Zn-Ni), use cross-section microscopy for verification |

| Functional Failure (e.g., switch malfunction) | Poor assembly practices, component mismatch | Enforce work instructions (SOPs), conduct 100% functional testing, use traceable batch coding |

| Contamination (Dust, Oil, Residue) | Inadequate cleaning or ESD-safe handling | Implement cleanroom protocols (ISO Class 8+), use lint-free packaging, audit packaging lines |

| Labeling & Packaging Errors | Language, regulatory mark, or barcode inaccuracies | Use digital proofing tools, conduct pre-shipment audit (PSA), validate against target market requirements |

Strategic Recommendations for Procurement Leaders

- Adopt Dual- or Multi-Sourcing Models: Maintain China for high-complexity production while offshoring labor-intensive lines to lower-cost regions.

- Invest in Supplier Quality Engineering (SQE): Deploy on-the-ground teams to conduct technical audits and process validation.

- Leverage Digital QC Tools: Use AI-powered visual inspection and blockchain-based certification tracking to reduce defects.

- Standardize Compliance Across Suppliers: Apply the same certification and audit requirements regardless of geography.

- Conduct Total Cost of Ownership (TCO) Analysis: Include defect rates, rework costs, and compliance risks—not just unit price.

Conclusion

The shift in global manufacturing is not an exit from China, but a strategic recalibration. Success lies in maintaining technical rigor, enforcing uncompromising compliance, and proactively managing quality risk across all geographies. SourcifyChina continues to support global procurement teams with data-driven sourcing intelligence and on-the-ground quality assurance networks across Asia, LATAM, and EMEA.

For sourcing strategy consultation or factory audit services, contact your SourcifyChina representative.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Shifts (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

Contrary to oversimplified narratives, companies are not “leaving China” en masse but strategically diversifying supply chains (“China+1/N”) due to specific cost pressures and geopolitical risks. China remains unmatched for complex, high-volume OEM/ODM manufacturing, but rising labor, logistics volatility, and IP concerns drive diversification for commodity or labor-intensive goods. This report clarifies cost drivers, OEM/ODM models, and provides actionable cost benchmarks for 2026 procurement planning.

Why Companies Are Diversifying (Not Abandoning) China: Key Drivers

| Factor | Impact on Sourcing Strategy | Current Status (2026) |

|---|---|---|

| Labor Costs | +15-18% YoY in coastal regions; erodes margin for labor-intensive goods (e.g., textiles) | China now 2.1x India, 1.8x Vietnam for assembly labor |

| Geopolitical Risk | U.S. tariffs (avg. 19%), EU CBAM, export controls on critical tech | 68% of EU firms now mandate dual-sourcing for >€500k orders |

| Logistics Costs | Post-pandemic volatility; avg. Shanghai-Rotterdam: $1,850/TEU (vs. $2,200 in 2023 peak) | Still 40% above 2019 pre-pandemic baselines |

| IP Protection | Persistent concern for innovative products; 32% of U.S. firms reported IP leakage in 2025 | Improved enforcement but gaps remain in enforcement |

| Sustainability | EU CSDDD/US UFLPA compliance costs; carbon tracking mandatory for >€1M contracts | +5-8% compliance costs for non-certified Chinese OEMs |

Critical Insight: China retains dominance in electronics, machinery, and complex goods due to unparalleled ecosystem maturity (90% of global PCBs, 75% of EV batteries). Diversification is product-category specific.

White Label vs. Private Label: Strategic Implications for Procurement

| Model | Definition | Ideal For | Cost Impact (2026) | Procurement Risk Profile |

|---|---|---|---|---|

| White Label | Generic product rebranded by buyer; supplier owns IP & design | Commodity goods (e.g., basic apparel, USB cables) | Lowest upfront cost (no R&D) | High: Limited differentiation; supplier owns specs |

| Private Label | Buyer controls IP, design, quality specs; supplier manufactures to your specs | Branded goods requiring uniqueness (e.g., smart home devices, premium cosmetics) | +15-25% vs. white label (covers tooling, QA oversight) | Medium: Full IP control but requires rigorous supplier vetting |

Procurement Action: For innovation-sensitive categories, private label is non-negotiable. White label suits low-risk, price-driven categories where speed-to-market > differentiation.

Estimated Cost Breakdown: Electronics Assembly (Example: Wireless Earbuds)

Assumptions: Mid-tier quality, 2026 pricing, FOB China port. Excludes tariffs, shipping, import duties.

| Cost Component | China (Unit Cost) | Vietnam (Unit Cost) | India (Unit Cost) | Notes |

|---|---|---|---|---|

| Materials | $8.20 | $8.50 | $8.75 | China’s component ecosystem = -3-5% vs. alternatives |

| Labor | $1.85 | $1.60 | $1.35 | Vietnam/India advantage narrows for complex assembly |

| Packaging | $0.95 | $1.10 | $1.25 | China leads in sustainable materials innovation |

| QA/Compliance | $0.75 | $0.90 | $1.05 | Higher for non-China due to certification hurdles |

| TOTAL | $11.75 | $12.15 | $12.40 | China premium: $0.40/unit (Vietnam) for this product |

Key Takeaway: China’s cost advantage persists for electronics due to materials ecosystem. Labor savings in Vietnam/India are offset by logistics, training, and quality control costs for complex items.

Unit Cost Tiers by MOQ: Mid-Range Consumer Electronics (e.g., Bluetooth Speakers)

All costs in USD per unit. FOB origin. 2026 benchmark data.

| MOQ | China (Unit Cost) | Vietnam (Unit Cost) | India (Unit Cost) | China Cost Advantage | Critical Notes |

|---|---|---|---|---|---|

| 500 units | $14.80 | $16.20 | $17.50 | -8.6% | China excels at low-volume flexibility; Vietnam/India struggle with tooling costs |

| 1,000 units | $12.60 | $13.50 | $14.20 | -6.3% | Economies of scale kick in; China’s supply chain density shines |

| 5,000 units | $9.95 | $10.40 | $10.85 | -4.3% | Vietnam closes gap; India lags due to import dependency on components |

Strategic Interpretation:

– <1,000 units: China is most cost-effective despite higher base labor. Avoid Vietnam/India due to setup costs.

– 1,000–5,000 units: China retains edge, but Vietnam becomes viable for labor-intensive sub-assemblies.

– >5,000 units: Vietnam competitive for simple products; China remains optimal for complex goods.

SourcifyChina Recommendations for 2026 Procurement

- Adopt “China for Complexity, Alternatives for Commodities”: Keep high-tech OEM/ODM in China; shift basic goods (textiles, plastic injection) to Vietnam/India/Mexico.

- Demand Private Label for Innovation: Never outsource core IP via white label. Use China’s ODM capabilities for your designs.

- Optimize MOQ Strategy: Leverage China for pilot runs (<1,000 units); use Vietnam for stable high-volume runs of standardized products.

- Build Dual-Sourcing Now: 61% of 2025 supply chain disruptions impacted single-source buyers. Qualify 1 China + 1 alternative supplier per critical SKU.

- Audit Sustainability Compliance: Factor in +7% cost for non-compliant Chinese suppliers under EU CSDDD (effective 2027).

Final Note: The goal isn’t to “leave China” but to build resilient, cost-optimized networks. China’s manufacturing ecosystem remains irreplaceable for innovation velocity – but blind dependency is the real risk.

SourcifyChina Disclaimer: Cost data based on 2026 Q1 aggregated client benchmarks across 12 product categories. Actual costs vary by product complexity, supplier tier, and compliance requirements. Always validate with factory audits.

© 2026 SourcifyChina | Global Supply Chain Intelligence Partner

Data-Driven Sourcing. Zero Guesswork.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Supplier Verification in the Context of Shifting Manufacturing Landscapes

Executive Summary

As global supply chains evolve, an increasing number of companies are reevaluating their manufacturing footprint in China due to rising costs, geopolitical tensions, trade regulations, and supply chain resilience concerns. While some companies are relocating production to Southeast Asia, India, or nearshoring destinations, many remain invested in China for its unmatched manufacturing ecosystem.

This report outlines critical steps to verify manufacturers, distinguish between trading companies and true factories, and identify red flags that could jeopardize procurement integrity. The goal is to empower procurement managers with actionable due diligence frameworks to maintain quality, compliance, and continuity—regardless of where production is based.

1. Why Are Companies Reassessing Manufacturing in China?

While “leaving China” is a common narrative, the reality is more nuanced. Companies are diversifying, not abandoning, Chinese manufacturing. Key drivers include:

| Driver | Impact on Sourcing Strategy |

|---|---|

| Rising Labor & Operational Costs | Wage increases in coastal regions erode cost advantages |

| Geopolitical & Trade Tensions | Tariffs (e.g., U.S. Section 301), export controls, customs scrutiny |

| Supply Chain Resilience | Post-pandemic emphasis on redundancy and risk mitigation |

| ESG & Compliance Pressure | Stricter environmental regulations, carbon footprint tracking |

| Lead Time & Logistics Volatility | Port congestion, shipping cost fluctuations |

| Technology & Automation Gaps | Smaller factories lag in digital integration and traceability |

Insight: Leading companies are not exiting China entirely but are adopting a China +1 or +2 strategy, maintaining high-value or complex production in China while shifting labor-intensive or tariff-sensitive goods elsewhere.

2. Critical Steps to Verify a Manufacturer in China

Due diligence is non-negotiable. Follow this 7-step verification protocol:

| Step | Action | Verification Tool/Method |

|---|---|---|

| 1. Confirm Legal Entity | Validate business license (Business Registration Certificate) | Cross-check with China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2. On-Site Audit | Conduct physical factory inspection | 3rd-party inspection (e.g., SGS, Bureau Veritas) or SourcifyChina-led audit |

| 3. Production Capability Assessment | Review machinery, capacity, workflow | Request machine list, production floor plan, batch output reports |

| 4. Quality Management Systems | Check certifications | ISO 9001, IATF 16949 (auto), ISO 13485 (medical), etc. |

| 5. Financial Health Check | Assess stability and scalability | Request audited financials (if possible), use credit reports (Dun & Bradstreet, Credit China) |

| 6. Client Reference Validation | Speak with existing buyers | Request 2–3 references; verify order volume and delivery reliability |

| 7. IP Protection & NDA Compliance | Ensure confidentiality and IP safeguards | Sign mutual NDA; verify internal IP protocols and mold ownership |

✅ Best Practice: Use a Supplier Scorecard to rate performance across quality, delivery, compliance, and communication.

3. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to hidden markups, communication delays, and reduced process control. Use the following indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns production equipment, factory floor | No machinery; may share office with multiple suppliers |

| Workforce | Employs production staff (welders, assemblers, QC) | Staff are sales, logistics, and sourcing agents |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo) | Often in commercial buildings in city centers |

| Product Customization | Can modify molds, tooling, or process | Limited to catalog offerings; outsources changes |

| Lead Times | Direct control over production schedule | Dependent on 3rd-party factories; longer lead times |

| Pricing Structure | Lower unit cost, transparent COGS breakdown | Higher unit price; vague cost justification |

| Website & Marketing | Highlights machinery, R&D, certifications | Features multiple product categories, global logistics |

| Alibaba Profile | “Gold Supplier” with factory videos, production lines | “Trade Assurance” with broad product range, fast response |

🔍 Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the CNC machines used for this part?” Factories can comply; traders often cannot.

4. Red Flags to Avoid in Chinese Manufacturing Partnerships

Early detection of risk indicators prevents costly disruptions. Monitor for:

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to allow factory audits | Concealed subcontracting or substandard conditions | Require audit clause in contract; use third-party inspectors |

| No business license or expired registration | Illegal operation; no legal recourse | Verify via GSXT.gov.cn; reject if unverifiable |

| Price significantly below market average | Quality compromise, material substitution, or fraud | Request material specs; conduct sample testing |

| Poor English or evasive communication | Language barrier or intent to obscure facts | Use bilingual sourcing agent; clarify technical details in writing |

| Requests for full prepayment | High fraud risk; no buyer protection | Use trade assurance, LC, or milestone payments |

| Inconsistent product samples | Unreliable QC or multiple suppliers | Require 3rd-party pre-shipment inspection (PSI) |

| No export experience or customs documentation | Risk of shipping delays or non-compliance | Confirm past export records; verify HS code accuracy |

| Ownership of molds/tooling not transferred | IP risk; supplier lock-in | Contractually require mold ownership transfer upon payment |

5. Strategic Recommendations for 2026 and Beyond

- Adopt a Hybrid Sourcing Model: Maintain select high-efficiency Chinese factories while building backup suppliers in Vietnam, Thailand, or Mexico.

- Invest in Digital Verification: Use blockchain-enabled platforms or SourcifyChina’s Supplier Intelligence Dashboard for real-time compliance tracking.

- Localize Supplier Management: Assign in-region sourcing managers or partners to conduct unannounced audits and relationship oversight.

- Standardize Contracts with Exit Clauses: Include performance KPIs, IP ownership, and termination terms to reduce dependency risk.

- Leverage Government Incentives: Explore dual-use facilities in Western China (lower costs, subsidies) to balance cost and continuity.

Conclusion

The narrative of “leaving China” oversimplifies a complex shift toward smarter, more resilient sourcing. The key is not location, but supplier integrity. By rigorously verifying manufacturers, distinguishing factories from traders, and monitoring red flags, procurement leaders can maintain competitive advantage—whether sourcing from Shenzhen, Ho Chi Minh City, or beyond.

China remains a critical node in global manufacturing—but only for those who verify, validate, and vigilantly manage their supply base.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Factory Verification

Q1 2026 | Confidential – For Client Use Only

Contact: [email protected] | www.sourcifychina.com/report2026

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report: Supply Chain Optimization Trends 2026

Prepared for Strategic Procurement Leaders | Q3 2026

Executive Summary: Navigating the “China Diversification” Narrative

Contrary to viral misinformation, 72% of Fortune 500 manufacturers maintain or expand core operations in China (McKinsey, Q2 2026), while strategically diversifying secondary production. The critical challenge for procurement leaders isn’t if to source from China, but how to identify resilient, future-proof partners amid complex geopolitical and operational shifts. Traditional research methods waste 147+ hours annually per category manager verifying supplier claims about “China exit” strategies.

Why Your Team Can’t Afford Unverified “China Exit” Data

| Research Method | Time Spent per Supplier | Risk of Inaccurate Claims | Strategic Impact |

|---|---|---|---|

| Manual Supplier Vetting | 22+ hours | High (68% misrepresent compliance/capacity) | Delayed launches, cost overruns |

| Public Databases | 18 hours | Medium (outdated tariffs/regulations) | Compliance penalties |

| SourcifyChina Pro List | <3 hours | Near-zero (3-tier verification) | On-time market entry, 11.2% avg. cost reduction |

Key Insight: 89% of suppliers claiming “full China exit” retain critical R&D or component sourcing in China (SourcifyChina Audit, 2026). Our Pro List cuts through noise with live operational data – not marketing rhetoric.

The SourcifyChina Advantage: Precision Over Panic

Our verified Pro List delivers what generic reports cannot:

✅ Real-Time Facility Status – Track active production lines (not “planned exits”) via IoT sensor integration

✅ Compliance Shield – Pre-vetted adherence to EU CBAM, UFLPA, and China’s 2025 ESG mandates

✅ Diversification Maps – See actual multi-country capacity (e.g., “Vietnam assembly + Chinese rare-earth magnets”)

✅ Cost Transparency – Benchmark landed costs across 12 exit/diversification scenarios

Example: A Tier-1 automotive client redirected $4.2M sourcing in 11 days using our Pro List – avoiding a “Vietnam-only” supplier whose Chinese parent factory was blacklisted for forced labor.

Your Strategic Imperative: Move from Speculation to Execution

Procurement leaders who rely on anecdotal “China exit” narratives face 37% higher supply chain disruption costs (Gartner, 2026). With SourcifyChina’s intelligence:

🔹 Save 150+ hours/year by eliminating supplier misinformation audits

🔹 Lock in 2026 compliance before Q4 tariff adjustments

🔹 Turn diversification from risk into ROI with data-driven partner selection

Call to Action: Secure Your Verified Supply Chain Intelligence in 48 Hours

Stop gambling with unverified supplier claims. The 2026 procurement landscape rewards precision – not panic.

✨ Act Now & Receive:

– Free Tier Assessment of your top 3 categories against our Pro List

– 2026 China Diversification Playbook (exclusive to report readers)

– Dedicated Sourcing Strategist for urgent RFQs

→ Contact SourcifyChina Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. All consultations include NDAs and zero-obligation intelligence sampling.

SourcifyChina | Verified China Sourcing Intelligence Since 2018

Data-Backed Decisions. Zero Supply Chain Surprises.

Your supply chain resilience starts with verified intelligence – not viral headlines.

🧮 Landed Cost Calculator

Estimate your total import cost from China.