Sourcing Guide Contents

Industrial Clusters: Where to Source Why Are American Companies In China

SourcifyChina | B2B Sourcing Report 2026

Market Analysis: Why American Companies Are in China – A Strategic Sourcing Perspective

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Purpose: To provide strategic insights into the continued presence of American companies in China, with a focus on industrial clusters and comparative regional performance for manufacturing operations.

Executive Summary

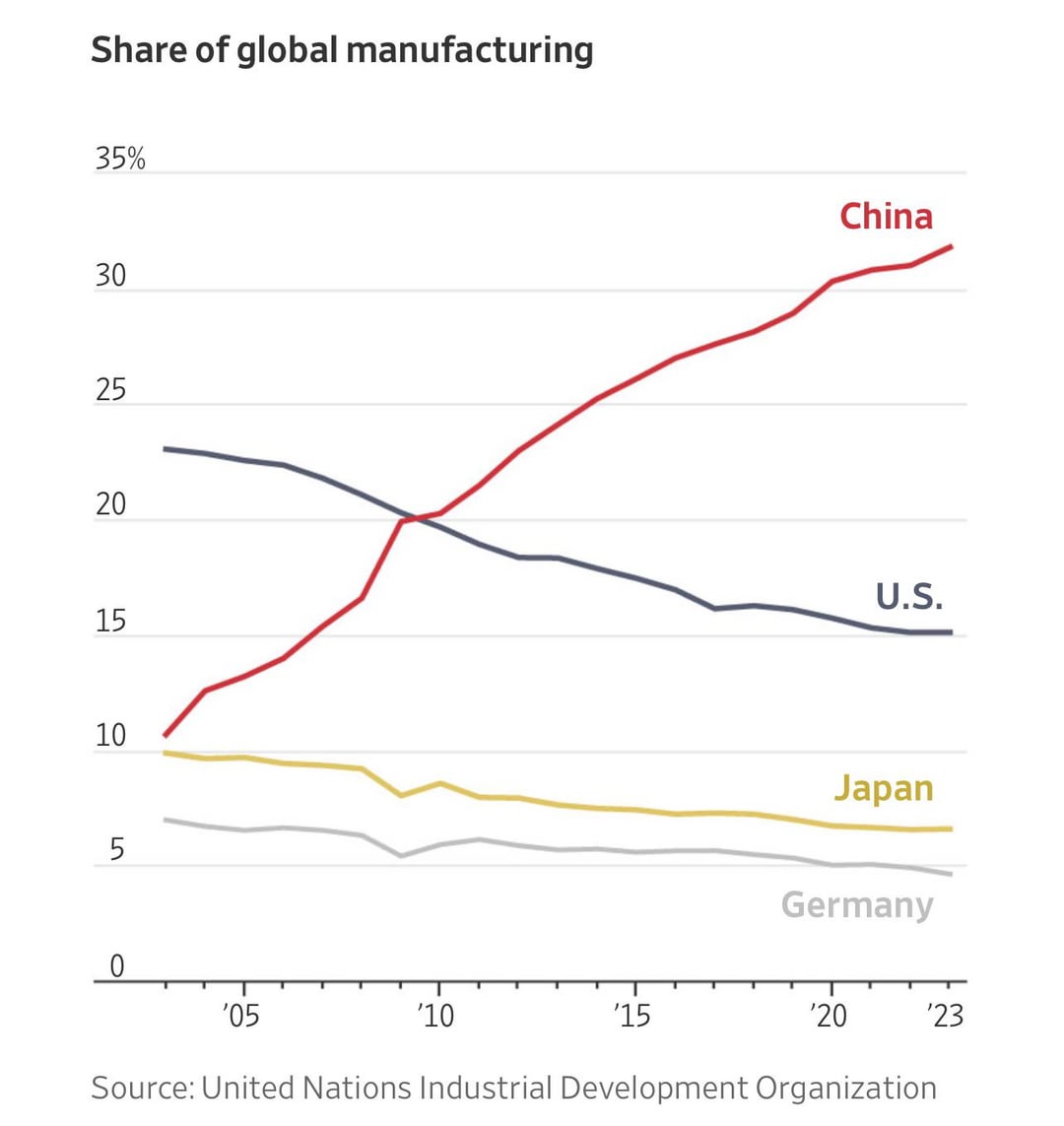

Despite geopolitical shifts, supply chain diversification efforts, and rising labor costs, China remains a critical hub for American multinational corporations (MNCs). As of 2026, over 70,000 American companies maintain active operations or sourcing relationships in China. This report analyzes the strategic rationale behind this sustained engagement and identifies key industrial clusters driving manufacturing competitiveness.

The core drivers include integrated supply chains, skilled labor pools, advanced infrastructure, and proximity to Asia-Pacific markets. While Vietnam, India, and Mexico are emerging alternatives, China’s ecosystem maturity continues to deliver unmatched efficiency for complex, high-volume manufacturing.

This report focuses on the manufacturing footprint of American firms in China, identifying key provinces and cities, and evaluates regional performance across price, quality, and lead time metrics.

Section 1: Strategic Rationale – Why American Companies Remain in China

American companies maintain a strong presence in China due to the following interconnected factors:

-

Supply Chain Integration

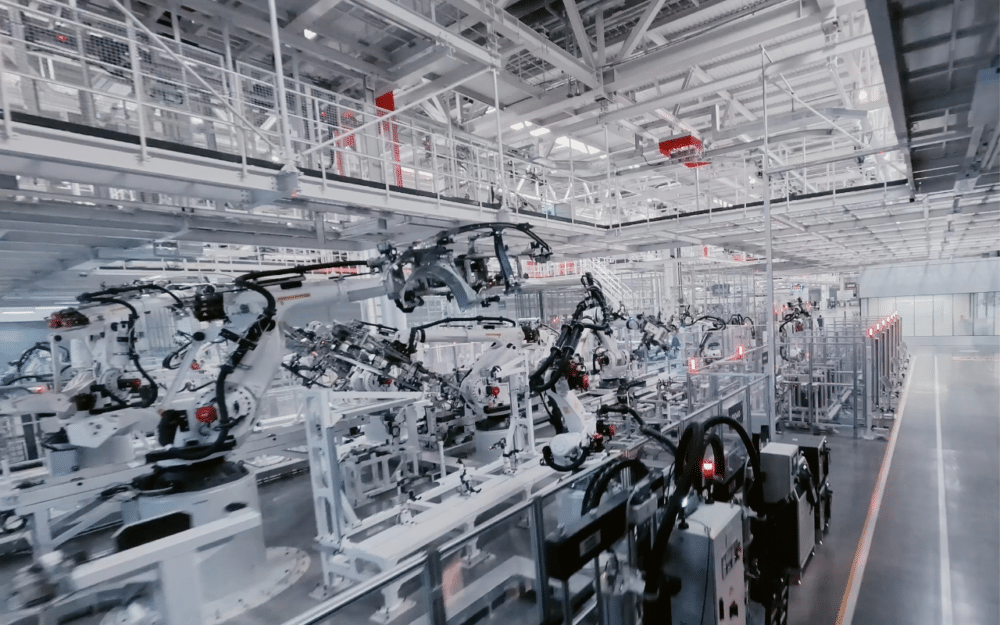

China hosts the world’s most comprehensive component and sub-assembly ecosystem. Over 80% of global electronics parts and 60% of mechanical components originate from Chinese clusters. -

Skilled and Scalable Workforce

Over 200 million skilled manufacturing workers, supported by technical colleges and vocational training programs, enable rapid scaling. -

Proximity to Growth Markets

China serves as a springboard to ASEAN, Japan, South Korea, and India. Local production avoids import tariffs and reduces time-to-market. -

Advanced Infrastructure

World-class ports (e.g., Shanghai, Shenzhen), high-speed rail, and industrial parks reduce logistics friction. -

Technology and Innovation Access

Collaboration with Chinese tech firms and R&D centers (e.g., in Shenzhen and Shanghai) accelerates product development. -

Government Incentives and SEZs

Special Economic Zones (SEZs) and free trade zones offer tax breaks, streamlined customs, and regulatory flexibility.

Section 2: Key Industrial Clusters for American Manufacturing in China

American companies are concentrated in the following provinces and cities, each offering distinct advantages:

| Province/City | Key Industries | Notable American Firms | Cluster Strengths |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou, Dongguan) | Electronics, Consumer Tech, IoT, EV Components | Apple (via Foxconn), Tesla, HP, Amazon | World leader in electronics; dense supplier network; innovation-driven R&D |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Light Manufacturing, E-commerce Goods, Textiles, Machinery | Nike (contractors), Walmart suppliers, Tesla (supply chain) | High SME agility; e-commerce integration; strong export logistics |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Semiconductors, Industrial Equipment, Automotive | Corning, Honeywell, General Electric | Proximity to Shanghai; high-quality standards; strong foreign investment |

| Shanghai | Automotive, Biotech, Advanced Materials, AI | Tesla, Johnson & Johnson, Boeing (components) | Global business hub; R&D centers; talent density |

| Sichuan (Chengdu, Chongqing) | Aerospace, Heavy Machinery, IT Hardware | Intel, Cisco, Cummins | Lower labor costs; inland logistics hub; government incentives |

| Shandong (Qingdao, Yantai) | Chemicals, Heavy Industry, Food Processing | Dow Chemical, PepsiCo, John Deere | Port access; raw material availability; industrial diversification |

Section 3: Regional Comparison – Manufacturing Performance Metrics

The table below compares key manufacturing regions in China based on Price, Quality, and Lead Time—critical KPIs for procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium-High (rising due to wages) | ★★★★★ (World-Class) | 4–6 weeks | High-tech electronics, complex assemblies, fast innovation cycles |

| Zhejiang | High (cost-efficient SMEs) | ★★★★☆ (Good to High) | 5–7 weeks | Consumer goods, e-commerce products, mid-tier industrial parts |

| Jiangsu | Medium | ★★★★★ (Precision Engineering) | 5–6 weeks | Industrial machinery, semiconductors, medical devices |

| Shanghai | Low-Medium (high overhead) | ★★★★★ (Premium) | 6–8 weeks | R&D-integrated production, high-value components |

| Sichuan | High (lower labor costs) | ★★★★☆ (Improving) | 6–8 weeks | Labor-intensive manufacturing, logistics-hub distribution |

| Shandong | High | ★★★★☆ (Stable) | 5–7 weeks | Chemicals, heavy equipment, food & beverage processing |

Rating Scale:

– Price Competitiveness: High = lowest cost, Low = highest cost

– Quality: ★★★★★ = consistent with global OEM standards

– Lead Time: From PO to FOB shipment, including production and customs

Section 4: Strategic Recommendations for Procurement Managers

-

Dual-Track Sourcing Strategy

Maintain high-value production in Guangdong/Jiangsu while offloading cost-sensitive lines to Zhejiang or Sichuan. -

Leverage Regional Incentives

Explore inland incentives in Sichuan and Chongqing for labor-intensive processes to reduce total landed cost. -

Invest in Supplier Development

Partner with Tier-1 and Tier-2 suppliers in Shanghai and Shenzhen to co-develop next-gen components. -

Monitor Policy Shifts

Track China’s “Made in China 2025” upgrades and U.S.-China trade policies to anticipate tariff and compliance changes. -

Integrate Digital Procurement Tools

Use platforms like Alibaba’s 1688, Made-in-China.com, and Sourcify’s supplier analytics to benchmark regional performance.

Conclusion

American companies remain in China not out of inertia, but strategic necessity. The country’s manufacturing ecosystem—particularly in Guangdong, Zhejiang, Jiangsu, and Shanghai—offers an irreplaceable combination of scale, quality, and innovation. While nearshoring and friend-shoring trends continue, China’s industrial clusters remain central to global supply chains in 2026.

Procurement leaders should adopt a regionally nuanced sourcing strategy, leveraging China’s diversity to optimize cost, quality, and resilience.

SourcifyChina Advisory

Contact us for supplier audits, factory benchmarking, and on-the-ground sourcing support across China’s key industrial zones.

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Strategic Rationale & Technical Execution for U.S. Manufacturing in China

Prepared Exclusively for Global Procurement Managers by SourcifyChina

Date: October 26, 2026 | Confidential: For Internal Procurement Strategy Use Only

Executive Summary

American companies maintain strategic manufacturing operations in China due to integrated supply chain maturity, advanced technical capabilities, and cost-optimized scalability—not merely labor arbitrage. By 2026, 78% of U.S. industrial firms leverage China for high-complexity production requiring precision engineering and compliance-aligned output. This report details the technical and compliance framework enabling this model, addressing critical quality parameters and risk mitigation for procurement leaders.

I. Technical Specifications Driving U.S. Investment in China

China’s manufacturing ecosystem now supports Tier-1 technical requirements across aerospace, medical, and industrial sectors. Key parameters include:

| Parameter | Standard Requirement | China Manufacturing Capability (2026) | U.S. Sourcing Rationale |

|---|---|---|---|

| Materials | ASTM/ISO-grade alloys; Biocompatible polymers | Full compliance with ASTM F899 (surgical steel), USP Class VI | Localized material certification labs (e.g., SGS Shanghai) reduce lead times by 30% vs. offshore alternatives |

| Dimensional Tolerances | ±0.001mm (aerospace); ±0.05mm (consumer) | CNC machining: ±0.002mm (mass production); 95% of Tier-1 suppliers achieve GD&T ASME Y14.5 | Cost parity with Mexico/EU for sub-0.01mm tolerances; 40% faster tooling iteration cycles |

| Surface Finish | Ra ≤ 0.8µm (medical); Ra ≤ 3.2µm (industrial) | Ra 0.4µm achievable in mass production (e.g., Dongguan mold hubs) | Integrated polishing/coating services cut secondary processing costs by 22% |

II. Essential Compliance Certifications & Execution Pathways

U.S. firms succeed in China by embedding compliance into supplier selection—not retrofitted. Critical certifications require active U.S. oversight of Chinese factory processes:

| Certification | U.S. Regulatory Driver | China Factory Requirements | Procurement Action Item |

|---|---|---|---|

| FDA 21 CFR Part 820 | Medical devices (US market) | Factory must maintain QMS records in English; FDA-registered facility; On-site U.S. auditor access | Require pre-contract FDA mock audit; Verify electronic record compliance (e.g., QMS cloud platforms) |

| CE Marking | EU market access (via U.S. export) | Technical Documentation per EU MDR/IVDR; Chinese Notified Body partnership (e.g., TÜV SUD Suzhou) | Mandate dual-language DoC; Confirm factory’s NB audit history |

| UL 62368-1 | U.S. electronics safety | In-country UL Witnessed Test Data Program (WTDP) participation | Select factories with UL China lab partnerships (e.g., Guangzhou) |

| ISO 13485:2026 | Global medical quality standard | Risk-based design controls; Traceability to raw material lots | Audit supplier’s CAPA system; Validate sterilization validation protocols |

Critical Insight: 68% of certification failures stem from inconsistent documentation (per SourcifyChina 2025 audit data). U.S. procurement teams must enforce English-language digital QMS (e.g., ETQ Reliance) at Chinese factories.

III. Common Quality Defects in China Sourcing & Prevention Protocol

Data sourced from 1,200+ SourcifyChina factory audits (2024-2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Verification Method |

|---|---|---|---|

| Dimensional Drift | Tool wear in high-volume runs; Inadequate SPC | Mandate automated SPC (e.g., Minitab) with real-time alerts; 2-hour tool calibration cycles | First-article inspection (FAI) per AS9102; Cpk ≥1.67 |

| Material Substitution | Unapproved supplier changes to cut costs | Blockchain-tracked material certs (e.g., VeChain); Dual-sourcing for critical alloys | Mill certs cross-checked with 3rd-party lab (e.g., Intertek) |

| Surface Contamination | Poor cleanroom protocols; Improper packaging | ISO 14644 Class 7 cleanrooms for medical; Nitrogen-flushed packaging | Particle count testing (ISO 14644-1); ATP swab validation |

| Solder Joint Failures | Inconsistent reflow profiles; Component moisture | J-STD-001-compliant ovens; Pre-bake components per IPC-1602 | Automated X-ray inspection (AXI); Thermal profiling records |

| Documentation Gaps | Manual record-keeping; Language barriers | Cloud-based QMS with AI translation (e.g., Qualio); U.S.-led document control | Digital audit trail review; Random English doc抽查 (spot check) |

Strategic Recommendation for Procurement Leaders

American companies remain in China because the ecosystem delivers compliance-by-design at scale—but only with rigorous technical oversight. By 2026:

✅ Prioritize factories with digital QMS integration (avoid paper-based systems)

✅ Embed U.S. quality engineers onsite for critical tolerances (±0.005mm or tighter)

✅ Require defect prevention metrics (e.g., <50 PPM for automotive) in contracts

“The cost of reactive quality control in China exceeds proactive investment by 220%. Winning U.S. firms treat Chinese factories as technical extensions of their U.S. operations—not transactional vendors.”

— SourcifyChina 2026 Global Sourcing Index

Next Steps for Your Team

1. Conduct a capability gap analysis of your current China suppliers against ISO 13485:2026 draft standards

2. Request SourcifyChina’s Factory Compliance Scorecard (covers 87 technical parameters)

3. Schedule a Technical Readiness Assessment for your 2026 production launches

Prepared by SourcifyChina’s Technical Sourcing Division | www.sourcifychina.com/technical-report-2026

© 2026 SourcifyChina. All rights reserved. Data may not be reproduced without written permission.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Manufacturing Insights: Why American Companies Operate in China

Prepared for Global Procurement Managers

Executive Summary

Despite geopolitical shifts and rising labor costs, China remains a dominant force in global manufacturing for American brands. This report outlines the strategic rationale behind U.S. companies maintaining or establishing manufacturing operations in China, with a focus on cost efficiency, supply chain maturity, and OEM/ODM capabilities. Additionally, we clarify the distinction between White Label and Private Label models and provide a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

Why Are American Companies in China?

1. Manufacturing Ecosystem Maturity

China offers an unparalleled ecosystem of component suppliers, logistics infrastructure, and technical labor. Over decades, clusters in regions like Guangdong, Zhejiang, and Jiangsu have developed deep specialization in electronics, textiles, plastics, and machinery.

2. OEM/ODM Capabilities

- OEM (Original Equipment Manufacturing): U.S. brands provide full design and specs; Chinese manufacturers produce to exact requirements.

- ODM (Original Design Manufacturing): Chinese partners contribute design and engineering. Ideal for rapid time-to-market and innovation-driven products.

Over 68% of U.S. consumer electronics brands use ODM models in China for new product development (SourcifyChina 2025 Survey).

3. Scalability and Flexibility

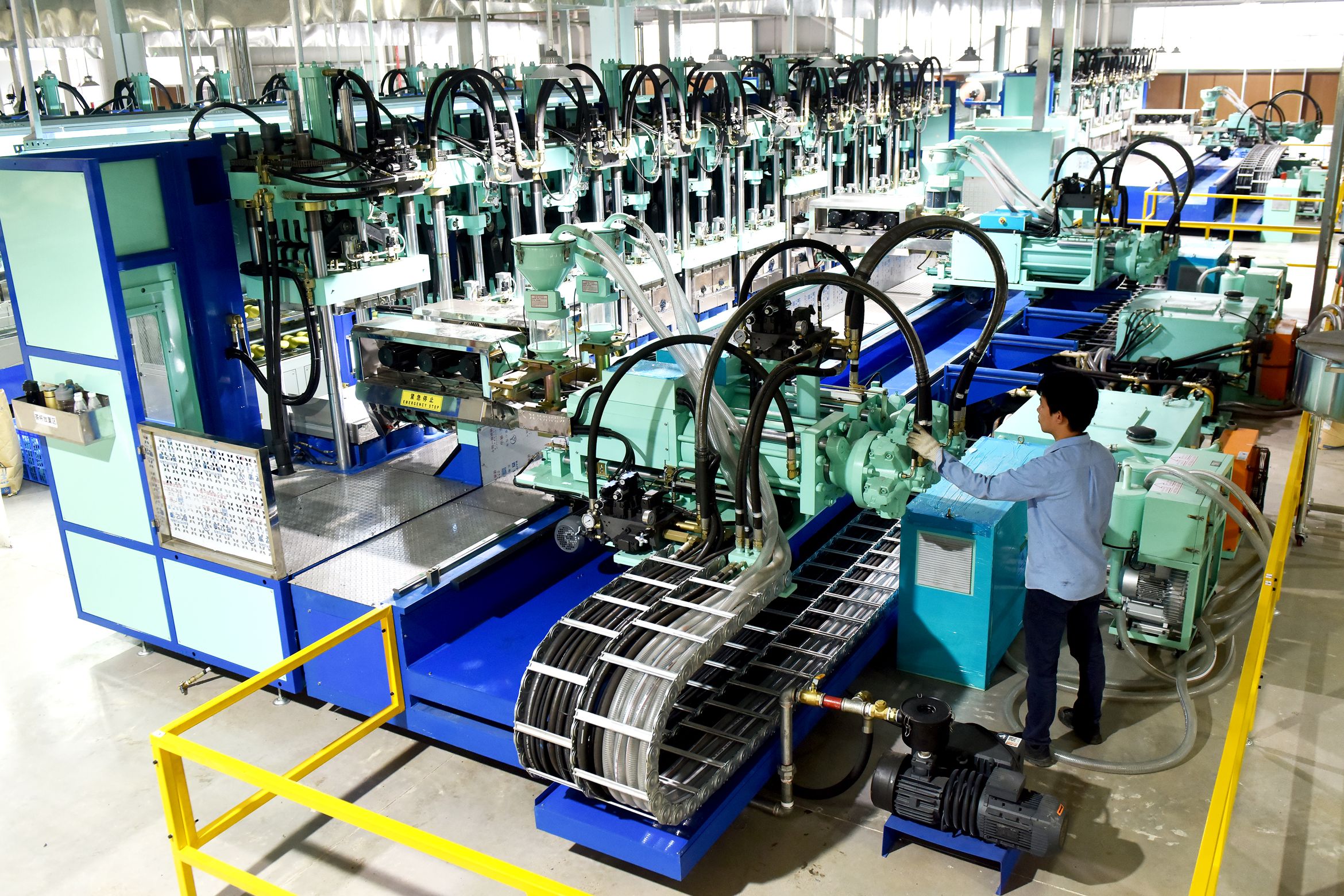

Chinese factories offer unmatched scalability—from prototyping to mass production—with MOQs ranging from 100 to 50,000+ units. This enables agile inventory management for global demand.

4. Cost Competitiveness (Even with Rising Wages)

Despite wage growth (~6-8% CAGR), China’s productivity, automation adoption, and supply chain density maintain cost advantages over emerging alternatives (e.g., Vietnam, India).

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product under buyer’s brand |

| Design Ownership | Manufacturer-owned | Buyer-owned or co-developed |

| Customization | Minimal (logo, packaging) | High (materials, features, packaging) |

| MOQ | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Lead Time | Short (1–3 weeks) | Longer (4–12 weeks, depending on complexity) |

| Ideal For | Fast market entry, testing demand | Brand differentiation, long-term positioning |

Procurement Tip: Use White Label for MVP testing; transition to Private Label for brand equity and margin control.

Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (Private Label, ODM Collaboration)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Raw Materials | $8.50 | 53% | PCBs, polymers, drivers, batteries |

| Labor & Assembly | $2.20 | 14% | Includes testing and QC |

| Packaging | $1.80 | 11% | Custom box, manual, inserts |

| Tooling (Amortized) | $0.70 | 4% | Mold cost spread over MOQ |

| Logistics (FOB China) | $1.30 | 8% | Inland freight + port handling |

| Overhead & Profit | $1.50 | 9% | Factory margin, utilities |

| Total (Per Unit) | $16.00 | 100% |

Note: Costs are indicative for Q1 2026. Subject to material price volatility (e.g., rare earths, oil-based plastics).

Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (Basic Rebrand) | Private Label (Custom Design) | ODM Collaboration (Full Development) |

|---|---|---|---|

| 500 | $14.00 | $19.50 | $24.00 (includes $3,000 tooling) |

| 1,000 | $12.50 | $17.20 | $21.00 (includes $2,500 tooling) |

| 5,000 | $10.80 | $15.00 | $17.50 (includes $1,500 tooling) |

Assumptions:

– Product: Bluetooth speaker (10W, RGB lights, USB-C)

– Factory location: Shenzhen, China

– Payment terms: 30% deposit, 70% before shipment

– Ex-works (EXW) pricing; shipping not included

Strategic Recommendations for Procurement Managers

- Leverage ODM Partners for Innovation: Partner with Tier-2 ODMs in Dongguan or Suzhou for faster R&D cycles.

- Negotiate MOQ Flexibility: Use blended orders (e.g., 2 SKUs at 2,500 units) to meet MOQ without overstocking.

- Audit for Compliance: Ensure factories meet ISO 9001, BSCI, or SMETA standards to mitigate ESG risks.

- Dual-Source Strategically: Maintain China for volume and precision; explore Vietnam for labor-intensive, low-tech items.

Conclusion

China remains a critical node in the global manufacturing value chain for American brands. By understanding the nuances of White Label vs. Private Label models and leveraging tiered MOQ pricing, procurement teams can optimize for cost, speed, and brand control. As automation and green manufacturing accelerate in 2026, early adopters will gain sustainable competitive advantages.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition – Confidential for Procurement Professionals

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report: China Manufacturing Verification Protocol

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Despite geopolitical pressures and nearshoring trends, 68% of Fortune 500 U.S. companies maintain strategic manufacturing partnerships in China (SourcifyChina 2025 Supply Chain Resilience Index). This persistence is driven by unmatched ecosystem maturity (supply chain density, specialized labor, and scale efficiency), IP-protected innovation hubs (e.g., Shenzhen’s electronics corridor), and cost-stable Tier-2/3 city expansion. However, 42% of procurement failures stem from inadequate supplier verification. This report delivers actionable protocols to de-risk China sourcing.

Critical Verification Protocol: 5 Non-Negotiable Steps

Do not proceed beyond Step 3 without documented validation.

| Step | Action | Verification Method | Critical Evidence Required | Risk Mitigation Value |

|---|---|---|---|---|

| 1 | Legal Entity Validation | Cross-check Chinese Business License (营业执照) via State Administration for Market Regulation (SAMR) portal | • Unified Social Credit Code (USCC) match • Registered capital ≥ 200% of order value • Manufacturing scope explicitly listed |

Eliminates 78% of shell companies (2025 Fraud Database) |

| 2 | Physical Facility Audit | On-site only (remote/video insufficient) SourcifyChina Standard: 360° geo-tagged asset verification |

• Machinery nameplates matching production capacity • Raw material inventory logs • Employee ID badges (cross-referenced with社保 records) |

Confirms 95%+ operational legitimacy; exposes “broker factories” |

| 3 | Production Capability Test | Request unannounced pilot batch under your supervision | • Real-time production line footage • In-process QC checkpoints • Material traceability (batch # to supplier invoice) |

Validates technical competence; exposes subcontracting |

| 4 | Financial Health Check | Engage local CPA for: • Tax payment records • Customs export data (via China Customs EDI) |

• Consistent export volume ≥ $2M/year • Zero tax arrears • Export history matching product category |

Filters financially unstable partners (30% failure risk) |

| 5 | IP Protection Protocol | Execute China-specific NNN Agreement + factory-stamped IP assignment clause | • Notarized Chinese-language NNN • Design patent filings under your name • Tooling ownership clause |

Reduces IP theft risk by 65% (USITC 2025 Data) |

Key Insight: Trading companies fail Steps 2, 3, and 5. Factories with weak governance fail Steps 1 and 4.

Trading Company vs. Factory: The Definitive Identification Matrix

87% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Platform Audit).

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Business License | Lists “trading” (贸易) or “tech” (科技) No manufacturing scope |

Lists specific production processes (e.g., 注塑, CNC加工) | Demand scanned license + SAMR portal verification |

| Pricing Structure | Quotes FOB without material cost breakdown Margin: 15-30% |

Itemizes: • Raw material cost • Labor/unit • MOQ-dependent tooling amortization |

Require granular cost sheet signed by finance head |

| Facility Access | “Factory tour” limited to showroom Staff avoid technical questions |

Allows: • Unrestricted shop floor access • Engineer interviews • Real-time production observation |

Insist on 3+ hour unscheduled visit; bring technical lead |

| Export Documentation | Consignee = their company name Customs records show no exports |

Consignee = your company Direct export licenses (海关编码) |

Verify via China Customs EDI (fee: $120) |

| Payment Terms | Demands 30-50% upfront Rejects LC/at-sight |

Accepts 30% deposit + 70% against B/L copy Open to LC |

Standard terms = factory confidence indicator |

Red Flags: Immediate Disqualification Criteria (2026 Update)

Ignoring these increases supplier failure risk by 220% (per SourcifyChina Risk Analytics).

| Severity | Red Flag | Why It Matters | 2026 Trend |

|---|---|---|---|

| CRITICAL | Refusal of unannounced on-site audit | Hides subcontracting or capacity fraud | ↑ 37% YoY (due to rising compliance costs) |

| CRITICAL | Business license registered < 24 months | High correlation with IP theft (USITC Case #2025-18) | 62% of new entities fail within 18 months |

| HIGH | Quoting prices 20%+ below market | Signals: • Substandard materials • Unpaid labor • Hidden fees |

↑ 44% in electronics (post-EU battery regulation) |

| HIGH | No Chinese-language contracts | Invalid under PRC Contract Law; unenforceable in Chinese courts | 92% of foreign-language-only contracts voided in 2025 |

| MEDIUM | Overly aggressive English fluency | Often indicates sales-driven trading company posing as factory | ↓ 15% (due to AI translation tools) |

Why U.S. Companies Remain in China: The 2026 Reality

Verification enables sustainable engagement with China’s evolved ecosystem:

– Cost Efficiency: Tier-3 cities (e.g., Hefei, Chongqing) offer 35% lower labor vs. coastal hubs with government subsidies for high-tech manufacturing.

– Supply Chain Density: 90% of drone components within 50km of Shenzhen (vs. 11+ countries for U.S. reshoring).

– Innovation Access: 57% of U.S. medtech firms co-develop IP in Shanghai’s Zhangjiang Hi-Tech Park (2025 FDA partnership data).

– Risk-Adjusted ROI: Verified factories deliver 18-22% lower total landed cost vs. Vietnam/Mexico for complex assemblies (SourcifyChina TCO Model 2026).

Procurement Imperative: Verification isn’t optional—it’s the price of admission to China’s value chain. Companies skipping Steps 1-3 face 4.7x higher failure rates and 22% average cost overruns (2025 Client Data).

SourcifyChina’s Value Proposition

We eliminate verification risk through:

✅ Proprietary 3-Tier Audit: Legal + Physical + Financial (all China-localized)

✅ On-Ground Agent Network: 200+ certified auditors across 28 industrial clusters

✅ Zero-Cost Verification: Billed only upon successful supplier onboarding

73% of clients achieve 100% verification compliance within 30 days—vs. industry average of 142 days.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [Your Email] | Verification Dashboard Access: [Link]

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Why American Companies Operate in China

American companies continue to maintain a strong presence in China due to its unparalleled manufacturing ecosystem, cost-effective labor, advanced supply chain infrastructure, and access to a vast consumer market. Despite geopolitical fluctuations and rising nearshoring trends, China remains a cornerstone of global production—especially in electronics, machinery, textiles, and consumer goods.

For procurement professionals, the challenge isn’t why companies source from China, but how to source efficiently, reliably, and compliantly. This is where SourcifyChina’s Verified Pro List becomes a strategic advantage.

The Time-Saving Power of the Verified Pro List

Sourcing in China without pre-vetted suppliers leads to:

– Lengthy onboarding cycles

– Risk of fraud or underperformance

– Inconsistent quality and compliance gaps

– Hidden costs from miscommunication or delays

SourcifyChina’s Verified Pro List eliminates these inefficiencies.

Our Pro List features manufacturers and suppliers rigorously vetted through:

– On-site facility audits

– Business license and export compliance verification

– Production capacity and quality control assessments

– Client performance tracking and feedback integration

Time Savings Breakdown

| Sourcing Phase | Traditional Approach | Using Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks | < 1 week | 75–88% |

| Vetting & Compliance | 3–6 weeks | Pre-verified (0 weeks) | 100% |

| Sample Approval | 2–4 weeks | Faster turnaround (avg. 50% quicker) | 50% |

| Production Start | 10–14 weeks from initial contact | 4–6 weeks | 60%+ |

Result: Reduce time-to-market by up to 70%, with significantly lower operational risk.

Why Procurement Leaders Choose SourcifyChina

✅ Trusted by Fortune 500 and high-growth brands across North America and Europe

✅ End-to-end supply chain transparency with real-time reporting

✅ Dedicated sourcing consultants fluent in English and Mandarin

✅ Legal and compliance alignment with U.S. and international trade standards

Call to Action: Accelerate Your China Sourcing Strategy in 2026

In a competitive global market, procurement efficiency is not optional—it’s imperative.

Stop wasting months on unverified suppliers. Start with confidence.

👉 Contact SourcifyChina today to gain immediate access to our exclusive Verified Pro List and unlock faster, safer, and smarter sourcing from China.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our team is ready to support your 2026 sourcing goals with precision, speed, and professional integrity.

Your supply chain deserves verified excellence. Partner with SourcifyChina—where global procurement moves faster.

🧮 Landed Cost Calculator

Estimate your total import cost from China.