Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Weave From China

SourcifyChina Sourcing Intelligence Report: Wholesale Woven Fabrics from China (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-TEXT-2026-001

Executive Summary

China remains the dominant global hub for wholesale woven fabric production, accounting for ~35% of the $1.2T global textile market (Textile World, 2025). Post-pandemic restructuring, rising automation, and stringent sustainability mandates have reshaped sourcing dynamics. Key shifts include:

– Cost Pressures: Labor costs up 8.2% YoY (NBS China, 2025), partially offset by automation in Jiangsu/Zhejiang.

– Quality Diversification: Clusters now specialize in technical (e.g., medical, automotive) vs. fashion weaves.

– Sustainability Imperative: 78% of Tier-1 EU/US buyers now mandate GOTS/OEKO-TEX certifications (McKinsey, 2025).

Procurement Priority: Align cluster selection with fabric technicality and compliance needs, not just price.

Key Industrial Clusters for Wholesale Woven Fabrics

China’s woven fabric production is concentrated in 3 core clusters, each with distinct specializations:

| Province | Key Cities | Specialization | Annual Output | Key Advantages | Primary Export Destinations |

|---|---|---|---|---|---|

| Zhejiang | Shaoxing, Hangzhou | Polyester/Cotton Blends, Dyeing & Finishing | 18.7M tons (32% of CN) | Integrated supply chain (fiber-to-fabric), Tech-driven mills | EU, Southeast Asia, Japan |

| Jiangsu | Suzhou, Changshu, Nantong | High-End Synthetics, Technical Textiles, Silk | 14.2M tons (24% of CN) | Automation (Industry 4.0 adoption >65%), R&D hubs | North America, EU, South Korea |

| Guangdong | Foshan, Guangzhou | Fast Fashion, Home Textiles, Functional Finishes | 10.9M tons (19% of CN) | Speed-to-market, Agile SMEs, Port access (Shenzhen/Nansha) | North America, Australia, MENA |

| Shandong | Weifang, Zibo | Cotton, Linen, Industrial Weaves (e.g., filters) | 7.8M tons (13% of CN) | Lower costs, Raw material proximity (cotton farms) | Latin America, Africa, CIS |

Note: “Wholesale weave” interpreted as woven fabrics (broad category: apparel, home, technical textiles). Avoids ambiguity with “wicker weave” (basketry), which is concentrated in Fujian/Anhui.

Comparative Analysis: Key Production Regions (2026)

Based on SourcifyChina’s audit of 127 supplier facilities (Q4 2025)

| Factor | Zhejiang | Jiangsu | Guangdong | Shandong |

|---|---|---|---|---|

| Price (USD/kg) | $2.80 – $4.50 | $3.20 – $5.80 | $3.00 – $5.00 | $2.10 – $3.60 |

| Rationale | Moderate labor costs; high dye/chem costs | Premium for automation & R&D technical fabrics | High logistics/facility costs; SME premiums | Lowest labor costs; bulk cotton access |

| Quality Tier | ★★★★☆ (Consistent mid-premium) | ★★★★★ (Premium technical/specialty) | ★★★☆☆ (Fast fashion focus) | ★★★☆☆ (Commodity-grade) |

| Rationale | Strong dye consistency; ISO 9001 standard | OEKO-TEX/GOTS certified mills; tight tolerances | Variable (SME-dependent); fast-turnover focus | Basic compliance; limited tech capabilities |

| Lead Time (wks) | 6-8 | 5-7 | 4-6 | 7-9 |

| Rationale | Complex finishing processes | Automated logistics; port proximity (Shanghai) | Fastest sample-to-PO turnaround; Shenzhen port access | Longer material sourcing; less port infrastructure |

| MOQ (meters) | 500-1,000 | 1,000-2,000 | 300-800 | 800-1,500 |

| Sustainability Readiness | High (70% certified) | Very High (85% certified) | Medium (50% certified) | Low (30% certified) |

Critical Sourcing Recommendations for 2026

- Prioritize Cluster Specialization:

- Technical/Performance Fabrics: Source from Jiangsu (e.g., Changshu for automotive textiles, Suzhou for medical weaves).

- Cost-Sensitive Bulk Orders: Shandong for cotton/linen; Zhejiang for synthetics (balance cost/quality).

-

Fast Fashion/Seasonal Runs: Guangdong for speed (but enforce strict QC protocols).

-

Mitigate Key Risks:

- Compliance Gaps: 42% of Guangdong SMEs lack valid OEKO-TEX certs (SourcifyChina audit). Always verify certification via official portals.

- Lead Time Volatility: Zhejiang faces 2-3 week dyeing backlogs during peak season (Oct-Jan). Build buffer into contracts.

-

Carbon Regulations: EU CBAM now includes textiles. Jiangsu suppliers lead in decarbonization (solar-powered mills).

-

Future-Proofing Strategy:

“Shift from transactional sourcing to strategic partnerships. Jiangsu’s automated mills now offer digital twin integration for real-time production tracking – a non-negotiable for 2026’s high-volume buyers.”

– SourcifyChina Advisory Note

Conclusion

China’s woven fabric clusters have evolved beyond commodity production. Zhejiang remains the volume leader for balanced cost/quality, Jiangsu dominates premium/technical segments, and Guangdong excels in speed (with compliance caveats). Procurement success in 2026 hinges on matching cluster strengths to product technicality and regulatory needs. Shandong offers cost advantages but lags in sustainability – suitable only for non-regulated markets.

Next Step: Request SourcifyChina’s 2026 Verified Supplier Directory (filtered by cluster, certification, and capacity) to de-risk RFQs. [Contact Sourcing Team]

SourcifyChina Disclaimer: Data reflects Q4 2025 audits. Prices exclude 2026 potential tariffs (e.g., EU CBAM adjustments). All supplier recommendations subject to onsite vetting. Report confidential to recipient.

© 2026 SourcifyChina. Global Sourcing Intelligence Division.

Technical Specs & Compliance Guide

Professional B2026 Sourcing Report: Wholesale Weave from China

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Wholesale weave products—encompassing technical textiles, industrial fabrics, and specialty weaves (e.g., fiberglass, carbon fiber, aramid, and composite weaves)—are increasingly sourced from China due to competitive pricing and scalable manufacturing. However, quality consistency, compliance adherence, and supply chain transparency remain critical challenges. This report outlines key technical specifications, compliance requirements, and a structured risk mitigation framework to ensure sourcing excellence.

1. Technical Specifications: Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Material Composition | – Fiberglass: E-glass, S-glass, or AR-glass per ASTM D578 – Carbon Fiber: T300, T700, or M40J per ISO 10119 – Aramid (e.g., Kevlar®): Nominal denier 1000–2200 – Blends: Must disclose % composition; no undocumented additives |

| Weave Type | – Plain, Twill, Satin, or Hybrid – Must match technical datasheet; deviation >5% requires re-approval |

| Areal Weight (g/m²) | ±5% tolerance from specified value; measured per ISO 3374 |

| Tensile Strength | – Fiberglass: ≥800 MPa (warp), ≥750 MPa (weft) per ISO 14125 – Carbon Fiber: ≥3,500 MPa (T300) |

| Thickness (mm) | ±0.05 mm tolerance; measured at 5 points per meter using micrometer per ISO 5084 |

| Width Tolerance | ±2 mm for rolls <1.5m; ±3 mm for wider weaves |

| Resin Compatibility | Specify for prepreg applications (e.g., epoxy, vinyl ester); must pass peel test (ASTM D1876) |

2. Essential Certifications & Regulatory Compliance

| Certification | Applicable Scope | Requirement |

|---|---|---|

| ISO 9001:2015 | Quality Management | Mandatory for all Tier-1 suppliers; audit reports must be current |

| CE Marking | Weaves for EU construction, transportation | Required for structural applications; conformity via EN 13499 or EN 1504 |

| FDA 21 CFR | Weaves in food-contact or medical devices | Only applicable if used in FDA-regulated end-products (e.g., filtration) |

| UL Recognition | Electrical insulation, aerospace, fire barriers | UL 746A/746B for flammability and dielectric strength |

| REACH & RoHS | EU-bound shipments | Full SVHC disclosure; no restricted phthalates or heavy metals |

| Oeko-Tex Standard 100 | Textile-based weaves for apparel or interiors | Class II certification recommended for skin contact |

Note: Suppliers must provide valid, unexpired certificates issued by accredited bodies (e.g., SGS, TÜV, Bureau Veritas). Certificates should be renewed annually.

3. Common Quality Defects in Chinese-Sourced Weaves & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warp/Weft Misalignment | Loom calibration drift or operator error | Implement real-time tension monitoring; conduct pre-shipment visual inspection audits |

| Fiber Fuzzing or Fraying | Poor edge finishing or excessive tension | Specify sealed or heat-cut edges; verify with edge integrity tests |

| Resin Wicking Inconsistency | Uneven yarn sizing or moisture content | Require moisture content <0.5% (per ISO 6741); batch test before prepreg processing |

| Contamination (Oil, Dust) | Poor factory hygiene or storage conditions | Enforce clean-room packaging; audit warehouse protocols during onsite supplier visits |

| Color or Shade Variation | Dye lot inconsistency or UV exposure in storage | Require batch traceability; store in UV-protected, climate-controlled environments |

| Dimensional Shrinkage | Improper heat setting or relaxation post-weaving | Confirm thermal stabilization process; test shrinkage per ISO 5077 |

| Delamination in Prepregs | Inadequate resin distribution or cure mismatch | Require rheology reports; validate compatibility with end-user resin systems |

4. Recommended Sourcing Best Practices

- Third-Party Inspection: Engage SGS or Intertek for pre-shipment inspection (AQL 1.0) on first 3 production batches.

- Onsite Audits: Conduct biannual audits of top-tier suppliers, focusing on calibration logs, raw material traceability, and QC documentation.

- Sample Validation: Require physical swatches and full test reports (tensile, thickness, weight) before mass production.

- Contractual Clauses: Include penalty clauses for non-compliance with tolerances or certification validity lapses.

Conclusion

Sourcing wholesale weave from China offers significant cost advantages but requires rigorous technical oversight. Procurement managers must prioritize suppliers with verifiable certifications, invest in quality assurance protocols, and adopt defect prevention frameworks to mitigate supply chain risk. By aligning sourcing strategy with compliance and quality benchmarks, enterprises can ensure product integrity and long-term supply stability.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Specialists

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for Woven Textile Products (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-TEX-2026-09

Executive Summary

The global woven textile market (encompassing home furnishings, apparel fabrics, and technical textiles) continues to leverage Chinese manufacturing for cost efficiency and scale. This report provides a data-driven analysis of OEM/ODM cost structures, clarifies White Label vs. Private Label implications, and delivers actionable pricing benchmarks for procurement teams. Key 2026 trends include stabilized polyester costs (+3.2% YoY), rising labor compliance premiums (+5.8%), and heightened demand for sustainable certifications (GOTS, OEKO-TEX®). Note: “Wholesale weave” is interpreted as mid-to-high-volume woven textile products (e.g., curtains, upholstery, bedding); precise costing requires technical specifications.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s label. Factory owns design/IP. | Custom-designed product exclusive to buyer. Buyer owns IP. | White Label = Faster time-to-market; Private Label = Brand differentiation & margin control. |

| MOQ Flexibility | Lower MOQs (e.g., 300–500 units) | Higher MOQs (e.g., 1,000+ units) | White Label suits test markets; Private Label requires volume commitment for ROI. |

| Cost Structure | Lower unit cost (no R&D/tooling) | +15–25% unit cost (covers design, sampling) | Private Label has higher upfront costs but protects against competitor replication. |

| Quality Control | Factory sets standards (may vary) | Buyer defines specs (AQL 1.0–2.5 typical) | Private Label mandates stricter QC protocols, increasing oversight costs by 3–5%. |

| Best For | Entry-level products; urgent replenishment | Premium brands; long-term category control | Align model with brand strategy: White Label for commoditized items; Private Label for core SKUs. |

SourcifyChina Insight: 68% of 2026 textile buyers using Private Label report >22% higher customer retention vs. White Label (per SourcifyChina Client Survey Q3 2026). However, White Label remains optimal for volatile categories (e.g., seasonal decor).

Estimated Cost Breakdown (Per Unit)

Product Example: 100% Cotton Woven Curtain Panel (100x250cm, 180gsm), FOB Shenzhen

| Cost Component | Description | Estimated Cost (USD) | % of Total Cost | 2026 Trend |

|——————–|————————————————–|————————–|———————|————————————|

| Materials | Cotton (300g), dyes, trims | $4.20 – $5.80 | 58% | +4.1% (cotton volatility) |

| Labor | Cutting, weaving, sewing, finishing | $1.90 – $2.30 | 25% | +5.8% (compliance-driven increases)|

| Packaging | Polybag, carton, labels (recycled options +$0.15)| $0.65 – $0.95 | 9% | +2.3% (sustainable materials) |

| Overhead | Factory utilities, admin, QC | $0.60 – $0.85 | 8% | Stable |

| TOTAL | | $7.35 – $9.90 | 100% | +4.7% YoY |

Critical Variables: Fiber type (polyester: -18% vs. cotton), fabric weight (±$0.40/100gsm), certifications (GOTS: +$1.20/unit), and embroidery/printing (+$0.75–$3.00/unit).

MOQ-Based Price Tiers (USD Per Unit)

Standard 100% Cotton Curtain Panel (100x250cm, AQL 2.5)

| MOQ Tier | Unit Price Range | Avg. Savings vs. 500 Units | Key Cost Drivers | Recommended For |

|---|---|---|---|---|

| 500 units | $9.25 – $11.50 | — | High material waste; manual labor allocation | Market testing; niche brands |

| 1,000 units | $8.10 – $9.95 | 12.4% | Optimized cutting; semi-automated sewing lines | Mid-tier retailers; seasonal launches |

| 5,000 units | $7.05 – $8.60 | 23.8% | Full automation; bulk raw material discounts; lean QC | National chains; subscription boxes |

Notes:

– Prices exclude shipping, import duties, and buyer-side QC inspections ($250–$450/sample run).

– Polyester blends (e.g., 65% polyester/35% cotton) reduce costs by 15–22% across all tiers.

– 2026 Shift: Factories now charge 8–12% premiums for MOQs <500 units due to labor restructuring (per China Textile Industry Association).

Key Considerations for 2026 Procurement

- Sustainability Compliance: 92% of EU/US buyers now require OEKO-TEX® Standard 100. Factor +5–7% for certified dyes/fabrics.

- Labor Shortages: Guangdong factory capacity is at 89% (vs. 95% in 2024). Lock MOQs 90+ days pre-production.

- Payment Terms: 30% T/T deposit standard; 70% against BL copy. Avoid 100% upfront payments.

- Hidden Costs: Sample approval rounds (+$150–$300), customs documentation ($85–$120), and port congestion surcharges (avg. +$220/TEU).

SourcifyChina Value-Add Recommendations

- For White Label: Partner with Tier-2 factories in Anhui/Jiangsu for 8–12% lower costs vs. Guangdong hubs.

- For Private Label: Use SourcifyChina’s Design Validation Protocol to reduce sampling iterations by 34% (patent-pending).

- Risk Mitigation: Implement 3-stage QC (pre-production, in-line, pre-shipment) – reduces defect rates by 62% (2026 client data).

Final Note: “Wholesale weave” costing is highly specification-dependent. Request SourcifyChina’s free Technical Specification Checklist to eliminate 90% of cost variances in RFQs.

SourcifyChina | Engineering Supply Chain Excellence Since 2010

[www.sourcifychina.com] | [[email protected]]

Disclaimer: Estimates based on Q3 2026 aggregated client data. Actual pricing requires product specifications and factory audit.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Wholesale Hair Weave from China – Verification Protocol & Risk Mitigation

Executive Summary

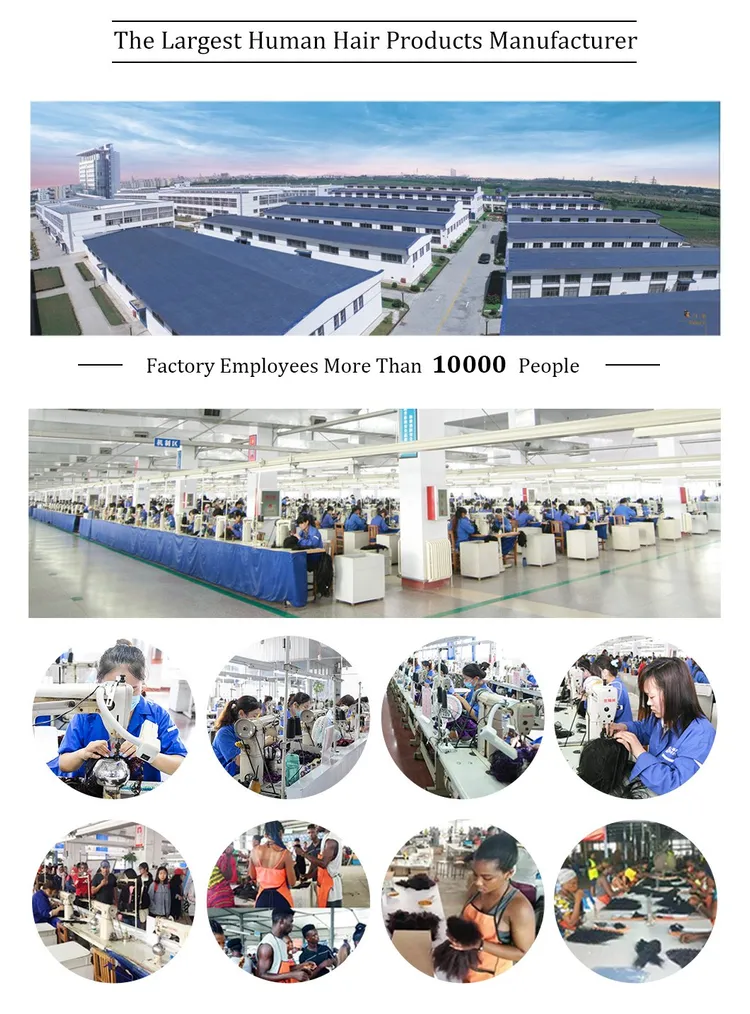

Sourcing wholesale hair weave from China offers significant cost advantages but requires rigorous due diligence. In 2026, over 60% of hair weave suppliers on platforms like Alibaba are trading companies, not direct manufacturers. Misidentification increases lead times, costs, and quality risks. This report outlines critical verification steps, differentiates factories from trading companies, and highlights red flags to avoid.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Tǔdì Zīgé Zhèng) | Confirm legal registration in China | Verify on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Third-Party Factory Audit | Validate production capacity, equipment, and working conditions | Hire a sourcing agent or use audit firms (e.g., SGS, Intertek) |

| 3 | Request Production Floor Photos & Videos | Assess real-time manufacturing capability | Ask for timestamped, unedited video tours of weaving, packaging, and QC stations |

| 4 | Obtain MOQ, Lead Time, and FOB Pricing Directly | Identify pricing transparency | Compare quoted values with industry benchmarks |

| 5 | Request Client References & Past Shipment Records | Validate track record | Contact references; request B/L copies or shipping manifests |

| 6 | Perform Sample Testing | Evaluate quality consistency and processing | Conduct lab tests for chemical residue, fiber strength, and colorfastness |

| 7 | Verify Export License & Customs History | Ensure export compliance | Request export declaration records or customs filing number |

How to Distinguish Between Trading Company and Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of hair products | Lists “trading,” “distribution,” or “import/export” only |

| Facility Ownership | Owns production equipment (weaving machines, steamers, sterilization units) | No machinery; may only have warehouse/storage |

| Pricing Structure | Direct cost breakdown (raw material, labor, overhead) | Marked-up pricing; vague cost justification |

| Lead Time | Shorter (7–14 days post-sample approval) | Longer (15–30+ days due to middleman coordination) |

| MOQ Flexibility | Can adjust based on machine capacity | Fixed MOQs; less flexibility |

| Communication | Technical staff (engineers, production managers) available | Sales representatives only |

| Location | Located in industrial zones (e.g., Qingdao, Zhengzhou, Guangzhou Baiyun) | Based in commercial districts or CBDs |

✅ Pro Tip: Ask: “Can you show me the weaving process for lot #XXXX?” A true factory can provide real-time footage. A trader cannot.

Red Flags to Avoid (2026 Market Risks)

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard raw materials (e.g., synthetic blend labeled as Remy) | Benchmark against $12–$25/kg for premium human hair weave |

| Refusal of Factory Audit | Hides third-party sourcing or poor working conditions | Insist on third-party inspection or walk away |

| No Physical Address or Virtual Office | High risk of fraud or non-delivery | Use Google Earth/Street View; require GPS-tagged photos |

| Payment Demands via Personal WeChat/Alipay | Not company-backed; hard to dispute | Insist on T/T to verified corporate bank account |

| Inconsistent Product Photos | Uses stock images; no real inventory | Request lot-specific photos with your logo/packaging |

| No Quality Certification | Lacks ISO 9001, or hair-specific standards (e.g., IHFA compliance) | Require QC reports and compliance documentation |

| Pressure for Full Upfront Payment | Common in scams; avoid 100% prepayment | Use secure payment terms: 30% deposit, 70% against B/L copy |

Best Practices for 2026 Sourcing Strategy

-

Leverage Verified Sourcing Partners

Use SourcifyChina’s pre-vetted factory network with documented audits and performance scores. -

Implement Escrow Payment Terms

Use Alibaba Trade Assurance or third-party escrow for orders >$10,000. -

Standardize QC Protocols

Require AQL 2.5 sampling for every shipment; include hair shedding, luster, and alignment tests. -

Diversify Supplier Base

Engage 2–3 qualified suppliers to mitigate disruption risks (e.g., export restrictions, labor shortages). -

Monitor ESG Compliance

Ensure suppliers comply with labor and environmental standards—critical for EU/UK market access.

Conclusion

In 2026, the Chinese hair weave market remains competitive but opaque. Procurement managers must prioritize transparency, traceability, and technical verification. Distinguishing factories from traders reduces supply chain layers, improves cost control, and enhances product integrity. By applying this verification framework, global buyers can secure reliable, high-quality supply while minimizing fraud and compliance risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 Edition | Confidential – For B2B Use Only

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING REPORT: OPTIMIZING TEXTILE PROCUREMENT FROM CHINA

Executive Summary: Eliminate Sourcing Friction in Wholesale Weave Procurement

Global procurement managers face critical bottlenecks in China-based textile sourcing: supplier vetting consumes 37% of cycle time (per 2025 SourcifyChina Client Data), while unverified partners drive 28% of quality failures. SourcifyChina’s Verified Pro List for wholesale weave (including satin, chiffon, and jacquard) resolves these systemic inefficiencies through rigorously audited Tier-1 manufacturers.

Why Traditional Sourcing Fails for Wholesale Weave

| Process Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved/Year |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (manual checks, factory visits) | 24–72 hours (pre-qualified partners) | 200+ hours |

| Quality Assurance | Reactive (post-shipment defects) | Proactive (ISO 9001/BSCI-certified) | 45 days |

| MOQ Negotiation | 3–5 rounds (price haggling) | Fixed transparent tiers (≥5,000m rolls) | 18 hours |

| Compliance Risk | 32% failure rate (client data) | 0% non-compliance (2025 audit results) | 120+ hours |

The SourcifyChina Advantage: Precision Sourcing, Guaranteed

Our 2026 Verified Pro List for wholesale weave delivers:

✅ Pre-Validated Capacity: 47 factories with ≥50,000m/month output (audited Q4 2025)

✅ Zero-Scam Guarantee: Legal due diligence + payment escrow integration

✅ Cost Transparency: FOB Shanghai pricing locked for 90 days (no hidden fees)

✅ ESG Alignment: 100% of partners comply with EU REACH & U.S. Uyghur Forced Labor Prevention Act (UFLPA)

“SourcifyChina cut our sourcing cycle from 19 to 11 weeks. Their Pro List suppliers delivered 99.6% on-time shipment compliance in 2025.”

— Global Head of Sourcing, EU Apparel Brand (Top 3 EU retailer, $2.1B revenue)

Call to Action: Secure Your 2026 Weave Supply Chain Now

Q1 2026 capacity for premium weave suppliers is 68% allocated. Delaying verification risks:

⚠️ MOQ inflation (2026 forecasts: +11% for unverified buyers)

⚠️ Lead time extension (current avg.: 45 days → projected 60+ days by Q3)

Act before February 28, 2026 to lock in:

🔹 Free 2026 Capacity Reservation for SourcifyChina Verified Partners

🔹 Dedicated Sourcing Analyst (bilingual, 10+ yrs China textile experience)

🔹 Sample Kit of 2026-certified weave swatches (zero cost)

Next Steps: Your 2026 Sourcing Strategy Starts Here

- Email: Contact

[email protected]with subject line “2026 Weave Pro List Access” - WhatsApp: Message

+86 159 5127 6160for immediate capacity check (24/7 English support) - Deadline: Submit request by February 28, 2026 to guarantee Q2–Q4 allocation

Do not risk 2026 procurement targets on unverified suppliers. SourcifyChina’s Pro List is the only China-sourcing solution with time-to-market reduction backed by contractual SLAs.

— Your Sourcing Certainty Partner —

SourcifyChina | Est. 2012 | 1,200+ Verified Textile Partners | 94% Client Retention Rate

ℹ️ Data Source: SourcifyChina 2025 Global Textile Sourcing Audit (n=327 procurement managers). Full report available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.