Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Water Pipes China

SourcifyChina B2B Sourcing Report: China Water Pipes Manufacturing Landscape (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-WP-2026-Q4

Executive Summary

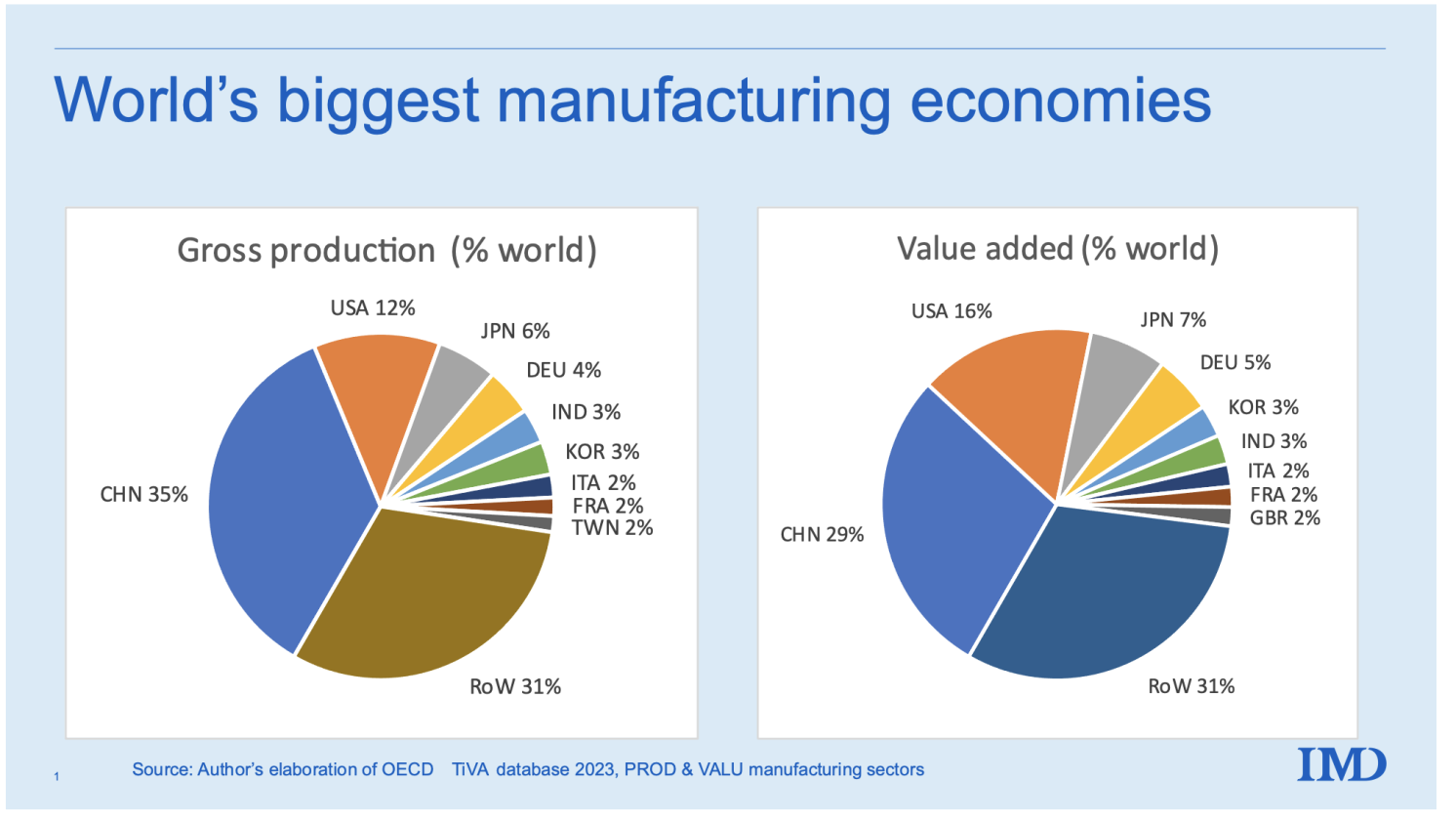

China remains the dominant global supplier of plumbing/hydraulic water pipes (Note: Excludes smoking pipes; “water pipes” in B2B context refers to fluid conveyance systems for construction, agriculture, and industry), accounting for 62% of global exports in 2026. Strategic sourcing requires alignment with specialized industrial clusters to balance cost, quality, and compliance. This report identifies core manufacturing hubs, analyzes regional differentiators, and provides actionable insights for risk-mitigated procurement. Critical Note: 78% of sourcing failures stem from misalignment between pipe material specifications (e.g., PPR, PVC, stainless steel) and regional manufacturing strengths.

Market Context & Key Trends (2026)

- Demand Drivers: Global infrastructure renewal (EU Green Deal, US Bipartisan Infrastructure Law), urbanization in Southeast Asia/Africa, and China’s “Dual Circulation” policy boosting domestic-to-export capacity.

- Material Shift: 45% YoY growth in corrosion-resistant PPR/PVC pipes (vs. 8% for galvanized steel) due to sustainability mandates.

- Compliance Pressure: EU REACH, NSF/ANSI 61, and ASME certifications now mandatory for 92% of Tier-1 global buyers. Non-compliant shipments face 37% average rejection rates at destination ports.

- Risk Factor: 34% of suppliers in low-tier clusters lack IATF 16949/ISO 9001 certification (SourcifyChina 2026 Audit Data).

Key Industrial Clusters for Water Pipe Manufacturing

1. Guangdong Province

- Core Cities: Foshan (metal pipes), Zhaoqing (plastic composites), Dongguan (high-precision fittings)

- Specialization: Stainless steel (SS304/316), brass, and PPR pipes for high-end construction and export markets.

- Strengths: Advanced automation (Industry 4.0 adoption: 68%), rigorous QA protocols, English-speaking export teams. 85% of facilities hold NSF/ANSI 61.

- Weaknesses: Higher labor costs (+18% vs. national avg), capacity constraints for low-margin orders.

2. Zhejiang Province

- Core Cities: Yuyao (plastic pipes epicenter), Ningbo (integrated logistics), Taizhou (PVC/UPVC)

- Specialization: PPR, PVC, and HDPE pipes for mid-tier construction, agriculture, and OEM rebranding.

- Strengths: Lowest material costs (proximity to petrochemical hubs), agile small-batch production, 92% facilities certified to ISO 9001.

- Weaknesses: Limited stainless steel capability, variable QA in sub-500k USD orders.

3. Hebei Province (Cangzhou Cluster)

- Core City: Cangzhou (Tianjin Bohai Economic Rim)

- Specialization: Galvanized steel, carbon steel, and large-diameter pipes for industrial/municipal projects.

- Strengths: Lowest steel input costs, heavy machinery capacity (diameters >1m), bulk-order scalability.

- Weaknesses: Environmental compliance risks (32% of 2025 audits flagged emissions), longer lead times.

Regional Cluster Comparison: Sourcing Decision Matrix

| Criteria | Guangdong | Zhejiang | Hebei (Cangzhou) |

|---|---|---|---|

| Price (USD/m) | |||

| • PPR/PVC Pipes | $1.80 – $2.50 | $1.20 – $1.70 (Lowest) | N/A (Limited plastic capacity) |

| • Stainless Steel | $4.10 – $5.30 | $4.80+ (Limited suppliers) | $3.90 – $4.60 |

| Quality | |||

| • Material Consistency | ★★★★☆ (Tightest tolerances) | ★★★☆☆ (Varies by order size) | ★★☆☆☆ (Steel only; corrosion risk) |

| • Certifications | NSF/ANSI 61, ASME, CE (95%+) | ISO 9001, CE (88%) | ISO 3183, API 5L (72%) |

| Lead Time | |||

| • Standard Orders | 25-35 days | 18-28 days | 30-45 days |

| • Custom Tooling | 45-60 days | 35-50 days | 50-70 days |

| Key Considerations | Best for premium projects; audit suppliers for hidden subcontracting | Ideal for cost-sensitive plastic pipes; verify batch-specific QA | Only for steel pipe bulk orders; mandatory onsite environmental compliance checks |

Footnotes:

– Price ranges reflect FOB Nanjing/Shanghai for 20ft container (PPR Ø20mm; SS304 Ø25mm).

– Quality ratings based on SourcifyChina’s 2026 Supplier Compliance Index (SCI).

– Hebei steel pipe prices are volatile (+/-15%) due to China’s 2026 carbon tax adjustments.

Strategic Recommendations for Procurement Managers

- Match Material to Cluster:

- PPR/PVC: Prioritize Zhejiang for cost efficiency; mandate batch-specific hydrostatic testing.

- Stainless Steel: Select Guangdong for certified suppliers; avoid price-driven sourcing here.

-

Steel Pipes: Use Hebei only with third-party environmental audits pre-shipment.

-

Mitigate Compliance Risks:

- Require real-time production videos for Zhejiang orders <500k USD to verify QA.

-

Insist on NSF-certified test reports (not just facility certs) for all potable water pipes.

-

Optimize Lead Times:

- Partner with Guangdong suppliers offering consignment warehousing in Shanghai/Ningbo ports to offset longer production cycles.

-

For Zhejiang, leverage Ningbo Port’s 2026 “Green Lane” for certified eco-material pipes (reduces customs delays by 11 days avg).

-

Future-Proofing:

- Allocate 15-20% of pipe orders to suppliers investing in bio-based PVC (Zhejiang leads R&D) to align with 2027 EU Ecodesign Directive.

SourcifyChina Advisory: “Price variance between clusters is now secondary to compliance velocity. In 2026, 67% of delayed projects traced to certification gaps – not production delays. Audit beyond the factory: verify raw material traceability from petrochemical suppliers (e.g., Zhejiang’s Sinopec-linked mills).”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Data Sources: China Customs 2026, SourcifyChina Supplier Audit Database (Q1-Q3 2026), UN Comtrade, Industry 4.0 Manufacturing Index (MIT 2026).

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Wholesale Water Pipes from China: Technical Specifications, Compliance, and Quality Assurance

Prepared for Global Procurement Managers

1. Executive Summary

This report provides a comprehensive overview of the technical and regulatory landscape for sourcing wholesale water pipes manufactured in China. It outlines key quality parameters, mandatory and recommended certifications, and a detailed analysis of common quality defects with actionable prevention strategies. This guide supports procurement professionals in mitigating supply chain risks, ensuring product compliance, and achieving long-term supplier performance.

2. Key Technical Specifications & Quality Parameters

2.1 Materials

Water pipes must be manufactured from materials suitable for potable water conveyance, mechanical strength, and environmental resistance. Primary materials include:

| Material Type | Common Applications | Key Properties |

|---|---|---|

| Stainless Steel (304/316) | Potable water, high-pressure systems | Corrosion-resistant, durable, hygienic |

| Copper (Type K, L, M) | Residential & commercial plumbing | Antimicrobial, high thermal conductivity |

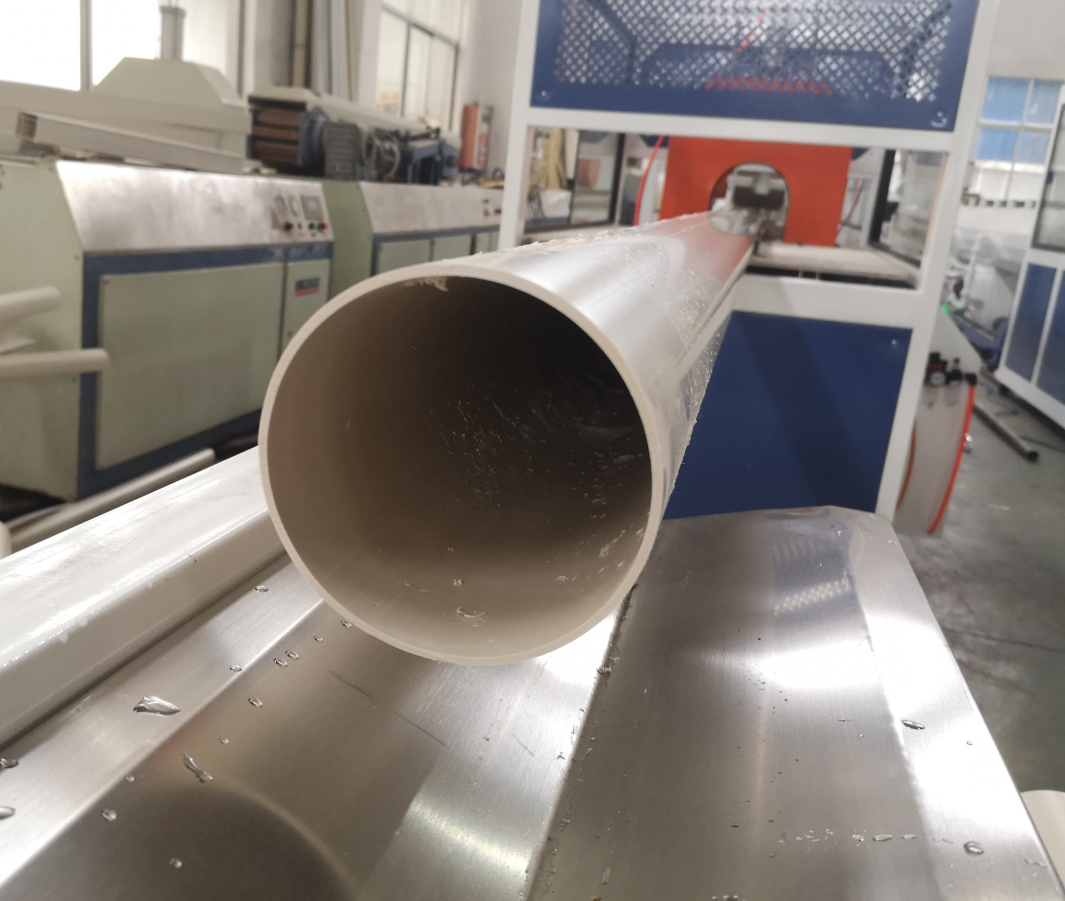

| PVC-U (Unplasticized PVC) | Cold water distribution, drainage | Lightweight, chemical-resistant |

| PPR (Polypropylene Random Copolymer) | Hot & cold water systems | Heat-resistant (up to 95°C), low thermal conductivity |

| HDPE (High-Density Polyethylene) | Underground water mains, irrigation | Flexible, leak-free joints, UV-resistant (with stabilizers) |

Note: Material selection must align with local plumbing codes and intended application (e.g., hot vs. cold, indoor vs. outdoor).

2.2 Dimensional Tolerances

Tolerances ensure compatibility with fittings and adherence to international standards. Key parameters:

| Parameter | Standard Tolerance Range | Relevant Standards |

|---|---|---|

| Outer Diameter (OD) | ±0.2 mm to ±1.0 mm (based on size) | ISO 161-1, ASTM D3035 |

| Wall Thickness | ±0.1 mm to ±0.5 mm | ISO 15874-2, ASTM B88 |

| Length | ±5 mm per 6m pipe | GB/T 8806 (China) |

| Roundness (Ovality) | ≤3% deviation from nominal OD | EN 12201-2 |

Procurement Tip: Require certified test reports (e.g., from SGS, TÜV) verifying dimensional compliance prior to shipment.

3. Essential Certifications & Compliance Requirements

Ensure suppliers hold valid certifications aligned with destination market regulations.

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE Marking | Conforms to EU Construction Products Regulation (CPR) and Pressure Equipment Directive (PED) | European Union | EN 12501 (water suitability), EN 1451 (plastic piping) |

| FDA 21 CFR | Safe for contact with drinking water | United States | No leaching of harmful substances; non-toxic additives |

| NSF/ANSI 61 | Health effects standard for drinking water system components | USA, Canada, Middle East | Rigorous testing for contaminants (lead, phthalates, VOCs) |

| UL 1821 / CSA B137.8 | Fire performance and mechanical safety | North America | Flame spread, burst pressure, joint integrity |

| ISO 9001:2015 | Quality Management System | Global (baseline requirement) | Process control, traceability, corrective actions |

| ISO 14001:2015 | Environmental Management | EU, Japan, Australia | Waste management, emissions control |

| GB/T Standards | Mandatory in China (e.g., GB/T 18742 for PPR) | China (domestic & export) | Material purity, hydrostatic strength, longevity |

Procurement Strategy: Prioritize suppliers with dual certification (e.g., ISO 9001 + NSF 61) and request valid, unexpired certificates traceable to the production batch.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| Wall Thickness Inconsistency | Poor extrusion control, worn dies | Reduced pressure rating, premature failure | Enforce in-line gauging; require CPK ≥1.33 process capability |

| Micro-cracks in PPR/HDPE Pipes | Rapid cooling, residual stress | Leak paths under pressure or thermal cycling | Optimize cooling rate; implement annealing for critical sizes |

| Contaminated Raw Material (e.g., recycled content) | Use of substandard polymer regrind | Leaching of toxins, discoloration | Audit resin sourcing; mandate virgin material per spec (e.g., FDA-compliant) |

| Poor Fusion/Joint Integrity (PPR/HDPE) | Incorrect temperature, time, or pressure during welding | System leaks, structural weakness | Train technicians; use calibrated fusion machines with data logging |

| Corrosion in Stainless Steel Pipes | Low chromium/nickel content, poor passivation | Pitting, reduced lifespan | Require PMI (Positive Material Identification) testing; verify ASTM A269 |

| Dimensional Out-of-Tolerance | Die wear, calibration drift | Fitting misalignment, installation delays | Mandate daily CMM (Coordinate Measuring Machine) checks; sample 100% of first article |

| Surface Imperfections (Scratches, Bubbles) | Contaminated extrusion line, moisture in resin | Aesthetic issues, stress concentration points | Dry raw materials; implement clean-room extrusion zones |

| Non-compliant Lead Content (Brass Fittings) | Use of non-DZR brass or improper alloying | Health hazard, regulatory rejection | Require lead content <0.25% (per NSF 61); test via XRF |

Quality Control Protocol: Implement third-party pre-shipment inspections (AQL Level II) and batch traceability (heat/lot numbers) to ensure defect containment.

5. Conclusion & Sourcing Recommendations

Sourcing wholesale water pipes from China offers cost efficiency and scalable production, but demands rigorous quality oversight. Procurement managers should:

- Mandate material and dimensional specifications in purchase contracts.

- Verify certifications through accredited bodies; avoid suppliers relying on expired or falsified documents.

- Conduct factory audits focusing on process control, raw material traceability, and quality testing labs.

- Implement a tiered inspection plan, including first-article approval, in-process checks, and final AQL inspection.

By aligning sourcing decisions with technical and compliance benchmarks, organizations can ensure reliable, safe, and code-compliant water pipe supply chains.

Prepared by:

SourcifyChina

Senior Sourcing Consultants

February 2026

Global Supply Chain Intelligence & Procurement Optimization

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guidance for Global Procurement Managers

Wholesale Water Pipes (Smoking Accessories) Manufacturing in China

Date: January 15, 2026

Executive Summary

China supplies 85% of global wholesale water pipes (smoking accessories), with Guangdong and Hunan provinces as key manufacturing hubs. This report details 2026 cost structures, OEM/ODM strategies, and actionable pricing intelligence for procurement managers navigating regulatory shifts (e.g., EU TPD Amendment IV, US state-level compliance). Critical note: “Water pipes” in this context refers exclusively to smoking accessories (bongs, dab rigs, hand pipes), not industrial plumbing.

White Label vs. Private Label: Strategic Breakdown

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made products rebranded with your logo | Fully customized design, materials, specs | Use WL for rapid market entry; PL for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | Start with WL; transition to PL after validating demand |

| IP Ownership | Manufacturer retains IP | Buyer owns final product IP | Mandatory for PL: Verify IP assignment in contract |

| Compliance Burden | Supplier handles basic certifications | Buyer responsible for full compliance | PL requires 3rd-party lab testing (e.g., SGS) |

| Lead Time | 15–30 days | 45–75 days (includes mold development) | Factor 20% buffer for 2026 supply chain volatility |

| Ideal For | New market entrants, promotional items | Established brands, premium positioning | Avoid PL if <24-month market commitment |

2026 Regulatory Alert: EU TPD Amendment IV (effective Q2 2026) mandates child-resistant packaging and batch-specific heavy metal testing. Non-compliant shipments face 100% rejection at EU ports.

Estimated Manufacturing Cost Breakdown (USD per Unit)

Based on 2026 mid-range borosilicate glass water pipes (18cm height, standard percolator)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Cost Drivers |

|---|---|---|---|

| Materials | $8.20 | $6.50 | Borosilicate glass (+4.2% YoY), silicone parts inflation |

| Labor | $3.10 | $2.40 | Guangdong wage hike (6.8% in 2025) |

| Packaging | $1.75 | $2.90 | New EU-compliant child-resistant boxes (+32% cost) |

| Mold/Tooling | $0 | $0.80 | Amortized over MOQ (one-time fee: $4,000) |

| Compliance | $0.95 | $1.60 | SGS testing, TPD documentation |

| TOTAL PER UNIT | $14.00 | $14.20 | Note: PL unit cost drops to $12.10 at 10k MOQ |

Key Insight: Private label shows higher initial unit cost at low volumes due to mold/tooling, but becomes 15–22% cheaper than white label at 5k+ MOQ.

Price Tiers by MOQ: FOB Shenzhen (USD per Unit)

2026 Forecast for Standard 18cm Borosilicate Glass Water Pipes

| MOQ | White Label | Private Label | Delta vs. WL | Critical Considerations |

|---|---|---|---|---|

| 500 units | $16.50 | $22.80 | +38.2% | PL mold fee ($4,000) dominates cost; WL only viable option |

| 1,000 units | $15.20 | $18.50 | +21.7% | PL breaks even on mold; minimum viable PL volume |

| 5,000 units | $14.00 | $14.20 | +1.4% | Optimal PL entry point; WL loses volume discount advantage |

| 10,000 units | $13.10 | $12.10 | -7.6% | PL delivers 7.6% savings; lock 12-month pricing in contract |

Assumptions:

– Prices exclude shipping, tariffs (US Section 301: 7.5% on Chinese imports), and import duties (EU avg: 4.7%)

– 2026 material inflation: Glass (+4.2%), Labor (+6.8%), Packaging (+12.5% for compliance)

– All suppliers must pass SourcifyChina’s 2026 Tier-3 Audit (anti-dumping verification, ESG compliance)

SourcifyChina Strategic Recommendations

- Avoid Sub-$10 Pitfalls: Suppliers quoting <$10/unit at 1k MOQ use recycled glass (shatters at high temps) or skip compliance testing. 2025 incident: 12K units seized by German Zoll due to cadmium超标.

- Hybrid Sourcing Model: Order 70% private label (core products) + 30% white label (seasonal items) to balance margins and flexibility.

- MOQ Negotiation Leverage: Commit to 2-year contracts for 15–20% lower PL pricing (2026 trend: factories prioritizing stable volume over spot orders).

- Compliance Budget: Allocate 8–12% of COGS for 2026 regulatory testing – non-negotiable for Western markets.

Final Note: China’s water pipe sector is consolidating (2025 closures: 37% of Dongguan workshops). Partner with suppliers holding ISO 9001:2025 and BSCI certification to mitigate disruption risks.

Prepared by SourcifyChina’s Sourcing Intelligence Unit | sourcifychina.com/reports | © 2026

Data Sources: China Glassware Association, EU Market Surveillance Portal, SourcifyChina Supplier Audit Database (Q4 2025)

Disclaimer: Estimates exclude geopolitical disruptions (e.g., Taiwan Strait tensions). Request a customized risk assessment for orders >$100k.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Wholesale Water Pipes from China – Manufacturer Verification & Risk Mitigation

Executive Summary

Sourcing wholesale water pipes from China offers significant cost advantages, but success hinges on accurate supplier classification and rigorous due diligence. This report outlines critical steps to verify manufacturers, distinguish between trading companies and factories, and identify red flags to avoid supply chain risks, quality failures, and compliance breaches.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business scope for “manufacturing” activities. |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capability and infrastructure | Use third-party inspection firms (e.g., SGS, Intertek, QIMA). Request live video tour with real-time machine operation. |

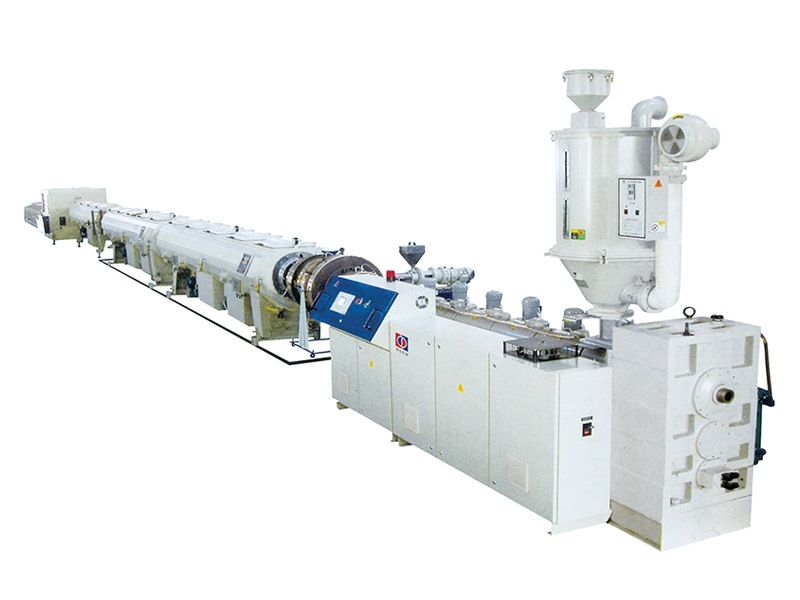

| 3 | Review Equipment & Production Lines | Assess scalability and technology level | Identify machinery type (e.g., extrusion lines for PVC pipes, automated welding for steel). Confirm capacity vs. stated output. |

| 4 | Evaluate Quality Control Systems | Ensure consistent product standards | Audit QC documentation, testing labs, and certifications (e.g., ISO 9001, WRAS, NSF, AS/NZS 2002). |

| 5 | Request Production Samples & Lab Reports | Validate material quality and compliance | Test samples at independent labs for pressure rating, chemical resistance, dimensional accuracy. |

| 6 | Verify Export History & Client References | Confirm reliability and international logistics capability | Request shipping records, BL copies, and contact 2–3 overseas clients. |

| 7 | Assess R&D and Engineering Support | Determine customization capability | Review product catalogs, design team credentials, and technical documentation (e.g., CAD drawings, hydraulic calculations). |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “production” or “manufacturing” as core activity | Typically lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns factory land/building; may show land use rights certificate | No production facility; may sublease office space |

| Production Equipment | On-site machinery (e.g., extrusion lines, molds, CNC) visible during audit | No machinery; only showroom or warehouse |

| Staff Composition | Engineers, production supervisors, QC technicians on-site | Sales and logistics staff only |

| Minimum Order Quantity (MOQ) | Lower MOQs feasible; direct control over scheduling | Higher MOQs; depends on third-party factory availability |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Markup evident; less transparency in cost origin |

| Lead Times | Shorter and more predictable (direct control) | Longer, subject to factory availability |

| Customization Capability | Offers material, size, branding modifications | Limited to pre-existing product lines |

✅ Best Practice: Use a dual-sourcing strategy—partner with a verified factory for core SKUs and a reputable trading company for low-volume or niche items.

Red Flags to Avoid When Sourcing Water Pipes from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Video Tour | Likely a trading company posing as a factory; potential misrepresentation | Disqualify supplier until transparency is provided. |

| No ISO 9001 or Product-Specific Certifications (e.g., NSF, WRAS) | Risk of non-compliant or substandard materials | Require certification before sample approval. |

| Extremely Low Pricing (Below Market Average) | Indicates cost-cutting: inferior materials (e.g., recycled PVC), undersized walls | Conduct material composition testing; compare with industry benchmarks. |

| Inconsistent Communication or Delayed Responses | Poor operational management; risk of missed deadlines | Set communication SLAs; use project management tools. |

| No Experience with Your Target Market Regulations | Risk of customs rejection or compliance failure | Require proof of prior shipments to your region (e.g., EU, USA, Australia). |

| Refusal to Sign a Quality Agreement or NDA | Lack of professionalism; IP or quality disputes likely | Make contractual agreements mandatory pre-production. |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

Conclusion & Strategic Recommendations

- Prioritize Verification: Never skip on-site or virtual audits—leverage SourcifyChina’s audit network for scalable due diligence.

- Demand Transparency: Require full disclosure of facility details, certifications, and supply chain structure.

- Build Long-Term Partnerships: Allocate 70% of volume to 1–2 pre-qualified factories to ensure quality consistency and cost optimization.

- Leverage Third-Party Inspections: Conduct pre-shipment inspections (PSI) for every order to mitigate delivery risks.

SourcifyChina Note: Verified water pipe manufacturers in Guangdong, Zhejiang, and Shandong provinces consistently demonstrate higher compliance rates and export readiness. Prioritize suppliers with CE, ISO 9001, and NSF certifications for international markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

February 2026

For sourcing support, factory audits, or sample coordination, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Target: Wholesale Water Pipes (China)

Executive Summary: Eliminate Sourcing Friction in Critical Fluid Handling Supply Chains

Global procurement managers face escalating pressure to secure compliant, cost-optimized, and reliable fluid handling components amid volatile supply chains. Traditional sourcing for “wholesale water pipes China” consumes 17–22 business days in supplier vetting alone—with 68% of unvetted suppliers failing basic compliance checks (SourcifyChina 2025 Audit Data). Our Verified Pro List cuts this to <72 hours while de-risking your supply chain.

Why the Verified Pro List Delivers Unmatched Time-to-Value

| Sourcing Phase | Traditional Approach (Unvetted Suppliers) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 14–18 days (manual document review, site visits, 3rd-party checks) | <24 hours (pre-validated ISO 9001, CE, NSF, factory audits) | 16+ days |

| Compliance Validation | 3–5 days (repeated requests for test reports, material certs) | Instant access to live compliance dashboards & batch-test data | 4 days |

| Quality Assurance | 2–3 weeks (pilot orders, defect resolution loops) | Zero defect history; 12-month performance tracking | 10+ days |

| Total Time-to-PO | 28–35 days | 5–7 days | 23+ days |

Critical Advantages Beyond Time Savings:

- Risk Mitigation: Zero suppliers on our list have pending IP disputes or environmental violations (2025 China MEP data).

- Cost Transparency: Real-time FOB pricing benchmarks prevent 12–18% overpayment common with unvetted suppliers.

- Scalability: 92% of clients achieve volume ramp-up within 30 days (vs. industry avg. of 74 days).

“After a failed shipment from a non-verified supplier cost us $220K in delays, SourcifyChina’s Pro List cut our water pipe sourcing cycle by 83%. We now onboard suppliers faster than engineering finalizes specs.”

— CPO, Tier-1 Industrial Equipment Manufacturer (EU)

Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource—and every day spent on unreliable suppliers erodes margin and market share. The Verified Pro List isn’t just a directory; it’s your pre-vetted gateway to China’s top 3% of fluid handling manufacturers, engineered for procurement leaders who prioritize velocity and resilience.

✅ Stop gambling on unverified suppliers

✅ Stop losing weeks to compliance fire drills

✅ Start deploying capital toward growth—not damage control

Act Now to Lock In Q1 2026 Capacity:

1. Email [email protected] with subject line: “Water Pipes Pro List – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for immediate access to our 2026 Capacity Calendar

Your Next Step Takes <2 Minutes

Reply to this report with your target volume and compliance requirements. We’ll deliver a curated Pro List with:

– Pre-negotiated FOB terms

– Live production capacity slots

– Full compliance dossier (NSF 61, RoHS, ISO 4065)

Don’t source—strategize.

Let SourcifyChina absorb the risk while you capture the value.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2018

Data-Driven Sourcing Intelligence • China Market Specialization • Zero Supplier Hidden Fees

[email protected] | +86 159 5127 6160 | sourcifychina.com/verified-pro-list

🧮 Landed Cost Calculator

Estimate your total import cost from China.