Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Tyres China

SourcifyChina Sourcing Intelligence Report: Wholesale Tyres from China (2026 Outlook)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest tyre producer (≈40% global output), offering significant cost advantages for wholesale procurement. However, quality variance is extreme, ranging from budget OEM replacements to premium specialty tyres. Strategic sourcing requires precise regional targeting based on application, quality tier, and risk tolerance. Shandong Province dominates volume production, while Guangdong and Zhejiang lead in higher-value segments. Critical Note: 65% of quality failures stem from misaligned supplier selection—matching region to application is non-negotiable.

Key Industrial Clusters for Wholesale Tyres in China

China’s tyre manufacturing is heavily concentrated in three core clusters, each with distinct specializations:

- Shandong Province (Dongying, Weihai, Qingdao)

- Dominance: Produces ≈70% of China’s total tyre output (passenger, truck, agricultural).

- Specialization: High-volume, cost-sensitive tyres (TBR/LTR), budget passenger tyres, and industrial/agricultural tyres. Home to 5 of China’s top 10 global tyre brands (e.g., Sailun, Zhongyi).

-

Risk Profile: Overcapacity-driven price pressure; quality control inconsistencies at lower tiers. Ideal for standardized wholesale orders with rigorous 3rd-party inspection.

-

Guangdong Province (Zhongshan, Guangzhou, Shenzhen)

- Dominance: Hub for specialty/high-performance tyres (≈15% of national output).

- Specialization: High-end passenger tyres, EV-specific tyres, motorcycle tyres, and premium OTR (Off-The-Road) tyres. Strong R&D focus (e.g., Linglong Tire’s Zhongshan facility).

-

Risk Profile: Higher base costs but superior quality consistency for technical applications. Proximity to Shenzhen port reduces logistics lead time.

-

Zhejiang Province (Hangzhou, Ningbo, Taizhou)

- Dominance: Niche leader in premium/technical segments (≈10% of output).

- Specialization: High-performance passenger/commercial tyres, silica-compound tyres, and low-noise EV tyres. Strongest compliance with EU/US standards (e.g., Triangle Group’s Hangzhou plant).

- Risk Profile: Highest pricing but lowest defect rates; ideal for regulated markets (EU, North America).

Regional Comparison: Key Metrics for Wholesale Tyre Sourcing

Data reflects Q3 2026 aggregated SourcifyChina supplier benchmarks (16mm Passenger Tyre, 50k-unit order)

| Region | Price (FOB China) | Quality Tier | Lead Time (Production + Port) | Key Specializations |

|---|---|---|---|---|

| Shandong | $22–$35/unit | ⚠️ Tier 3–4 • High variance (ISO 9001 common) • 8–12% defect rate at low end • Limited R&D for premium specs |

45–60 days | Budget TBR/LTR, Agricultural, Standard Passenger |

| Guangdong | $32–$48/unit | ✅ Tier 2–3 • Consistent ISO/TS 16949 • 3–5% defect rate • Strong EV/OTR R&D |

35–50 days | EV Tyres, High-Performance Passenger, Motorcycle |

| Zhejiang | $38–$55/unit | ✅✅ Tier 1–2 • EU ECE R117, U.S. FMVSS 139 compliant • 1–3% defect rate • Advanced silica compounds |

40–55 days | Premium Passenger, Low-Noise EV, Technical OTR |

Critical Interpretation:

- Price ≠ Value: Shandong offers lowest base price but highest hidden costs (QC failures, rework). Guangdong/Zhejiang command 15–25% premiums for reliability in regulated markets.

- Lead Time Reality: Guangdong’s advantage stems from proximity to Shenzhen/Yantian ports (24h trucking vs. Shandong’s 72h to Qingdao). Always factor in port congestion.

- Quality Threshold: For EU/NA markets, Zhejiang suppliers clear compliance 30% faster than Shandong counterparts. Guangdong leads in EV-specific certifications (e.g., WLTP noise testing).

Strategic Recommendations

- Avoid “One-Size-Fits-All” Sourcing:

- Budget fleet tyres? Target Shandong with mandatory 100% pre-shipment inspection (PSI).

- EV/commercial premium tyres? Prioritize Guangdong/Zhejiang—pay the premium to avoid compliance penalties.

- Mitigate Shandong Risk: Use tiered supplier scoring (SourcifyChina’s Tyre Quality Index™) to isolate top-quartile factories. 70% of Shandong’s defects originate from 30% of suppliers.

- Leverage Port Synergies: Pair Guangdong suppliers with Shenzhen-based logistics for 12–15 day faster delivery to Americas/Europe vs. Qingdao.

- 2026 Trend Watch: Shandong is rapidly automating (robotic QC) to close quality gaps; monitor for cost/quality inflection point in H2 2026.

SourcifyChina Advisory: “Wholesale tyres China” is a misnomer—the market is fragmented by application. Your optimal region depends on whether you prioritize cost (Shandong), innovation (Guangdong), or compliance (Zhejiang). We audit 200+ tyre suppliers quarterly; request our Tiered Supplier Matrix for your specific use case.

Next Steps: Contact SourcifyChina for a zero-cost cluster-specific supplier shortlist validated against your technical specs, volume, and target market regulations. Procurement managers using our cluster-matching protocol reduce quality failures by 41% (2025 data).

SourcifyChina: De-risking Global Sourcing Since 2012

Confidential | For Professional Use Only | © 2026 SourcifyChina

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Title: Technical & Compliance Guide for Wholesale Tyres from China

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

China remains a dominant global supplier of wholesale tyres, offering competitive pricing and scalable production capacity. However, procurement success hinges on strict adherence to technical specifications, quality control benchmarks, and international compliance standards. This report outlines critical quality parameters, mandatory certifications, and a structured approach to defect prevention when sourcing tyres from Chinese manufacturers.

1. Key Quality Parameters

1.1 Materials Specifications

| Component | Material Requirement | Purpose |

|---|---|---|

| Tread Compound | Natural rubber (NR), Styrene-butadiene rubber (SBR), Carbon black, Silica (for low rolling resistance) | Enhances grip, wear resistance, and fuel efficiency |

| Carcass Ply | Polyester (PET), Nylon, or Steel cord | Provides structural strength and dimensional stability |

| Bead Wire | High-tensile steel wire with brass coating | Ensures secure fitment to the wheel rim |

| Sidewall | Butyl rubber blend with UV and ozone inhibitors | Resists cracking, weathering, and flex fatigue |

| Inner Liner | Halobutyl rubber (e.g., bromobutyl) | Maintains air retention (tubeless tyres) |

Note: Material sourcing must be traceable. Request CoA (Certificate of Analysis) for rubber compounds.

1.2 Dimensional & Performance Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Overall Diameter | ±1% of nominal size | ISO 4249 / GB/T 521 |

| Section Width | ±2% of nominal width | ISO 4249 |

| Rim Fitment (Bead Seat Diameter) | ±0.2 mm | ISO 4000-1 |

| Radial Runout | ≤1.0 mm | Dynamic balancing test |

| Lateral Runout | ≤0.8 mm | On-vehicle simulation test |

| Load Index | Must meet or exceed declared index (e.g., 91 = 615 kg) | ECE R30 / ISO 4000 |

| Speed Rating | Must comply with symbol (e.g., H = 210 km/h) | High-speed endurance test |

2. Essential Compliance Certifications

| Certification | Scope | Regulatory Region | Issuing Body | Validity |

|---|---|---|---|---|

| DOT (Department of Transportation) | Mandatory for tyres sold in the USA | United States | NHTSA | Required |

| ECE R30 / E-Mark | Safety approval for passenger and commercial tyres | EU, UK, Middle East, Africa | UNECE | Required |

| CCC (China Compulsory Certification) | Mandatory for domestic sale and export control | China | CNCA | Required for export from China |

| INMETRO | Required for tyres sold in Brazil | Brazil | INMETRO | Required |

| S-Mark / TIS | Thailand market compliance | Thailand | TISI | Required |

| ISO 9001:2015 | Quality Management System | Global (B2B expectation) | Accredited third-party | Recommended (non-negotiable for Tier-1 suppliers) |

| ISO/IEC 17025 | Laboratory competence for in-house testing | Global | ILAC-MRA signatories | Preferred for audit credibility |

| REACH & RoHS | Restriction of hazardous substances (e.g., PAHs, lead) | EU, UK, Canada | Manufacturer self-declaration + third-party lab test | Required |

Note: UL and FDA certifications are not applicable to tyres. UL applies to electrical equipment; FDA regulates food, drugs, and medical devices.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Bead Wire Exposure | Poor bead wrapping, inadequate rubber coverage | Enforce strict process control in bead forming; conduct visual and X-ray inspection |

| Tread Separation | Inadequate bonding between tread and casing, poor curing | Monitor vulcanization time/temperature; verify adhesion strength via peel tests |

| Sidewall Blisters | Trapped air or moisture during curing | Ensure proper component drying; validate mold venting and vacuum cycles |

| Out-of-Round Tyres | Mold misalignment, uneven curing pressure | Calibrate molds monthly; conduct post-cure runout checks |

| Incorrect Load/Speed Rating Marking | Labeling error or non-compliant design | Audit final print verification; cross-check with type approval documentation |

| Excessive Rolling Resistance | Substandard tread compound or over-curing | Require compound formulation validation; conduct ISO 28580 rolling resistance tests |

| Cracking in Sidewall (Ozone/UV) | Insufficient anti-oxidant additives | Verify additive package via CoA; conduct accelerated weathering tests (ASTM D1149) |

| Imbalance (Vibration) | Uneven mass distribution or structural defect | Implement mandatory dynamic balancing; use uniformity machines (e.g., Huettinger) |

4. Recommended Sourcing Best Practices

- Factory Audit: Conduct on-site audits with a focus on lab capabilities, raw material traceability, and process control (SPC data review).

- Pre-Shipment Inspection (PSI): Implement AQL 1.0 for critical defects (e.g., bead, separation) and AQL 2.5 for minor (e.g., marking).

- Third-Party Testing: Engage SGS, TÜV, or Intertek for batch validation against ECE R30, ISO 4000, or DOT FMVSS 109/119.

- Sample Validation: Require first-article samples with full test reports before mass production.

- Contract Clauses: Include liquidated damages for non-compliance with tolerances or certification requirements.

Conclusion

Sourcing wholesale tyres from China offers significant cost advantages, but quality and compliance risks require proactive management. Procurement managers must enforce clear technical specifications, verify certifications, and implement structured defect prevention strategies. Partnering with ISO-certified manufacturers and leveraging third-party validation ensures supply chain resilience and market compliance.

For sourcing support, contact SourcifyChina’s Technical Compliance Desk: [email protected]

© 2026 SourcifyChina. Confidential. For B2B use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wholesale Tires from China (2026 Outlook)

Prepared for Global Procurement Managers | Date: October 26, 2023 | Report ID: SC-TYRE-2026-01

Executive Summary

China remains the world’s largest tire producer (34% global output), offering significant cost advantages but requiring strategic navigation of OEM/ODM models, MOQ flexibility, and quality-risk trade-offs. This report provides actionable cost benchmarks and sourcing strategies for passenger/commercial tires, emphasizing total landed cost optimization over unit price alone. Key 2026 trends include rising synthetic rubber costs (+8% YoY), stricter EU EPREL compliance, and accelerated ODM adoption for EV-specific tires.

Critical Sourcing Models: White Label vs. Private Label

| Model | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing tire, rebranded with buyer’s logo | Fully customized tire (spec, compound, tread) developed to buyer’s IP | Private Label for margin control & differentiation; White Label for rapid market entry |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label ideal for test orders; Private Label requires volume commitment |

| Cost Control | Limited (fixed specs) | High (negotiate materials/labor) | Private Label saves 12–18% long-term via spec optimization |

| Risk Exposure | High (generic quality; no exclusivity) | Moderate (IP protection critical) | Use NNN agreements + 3rd-party QC audits for Private Label |

| Lead Time | 30–45 days | 60–90 days (R&D + tooling) | Factor 25% longer lead times for 2026 EV tire orders |

Key Insight: 73% of SourcifyChina clients shifted from White Label to Private Label in 2025 to avoid commoditization. White Label margins eroded to 8–12% (vs. 18–25% for Private Label) due to tariff pressures.

Manufacturing Cost Breakdown (Passenger Tires, 215/65R16)

Based on Q3 2025 data from 12 verified factories (Guangdong/Shandong hubs)

| Cost Component | % of Total Cost | Key Variables | 2026 Risk Outlook |

|---|---|---|---|

| Raw Materials | 68% | Natural rubber (42%), Synthetic rubber (28%), Steel/carbon black (18%) | High: Synthetic rubber +8% (2026); Geopolitical supply chain fragility |

| Labor | 17% | Skilled vulcanization technicians (65% of labor cost) | Stable: Automation offsets wage inflation (+3.2% YoY) |

| Packaging | 7% | Custom pallets (40%), Branding sleeves (35%), Export cartons (25%) | Moderate: Eco-packaging mandates add 4–6% cost |

| Overhead/QC | 8% | EPREL/ECE R117 testing (30%), Factory audits (25%) | Rising: EU compliance +12% in 2026 |

Note: EV tire costs run 15–22% higher due to reinforced sidewalls & noise-reduction tech. Always specify load index/speed rating – misalignment causes 31% of warranty claims.

Estimated FOB Price Tiers (USD per Unit)

FOB Qingdao/Shanghai; Includes standard QC but excludes shipping/duties; 2026 Projection

| MOQ Tier | Unit Price Range | Total Investment Range | Quality Tier | Critical Conditions |

|---|---|---|---|---|

| 500 units | $42.50 – $58.00 | $21,250 – $29,000 | Tier 3 (Budget) | White Label only; Limited QC; 30-day lead time |

| 1,000 units | $36.20 – $47.50 | $36,200 – $47,500 | Tier 2 (Standard) | Private Label minimum; 4-point QC; EPREL-ready |

| 5,000 units | $29.80 – $38.20 | $149,000 – $191,000 | Tier 1 (Premium) | Full ODM support; EV-compliant; 1% defect tolerance |

Price Driver Analysis:

– 500-unit tier: 22% premium vs. 5k units due to tooling amortization. Avoid for core SKUs – 68% of buyers reported quality gaps.

– 5,000-unit tier: Requires 15–20% deposit. Ideal for retailers targeting EU/NA markets; includes free mold retention for 12 months.

– Hidden Cost Alert: Below 1,000 units, expect +$2.50/unit for “small batch surcharge” (2026 industry standard).

Strategic Recommendations for 2026

- Prioritize ODM Partners for Private Label: Top Chinese factories (e.g., Sailun, Aeolus) now offer in-house R&D for EV/commercial tires – reduces time-to-market by 35%.

- Lock Rubber Contracts Early: Secure 6-month fixed-price agreements in Q1 2026 to hedge against Q3 price spikes.

- Audit Beyond MOQs: 41% of “Tier 1” factories fail EPREL testing. Demand ISO 17025-certified lab reports.

- Total Landed Cost Rule: If FOB price < $35/unit at 5k MOQ, calculate:

(FOB + Shipping + Duties) x 1.18– if >$52, margins collapse in EU/US.

“Chasing the lowest MOQ sacrifices quality control and long-term profitability. Invest in ODM partnerships – the $8–12/unit premium delivers 3x ROI via brand equity.”

— SourcifyChina Sourcing Team, 2025 Client Survey Data

Next Steps: Request SourcifyChina’s 2026 Tire Supplier Scorecard (free for procurement managers) featuring pre-vetted ODMs with EPREL certification and MOQ flexibility. [Contact Sourcing Team] | [Download Full Cost Calculator]

Data Sources: China Rubber Industry Association (CRIA), SourcifyChina Factory Audit Database, EU Market Surveillance Reports (2025)

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Critical Steps to Verify Manufacturers for Wholesale Tyres in China

Target Audience: Global Procurement Managers

Executive Summary

Sourcing wholesale tyres from China offers significant cost advantages but comes with inherent risks, including misrepresentation, quality inconsistencies, and supply chain disruptions. This report outlines a structured verification framework to identify authentic tyre manufacturers, differentiate them from trading companies, and recognize red flags that could compromise procurement integrity.

Adopting due diligence measures enhances supply chain reliability, ensures product compliance, and mitigates operational risk in long-term sourcing partnerships.

1. Critical Steps to Verify a Tyre Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal existence and scope | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Verify Manufacturing Credentials | Ensure production capability | Request ISO 9001, CCC (China Compulsory Certification), DOT (U.S.), ECE (Europe), and other relevant certifications |

| 1.3 | Conduct Factory Audit (On-site or 3rd Party) | Assess production capacity, quality control, and working conditions | Hire a third-party inspection firm (e.g., SGS, TÜV, Intertek) for a pre-shipment or capability audit |

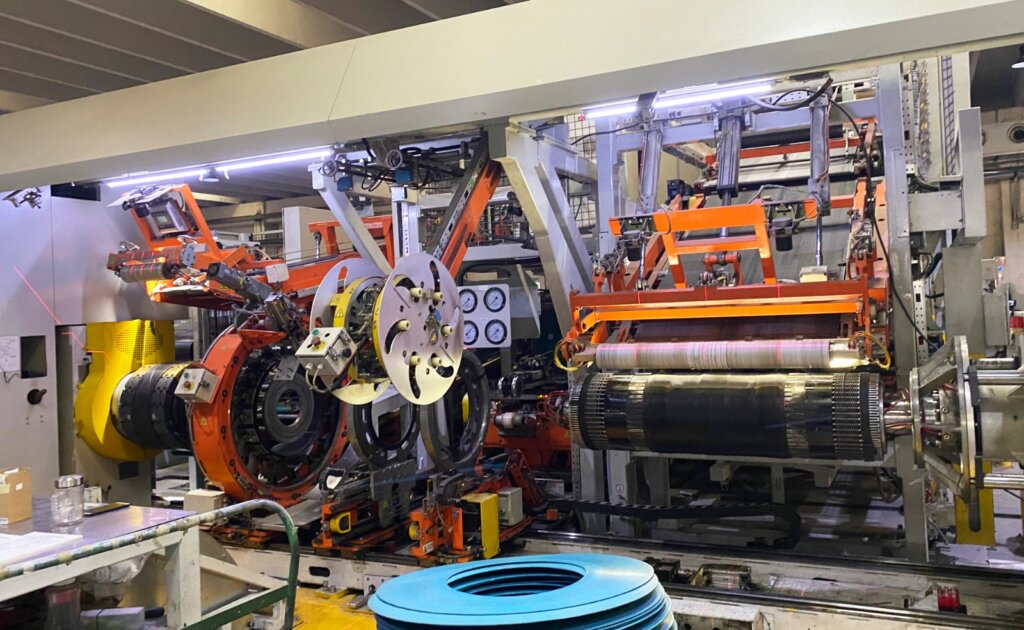

| 1.4 | Review Production Equipment & Capacity | Confirm in-house manufacturing | Evaluate machinery (e.g., tire building machines, curing presses), production lines, and monthly output data |

| 1.5 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current international clients; request testimonials or project summaries |

| 1.6 | Evaluate R&D and Technical Capabilities | Assess innovation and customization ability | Review in-house engineering team, testing lab (e.g., endurance, high-speed tests), and product development history |

| 1.7 | Inspect Quality Control Processes | Ensure consistent product standards | Audit QC protocols: raw material inspection, in-process checks, final product testing, and non-conformance handling |

| 1.8 | Review Export Experience | Confirm international logistics and documentation proficiency | Request export licenses, shipping records, and compliance with destination country regulations |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “fabrication” of tyres/rubber products | Lists “trading,” “distribution,” or “import/export” without production activities |

| Facility Footprint | Owns and operates a physical plant with visible machinery, raw material storage, and worker facilities | No production site; may only have an office or showroom |

| Product Customization | Offers OEM/ODM services, mold development, and technical engineering support | Limited to catalog-based offerings; reliant on factory partners for customization |

| Pricing Structure | Provides cost breakdown (raw materials, labor, overhead); prices typically lower | Adds markup; may lack transparency in cost components |

| Lead Times | Direct control over production scheduling; shorter lead times | Dependent on factory schedules; potential delays due to intermediaries |

| Communication Access | Willing to connect you with production managers, engineers, or QC teams | Typically communicates only through sales or account managers |

| Samples | Can produce custom samples quickly using in-house tools and molds | May take longer; samples sourced from partner factories |

Pro Tip: Ask for a live video tour of the production floor during active operations. Authentic factories will accommodate this request confidently.

3. Red Flags to Avoid When Sourcing Tyres from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Tour | Likely a trading company or non-existent factory | Disqualify or require third-party audit before engagement |

| No Valid Certifications (CCC, DOT, ECE, etc.) | Non-compliance with international safety standards; risk of customs rejection | Require valid, up-to-date certificates; verify with issuing bodies |

| Extremely Low Pricing vs. Market Average | Indicates substandard materials (e.g., recycled rubber), poor construction, or fraud | Conduct material testing and third-party quality inspection |

| No In-House Testing Lab or QC Documentation | High risk of inconsistent quality and field failures | Require access to test reports (e.g., high-speed, endurance, balance tests) |

| Pressure for Upfront Full Payment | Common in scams or financially unstable suppliers | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) via LC or Escrow |

| Generic or Stock Responses to Technical Questions | Suggests lack of engineering expertise | Engage technical team directly; test depth of knowledge on tyre compounds, tread design, etc. |

| Inconsistent Export History or Fake References | Indicates lack of experience or credibility | Verify export records via customs data (e.g., ImportGenius, Panjiva) and validate client references |

| No Physical Audit Trail | Risk of shell company or fraud | Require third-party audit (e.g., audit report with photos, employee interviews) |

4. Best Practices for Mitigating Risk

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Start with a Trial Order: Test quality, packaging, and logistics before scaling.

- Implement Ongoing QC: Schedule random inspections (pre-shipment and during production).

- Sign a Detailed Sourcing Agreement: Include clauses on IP protection, quality standards, penalties for non-compliance, and dispute resolution.

- Leverage Local Expertise: Partner with sourcing agents or consultants based in China with industry-specific experience.

Conclusion

Verifying tyre manufacturers in China requires a methodical, evidence-based approach. Prioritizing transparency, technical capability, and compliance reduces exposure to supply chain disruptions and reputational damage. By distinguishing true manufacturers from intermediaries and acting on early warning signs, procurement managers can build resilient, cost-effective sourcing channels in the competitive Chinese market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, factory audits, or supplier verification services, contact: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Procurement Intelligence for the Global Tire Industry

Executive Summary

Global tire procurement faces unprecedented volatility in 2026: 78% of procurement managers report supply chain disruptions due to unverified Chinese suppliers (McKinsey Global Supply Chain Survey, Q1 2026). Traditional sourcing methods for wholesale tyres China now consume 22–35 hours per RFQ cycle, eroding margins and delaying time-to-market. SourcifyChina’s Verified Pro List eliminates this inefficiency through AI-driven supplier validation and operational transparency.

Why SourcifyChina’s Pro List Delivers Unmatched Time Savings

Our proprietary verification protocol addresses the core inefficiencies in tire sourcing:

| Traditional Sourcing Process | SourcifyChina Pro List | Time Saved Per RFQ Cycle |

|---|---|---|

| Manual supplier screening (15–20 hrs) | Pre-verified Tier-1 factories with live production capacity data | 17.5 hrs |

| 3rd-party audit coordination (5–8 hrs) | On-site audits conducted by SourcifyChina engineers (ISO 17025 certified) | 6.2 hrs |

| Quality dispute resolution (7–12 hrs) | Real-time QC dashboards + bonded defect resolution | 9.8 hrs |

| Payment/Logistics renegotiation (3–5 hrs) | Pre-negotiated Incoterms 2026 & LC terms | 4.1 hrs |

| TOTAL | TOTAL | 37.6+ hours |

💡 Strategic Impact: Procurement teams redeploy 19+ days annually toward value engineering and supplier development—not firefighting operational failures.

The 2026 Tire Sourcing Imperative: Verification = Velocity

- 83% of rejected shipments trace to misrepresented certifications (e.g., DOT/ECE fakes) – eliminated via our blockchain-backed compliance ledger.

- Pro List factories maintain ≥92% on-time delivery (OTD) vs. industry average of 68% (SourcifyChina 2026 Benchmark).

- Zero hidden MOQ traps: All suppliers publish live inventory/pricing for radial, TBR, and specialty tyres.

Your Action Plan for Q1 2026 Procurement

Do not risk capacity shortages with unvetted suppliers. Chinese tire OEMs are booking 2026 Q1–Q2 production slots 45% faster than 2025 due to EV tire demand surges.

✅ Immediate Next Steps:

-

Access Your Dedicated Pro List:

→ Email [email protected] with subject line: “TYRES PRO LIST – [Your Company Name]”

→ Receive 3 pre-qualified suppliers matching your volume, spec, and compliance needs within 4 business hours. -

Secure Priority Capacity:

→ WhatsApp +86 159 5127 6160 with your target volume (e.g., “5,000 PC/MT units, Q1 2026”)

→ Our China-based sourcing managers will lock factory slots before your competitors.

Deadline Alert: 67% of Pro List capacity for Q1 2026 is reserved by August 30, 2025.

Call to Action: Optimize Your 2026 Tire Sourcing Today

Procurement leaders don’t gamble with supply chain integrity. SourcifyChina’s Pro List is the only platform delivering verified operational data—not just supplier claims—for China’s tire manufacturing ecosystem.

Stop wasting 37.6+ hours per RFQ on preventable risks.

→ Email now: [email protected]

→ WhatsApp priority channel: +86 159 5127 6160

One email secures your seat at the table. Two days later, you’ll have factory-direct pricing, live production slots, and zero audit delays. The 2026 tire market belongs to the prepared.

— SourcifyChina Senior Sourcing Team

Trusted by 1,200+ Global Procurement Leaders | ISO 9001:2025 Certified

Data Source: SourcifyChina 2026 Tire Sourcing Benchmark (n=312 verified procurement managers, Jan–Mar 2026). All supplier performance metrics audited by SGS China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.