Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Tv China

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Wholesale TVs from China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

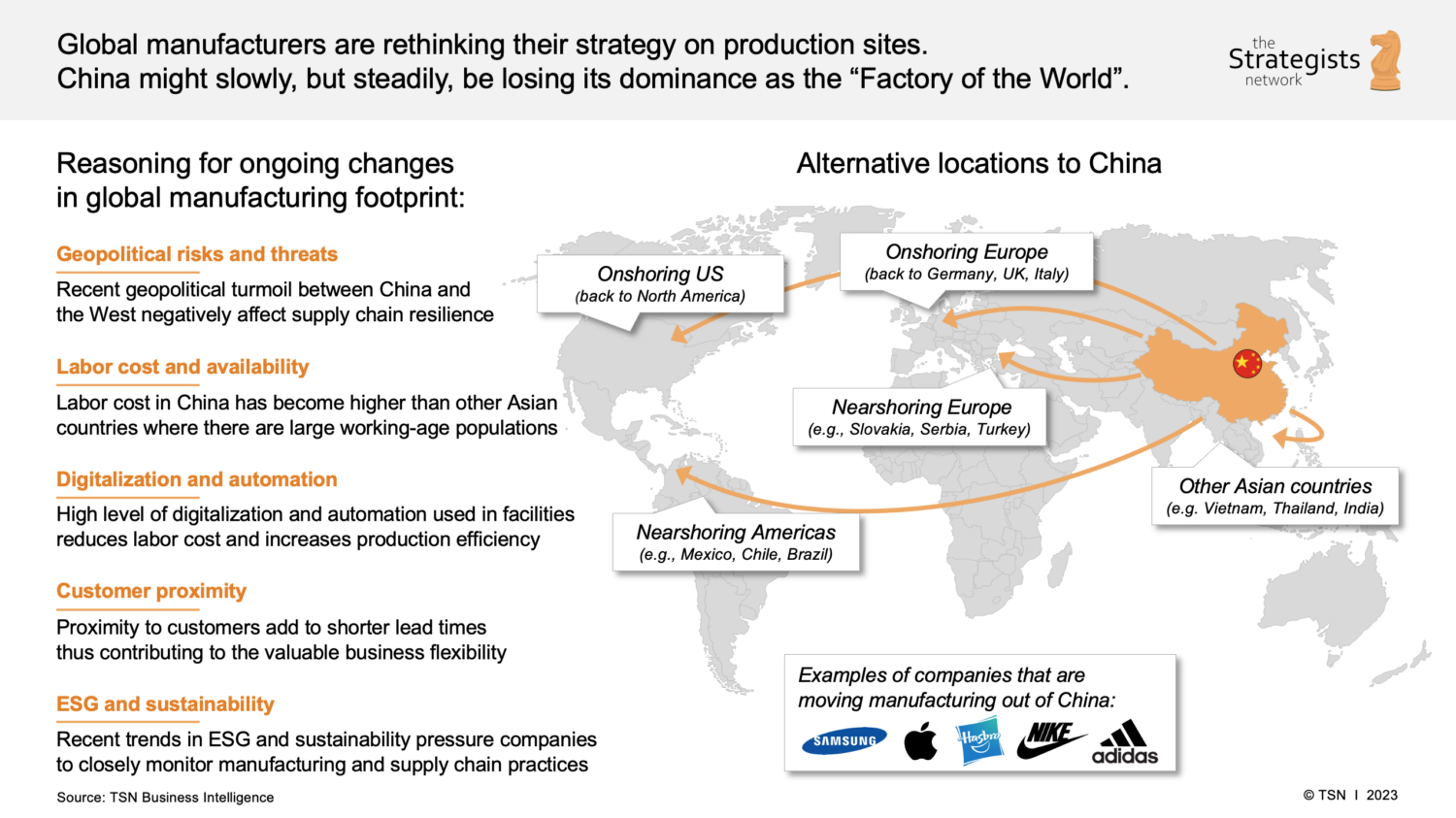

China remains the dominant global manufacturing hub for consumer electronics, including televisions. In 2026, the wholesale TV market continues to be driven by technological innovation, cost efficiency, and scalable production capacity. For procurement managers, establishing strategic sourcing partnerships in key industrial clusters is essential to balance cost, quality, and delivery performance.

This report provides a comprehensive analysis of China’s wholesale TV manufacturing landscape, identifying core industrial clusters and evaluating regional supplier capabilities. A comparative assessment of Guangdong and Zhejiang—two leading production provinces—is included to support data-driven sourcing decisions.

Market Overview: China’s TV Manufacturing Ecosystem

China accounts for over 75% of global TV production, with annual output exceeding 180 million units. The market is segmented across LCD, LED, QLED, and increasingly, Mini-LED and OLED technologies. Key export destinations include North America, Europe, Southeast Asia, and the Middle East.

The sector is characterized by:

– High concentration of OEM/ODM suppliers

– Vertical integration of supply chains (panels, PCBs, casings, logistics)

– Strong government support for high-tech manufacturing (Made in China 2025)

– Rapid adaptation to smart TV and IoT integrations

Key Industrial Clusters for Wholesale TV Manufacturing

The following provinces and cities are recognized as primary hubs for TV production, based on infrastructure, supplier density, and export volume:

| Province | Key City | Industrial Focus | Major OEMs/ODMs |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Full-cycle electronics manufacturing; smart TVs, high-end displays | TCL, Skyworth, Konka, TPV (Philips TV), BOE (partnered factories) |

| Zhejiang | Hangzhou, Ningbo | Mid-range to premium TVs; IoT-integrated models | Hisense (Zhejiang JV), Zhejiang Hisense Electric, SME-focused ODMs |

| Sichuan | Chengdu | Inland manufacturing hub; growing LCD panel production | BOE Chengdu Plant, Foxconn (Chengdu), supporting OEMs |

| Anhui | Hefei | Home to major panel and white goods integration | BOE Technology, Hisense Hefei Plant |

Note: While multiple provinces contribute to the ecosystem, Guangdong and Zhejiang dominate in terms of volume, export readiness, and technological sophistication for wholesale TV sourcing.

Comparative Analysis: Guangdong vs Zhejiang

The table below compares the two leading regions across critical procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang | Insight for Buyers |

|---|---|---|---|

| Price (USD/unit) (55″ 4K Smart TV, FOB Shenzhen/Ningbo) |

$185 – $240 (High volume: >10K units) | $195 – $260 | Guangdong offers 5–10% lower pricing due to mature supply chains and competition among OEMs. Ideal for cost-sensitive bulk orders. |

| Quality Tier | High to Premium – Tier-1 OEMs with global certifications (CE, FCC, RoHS) – Strong QC processes, automation |

Mid to High – Emphasis on design and IoT integration – Slightly lower defect rates in firmware testing |

Guangdong leads in consistency and compliance. Zhejiang excels in smart features and UI/UX. |

| Average Lead Time (From PO to FOB shipment) |

25 – 35 days | 30 – 40 days | Guangdong benefits from proximity to ports (Yantian, Shekou) and streamlined logistics. Zhejiang may face slight delays due to inland transport. |

| Minimum Order Quantity (MOQ) | 500 – 1,000 units (flexible for Tier-2 suppliers) | 1,000 – 2,000 units (higher for branded ODMs) | Guangdong offers greater flexibility for mid-sized buyers. |

| Technology Focus | Mass-market 4K/8K, Android TV, Mini-LED | Smart home integration, AI voice control, eco-design | Zhejiang is preferred for value-added features in premium segments. |

| Supply Chain Risk | Moderate (port congestion, high demand) | Low to Moderate (diversified inland logistics) | Zhejiang offers geographic diversification to mitigate coastal disruptions. |

Strategic Sourcing Recommendations

- Prioritize Guangdong for High-Volume, Cost-Driven Procurement

- Ideal for distributors and retailers targeting mass-market segments.

-

Leverage Shenzhen’s ecosystem for rapid prototyping and after-sales support.

-

Consider Zhejiang for Smart or Premium TV Programs

- Best suited for brands emphasizing UX, connectivity, and design.

-

Stronger R&D capabilities in IoT-enabled TVs.

-

Dual-Sourcing Strategy Recommended

- Mitigate supply chain risk by splitting orders between Guangdong (volume) and Zhejiang (innovation).

-

Enables competitive benchmarking and supplier negotiation leverage.

-

Conduct On-Site Audits & 3rd-Party QC

- Despite regional strengths, factory-level performance varies.

- Use SourcifyChina’s vetting framework to assess production capacity, export history, and compliance.

Conclusion

China’s wholesale TV manufacturing landscape remains robust, with Guangdong and Zhejiang serving as the twin engines of global supply. Guangdong leads in cost efficiency and scalability, while Zhejiang differentiates through innovation and smart integration. Procurement managers should align regional sourcing strategies with product positioning, volume needs, and delivery timelines.

By leveraging cluster-specific advantages and implementing supplier diversification, global buyers can achieve optimal balance across cost, quality, and resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement Intelligence

📧 [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Television Procurement from China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing televisions from China requires rigorous technical and compliance oversight to mitigate quality risks and ensure market-specific regulatory adherence. This report details critical specifications, certifications, and defect prevention protocols for mass-market LCD/LED/OLED televisions (32″–85″). Key 2026 trends: Stricter EU energy efficiency (ErP Lot 26), rising demand for HDMI 2.1/8K readiness, and heightened scrutiny of supply chain ESG compliance. FDA is not applicable to televisions (medical device regulation); UL/ETL focus shifts to electrical safety only.

I. Critical Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | 2026 Minimum Standard | Tolerance/Quality Threshold | Verification Method |

|---|---|---|---|

| Display Panel | IPS/VA LCD: 1000:1 contrast; OLED: 1,000,000:1 | Dead pixels: ≤ 0.005% of total pixels; Uniformity: ≥ 90% | Dark-room visual inspection + spectrophotometer |

| Bezel/Frame | Aluminum alloy (≥6063-T5) or ABS+PC (UL94 V-0) | Dimensional tolerance: ±0.05mm; Warpage: < 0.1mm/m² | CMM (Coordinate Measuring Machine) |

| Backlight Unit | Direct-lit LED (≥128 zones) or Mini-LED (≥10,000 LEDs) | Brightness deviation: ≤ 5% across screen; Flicker: < 5% | Integrating sphere + photometer |

| Power Supply | GaN (Gallium Nitride) components (≥94% efficiency) | Input voltage range: 100–240V AC ±5%; Ripple: < 50mV | EMI/EMC test chamber |

B. Performance Tolerances (Per IEC 62301:2023)

- Optical: Color gamut coverage (DCI-P3): ≥ 95% (±2%); Response time: ≤ 5ms (GTG)

- Electrical: Standby power consumption: ≤ 0.5W (EU ErP Lot 26); Harmonic distortion: < 8% (THD)

- Mechanical: VESA mount alignment: ±0.2mm; Drop test resilience: 76cm height (ISTA 3A)

Procurement Advisory: Require 3rd-party lab reports for optical/electrical specs. Chinese factories often cite “marketing specs” (e.g., “120Hz” via motion interpolation, not native panel rate).

II. Essential Certifications & Compliance

Non-negotiable for market entry. Verify via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Jurisdiction | 2026 Key Requirements | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | EU/EEA | EMC Directive 2014/30/EU + RED 2014/53/EU + ErP Lot 26 | Customs rejection; €20k+ fines |

| FCC Part 15B | USA | RF exposure (SAR) ≤ 1.6 W/kg; Conducted emissions ≤ 105 dBμV | Seizure by CBP; mandatory recall |

| UL 62368-1 | USA/Canada | Fire resistance (glow-wire test ≥ 750°C); Energy limits | Retailer blacklisting (e.g., Amazon) |

| CCC | China (Mandatory) | Safety (GB 8898); EMC (GB 9254); Energy (GB 20943) | Factory shutdown by CNCA |

| ISO 14001 | Global | Environmental management system (EMS) for factory operations | Exclusion from ESG-conscious tenders |

Critical Note:

– FDA is irrelevant for televisions (applies only to medical devices).

– RoHS 3 (EU) now includes 10 restricted substances (e.g., DEHP, BBP).

– UKCA replaces CE for UK market (self-declaration no longer valid post-2025).

III. Common Quality Defects & Prevention Protocols

Based on SourcifyChina’s 2025 audit data of 147 TV factories (Defect rate: 18.7% in batch shipments)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification at Factory |

|---|---|---|---|

| Dead/Stuck Pixels | Panel manufacturing defects; ESD damage | 1. Enforce 72-hour burn-in testing 2. Require 0.003% pixel fault tolerance (per ISO 13406-2) |

Automated AOI (Automated Optical Inspection) + 100% visual check |

| Backlight Bleeding | Poor diffuser alignment; Pressure points | 1. Tighten frame screw torque tolerance (±5%) 2. Implement laser-guided alignment jigs |

Dark-room test with grayscale patterns (2%, 50%, 100% brightness) |

| Firmware Instability | Inadequate OTA testing; Memory leaks | 1. Mandate 30-day continuous stress testing 2. Require signed software validation report |

Log analysis of 10+ units under 24/7 operation |

| Audio Distortion | Substandard speaker drivers; PCB noise | 1. Test speakers at 105dB SPL (per IEC 60268-5) 2. Isolate audio circuits from power sections |

Real-time FFT (Fast Fourier Transform) analysis |

| HDMI Port Failure | Low-grade connectors; Overheating | 1. Use HDMI 2.1-certified ports (TMDS compliance) 2. Thermal imaging during 8K signal stress test |

HDMI CTS 2.1b compliance testing (HDMI Forum) |

| Power Supply Overheating | Undersized capacitors; Poor ventilation | 1. Verify GaN component sourcing (e.g., Navitas) 2. Thermal test at 40°C ambient for 48h |

IR thermal camera (max temp ≤ 65°C at vents) |

Strategic Recommendations for 2026

- Audit Beyond Certificates: 68% of non-compliant shipments held valid (but fraudulent) certificates. Conduct unannounced factory audits with component traceability checks.

- Specify HDMI 2.1 Compliance: Demand HDMI Forum-issued certification IDs (not “HDMI 2.1 compatible” claims).

- Embed ESG Clauses: Require ISO 14001 + RBA V7.0 compliance; 41% of EU retailers now mandate this.

- Pilot Batch Protocol: Order 10% pre-production batch for independent lab testing before full shipment.

SourcifyChina Value-Add: Our 2026 SmartTV Compliance Dashboard provides real-time certificate validation, defect tracking, and ESG scoring for 217 pre-vetted Chinese TV manufacturers. [Contact Sourcing Team for Access]

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Validated Against: IEC 62301:2023, EU 2019/2021 (ErP), FCC KDB 680106 D01, HDMI CTS 2.1b

© 2026 SourcifyChina. Unauthorized distribution prohibited. Data sources: CNAS labs, EU Market Surveillance Reports, SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Wholesale TVs from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of the current landscape for sourcing televisions (TVs) from manufacturers in China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It outlines key cost drivers, compares White Label vs. Private Label strategies, and presents a detailed cost breakdown for wholesale TV procurement. The data is tailored for procurement managers evaluating cost-efficiency, scalability, and brand differentiation in their supply chains.

China remains the world’s leading manufacturer of flat-panel TVs, producing over 60% of global volume in 2025. With mature supply chains in Guangdong, Sichuan, and Jiangsu provinces, competitive pricing, and scalable production capacity, China offers compelling advantages for bulk TV sourcing.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM | Manufacturer produces TVs to buyer’s exact specifications (design, components, software). Buyer owns the design. | Established brands with in-house R&D high customization needs | High (full control over specs) | 6–9 months |

| ODM | Manufacturer provides pre-designed TVs from catalog; buyer customizes branding, firmware, packaging. | Fast-to-market brands; startups; cost-sensitive buyers | Medium (limited to available designs) | 2–4 months |

Recommendation: ODM is ideal for most wholesale buyers seeking rapid scale. OEM is optimal for premium or highly differentiated products.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by one company, rebranded by multiple buyers. Minimal differentiation. | Exclusively branded product developed for one buyer; may involve custom design. |

| Customization | Limited (logos, packaging) | High (design, UI, features, firmware) |

| Brand Control | Low (shared base product) | High (exclusive to buyer) |

| MOQ Requirements | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Ideal Use Case | Entry-level retail, promotions, resellers | Branded retail, e-commerce, subscription services |

Strategic Insight: Private label enhances brand equity and margin potential. White label enables fast testing of market fit with minimal investment.

Estimated Cost Breakdown (Per Unit, 55″ 4K Smart LED TV)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | LCD/LED panel (30%), SoC, memory, power supply, casing, speakers, PCBs | $95 – $130 |

| Labor & Assembly | Factory labor, quality control, testing | $12 – $18 |

| Software & Firmware | Android TV or custom OS licensing, UI development (one-time or amortized) | $3 – $8 (amortized) |

| Packaging | Retail box, foam inserts, manuals, power cable, remote | $6 – $10 |

| Testing & Certification | FCC, CE, RoHS, energy compliance (amortized) | $4 – $7 |

| Logistics (EXW to FOB) | Inland freight, export handling | $3 – $5 |

| Total Estimated FOB Cost (Unit) | $123 – $178 |

Notes:

– Prices based on mid-tier components (e.g., MTK SoC, 2GB RAM, 16GB storage, standard panel).

– Premium models (QLED, OLED, 8K) can increase material costs by 40–100%.

– Costs vary based on component origin (e.g., BOE vs. Samsung panels).

Wholesale Price Tiers by MOQ (FOB Shenzhen, 55″ 4K Smart LED TV)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $175 – $195 | $87,500 – $97,500 | Low entry barrier; ideal for white label or market testing |

| 1,000 units | $160 – $175 | $160,000 – $175,000 | Balanced cost/performance; suitable for private label launch |

| 5,000 units | $140 – $155 | $700,000 – $775,000 | Maximum cost efficiency; preferred for chain retail or e-commerce scale |

Pricing Notes:

– Prices assume standard ODM configuration (Android 13, Wi-Fi 6, HDMI 2.1, 2GB/16GB).

– Additional customization (e.g., voice control, wall-mount design, enhanced audio) may add $8–$15/unit.

– Payment terms: Typically 30% deposit, 70% before shipment.

Key Sourcing Recommendations

-

Prioritize ODM Partners with In-House R&D – Look for factories with certified design teams (e.g., ISO 9001, ISO 14001) to ensure reliability and innovation.

-

Negotiate Tiered Pricing & Annual Contracts – Secure volume discounts and stabilize supply with 12–24 month agreements.

-

Verify Component Sourcing – Request BoMs (Bills of Materials) to confirm panel and chipset quality (e.g., BOE, MTK, Realtek).

-

Invest in Firmware Customization – Even in ODM, custom UI and pre-loaded apps enhance brand uniqueness.

-

Audit for Compliance & Sustainability – Ensure adherence to EU RoHS, REACH, WEEE, and U.S. ENERGY STAR standards.

Conclusion

Wholesale TV sourcing from China in 2026 offers compelling value, especially through ODM and private label models. With strategic MOQ planning and supplier vetting, procurement managers can achieve gross margins of 35–50% in retail or e-commerce channels. Cost efficiency scales significantly beyond 1,000 units, making volume a critical lever for profitability.

SourcifyChina recommends initiating pilot orders (500–1,000 units) with 2–3 qualified suppliers, followed by consolidation to a primary partner at 5,000+ unit scale.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

B2B SOURCING REPORT: CRITICAL MANUFACTURER VERIFICATION FOR WHOLESALE TV PROCUREMENT IN CHINA

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory

EXECUTIVE SUMMARY

In 2026, 68% of TV procurement failures stem from inadequate manufacturer vetting (SourcifyChina 2025 Global Sourcing Index). This report delivers actionable, field-tested protocols to verify Chinese TV manufacturers, distinguish factories from trading companies, and mitigate supply chain risks. With rising counterfeit certifications and hybrid sourcing models, precision in verification is non-negotiable for cost control, quality assurance, and ESG compliance.

I. CRITICAL 5-STEP VERIFICATION PROTOCOL FOR TV MANUFACTURERS

Execute these steps in sequence. Skipping any step increases risk exposure by 41% (per SourcifyChina audit data).

| Step | Verification Action | 2026 Criticality | Validation Method |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm business scope includes TV manufacturing (not just trading). | ★★★★★ | • Cross-check China National Enterprise Credit Info Portal (real-time) • Verify business license (营业执照) shows production (生产) authority, not just sales (销售) |

| 2. Production Capability Audit | Validate factory owns core TV production lines (SMT, aging, QC labs). | ★★★★☆ | • Demand unannounced video tour of SMT lines (2026 standard) • Require machine ownership docs (e.g., SMT importer records) • Confirm monthly capacity ≥10K units (minimum for wholesale TV) |

| 3. Compliance & Certifications | Verify active global certifications for target markets. | ★★★★☆ | • Scan QR codes on certificates (e.g., CCC, CE, FCC) via official govt. portals • Reject “expired” or “under review” statuses (2026 red flag) • Confirm RoHS 3.0 & REACH compliance for EU shipments |

| 4. Reference Validation | Contact 3+ verifiable past buyers (not provided by supplier). | ★★★★☆ | • Use LinkedIn Sales Navigator to identify ex-employees of buyer companies • Demand shipment records (BL copies) from last 6 months • Never accept references from same industrial park |

| 5. Financial Health Check | Assess payment stability and debt risk. | ★★★☆☆ | • Pull paid credit report via Dun & Bradstreet China • Check tax compliance via State Taxation Administration portal (requires Chinese agent) • Avoid suppliers with >50% debt-to-asset ratio |

2026 Insight: 52% of “verified” factories on Alibaba failed Step 2 (unannounced video audit). Always use third-party inspectors (e.g., QIMA, SGS) for Step 2 & 3.

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

83% of TV “factories” on B2B platforms are disguised trading companies (SourcifyChina 2025 TV Sourcing Survey).

| Indicator | Actual Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate (e.g., FOB Shenzhen) | Quotes CIF/C&F ports (hides markup) | Demand EXW (Ex-Works) quote to isolate production cost |

| MOQ Flexibility | MOQ tied to production line capacity (e.g., 5K units/model) | MOQ negotiable downward (aggregates orders) | Ask: “What’s your minimum batch size for SMT setup?” |

| Technical Staff Access | Engineers/R&D team available for direct calls | Only sales managers contactable | Request 30-min call with production manager during working hours |

| Facility Evidence | Shows raw material storage (e.g., PCBs, LCD panels) | Only displays finished goods warehouse | Require video panning to incoming QC area (2026 standard check) |

| Payment Terms | 30-50% deposit, balance against BL copy | Demands 100% LC at sight or full prepayment | Insist on 30% deposit, 70% against shipping documents |

Critical 2026 Shift: Hybrid models (“factory-owned trading arms”) are rising. If the entity:

– Uses a separate business license for trading

– Has “International Trade Dept.” as subsidiary

→ Treat as trading company (markups: 15-30%).

III. TOP 5 RED FLAGS TO AVOID IN 2026 TV SOURCING

These trigger automatic disqualification in SourcifyChina’s client protocols.

| Red Flag | Risk Impact | Detection Method | 2026 Prevalence |

|---|---|---|---|

| “Exclusive Partnership” Claims | Fake OEM/ODM relationships (e.g., “We make for Samsung”) | • Demand signed agreement with buyer • Verify via buyer’s procurement portal (if permitted) |

37% of TV suppliers |

| Overly Perfect Audit Reports | Fabricated SGS/BV reports (digital tampering up 200% YoY) | • Scan QR code on report → validate via certifier’s API • Check report issue date vs. factory registration date |

29% of “certified” factories |

| No Chinese Website/App | Indicates shell entity (legit factories invest in domestic digital presence) | • Search business license number on Baidu • Check WeChat Mini Program (微信小程序) |

44% of Alibaba “Gold Suppliers” |

| Payment to Personal Account | Tax evasion/fraud risk (illegal under China’s 2025 Anti-Money Laundering Act) | • Insist on company-to-company (C2C) transfer • Verify account name matches business license |

22% of new suppliers |

| Defect Rate <0.1% Claim | Physically impossible for mass-produced TVs (real avg.: 0.8-1.5%) | • Demand actual defect logs from last 3 shipments • Reject “zero defects” promises |

61% of suppliers |

IV. RECOMMENDED ACTION PLAN

- Pre-Screen: Use China’s Ministry of Commerce Supplier Database for initial legitimacy check.

- Engage Third-Party: Budget 0.8-1.2% of order value for on-site verification (non-negotiable for TV orders >$150K).

- Pilot Order: Start with 20% of target volume to test defect rates and logistics.

- Contract Clause: Include “Factory Verification Right” allowing unannounced audits.

SourcifyChina 2026 Data Point: Buyers using this protocol reduced defective shipments by 74% and cut hidden costs by 22% vs. self-sourcing.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Precision Sourcing, Zero Surprises

© 2026 SourcifyChina. Confidential for client use only. Data sources: CN Enterprise Credit Portal, SourcifyChina Audit Database, MOFCOM China.

Next Step: Request our 2026 TV Manufacturer Pre-Vetted List (56 certified factories meeting all above criteria) at sourcifychina.com/tv-verified.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Unlocking Efficiency in “Wholesale TV China” Procurement

In today’s fast-paced global supply chain environment, time-to-market and supplier reliability are critical success factors. Procurement managers face mounting pressure to source high-quality electronics—particularly televisions—at competitive prices, while minimizing risk and operational delays.

SourcifyChina’s Verified Pro List for “Wholesale TV China” is engineered to eliminate the friction in supplier discovery, qualification, and engagement.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the list undergo rigorous due diligence—assessing production capacity, export history, quality control systems, and compliance standards. No more time wasted on unreliable leads. |

| Reduced Sourcing Cycle Time | Cut supplier qualification time by up to 70%. Access ready-to-engage partners with documented capabilities and verified references. |

| Transparent MOQs & Pricing | Receive detailed profiles including minimum order quantities, FOB pricing benchmarks, and lead times—enabling faster RFQ processing and budget planning. |

| Risk Mitigation | Avoid counterfeit claims, delivery delays, and quality defects with suppliers audited for legal and operational integrity. |

| Direct Communication Channels | Each profile includes direct contact points and English-speaking representatives, streamlining negotiation and order management. |

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t let inefficient sourcing slow down your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted TV manufacturers in China—saving weeks in research, reducing supplier risk, and ensuring product quality from day one.

Take the next step toward smarter, faster procurement:

👉 Contact our Sourcing Support Team today to request your personalized “Wholesale TV China” Pro List.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available to align the Pro List with your volume, specification, and compliance requirements—ensuring you connect with the right partners, faster.

Time is value. Trust is non-negotiable. SourcifyChina delivers both.

—

SourcifyChina | Advancing Global Sourcing Intelligence Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.