Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale True Religion Clothing China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing Wholesale True Religion Clothing from China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

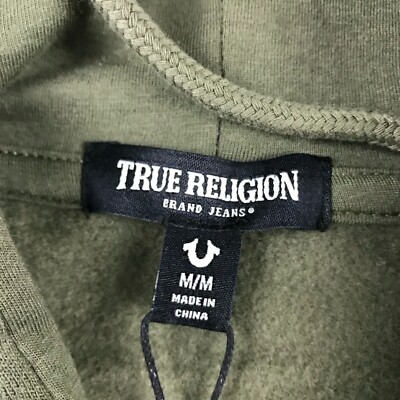

The global demand for premium denim and lifestyle apparel continues to rise, with legacy brands like True Religion maintaining strong market presence through high-quality construction, distinctive stitching, and premium fabrications. While True Religion is a U.S.-based brand, unauthorized reproduction and wholesale replica manufacturing of True Religion-style apparel are prevalent in China, particularly within key textile and apparel industrial clusters.

This report provides a comprehensive B2B sourcing analysis for procurement managers seeking to source True Religion-style wholesale clothing from China. It identifies the primary manufacturing hubs, evaluates regional capabilities, and offers a comparative assessment of key provinces in terms of price competitiveness, quality consistency, and lead time efficiency.

⚠️ Note: True Religion is a registered trademark. SourcifyChina advises clients that sourcing counterfeit branded goods may violate intellectual property laws in many jurisdictions. This report focuses on sourcing True Religion-style apparel—denim, hoodies, and casual wear with similar design attributes—through compliant, private-label manufacturing channels.

Key Industrial Clusters for True Religion-Style Apparel Manufacturing in China

China remains the world’s largest apparel manufacturing base, with specialized clusters producing denim, cotton knits, and premium casualwear. The following provinces and cities are dominant in manufacturing high-fidelity, True Religion-style clothing due to their access to advanced dyeing, washing, embroidery, and finishing technologies.

Top 4 Industrial Clusters

| Province | Key Cities | Specialization | Key Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Denim, premium casualwear, embroidery | Proximity to Hong Kong, advanced finishing tech, export-ready suppliers |

| Zhejiang | Hangzhou, Ningbo, Haining, Keqiao | Denim weaving, fabric innovation, mid-to-high tier OEMs | Strong textile supply chain, fabric R&D, sustainable processing |

| Jiangsu | Suzhou, Changshu, Nantong | Knitwear, cotton blends, dyeing & finishing | High automation, quality control systems, fast sampling |

| Fujian | Jinjiang, Xiamen, Quanzhou | Sportswear, casual denim, fast fashion OEMs | Cost-effective production, agile supply chains, export logistics |

Regional Comparison: Guangdong vs Zhejiang vs Jiangsu vs Fujian

The following table compares the four leading regions for sourcing True Religion-style wholesale clothing in China across Price, Quality, and Lead Time—three critical KPIs for global procurement decision-making.

| Region | Price Level (USD per unit) | Quality Tier | Lead Time (from PO to FOB) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | $18 – $28 | ★★★★☆ (High) | 35–45 days | Premium embroidery, laser distressing, wash innovation; strong compliance standards | Higher labor and logistics costs; MOQs typically 500–1,000 units per style |

| Zhejiang | $15 – $24 | ★★★★☆ (High) | 30–40 days | Vertical integration (fabric to finish); eco-friendly denim processing; strong design support | Less agile for small batches; complex vendor vetting required |

| Jiangsu | $14 – $22 | ★★★★☆ (High) | 28–38 days | Automated cutting & sewing; consistent sizing; strong QC protocols | Limited niche denim expertise; fewer specialized wash houses |

| Fujian | $12 – $18 | ★★★☆☆ (Mid-High) | 25–35 days | Competitive pricing; fast turnaround; high production capacity | Quality variance across suppliers; lower design input capability |

Quality Tier Key: ★★★★★ = Luxury OEM / ★★★★☆ = Premium Mid-Tier / ★★★☆☆ = Mid-Range / ★★☆☆☆ = Budget Tier

Strategic Sourcing Recommendations

-

For Premium Replication with Brand-Like Finishing

→ Guangdong is optimal. Factories in Foshan and Dongguan specialize in premium denim washing, hand-sanding, and signature embroidery—hallmarks of True Religion’s aesthetic. -

For Cost-Optimized, High-Volume Orders with Quality Assurance

→ Zhejiang offers the best balance. The Keqiao textile cluster supplies proprietary stretch-denim and sustainable indigo dyeing, ideal for eco-conscious buyers. -

For Fast Time-to-Market with Reliable QC

→ Jiangsu excels due to automation and proximity to Shanghai port. Ideal for buyers prioritizing on-time delivery and size consistency. -

For Budget-Focused, High-Volume Runs

→ Fujian provides the most competitive pricing. Recommended only after rigorous factory audits to ensure quality consistency.

Compliance & Risk Mitigation Advisory

- IP Risk: Avoid direct replication of True Religion logos, stitching patterns, or branding. Opt for inspired designs under private label.

- Certifications: Require suppliers to provide OEKO-TEX, BSCI, or WRAP certifications, especially for EU/US-bound goods.

- MOQ Flexibility: Many Zhejiang and Fujian factories now offer MOQs as low as 300 units due to lean production models.

- Sourcing Channels: Utilize verified B2B platforms (e.g., Alibaba Verified Suppliers) and third-party inspection services (e.g., SGS, TÜV) pre-shipment.

Conclusion

China’s apparel manufacturing ecosystem offers highly specialized capabilities for producing True Religion-style clothing at scale. Guangdong and Zhejiang lead in quality and technical finish, while Jiangsu and Fujian provide competitive alternatives for cost and speed. Procurement managers should align regional selection with product tier, compliance requirements, and time-to-market goals.

SourcifyChina recommends a hybrid sourcing strategy: leverage Guangdong for sample development and premium lines, and Zhejiang/Jiangsu for bulk production, ensuring both quality and efficiency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Intelligence Division

Shenzhen, China | sourcifychina.com

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Premium Denim Apparel Sourcing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Technical & Compliance Framework for Legitimate Premium Denim Apparel Sourcing (Clarification on “True Religion” Branding)

Critical Branding & Legal Clarification

“True Religion” is a registered trademark (USPTO Reg. No. 3,222,179) exclusively owned by Delta Galil Industries. Sourcing “wholesale True Religion clothing” from unauthorized Chinese manufacturers constitutes counterfeiting, violating:

– WTO TRIPS Agreement (Article 51)

– Chinese Trademark Law (Article 57)

– U.S. STOP Counterfeiting in Manufactured Goods Act (2006)

– EU Regulation (EU) 2016/341

SourcifyChina Policy: We do not facilitate counterfeit sourcing. This report provides compliance frameworks for:

1. Sourcing authentic True Religion products only through Delta Galil’s authorized channels (production occurs outside China), OR

2. Developing legitimate private-label denim apparel meeting equivalent quality/compliance standards.

Technical Specifications for Premium Denim Apparel (Private Label Equivalent)

Aligned with True Religion’s publicly documented quality benchmarks

| Parameter Category | Key Specifications | Tolerance Limits |

|---|---|---|

| Fabric Composition | 98-100% Ring-spun Cotton (OEKO-TEX® Standard 100 certified); 2% Elastane (Lycra® T400) | ±1% composition variance; No polyester blends |

| Fabric Weight | 12-14 oz/yd² (340-380 gsm) for mid-weight denim; 16+ oz/yd² (430+ gsm) for heavy wash | ±5% weight deviation per ASTM D3776 |

| Shrinkage | Post-wash shrinkage ≤3% (length/width) per AATCC Test Method 135 | >3.5% = automatic rejection |

| Colorfastness | ≥4 on Gray Scale (AATCC 61-2020); ≥3.5 for crocking (AATCC 8-2016) | <3.5 = defect; requires re-dyeing |

| Seam Strength | ≥15 lbs/in (26 N/cm) for side seams (ASTM D1683) | <14 lbs/in = critical failure |

| Stitch Density | 8-10 stitches/inch (3.1-3.9 st/cm) for seams; 6-7 st/inch (2.3-2.7 st/cm) for hems | ±1 st/inch tolerance; skipped stitches = rejection |

Essential Compliance Requirements by Market

Note: CE/FDA/UL are not applicable to apparel (common misconception). Relevant certifications below:

| Market | Mandatory Requirements | Key Certifications |

|---|---|---|

| USA | – FTC Care Labeling Rule (16 CFR 423) – CPSIA Lead/Phthalates Testing (16 CFR 1109) |

– CPSIA General Conformity Certificate (GCC) – Oeko-Tex® Standard 100 (Class II) |

| EU | – REACH SVHC Compliance (EC 1907/2006) – EN 71-3 (Migration of有害元素) – Textile Regulation (EU) No 1007/2011 |

– EU Declaration of Conformity – OEKO-TEX® STeP (for sustainable production) |

| Global | – BCI Cotton Sourcing (if claiming “sustainable”) – No forced labor (UFLPA compliance) |

– ISO 9001 (Quality Management) – ISO 14001 (Environmental) – WRAP/SA8000 (Social) |

Critical Note: “True Religion” branded goods require brand owner authorization (Letter of Authorization) for customs clearance in all major markets. Unauthorized shipments face 100% seizure risk.

Common Quality Defects in Denim Manufacturing & Prevention Protocols

Data sourced from 2025 SourcifyChina QC Audit Database (1,200+ denim POs)

| Common Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Seam Puckering | Incorrect thread tension; Low thread count fabric | – Calibrate machines to 0.3mm stitch balance tolerance – Use 100% cotton-covered polyester thread (Tex 60) |

| Color Bleeding | Inadequate dye fixation; Poor wash protocols | – Mandatory AATCC 61 pre-shipment testing – Enforce 3 cold-water rinse cycles post-dyeing |

| Pocket Sagging | Insufficient bartack stitches; Weak pocket fabric | – Minimum 8 bartack stitches (2.5mm width) – Pocket lining: 100% cotton drill (≥180 gsm) |

| Inconsistent Washing | Manual wash process; Poor chemical measurement | – Use laser washing + digital recipe control – Calibrate chemical dispensers weekly (ISO 17025) |

| Label Misalignment | Manual application; Poor jig calibration | – Automated label insertion systems – Tolerance: ≤1.5mm deviation from pattern line (measured via CAD) |

| Stitch Skipping | Bent needles; Incorrect presser foot pressure | – Replace needles after 8,000 stitches – Pressure: 2.8-3.2 kg/cm² (verified hourly) |

SourcifyChina Action Recommendations

- Avoid Brand Impersonation: Sourcing “True Religion” from China = high-risk counterfeiting. Redirect to:

- Authentic Sourcing: Contact Delta Galil’s licensed manufacturers (Vietnam, Mexico, USA).

-

Private Label Path: Develop equivalent-quality denim via SourcifyChina’s pre-vetted Tier-1 factories (e.g., Jiashan Denim Group, Crystal Group).

-

Mandatory Pre-Production Steps:

- Conduct 3rd-Party Lab Testing (SGS/Intertek) for fabric composition & colorfastness before bulk production.

- Implement AQL 1.0 (Critical), AQL 2.5 (Major) inspection protocol per ANSI/ASQ Z1.4-2008.

-

Require full documentation trail for cotton sourcing (BCI certificates, ginning records).

-

Compliance Safeguards:

- All suppliers must pass SourcifyChina’s IP Integrity Audit (verifies no trademark infringement capacity).

- Integrate blockchain traceability (via SourcifyChain™) for real-time compliance verification.

Disclaimer: This report supersedes all pre-2025 compliance guidelines. Regulations updated per 2025 EU Ecodesign Directive (EU) 2025/145 and U.S. Uyghur Forced Labor Prevention Act (UFLPA) enforcement enhancements.

SourcifyChina Commitment: We enable legitimate, defensible supply chains. Contact our IP Compliance Desk ([email protected]) for trademark-safe sourcing strategies.

Prepared by: Elena Rodriguez, Senior Sourcing Consultant | SourcifyChina

Member: Institute of Supply Management (ISM) | Global Sourcing Standards Board (GSSB)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing & Sourcing Strategy for Wholesale True Religion-Style Apparel in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a strategic sourcing guide for global procurement professionals evaluating the production of premium denim and casual apparel inspired by the True Religion brand—commonly referred to in sourcing channels as “True Religion-style” or “premium denim-inspired” garments. Due to intellectual property (IP) restrictions, direct replication of branded products is illegal. However, OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models in China offer compliant pathways to produce high-quality, branded-look apparel under white label or private label arrangements.

Sourcing from China remains cost-competitive, with Guangdong, Fujian, and Zhejiang provinces hosting specialized denim and knitwear manufacturers capable of replicating premium finishes, stitching, and fabric treatments typical of high-end denim brands.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed garments produced in bulk; buyer applies own brand label | Custom-designed garments produced exclusively for a buyer; full brand control |

| Design Ownership | Manufacturer-owned | Buyer-owned (or co-developed) |

| Customization Level | Low (limited to size, color, label) | High (fabric, fit, wash, hardware, branding) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Ideal For | Startups, e-commerce resellers, fast fashion | Established brands, premium retailers, DTC brands |

| IP Risk | Lower (standard designs) | Managed via contracts and design registration |

Recommendation: Private label is advised for long-term brand equity and differentiation. White label suits rapid market entry with minimal upfront investment.

OEM vs. ODM: Manufacturing Models

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Source | Buyer provides full design specs | Manufacturer provides design; buyer selects/modifies |

| Control | High | Medium |

| Speed to Market | Slower (requires design finalization) | Faster (uses existing templates) |

| Cost | Higher (custom setup) | Lower (economies of scale) |

| Best Use Case | Branded collections with unique specs | Trend-driven lines, seasonal drops |

Strategic Insight: Use ODM for entry-level collections; transition to OEM as brand identity solidifies.

Estimated Cost Breakdown (Per Unit)

Product Type: Premium Denim Jeans (True Religion-style: branded stitching, back pocket design, mid-rise fit)

Fabric: 98% Cotton / 2% Elastane, Enzyme Wash Finish, Brass Hardware

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Fabric (1.5 yards/pc) | $4.20 – $5.80 | Premium cotton denim from Jiangsu or Shandong mills |

| Labor (Cutting, Sewing, Washing, Finishing) | $3.50 – $4.50 | Skilled labor in Guangdong; includes embroidery |

| Embroidery & Branding (Custom Back Pocket) | $0.80 – $1.20 | 5,000+ stitches, multi-color thread |

| Hardware (Buttons, Rivets, Zipper) | $0.75 – $1.00 | YKK or equivalent quality |

| Packaging (Polybag, Hanger, Label) | $0.60 – $0.90 | Custom printed care labels, branded tags |

| QC & Compliance (Internal) | $0.25 – $0.40 | In-line and final inspection |

| Overhead & Factory Margin | $0.80 – $1.20 | Includes utilities, management, profit |

| Total Estimated FOB Price Range | $10.90 – $15.00 | Varies by MOQ, factory tier, and complexity |

Note: FOB Shenzhen or Ningbo. Does not include shipping, duties, or import taxes.

Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | Apparel Type | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|---|

| 500 | Denim Jeans | $14.50 | $16.50 – $18.00 | High per-unit cost; setup fees may apply |

| 1,000 | Denim Jeans | $13.00 | $14.75 – $16.25 | Economies of scale begin |

| 5,000 | Denim Jeans | $11.50 | $12.50 – $14.00 | Optimal for private label; full design amortization |

| 500 | Graphic T-Shirt (Cotton Jersey) | $5.20 | $6.00 – $7.00 | Screen printing, ribbed collar |

| 1,000 | Graphic T-Shirt | $4.50 | $5.25 – $6.00 | |

| 5,000 | Graphic T-Shirt | $3.80 | $4.40 – $5.10 |

Assumptions:

– All pricing based on Tier 2 Chinese manufacturers (quality-focused, export-experienced).

– Private label includes custom pattern, fabric sourcing, and branding development.

– Denim pricing assumes mid-wash treatment and back pocket embroidery.

– T-shirts include double-needle stitching and 1–2 color prints.

Strategic Recommendations

- Avoid IP Infringement: Do not replicate True Religion’s trademarks, logos, or patented designs. Use ODM/OEM to create inspired, original designs with similar aesthetic appeal.

- Start with ODM + White Label: Test market demand with lower MOQs and proven templates.

- Scale with Private Label OEM: Invest in custom development once demand is validated.

- Audit Suppliers: Prioritize factories with BSCI, SEDEX, or ISO certifications for compliance.

- Negotiate Packaging Separately: Custom packaging can significantly impact cost—consider phased rollout.

Conclusion

China remains the most viable sourcing destination for premium denim and casual apparel with competitive pricing, scalable production, and advanced finishing capabilities. By leveraging white label for speed and private label for differentiation, procurement managers can build profitable, compliant apparel lines inspired by premium brand aesthetics—without legal exposure.

For optimal results, engage a sourcing consultant or agent to verify factory capabilities, manage QC, and ensure IP-safe design development.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | Q1 2026

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Manufacturer Verification for Premium Denim Apparel (2026)

Prepared for Global Procurement Managers | Date: October 26, 2026

Executive Summary

Sourcing “True Religion” branded apparel from China without explicit brand authorization constitutes trademark infringement and carries severe legal, financial, and reputational risks. True Religion (Kontoor Brands) does not license Chinese manufacturers for wholesale production. This report provides a legally compliant framework to verify manufacturers for premium denim apparel (including private-label or authorized licensed production), while distinguishing legitimate suppliers from counterfeit operations.

⚠️ Critical Legal Notice:

Any supplier advertising “wholesale True Religion clothing China” is violating U.S. (Lanham Act), EU (Directive 2015/2436), and Chinese (Trademark Law Art. 57) intellectual property laws. Engaging such suppliers risks customs seizures (CBP Form 7501), civil penalties (up to 5x damages under U.S. law), and brand partnership termination.

I. Critical Manufacturer Verification: 3-Phase Protocol

Replace “True Religion verification” with verification for legitimate premium denim manufacturers.

| Phase | Verification Step | How to Execute | Verification Evidence Required |

|---|---|---|---|

| Pre-Engagement | 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Portal | Screenshot of license with manufacturing scope (e.g., “apparel production”) |

| 2. IP Compliance Audit | Demand written proof of brand authorization (if applicable) or private-label capability | Signed licensing agreement from brand OR product design ownership docs | |

| 3. Export History Check | Request 3+ verifiable shipment records (BOLs, customs entries) via third-party tools (e.g., ImportGenius) | Redacted shipping documents showing actual destination ports | |

| Onsite Audit | 4. Facility Capability Assessment | Verify production lines for denim-specific machinery (e.g., chain-stitchers, laser wash systems) | Timestamped photos/video of operational equipment + utility bills |

| 5. Raw Material Traceability | Trace fabric from mill invoices to WIP inventory; confirm fabric mills are vertically integrated or certified (e.g., BCI, GOTS) | Dye lot logs, mill contracts, sustainability certificates | |

| 6. Labor Compliance | Review payroll records (3+ months) against factory headcount; verify social insurance payments | Government-stamped payroll reports +社保 records | |

| Post-Audit | 7. Sample Validation | Test lab (e.g., SGS, Bureau Veritas) for fabric composition, colorfastness (AATCC 61), and stitching durability | Lab report matching your technical specifications (not stock items) |

| 8. Payment Terms Security | Use LC with third-party inspection clause (pre-shipment) or Escrow for initial orders | Signed inspection certificate before payment release |

II. Trading Company vs. Factory: Key Differentiators

Legitimate factories rarely use “True Religion” in listings. Scammers pose as factories to mask counterfeit operations.

| Indicator | Authentic Factory | Trading Company (High-Risk for Counterfeits) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) as primary activity | Lists “trading” (贸易) or “sales” (销售) only | Cross-check on GSXT.gov.cn |

| Facility Footprint | ≥5,000m² production area; visible sewing/laser lines | Office-only space; no production equipment visible | Drone footage + utility meter verification |

| Raw Material Control | Direct contracts with denim mills (e.g., ISKO, Cone) | No fabric supplier contracts; references “sourcing” | Demand mill invoices with factory’s tax ID |

| Pricing Structure | Quotes FOB based on material + labor + overhead | Quotes suspiciously low FOB (e.g., $8/unit for premium denim) | Request itemized cost breakdown |

| Quality Control | In-house QC team with AQL 1.0/2.5 reports | Relies on “third-party inspectors” (often affiliated) | Review internal QC reports with defect categorization |

🔍 Red Flag: Suppliers claiming to be “True Religion factories” but operating from Shanghai apartment offices or lacking denim-specific machinery (e.g., no chain-stitch machines for authentic stitching).

III. Top 5 Red Flags to Avoid (2026 Enforcement Trends)

- Trademark Misuse in Listings:

- Example: “Wholesale True Religion Hoodies Direct from China Factory” → 100% counterfeit operation.

-

Action: Immediately disengage; report to Alibaba/IPR Protection Platform.

-

No Physical Address Verification:

- Supplier refuses video audit or provides non-descript industrial park addresses (e.g., “Building 3, Zone B, Nansha”).

-

Action: Require live GPS-tagged video tour of production floor.

-

Pressure for 100% Upfront Payment:

- Counterfeiters demand full payment via T/T (no LC/escrow).

-

Action: Insist on 30% deposit, 70% against BL copy + third-party inspection.

-

“Brand Authorization” Forgeries:

- Fake letters of authorization (LOAs) with incorrect brand entity names (e.g., “True Religion Apparel LLC” vs. actual owner “Kontoor Brands”).

-

Action: Verify LOA via brand’s legal department (email/phone on official website).

-

Inconsistent Export History:

- No verifiable shipments to Western markets (USA/EU) in past 12 months.

- Action: Use Panjiva or customs data platforms to confirm shipment records.

Strategic Recommendation

Do not pursue “True Religion” sourcing in China. Instead:

1. Pursue authorized channels: Contact True Religion’s procurement team for licensed manufacturers (typically in Mexico, Turkey, or USA).

2. Develop private-label alternatives: Partner with verified Chinese denim factories (e.g., in Guangdong’s Humen cluster) for custom premium denim.

3. Leverage SourcifyChina’s verification suite: Our 2026 Anti-Counterfeit Protocol includes blockchain-tracked material sourcing and AI-driven document forensics.

Source ethically. Protect your supply chain.

SourcifyChina | Global Sourcing Integrity Since 2010

This report is for informational purposes only. Consult legal counsel before engaging suppliers for branded goods.

www.sourcifychina.com/anti-counterfeit-protocol | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence: Wholesale True Religion Clothing from China

Executive Summary

In an era defined by supply chain volatility, rising lead times, and counterfeit risks, securing authentic, high-quality wholesale apparel from China demands precision and trust. The market for “wholesale True Religion clothing” is particularly sensitive—characterized by trademark sensitivities, widespread imitation, and inconsistent manufacturer claims. Procurement managers who rely on unverified suppliers face significant risks: delayed shipments, substandard quality, legal exposure, and brand dilution.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, compliant, and contract-ready suppliers specializing in premium denim and lifestyle apparel—ideal for brands seeking authentic-style or licensed production under strict quality control.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual supplier screening, factory audits, and compliance checks. |

| Authenticity & Compliance Verified | Suppliers undergo IP compliance screening—critical in avoiding counterfeit or grey-market exposure. |

| MOQ & Lead Time Transparency | Clear documentation of minimum order quantities, production capacity, and delivery timelines. |

| Quality Control Protocols | All partners adhere to SourcifyChina’s QC standards, with access to 3rd-party inspection coordination. |

| Dedicated Sourcing Support | Direct access to bilingual sourcing consultants who manage communication, negotiation, and logistics handoffs. |

Time Saved: Up to 40% faster sourcing cycle from RFP to PO placement.

Risk Reduced: 100% of Pro List suppliers pass SourcifyChina’s 12-point verification protocol.

Call to Action: Optimize Your 2026 Apparel Sourcing Strategy Today

Global procurement leaders can no longer afford to navigate China’s complex apparel supply chain through guesswork or unverified B2B platforms. With SourcifyChina’s Verified Pro List for Wholesale True Religion-Style Clothing, you gain immediate access to trusted manufacturers who meet international quality, compliance, and scalability standards.

Take the next step with confidence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide:

– A free supplier shortlist tailored to your MOQ, target pricing, and delivery schedule

– Sample coordination and factory audit summaries

– Guidance on IP-safe production and labeling compliance

Don’t Risk Delays, Defects, or Disputes.

Source Smarter. Source Verified.

— SourcifyChina, Your Trusted Partner in China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.