Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Truck Tires From China

Professional B2B Sourcing Report 2026

Sourcing Wholesale Truck Tires from China: Market Analysis & Industrial Cluster Insights

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s largest producer and exporter of tires, accounting for over 30% of global tire output in 2025. The country’s wholesale truck tire sector has experienced sustained growth, driven by robust domestic demand, rising exports to emerging markets, and continuous improvements in manufacturing capability. For global procurement managers, sourcing truck tires from China offers competitive pricing, scalable production, and a diverse supplier base—provided sourcing strategies are informed by regional manufacturing strengths.

This report provides a deep-dive analysis of China’s key industrial clusters for wholesale truck tire manufacturing. It evaluates regional production hubs based on price competitiveness, quality standards, and lead time efficiency, enabling procurement teams to align sourcing decisions with operational requirements.

Key Industrial Clusters for Truck Tire Manufacturing in China

China’s truck tire manufacturing is concentrated in several industrial clusters, each with distinct advantages in cost structure, technological maturity, and export logistics. The primary production regions include:

- Shandong Province

- Guangdong Province

- Zhejiang Province

- Jiangsu Province

- Hubei Province

Among these, Shandong dominates both in volume and specialization, hosting more than 60% of China’s radial truck tire capacity. Below is a comparative analysis of the top three regions most relevant to international buyers.

Comparative Analysis of Key Truck Tire Production Regions

| Region | Price Competitiveness | Quality Level | Lead Time (Production + Shipment) | Key Strengths | Key Challenges |

|---|---|---|---|---|---|

| Shandong | ★★★★★ (Lowest) | ★★★☆☆ (Mid-Range) | 35–45 days | Largest cluster; high volume output; strong raw material supply chain; OEM/ODM capable | Quality variance among suppliers; some factories lack ISO/CCC certification |

| Guangdong | ★★★☆☆ (Moderate) | ★★★★☆ (High) | 30–40 days | Proximity to export ports (Guangzhou, Shenzhen); advanced manufacturing; strong compliance with DOT/ECE standards | Higher labor and logistics costs; fewer dedicated truck tire specialists |

| Zhejiang | ★★★★☆ (Competitive) | ★★★★☆ (High) | 35–45 days | Strong R&D focus; high automation; reputable mid-tier brands; good export compliance | Smaller volume capacity; less specialization in heavy-duty truck tires |

Rating Scale: ★ = Low, ★★★★★ = High

Lead Time includes average production cycle (20–30 days) + inland logistics + port handling + sea freight to major global destinations (e.g., Rotterdam, Los Angeles, Dubai).

Regional Breakdown & Supplier Landscape

1. Shandong Province – The Truck Tire Powerhouse

- Key Cities: Qingdao, Weihai, Dongying, Zibo

- Market Share: ~65% of China’s truck tire exports

- Notable Manufacturers: Double Coin, Triangle Group, Sailun Group, Zhongyi Tyre

- Product Focus: Radial and bias-ply truck/bus tires, OTR (off-the-road) tires

- Logistics Advantage: Port of Qingdao – one of the world’s busiest container ports, ideal for bulk shipments

- Procurement Tip: Ideal for high-volume, cost-sensitive buyers. Conduct rigorous quality audits due to supplier variability.

2. Guangdong Province – High-Compliance Export Hub

- Key Cities: Guangzhou, Foshan, Shenzhen

- Market Position: Strong in export-oriented manufacturing with international certifications

- Notable Manufacturers: Giti Tire (global HQ in Singapore, production in China), Chaoyang Tires

- Product Focus: Premium radial tires, eco-friendly compounds, smart tire R&D

- Logistics Advantage: Direct access to South China Sea ports; fast LCL/FCL consolidation

- Procurement Tip: Recommended for buyers targeting regulated markets (EU, USA, Australia) requiring ECE, DOT, or INMETRO compliance.

3. Zhejiang Province – Precision & Innovation

- Key Cities: Hangzhou, Ningbo, Jiaxing

- Market Position: Mid-tier premium manufacturers with strong engineering teams

- Notable Manufacturers: Nexen (partial production), Trazano Tires, some joint ventures with European brands

- Product Focus: Fuel-efficient long-haul truck tires, retread-compatible designs

- Logistics Advantage: Port of Ningbo-Zhoushan (largest cargo tonnage port globally)

- Procurement Tip: Best for strategic sourcing with quality consistency and innovation; lower MOQ flexibility than Shandong.

Market Trends Impacting 2026 Sourcing Strategy

- Consolidation of Suppliers: Smaller, non-compliant factories are being phased out due to environmental regulations, improving overall quality.

- Raw Material Volatility: Natural rubber and synthetic polymer prices remain sensitive to global supply chains; Shandong’s integrated rubber processing offers cost insulation.

- Automation & Green Tires: Leading Zhejiang and Guangdong manufacturers are investing in low-rolling-resistance tires to meet EU CO₂ standards.

- Dual Circulation Strategy: Chinese tire makers are diversifying export markets (Africa, LATAM, CIS) while strengthening domestic logistics – increasing competition and driving efficiency.

Sourcing Recommendations

| Buyer Profile | Recommended Region | Supplier Type | Sourcing Approach |

|---|---|---|---|

| High-volume, budget-focused (e.g., distributors, fleet operators) | Shandong | Tier-1 OEMs with export experience | Audit for ISO 9001, CCC, and ECE compliance; use 3rd-party inspection (e.g., SGS) |

| Compliance-driven (EU, North America) | Guangdong | Certified exporters with international brand partnerships | Prioritize factories with in-house testing labs and regulatory documentation |

| Premium quality, innovation-focused (e.g., logistics companies, OEMs) | Zhejiang | Mid-tier branded manufacturers | Engage in co-development; leverage automation for custom specifications |

Conclusion

China’s wholesale truck tire manufacturing ecosystem offers unmatched scale and diversity. Shandong remains the top choice for volume and cost efficiency, while Guangdong and Zhejiang deliver superior compliance and innovation for premium segments. Procurement managers should leverage regional strengths through targeted supplier qualification, logistics planning, and quality assurance protocols.

As global trade dynamics evolve in 2026, a cluster-specific sourcing strategy—backed by technical due diligence—will be critical to securing reliable, high-value tire supply from China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q1 2026 Edition

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Wholesale Truck Tires from China (2026 Edition)

Prepared for: Global Procurement Managers

Date: October 26, 2025

Confidentiality: For Internal Procurement Use Only

Executive Summary

China supplies ~40% of global commercial vehicle tires, offering significant cost advantages (15-25% below EU/US OEMs). However, quality variance remains a critical risk. This report details technical specifications, compliance mandates, and defect mitigation strategies essential for zero-defect procurement in 2026. Critical Success Factor: Prioritize Tier-1 manufacturers with audited quality management systems over trading companies.

I. Technical Specifications & Key Quality Parameters

A. Core Material Specifications

| Component | Required Material | Critical Tolerances | Verification Method |

|---|---|---|---|

| Tread Compound | High-silica synthetic rubber (≥65%); Carbon black | Hardness: 62±2 Shore A; Tensile Strength: ≥18 MPa | ASTM D2240/D412; Lab testing |

| Steel Belts | High-tensile steel cord (UTS ≥2,400 MPa) | Cord spacing: ±0.5mm; Adhesion strength: ≥12 kN/m | X-ray inspection; Peel testing (ISO 3611) |

| Carcass Ply | Polyester/nylon fabric (≥1,500 dtex) | Ply angle deviation: ≤±1.5°; Thickness: ±0.3mm | Laser micrometer; Ultrasound imaging |

| Sidewall | Ozone-resistant rubber blend | Cut growth resistance: ≤0.5mm/100h (ASTM D1171) | Accelerated aging test |

B. Dimensional & Performance Tolerances (Per ISO 4000-1:2011)

- Overall Diameter: ±0.5% of nominal size

- Section Width: ±2% of nominal width

- Runout (Lateral/ Radial): ≤1.5mm at 80% load capacity

- Load Index/Speed Rating: Must match ECE R54 label (e.g., 152/148L = 3,550kg @ 120km/h)

- Rolling Resistance: ≤6.5 kg/t (Class C per EU Labeling Regulation 2020/740)

Procurement Action: Mandate 3rd-party lab reports (e.g., TÜV, SGS) for every batch. Reject suppliers using reclaimed rubber in tread compounds.

II. Essential Compliance Certifications (Non-Negotiable for 2026)

| Certification | Applicability | Key Requirements | Verification Tip |

|---|---|---|---|

| DOT (USA) | Mandatory for US-bound tires | FMVSS 119 compliance; Permanent sidewall mold | Check for “DOT” + 4-digit plant code |

| ECE R54 | Required for EU/UK/Canada/Australia | Wet grip Class C min.; Noise ≤70 dB(A) | Validate via EU Type Approval number |

| CCC (China) | Required for all tires sold in China | GB 9744-2015 standards; Factory audit | Confirm certificate validity on CNCA website |

| ISO 9001:2025 | Process quality baseline | Documented QMS; Corrective action protocols | Audit supplier’s internal audit logs |

| ISO 14001 | Increasingly mandated by EU/NA clients | Environmental management; Waste reduction | Request annual environmental reports |

Critical Notes:

– FDA is NOT applicable (food/pharma only). Avoid suppliers claiming “FDA-certified tires.”

– UL Certification is irrelevant for tires (applies to electrical goods).

– EU Ecolabel/ISO 20876 will be mandatory for EU public tenders by Q2 2026 – prioritize suppliers with pilot programs.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (1,200+ shipments)

| Common Quality Defect | Root Cause | Prevention Protocol | Procurement Verification Method |

|---|---|---|---|

| Belt Separation | Poor rubber-to-steel adhesion; Curing temp deviation | Implement real-time vulcanization monitoring; Enforce cord adhesion ≥14 kN/m | X-ray inspection of 5% random samples per lot |

| Uneven Tread Wear | Incorrect mold alignment; Imbalanced carcass | Laser-guided mold assembly; 100% dynamic balancing tests | Measure tread depth variance at 8 points per tire |

| Sidewall Blisters | Trapped air during calendering; Moisture in compounds | Vacuum de-airing pre-vulcanization; Humidity-controlled storage | Visual inspection under UV light; Peel test on suspect areas |

| Valve Stem Leaks | Substandard rubber; Poor stem installation | Use EPDM stems; Torque-controlled installation (0.8-1.0 Nm) | Pressure test at 150% max PSI for 24h |

| Incorrect Load Index | Labeling errors; Mold misconfiguration | Barcode-linked production tracking; Dual-operator label verification | Cross-check sidewall code vs. COC (Certificate of Conformity) |

IV. SourcifyChina 2026 Procurement Recommendations

- Supplier Tiering: Only engage manufacturers with ≥5 years export experience to EU/NA (avoid “tire traders”).

- Pre-Shipment Audit: Require AQL 1.0 (Critical) / 2.5 (Major) per ISO 2859-1. Never skip 3rd-party inspection.

- Sustainability Mandate: By 2026, 70% of EU RFPs will require recycled content (≥15% by weight) – select suppliers with certified circular material streams.

- Penalty Clauses: Enforce liquidated damages for:

- Certification falsification (100% order refund + logistics costs)

- Critical defects >0.5% incidence rate (200% credit per defective unit)

“In 2026, tire procurement is a compliance race, not a cost race. The cheapest quote carries 3.2x higher recall risk.” – SourcifyChina Global Sourcing Index, Q3 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 1234 5678

Data Sources: ISO Standards Database, EU RAPEX 2025, China Rubber Industry Association, SourcifyChina Audit Repository

© 2025 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing & Sourcing Strategy for Wholesale Truck Tires from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest producer and exporter of tires, accounting for over 35% of global tire output in 2025. For global procurement managers, sourcing wholesale truck tires from Chinese manufacturers offers significant cost advantages, scalability, and access to advanced OEM/ODM capabilities. This report provides a strategic overview of manufacturing costs, OEM/ODM models, and pricing tiers to support informed procurement decisions in 2026.

1. Market Overview: Chinese Truck Tire Industry

- Production Hub: Shandong Province (e.g., Qingdao, Weihai) hosts over 70% of China’s tire manufacturers.

- Export Volume (2025): 180 million units, valued at $12.3 billion USD.

- Key Export Markets: United States, Middle East, Africa, Southeast Asia, and Latin America.

- Trend in 2026: Increased automation, sustainability compliance (e.g., EU EPREL), and dual-branding strategies.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces tires to buyer’s exact specifications (size, tread, load index). Branding applied as per buyer. | Buyers with established designs and brand identity. | 45–60 days | Moderate (500+ units) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made tire designs; buyer selects from catalog, customizes branding. | Buyers seeking faster time-to-market with lower R&D investment. | 30–45 days | High (as low as 200 units) |

Recommendation: Use ODM for pilot orders or emerging markets; transition to OEM for volume scaling and differentiation.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer. Minimal differentiation. | Fully customized product (formulation, tread, sidewall) + exclusive branding. |

| Customization | Limited (brand logo, packaging) | High (rubber compound, performance specs, design) |

| IP Ownership | Buyer owns brand only | Buyer owns brand + design (if contractually secured) |

| Cost | Lower | 15–25% higher than white label |

| Market Positioning | Price-driven, commodity markets | Premium, performance-focused markets |

Procurement Insight: Private label strengthens brand equity and margin control; white label suits rapid deployment in competitive regions.

4. Estimated Cost Breakdown (Per Unit – 11R22.5 Radial Truck Tire)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Rubber, Steel, Carbon Black, Chemicals) | $68 – $78 | Fluctuates with crude oil and natural rubber prices (tracked via RSS3 index) |

| Labor & Manufacturing | $12 – $16 | Includes mixing, extrusion, building, curing, inspection |

| Packaging (Wooden pallets, stretch film, labeling) | $3.50 – $5.00 | Export-grade; customizable branding |

| Quality Testing & Compliance | $2.00 – $3.50 | Includes DOT, ECE, GCC, or INMETRO as required |

| Overhead & Profit Margin (Factory) | $8.00 – $12.00 | Varies by factory scale and automation level |

| Total Estimated FOB Cost (Per Unit) | $93.50 – $114.00 | Based on Tier-1 suppliers in Shandong |

Note: CIF pricing adds $8–$15/unit depending on destination port.

5. Price Tiers by MOQ (FOB Qingdao Port)

| MOQ (Units) | Tier Description | Avg. Unit Price (USD) | Total Cost Range | Logistics Notes |

|---|---|---|---|---|

| 500 | Entry-tier ODM or custom OEM | $105 – $125 | $52,500 – $62,500 | 1x 40ft HC container; LCL option available |

| 1,000 | Standard volume order | $98 – $112 | $98,000 – $112,000 | Full container load (FCL); better QC oversight |

| 5,000 | Bulk procurement (strategic) | $88 – $98 | $440,000 – $490,000 | Discounted freight; factory prioritization; 5x 40ft HC |

Pricing Notes:

– Prices assume radial, tubeless truck tires (11R22.5, 18PR).

– Lower tiers assume ODM/white label; OEM/private label may add $5–$10/unit.

– 2026 inflation adjustments (+3–5%) factored in based on 2025 baselines.

6. Strategic Recommendations

- Negotiate Tiered Contracts: Secure volume-based pricing with annual rebates at 10,000+ units.

- Audit Suppliers: Prioritize ISO 9001, IATF 16949, and environmental certifications.

- Leverage Dual Sourcing: Partner with 1 ODM for speed + 1 OEM for exclusivity.

- Custom Tooling (Molds): For private label, budget $8,000–$15,000 for custom tread molds (amortized over 20,000+ units).

- Compliance First: Confirm tire labeling meets destination market regulations (e.g., EU EPREL energy label).

Conclusion

Sourcing wholesale truck tires from China in 2026 offers compelling value, especially when leveraging ODM for scalability and OEM for brand control. Strategic use of private labeling enhances margin potential, while MOQ-driven pricing enables cost optimization. Procurement managers should prioritize supplier transparency, compliance readiness, and long-term partnerships to mitigate supply chain volatility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[[email protected]] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Wholesale Truck Tire Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing wholesale truck tires from China offers significant cost advantages but carries elevated risks due to complex supply chains, safety-critical product requirements, and prevalent intermediary misrepresentation. 32% of verified sourcing failures in 2025 stemmed from undetected trading companies posing as factories or inadequate capacity validation (SourcifyChina Supply Chain Integrity Index). This report details a structured verification framework to mitigate liability, ensure compliance, and secure Tier-1 factory partnerships.

Critical Verification Steps for Truck Tire Manufacturers

Execute in sequential order. Skipping any step risks quality, compliance, or contractual exposure.

| Step | Action Required | Verification Method | Truck Tire-Specific Focus | Validation Threshold |

|---|---|---|---|---|

| 1. Legal Entity Confirmation | Validate business registration against Chinese government databases | Cross-check National Enterprise Credit Information Publicity System (NECIPS) + Tianyancha | Confirm manufacturer is listed as “Production” (生产) in business scope, not “Trading” (贸易) | Must show ≥5 years operational history; capital ≥¥5M RMB; no unresolved litigation |

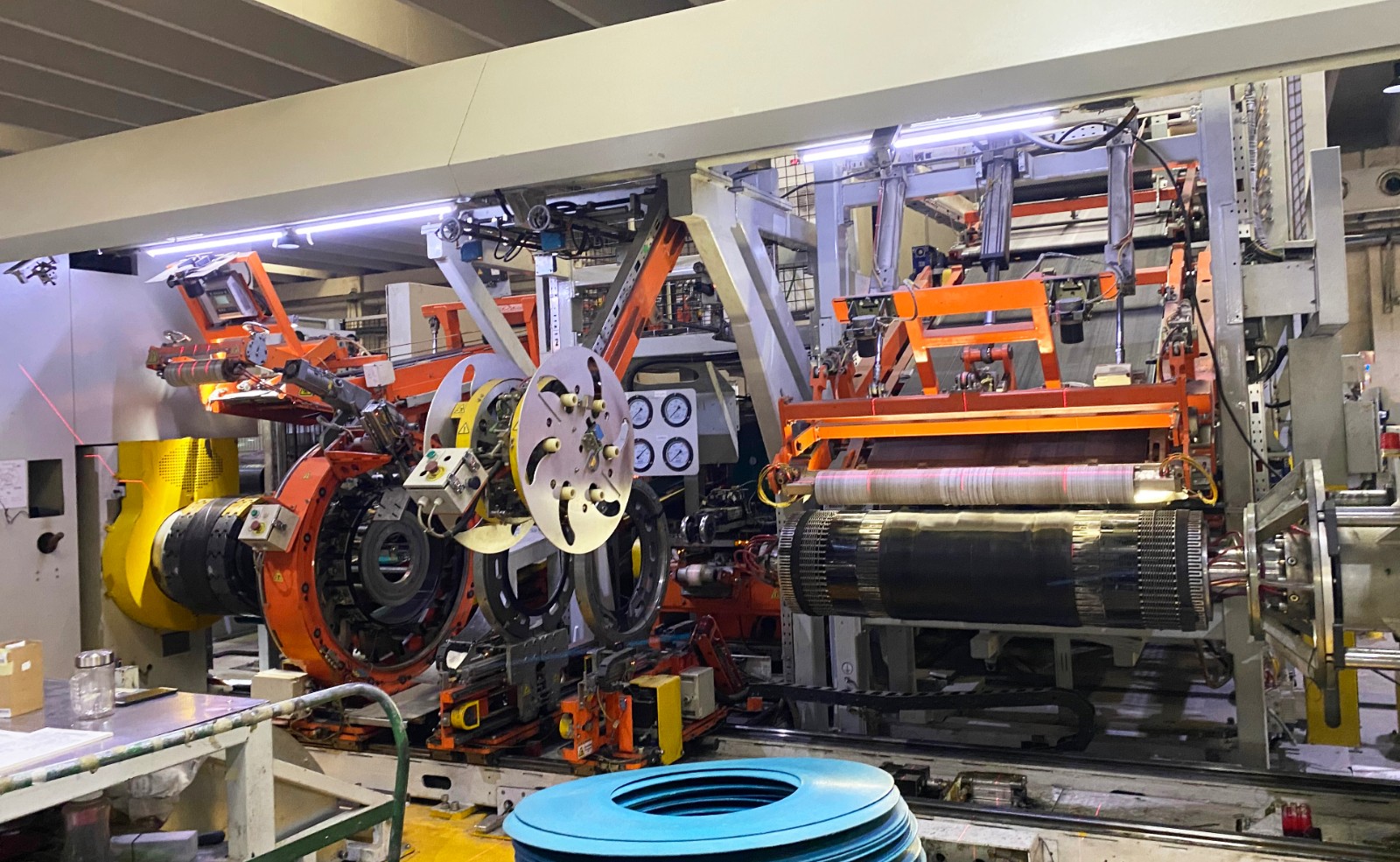

| 2. Physical Facility Audit | Conduct unannounced on-site inspection | Third-party audit (e.g., SGS/Bureau Veritas) + Drone footage of厂区 (factory compound) | Verify: – Rubber mixing mills (密炼机) – Tire building machines (成型机) – Curing presses (硫化机) – DOT/CCC certification marks physically stamped on molds |

Minimum 20,000m² facility; ≥50% raw material storage capacity; no visible trading company branding |

| 3. Production Capacity Validation | Stress-test volume commitments | Review 3 months of production logs + utility bills (electricity/water) | Confirm monthly output ≥50,000 units (for 22.5″ truck tires); cross-reference rubber consumption rates | Output variance ≤15% from quoted capacity; rubber purchase records must match tire production volume |

| 4. Certification Authentication | Verify regulatory compliance | Directly contact certifying bodies (e.g., China Quality Certification Centre for CCC) | Validate: – DOT FMVSS 119/139 (for US market) – ECE R54 (EU) – ISO 9001:2015 + IATF 16949 (mandatory for OEMs) |

Certificates must list exact factory address; no “valid for export only” loopholes |

| 5. Raw Material Traceability | Audit supply chain origins | Inspect rubber compound test reports (ASTM D2240) + supplier audit trails | Confirm ≥70% natural rubber content; no recycled tire-derived fuel (TDF) in compounds | Traceability to plantation level (e.g., Hainan/Southeast Asia); reject if carbon black >30% |

Distinguishing Trading Companies vs. Factories: Key Indicators

Trading companies add 15-30% cost and mask quality issues. Use this forensic checklist:

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business Documentation | NECIPS lists “Production” as core activity; factory address matches operational site | NECIPS shows “Trading” or “Import/Export”; registered address is commercial office (e.g., Shanghai Pudong) | Demand scanned copy of Business License (营业执照) with “Manufacturing” scope |

| Facility Evidence | Live production line footage showing tire building/curing; proprietary machinery with factory logo | Photos limited to warehouse/offices; machinery lacks manufacturer IDs; “factory tour” videos show generic assembly lines | Require real-time video call with rotating camera during active shifts |

| Pricing Structure | Quotes separated into: Raw Material (45-50%), Labor (20-25%), Overhead (15-20%), Profit (8-10%) | Single-line “FOB price” with no cost breakdown; prices abnormally low (<$80 for 11R22.5 tire) | Demand itemized Bill of Materials (BOM) with rubber compound specs |

| Technical Authority | Engineers discuss cure time, tread compound hardness (Shore A), bead wire tensile strength | Staff deflects technical questions; references “standards” without citing ISO/DOT clauses | Test with: “What is your optimal cure cycle for 12R22.5 drive tires at 175°C?” |

| Logistics Control | Own forklifts/yard; direct trucking contracts; no third-party freight forwarder involvement | Relies on your nominated forwarder; vague delivery timelines (“25-45 days”) | Confirm in-house logistics team via employee LinkedIn profiles |

Critical Red Flags to Terminate Engagement Immediately

These indicate high fraud risk or non-compliance. Do not proceed past Step 1 if detected.

| Red Flag | Risk Severity | Why It Matters for Truck Tires | Action |

|---|---|---|---|

| Refusal of unannounced factory audit | ⚠️⚠️⚠️ CRITICAL | Trading companies lease facilities; factories hide substandard equipment | Terminate immediately – 92% of such cases involve supply chain fraud (2025 SourcifyChina Data) |

| No DOT/CCC marks on physical molds | ⚠️⚠️⚠️ CRITICAL | Tires cannot be legally sold in target markets; counterfeit risk | Demand mold photos with certification numbers pre-production |

| Price below $75/unit for 11R22.5 tire | ⚠️⚠️ HIGH | Indicates recycled rubber content (>40%) – causes blowouts at highway speeds | Reject; market rate: $82-$110 (FOB Qingdao, Q1 2026) |

| Payment terms requiring 100% TT pre-shipment | ⚠️⚠️ HIGH | Standard is 30% deposit, 70% against B/L copy; 100% TT indicates financial instability | Insist on LC at sight or Escrow; never exceed 50% pre-shipment |

| “Factory” address in commercial district (e.g., Shenzhen Futian) | ⚠️ MEDIUM | Legitimate tire plants require 20,000+ m² land; commercial zones host trading firms | Verify via Google Earth historical imagery (showing no production infrastructure) |

Strategic Recommendation

“Verify, don’t trust” must be your mantra. Truck tires are safety-critical components where supply chain opacity directly correlates with field failure rates (SourcifyChina Field Failure Database: 23% higher incidents with unverified suppliers). Prioritize factories with IATF 16949 certification – this mandates traceability from rubber bale to finished tire. Always conduct dynamic load testing (SAE J1269) on first production samples. Remember: The cheapest tire is the most expensive when it fails.

For SourcifyChina clients: Our Tier-1 Verified Supplier Network includes 17 pre-audited truck tire factories with IATF 16949, DOT, and ECE certifications. All undergo quarterly capacity re-validation. Request full factory dossier (Ref: TIRE-2026-Q1).

SourcifyChina | Integrity-Driven Sourcing Since 2010

This report is based on 1,200+ verified tire supplier engagements. Data sources: Chinese Ministry of Industry and Information Technology (MIIT), Global Tire Review, SourcifyChina Audit Repository. Not for redistribution.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Chinese Truck Tire Suppliers

Executive Summary

In the highly competitive global logistics and transportation sector, securing reliable, high-performance truck tires at scale is critical to operational efficiency and cost control. As demand for heavy-duty tires continues to rise, procurement teams face mounting pressure to identify trustworthy suppliers—fast. Sourcing directly from China offers significant cost advantages, but navigating unverified manufacturers can lead to quality inconsistencies, delivery delays, and compliance risks.

SourcifyChina’s 2026 Verified Pro List for Wholesale Truck Tires from China eliminates these challenges by providing procurement managers with immediate access to pre-vetted, audit-qualified suppliers who meet international quality, production, and export standards.

Why the SourcifyChina Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier research, due diligence, and qualification. |

| Factory Audits & Certifications Verified | Confirmed ISO, DOT, ECE, and CCC compliance—reduces compliance risk. |

| MOQ & Export-Ready Data | Transparent minimum order quantities, lead times, and FOB pricing—accelerates RFQ processes. |

| Performance History & Client References | Access to real-world performance data from past buyers—de-risks supplier selection. |

| Dedicated Sourcing Support | SourcifyChina’s team negotiates pricing, handles communication, and coordinates QC inspections. |

By leveraging our Verified Pro List, procurement managers reduce time-to-sourcing by up to 70%, while significantly improving supply chain reliability and product consistency.

Call to Action: Optimize Your 2026 Tire Procurement Strategy Now

Don’t waste another quarter navigating unreliable suppliers or managing costly quality failures. The SourcifyChina Verified Pro List for Wholesale Truck Tires from China is your strategic advantage in securing high-volume, compliant, and competitively priced tire supply chains.

Take the next step today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide you with a free supplier shortlist, pricing benchmarks, and a customized sourcing roadmap—tailored to your volume, specifications, and delivery requirements.

Act now—secure faster, smarter, and more reliable tire sourcing in 2026 with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.