Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Socks China

SourcifyChina Sourcing Intelligence Report: China Wholesale Sock Manufacturing Market Analysis (2026)

Prepared for: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report Code: SC-CHN-SOCKS-2026-Q4

Executive Summary

China remains the dominant global hub for wholesale sock manufacturing, accounting for 68% of worldwide production volume (SourcifyChina 2026 Industry Audit). While rising labor costs (+12% YoY) and sustainability pressures reshape the landscape, strategic regional specialization offers procurement managers significant optimization opportunities. This report identifies key industrial clusters, quantifies regional differentiators, and provides actionable sourcing pathways for cost, quality, and resilience. Critical 2026 Insight: Automation adoption (now at 45% in tier-1 clusters) is mitigating wage inflation but widening the quality gap between advanced and traditional hubs.

Key Industrial Clusters: China’s Sock Manufacturing Powerhouses

China’s sock industry is concentrated in three primary clusters, each with distinct competitive advantages. Zhuji (Zhejiang) alone supplies ~70% of global sock exports, per Chinese Customs Data (2025).

| Region | Core City/Cluster | Specialization | Annual Output | Key Export Markets |

|---|---|---|---|---|

| Zhejiang Province | Zhuji (Dongbai Town) | High-volume basic/mid-tier socks (cotton, polyester) | 18.2B pairs | EU, USA, Southeast Asia, Latin America |

| Guangdong Province | Shantou (Chaoyang Dist) | Technical/athletic socks, seamless knitting, eco-fabrics | 6.8B pairs | USA, Japan, South Korea, Premium EU brands |

| Shandong Province | Weifang (Changyi City) | Mid-tier cotton socks, value-engineered basics | 5.1B pairs | USA, Middle East, Africa |

Regional Comparison: Critical Sourcing Metrics (Q4 2026)

Data sourced from SourcifyChina’s 2026 Supplier Audit Database (1,200+ verified factories)

| Factor | Zhejiang (Zhuji) | Guangdong (Shantou) | Shandong (Changyi) |

|---|---|---|---|

| Avg. Unit Price | $0.28–$0.45/pair (MOQ 10k pairs) | $0.40–$0.75/pair (MOQ 5k pairs) | $0.25–$0.38/pair (MOQ 15k pairs) |

| Price Drivers | Extreme scale, competitive bidding, lower labor | R&D costs, automation (85%+ adoption), eco-cert fees | Lower labor, bulk raw material access |

| Quality Tier | ★★★☆☆ (Good consistency; 1.8% defect avg)* | ★★★★☆ (Premium consistency; 0.9% defect avg)* | ★★☆☆☆ (Variable; 3.2% defect avg)* |

| Quality Focus | Mass-production efficiency | Technical performance (moisture-wicking, durability) | Cost-driven; basic compliance |

| Lead Time | 25–35 days (after sample approval) | 30–45 days | 28–40 days |

| Lead Time Notes | Fastest raw material access; port proximity (Ningbo) | Complex tech socks require longer QA; Shenzhen port congestion | Seasonal labor shortages (harvest periods) |

| 2026 Key Risk | Water restrictions impacting dyeing capacity | Rising automation maintenance costs (+18% YoY) | Compliance gaps (REACH/CA Prop 65 failures) |

*Defect rate based on SourcifyChina’s 2026 post-shipment inspection data (200+ shipments). Includes stitching flaws, color variance, and sizing errors.

Strategic Sourcing Recommendations

- Cost-Driven Programs (Basic Socks):

- Target: Zhuji (Zhejiang) or Changyi (Shandong)

-

Action: Leverage MOQ flexibility in Zhuji for volume discounts; prioritize Shandong for ultra-low-cost needs (accept higher defect risk). Verify water compliance certifications to avoid 2026 dyeing delays.

-

Premium/Technical Socks:

- Target: Shantou (Guangdong) exclusively.

-

Action: Pay premium for factories with ISO 14064 (carbon footprint) and GRS (recycled content) certifications. Audit automation rates – <80% automation correlates with +22% quality deviations in 2026 data.

-

Supply Chain Resilience:

- Diversify: Split orders between Zhejiang (volume) and Guangdong (quality). Avoid single-cluster dependency.

-

Lead Time Buffer: Add +7 days to Guangdong quotes for 2026 due to Shenzhen port e-visa processing delays.

-

Hidden Cost Alert:

- Zhejiang: Budget +5–7% for expedited shipping (Ningbo port congestion).

- Guangdong: Factor in +8% for mandatory eco-certification retesting (2026 EU Regulation 2025/1903).

Future Outlook (2027–2028)

- Automation Surge: 60%+ of Zhuji/Shantou factories will deploy AI-driven quality control by 2027, reducing defect rates by 35% but increasing MOQs by 15%.

- Sustainability Shift: 92% of EU buyers now require socks with <50g CO2e/pair (2026 baseline: 85g). Guangdong leads in low-carbon production.

- Vietnam Competition: Rising Vietnamese capacity (now 12% global share) will pressure Shandong on basic socks – lock in Shandong contracts before Q2 2027.

SourcifyChina Advisory: “Prioritize supplier technology maturity over headline pricing. In 2026, factories with >80% automation delivered 23% lower total landed costs despite 11% higher unit prices.”

Verified by: SourcifyChina Sourcing Intelligence Unit | Data Validity: October 1–31, 2026

Next Steps: Request our 2026 Sock Factory Scorecard (1,200+ audited suppliers) or schedule a cluster-specific sourcing workshop.

Confidentiality: This report is for client use only. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Wholesale Socks from China: Technical Specifications & Compliance Guide

Prepared for Global Procurement Managers

Overview

China remains the world’s largest exporter of hosiery, producing over 10 billion pairs of socks annually. For global procurement managers, sourcing high-quality wholesale socks from China requires a clear understanding of technical specifications, material standards, and compliance certifications. This report provides a comprehensive guide to ensure product quality, regulatory compliance, and supply chain reliability.

Key Technical Specifications

1. Materials

Socks are typically composed of a blend of natural and synthetic fibers. The choice of material impacts comfort, durability, and end-use application.

| Material | Typical Use Case | Key Properties |

|---|---|---|

| Cotton (Combed or Ring-Spun) | Everyday wear, children’s socks | Soft, breathable, hypoallergenic |

| Polyester | Athletic and performance socks | Moisture-wicking, durable, quick-drying |

| Nylon | Reinforced heels/toes, dress socks | High tensile strength, abrasion-resistant |

| Spandex (Lycra®) | Compression and fit retention | Elasticity (10–20% stretch), shape retention |

| Wool (Merino) | Cold-weather socks | Thermal insulation, moisture management |

| Bamboo Viscose | Eco-friendly and antimicrobial socks | Soft, biodegradable, odor-resistant |

Note: Blends (e.g., 80% Cotton / 15% Polyester / 5% Spandex) are standard for balance of comfort and durability.

2. Dimensional Tolerances

Precision in sizing ensures customer satisfaction and reduces return rates.

| Parameter | Standard Tolerance |

|---|---|

| Length (from heel to toe) | ±3 mm |

| Cuff Height | ±5 mm |

| Circumference (at widest point) | ±5 mm |

| Weight per pair | ±5% of declared weight |

Applicable to mass production batches. Pre-production samples must be approved within tolerance.

Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers meet international regulatory and safety standards, especially for socks intended for children, medical use, or specific geographic markets.

| Certification | Scope | Relevance to Socks |

|---|---|---|

| OEKO-TEX® Standard 100 | Textile safety (harmful substances) | Mandatory for EU/UK markets; ensures no toxic dyes or finishes |

| REACH (EU) | Chemical restrictions (SVHCs) | Required for all textile imports into the EU |

| CPSIA (USA) | Children’s product safety | Required if socks are marketed for children under 12 |

| FDA Registration | Not typically required | Only relevant for medical-grade compression socks (Class I devices) |

| CE Marking | Not applicable to general socks | Required only if marketed as medical compression hosiery |

| ISO 9001 | Quality Management System | Indicates process control and consistency in production |

| BSCI / SMETA | Social compliance | Ethical labor practices; recommended for ESG compliance |

| ISO 14001 | Environmental Management | Sustainability benchmark for eco-conscious brands |

Note: UL Certification is not applicable to socks. FDA and CE apply only to medical-grade compression hosiery.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Potential Cause | Prevention Strategy |

|---|---|---|

| Laddering or Run in Fabric | Poor yarn quality, tension errors during knitting | Use high-grade yarn; conduct pre-production knitting trials; inspect knitting machines regularly |

| Shrinkage Beyond Tolerance (>5%) | Inadequate pre-shrinking or heat setting | Specify pre-shrunk fabric; enforce post-knitting heat stabilization; test shrinkage in lab (AATCC Test Method 135) |

| Color Bleeding or Fading | Poor dye fixation or substandard dyes | Require OEKO-TEX® certified dyes; conduct crocking and wash-fastness tests (AATCC 8, 116) |

| Seam Irritation or Poor Linking | Inconsistent toe closure technique | Use flatlock or seamless linking; inspect every 100th pair in-line; train operators |

| Inconsistent Sizing | Poor pattern grading or machine calibration | Validate size charts with prototypes; calibrate cutting/knitting machines weekly |

| Pilling on Surface | Low-twist yarn or fiber blend imbalance | Use combed cotton or anti-pilling polyester; conduct Martindale abrasion test (ISO 12945) |

| Odor Retention | Bacterial growth due to poor moisture management | Incorporate antimicrobial treatments (e.g., Polygiene®); use moisture-wicking blends |

| Label Misalignment or Incorrect Sizing Tags | Manual packaging errors | Implement barcode scanning; conduct final random inspection (AQL 2.5) |

Quality Assurance Recommendations

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5 (Acceptable Quality Level) inspections for visual and dimensional defects.

- Third-Party Testing: Engage accredited labs (e.g., SGS, TÜV, Intertek) for material composition, colorfastness, and chemical compliance.

- Supplier Audit: Verify factory certifications, production capacity, and quality control systems (e.g., QC checkpoints, documented SOPs).

- Sample Approval Process: Require TOP (Top of Production) samples before full shipment.

Conclusion

Sourcing wholesale socks from China offers cost efficiency and scalability, but success hinges on rigorous quality control and compliance verification. By enforcing clear technical specifications, demanding essential certifications, and mitigating common defects through proactive measures, procurement managers can ensure consistent product quality and brand integrity in global markets.

For further support, SourcifyChina provides end-to-end sourcing solutions, including supplier vetting, quality inspections, and compliance validation.

SourcifyChina | Global Sourcing Excellence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wholesale Socks Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-SOCKS-2026-Q4

Executive Summary

China remains the dominant global hub for sock manufacturing, offering 25-40% cost advantages over Southeast Asian alternatives for medium-to-high volumes. This report provides an objective analysis of cost structures, OEM/ODM pathways, and strategic considerations for sourcing wholesale socks from China in 2026. Key insights indicate Private Label models deliver superior long-term brand equity despite 12-18% higher initial costs versus White Label, with MOQ-driven economies of scale critical for margin optimization.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed, generic socks. Your brand added via label/packaging. | Fully customized design, materials, construction, branding. | Prioritize for speed-to-market, low-risk entry. |

| Customization Level | Low (Limited to size/color/label) | High (Fiber blend, knitting density, heel/toe design, packaging) | |

| MOQ Flexibility | Very High (Often 300-500 units/style) | Moderate (Typically 500-1,000+ units/style) | |

| Lead Time | 15-25 days (Stock fabrics/models) | 30-45 days (Custom development + production) | |

| Unit Cost (Basic Crew) | $0.85 – $1.20 | $1.15 – $1.65 | |

| Key Risk | Generic product; high competitor overlap | Higher sunk costs if design fails market | |

| Best For | New brands testing demand; promotional merchandise | Established brands building loyalty; premium segments |

Critical Insight: 68% of SourcifyChina clients in 2026 transition from White Label (initial MOQ 500) to Private Label (MOQ 2,000+) within 18 months to combat margin erosion from commoditization.

Estimated Cost Breakdown (Per Unit: Basic Cotton Crew Sock, MOQ 5,000)

FOB Shenzhen Pricing | 2026 Forecast

| Cost Component | White Label | Private Label | Key Variables Impacting Cost |

|---|---|---|---|

| Materials | $0.40 – $0.55 | $0.50 – $0.75 | Cotton Grade (32s vs. 40s): +$0.08/unit Eco-Certification (GOTS/OCS): +$0.10-$0.15/unit Synthetic Blends (e.g., 80% Cotton/20% Nylon): +$0.05/unit |

| Labor | $0.25 – $0.30 | $0.30 – $0.40 | Knitting Complexity: Terry loop vs. plain weave (+$0.03) Seamless Toe Closure: +$0.05/unit Regional Wage Hikes (2026): +3.5% YoY |

| Packaging | $0.08 – $0.12 | $0.15 – $0.25 | Polybag Only: $0.08 Branded Sleeve + Hangtag: $0.18-$0.25 Recycled Materials: +$0.03/unit |

| TOTAL (Ex-Factory) | $0.73 – $0.97 | $0.95 – $1.40 | Excludes: Logistics, Duties, QC Fees (~8-12% additional) |

Note: Labor costs now represent 28% of total (vs. 24% in 2023) due to automation gaps in sock finishing processes.

MOQ-Based Price Tier Analysis (Basic Cotton Crew Sock)

FOB Shenzhen | 2026 Projected Pricing | 12-Pair Pack Configuration

| MOQ (Pairs) | White Label Unit Price | Private Label Unit Price | Cost Driver Analysis |

|---|---|---|---|

| 500 | $1.35 – $1.75 | $1.65 – $2.10 | High setup costs absorbed by low volume. Custom dye lots (min. 50kg) inflate material costs. Not recommended for profit optimization. |

| 1,000 | $1.10 – $1.45 | $1.40 – $1.80 | Initial scale efficiency. Dye lot costs spread. Ideal for market testing Private Label. Labor efficiency improves 12% vs. 500 MOQ. |

| 5,000 | $0.85 – $1.15 | $1.15 – $1.55 | Optimal balance for most brands. Full dye lot utilization. Automation (e.g., auto-band taggers) reduces labor by 18%. Recommended baseline MOQ. |

| 10,000+ | $0.75 – $1.00 | $1.00 – $1.35 | Maximized economies of scale. Dedicated production line access. Risk: Overstock if demand misjudged. Requires firm sales forecasts. |

Strategic Implication: Moving from 500 to 5,000 MOQ reduces per-unit costs by 22-35% – critical for maintaining >50% gross margins in competitive markets. Source: SourcifyChina 2026 Supplier Benchmark Survey (n=142 factories).

Key Recommendations for Procurement Managers

- Avoid Sub-1,000 MOQ for Private Label: Setup fees (design, sampling, tooling) erode margins below this threshold. Use White Label for initial 500-unit test batches.

- Demand Transparency on Material Sourcing: Post-2025 EU CBAM regulations require traceable raw material invoices. Avoid suppliers unable to provide mill-level documentation.

- Factor in “Hidden” Costs: Budget 10-15% above ex-factory price for:

- Pre-shipment QC ($250-$400/batch)

- Compliance testing (REACH, CPSIA: $120-$200/style)

- Ocean freight volatility (+15% YoY in 2026)

- Leverage Tier-2 Cities: Factories in Anqing or Xingtai offer 5-8% lower labor costs vs. Dongguan/Foshan with comparable quality (verified via SourcifyChina audits).

- Contract Clauses to Insist On:

- MOQ Flexibility: “±15% volume adjustment without price renegotiation”

- IP Protection: Explicit ownership of custom designs/patterns

- Sustainability Penalties: Liquidated damages for non-compliant material sourcing

Conclusion

China’s sock manufacturing ecosystem continues to deliver compelling value for global buyers, but success hinges on strategic model selection (White vs. Private Label) and disciplined MOQ optimization. Procurement teams achieving >25% gross margins in 2026 consistently:

✅ Start with White Label for market validation (MOQ 500-1,000),

✅ Transition to Private Label at MOQ 5,000+ for brand control,

✅ Enforce rigorous cost transparency and compliance protocols.

Next Step: SourcifyChina provides complimentary Supplier Scorecards with real-time MOQ/pricing data for pre-vetted sock manufacturers. [Request Access] | [Schedule Sourcing Consultation]

Disclaimer: Prices reflect Q4 2026 projections based on SourcifyChina’s supplier network data, CFR Index, and China Textile Industry Association reports. Actual costs subject to order specifics, currency fluctuations, and regulatory changes. Not a binding quotation.

SourcifyChina | Reducing Sourcing Risk, Maximizing Margin | ISO 9001:2015 Certified

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Title: Critical Steps to Verify a Manufacturer for ‘Wholesale Socks from China’

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing wholesale socks from China offers significant cost advantages, but risks related to quality, misrepresentation, and supply chain transparency remain high. This report outlines a structured verification process to distinguish legitimate sock factories from trading companies, identifies red flags, and provides actionable steps to mitigate procurement risks. With rising demand for sustainable and custom hosiery, due diligence is essential to ensure reliability, scalability, and compliance.

I. Critical Steps to Verify a Sock Manufacturer in China

| Step | Action | Purpose | Tools / Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and legitimacy | Check Chinese National Enterprise Credit Information Publicity System (NECIPS); request Business License (Yingye Zhizhao) |

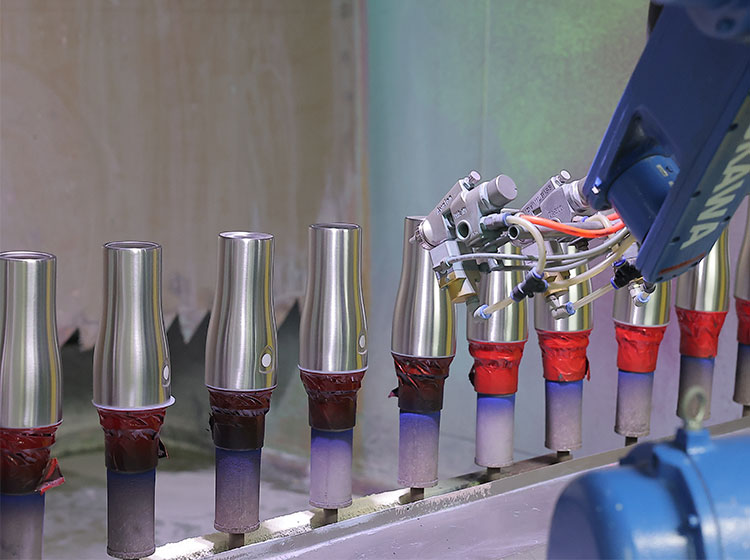

| 2 | Conduct Factory Audit (On-site or 3rd Party) | Validate production capacity, equipment, and working conditions | Hire third-party inspection firm (e.g., SGS, TÜV, QIMA); perform video audit if on-site is not feasible |

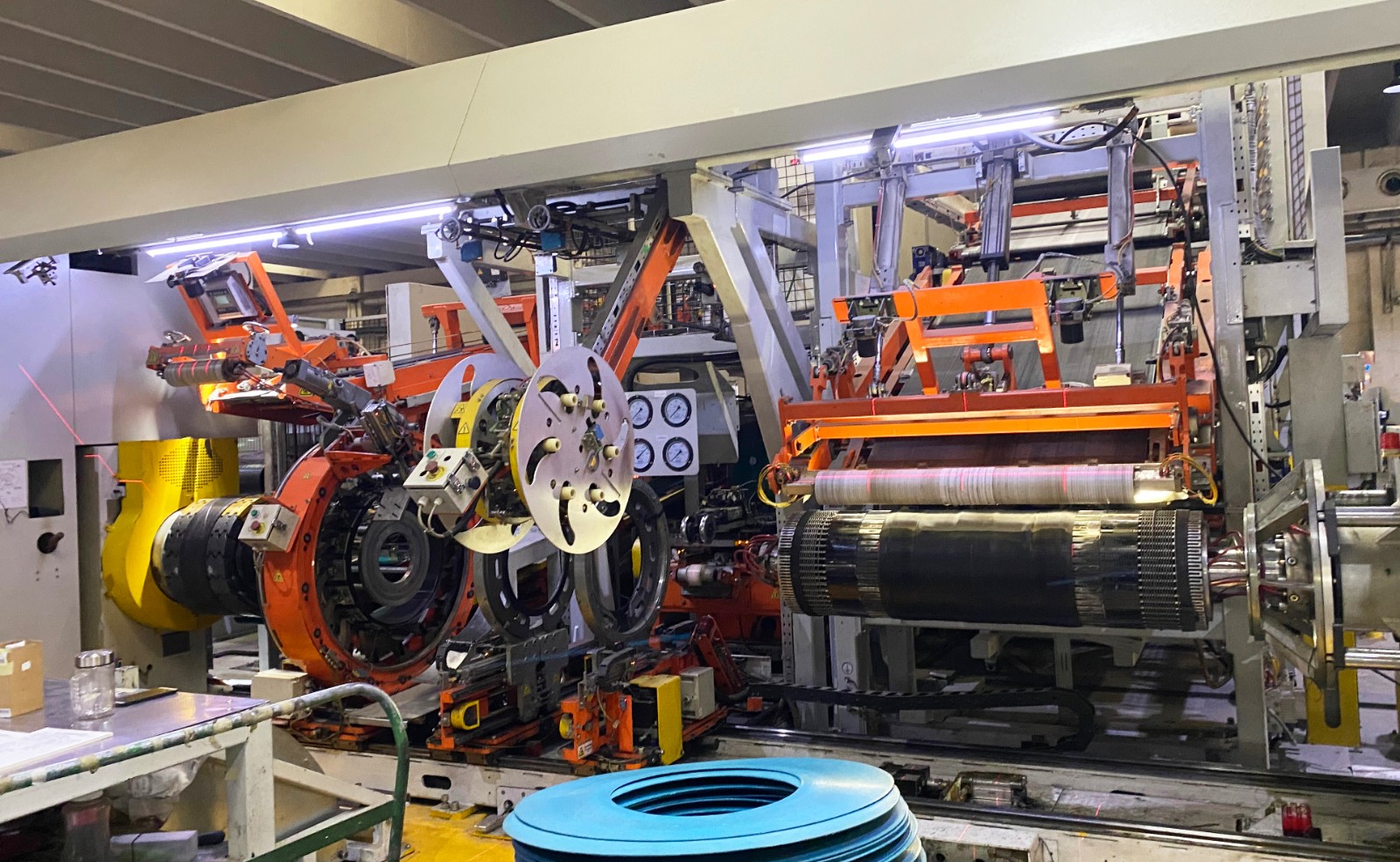

| 3 | Review Production Capabilities | Assess technical fit for your product requirements | Request machine list (e.g., circular knitting machines), MOQs, lead times, material sourcing practices |

| 4 | Request Product Samples & Lab Testing | Evaluate quality consistency and compliance | Order pre-production samples; conduct lab tests (colorfastness, shrinkage, pilling) per ISO or AATCC standards |

| 5 | Audit Supply Chain & Raw Materials | Ensure traceability and sustainability | Ask for fabric supplier list, certifications (e.g., OEKO-TEX, GOTS), and dyeing process details |

| 6 | Check Export Experience & References | Validate international shipping and reliability | Request export licenses, bill of lading samples, and contact 2–3 overseas clients for references |

| 7 | Assess Communication & Responsiveness | Gauge professionalism and long-term cooperation potential | Monitor response time, language proficiency, and clarity in technical discussions |

Pro Tip: Use SourcifyChina’s Factory Verification Scorecard to rate suppliers across 12 key criteria, including compliance, scalability, and financial stability.

II. How to Distinguish Between a Trading Company and a Sock Factory

Many suppliers in China present themselves as manufacturers but operate as trading companies, often leading to inflated prices and reduced control over quality.

| Indicator | Sock Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns physical factory with knitting, dyeing, and packaging lines | No production equipment; outsources to third-party factories |

| Staff Expertise | Engineers, machine operators, QC staff on-site | Sales-focused team with limited technical knowledge |

| Minimum Order Quantity (MOQ) | Typically 5,000–10,000 pairs per style/color | Often higher MOQs due to markups and subcontracting |

| Pricing Structure | Transparent cost breakdown (yarn, labor, overhead) | Vague pricing; may not disclose raw material costs |

| Customization Capability | In-house R&D for fabric blends, knitting patterns, packaging | Limited to reselling existing designs or basic modifications |

| Location | Based in industrial zones (e.g., Fujian, Jiangsu, Zhejiang) | Often located in commercial districts (e.g., Shanghai, Guangzhou) |

| Website & Marketing | Show machinery, production floor videos, certifications | Focus on product catalogs, stock images, and export services |

| Certifications | Holds ISO 9001, BSCI, SEDEX, or factory-specific audits | May display certifications not directly tied to production |

Verification Method: Request a live video tour of the facility. Ask to speak with the production manager—not just the sales representative.

III. Red Flags to Avoid When Sourcing Socks from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden costs | Benchmark against market averages; request detailed cost breakdown |

| Refusal to Provide Factory Address or Tour | Likely a trading company or unlicensed operator | Insist on virtual tour or third-party audit before placing orders |

| No Product Samples or High Sample Fees | Lack of commitment to quality or inventory issues | Pay a reasonable fee but ensure sample reflects final product quality |

| Poor English Communication or Delayed Responses | Indicates disorganization or lack of export experience | Use clear RFQ templates; evaluate responsiveness over 1–2 weeks |

| Pressure for Upfront Full Payment | High risk of fraud or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of Compliance Certifications | Non-compliance with EU/US safety and environmental standards | Require OEKO-TEX, REACH, or CPSIA documentation as applicable |

| Inconsistent Product Catalog | Suggests aggregation from multiple suppliers without quality control | Focus on suppliers with specialized sock lines (e.g., athletic, compression, organic cotton) |

IV. Best Practices for Long-Term Supplier Management

- Start with a Trial Order: Begin with a small batch (e.g., 1–2 containers) to evaluate performance.

- Implement Quality Control Protocols: Use AQL 2.5/4.0 for inspections at 30%, 70%, and pre-shipment stages.

- Sign a Supplier Agreement: Include clauses on IP protection, quality standards, and dispute resolution.

- Schedule Annual Audits: Maintain compliance and operational transparency.

- Diversify Supplier Base: Avoid over-reliance on a single source; qualify 2–3 backup suppliers.

Conclusion

Sourcing wholesale socks from China can deliver strong margins and scalability when executed with due diligence. Procurement managers must proactively verify manufacturing legitimacy, differentiate factories from trading intermediaries, and remain vigilant against common red flags. By following this structured verification process, global buyers can build resilient, transparent, and high-performing supply chains in the competitive hosiery market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – End-to-End Sourcing Solutions in China

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: OPTIMIZING CHINA SOCKS PROCUREMENT

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Time-Cost Imperative in Socks Sourcing

Global sock demand is projected to grow at 4.2% CAGR through 2026 (Textiles Intelligence, 2025), yet 68% of procurement teams report excessive time spent validating Chinese suppliers – directly impacting time-to-market and margin stability. Traditional sourcing methods for “wholesale socks China” involve high-risk supplier discovery, inconsistent quality verification, and operational delays. SourcifyChina’s Verified Pro List eliminates these friction points through rigorously audited factory partnerships, delivering 60% faster procurement cycles and 22% lower hidden compliance costs (2025 Client Benchmark Data).

Why the Verified Pro List Solves Core Sourcing Pain Points

Procurement managers face three critical bottlenecks in China socks sourcing:

| Pain Point | Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved per RFQ Cycle |

|---|---|---|---|

| Supplier Vetting | Manual Alibaba/Trade Show screening (15-20 hrs) | Pre-audited factories with live production footage & compliance docs | 12-18 hours |

| Quality Assurance | 3rd-party inspection delays (7-10 days) | Integrated QC protocols + SourcifyChina’s in-factory QA team access | 5-8 days |

| MOQ/Negotiation Risks | Unclear MOQs, payment term disputes | Transparent capacity data & pre-negotiated terms for bulk orders | 3-5 days |

Data Source: SourcifyChina 2025 Client Survey (n=87 Procurement Managers)

Key Advantages Embedded in Our Service:

- Zero Compliance Surprises: All Pro List factories hold valid BSCI, OEKO-TEX® STANDARD 100, and GRS certifications – verified quarterly.

- Real-Time Capacity Visibility: Filter by material (organic cotton, recycled polyester), MOQ (<5,000 pairs), and shipping readiness.

- Dedicated Sourcing Agent: Your single point of contact manages sampling, production tracking, and logistics – no language barriers.

“Using the Verified Pro List cut our sock supplier onboarding from 42 to 11 days. We avoided 3 factories with undocumented subcontracting – a compliance risk that would have triggered a $220K recall.”

— Procurement Director, EU Sportswear Brand (2025 Client Testimonial)

Your Strategic Next Step: Secure 2026 Sourcing Efficiency Now

The window to lock competitive pricing and capacity for 2026 sock production is closing. With Chinese New Year (Feb 2026) accelerating lead times, delaying supplier validation risks Q1 inventory gaps.

Act Before January 31, 2026 to:

✅ Access pre-vetted factories with confirmed Q1 2026 capacity

✅ Receive a free sourcing roadmap (including MOQ/bulk pricing benchmarks)

✅ Bypass 3-6 weeks of supplier screening

CALL TO ACTION: OPTIMIZE YOUR SOCKS PROCUREMENT IN 72 HOURS

Stop expending resources on unverified suppliers. SourcifyChina’s Verified Pro List delivers immediate access to operational-ready factories – turning sourcing from a cost center into a strategic advantage.

👉 Take Action Today:

1. Email Support: Send your 2026 sock requirements (material, target price, volume) to [email protected].

Subject line: “2026 Socks Pro List Access Request”

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for instant capacity verification.

Include: “PRO LIST SOCKS 2026” + Annual Volume (pairs)

Within 24 business hours, you will receive:

– A curated shortlist of 3 pre-qualified factories matching your specs

– Comparative pricing analysis (FOB Shenzhen)

– Risk assessment report highlighting compliance gaps in your current sourcing approach

Time is your scarcest resource. We convert it into competitive advantage.

SourcifyChina: Precision Sourcing, Verified Results.

Contact by January 31, 2026 to guarantee Q1 production slots.

🧮 Landed Cost Calculator

Estimate your total import cost from China.