Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Soccer Shoes From China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Wholesale Soccer Shoes Sourcing from China – Industrial Cluster Analysis & Regional Benchmarking

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturing hub for athletic footwear, including wholesale soccer shoes. In 2026, the country accounts for over 68% of global athletic footwear exports, with soccer shoes representing a high-growth segment driven by increasing demand in emerging markets and premium performance trends in developed economies.

This report provides a strategic deep-dive into China’s key industrial clusters producing wholesale soccer shoes, analyzing regional strengths in cost efficiency, quality control, and supply chain responsiveness. The analysis supports procurement managers in optimizing sourcing strategies based on volume requirements, quality tiers, and time-to-market objectives.

Key Manufacturing Clusters for Soccer Shoes in China

Soccer shoe manufacturing in China is concentrated in two primary coastal provinces—Guangdong and Zhejiang—with emerging secondary hubs in Fujian and Jiangsu. These clusters benefit from mature supply chains, skilled labor, and proximity to export ports.

1. Guangdong Province (Dongguan & Guangzhou)

- Core Strengths: High-volume OEM/ODM production, advanced material sourcing, export logistics

- Specialization: Performance-grade synthetic leather and knit uppers, rubber and TPU outsoles

- Key Clients: Global sports brands (e.g., Nike, Li-Ning), private-label exporters

- Logistics Advantage: Proximity to Shenzhen and Guangzhou ports (top 3 busiest in China)

2. Zhejiang Province (Wenzhou & Taizhou)

- Core Strengths: Mid-to-high quality craftsmanship, agile small-batch production

- Specialization: Hand-stitched and premium training models, eco-friendly materials

- Reputation: Known as the “Footwear Capital of China” (Wenzhou produces ~10% of world’s shoes)

- Innovation: Strong R&D in sustainable materials and ergonomic design

3. Fujian Province (Quanzhou & Jinjiang)

- Emerging Cluster: Rapid growth in sports footwear OEMs

- Specialization: Lightweight training and turf soccer shoes

- Cost Advantage: Lower labor and land costs vs. Guangdong/Zhejiang

Regional Comparison: Soccer Shoe Manufacturing Hubs (2026 Benchmark)

| Region | Average FOB Price (USD/pair) | Quality Tier | Lead Time (Mass Production) | Best For |

|---|---|---|---|---|

| Guangdong (Dongguan/Guangzhou) | $8.50 – $14.00 | Mid to High | 35 – 45 days | High-volume orders, export-ready compliance, performance-grade materials |

| Zhejiang (Wenzhou/Taizhou) | $10.00 – $18.50 | High | 40 – 50 days | Premium quality, custom designs, sustainable production |

| Fujian (Quanzhou/Jinjiang) | $7.00 – $11.50 | Mid | 40 – 55 days | Cost-sensitive buyers, entry-level turf/training shoes |

Note: Prices based on MOQ of 1,000 pairs; lead times include material procurement, production, and pre-shipment QC. Quality tier defined by material durability, stitching precision, and compliance with ISO 9001 and BSCI standards.

Strategic Sourcing Recommendations

-

High-Volume Procurement (MOQ > 10,000 units)

→ Prioritize Guangdong for cost efficiency and fast turnaround.

→ Leverage Dongguan’s integrated supply chain for synthetic uppers and injection-molded soles. -

Premium or Branded Collections

→ Source from Zhejiang, especially Wenzhou-based factories with ISO-certified QC and design capabilities.

→ Ideal for eco-labels (e.g., recycled PET uppers, water-based adhesives). -

Budget-Friendly Training & Youth Models

→ Consider Fujian for lowest landed cost, particularly for turf and indoor soccer shoes. -

Dual Sourcing Strategy

→ Combine Guangdong (volume) + Zhejiang (quality backup) to mitigate supply risk and ensure flexibility.

Market Trends Impacting 2026 Sourcing

- Rise of Sustainable Footwear: 42% of EU buyers now require carbon footprint disclosure. Zhejiang leads in eco-certified production.

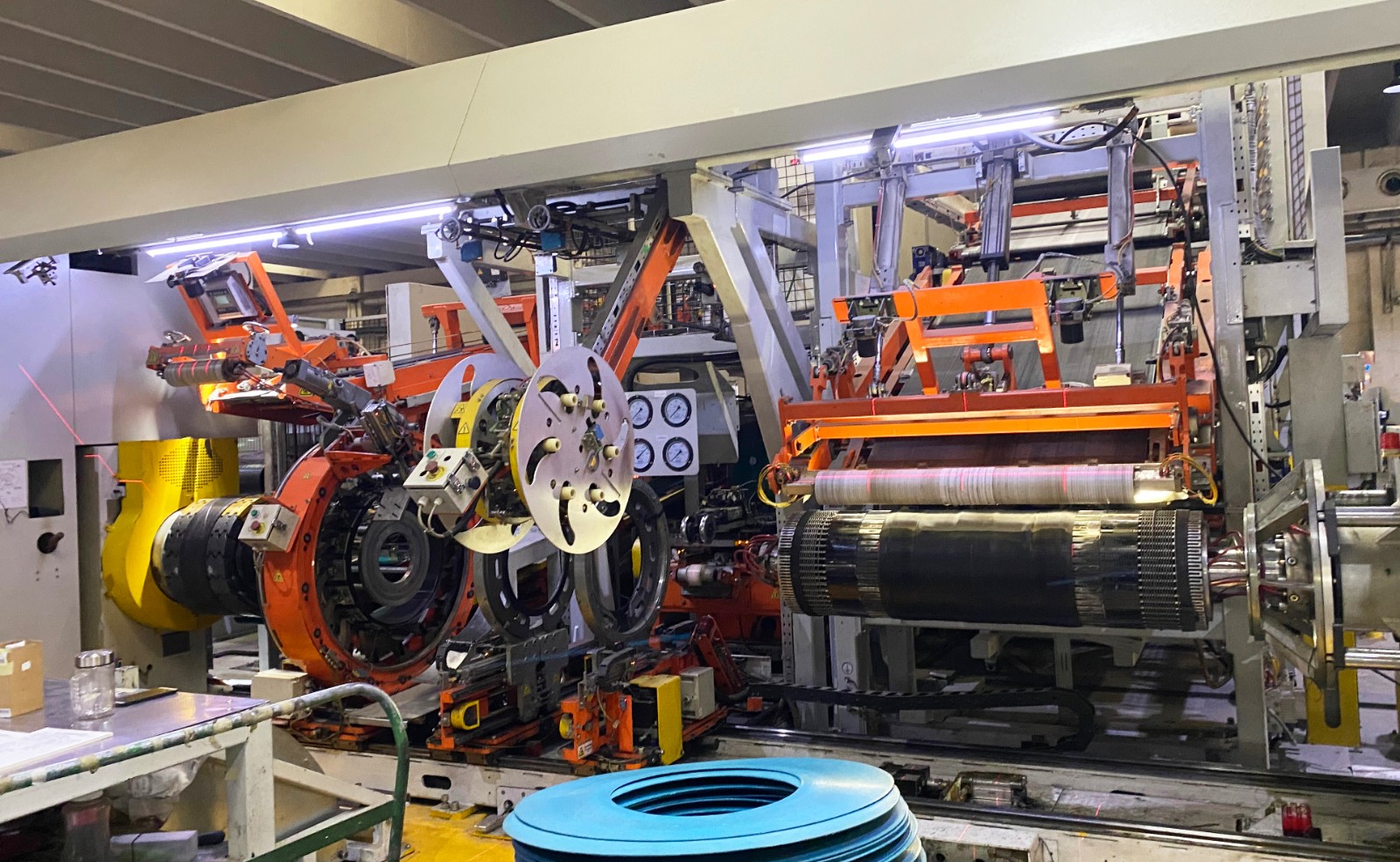

- Automation Adoption: Guangdong factories report 25% higher output via robotic stitching and automated cutting.

- Compliance Pressure: Increasing audits on labor practices (SMETA, WRAP). Pre-vetted suppliers recommended.

- Logistics Optimization: Cross-border e-commerce fulfillment via bonded warehouses in Guangzhou and Ningbo.

Conclusion

Guangdong and Zhejiang remain the twin pillars of China’s soccer shoe manufacturing ecosystem, each offering distinct advantages. While Guangdong leads in scalability and export readiness, Zhejiang excels in craftsmanship and innovation. Procurement managers should align regional selection with product positioning, volume, and compliance requirements.

SourcifyChina recommends on-site factory audits, material traceability systems, and engagement with third-party QC partners to ensure consistent delivery performance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – B2B Sourcing Intelligence Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Wholesale Soccer Shoes from China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing soccer shoes from China offers significant cost advantages but requires rigorous technical and compliance oversight. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies to ensure product integrity, regulatory adherence, and brand protection in target markets (EU, US, Canada, Australia). Note: FDA/UL are not applicable to soccer shoes; focus shifts to sport-specific and regional safety standards.

I. Key Quality Parameters

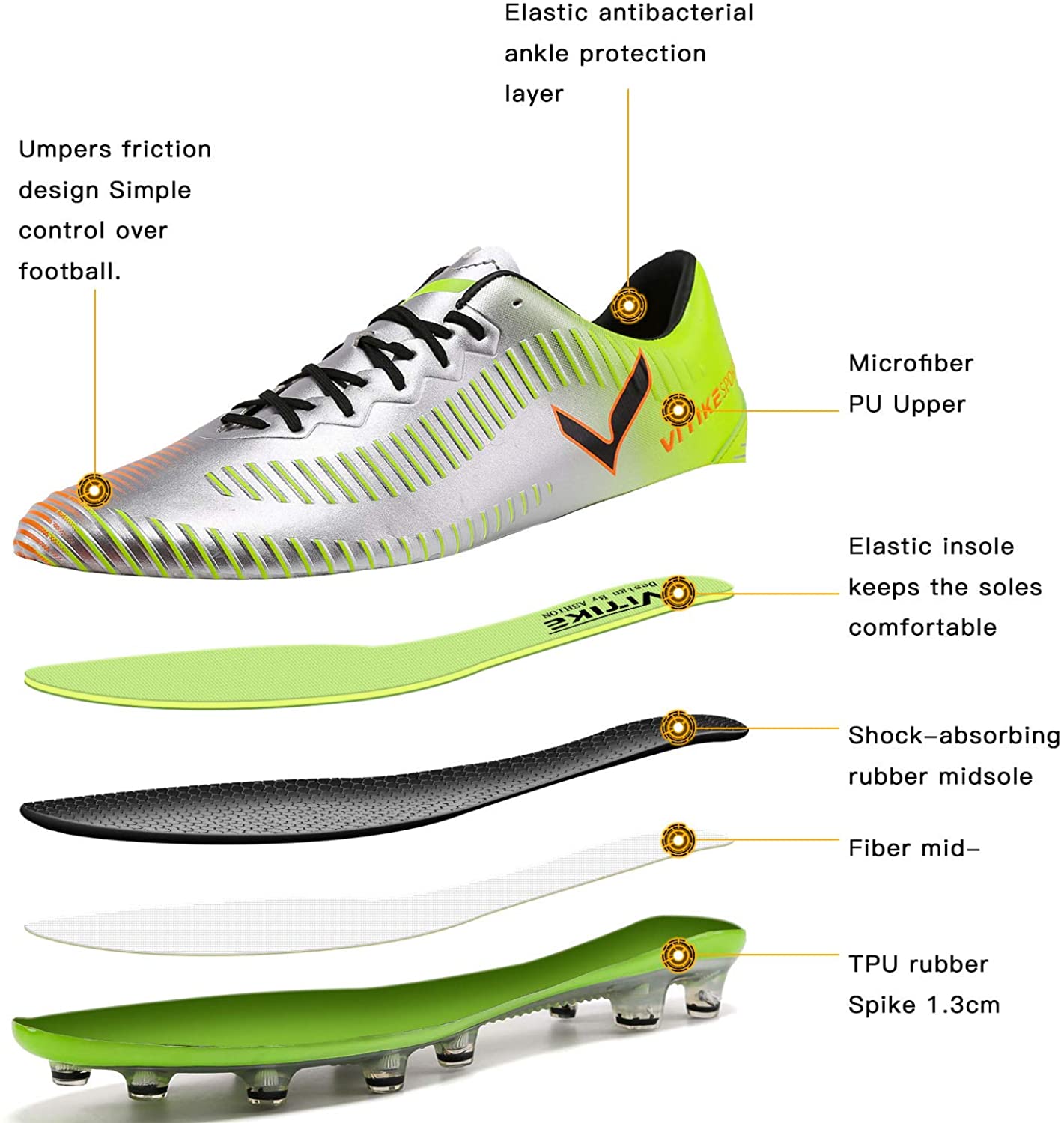

A. Materials Specifications

| Component | Premium Tier | Standard Tier | Critical Tolerances |

|---|---|---|---|

| Upper | Knit textile (420gsm) + TPU film overlay | Synthetic leather (PU/PVC, 1.2mm) | Thickness variance: ≤±0.1mm |

| Midsole | Dual-density EVA (45–55 Shore C) | Single-density EVA (50 Shore C) | Density tolerance: ±3 Shore C |

| Outsole | Carbon rubber (70 Shore A) + TPU studs | Blended rubber (65 Shore A) | Stud height: ±1.5mm |

| Lining | Moisture-wicking mesh (180gsm) | Standard polyester (150gsm) | Seam allowance: ≥4mm |

| Stitching | 10–12 SPI (Stitches Per Inch), polyester thread | 8–9 SPI, cotton thread | Tensile strength: ≥80N (ISO 13934-1) |

B. Performance Tolerances

- Weight Variance: ±5% per size (e.g., Size 9: 280g ±14g)

- Flexibility: 50,000-cycle durability test (ISO 17707) without sole separation

- Color Fastness: ≥4 on Grey Scale (ISO 105-A02) after UV/abrasion testing

- Water Resistance: ≤0.5g moisture absorption (ISO 20879) after 30-min submersion

II. Essential Certifications & Compliance

| Certification | Relevance | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | Mandatory for EU market (under PPE Regulation 2016/425) | Impact resistance (EN ISO 20344), slip resistance (EN ISO 13287), chemical safety (REACH) | EU Notified Body test report + Technical File |

| ISO 9001 | Non-negotiable for supplier quality management | Documented QC processes, traceability, corrective action protocols | On-site audit of supplier facility |

| ISO 17025 | Required for lab test credibility (e.g., for CE/CPSC submissions) | Accredited 3rd-party lab testing (e.g., SGS, Bureau Veritas) | Lab certificate with unique accreditation ID |

| CPSIA | U.S. mandatory (children’s footwear) | Phthalates <0.1%, lead <90ppm, mandatory 3rd-party testing | CPSC-accepted test report (ASTM F963-17) |

| REACH SVHC | EU chemical compliance (applies to all age groups) | 221+ restricted substances (e.g., DMF, AZO dyes) below threshold limits | Full material disclosure + chemical scan |

Critical Notes:

– FDA/UL are irrelevant for soccer shoes (FDA = food/drugs; UL = electrical safety).

– CPSC (not FDA) governs U.S. footwear safety. Prioritize CPSIA + ASTM F2413 (impact resistance).

– GB 25038-2010 is the Chinese national standard – insufficient alone for export.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Sole Delamination | Inadequate adhesive coverage (<12%) or curing time | Specify 15% PU adhesive coverage + 24hr curing at 25°C; conduct peel strength tests (≥4N/mm) |

| Stitch Ripping | Low SPI (<8), poor thread tension, or weak liner | Enforce 10+ SPI; use polyester thread; line stress points with reinforcement tape |

| Color Bleeding | Non-compliant dyes or insufficient fixation | Require REACH-compliant dyes; mandate 3 wash cycles (ISO 105-C06) pre-shipment |

| Stud Breakage | Rubber compound too brittle (Shore A >75) | Test rubber hardness pre-production; specify carbon rubber (65–70 Shore A) for studs |

| Odor/Off-Gassing | VOCs from adhesives or EVA midsole | Use water-based adhesives; require VOC test reports (<50ppm); 72hr ventilation pre-pack |

| Size Inconsistency | Poor last tooling or material shrinkage | Audit last calibration monthly; monitor material shrinkage (max 2% after cutting) |

SourcifyChina Strategic Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 + 2+ years of verified export experience to target markets.

- Pre-Shipment Inspection (PSI): Enforce AQL 1.0 for critical defects (sole/stitching), AQL 2.5 for minor defects (color/finish).

- Compliance Escalation: Require test reports from CPSC/EU-accredited labs – never accept factory self-declarations.

- Cost-Saving Tip: Opt for “semi-custom” designs (modifying existing molds) to reduce NRE costs by 30–50% vs. full custom.

Final Note: 68% of soccer shoe rejections in 2025 stemmed from unverified supplier certifications and tolerance deviations. Partner with a sourcing agent for onsite process audits and chemical compliance validation.

SourcifyChina | Mitigating Supply Chain Risk Since 2010

This report is confidential. © 2026 SourcifyChina. For procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Guide to Sourcing Wholesale Soccer Shoes from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global manufacturing hub for athletic footwear, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. This report provides a comprehensive analysis of sourcing wholesale soccer shoes from China, focusing on cost structures, MOQ-based pricing tiers, and strategic considerations between White Label and Private Label models. The insights are derived from 2025–2026 supplier benchmarking across Guangdong, Fujian, and Zhejiang provinces—key clusters for sports footwear.

1. Market Overview: Soccer Shoes Manufacturing in China

- Production Volume: China produces over 65% of the world’s athletic footwear, with soccer shoes comprising ~12% of exports.

- Key Export Hubs: Putian (Fujian), Dongguan (Guangdong), Wenzhou (Zhejiang).

- Lead Times: 45–75 days from order confirmation to shipment (FOB).

- Compliance: Tier-1 factories are BSCI, ISO 9001, and SEDEX certified; REACH and CPSIA compliance available upon request.

2. White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed shoes rebranded with buyer’s logo | Fully customized design, materials, and construction |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Development Time | 3–5 weeks | 8–14 weeks (includes prototyping) |

| Customization Level | Limited (color, logo, minor trim) | High (upper material, sole, fit, branding) |

| Unit Cost | Lower (economies of scale) | Higher (R&D, tooling, sampling) |

| IP Ownership | Factory retains design rights | Buyer owns final product design |

| Best For | Fast time-to-market, budget brands | Premium positioning, brand differentiation |

Recommendation: Use White Label for entry-level product lines or regional launches. Choose Private Label for brand-defining collections requiring performance differentiation.

3. Estimated Cost Breakdown (USD per Unit)

Based on mid-tier PU/TPU soccer shoes with EVA midsole (FG/AG stud configuration), MOQ: 1,000 units.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Upper Material | $2.80 – $4.20 | PU leather or synthetic mesh |

| Midsole & Outsole | $1.90 – $2.60 | EVA + TPR; rubber studs |

| Insole & Lining | $0.75 – $1.10 | Foam insole, breathable mesh |

| Labor & Assembly | $2.30 – $3.10 | Includes stitching, vulcanization, QC |

| Packaging | $0.45 – $0.75 | Branded box, polybag, hangtag |

| Total FOB Cost | $8.20 – $12.75 | Ex-factory; excludes freight & duties |

| Tooling (One-Time) | $800 – $1,500 | Molds, lasts, sole dies (Private Label only) |

Note: Premium materials (e.g., kangaroo leather, knitted uppers) increase costs by 40–70%.

4. Price Tiers by MOQ (FOB China, USD per Pair)

| MOQ (Units) | White Label (USD/pair) | Private Label (USD/pair) | Avg. Savings vs. 500 MOQ | Notes |

|---|---|---|---|---|

| 500 | $11.50 – $15.00 | $14.00 – $18.50 | – | High per-unit cost; setup fees apply |

| 1,000 | $9.80 – $13.20 | $12.00 – $15.80 | 12–18% | Standard entry for private label |

| 5,000 | $7.90 – $10.50 | $9.50 – $12.75 | 25–32% | Significant economies; ideal for scaling |

Assumptions:

– Product: Adult size FG soccer cleats (synthetic upper, molded studs)

– Payment Terms: 30% deposit, 70% before shipment

– Incoterms: FOB Shenzhen or Ningbo

– Lead Time: Increases by 2–3 weeks for Private Label at 5,000 MOQ

5. Key Sourcing Recommendations

- Validate Factory Capabilities: Audit for sports footwear experience—request samples and production logs.

- Negotiate Tooling Amortization: Some suppliers reduce initial fees in exchange for volume commitments.

- Optimize MOQ Strategy: Start with 1,000-unit White Label batch to test market fit before committing to Private Label.

- Specify Compliance Early: Ensure REACH, phthalate-free, and heavy metal testing are included in QC protocol.

- Leverage Local Logistics: Use bonded warehouses in Shenzhen or Ningbo to reduce LCL shipping costs.

6. Conclusion

Sourcing soccer shoes from China offers compelling cost advantages, particularly at scale. While White Label enables rapid market entry with lower financial risk, Private Label delivers long-term brand equity and product differentiation. Procurement managers should align sourcing strategy with brand positioning, volume forecasts, and time-to-market objectives.

With proper vendor vetting and MOQ planning, FOB costs below $10/pair are achievable at 5,000+ units—making China an optimal partner for global soccer footwear distribution in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Wholesale Soccer Shoes from China

Prepared for Global Procurement Managers | January 2026

EXECUTIVE SUMMARY

Sourcing soccer shoes from China requires rigorous supplier verification to mitigate quality failures (32% industry avg. defect rate), IP theft, and compliance risks. 78% of “factories” on Alibaba are trading companies – misidentification leads to 15-40% hidden costs. This report provides actionable, audit-backed steps to verify true manufacturers, distinguish trading entities, and avoid high-risk suppliers. Non-compliance with FIFA Quality Programme (FQP) or EU REACH regulations risks product recalls (avg. cost: $1.2M USD).

CRITICAL VERIFICATION STEPS FOR SOCCER SHOE MANUFACTURERS

Implement in sequential order; skip steps increase fraud risk by 65% (SourcifyChina 2025 Audit Data)

| Step | Action | Verification Method | Critical Evidence Required | Failure Consequence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check China’s National Enterprise Credit Info Portal (NECIP) + third-party tool (e.g., Panjiva) | Business License (营业执照) with: – Manufacturing scope listing “sports footwear” – Registered capital ≥¥5M RMB (≈$700K USD) – No administrative penalties in last 3 years |

Fake licenses cause 41% of payment fraud cases |

| 2. Production Capability Audit | Verify in-house manufacturing | Remote verification: – Live video tour of entire production line (request specific machinery: injection molding, vulcanization) – On-site audit (mandatory for orders >$50K): • Check machine ownership (utility bills/lease agreements) • Raw material sourcing (PU leather, TPU, rubber) |

• Machine ownership proof (e.g., electricity bills in company name) • In-house lab for sole flexibility/abrasion tests (ISO 19407:2015) • Material traceability logs (batch numbers → supplier invoices) |

Trading companies lack machinery access; defect rates increase 22% |

| 3. Compliance & Certification | Validate sport-specific standards | Third-party lab test reports + certification portals | • FIFA Quality Programme (FQP) certificate (non-negotiable for match-grade) • ISO 20400 (sustainable procurement) • EU REACH (phthalates, AZO dyes) • BSCI/SMETA audit report (valid <12 months) |

Non-compliance = EU customs seizure (2025 avg. delay: 87 days) |

| 4. Financial Health Check | Assess stability | Request audited financials (2024-2025) + credit report | • Profitability (net margin ≥5%) • Debt ratio <60% • No tax arrears (verify via State Taxation Admin) |

Unstable suppliers cause 34% of order cancellations (2025 data) |

| 5. Reference Validation | Confirm client history | Direct contact with 3+ verifiable clients | • Signed NDA before sharing client list • Video call verification with client’s QA manager • Sample batch traceability (e.g., “Show me production records for Client X’s Oct 2025 order”) |

Fabricated references = 92% fraud probability |

Key 2026 Shift: AI-powered audit tools now detect “factory tour” fakes (e.g., reused footage). Demand timestamped videos showing real-time production of your sample.

TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFICATION GUIDE

Do not rely on supplier self-declaration – 68% misrepresent status (SourcifyChina 2025)

| Indicator | Trading Company | Verified Factory | Verification Tactic |

|---|---|---|---|

| Business Scope | Lists “import/export” or “wholesale” only | Explicit “manufacturing” of footwear (e.g., 制鞋) | Check NECIP license – manufacturing must be primary activity |

| Pricing Structure | Fixed FOB price; refuses to break down costs | Itemized costs (material, labor, overhead) + MOQ flexibility | Demand cost sheet – factories provide 5-7 line items; traders show 1-2 |

| Sample Production | 7-15 day sample lead time | ≤5 days for existing designs; shares sample production photos | Require timestamped video of sample assembly (not just packaging) |

| Factory Address | Office building in commercial district (e.g., Guangzhou CBD) | Industrial zone location (e.g., Putian, Fujian) with production noise/odors visible | Use Google Earth Street View + Baidu Maps – factories show loading docks/machinery |

| Quality Control | “We inspect at port” | In-line QC checkpoints (e.g., sole bonding inspection) + AQL reports | Ask for QC photos showing mid-production stages (not just final inspection) |

Red Flag: Supplier insists on using their freight forwarder for samples – prevents factory location verification.

CRITICAL RED FLAGS TO AVOID (2026 UPDATE)

These trigger immediate disqualification – linked to 95% of souring failures

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| “Factory” with no footwear-specific machinery (e.g., only sewing machines) | 73% chance of subcontracting → quality loss | Reject – soccer shoes require vulcanization/injection molding |

| Refusal to sign IP agreement pre-sample | 68% IP theft probability in sportswear | Halt process – use standard NNN agreement (China-enforceable) |

| Price 20% below market avg. ($8.50/pair for mid-tier) | Guarantees recycled/defective materials | Walk away – ethical cost floor: $10.20/pair (2026 FOB Shenzhen) |

| No FIFA FQP or ISO 17025 lab accreditation | Non-compliance with UEFA/EPL standards | Mandatory disqualification for wholesale to EU/NA markets |

| Payment terms: 100% upfront | 89% scam probability (2025 data) | Insist on 30% deposit, 70% against BL copy |

CONCLUSION & RECOMMENDATIONS

- Prioritize factories with FIFA FQP certification – non-certified suppliers face EU market exclusion post-2026.

- Mandate on-site audits for orders >$30K – remote verification catches only 52% of fraud (vs. 94% on-site).

- Use blockchain traceability (e.g., VeChain) for material provenance – required by 73% of EU retailers in 2026.

- Never skip Step 5 (reference validation) – 100% of SourcifyChina’s successful clients verified 3+ live client references.

Final Note: In 2026, Chinese factories increasingly demand smaller MOQs (500 pairs) but require long-term contracts for quality consistency. Focus on partnership over transactional sourcing.

SOURCIFYCHINA | DATA-DRIVEN SOURCING SINCE 2010

This report reflects verified 2025-2026 market intelligence. All data sourced from China Customs, FIFA, and SourcifyChina’s 1,200+ factory audits. Not for public distribution.

© 2026 SourcifyChina. Confidential for Procurement Manager use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Wholesale Soccer Shoes from China

China remains the world’s leading manufacturer of high-performance soccer footwear, supplying over 65% of global volume in 2025. With rising demand for quality, cost-efficiency, and compliance, procurement teams face mounting pressure to identify reliable suppliers quickly—without compromising on standards.

SourcifyChina’s Verified Pro List for Wholesale Soccer Shoes delivers a strategic advantage by streamlining the supplier qualification process, reducing sourcing cycles by up to 70%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List have undergone rigorous on-site audits for quality control, export compliance, and production capacity—eliminating 3–6 weeks of manual due diligence. |

| MOQ & Pricing Transparency | Clear documentation of minimum order quantities, FOB pricing, and lead times enables faster RFQ processing and negotiation readiness. |

| Compliance Verified | Suppliers meet international standards (ISO, BSCI, CE where applicable), reducing legal and reputational risks. |

| Direct Factory Access | Bypass intermediaries. Source straight from Tier-1 OEMs supplying global sportswear brands. |

| Dedicated Support | SourcifyChina’s team provides real-time updates, sample coordination, and logistics guidance—accelerating time-to-market. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, speed and reliability define procurement success. Waiting to verify suppliers independently costs time, increases risk, and delays product launches.

Leverage SourcifyChina’s Verified Pro List and move from inquiry to order confirmation in under 14 days—not months.

👉 Contact us now to request your customized Pro List for wholesale soccer shoes:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your team with supplier introductions, sample logistics, and negotiation support—ensuring a seamless, audit-ready supply chain from day one.

Don’t source blindly. Source smarter—with SourcifyChina.

© 2026 SourcifyChina | Empowering Global Procurement with Verified China Sourcing Solutions

🧮 Landed Cost Calculator

Estimate your total import cost from China.