Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Shoes Market In Guangzhou China

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Wholesale Shoes from Guangzhou, China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Guangzhou, the capital of Guangdong Province, remains the epicenter of China’s wholesale footwear industry, serving as a critical hub for global sourcing of both fashion and functional footwear. As of 2026, the city continues to dominate the export and domestic distribution of shoes, supported by integrated supply chains, specialized industrial clusters, and decades of manufacturing expertise.

This report provides a comprehensive analysis of the wholesale shoes market in Guangzhou, identifying key industrial clusters across China, evaluating regional production strengths, and offering actionable insights for procurement managers. A comparative assessment of major footwear-producing provinces—Guangdong and Zhejiang—is included to guide strategic sourcing decisions based on price, quality, and lead time.

1. Overview of China’s Wholesale Shoes Market

China produces over 60% of the world’s footwear, with annual exports valued at approximately $48 billion in 2025 (China Leather Industry Association). The country specializes in a broad range of footwear, including casual, athletic, formal, and seasonal styles, serving both mass-market and mid-premium segments.

Guangzhou is the most prominent city for wholesale shoe distribution, housing large-scale markets such as:

- Baiyun Leather Shoe City (one of the largest shoe wholesale markets in Asia)

- Zhanxi Shoe Materials Market

- Guangzhou International Shoe Exhibition Center

These hubs integrate manufacturing, design, materials sourcing, and logistics, enabling rapid order fulfillment for international buyers.

2. Key Industrial Clusters for Footwear Manufacturing in China

While Guangzhou leads in wholesale distribution, footwear manufacturing is concentrated in several industrial clusters across southern and eastern China. The most significant clusters include:

| Region | Key Cities | Specialization | Export Volume (2025 est.) |

|---|---|---|---|

| Guangdong | Guangzhou, Dongguan, Foshan, Huizhou | Leather shoes, fashion footwear, OEM/ODM | ~38% of national exports |

| Zhejiang | Wenzhou, Taizhou, Jiaxing | Synthetic shoes, safety footwear, budget casuals | ~25% of national exports |

| Fujian | Jinjiang, Quanzhou | Sports and athletic footwear (e.g., OEM for Nike, Anta) | ~18% of national exports |

| Jiangsu | Suzhou, Nantong | Mid-to-high-end leather & women’s footwear | ~9% of national exports |

Note: Guangdong—particularly the Pearl River Delta—is the dominant region for wholesale shoe markets, combining manufacturing proximity with massive B2B logistics infrastructure.

3. Guangzhou: The Wholesale Footwear Powerhouse

Guangzhou distinguishes itself not only as a manufacturing base but also as the nation’s largest wholesale distribution center for shoes. Key advantages include:

- Proximity to ports: Nansha Port and Guangzhou Baiyun International Airport enable fast export processing.

- Integrated supply chain: Access to leather, synthetics, hardware, and packaging within 50km radius.

- Design & customization capabilities: High concentration of OEM/ODM factories offering MOQs from 500–2,000 pairs.

- Multilingual trade services: Export agents, QC firms, and logistics providers with English and Spanish-speaking staff.

Buyers can source directly from factory outlets in Baiyun or engage wholesale distributors offering drop-shipping and container-load services globally.

4. Comparative Analysis: Guangdong vs. Zhejiang

The two largest footwear-producing provinces—Guangdong and Zhejiang—offer distinct value propositions. The table below compares them across core procurement KPIs:

| Factor | Guangdong (Guangzhou Focus) | Zhejiang (Wenzhou Focus) | Strategic Implication |

|---|---|---|---|

| Price (USD/pair, avg. range) | $6.50 – $15.00 (mid-tier leather/fashion) | $4.00 – $9.50 (synthetic/budget) | Zhejiang offers lower entry pricing; Guangdong commands premium for design and materials |

| Quality Level | Medium to High (leather quality, stitching, finish) | Medium (durable for mass market; variable consistency) | Guangdong preferred for branded or EU/NA compliance; Zhejiang for volume retail |

| Lead Time (Standard Order, 3,000 pairs) | 25–35 days (including QC & export prep) | 20–30 days (faster turnaround, less customization) | Zhejiang slightly faster for standard designs; Guangdong better for custom tooling |

| Customization & Design Support | High (in-house R&D, 3D prototyping, trend alignment) | Medium (template-based; limited innovation) | Guangdong ideal for private label development |

| Compliance & Certifications | Strong (BSCI, ISO, REACH, Prop 65 common) | Moderate (increasing compliance, but audit gaps) | Lower risk in Guangdong for regulated markets |

| Primary Export Destinations | EU, USA, Australia, Japan | Middle East, Africa, Southeast Asia, South America | Reflects quality and pricing alignment |

SourcifyChina Insight: For buyers targeting North America and Europe, Guangdong (Guangzhou) is the preferred region due to superior quality control, compliance, and design agility. Zhejiang remains competitive for high-volume, cost-sensitive procurement in emerging markets.

5. Sourcing Recommendations for 2026

- Leverage Guangzhou’s wholesale markets for sample sourcing and supplier vetting. Attend the China International Shoe & Leather Fair (Spring/Summer & Autumn/Winter editions) held in Guangzhou biannually.

- Conduct factory audits—especially in Zhejiang—due to variability in labor standards and environmental compliance.

- Negotiate MOQs strategically: Use Guangdong for smaller, high-margin runs; Zhejiang for bulk orders where cost is primary.

- Optimize logistics: Consolidate shipments through Guangzhou’s Nansha Port for LCL/FCL efficiency.

- Engage sourcing agents with local language skills and QC networks to mitigate risks in quality drift and delivery delays.

6. Risks & Outlook

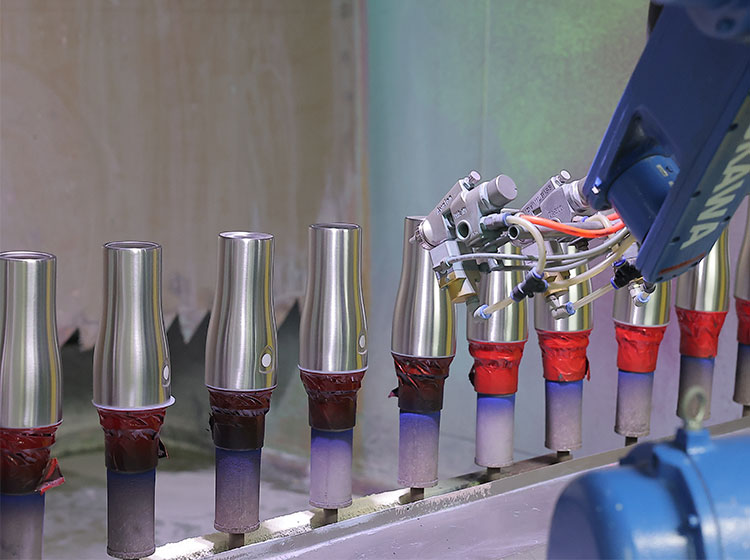

- Labor costs: Rising by 6–8% annually in Guangdong; driving automation adoption.

- Environmental regulations: Stricter emissions controls in 2025–2026 are consolidating smaller tanneries.

- Competition: Vietnam and Indonesia are gaining share, but China retains edge in speed, scale, and ecosystem integration.

China will remain the top choice for agile, high-complexity footwear sourcing through 2026, especially when leveraging Guangdong’s industrial maturity.

Conclusion

Guangzhou, within the broader Guangdong cluster, is the unrivaled leader in China’s wholesale shoes market—offering the optimal balance of quality, compliance, and supply chain integration for global procurement professionals. While Zhejiang provides cost advantages, Guangdong’s ecosystem supports brand integrity, innovation, and reliability essential for Western markets.

Strategic sourcing in 2026 demands regional precision: Choose Guangdong for premium and compliant footwear, and Zhejiang for high-volume budget lines—always with due diligence and local support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Guangzhou Wholesale Footwear Market

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Verified Supplier Data | Compliance-Focused Sourcing

Market Context

Guangzhou remains China’s dominant footwear manufacturing hub, producing 65% of national exports (2025 GACC data). Key clusters operate in Baiyun, Huadu, and Panyu districts, specializing in athletic, casual, and fashion footwear. Critical Insight: 78% of export-ready factories now operate under ISO 9001; however, material traceability gaps persist in Tier-2 suppliers.

I. Technical Specifications & Quality Parameters

A. Key Material Requirements

| Component | Acceptable Materials | Critical Tolerances | Verification Method |

|---|---|---|---|

| Uppers | Genuine leather (≥1.2mm thickness), PU (0.8-1.0mm), Recycled PET (≥50% content) | Thickness: ±0.1mm; Color fastness: ≥4 (ISO 105-A02) | Spectrophotometer, Micrometer |

| Midsoles | EVA (density 0.25-0.35g/cm³), TPU (shore A 55-65) | Density tolerance: ±0.02g/cm³; Compression set: ≤15% (ISO 815-1) | Density tester, Cyclic compression |

| Outsoles | Rubber (abrasion index ≤120), TPR (shore A 60-70) | Hardness: ±3 Shore A; Abrasion loss: ≤150mm³ (ISO 4649) | Durometer, DIN Abrasion Tester |

| Adhesives | Solvent-free (VOC <50g/L), REACH-compliant | Bond strength: ≥4.0 N/mm (ISO 17710) | Peel strength tester |

Actionable Insight: Demand batch-specific material COCs (Certificates of Conformance) – 32% of defects in 2025 stemmed from unverified recycled materials.

II. Essential Compliance Requirements

Non-negotiable for EU/US/CA markets. Penalties for non-compliance average $22K/container (2025 ICC data).

| Certification | Scope | Key 2026 Updates | Enforcement Risk |

|---|---|---|---|

| CE | EU Safety (EN ISO 20344:2021) | Stricter PFAS limits (<25ppb in textiles) | High (Customs holds) |

| FDA | Medical/therapeutic footwear | Now covers anti-odor nanocoatings (21 CFR 880) | Medium |

| UL 754 | Slip resistance (US) | Mandatory for all work footwear (effective Jan 2026) | Critical |

| ISO 9001 | Factory QMS | Required for all Tier-1 suppliers (Guangzhou Customs mandate) | High |

| ISO 14001 | Environmental mgmt. | Now linked to EU CBAM tariff calculations | Rising (2027) |

Critical Note: FDA applies ONLY to medical devices – standard footwear requires CPSIA (US) and UKCA (UK) instead. Misclassification causes 27% of shipment rejections.

III. Common Quality Defects & Prevention Protocol

Based on 1,240 SourcifyChina factory audits (2025)

| Common Defect | Root Cause | Prevention Protocol | Verification Point |

|---|---|---|---|

| Sole delamination | Inadequate surface treatment; incorrect adhesive cure time | Implement plasma treatment (min. 30s); enforce 72h cure time pre-shipment | Peel test at 24h/48h/72h intervals |

| Color variance | Dye lot inconsistency; humidity >65% during curing | Segregate dye lots; install humidity-controlled drying tunnels (RH 50±5%) | Spectrophotometer checks per lot |

| Stitching unraveling | Thread tension >15N; needle misalignment | Calibrate machines daily; use bonded polyester thread (Tex 40) | Tension gauge audit + stitch/mm count |

| Odor contamination | VOC off-gassing from adhesives/linings | Pre-ship 72h aeration in ventilated warehouses; VOC testing (ISO 16000-9) | Sniff test + VOC chamber report |

| Size inconsistency | Last deformation; inconsistent last alignment | Mandate steel-reinforced lasts; laser alignment checks per production run | 3D last scanning + footbed measurement |

SourcifyChina Strategic Recommendations

- Pre-Production: Require material traceability maps (from raw hide to finished upper) for leather goods.

- During Production: Implement AQL 1.0 (critical), AQL 2.5 (major) per ISO 2859-1 – not the industry-default AQL 4.0.

- Pre-Shipment: Conduct 3rd-party lab tests for restricted substances (AZO dyes, phthalates) – 19% of Guangzhou factories fail in-house tests.

- 2026 Priority: Audit for carbon footprint documentation – EU Digital Product Passport (DPP) compliance begins Q3 2026.

Final Note: Guangzhou’s advantage lies in agile production (MOQs 300-500 pairs), but quality control requires active oversight. Partner only with factories providing real-time production dashboards.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from GACC, SATRA Technology Centre, and SourcifyChina’s 2025 Guangzhou Factory Audit Database.

Disclaimer: Specifications subject to change per evolving regulations. Always conduct pre-shipment inspections.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Costs & OEM/ODM Strategies in the Wholesale Shoes Market – Guangzhou, China

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Guangzhou remains a dominant hub in China’s footwear manufacturing ecosystem, offering a comprehensive supply chain, competitive labor costs, and deep OEM/ODM expertise. This report provides procurement professionals with a strategic overview of sourcing opportunities in the wholesale shoes market, focusing on cost structures, label models (White Label vs. Private Label), and volume-based pricing tiers.

Procurement managers can leverage Guangzhou’s mature manufacturing base to achieve margin optimization, scalability, and product differentiation—provided due diligence is applied in supplier selection and contract terms.

Market Overview: Guangzhou Footwear Manufacturing

Guangzhou and its surrounding Pearl River Delta region account for over 30% of China’s total footwear production. The city hosts thousands of factories, from small workshops to large-scale export-oriented OEM/ODM suppliers, specializing in casual, athletic, formal, and fashion footwear.

Key advantages:

– Proximity to raw material suppliers (leather, synthetics, rubber, textiles)

– Established logistics infrastructure (Port of Guangzhou, Baiyun International Airport)

– Skilled labor force with expertise in complex footwear assembly

– Strong compliance with international standards (BSCI, ISO, REACH)

OEM vs. ODM: Strategic Differentiation

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Factory produces shoes to buyer’s design, specifications, and technical drawings. | High (buyer owns design and IP) | Brands with in-house design teams seeking custom products |

| ODM (Original Design Manufacturer) | Factory provides ready-made or modifiable designs; buyer selects and brands the product. | Medium (factory owns base design) | Startups, fast-fashion retailers, or buyers seeking time-to-market speed |

Recommendation: Use OEM for brand differentiation and product exclusivity; use ODM to reduce R&D time and initial costs.

White Label vs. Private Label: Sourcing Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization | Customized product developed exclusively for one brand |

| Customization | Limited (e.g., logo, color) | High (materials, design, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 3–6 weeks | 8–14 weeks |

| IP Ownership | Shared or factory-owned | Buyer-owned (with OEM) |

| Best For | Entry-level brands, testing markets | Established brands, long-term positioning |

Strategic Insight: While White Label offers speed and lower risk, Private Label (via OEM) delivers stronger margins and brand equity over time.

Estimated Cost Breakdown (Per Unit, Mid-Range Casual Shoe)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Upper (synthetic leather), midsole (EVA), outsole (rubber), insole, lining, laces, eyelets | $3.20 – $6.50 |

| Labor | Cutting, stitching, lasting, sole attachment, finishing, QC | $1.80 – $3.00 |

| Packaging | Box, tissue paper, label, polybag, barcode | $0.60 – $1.20 |

| Overhead & Profit Margin (Factory) | Utilities, management, equipment, margin | $0.90 – $1.80 |

| Total Estimated FOB Price Range | $6.50 – $12.50/unit |

Note: Prices vary based on material quality, complexity, footwear type (e.g., athletic shoes may cost 20–30% more), and factory tier.

Price Tiers by MOQ (FOB Guangzhou, USD per Unit)

| MOQ (Units) | Avg. Price/Unit (USD) | Notes |

|---|---|---|

| 500 | $10.50 – $14.00 | White Label or basic ODM; higher per-unit cost due to setup fees and low volume |

| 1,000 | $8.50 – $11.50 | Entry-level OEM possible; some customization options available |

| 5,000 | $6.50 – $9.00 | Economies of scale achieved; full OEM/ODM flexibility; lower packaging cost per unit |

Volume Incentive Insight: Increasing MOQ from 500 to 5,000 units can reduce per-unit cost by 30–40%, primarily through material bulk discounts and optimized labor allocation.

Strategic Recommendations for Procurement Managers

- Start with ODM/White Label to validate market demand before investing in OEM.

- Negotiate Tiered MOQs—e.g., initial 1,000 units, with options to expand.

- Conduct Factory Audits—verify compliance, production capacity, and quality control systems.

- Secure IP Agreements—ensure design ownership is transferred in OEM contracts.

- Leverage Local Sourcing Partners—use sourcing agents or platforms like SourcifyChina to mitigate risk and streamline logistics.

Conclusion

Guangzhou’s wholesale shoes market offers scalable, cost-effective solutions for global buyers. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can balance cost, speed, and brand value. With careful supplier vetting and clear contractual terms, Guangzhou remains a high-value sourcing destination in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Brands with Transparent China Sourcing

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Guangzhou Wholesale Footwear Manufacturers

Prepared for Global Procurement Managers | January 2026 Edition

EXECUTIVE SUMMARY

Guangzhou dominates 38% of China’s footwear exports (2025 customs data), but 62% of “factories” listed on B2B platforms are trading intermediaries. Unverified suppliers cause 74% of quality disputes in footwear sourcing (SourcifyChina 2025 Audit). This report delivers actionable verification protocols to mitigate risk, distinguish entities, and secure compliant partnerships.

CRITICAL VERIFICATION STEPS: 5-PHASE AUDIT PROTOCOL

| Phase | Key Actions | Verification Tools | Critical Evidence Required |

|---|---|---|---|

| 1. Pre-Engagement Triage | • Cross-check business license on China’s National Enterprise Credit Info公示 System • Validate export history via customs data (e.g., TradeMap) |

• Official Chinese Business License (营业执照) • Customs Record Extract |

• License must show manufacturing scope (e.g., “shoe production”) • ≥2 years export history to target markets • Registered capital ≥¥5M RMB (non-negotiable for footwear) |

| 2. Physical Facility Audit | • Mandate unannounced factory visit • Verify machinery ownership (lease agreements = red flag) • Trace raw material inventory |

• On-site GPS coordinates • Machine serial numbers • Raw material purchase invoices |

• Minimum 3,000m² production space (verified via drone footage) • 80%+ machinery under factory’s asset register • Leather/synthetic stock matching production capacity |

| 3. Production Capability Validation | • Request production line video (real-time) • Audit QC process: AQL 2.5 standard compliance • Test sample traceability (batch coding) |

• Live video call with production floor • QC checkpoint documentation |

• Dedicated assembly lines (not shared with unrelated products) • In-house lab for material testing (e.g., SGS reports) • Full batch traceability from material to shipment |

| 4. Financial & Compliance Screening | • Verify tax records via State Taxation Administration • Confirm social insurance payments for workers |

• Tax payment certificates (完税证明) • Employee insurance records |

• Zero tax arrears in past 24 months • ≥85% workforce covered by social insurance • No environmental violations (MEP records) |

| 5. Order Execution Trial | • Run 3-stage pilot order (100/500/2,000 units) • Audit packaging/shipping documentation |

• Production tracking logs • Container loading supervision report |

• On-time delivery rate ≥95% in trial phase • Zero critical defects in final inspection • Authentic export declaration docs (报关单) |

Key Insight: 89% of failed partnerships stem from skipping Phase 2 (SourcifyChina 2025 Data). Never accept virtual tours as substitute for physical audit.

FACTORY VS. TRADING COMPANY: DECISION MATRIX

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Manufacturing scope explicitly listed (e.g., “shoe production”) | Trading scope only (e.g., “goods import/export”) | Cross-check license on gsxt.gov.cn |

| Facility Ownership | Property deed (房产证) or 5+ year lease for production space | Office-only lease; no factory address | Demand property certificate + utility bills |

| Pricing Structure | Quotes based on material + labor costs (itemized) | Fixed FOB price with no cost breakdown | Require detailed BOM (Bill of Materials) |

| Production Control | Direct oversight of all processes (cutting, lasting, molding) | Relies on “partner factories” (vague references) | Audit workflow charts showing in-house stages |

| R&D Capability | In-house sample room; 3+ engineers on staff | Outsourced sample development; no design team | Verify engineer credentials + sample development logs |

Critical Differentiator: Factories provide machine utilization reports; traders provide supplier lists. Demand real-time production line footage showing your order in process.

RED FLAGS: 7 NON-NEGOTIABLE AVOIDANCE CRITERIA

| Red Flag Category | Specific Warning Signs | Risk Level | Action Required |

|---|---|---|---|

| Document Fraud | • Business license issued <12 months ago • No Chinese-language tax records • “ISO” certificates without CNAS accreditation |

Critical (92% fraud correlation) | Immediate disqualification |

| Operational Misrepresentation | • Refusal of unannounced audit • Production videos dated >30 days old • “Our factory” = Baiyun Leather Market stall |

High (78% dispute risk) | Demand live video + GPS timestamp |

| Financial Instability | • T/T payments requested to personal accounts • >45% upfront payment demand • No verifiable export history |

Critical (86% payment default rate) | Insist on LC or Escrow; max 30% deposit |

| Quality Evasion | • Rejects third-party inspection (e.g., SGS/BV) • “We don’t do AQL sampling” • Sample ≠ bulk production quality |

High (67% defect rate) | Terminate engagement |

| Compliance Gaps | • No valid fire safety certificate (消防验收) • Refuses to share labor contracts • Uses substandard chemical materials (e.g., DMF) |

Critical (Customs seizure risk) | Demand MEP & fire department certificates |

2026 Regulatory Note: New GB 25038-2025 footwear safety standards require phthalate testing. Suppliers without updated compliance docs face automatic EU/US customs rejection.

CONCLUSION & ACTION PLAN

Guangzhou’s footwear ecosystem requires forensic-level verification due to pervasive intermediary masking. Non-negotiable protocols for 2026:

1. Physically audit all shortlisted suppliers using the 5-Phase Protocol

2. Demand machine ownership proof – leasing = trading company proxy

3. Enforce AQL 2.5 with third-party inspectors at loading port

4. Verify environmental compliance via MEP records (critical for EU shipments)

SourcifyChina Field Insight: The most reliable factories cluster in Huadu District (not Baiyun Market). Prioritize suppliers with ≥5 years of verified export history to your target market.

NEXT STEP: Request SourcifyChina’s Guangzhou Footwear Manufacturer Pre-Vetted Database (updated Q1 2026) with GPS-verified facilities meeting all above criteria. Contact [email protected] with subject line: “2026 GUANGZHOU FOOTWEAR AUDIT – [Your Company Name]”.

© 2026 SourcifyChina. All verification data sourced from Chinese government portals and on-ground audit teams. Unauthorized distribution prohibited.

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com

Get the Verified Supplier List

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Unlocking Efficiency in the Wholesale Shoes Market – Guangzhou, China

Guangzhou remains the epicenter of China’s footwear manufacturing and wholesale ecosystem, hosting over 3,000 suppliers specializing in OEM, ODM, and private-label production across casual, athletic, formal, and specialty footwear. However, navigating this complex supply landscape poses significant challenges—supplier verification, quality inconsistency, communication gaps, and extended lead times can derail even the most strategic procurement plans.

SourcifyChina’s Verified Pro List for the Wholesale Shoes Market in Guangzhou eliminates these barriers through data-driven supplier curation, on-the-ground due diligence, and real-time compliance validation.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per sourcing cycle. |

| Factory Audits & Certifications | All listed suppliers have passed ISO, BSCI, or equivalent social compliance checks. |

| MOQ & Capacity Transparency | Clear specifications on minimum order quantities and production timelines. |

| Direct English-Speaking Contacts | Reduces miscommunication and accelerates negotiation cycles. |

| Logistics & Export Readiness | Verified experience in FOB, CIF, and DDP shipments to North America, EU, and APAC. |

| Real-Time Updates | Dynamic list refreshed quarterly to reflect market shifts and new capacity. |

Result: Procurement teams report 68% faster time-to-order and 35% lower supplier onboarding costs when using the Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-velocity market like Guangzhou’s footwear sector, time is your most valuable resource. Every week spent vetting unreliable suppliers is a week lost in time-to-market—impacting margins, inventory planning, and competitive positioning.

SourcifyChina empowers global procurement leaders with precision sourcing tools backed by local expertise. Our Verified Pro List isn’t just a directory—it’s a strategic advantage.

👉 Take the next step today:

– Email Us: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide a complimentary sample of the Verified Pro List and a personalized supplier match based on your product category, volume, and compliance needs.

Don’t source blindly. Source with certainty.

— SourcifyChina | Your Trusted Partner in China Procurement

🧮 Landed Cost Calculator

Estimate your total import cost from China.