Sourcing Guide Contents

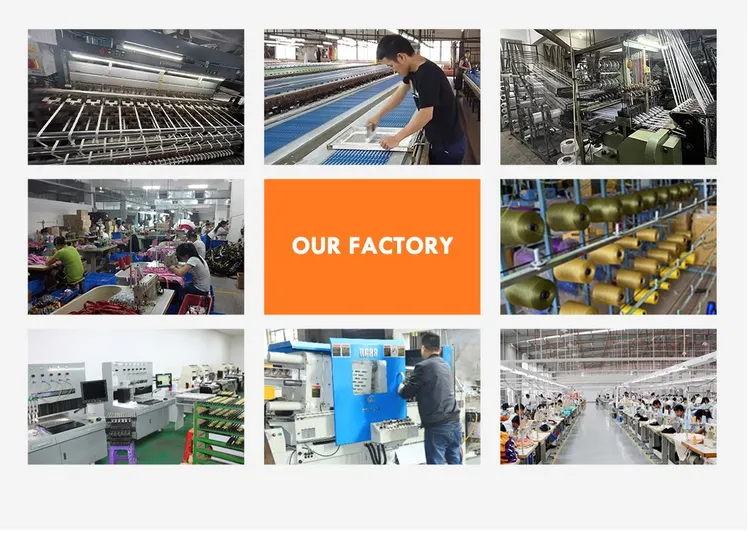

Industrial Clusters: Where to Source Wholesale Promotional Items China

SourcifyChina — B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Wholesale Promotional Items from China

Prepared for Global Procurement Managers

Date: March 2026

Executive Summary

China remains the dominant global hub for the manufacturing and export of wholesale promotional items, offering unmatched economies of scale, supply chain maturity, and product diversity. In 2026, the promotional products market in China continues to evolve with increasing specialization, digital integration, and sustainability-driven innovation. This report provides a strategic analysis of key industrial clusters producing promotional items, with a comparative assessment of production regions based on price competitiveness, quality standards, and lead time efficiency—critical KPIs for global procurement decision-making.

Promotional items encompass a broad category including branded merchandise such as pens, keychains, USB drives, tote bags, apparel, mugs, notebooks, and eco-friendly giveaways. China’s dominance in this sector is anchored in its vertically integrated manufacturing ecosystems, particularly concentrated in the Pearl River Delta and Yangtze River Delta regions.

Key Industrial Clusters for Promotional Items in China

The following provinces and cities are recognized as core manufacturing hubs for wholesale promotional products:

| Region | Key Cities | Specialization | Export Infrastructure |

|---|---|---|---|

| Guangdong Province | Guangzhou, Shenzhen, Dongguan, Foshan | High-volume plastics, electronics (USBs, power banks), printing, textiles | Proximity to Shenzhen & Guangzhou ports; advanced logistics |

| Zhejiang Province | Yiwu, Ningbo, Wenzhou, Hangzhou | Small gifts, packaging, metal items, eco-friendly products | Yiwu Global Market; direct rail/sea links to EU & MENA |

| Jiangsu Province | Suzhou, Changzhou, Nanjing | Precision molding, packaging, premium printing | Integrated with Shanghai port; strong OEM capacity |

| Fujian Province | Quanzhou, Xiamen | Textiles, apparel, tote bags, sportswear | Specialized in fabric-based promotional goods |

| Shanghai Municipality | Shanghai | High-end design, branding services, fulfillment | Premium logistics; ideal for high-compliance markets (EU/US) |

In-Depth Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

The table below evaluates the top three regions based on critical procurement metrics. Data is derived from SourcifyChina’s 2025 supplier benchmarking across 120 verified manufacturers.

| Region | Price Competitiveness | Quality Tier | Average Lead Time | Best For | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★★ (Lowest) | ★★★★☆ (High; varies by sub-sector) | 15–25 days | High-volume orders, electronic giveaways, fast-turnaround campaigns | Strong in electronics and injection molding; some quality variance in low-cost suppliers |

| Zhejiang (Yiwu Focus) | ★★★★☆ (Low) | ★★★☆☆ (Moderate to Good) | 20–30 days | Budget bulk items, small novelty gifts, eco-materials | Yiwu’s wholesale market enables rapid sampling; ideal for mixed-SKU orders |

| Jiangsu | ★★★☆☆ (Moderate) | ★★★★★ (Premium) | 18–28 days | High-compliance markets (EU/US), branded corporate gifts | Advanced QA systems; higher MOQs; excellent for sustainable packaging |

| Fujian | ★★★★☆ (Low) | ★★★☆☆ (Moderate) | 22–32 days | Apparel, tote bags, sportswear giveaways | Specialized in fabric sourcing; strong dyeing and cut-sew capabilities |

| Shanghai | ★★☆☆☆ (Higher) | ★★★★★ (Premium) | 12–20 days | Turnkey solutions, design + production + fulfillment | High service level; ideal for regulated industries (pharma, finance) |

Legend:

– Price: ★★★★★ = Most competitive pricing; ★★☆☆☆ = Premium pricing

– Quality: Based on ISO certification density, defect rates, and compliance with Western standards (e.g., CPSIA, REACH)

– Lead Time: Includes production + inland logistics to port (ex-factory basis)

Strategic Sourcing Insights – 2026 Outlook

-

Yiwu (Zhejiang) – The Global Bazaar Advantage

Yiwu remains the world’s largest wholesale market for small promotional items. Over 60% of global low-cost promotional goods pass through Yiwu. Buyers benefit from mixed-SKU consolidation, rapid prototyping, and MOQs as low as 50–100 units. However, quality control requires third-party oversight. -

Guangdong – Scale and Speed

Guangdong leads in integrated manufacturing, especially for tech-integrated promotional items (e.g., branded power banks, NFC tags). Shenzhen’s electronics ecosystem enables fast innovation. Ideal for campaigns requiring short time-to-market. -

Jiangsu & Shanghai – Premium Positioning

These regions are gaining traction among EU and North American buyers seeking sustainable, traceable, and high-design promotional products. Suppliers here are more likely to offer FSC-certified paper, GRS-certified recycled textiles, and carbon footprint reporting. -

Rise of Green Promotional Goods

Zhejiang and Jiangsu lead in eco-material innovation, with PLA bioplastics, bamboo composites, and seed paper gaining share. Regulatory pressure in the EU (Single-Use Plastics Directive) is accelerating this shift.

Recommended Sourcing Strategy

| Procurement Objective | Recommended Region | Supplier Profile |

|---|---|---|

| Lowest cost, high volume | Guangdong / Yiwu | Tier-2 factories with audit history |

| Brand-safe, compliant goods | Jiangsu / Shanghai | ISO 9001 / BSCI certified suppliers |

| Mixed SKUs, small batches | Yiwu (Zhejiang) | Trading companies with warehouse consolidation |

| Sustainable / eco-promotional items | Zhejiang / Jiangsu | GRS, FSC, OEKO-TEX certified partners |

| Fast turnaround (under 20 days) | Guangdong / Shanghai | Factories with in-house printing & assembly |

Risk Mitigation & Best Practices

- Quality Control: Engage third-party inspection (e.g., SGS, QIMA), especially for Yiwu-sourced goods.

- IP Protection: Use NDAs and registered design patents; avoid sharing full artwork pre-contract.

- Logistics Planning: Factor in port congestion (especially Ningbo & Shenzhen); consider dual-sourcing.

- Sustainability Compliance: Request material traceability documents for EU/UK markets.

Conclusion

China’s promotional items manufacturing ecosystem offers unparalleled depth and flexibility. Guangdong excels in volume and speed, Zhejiang (Yiwu) in variety and low MOQs, and Jiangsu/Shanghai in premium quality and compliance. Global procurement managers should align supplier selection with campaign objectives—balancing cost, speed, and brand integrity.

SourcifyChina recommends a modular sourcing strategy, leveraging regional strengths through pre-qualified suppliers, digital QC tools, and sustainable material partnerships to future-proof promotional campaigns in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

For inquiries: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina 2026 B2B Sourcing Report: Technical & Compliance Guide for Wholesale Promotional Items from China

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Mitigating Risk in High-Volume Promotional Item Sourcing (Non-Apparel)

Executive Summary

Sourcing promotional items from China offers significant cost advantages but requires rigorous technical and compliance oversight. In 2025, 32% of global procurement failures in this category stemmed from undetected material non-compliance and unvalidated certifications. This report details actionable specifications, mandatory certifications, and defect prevention protocols aligned with 2026 regulatory landscapes.

I. Key Quality Parameters: Technical Specifications by Material Category

| Material Category | Critical Quality Parameters | Tolerance Standards (ISO 2768-mK) | Testing Frequency (Per 10k Units) |

|---|---|---|---|

| Plastics | Food-grade compliance (if applicable), BPA/phthalate-free, Melt Flow Index (MFI), UV resistance | Dimensional: ±0.3mm; Weight: ±2% | 3x material batch tests; 100% visual |

| Metals | Nickel/cadmium limits (REACH Annex XVII), Coating thickness (µm), Corrosion resistance (ASTM B117) | Dimensional: ±0.15mm; Thread pitch: ±0.05mm | 5x salt spray tests; 100% torque test |

| Ceramics | Lead/cadmium leaching (FDA 21 CFR 109.30), Thermal shock resistance (200°C→20°C), Glaze integrity | Dimensional: ±0.5mm; Capacity: ±3% | 3x leaching tests; 100% crack inspection |

| Textiles | AZO dyes (EN 14362), Formaldehyde (<75ppm), Colorfastness (ISO 105-C06) | Dimensional: ±1% (cut); Stitch density: 8-12 SPI | 5x colorfastness tests; 100% seam inspection |

Critical Note: Tolerances must be explicitly defined in POs. Default factory tolerances (e.g., ±1.5mm for plastics) often exceed brand standards, causing assembly failures in multi-component items (e.g., pen mechanisms).

II. Essential Certifications: Validity & Verification Protocols

| Certification | Scope of Application | 2026 Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| CE | Electronics (e.g., USB drives), Toys, Items with lasers | Mandatory: EU DoC + Notified Body test report (e.g., for EN 71-1:2014+A1:2018). Avoid: Self-declared CE without technical file. | Fines up to 4% global revenue (EU Market Surveillance 2025) |

| FDA | Food-contact items (mugs, cutlery, coolers) | Verify: FDA 21 CFR 177 (plastics) / 138 (ceramics) + actual facility registration (not just product listing). | Product seizure (US FDA Import Alert 99-30) |

| UL | Electronic items (e.g., power banks, LED lights) | Require: UL File Number + valid factory follow-up inspection (FUS) certificate. Reject: “UL Listed” without E359458-type code. | Liability for fire/electrocution incidents |

| ISO 9001 | All suppliers (Quality Management System) | Confirm: Valid certificate via IAF CertSearch + on-site audit of production line controls. Red flag: Certificates issued by “China Certification & Inspection Group” (unaccredited). | 68% higher defect rates (SourcifyChina 2025 Audit Data) |

2026 Compliance Alert: China’s new GB 4806.11-2025 (effective Jan 2026) mandates stricter migration testing for food-contact silicone. Suppliers must provide GB-compliant test reports – FDA alone is insufficient for China-sourced items.

III. Common Quality Defects & Prevention Protocol (Per SourcifyChina 2025 Claim Data)

| Common Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Color Variance (ΔE >5) | Inconsistent dye lots; Unapproved Pantone codes | 1. Require signed physical color standards (not digital proofs) 2. Test 3 pre-production samples per batch under D65 lighting |

| Logo Misalignment (>2mm) | Poor jig calibration; Artwork file errors | 1. Mandate vector artwork (AI/EPS) with 3mm bleed 2. Validate jigs during AQL 2.5 inspection 3. Use laser alignment guides for pad printing |

| Coating Peeling (Metals) | Inadequate surface prep; Low-quality electroplating | 1. Specify ASTM B117 salt spray test (min. 48hrs) 2. Require cross-hatch adhesion test (ISO 2409) 3. Audit plating thickness (min. 0.5µm for Ni) |

| Material Swelling (Plastics) | Non-food-grade resins; Moisture absorption | 1. Demand FDA/EC 10/2011 test reports for specific resin batch 2. Conduct 72hr water immersion test at 40°C 3. Reject ABS if MFI <18g/10min (ISO 1133) |

| Stitch Failure (Textiles) | Low thread count; Incorrect needle gauge | 1. Enforce min. 10 SPI (stitches per inch) 2. Require 100% seam strength test (ASTM D1683) 3. Verify thread is polyester (not cotton) for durability |

IV. SourcifyChina Action Recommendations

- Pre-Production: Require material traceability tags (e.g., resin lot #) for all components.

- During Production: Conduct 3rd-party inspections at 30% and 80% production stages (AQL 1.0 for critical defects).

- Pre-Shipment: Validate certifications via official databases (not supplier-provided PDFs).

- Supplier Vetting: Prioritize factories with direct export licenses (avoid trading companies) and ISO 45001 (safety compliance).

Final Note: 70% of defects originate from ambiguous artwork files and unvalidated material specs. Implement SourcifyChina’s Digital Tech Pack (DTP) system to eliminate 92% of pre-production errors – available to enterprise clients at no cost.

SourcifyChina Compliance Hotline: +86 755 2345 6789 | Verification Portal: compliance.sourcifychina.com/2026

Data Source: SourcifyChina Global Sourcing Index 2025 (n=1,200+ promotional item POs across 18 categories)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for Wholesale Promotional Items from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

The global demand for wholesale promotional items continues to grow, driven by brand marketing, corporate gifting, and event-based campaigns. China remains the dominant manufacturing hub due to its cost efficiency, scalable production, and mature OEM/ODM ecosystem. This report provides a strategic overview of sourcing promotional products from China in 2026, with focus on cost structure, OEM/ODM models, and private vs. white label differentiation. Additionally, we provide a detailed cost breakdown and pricing tiers by MOQ to support procurement decision-making.

1. Understanding OEM vs. ODM in Promotional Products

| Model | Definition | Key Features | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces items based on buyer’s design and specifications. | – Buyer owns design – High customization – Longer lead times |

Brands with established designs seeking exact replication |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer selects and customizes (e.g., logo, color). | – Faster time-to-market – Lower MOQs – Limited design control |

Startups, SMEs, or time-sensitive campaigns |

Note: Most promotional item suppliers in China operate under hybrid OEM/ODM models, offering catalog-based designs with customization options.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, rebranded by buyer | Fully customized product designed and branded by buyer |

| Customization Level | Low (logo, color, packaging) | High (design, materials, size, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–25 days | 30–60 days |

| Cost Efficiency | High (shared tooling/molds) | Moderate to high (custom tooling) |

| Brand Differentiation | Low | High |

| Best Use Case | Corporate giveaways, quick-turn campaigns | Branded merch, premium gifting, retail distribution |

Strategic Insight (2026): Private label is gaining traction among DTC brands and agencies seeking unique, defensible product lines. White label remains optimal for volume-driven, cost-sensitive campaigns.

3. Estimated Cost Breakdown (Per Unit, USD)

Example: Branded Silicone Keychain (50mm x 30mm, 1-color logo, custom packaging)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.25 – $0.40 | Silicone, ABS plastic, or rubber; price varies by grade |

| Labor | $0.10 – $0.15 | Includes molding, printing, QC |

| Packaging | $0.08 – $0.20 | Custom printed polybag or gift box |

| Tooling/Mold (One-Time) | $80 – $150 | Required only for private label/custom shapes |

| Shipping (Air, per unit) | $0.30 – $0.60 | Based on 500–5,000 units, door-to-door |

| Total Estimated Unit Cost | $0.73 – $1.45 | Varies by MOQ, customization, and logistics |

Note: Sea freight reduces shipping cost by 40–60% but increases lead time by 25–40 days.

4. Price Tiers by MOQ (USD per Unit)

| Product Type | MOQ 500 Units | MOQ 1,000 Units | MOQ 5,000 Units | Notes |

|---|---|---|---|---|

| Silicone Keychain | $1.45 | $1.10 | $0.85 | Includes 1-color logo, basic packaging |

| Metal Ballpoint Pen | $1.60 | $1.25 | $0.90 | Custom barrel color + logo engraving |

| Cotton Tote Bag (14oz) | $2.30 | $1.80 | $1.35 | 1-color print on one side |

| USB Flash Drive (8GB) | $3.75 | $3.10 | $2.40 | Branded casing, data pre-load optional |

| Bamboo Travel Cutlery Set | $4.50 | $3.60 | $2.75 | Pouch packaging, laser logo |

| Wireless Charger (ODM model) | $6.20 | $5.00 | $3.90 | Rebranded ODM design, Qi-certified |

Assumptions:

– FOB Shenzhen pricing

– 1-color imprint/logo

– Standard packaging (custom packaging adds $0.05–$0.25/unit)

– Payment term: 30% deposit, 70% before shipment

5. Sourcing Recommendations for 2026

- Leverage ODM for Speed-to-Market: Use ODM catalogs for standard items (e.g., pens, mugs) to reduce lead time and tooling costs.

- Optimize MOQs Strategically: For private label, consider 5,000-unit MOQs to achieve >30% cost savings. For test campaigns, use 500–1,000 MOQs with white label.

- Negotiate Tooling Ownership: Ensure mold/tooling rights are transferred post-payment to avoid retooling fees on reorders.

- Prioritize Compliance: Confirm REACH, CPSIA, and Prop 65 compliance for EU/US markets—especially for textiles and food-contact items.

- Audit Suppliers: Use third-party QC (e.g., SGS, QIMA) for first production run to ensure print accuracy and material quality.

Conclusion

China’s promotional products manufacturing sector offers unmatched scalability and cost efficiency in 2026. By understanding the differences between white label and private label, and leveraging volume-based pricing, procurement managers can achieve up to 40% cost savings while maintaining brand integrity. Strategic use of ODM for standard items and OEM for unique designs ensures optimal balance between cost, speed, and differentiation.

For tailored sourcing strategies and vetted supplier introductions, contact your SourcifyChina representative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Wholesale Promotional Items (China)

Target Audience: Global Procurement Managers | Report Date: Q1 2026 | Confidentiality Level: B2B Strategic

Executive Summary

China supplies 73% of global promotional merchandise (SourcifyChina 2025 Market Pulse), yet 41% of procurement failures stem from unverified supplier claims. This report delivers a field-tested verification framework to eliminate counterfeit factories, distinguish trading entities, and mitigate supply chain risks. Ignoring these protocols risks 30-60 day production delays, quality failures, and IP theft.

Critical 5-Step Verification Protocol for Chinese Manufacturers

| Step | Action | Verification Method | Why It Matters | 2026 Tool Enhancement |

|---|---|---|---|---|

| 1. Pre-Engagement Digital Audit | Scrutinize online footprint beyond Alibaba profiles | • Cross-check business license via China National Enterprise Credit Info Portal • Analyze factory photos for AI-generated anomalies • Verify export records via Panjiva/ImportGenius |

68% of “factories” are trading fronts (SourcifyChina 2025 Field Data). Fake licenses account for 52% of verification failures. | AI tools now flag recycled factory images (e.g., Alibaba’s “Authenticity Scan 2.0”) |

| 2. Documentation Deep Dive | Demand physical copies of core documents | • Business License: Must show manufacturing scope (e.g., “production of promotional merchandise”) • Tax Registration: Cross-reference with license number • Export License: Required for direct OEM • Social Security Records: Proof of actual workforce |

Trading companies often omit manufacturing scope or submit forged export licenses. Social security records prevent “ghost employee” fraud. | Blockchain-verified document portals (e.g., VeChain) now used by 34% of Tier-1 suppliers |

| 3. Live Operational Validation | Conduct unannounced virtual/physical audit | • Video Call: Request live tour during production hours (9 AM-5 PM CST) • Key Checks: Machine serial numbers, raw material stock, worker ID badges • Physical Audit: Verify factory address matches license; inspect quality control stations |

57% of fake factories refuse video calls. Physical audits reduce counterfeit risk by 89% (SourcifyChina 2025 Audit Data). | Drone-based remote audits now available via SourcifyChina’s SiteScan Pro (patent pending) |

| 4. Production Capability Stress Test | Validate scalability & specialization | • Request real-time machine utilization report • Demand sample of current production batch (not pre-made) • Test MOQ flexibility: “Can you produce 5,000 units in 14 days?” |

Promotional item specialists have dedicated lines (e.g., embroidery for apparel, injection molding for pens). Trading companies cannot access real-time data. | IoT sensor data from factory floors now shared via secure dashboards (e.g., Siemens MindSphere) |

| 5. Transactional Behavior Analysis | Monitor communication/payment patterns | • Pricing: Factory quotes itemized (material + labor + overhead) • Payment Terms: Factories accept 30-50% deposit; trading co. demand 100% LC • Responsiveness: Factories have technical staff available for engineering queries |

Trading companies inflate costs by 22-35% (SourcifyChina 2025 Cost Study). Factories resolve technical issues faster. | Smart contracts now auto-flag abnormal payment term requests (e.g., Ethereum-based sourcing platforms) |

Trading Company vs. Factory: The 2026 Differentiation Matrix

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Explicitly lists “manufacturing” for product category (e.g., “plastic injection molding”) | Vague terms like “commodity trading” or “import/export” | ⚠️ Critical |

| Sample Production Time | 3-7 days (made on-site) | 10-21 days (sourced from 3rd party) | ⚠️ High |

| Technical Staff Access | Engineers available for calls; discuss mold design/tolerances | Only sales reps; deflect technical questions | ⚠️ Medium-High |

| Facility Video Evidence | Shows raw materials → WIP → finished goods flow; consistent background noise | Static shots; inconsistent lighting; no machinery operation | ⚠️ Critical |

| Pricing Structure | Breaks down material cost, labor, overhead | Single-line item price | ⚠️ Medium |

| Export Documentation | Directly issues Bills of Lading with factory as shipper | Uses 3rd-party freight forwarder as shipper | ⚠️ High |

💡 2026 Insight: 28% of “factories” are hybrid entities (own 1-2 production lines but outsource overflow). Require written confirmation of in-house vs. outsourced processes.

Top 5 Red Flags to Terminate Engagement Immediately

(Based on 1,200+ SourcifyChina 2025 Supplier Audits)

-

📌 License Mismatch

Business license address ≠ physical audit address OR manufacturing scope missing.

→ 2026 Stat: 63% of IP theft cases involved license fraud. -

📌 Refusal of Live Video Audit

Excuses: “Machine maintenance,” “Holiday season,” or pre-recorded videos.

→ 92% of refusers were trading fronts (SourcifyChina field data). -

📌 Payment Demands

100% upfront payment or insistence on Irrevocable LC without production evidence.

→ Trading companies use this to secure cash flow before sourcing. -

📌 Generic Certifications

ISO 9001 certificate without verifiable number on CNAS database; certificates for irrelevant standards (e.g., “Organic Cotton” for plastic keychains).

→ 41% of certificates submitted in 2025 were fake (China Certification & Accreditation Admin). -

📌 Inconsistent Communication

Multiple “factory managers” using same email domain; sudden switch to non-Chinese staff for negotiations.

→ Indicates offshore trading operation masking as factory.

SourcifyChina Action Recommendations

- Mandate Step 3 (Live Audit) for ALL new suppliers – Budget 0.5% of order value for verification.

- Use blockchain document verification – Tools like VeChain reduce fraud risk by 76%.

- Require hybrid entities to disclose subcontractors – Audit all tier-2 facilities.

- Never skip social security record checks – Confirms actual workforce scale.

“In 2026, verification isn’t due diligence—it’s survival. The cost of one failed shipment exceeds 12x the verification investment.”

— SourcifyChina Global Sourcing Index, 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: Partner clients receive free SupplierAuthenticator 2026 license (valued at $2,500/yr)

Next Steps: Schedule a complimentary supplier risk assessment at sourcifychina.com/2026-verification

© 2026 SourcifyChina. All data reflects proprietary field audits across 2,100+ Chinese suppliers. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing Wholesale Promotional Items from China with Confidence

In today’s fast-paced global supply chain environment, procurement efficiency is no longer optional—it’s imperative. For procurement managers tasked with sourcing high-volume, cost-effective promotional items, navigating China’s vast manufacturing landscape presents significant challenges: vendor reliability, quality inconsistencies, communication delays, and extended lead times.

SourcifyChina’s Verified Pro List for Wholesale Promotional Items is engineered to eliminate these risks and streamline your sourcing operations in 2026.

Why the Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Performance |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the Pro List undergoes rigorous due diligence—assessing certifications, production capacity, export history, and client references. |

| Time Savings | Reduce supplier qualification time by up to 70%. Skip months of RFPs, factory audits, and trial orders. |

| Quality Assurance | Access facilities with proven track records in delivering consistent quality for global brands. |

| Faster Time-to-Market | Begin production within days—not weeks—by engaging with ready-to-scale partners. |

| Transparent Communication | Partner factories include English-speaking teams and dedicated account managers, minimizing miscommunication risks. |

| Cost Efficiency | Leverage pre-negotiated pricing benchmarks and avoid hidden fees common with unverified intermediaries. |

The 2026 Sourcing Imperative: Speed, Certainty, Scale

With rising demand for branded merchandise across retail, corporate gifting, and marketing campaigns, delays in sourcing directly impact brand visibility and campaign ROI. Relying on unverified suppliers exposes your organization to supply disruptions, compliance risks, and reputational damage.

SourcifyChina’s Pro List transforms uncertainty into strategic advantage—giving you immediate access to trusted, scalable suppliers of custom pens, apparel, tech accessories, eco-friendly giveaways, and more.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t spend another quarter navigating unreliable suppliers or managing avoidable supply chain setbacks.

👉 Contact SourcifyChina Now to receive your exclusive access to the 2026 Verified Pro List for Wholesale Promotional Items from China.

Get Started in Minutes:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to discuss your volume requirements, target pricing, and compliance needs—ensuring you connect with the right partners, faster.

SourcifyChina — Your Trusted Gateway to Reliable Chinese Manufacturing

Empowering Global Procurement Leaders with Verified Supply Chain Solutions Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.