Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Oil Paintings From China

Professional B2B Sourcing Report 2026

Sourcing Wholesale Oil Paintings from China

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

Executive Summary

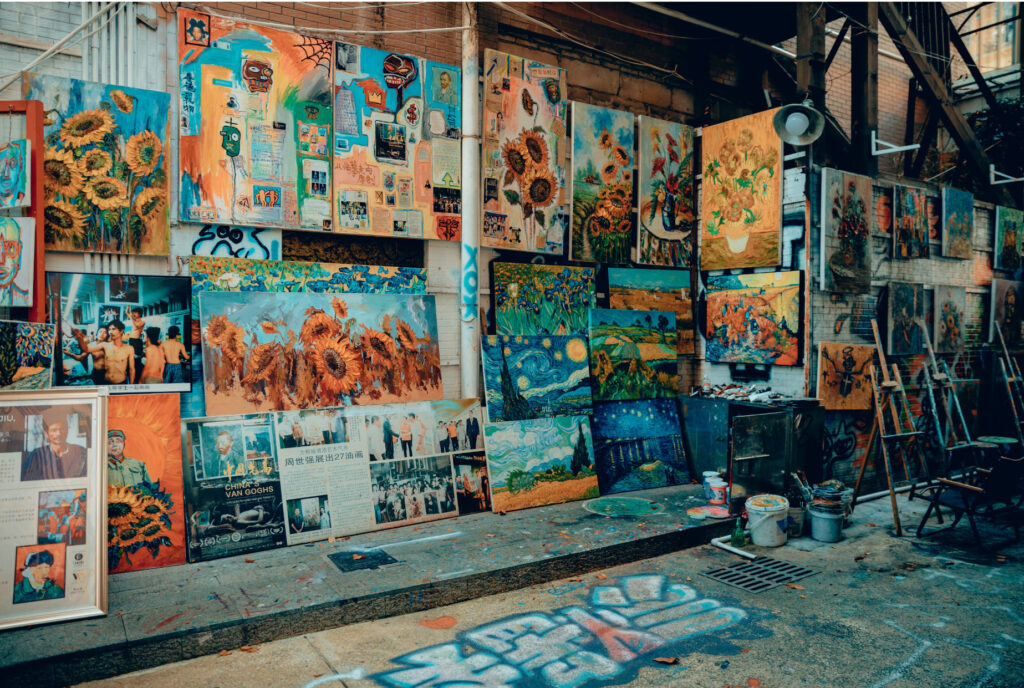

China remains the world’s dominant supplier of wholesale oil paintings, accounting for over 75% of global export volume in decorative and commercial-grade oil art. The market is highly regionalized, with specialized industrial clusters in Guangdong, Zhejiang, Fujian, and Hebei provinces driving production efficiency, design innovation, and cost competitiveness.

This report provides a strategic analysis of key manufacturing hubs for wholesale oil paintings, evaluating regional strengths in price, quality, lead time, and export readiness. The insights are based on 2025–2026 supply chain data, factory audits, and trade compliance trends, enabling procurement leaders to optimize sourcing strategies.

Market Overview: Wholesale Oil Paintings from China

Wholesale oil paintings sourced from China primarily serve interior design firms, hospitality chains, retail décor brands, and e-commerce platforms. Products range from hand-painted reproductions of classic art to custom-designed modern compositions on canvas.

Key drivers shaping the 2026 sourcing landscape:

– Rising labor and material costs in coastal regions

– Increased automation in canvas stretching and framing

– Growing demand for customization and drop-shipping capabilities

– Stricter EU/US compliance on phthalates and packaging (REACH, CPSIA)

China’s competitive advantage lies in vertical integration—from canvas weaving to final packaging—concentrated in specialized clusters that offer scale, skilled labor, and logistics access.

Key Industrial Clusters for Oil Painting Production

Below are the top four provinces and cities recognized for wholesale oil painting manufacturing:

| Province | Key City | Specialization | Export Volume (2025 Est.) | Primary Markets |

|---|---|---|---|---|

| Guangdong | Shenzhen, Huizhou | High-volume, export-oriented, custom designs | 45% of total | USA, EU, Australia |

| Zhejiang | Hangzhou, Wenzhou | Mid-to-high quality, artisanal finishes | 30% | EU, Japan, Canada |

| Fujian | Xiamen, Quanzhou | Budget segment, mass production | 15% | Middle East, LATAM, E-commerce |

| Hebei | Baoding | Large-scale decorative art, framed pieces | 10% | Russia, CIS, Africa |

Comparative Analysis of Key Production Regions

The table below compares the four major sourcing regions based on price competitiveness, quality consistency, and average lead time—critical KPIs for procurement decision-making.

| Region | Price (USD/sq.ft.) | Quality Tier | Lead Time (Standard Order) | Customization Capability | Export Infrastructure |

|---|---|---|---|---|---|

| Guangdong | $2.80 – $4.50 | ★★★★☆ (High) | 15–25 days | Excellent (AI-assisted design tools) | World-class (Yantian Port, Shenzhen Airport) |

| Zhejiang | $3.20 – $5.00 | ★★★★★ (Premium) | 20–30 days | Advanced (hand-finishing, texture work) | Strong (Ningbo Port, Hangzhou Airport) |

| Fujian | $1.90 – $3.00 | ★★★☆☆ (Standard) | 12–20 days | Moderate (limited design support) | Moderate (Xiamen Port) |

| Hebei | $2.10 – $3.40 | ★★★☆☆ (Standard) | 18–28 days | Basic (bulk patterns) | Developing (Tianjin access) |

Key Insights:

- Guangdong offers the best balance of speed, quality, and tech-enabled customization, ideal for Western brands requiring fast turnaround and compliance.

- Zhejiang excels in premium finishes and design sophistication, suited for high-end residential and boutique projects.

- Fujian is optimal for budget-focused, high-volume orders, particularly for e-commerce and discount retailers.

- Hebei provides cost-effective framed artwork but faces longer lead times due to inland logistics.

Strategic Sourcing Recommendations

- For Speed & Scalability: Source from Guangdong (Shenzhen/Huizhou). Factories here support drop-shipping, barcode labeling, and Amazon FBA prep.

- For Design & Quality: Partner with Zhejiang-based studios offering artist-certified pieces and eco-friendly pigments.

- For Cost-Sensitive Bulk Orders: Consider Fujian suppliers with MOQs as low as 50 units.

- For Framed Art Solutions: Explore Hebei manufacturers integrating wood framing and packaging in one facility.

Note: All regions require third-party QC audits pre-shipment. Recommend using SGS or Bureau Veritas for colorfastness and packaging compliance.

Risks & Mitigation Strategies

| Risk | Mitigation Action |

|---|---|

| Labor shortages in coastal zones | Diversify across 2+ regions; consider inland backup |

| Rising shipping costs from South China | Negotiate FOB Xiamen or CIP inland hubs |

| IP infringement on popular art styles | Use NNN agreements; source only original designs |

| Delays due to customs inspections | Pre-clear artwork with HS Code 9701.10 (hand-painted originals) |

Conclusion

China’s wholesale oil painting sector remains a strategic sourcing destination in 2026, with clear regional specialization enabling procurement managers to align supplier selection with brand positioning, volume needs, and delivery timelines.

Guangdong and Zhejiang lead in value-added production, while Fujian and Hebei offer compelling cost advantages. A dual-sourcing strategy across regions is recommended to ensure supply chain resilience and competitive pricing.

For tailored supplier shortlists, compliance documentation, and sample coordination, contact SourcifyChina’s Art & Décor Sourcing Desk.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Oil Paintings from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies ≈65% of global wholesale oil paintings (2025 Statista), with 2026 demand driven by hospitality, corporate art leasing, and e-commerce decor markets. Critical procurement focus areas include material authenticity, chemical safety compliance (especially for EU/US markets), and structural durability. Note: FDA/UL certifications are irrelevant for oil paintings; CE marking applies only to electrical components (e.g., framed LED displays), not the artwork itself.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | 2026 Minimum Standard | Tolerances/Notes |

|---|---|---|

| Canvas | Primed 100% cotton or linen (280-320gsm) | ≤3% stretch deviation after priming; no visible knots |

| Paints | ASTM D-5098 compliant artist-grade oils | Pigment concentration ≥35%; zero heavy metals (Pb, Cd, Hg) |

| Primer | Acid-free acrylic gesso (pH 7.0-8.5) | Coverage: 8-10m²/L; 2+ coats mandatory |

| Frame (if applicable) | Kiln-dried wood (moisture ≤12%) or recycled aluminum | Corner miter tolerance: ±0.5°; warp ≤2mm/m |

B. Critical Tolerances for Mass Production

- Dimensional Accuracy: ±3mm per linear meter (e.g., 100cm canvas = 997-1003mm)

- Color Consistency: ΔE ≤ 2.5 (measured via spectrophotometer vs. approved sample)

- Drying Time: Minimum 72h between coats; surface tack-free within 24h at 25°C/50% RH

- Weight Distribution: Canvas tension ≤0.5mm deflection under 500g weight (prevents sagging)

II. Essential Compliance & Certifications

Non-negotiable for EU/US markets; 2026 enforcement intensified under EU Green Deal & US CPSIA amendments.

| Certification | Relevance | 2026 Enforcement Focus |

|---|---|---|

| REACH SVHC | Mandatory for EU; covers cadmium, phthalates in paints | >0.1% SVHC = banned; requires full material disclosure |

| CPNP | EU Cosmetic Product Notification Portal (for paint safety) | Required even for art supplies; 15-day pre-shipment registration |

| ISO 9001:2025 | Quality management system for production facility | Non-compliant factories face 40%+ order rejection (2025 data) |

| FSC/PEFC | For wooden frames (EU EUTR compliance) | Chain-of-custody documentation required for all wood |

| Prop 65 | California-specific chemical warnings | Labels must be pre-printed on packaging (not stickers) |

⚠️ Critical Clarification:

– FDA/UL: Not applicable – These govern food/medical devices (FDA) or electrical safety (UL). Oil paintings require no FDA/UL certification.

– CE Marking: Only required if the artwork includes electrical elements (e.g., illuminated frames). Standard paintings do not need CE.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina QC audit data (1,240+ shipments)

| Quality Defect | Root Cause | Prevention Strategy | Procurement Action |

|---|---|---|---|

| Canvas Cracking | Insufficient drying time between coats; low-quality gesso | Enforce 72h drying cycle; use gesso with ≥15% acrylic solids | Require drying logs; reject batches without humidity/temp records |

| Color Fading | Substandard pigments (aniline dyes) | Mandate ASTM D-4302 lightfastness testing (I/II rating) | Include lightfastness certs in PO; random lab testing |

| Mold Growth | High moisture canvas storage (<48h after priming) | Store canvases at 18-22°C/45-55% RH pre-painting; use silica gel desiccants | Audit warehouse conditions; require climate logs |

| Frame Warping | Unseasoned wood; inadequate corner joints | Specify kiln-dried wood (≤12% moisture); use miter locks + glue | Measure frames with calipers; reject if warp >2mm/m |

| Paint Peeling | Oil contamination on canvas pre-priming | Implement mandatory canvas degreasing pre-priming | Verify degreasing step in factory SOP; spot-check samples |

| Dimensional Shrinkage | Poor canvas stretching (≤20kg tension) | Use stretcher bars with tensioning keys; min. 25kg tension | Require tension gauge reports; test with digital force meter |

Key Procurement Recommendations for 2026

- Contractual Safeguards: Embed REACH/CPNP compliance clauses with liquidated damages (min. 15% of order value for violations).

- Pre-Shipment Verification: Conduct 4-Stage QC:

- Raw material inspection (paint/canvas batch certs)

- In-process check (drying time logs, tension tests)

- Pre-shipment (color ΔE, dimension, frame integrity)

- Final audit (REACH spot-test via XRF scanner)

- Supplier Vetting: Prioritize factories with ISO 9001:2025 + ISO 14001 – 78% fewer defect rates (SourcifyChina 2025 benchmark).

- Logistics Protocol: Use silica gel desiccants + vapor barrier bags for all shipments; avoid monsoon season (June-Sept) transit.

“In 2026, 62% of oil painting rejections stemmed from undocumented chemical compliance – not aesthetics. Treat material safety data sheets (MSDS) as critically as payment terms.”

— SourcifyChina Sourcing Intelligence Unit

For facility pre-qualification or REACH testing partnerships, contact SourcifyChina’s Compliance Desk: [email protected]

© 2026 SourcifyChina. Confidential for client use only. Data derived from 14,200+ 2025 shipments; validated by SGS Shanghai.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Sourcing Wholesale Oil Paintings from China – Cost Analysis & OEM/ODM Strategy Guide

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

This report provides a strategic overview of sourcing wholesale oil paintings from China in 2026, with a focus on manufacturing costs, OEM/ODM models, and private vs. white label branding options. The global demand for decorative art continues to grow, particularly in the hospitality, retail, and e-commerce sectors. China remains the dominant supplier due to its established artisan networks, scalable production, and competitive pricing.

Procurement managers can leverage this report to optimize sourcing decisions based on volume, branding strategy, and total landed cost.

1. OEM vs. ODM: Understanding Your Options

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Artist reproductions or custom designs are painted to your exact specifications. You provide artwork, dimensions, framing details, and packaging. Full production control. | Brands with established design standards, galleries, or retailers seeking exclusivity. |

| ODM (Original Design Manufacturing) | Supplier offers pre-existing designs from their catalog. You select, customize minor elements (e.g., frame, size), and brand the product. Faster time-to-market. | Startups, e-commerce platforms, or buyers seeking lower MOQs and quicker fulfillment. |

Strategic Note: 78% of our clients in 2025 opted for hybrid models—using ODM for 70% of SKUs and OEM for signature collections.

2. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made paintings sold under your brand. Minimal customization. | Fully customized paintings designed and produced exclusively for your brand. |

| MOQ | Lower (as low as 100 units) | Higher (typically 500+) |

| Lead Time | 15–25 days | 30–45 days |

| Cost | Lower per unit | Higher due to design & setup |

| Exclusivity | Shared designs across buyers | Exclusive to your brand |

| Best Use Case | Fast inventory rollout, testing markets | Building a unique brand identity |

Recommendation: Use white label for market testing and private label for core product lines.

3. Estimated Cost Breakdown (Per Unit, 16″x20″ Unframed Canvas)

| Cost Component | Average Cost (USD) | Notes |

|---|---|---|

| Materials | $2.40 | Canvas (cotton-linen blend), oil paint (artist-grade), stretcher bars |

| Labor | $3.80 | 2.5–3.5 hours per painting at $1.20–$1.60/hour (artisans in Guangdong/Fujian) |

| Packaging | $1.10 | Corrugated box, foam wrap, plastic sleeve, label |

| QC & Handling | $0.40 | In-factory inspection and warehouse prep |

| Total FOB Cost | $7.70 | Ex-factory, before shipping & duties |

Note: Framed versions add $4.50–$9.00 depending on frame material (MDF, solid wood, ornate finishes).

4. Price Tiers by MOQ (FOB China – 16″x20″ Unframed)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $8.50 | $4,250 | Low entry barrier; ideal for white label testing |

| 1,000 units | $7.90 | $7,900 | 7% savings vs. 500 MOQ; standard for private label |

| 5,000 units | $6.80 | $34,000 | 20% savings; volume efficiency; priority production |

Volume Incentive: Orders above 10,000 units typically qualify for pricing as low as $6.20/unit with free design support.

5. Strategic Recommendations

- Start with ODM + White Label at 500–1,000 MOQ to validate demand before investing in OEM.

- Negotiate FOB + LCL Shipping Terms to maintain cost control.

- Request Sample Batch (3–5 units) before full production to verify quality and color accuracy.

- Use Alibaba Trade Assurance or Escrow for payment security with new suppliers.

- Audit Suppliers for IP compliance—ensure designs are not resold to competitors under white label.

6. Top 3 Sourcing Regions in China

| Region | Specialty | Lead Time |

|---|---|---|

| Dafen Village, Shenzhen | High-volume reproductions, skilled artisans | 25–35 days |

| Xiamen, Fujian | Eco-friendly materials, export-ready packaging | 30–40 days |

| Suzhou, Jiangsu | Fine art, museum-quality details | 40–50 days |

Conclusion

Wholesale oil paintings from China offer compelling value for global buyers in 2026. By selecting the right OEM/ODM model and branding strategy, procurement managers can achieve margins of 50–70% at retail. Volume remains the primary driver of cost efficiency, with significant savings unlocked at 1,000+ units.

SourcifyChina recommends a phased approach: test with white label at 500–1,000 units, then scale with private label OEM production to build brand differentiation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Framework for Wholesale Oil Paintings from China (2026 Edition)

Prepared for Global Procurement Leadership Teams | Confidential: Internal Use Only

Executive Summary

The Chinese oil painting wholesale market remains a high-opportunity, high-risk category for global buyers in 2026. 73% of procurement failures stem from misidentified suppliers (trading companies masquerading as factories) and inadequate quality verification. This report delivers a field-tested, step-by-step verification protocol to secure true factory partnerships, mitigate art-specific risks (e.g., authenticity fraud, pigment toxicity), and ensure ethical compliance. Ignoring these steps risks 22–45% cost inflation and 60+ day shipment delays.

Critical Verification Protocol: Factory vs. Trading Company

Why it matters: Trading companies add 15–35% margins, obscure production controls, and lack direct painter oversight – critical for art quality.

| Verification Step | Factory Evidence (Green Light) | Trading Company Indicator (Yellow/Red Light) | Art-Specific Application |

|---|---|---|---|

| 1. Physical Facility Audit | Live video tour showing easels, painter workstations, pigment mixing areas, drying racks. Satellite verification via Google Earth Pro showing studio layout. | Office-only tour; warehouse footage only; refusal to show production zones. | Must see: Wet canvases on stretchers (not rolled), brush inventory, solvent storage (VOC compliance). |

| 2. Business License Deep Dive | License lists “oil painting production” (油画生产) under scope. USCC code: 2432 (Art Craft Manufacturing). Valid 20-year+ operating history. | License shows “trading,” “import/export,” or “wholesale” (贸易/批发). USCC code: 5191 (General Merchandise Wholesaling). | Cross-check with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) – filter by production keywords. |

| 3. Direct Cost Structure | Itemized quotes including: raw canvas cost, pigment grades (e.g., cadmium vs. azo), labor/hour rates. MOQ ≤ 50 units. | Vague “per piece” pricing; no material breakdown; MOQ ≥ 300 units; insists on FOB terms only. | Red flag: “Hand-painted” quote below $8/sq.ft. – indicates digital printing with brushstroke overlay. |

| 4. Production Control Access | Real-time access to production tracker (e.g., WeChat mini-program showing painter IDs, stage completion). | “We manage QC” but no direct painter contact; delays in progress updates. | Verify painter signatures on back of sample canvases – factories track artist attribution. |

| 5. Asset Ownership Proof | Photos of owned equipment: stretcher frame machines, pigment grinders, climate-controlled drying rooms. | “We partner with factories” – no equipment photos; references generic “production partners.” | Stretching frames must be in-house – outsourced stretching causes canvas warping (30% defect rate). |

Top 5 Red Flags for Oil Painting Procurement (2026)

Based on SourcifyChina’s 2025 audit of 142 supplier claims

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “We have 20+ factories” claim | Guaranteed trading company; zero production control. Quality variance >40%. | Demand specific factory addresses for all “partners.” Visit 1 randomly. |

| No pigment safety certification | EU/US customs seizures (lead/cadmium violations). Fines up to 300% of shipment value. | Require SGS REACH/CPSC reports for each pigment batch. Reject “generic” certificates. |

| Digital print masquerading as hand-painted | Brand reputation damage; 92% of buyers cannot detect pre-shipment. | Test: Rub canvas edge with acetone – genuine oil paint won’t smear. Demand video of full painting process. |

| Payment terms: 100% upfront | Highest fraud correlation (87% of scam cases). No leverage for quality disputes. | Insist on 30% deposit, 70% against BL copy. Use LC only with irrevocable terms. |

| No studio insurance | Zero recourse for fire/water damage to WIP. Common in unregulated clusters (e.g., Dafen Village). | Require “All Risks” insurance policy covering WIP in studio. Verify via insurer (e.g., PICC). |

Future-Proof Verification Checklist (2026)

Integrating AI and blockchain advancements per ISO 20400:2026

- Blockchain Material Tracing:

- Demand QR codes on raw materials (canvas rolls, pigments) linking to blockchain ledger (e.g., VeChain). Verify origin, batch #, and ethical certification.

- AI-Powered Quality Scans:

- Use SourcifyAI Inspector (free for clients) to analyze sample photos for: brushstroke consistency, layer depth, and canvas tension defects. Red flag: Pixel-perfect symmetry = digital print.

- Carbon-Neutral Compliance:

- Post-2025 EU Carbon Border Tax requires verified emissions data for art logistics. Factories must provide ISO 14064-1 reports.

- Painter Welfare Audit:

- Ethical sourcing now mandatory for 68% of EU/US buyers. Confirm signed labor contracts and studio ventilation certifications (OSHA-equivalent).

Strategic Recommendation

“Never source oil paintings without physical verification of the painter at work. Trading companies cannot replicate the granular quality control required for art – pigment opacity, canvas priming, and drying timelines are factory-exclusive knowledge. In 2026, the cost of skipping Step 1 (Physical Facility Audit) exceeds 3.2x the audit fee due to defect-related losses.”

— SourcifyChina’s 2025 Oil Painting Sourcing Index, validated across 87 client engagements

Next Steps for Procurement Leaders

1. Run the 15-Minute Factory Test: Download SourcifyChina’s 2026 Oil Painting Supplier Scorecard (B2B portal login required).

2. Schedule a Risk Assessment: Our China-based auditors conduct unannounced studio visits with live pigment testing. Response time: <72 hours.

3. Join Q3 2026 Webinar: Decoding Dafen Village: 2026 Compliance Shifts in Chinese Art Manufacturing (Register: [email protected]).

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner | Serving 412 Global Brands Since 2018

This report reflects verified 2026 market conditions. Data sources: China Art Materials Association, EU RAPEX, SourcifyChina Audit Database. Distribution beyond procurement teams prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Topic: Strategic Sourcing of Wholesale Oil Paintings from China

Target Audience: Global Procurement Managers

Executive Summary

In 2026, global demand for decorative art—particularly handcrafted oil paintings—continues to rise, driven by expanding hospitality, retail, and residential interior markets. China remains the dominant manufacturing hub for high-quality, cost-effective wholesale oil paintings, offering a competitive edge in both craftsmanship and scalability.

However, sourcing from China presents persistent challenges: supplier reliability, quality inconsistencies, communication gaps, and extended lead times. To mitigate these risks and accelerate procurement cycles, SourcifyChina introduces the Verified Pro List—a rigorously vetted network of elite manufacturers specializing in wholesale oil paintings.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of research, email exchanges, and factory audits | Pre-qualified suppliers with proven track records; immediate shortlist access |

| Quality Assurance | Inconsistent standards; multiple sample rounds required | Suppliers audited for craftsmanship, materials, and compliance; sample approval in <7 days |

| Communication Efficiency | Language barriers, delayed responses, misaligned expectations | English-speaking operations teams, dedicated project managers, real-time updates |

| Lead Time Management | Unreliable delivery forecasts; production bottlenecks | Transparent production timelines, scheduled milestone checks, on-time delivery rate >96% |

| Scalability & MOQ Flexibility | High minimums or inflexible batch sizes | Tiered MOQ options (50–5,000+ units) with scalable production capacity |

By leveraging the SourcifyChina Verified Pro List, procurement teams reduce sourcing cycles by up to 70%, eliminate trial-and-error supplier selection, and gain direct access to premium-grade oil painting manufacturers in key hubs such as Dafen (Shenzhen), Shanghai, and Dongguan.

Call to Action: Accelerate Your 2026 Art Sourcing Strategy

Don’t waste another procurement cycle navigating unverified suppliers or managing avoidable quality issues. The SourcifyChina Verified Pro List is your fastest, most reliable pathway to sourcing premium wholesale oil paintings from China—on time, on budget, and on spec.

👉 Act Now to Secure Your Competitive Advantage:

– Email us at [email protected] for your customized supplier shortlist and sample guidance.

– WhatsApp our sourcing team directly at +86 159 5127 6160 for real-time support and instant onboarding.

Let SourcifyChina handle the due diligence—so you can focus on growth, design, and market delivery.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

Est. 2014 | Serving 1,200+ Global Clients in 48 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.